Equities

Low Volatility, Low Volume, Low Returns

Meme stocks up by double digits (AMC, GME), as well as a rebound for Chinese K12 education stocks recently battered by upcoming regulations of the sector

Published ET

Market Caps Of The Dow Jones Composite Average | Sources: ϕpost, FactSet data

QUICK SUMMARY

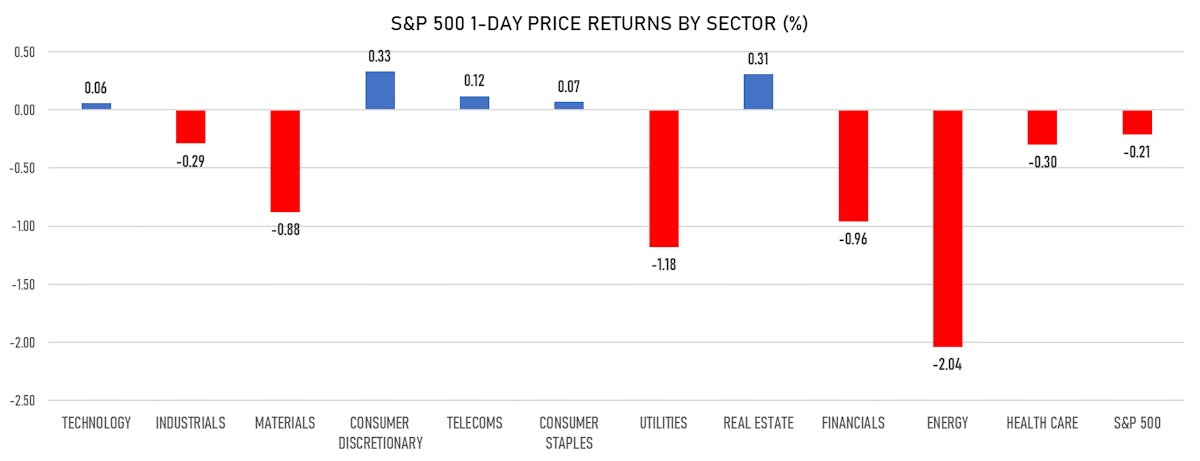

- Daily performance of US indices: S&P 500 down -0.21%; Nasdaq Composite down -0.03%; Wilshire 5000 down -0.30%

- Top performing sectors: consumer discretionary up 0.33% and real estate up 0.31%

- Bottom performing sectors: energy down -2.04% and utilities down -1.18%

- Daily performance of international indices: Europe Stoxx 600 up 0.03%; China CSI 300 down -0.02%; Japan down -0.11%; UK FTSE 100 down -0.31%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.4%, up from 13.2%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.9%, down from 13.6%

NOTABLE S&P 500 EARNINGS RELEASES

- Agilent Technologies Inc (Healthcare): beat on EPS (0.97 act. vs. 0.89 est.) and beat on revenue (1,525m act. vs. 1,440m est.)

- Baxter International Inc (Healthcare): beat on EPS (0.76 act. vs. 0.65 est.) and beat on revenue (2,946m act. vs. 2,897m est.)

- IQVIA Holdings Inc (Healthcare): beat on EPS (2.18 act. vs. 1.85 est.) and beat on revenue (3,409m act. vs. 3,177m est.)

TOP WINNERS

- New Oriental Education & Technology Group Inc (EDU), up 20.8% to $10.96 / YTD price return: -41.0% / 12-Month Price Range: $ 9.05-19.97 (the stock is currently on the short sale restriction list)

- AMC Entertainment Holdings Inc (AMC), up 20.0% to $16.41 / YTD price return: +674.1% / 12-Month Price Range: $ 1.91-20.36 / Short interest (% of float): 19.5%; days to cover: 1.6

- TAL Education Group (TAL), up 18.5% to $42.14 / YTD price return: -41.1% / 12-Month Price Range: $ 34.26-90.96 / Short interest (% of float): 3.0%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- GameStop Corp (GME), up 16.3% to $209.43 / YTD price return: +1,011.6% / 12-Month Price Range: $ 3.77-483.00 / Short interest (% of float): 20.9%; days to cover: 1.0

- UP Fintech Holding Ltd (TIGR), up 14.9% to $19.70 / YTD price return: +148.1% / 12-Month Price Range: $ 3.20-38.50 / Short interest (% of float): 4.5%; days to cover: 0.5

- Viant Technology Inc (DSP), up 13.7% to $25.86 / 12-Month Price Range: $ 20.59-69.16 / Short interest (% of float): 9.8%; days to cover: 2.2

- Neogames SARL (NGMS), up 10.0% to $56.86 / YTD price return: +49.7% / 12-Month Price Range: $ 18.67-51.99 / Short interest (% of float): 5.5%; days to cover: 2.1

- Opera Ltd (OPRA), up 9.9% to $11.52 / YTD price return: +26.2% / 12-Month Price Range: $ 6.01-13.93 / Short interest (% of float): 0.4%; days to cover: 2.2

- Cricut Inc (CRCT), up 9.4% to $30.93 / 12-Month Price Range: $ 14.88-30.05 / Short interest (% of float): 2.9%; days to cover: 0.4

- Hydrofarm Holdings Group Inc (HYFM), up 9.2% to $58.65 / YTD price return: +11.5% / 12-Month Price Range: $ 41.59-95.48 / Short interest (% of float): 6.3%; days to cover: 2.0

BIGGEST LOSERS

- Gracell Biotechnologies Inc (GRCL), down 15.8% to $15.51 / 12-Month Price Range: $ 9.75-33.70 / Short interest (% of float): 0.6%; days to cover: 3.9 (the stock is currently on the short sale restriction list)

- Dycom Industries Inc (DY), down 15.1% to $70.51 / YTD price return: -6.6% / 12-Month Price Range: $ 36.37-101.16 / Short interest (% of float): 4.4%; days to cover: 3.9 (the stock is currently on the short sale restriction list)

- Newegg Commerce Inc (NEGG), down 14.8% to $10.63 / YTD price return: +156.1% / 12-Month Price Range: $ 2.76-17.14 / Short interest (% of float): 0.0%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Skywater Technology Inc (SKYT), down 12.0% to $25.78 / 12-Month Price Range: $ 14.25-29.73 / Short interest (% of float): 0.6%; days to cover: 0.0 (the stock is currently on the short sale restriction list)

- Star Bulk Carriers Corp (SBLK), down 10.5% to $20.33 / YTD price return: +130.2% / 12-Month Price Range: $ 4.86-23.29 / Short interest (% of float): 0.8%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Cerevel Therapeutics Holdings Inc (CERE), down 8.8% to $13.13 / YTD price return: -20.8% / 12-Month Price Range: $ 9.00-18.84 / Short interest (% of float): 12.0%; days to cover: 16.1

- Prelude Therapeutics Inc (PRLD), down 8.7% to $32.91 / YTD price return: -54.0% / 12-Month Price Range: $ 23.69-95.38 / Short interest (% of float): 4.5%; days to cover: 6.8

- CVR Energy Inc (CVI), down 8.4% to $21.40 / YTD price return: +43.6% / 12-Month Price Range: $ 9.81-27.02 / Short interest (% of float): 1.3%; days to cover: 2.4

- Greenbrier Companies Inc (GBX), down 7.5% to $43.94 / YTD price return: +20.8% / 12-Month Price Range: $ 20.13-50.21 / Short interest (% of float): 13.1%; days to cover: 8.9

- E2open Parent Holdings Inc (ETWO), down 7.5% to $12.76 / YTD price return: +17.7% / 12-Month Price Range: $ 8.26-13.94 / Short interest (% of float): 7.1%; days to cover: 5.6

NEW IPOs ANNOUNCED OR PRICED

- Fifth Wall Acquisition Corp III / Cayman Islands - Financials / Listing Exchange: Nasdaq / Ticker: FWAC / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Deutsche Bank Securities Inc, Bofa Securities Inc

- Taylor Maritime Investments Ltd / United Kingdom - Financials / Listing Exchange: London / Ticker: TMI / Gross proceeds (including overallotment): US$ 160.00m (offering in U.S. Dollar) / Bookrunners: Jefferies International Ltd

- Eastern Air Logistics Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 601156 / Gross proceeds (including overallotment): US$ 117.03m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Globant SA / Luxembourg - High Technology / Listing Exchange: New York / Ticker: GLOB / Gross proceeds (including overallotment): US$ 256.80m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, JP Morgan Securities LLC

- Weimob Inc / China - High Technology / Listing Exchange: Hong Kong / Ticker: 2013 / Gross proceeds (including overallotment): US$ 241.09m (offering in Hong Kong Dollar) / Bookrunners: Morgan Stanley International Hong Kong, Credit Suisse (Hong Kong) Ltd, China International Capital Corp HK Securities Ltd

- Krungthai Card PCL / Thailand - Financials / Listing Exchange: Thailand / Ticker: KTC / Gross proceeds (including overallotment): US$ 238.67m (offering in Thai Baht) / Bookrunners: Morgan Stanley & Co

- Frasers Logistics & Commercial Trust / Singapore - Real Estate / Listing Exchange: Singapore / Ticker: BUOU / Gross proceeds (including overallotment): US$ 231.87m (offering in Singapore Dollar) / Bookrunners: Oversea-Chinese Banking Corp Ltd, DBS Bank Ltd, JP Morgan (S.E.A) Ltd