Credit

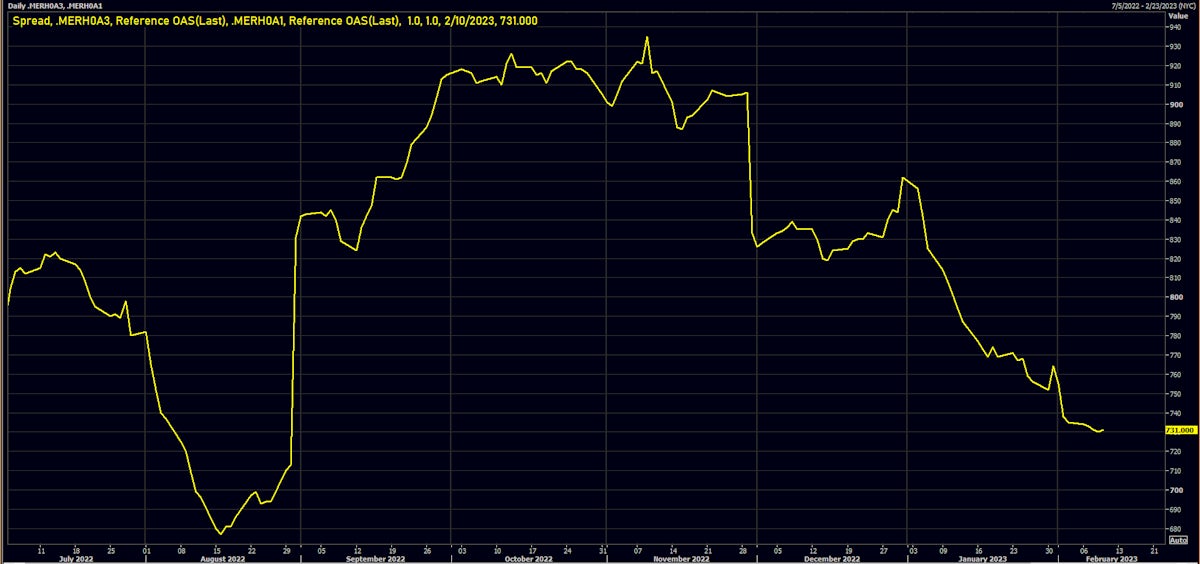

Despite Broadly Wider Spreads, The Compression In US High Yield Continues With CCC-BB Back To August Level

After a good week, YTD volumes of corporate USD bond issuance are now ahead of last year: 33 tranches for $33.7bn in IG (2023 YTD volume $190.9bn vs 2022 YTD $184.465bn), 12 tranches for $8.425bn in HY (2023 YTD 38 Tranches for $31.475bn vs 2022 YTD $30.686bn)

Published ET

ICE BofAML US HY CCC - BB Spread | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was down -0.67% today, with investment grade down -0.65% and high yield down -0.84% (YTD total return: +2.27%)

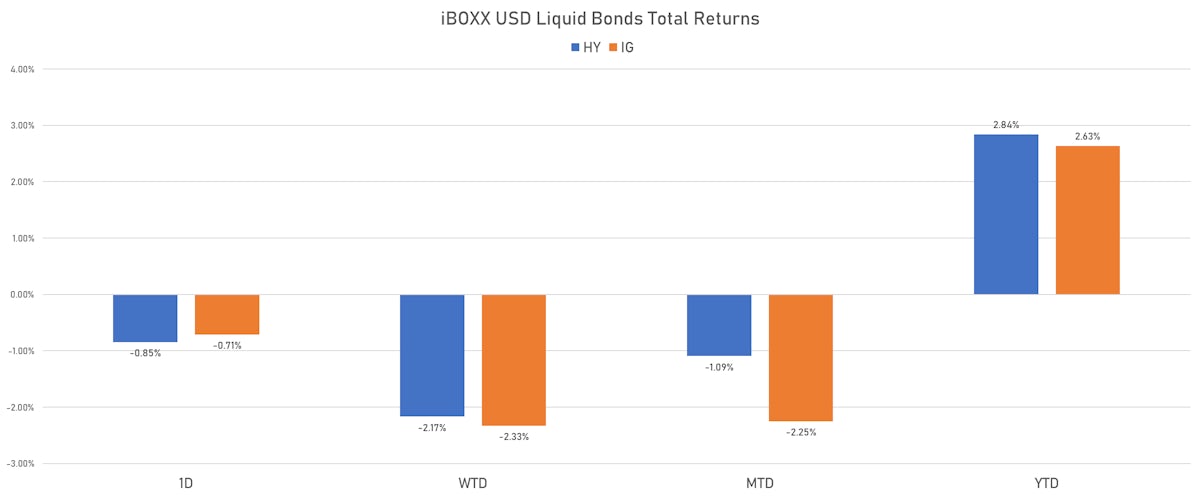

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.710% today (Week-to-date: -2.33%; Month-to-date: -2.25%; Year-to-date: 2.63%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.845% today (Week-to-date: -2.17%; Month-to-date: -1.09%; Year-to-date: 2.84%)

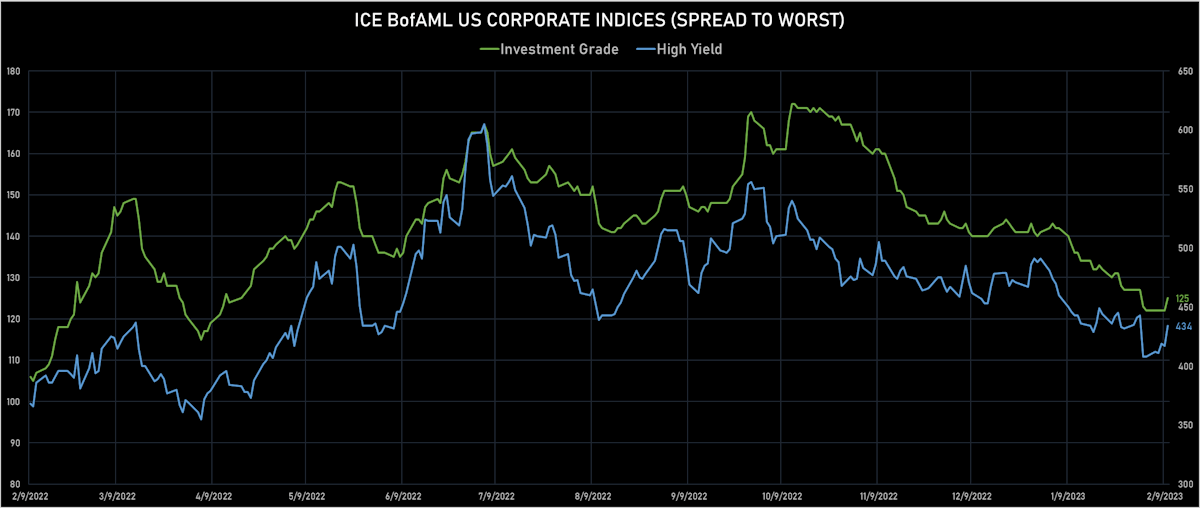

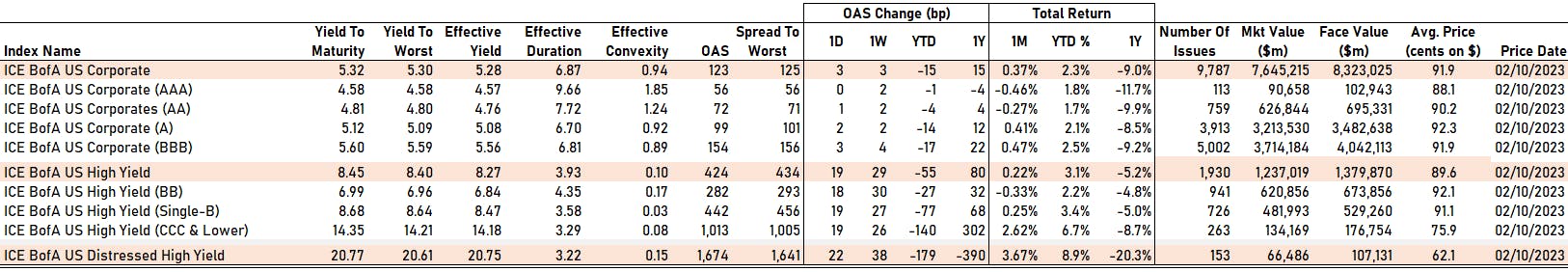

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 3.0 bp, now at 125.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst up 17.0 bp, now at 434.0 bp (YTD change: -54.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +3.7%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 56 bp

- AA up by 1 bp at 72 bp

- A up by 2 bp at 99 bp

- BBB up by 3 bp at 154 bp

- BB up by 18 bp at 282 bp

- B up by 19 bp at 442 bp

- ≤ CCC up by 19 bp at 1,013 bp

CDS INDICES TODAY (mid-spreads)

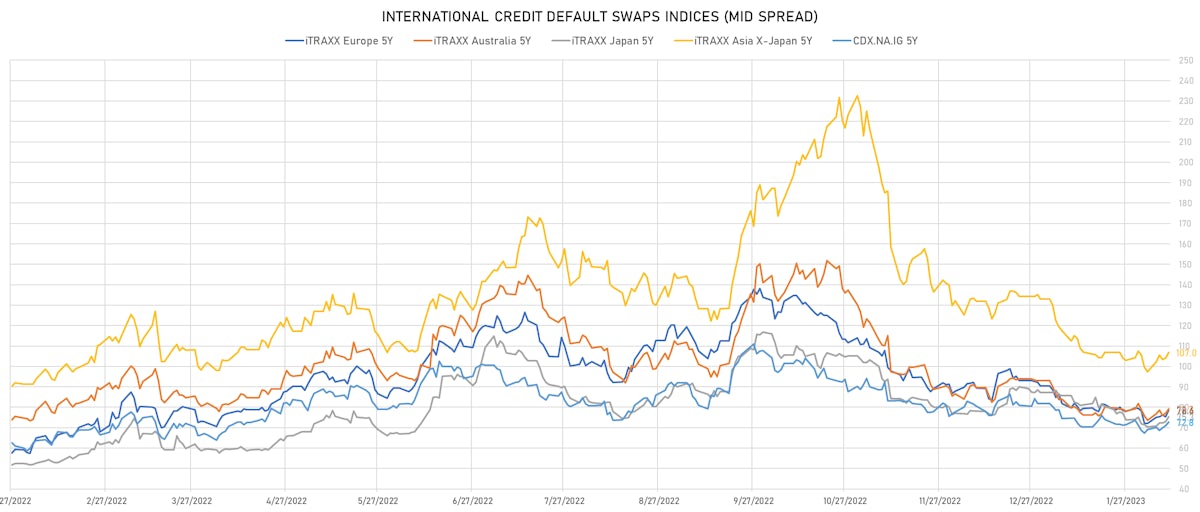

- Markit CDX.NA.IG 5Y up 1.8 bp, now at 73bp (1W change: +3.7bp; YTD change: -9.1bp)

- Markit CDX.NA.IG 10Y up 1.7 bp, now at 112bp (1W change: +3.2bp; YTD change: -5.4bp)

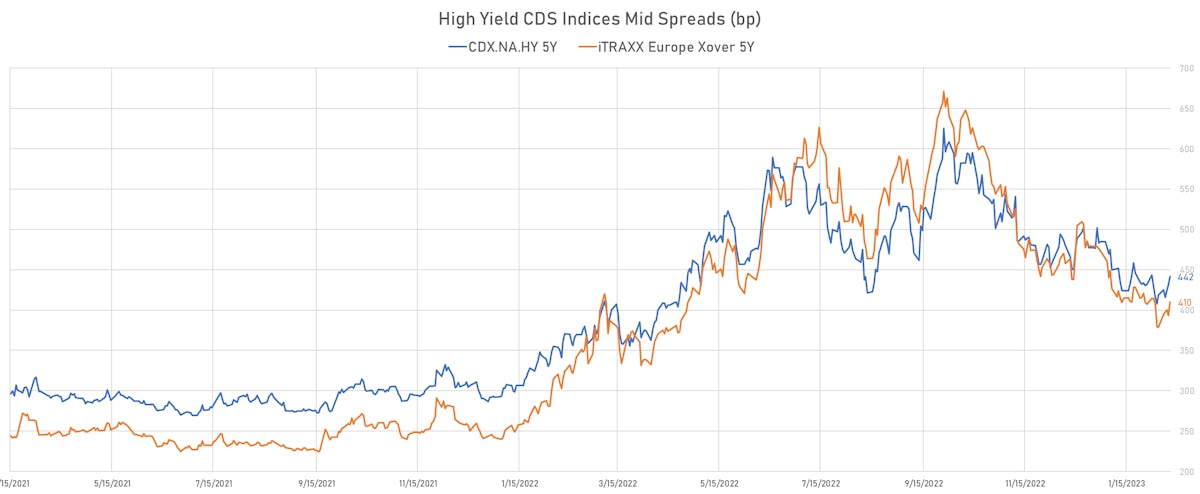

- Markit CDX.NA.HY 5Y up 10.4 bp, now at 442bp (1W change: +22.8bp; YTD change: -43.3bp)

- Markit iTRAXX Europe 5Y up 3.3 bp, now at 79bp (1W change: +6.4bp; YTD change: -11.8bp)

- Markit iTRAXX Europe Crossover 5Y up 16.4 bp, now at 410bp (1W change: +31.4bp; YTD change: -64.2bp)

- Markit iTRAXX Japan 5Y up 2.3 bp, now at 75bp (1W change: +4.9bp; YTD change: -11.9bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 2.8 bp, now at 107bp (1W change: +9.6bp; YTD change: -26.1bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Nabors Inds Inc (Country: US; rated: BB-): up 41.5 bp to 465.8bp (1Y range: 390-887bp)

- Bath Body Wks Inc (Country: US; rated: Ba2): up 43.7 bp to 328.6bp (1Y range: 124-401bp)

- Newell Brands Inc (Country: US; rated: Ba1): up 48.6 bp to 295.9bp (1Y range: 83-296bp)

- Unisys Corp (Country: US; rated: B1): up 52.0 bp to 973.5bp (1Y range: 266-1,096bp)

- K Hovnanian Entpers Inc (Country: US; rated: B3): up 55.5 bp to 843.1bp (1Y range: 695-1,472bp)

- Staples Inc (Country: US; rated: B3): up 56.0 bp to 1,675.1bp (1Y range: 1,014-1,986bp)

- GAP INC (Country: US; rated: Ba2): up 63.6 bp to 524.4bp (1Y range: 302-819bp)

- BEAZER HOMES USA INC (Country: US; rated: A2): up 72.2 bp to 569.3bp (1Y range: 387-899bp)

- Cmnty Health Sys Inc (Country: US; rated: B): up 74.9 bp to 2,733.2bp (1Y range: 625-4,371bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 82.5 bp to 957.6bp (1Y range: 625-1,783bp)

- DISH DBS Corp (Country: US; rated: B2): up 152.0 bp to 1,348.4bp (1Y range: 545-1,506bp)

- Liberty Interactive LLC (Country: US; rated: B1): up 156.4 bp to 2,270.5bp (1Y range: 538-2,584bp)

- Lumen Tech Inc (Country: US; rated: WR): up 492.6 bp to 1,429.9bp (1Y range: 195-1,430bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Telecom Italia SpA (Country: IT; rated: BB-): down 29.4 bp to 318.7bp (1Y range: 268-545bp)

- Hammerson PLC (Country: GB; rated: A2): down 28.2 bp to 359.3bp (1Y range: 187-482bp)

- ARDAGH PACKAGING FIN PUB LTD CO (Country: IE; rated: B1): down 22.7 bp to 680.5bp (1Y range: 352-1,254bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 13.0 bp to 219.2bp (1Y range: 217-606bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): down 13.0 bp to 348.2bp (1Y range: 272-705bp)

- Brit Amern Tob plc (Country: GB; rated: A1): up 10.7 bp to 114.1bp (1Y range: 69-131bp)

- ArcelorMittal (Country: LU; rated: WD): up 11.1 bp to 177.9bp (1Y range: 133-353bp)

- NOVAFIVES (Country: FR; rated: Caa1): up 15.7 bp to 959.1bp (1Y range: 618-2,936bp)

- IMPERIAL BRANDS PLC (Country: GB; rated: NR): up 19.2 bp to 117.8bp (1Y range: 77-136bp)

- INEOS Group Hldgs SA (Country: LU; rated: WR): up 29.0 bp to 254.7bp (1Y range: 134-420bp)

- Credit Suisse Gp AG (Country: CH; rated: A+): up 31.7 bp to 319.5bp (1Y range: 78-442bp)

- CASINO GUICHARD PERRACHON (Country: FR; rated: CCC): up 36.4 bp to 2,207.7bp (1Y range: 784-4,917bp)

- JAGUAR LD ROVER AUTOMOTIVE PLC (Country: GB; rated: WD): up 40.9 bp to 738.3bp (1Y range: 421-1,296bp)

- CMA CGM S A (Country: FR; rated: WR): up 48.2 bp to 286.7bp (1Y range: 243-648bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Lumen Technologies Inc (United States) | Coupon: 5.63% | Maturity: 1/4/2025 | Rating: B | CUSIP: 156700AZ9 | OAS up by 225.2 bp to 562.7 bp, with the yield to worst at 10.0% and the bond now trading down to 91.0 cents on the dollar (1Y price range: 90.5-96.6).

- Issuer: Block Inc (United States) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | CUSIP: 852234AN3 | OAS up by 125.9 bp to 226.4 bp, with the yield to worst at 6.2% and the bond now trading down to 88.8 cents on the dollar (1Y price range: 88.8-93.9).

- Issuer: Service Properties Trust (United States) | Coupon: 4.35% | Maturity: 1/10/2024 | Rating: B | CUSIP: 44106MAZ5 | OAS up by 98.9 bp to 313.1 bp, with the yield to worst at 7.5% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 90.9-96.5).

- Issuer: Newell Brands Inc (United States) | Coupon: 4.88% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 651229BB1 | OAS up by 89.2 bp to 208.9 bp, with the yield to worst at 6.6% and the bond now trading down to 95.9 cents on the dollar (1Y price range: 95.9-98.9).

- Issuer: Las Vegas Sands Corp (United States) | Coupon: 2.90% | Maturity: 25/6/2025 | Rating: BB+ | CUSIP: 517834AH0 | OAS up by 65.6 bp to 195.8 bp, with the yield to worst at 6.6% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 91.9-94.6).

- Issuer: Ball Corp (United States) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS up by 57.2 bp to 166.9 bp (CDS basis: -65.4bp), with the yield to worst at 5.6% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 96.4-99.3).

- Issuer: Sensata Technologies BV (Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 81725WAJ2 | OAS up by 52.7 bp to 134.5 bp, with the yield to worst at 5.5% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 97.0-99.6).

- Issuer: Occidental Petroleum Corp (United States) | Coupon: 5.88% | Maturity: 1/9/2025 | Rating: BB+ | CUSIP: 674599EB7 | OAS up by 51.9 bp to 122.2 bp (CDS basis: -65.5bp), with the yield to worst at 5.5% and the bond now trading down to 99.8 cents on the dollar (1Y price range: 99.5-101.9).

- Issuer: Delta Air Lines Inc (United States) | Coupon: 2.90% | Maturity: 28/10/2024 | Rating: BB | CUSIP: 247361ZU5 | OAS up by 49.9 bp to 92.9 bp (CDS basis: 20.7bp), with the yield to worst at 5.8% and the bond now trading down to 95.1 cents on the dollar (1Y price range: 94.4-96.9).

- Issuer: Ford Motor Credit Company LLC (United States) | Coupon: 4.06% | Maturity: 1/11/2024 | Rating: BB | CUSIP: 345397ZX4 | OAS up by 49.1 bp to 141.9 bp (CDS basis: 14.6bp), with the yield to worst at 6.2% and the bond now trading down to 96.2 cents on the dollar (1Y price range: 95.7-97.9).

- Issuer: Occidental Petroleum Corp (United States) | Coupon: 5.55% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 674599DC6 | OAS up by 46.9 bp to 139.9 bp (CDS basis: -75.6bp), with the yield to worst at 5.5% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 99.0-101.9).

- Issuer: Newell Brands Inc (United States) | Coupon: 4.00% | Maturity: 1/12/2024 | Rating: BB+ | CUSIP: 651229AQ9 | OAS up by 38.5 bp to 92.5 bp, with the yield to worst at 5.9% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 96.8-97.8).

- Issuer: Sensata Technologies BV (Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS down by 32.8 bp to 61.5 bp, with the yield to worst at 5.2% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 98.8-100.5).

- Issuer: Range Resources Corp (United States) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS down by 65.1 bp to 125.5 bp, with the yield to worst at 5.6% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 95.3-97.6).

- Issuer: Owens-Brockway Glass Container Inc (United States) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | CUSIP: 69073TAS2 | OAS down by 84.1 bp to 207.1 bp (CDS basis: 127.8bp), with the yield to worst at 5.7% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 97.0-99.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Iliad SA (France) | Coupon: 1.88% | Maturity: 11/2/2028 | Rating: BB | ISIN: FR0014001YB0 | OAS up by 46.0 bp to 264.8 bp, with the yield to worst at 5.5% and the bond now trading down to 84.1 cents on the dollar (1Y price range: 82.1-86.6).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Netherlands) | Coupon: 4.38% | Maturity: 9/5/2030 | Rating: BB- | ISIN: XS2406607171 | OAS up by 38.3 bp to 401.7 bp, with the yield to worst at 6.7% and the bond now trading down to 86.2 cents on the dollar (1Y price range: 82.1-88.7).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | OAS up by 37.8 bp to 346.4 bp, with the yield to worst at 6.3% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 86.2-92.4).

- Issuer: SoftBank Group Corp (Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | OAS up by 37.5 bp to 300.7 bp, with the yield to worst at 5.5% and the bond now trading down to 92.8 cents on the dollar (1Y price range: 88.9-94.3).

- Issuer: SoftBank Group Corp (Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | OAS up by 37.4 bp to 446.4 bp, with the yield to worst at 7.2% and the bond now trading down to 80.4 cents on the dollar (1Y price range: 73.0-82.1).

- Issuer: Iliad SA (France) | Coupon: 1.88% | Maturity: 25/4/2025 | Rating: BB | ISIN: FR0013331196 | OAS up by 36.7 bp to 153.0 bp, with the yield to worst at 4.4% and the bond now trading down to 93.9 cents on the dollar (1Y price range: 91.9-95.0).

- Issuer: Volvo Car AB (Sweden) | Coupon: 4.25% | Maturity: 31/5/2028 | Rating: BB+ | ISIN: XS2486825669 | OAS up by 33.6 bp to 259.5 bp, with the yield to worst at 5.4% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 91.4-96.8).

- Issuer: Volvo Car AB (Sweden) | Coupon: 2.50% | Maturity: 7/10/2027 | Rating: BB+ | ISIN: XS2240978085 | OAS up by 33.6 bp to 195.1 bp, with the yield to worst at 4.7% and the bond now trading down to 90.0 cents on the dollar (1Y price range: 87.5-92.3).

- Issuer: Iliad SA (France) | Coupon: 5.38% | Maturity: 14/6/2027 | Rating: BB | ISIN: FR001400EJI5 | OAS up by 32.9 bp to 245.3 bp, with the yield to worst at 5.4% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.1-101.4).

- Issuer: SoftBank Group Corp (Japan) | Coupon: 3.88% | Maturity: 6/7/2032 | Rating: BB+ | ISIN: XS2362416617 | OAS up by 31.4 bp to 465.6 bp, with the yield to worst at 7.4% and the bond now trading down to 76.3 cents on the dollar (1Y price range: 66.1-78.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | OAS up by 30.9 bp to 316.9 bp, with the yield to worst at 5.8% and the bond now trading down to 84.6 cents on the dollar (1Y price range: 80.0-86.2).

- Issuer: Bulgarian Energy Holding EAD (Bulgaria) | Coupon: 3.50% | Maturity: 28/6/2025 | Rating: BB | ISIN: XS1839682116 | OAS down by 38.5 bp to 278.5 bp (CDS basis: -241.0bp), with the yield to worst at 6.0% and the bond now trading up to 94.4 cents on the dollar (1Y price range: 90.4-95.0).

- Issuer: Atos SE (France) | Coupon: 1.75% | Maturity: 7/5/2025 | Rating: BB | ISIN: FR0013378452 | OAS down by 42.3 bp to 376.6 bp, with the yield to worst at 5.4% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 80.6-89.3).

- Issuer: Atos SE (France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | OAS down by 65.7 bp to 557.6 bp, with the yield to worst at 7.4% and the bond now trading up to 73.5 cents on the dollar (1Y price range: 64.8-73.8).

- Issuer: Banco BPM SpA (Italy) | Coupon: 4.00% | Maturity: 20/7/2026 | Rating: BB+ | ISIN: XS2506285365 | OAS down by 145.0 bp to 178.4 bp, with the yield to worst at 4.8% and the bond now trading up to 97.2 cents on the dollar (1Y price range: 92.6-97.9).

RECENT DOMESTIC USD BOND ISSUES

- Albertsons Companies Inc (Retail Stores - Food/Drug | Boise, Idaho, United States | Rating: BB): US$750m Senior Note (USU0126BAA99), fixed rate (6.50% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 272 bp), callable (5nc2)

- Alliant Holdings Intermediate LLC (Life Insurance | Newport Beach, California, United States | Rating: B): US$1,250m Note (US01883LAE39), fixed rate (6.75% coupon) maturing on 15 April 2028, priced at 100.00 (original spread of 333 bp), callable (5nc2)

- Ally Financial Inc (Financial - Other | Detroit, Michigan, United States | Rating: BBB-): US$500m Subordinated Note (US02005NBS80), fixed rate (6.70% coupon) maturing on 14 February 2033, priced at 97.82 (original spread of 354 bp), callable (10nc10)

- American Airlines Inc (Airline | Fort Worth, Texas, United States | Rating: B-): US$750m Note (US023771T329), fixed rate (7.25% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 346 bp), callable (5nc2)

- Associated Banc-Corp (Banking | Green Bay, Wisconsin, United States | Rating: BBB-): US$300m Subordinated Note (US0454876006), fixed rate (6.63% coupon) maturing on 1 March 2033, priced at 100.00 (original spread of 291 bp), callable (10nc5)

- BP Capital Markets America Inc (Financial - Other | Chicago, Illinois, United States | Rating: A-): US$2,250m Senior Note (US10373QBU31), fixed rate (4.81% coupon) maturing on 13 February 2033, priced at 100.00 (original spread of 112 bp), callable (10nc10)

- Becton Dickinson and Co (Health Care Supply | Franklin Lakes, New Jersey, United States | Rating: BBB): US$800m Senior Note (US075887CQ08), fixed rate (4.69% coupon) maturing on 13 February 2028, priced at 100.00 (original spread of 90 bp), callable (5nc5)

- Collegium Pharm (Pharmaceuticals | Stoughton, Massachusetts, United States | Rating: NR): US$210m Bond (US19459JAB08), fixed rate (2.88% coupon) maturing on 15 February 2029, priced at 100.00, non callable, convertible

- Deutsche Bank AG (New York Branch) (Banking | New York City, New York, United States | Rating: BB+): US$1,500m Subordinated Note (US251526CT41), floating rate maturing on 10 February 2034, priced at 100.00 (original spread of 340 bp), callable (11nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$120m Bond (US3133EPAT22), fixed rate (5.60% coupon) maturing on 14 February 2030, priced at 100.00, callable (7nc6m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$110m Bond (US3133EPAV77), fixed rate (3.88% coupon) maturing on 14 February 2028, priced at 99.86 (original spread of 10 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133EPAQ82), fixed rate (4.13% coupon) maturing on 13 February 2026, priced at 99.81 (original spread of 6 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPAG01), fixed rate (4.25% coupon) maturing on 10 February 2025, priced at 99.79 (original spread of 8 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$600m Bond (US3133EPAX34), floating rate (SOFR + 15.0 bp) maturing on 14 February 2025, priced at 100.00, callable (2nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$125m Bond (US3130AUVZ45), fixed rate (4.50% coupon) maturing on 13 February 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$230m Bond (US3130AUUQ54), fixed rate (5.02% coupon) maturing on 13 February 2025, priced at 100.00 (original spread of 61 bp), callable (2nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$500m Unsecured Note (US3134GYJ296), fixed rate (5.15% coupon) maturing on 14 February 2025, priced at 100.00 (original spread of 67 bp), callable (2nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$265m Unsecured Note (US3134GYJC77), fixed rate (5.40% coupon) maturing on 24 February 2026, priced at 100.00, callable (3nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$135m Unsecured Note (US3134GYJQ63), fixed rate (5.30% coupon) maturing on 24 February 2025, priced at 100.00, callable (2nc6m)

- HanesBrands Inc (Textiles/Apparel/Shoes | Winston-Salem, North Carolina, United States | Rating: BB-): US$600m Senior Note (US410345AQ54), fixed rate (9.00% coupon) maturing on 15 February 2031, priced at 100.00 (original spread of 523 bp), callable (8nc3)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,250m Senior Note (US458140CF51), fixed rate (5.13% coupon) maturing on 10 February 2030, priced at 99.97 (original spread of 135 bp), callable (7nc7)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,250m Senior Note (US458140CK47), fixed rate (5.90% coupon) maturing on 10 February 2063, priced at 99.95 (original spread of 260 bp), callable (40nc40)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$2,000m Senior Note (US458140CJ73), fixed rate (5.70% coupon) maturing on 10 February 2053, priced at 99.96 (original spread of 226 bp), callable (30nc30)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$2,250m Senior Note (US458140CG35), fixed rate (5.20% coupon) maturing on 10 February 2033, priced at 99.72 (original spread of 155 bp), callable (10nc10)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,000m Senior Note (US458140CH18), fixed rate (5.63% coupon) maturing on 10 February 2043, priced at 99.94 (original spread of 207 bp), callable (20nc20)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,750m Senior Note (US458140CE86), fixed rate (4.88% coupon) maturing on 10 February 2028, priced at 99.92 (original spread of 105 bp), callable (5nc5)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,500m Senior Note (US458140CD04), fixed rate (4.88% coupon) maturing on 10 February 2026, priced at 100.00 (original spread of 75 bp), with a make whole call

- Inter-American Investment Corp (Supranational | Washington, Washington Dc, United States | Rating: AA+): US$1,000m Senior Note (US45828Q2B29), fixed rate (4.13% coupon) maturing on 15 February 2028, priced at 99.62 (original spread of 39 bp), non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$5,000m Senior Note (US459058KQ56), fixed rate (3.88% coupon) maturing on 14 February 2030, priced at 99.87 (original spread of 21 bp), non callable

- Micron Technology Inc (Electronics | Boise, Idaho, United States | Rating: BBB-): US$750m Senior Note (US595112BZ51), fixed rate (5.88% coupon) maturing on 9 February 2033, priced at 99.93 (original spread of 245 bp), callable (10nc10)

- Nabors Ind (Oilfield Machinery and Services | Houston, Texas, United States | Rating: CCC): US$225m Bond (US62957HAK14), fixed rate (1.75% coupon) maturing on 15 June 2029, priced at 100.00, non callable, convertible

- Neptune Bidco US Inc (Financial - Other | United States | Rating: NR): US$650m Senior Note (USU64059AC96), fixed rate (9.29% coupon) maturing on 15 April 2029, priced at 98.00 (original spread of 655 bp), callable (6nc3)

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, Florida, United States | Rating: BBB+): US$1,250m Senior Debenture (US65339KCM09), fixed rate (4.90% coupon) maturing on 28 February 2028, priced at 99.79 (original spread of 118 bp), callable (5nc5)

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, Florida, United States | Rating: BBB+): US$1,000m Senior Debenture (US65339KCP30), fixed rate (5.05% coupon) maturing on 28 February 2033, priced at 99.97 (original spread of 154 bp), callable (10nc10)

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, Florida, United States | Rating: BBB+): US$1,150m Senior Debenture (US65339KCQ13), fixed rate (5.25% coupon) maturing on 28 February 2053, priced at 99.95 (original spread of 199 bp), callable (30nc30)

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, Florida, United States | Rating: BBB+): US$600m Senior Debenture (US65339KCN81), fixed rate (5.00% coupon) maturing on 28 February 2030, priced at 99.93 (original spread of 142 bp), callable (7nc7)

- Northrop Grumman Corp (Electronics | Falls Church, Virginia, United States | Rating: BBB+): US$1,000m Senior Note (US666807CJ91), fixed rate (4.95% coupon) maturing on 15 March 2053, priced at 99.59 (original spread of 171 bp), callable (30nc30)

- Northrop Grumman Corp (Electronics | Falls Church, Virginia, United States | Rating: BBB+): US$1,000m Senior Note (US666807CH36), fixed rate (4.70% coupon) maturing on 15 March 2033, priced at 99.90 (original spread of 118 bp), callable (10nc10)

- Rand Parent LLC (Financial - Other | United States | Rating: BB): US$850m Note (USU74922AA01), fixed rate (8.50% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 479 bp), callable (7nc3)

- Spire Missouri Inc (Gas Utility - Local Distrib | St. Louis, Missouri, United States | Rating: A-): US$400m First Mortgage Bond (US84859DAC11), fixed rate (4.80% coupon) maturing on 15 February 2033, priced at 99.85 (original spread of 131 bp), callable (10nc10)

- Starbucks Corp (Restaurants | Seattle, Washington, United States | Rating: BBB+): US$1,000m Senior Note (US855244BE89), fixed rate (4.75% coupon) maturing on 15 February 2026, priced at 99.88 (original spread of 68 bp), with a make whole call

- Starbucks Corp (Restaurants | Seattle, Washington, United States | Rating: BBB+): US$500m Senior Note (US855244BF54), fixed rate (4.80% coupon) maturing on 15 February 2033, priced at 99.80 (original spread of 124 bp), callable (10nc10)

- Synovus Bank (Banking | Columbus, Georgia, United States | Rating: BBB-): US$500m Senior Bank Note (US87164DVJ61), fixed rate (5.63% coupon) maturing on 15 February 2028, priced at 99.81 (original spread of 185 bp), callable (5nc5)

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, United States | Rating: BBB-): US$1,250m Senior Note (US87264ACY91), fixed rate (5.05% coupon) maturing on 15 July 2033, priced at 99.83 (original spread of 162 bp), callable (10nc10)

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, United States | Rating: BBB-): US$1,000m Senior Note (US87264ACZ66), fixed rate (4.95% coupon) maturing on 15 March 2028, priced at 99.79 (original spread of 118 bp), callable (5nc5)

- TransDigm Inc (Aerospace | Cleveland, Ohio, United States | Rating: B+): US$1,000m Note (US893647BR70), fixed rate (6.75% coupon) maturing on 15 August 2028, priced at 100.00 (original spread of 284 bp), callable (5nc2)

- W R Grace Holdings LLC (Financial - Other | United States | Rating: B): US$350m Note (US92943GAE17), fixed rate (7.38% coupon) maturing on 1 March 2031, priced at 100.00 (original spread of 374 bp), callable (8nc3)

- Waste Management Inc (Service - Other | Houston, Texas, United States | Rating: BBB+): US$500m Senior Note (US94106LBU26), fixed rate (4.63% coupon) maturing on 15 February 2033, priced at 99.83 (original spread of 108 bp), callable (10nc10)

- Waste Management Inc (Service - Other | Houston, Texas, United States | Rating: BBB+): US$750m Senior Note (US94106LBT52), fixed rate (4.63% coupon) maturing on 15 February 2030, priced at 99.86 (original spread of 97 bp), callable (7nc7)

- Wisdomtree (Financial - Other | New York City, New York, United States | Rating: NR): US$130m Bond (), fixed rate (5.63% coupon) maturing on 15 August 2028, priced at 100.00, non callable, convertible

- Wynn Resorts Finance LLC (Financial - Other | Las Vegas, Nevada, United States | Rating: B): US$600m Senior Note (US983133AC37), fixed rate (7.13% coupon) maturing on 15 February 2031, priced at 100.00, callable (8nc8)

RECENT INTERNATIONAL USD BOND ISSUES

- Agence Francaise de Developpement EPIC (Agency | France | Rating: AA): US$1,750m Bond (FR001400FVZ1), fixed rate (4.50% coupon) maturing on 17 February 2026, priced at 99.93 (original spread of 37 bp), non callable

- Agence France Locale SA (Agency | France | Rating: AA-): US$125m Bond (FR001400FSD4), fixed rate (4.71% coupon) maturing on 10 February 2025, priced at 100.00 (original spread of 61 bp), non callable

- Braskem Netherlands Finance BV (Financial - Other | Netherlands | Rating: BBB-): US$1,000m Senior Note (US10554TAG04), fixed rate (7.25% coupon) maturing on 13 February 2033, priced at 100.00 (original spread of 390 bp), callable (10nc10)

- CDP Financial Inc (Financial - Other | Canada | Rating: AAA): US$2,000m Senior Note (USC23264AS02), fixed rate (4.50% coupon) maturing on 13 February 2026, priced at 99.77 (original spread of 48 bp), non callable

- DIB Sukuk Ltd (Financial - Other | Cayman Islands | Rating: A-): US$1,000m Islamic Sukuk (Wakala bil istithmar) (XS2579950200), fixed rate (4.80% coupon) maturing on 16 August 2028, priced at 100.00 (original spread of 97 bp), non callable

- Deutsche Bank AG (Banking | Germany | Rating: BBB+): US$500m Note (XS0460013625), fixed rate (4.25% coupon) maturing on 3 March 2025, priced at 100.00, non callable

- Erste Abwicklungsanstalt (Agency | Germany | Rating: AA): US$500m Senior Note (XS2587133971), fixed rate (4.38% coupon) maturing on 17 February 2026, priced at 99.74 (original spread of 44 bp), non callable

- European Investment Bank (Supranational | Luxembourg | Rating: AAA): US$5,000m Senior Note (US298785JV96), fixed rate (3.75% coupon) maturing on 14 February 2033, priced at 99.49 (original spread of 19 bp), non callable

- Export Development Canada (Agency | Canada | Rating: AAA): US$3,500m Bond (US30216BJW37), fixed rate (3.88% coupon) maturing on 14 February 2028, priced at 99.59 (original spread of 18 bp), non callable

- GACI First Investment Co (Financial - Other | Cayman Islands | Rating: A+): US$1,750m Senior Note (XS2585987683), fixed rate (4.75% coupon) maturing on 14 February 2030, priced at 98.95 (original spread of 115 bp), callable (7nc7)

- GACI First Investment Co (Financial - Other | Cayman Islands | Rating: A+): US$1,750m Senior Note (XS2585988145), fixed rate (5.13% coupon) maturing on 14 February 2053, priced at 93.29 (original spread of 228 bp), callable (30nc30)

- GACI First Investment Co (Financial - Other | Cayman Islands | Rating: A+): US$2,000m Senior Note (XS2585988061), fixed rate (4.88% coupon) maturing on 14 February 2035, priced at 97.75 (original spread of 154 bp), callable (12nc12)

- Geophysical Sub-Strata Ltd (Financial - Other | Virgin Islands (British) | Rating: B-): US$266m Unsecured Note (XS2586740818), fixed rate (8.25% coupon) maturing on 24 February 2028, priced at 100.00, non callable

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Jersey | Rating: NR): US$350m Senior Note (XS2482783151) zero coupon maturing on 20 February 2028, non callable

- GreenSaif Pipelines Bidco Sa rl (Financial - Other | Luxembourg | Rating: NR): US$1,500m Senior Note (US39541EAC75), fixed rate (6.51% coupon) maturing on 23 February 2042, priced at 100.00 (original spread of 3 bp), non callable

- GreenSaif Pipelines Bidco Sa rl (Financial - Other | Luxembourg | Rating: NR): US$1,500m Senior Note (US39541EAA10), fixed rate (6.13% coupon) maturing on 23 February 2038, priced at 100.00 (original spread of 2 bp), non callable

- ING Bank NV (Banking | Netherlands | Rating: A+): US$150m Unsecured Note (XS2569724680) zero coupon maturing on 23 February 2038, priced at 100.00, non callable

- Ineos Finance PLC (Financial - Other | United Kingdom | Rating: BB): US$425m Note (USG47718AH72), fixed rate (6.75% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 315 bp), callable (5nc2)

- Korea Development Bank (Agency | South Korea | Rating: AA-): US$1,000m Senior Note (US500630DW55), fixed rate (4.38% coupon) maturing on 15 February 2028, priced at 99.77 (original spread of 60 bp), non callable

- Korea Development Bank (Agency | South Korea | Rating: AA-): US$1,000m Senior Note (US500630DX39), fixed rate (4.38% coupon) maturing on 15 February 2033, priced at 99.22 (original spread of 80 bp), non callable

- OTP Bank Nyrt (Banking | Hungary | Rating: BBB-): US$650m Subordinated Note (XS2586007036), floating rate maturing on 15 May 2033, priced at 99.42 (original spread of 425 bp), callable (10nc5)

- Pera Funding DAC (Financial - Other | Ireland | Rating: NR): US$123m Unsecured Note (XS2587555702) zero coupon maturing on 15 March 2028, non callable

- Royal Caribbean Cruises Ltd (Leisure | Liberia | Rating: B+): US$700m Senior Note (US780153BT81), fixed rate (7.25% coupon) maturing on 15 January 2030, priced at 100.00 (original spread of 352 bp), callable (7nc3)

- Sharjah Sukuk Programme Ltd (Financial - Other | Cayman Islands | Rating: NR): US$110m Senior Note (XS2583735027), fixed rate (5.59% coupon) maturing on 15 February 2026, priced at 100.00, non callable

- Societe Generale SA (Banking | France | Rating: A): US$335m Senior Note (XS2558222506) zero coupon maturing on 7 February 2028, priced at 100.00, callable (5nc3)

- Swedish Export Credit Corp (Agency | Sweden | Rating: AA+): US$1,750m Senior Note (US87031CAJ27), fixed rate (4.38% coupon) maturing on 13 February 2026, priced at 99.77 (original spread of 36 bp), non callable

- Tms Issuer SARL (Financial - Other | Luxembourg | Rating: NR): US$1,500m Senior Note (XS2568343672), fixed rate (5.78% coupon) maturing on 23 August 2032, priced at 100.00 (original spread of 200 bp), non callable

- Vodafone Group PLC (Telecommunications | United Kingdom | Rating: BBB): US$500m Senior Note (US92857WBZ23), fixed rate (5.75% coupon) maturing on 10 February 2063, priced at 99.16 (original spread of 271 bp), callable (40nc40)

- Vodafone Group PLC (Telecommunications | United Kingdom | Rating: BBB): US$700m Senior Note (US92857WBY57), fixed rate (5.63% coupon) maturing on 10 February 2053, priced at 99.58 (original spread of 240 bp), callable (30nc30)

- Wanda Properties Global Co Ltd (Financial - Other | Virgin Islands (British) | Rating: BB-): US$300m Senior Note (XS2586129574), fixed rate (11.00% coupon) maturing on 13 February 2026, priced at 96.64 (original spread of 824 bp), non callable

- Westpac New Zealand Ltd (Banking | New Zealand | Rating: A+): US$750m Senior Note (US96122FAA57), fixed rate (4.90% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 105 bp), non callable

- YPF Energia Electrica SA (Utility - Other | Argentina | Rating: CCC+): US$130m Bond (ARYPFE5600J9) zero coupon maturing on 10 February 2025, priced at 100.10, non callable

RECENT EURO BOND ISSUES

- Aareal Bank AG (Banking | Germany | Rating: A-): €750m Hypothekenpfandbrief (Covered Bond) (DE000AAR0389), fixed rate (3.13% coupon) maturing on 13 February 2026, priced at 99.90 (original spread of 69 bp), non callable

- Action Logement Services SAS (Service - Other | France | Rating: AA): €1,200m Bond (FR001400FTI1), fixed rate (3.63% coupon) maturing on 25 May 2043, priced at 98.48 (original spread of 56 bp), non callable

- Asian Infrastructure Investment Bank (Supranational | China | Rating: AAA): €1,500m Senior Note (XS2586011491), fixed rate (3.00% coupon) maturing on 14 February 2028, priced at 99.63 (original spread of 76 bp), non callable

- BNP Paribas Issuance BV (Financial - Other | Netherlands | Rating: A+): €120m Unsecured Note (XS2442385998) zero coupon maturing on 1 June 2028, priced at 100.00, non callable

- BPCE SFH SA (Financial - Other | France | Rating: NR): €1,500m Obligation de Financement de l'Habitat (Covered Bond) (FR001400FWP0), fixed rate (3.00% coupon) maturing on 17 October 2029, priced at 99.65 (original spread of 84 bp), non callable

- Banco Santander SA (Banking | Spain | Rating: AA+): €500m Cedula de Internacionalizacion (Covered Bond) (ES0413900939), fixed rate (3.25% coupon) maturing on 14 February 2028, priced at 99.61 (original spread of 96 bp), non callable

- Banco de Sabadell SA (Banking | Spain | Rating: BB): €500m Subordinated Note (XS2588884481), fixed rate (6.00% coupon) maturing on 16 August 2033, priced at 99.82 (original spread of 393 bp), callable (11nc5)

- Bank of Nova Scotia (Banking | Canada | Rating: A): €500m Unsecured Note (XS2589018519), floating rate maturing on 18 January 2028, priced at 100.00, non callable

- Basque, Autonomous Community of (Official and Muni | Spain | Rating: A): €700m Bond (ES0000106742), fixed rate (3.50% coupon) maturing on 30 April 2033, priced at 99.20 (original spread of 119 bp), non callable

- Bayerische Landesbank (Banking | Germany | Rating: NR): €250m Hypothekenpfandbrief (Covered Bond) (DE000BLB9TJ3), floating rate (EU03MLIB + 3.0 bp) maturing on 14 February 2028, priced at 100.00, non callable

- Becton Dickinson Euro Finance SARL (Electronics | Luxembourg | Rating: BBB): €800m Senior Note (XS2585932275), fixed rate (3.55% coupon) maturing on 13 September 2029, priced at 100.00 (original spread of 140 bp), callable (7nc6)

- Belfius Banque SA (Banking | Belgium | Rating: AAA): €500m Belgian Mortgage Pandbrieven (Covered Bond) (BE0002921022), fixed rate (3.00% coupon) maturing on 15 February 2027, priced at 99.63 (original spread of 79 bp), non callable

- Berlin, State of (Official and Muni | Germany | Rating: AAA): €750m Inhaberschuldverschreibung (DE000A3MQYP1), fixed rate (2.75% coupon) maturing on 14 February 2033, priced at 99.20 (original spread of 59 bp), non callable

- British Telecommunications PLC (Telecommunications | United Kingdom | Rating: BBB): €800m Senior Note (XS2582814039), fixed rate (3.75% coupon) maturing on 13 May 2031, priced at 99.92 (original spread of 157 bp), callable (8nc8)

- Caisse de Refinancement de l Habitat SA (Financial - Other | France | Rating: NR): €1,250m Obligation Fonciere (Covered Bond) (FR001400FXU8), fixed rate (3.13% coupon) maturing on 23 February 2033, priced at 99.60 (original spread of 82 bp), non callable

- Caisse des Depots et Consignations (Agency | France | Rating: AA): €1,000m Bond (FR001400FTZ5), fixed rate (3.13% coupon) maturing on 25 May 2033, priced at 99.99 (original spread of 73 bp), non callable

- Cajamar Caja Rural S Coop de Credito (Financial - Other | Spain | Rating: BB): €750m Cedula Hipotecaria (Covered Bond) (ES0422714172), fixed rate (3.38% coupon) maturing on 16 February 2028, priced at 99.82 (original spread of 110 bp), non callable

- Cassa Centrale Banca Credito Cooperativo Italiano SpA (Banking | Italy | Rating: BBB-): €500m Note (XS2585964476), floating rate maturing on 16 February 2027, priced at 100.00 (original spread of 341 bp), callable (4nc3)

- Cassa Depositi e Prestiti SpA (Agency | Italy | Rating: BBB): €500m Senior Note (IT0005532574), fixed rate (3.88% coupon) maturing on 13 February 2029, priced at 99.60 (original spread of 175 bp), non callable

- DNB Bank ASA (Banking | Norway | Rating: A): €1,000m Note (XS2588099478), floating rate maturing on 16 February 2027, priced at 99.74 (original spread of 132 bp), callable (4nc3)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C136), fixed rate (2.75% coupon) maturing on 2 March 2028, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C128), fixed rate (2.65% coupon) maturing on 2 March 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Germany | Rating: A+): €1,000m Inhaberschuldverschreibung (DE000DW6C110), fixed rate (2.50% coupon) maturing on 3 March 2025, priced at 100.00, non callable

- Eni SpA (Oil and Gas | Italy | Rating: BBB+): €2,000m Bond (IT0005521171), fixed rate (4.30% coupon) maturing on 10 February 2028, priced at 100.00 (original spread of 124 bp), non callable

- European Investment Bank (Supranational | Luxembourg | Rating: AAA): €5,000m Senior Note (XS2587298204), fixed rate (2.75% coupon) maturing on 28 July 2028, priced at 99.56 (original spread of 46 bp), non callable

- Findomestic Banca SpA (Banking | Italy | Rating: NR): €250m Bond (IT0005532061), floating rate (EU03MLIB + 0.0 bp) maturing on 8 February 2029, priced at 100.00, non callable

- Ford Motor Credit Company LLC (Financial - Other | United States | Rating: BB+): €1,000m Senior Note (XS2586123965), fixed rate (4.87% coupon) maturing on 3 August 2027, priced at 100.00 (original spread of 255 bp), with a make whole call

- France, Republic of (Government) (Sovereign | France | Rating: AA): €5,000m Obligation Assimilable du Tresor (FR001400FTH3), fixed rate (3.00% coupon) maturing on 25 May 2054, priced at 97.42 (original spread of 84 bp), non callable

- General Motors Financial Company Inc (Financial - Other | United States | Rating: BBB): €750m Senior Note (XS2587352340), fixed rate (4.30% coupon) maturing on 15 February 2029, priced at 99.86 (original spread of 206 bp), callable (6nc6)

- Hypo Vorarlberg Bank AG (Banking | Austria | Rating: A-): €500m Inhaberschuldverschreibung (AT0000A32RP0), fixed rate (4.13% coupon) maturing on 16 February 2026, priced at 99.87 (original spread of 178 bp), with a regulatory call

- ING Bank NV (Banking | Netherlands | Rating: A+): €2,000m Covered Bond (Other) (XS2585966505), fixed rate (3.00% coupon) maturing on 15 February 2033, priced at 99.17 (original spread of 74 bp), non callable

- ING Bank NV (Banking | Netherlands | Rating: A+): €2,000m Covered Bond (Other) (XS2585966257), fixed rate (3.00% coupon) maturing on 15 February 2026, priced at 99.64 (original spread of 66 bp), non callable

- Iliad SA (Cable/Media | France | Rating: BB): €500m Senior Note (FR001400FV85), fixed rate (5.63% coupon) maturing on 15 February 2030, priced at 99.30 (original spread of 361 bp), callable (7nc7)

- Im Group SAS (Financial - Other | France | Rating: B): €265m Note (XS2587104444), fixed rate (8.00% coupon) maturing on 1 March 2028, priced at 100.00 (original spread of 574 bp), callable (5nc2)

- Imperial Brands Finance Netherlands BV (Financial - Other | Netherlands | Rating: BBB-): €600m Senior Note (XS2586739729), fixed rate (5.25% coupon) maturing on 15 February 2031, priced at 99.55 (original spread of 309 bp), callable (8nc8)

- Ineos Finance PLC (Financial - Other | United Kingdom | Rating: NR): €400m Note (XS2587558474), fixed rate (6.63% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 432 bp), callable (5nc2)

- Instituto de Credito Oficial (Agency | Spain | Rating: BBB+): €500m Senior Note (XS2586947082), fixed rate (3.05% coupon) maturing on 31 October 2027, priced at 99.90 (original spread of 73 bp), non callable

- Japan Bank for International Cooperation (Agency | Japan | Rating: A+): €1,000m Senior Note (XS2570364138), fixed rate (3.13% coupon) maturing on 15 February 2028, priced at 99.86 (original spread of 79 bp), non callable

- KfW (Agency | Germany | Rating: AAA): €3,000m Unsecured Note (XS2586942448), fixed rate (2.75% coupon) maturing on 14 February 2033, priced at 99.16 (original spread of 53 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB46C4), fixed rate (2.85% coupon) maturing on 23 March 2028, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB46B6), fixed rate (2.75% coupon) maturing on 23 March 2027, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB4595), fixed rate (2.25% coupon) maturing on 24 March 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB46D2), fixed rate (3.00% coupon) maturing on 23 March 2033, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB46A8), fixed rate (2.35% coupon) maturing on 23 March 2026, priced at 100.00, non callable

- Landesbank Saar (Banking | Germany | Rating: A+): €250m Oeffenlicher Pfandbrief (Covered Bond) (DE000SLB4345), fixed rate (3.00% coupon) maturing on 14 February 2028, priced at 99.88 (original spread of 75 bp), non callable

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Germany | Rating: AA+): €1,250m Inhaberschuldverschreibung (DE000A3MQUF0), fixed rate (2.75% coupon) maturing on 16 February 2028, priced at 99.67 (original spread of 54 bp), non callable

- Landwirtschaftliche Rentenbank (Agency | Germany | Rating: AAA): €500m Senior Note (XS2587748174), fixed rate (2.75% coupon) maturing on 16 February 2032, priced at 99.75 (original spread of 56 bp), non callable

- Nokia Oyj (Telecommunications | Finland | Rating: BBB-): €500m Senior Note (XS2488809612), fixed rate (4.38% coupon) maturing on 21 August 2031, priced at 99.54 (original spread of 215 bp), callable (9nc8)

- North Macedonia, Republic of (Government) (Sovereign | North Macedonia | Rating: BB+): €600m Senior Note (XS2582522681), fixed rate (6.25% coupon) maturing on 15 February 2027, priced at 99.14 (original spread of 421 bp), callable (4nc4)

- North-Rhine Westphalia, State of (Official and Muni | Germany | Rating: AA): €250m Landesschatzanweisung (DE000NRW0NY9), floating rate maturing on 10 February 2053, priced at 100.00, non callable

- Oma Saastopankki Oyj (Banking | Finland | Rating: BBB+): €350m Covered Bond (Other) (FI4000549035), fixed rate (3.13% coupon) maturing on 15 June 2028 (original spread of 88 bp), non callable

- Poland, Republic of (Government) (Sovereign | Poland | Rating: A-): €1,250m Senior Note (XS2586944147), fixed rate (4.25% coupon) maturing on 14 February 2043, priced at 99.71 (original spread of 188 bp), non callable

- Poland, Republic of (Government) (Sovereign | Poland | Rating: A-): €2,250m Senior Note (XS2586944659), fixed rate (3.88% coupon) maturing on 14 February 2033, priced at 99.43 (original spread of 167 bp), non callable

- RWE AG (Utility - Other | Germany | Rating: BBB): €500m Senior Note (XS2584685387), fixed rate (4.13% coupon) maturing on 13 February 2035, priced at 99.79 (original spread of 190 bp), callable (12nc12)

- RWE AG (Utility - Other | Germany | Rating: BBB): €500m Senior Note (XS2584685031), fixed rate (3.63% coupon) maturing on 13 February 2029, priced at 99.71 (original spread of 147 bp), callable (6nc6)

- Sage Group PLC (Information/Data Technology | United Kingdom | Rating: BBB+): €500m Senior Note (XS2587306403), fixed rate (3.82% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 148 bp), callable (5nc5)

- Saxony-Anhalt, State of (Official and Muni | Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000A30V9A9), fixed rate (2.85% coupon) maturing on 15 February 2033, priced at 99.87 (original spread of 52 bp), non callable

- Societe Generale SA (Banking | France | Rating: A): €249m Senior Note (XS2558245549), fixed rate (3.00% coupon) maturing on 6 March 2026, priced at 100.00, non callable

- Sumitomo Mitsui Banking Corporation Fil Duesseldorf Zweigniederlassung der Sumit (Banking | Germany | Rating: NR): €750m Covered Bond (Other) (XS2547591474), fixed rate (3.60% coupon) maturing on 16 February 2026, priced at 100.00 (original spread of 114 bp), non callable

- Svenska Handelsbanken AB (Banking | Sweden | Rating: AA-): €1,000m Note (XS2588099981), fixed rate (3.38% coupon) maturing on 17 February 2028, priced at 99.44 (original spread of 117 bp), with a regulatory call

- Tatra Banka as (Banking | Slovakia | Rating: A-): €300m Bond (SK4000022505), floating rate maturing on 17 February 2026, priced at 100.00, non callable

- Temasek Financial (I) Ltd (Financial - Other | Singapore | Rating: AAA): €750m Bond (XS2586780012), fixed rate (3.50% coupon) maturing on 15 February 2033, priced at 99.65 (original spread of 118 bp), callable (10nc10)

- Temasek Financial (I) Ltd (Financial - Other | Singapore | Rating: AAA): €750m Bond (XS2586779782), fixed rate (3.25% coupon) maturing on 15 February 2027, priced at 99.96 (original spread of 87 bp), callable (4nc4)

- UniCredit Bank Czech Republic and Slovakia as (Banking | Czech Republic | Rating: NR): €500m Covered Bond (Other) (XS2585977882), fixed rate (3.63% coupon) maturing on 15 February 2026, priced at 99.69 (original spread of 96 bp), non callable

- UniCredit SpA (Banking | Italy | Rating: BBB-): €1,000m Unsecured Note (XS2588885025), floating rate maturing on 16 February 2029, priced at 99.84 (original spread of 232 bp), callable (6nc5)

- Virgin Money UK PLC (Banking | United Kingdom | Rating: BBB-): €500m Senior Note (XS2585239200), fixed rate (4.63% coupon) maturing on 29 October 2028, priced at 96.67 (original spread of 239 bp), callable (6nc5)

- Vodafone International Financing DAC (Financial - Other | Ireland | Rating: BBB): €500m Senior Note (XS2586851300), fixed rate (4.00% coupon) maturing on 10 February 2043, priced at 98.92 (original spread of 176 bp), callable (20nc20)

- Volvo Treasury AB (Financial - Other | Sweden | Rating: A-): €700m Senior Note (XS2583352443), fixed rate (3.50% coupon) maturing on 17 November 2025, priced at 99.95 (original spread of 98 bp), callable (3nc3)

- Wallonie, State of (Official and Muni | Belgium | Rating: A-): €1,000m Bond (BE0002922038), fixed rate (3.25% coupon) maturing on 22 June 2033, priced at 99.08 (original spread of 106 bp), non callable

- Wallonie, State of (Official and Muni | Belgium | Rating: A-): €500m Bond (BE0002923044), fixed rate (3.50% coupon) maturing on 15 March 2043, priced at 98.36 (original spread of 126 bp), non callable

RECENT USD LOANS

- Apax Global Alpha Ltd (Guernsey), signed a € 250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/02/25 and initial pricing is set at EURIBOR +230.0bp

- Bl Memorial Partners LLC (United States of America), signed a US$ 325m Term Loan, to be used for general corporate purposes. It matures on 02/01/28.

- Blackstone CQP Holdco LP (United States of America | BB), signed a US$ 275m Term Loan B, to be used for general corporate purposes. It matures on 06/04/28 and initial pricing is set at LIBOR +350.0bp

- Citrin Cooperman Advisors LLC (United States of America), signed a US$ 112m Term Loan B, to be used for acquisition financing. It matures on 10/01/27 and initial pricing is set at Term SOFR +625.0bp

- Falcon Minerals Operating (United States of America), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/27 and initial pricing is set at Term SOFR +250.0bp

- First Brands Group LLC (United States of America | B+), signed a US$ 300m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 03/30/27 and initial pricing is set at Term SOFR +500.0bp

- Franklin Templeton Funds (United Kingdom), signed a US$ 2,675m 364d Revolver, to be used for general corporate purposes. It matures on 02/02/24 and initial pricing is set at Term SOFR +100.0bp

- INEOS Group AG (United Kingdom), signed a € 700m Term Loan B, to be used for general corporate purposes. It matures on 11/09/27 and initial pricing is set at EURIBOR +400.0bp

- INEOS Group AG (United Kingdom), signed a US$ 1,200m Term Loan B, to be used for general corporate purposes. It matures on 02/09/30 and initial pricing is set at Term SOFR +350.0bp

- Inspire Brands Inc (United States of America), signed a US$ 1,750m Term Loan B, to be used for general corporate purposes. It matures on 12/15/27 and initial pricing is set at Term SOFR +300.0bp

- Meituan (China), signed a US$ 400m Revolving Credit / Term Loan, to be used for general corporate purposes and working capital. It matures on 02/02/24 and initial pricing is set at Term SOFR +90.0bp

- Optimus Comunicacoes SA (Portugal), signed a € 350m Term Loan, to be used for refin/ret bank debt. It matures on 02/02/28.

- Par Pacific Holdings Inc (United States of America), signed a US$ 550m Term Loan B, to be used for refin/ret bank debt. It matures on 02/14/30 and initial pricing is set at Term SOFR +425.0bp

- Portillo's Hldgs (United States of America | B), signed a US$ 300m Term Loan A, to be used for general corporate purposes. It matures on 02/02/28.

- Saia Inc (United States of America), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/03/28 and initial pricing is set at Term SOFR +175.0bp

- Scatec Asa (Norway), signed a US$ 180m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/03/25.

- Store Capital LLC (United States of America), signed a US$ 2,000m Term Loan, to be used for general corporate purposes. It matures on 02/03/26 and initial pricing is set at Term SOFR +275.0bp

- Store Capital LLC (United States of America), signed a US$ 600m Term Loan A, to be used for general corporate purposes. It matures on 04/28/27 and initial pricing is set at Term SOFR +170.0bp

- Store Capital LLC (United States of America), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/03/27 and initial pricing is set at Term SOFR +145.0bp

- United Hampshire US REIT (Singapore), signed a US$ 250m Term Loan, to be used for general corporate purposes.

- Vietnam Technological & Commer (Vietnam | BB-), signed a US$ 200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 02/03/26.