Equities

S&P 500 Closes The Month At A New All-Time High, With Its Price Up 6.9% In October (+23% YTD)

A solid week for ECM activity, with total volumes in the US of $7.4bn for IPOs, $2bn for SPAC IPOs, $922m for blocks, $437m for follow-ons, $155m for convertibles and $232m for international offerings (IFR data)

Published ET

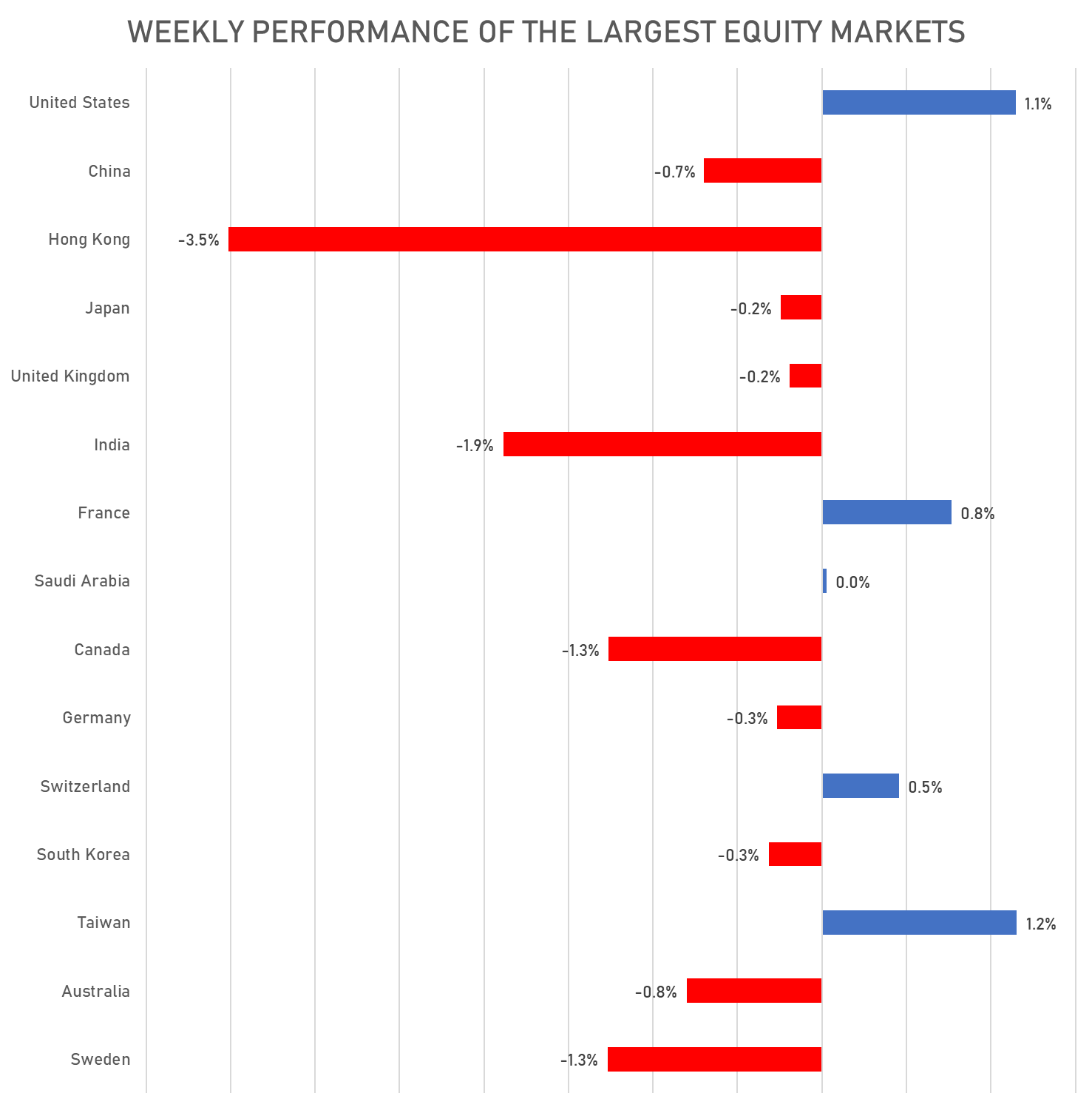

Year-To-Date Total Return By Country | Sources: ϕpost, FactSet data

QUICK SUMMARY

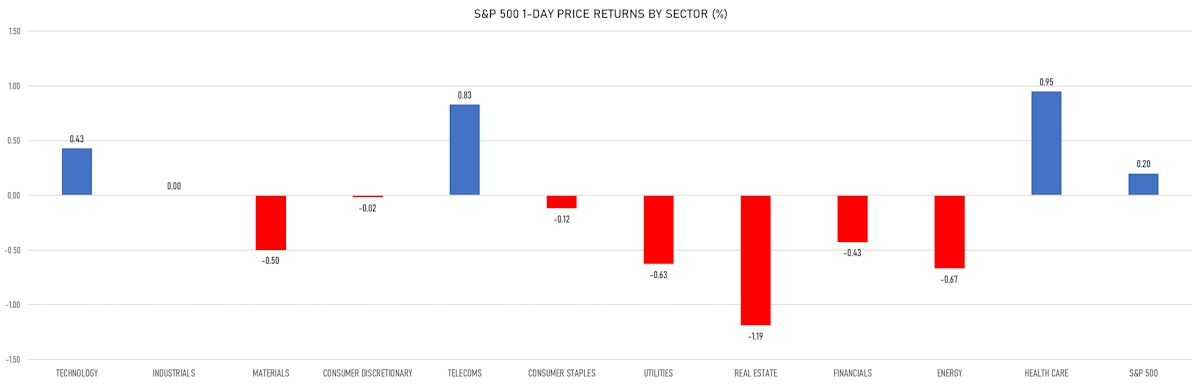

- Daily performance of US indices: S&P 500 up 0.19%; Nasdaq Composite up 0.33%; Wilshire 5000 up 0.16%

- 42.4% of S&P 500 stocks were up today, with 70.3% of stocks above their 200-day moving average (DMA) and 60.4% above their 50-DMA

- Top performing sectors in the S&P 500: health care up 0.95% and telecoms up 0.83%

- Bottom performing sectors in the S&P 500: real estate down -1.19% and energy down -0.67%

- The number of shares in the S&P 500 traded today was 704m for a total turnover of US$ 92 bn

- The S&P 500 Value Index was down -0.3%, while the S&P 500 Growth Index was up 0.6%; the S&P small caps index was down -0.2% and mid caps were up 0.0%

- The volume on CME's INX (S&P 500 Index) was 2.3m (3-month z-score: 1.2); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.07%; UK FTSE 100 down -0.16%; Hang Seng SH-SZ-HK 300 Index up 0.35%; Japan's TOPIX 500 up 0.09%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.9%, down from 12.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.5%, up from 11.7%

NOTABLE S&P 500 EARNINGS RELEASES

- Exxon Mobil Corp (XOM | Energy): beat EPS median estimate (1.58 act. vs. 1.57 est.) and beat revenue median estimate (73,786m act. vs. 72,144m est.), up 0.25% today, closed at 64.47 and now at 64.52 (+0.08%) after hours

- Chevron Corp (CVX | Energy): beat EPS median estimate (2.96 act. vs. 2.23 est.) and beat revenue median estimate (44,710m act. vs. 41,357m est.), up 1.21% today, closed at 114.49 and now at 114.65 (+0.14%) after hours

- Abbvie Inc (ABBV | Healthcare): beat EPS median estimate (3.33 act. vs. 3.23 est.) and beat revenue median estimate (14,342m act. vs. 14,307m est.), up 4.56% today, closed at 114.67 and now at 114.66 (-0.01%) after hours

- Charter Communications Inc (CHTR | Technology): beat EPS median estimate (6.50 act. vs. 5.78 est.) and beat revenue median estimate (13,146m act. vs. 12,923m est.), down -4.44% today, closed at 674.89 and now at 675.62 (+0.11%) after hours

- Aon PLC (AON | Financials): beat EPS median estimate (1.74 act. vs. 1.71 est.) and beat revenue median estimate (2,702m act. vs. 2,600m est.), down -0.20% today, closed at 319.92 and now at 319.92 (unchanged) after hours

- Colgate-Palmolive Co (CL | Consumer Non-Cyclicals): beat EPS median estimate (0.81 act. vs. 0.80 est.) and beat revenue median estimate (4,414m act. vs. 4,403m est.), down -0.90% today, closed at 76.19 and now at 76.49 (+0.39%) after hours

- L3harris Technologies Inc (LHX | Industrials): beat EPS median estimate (3.21 act. vs. 3.19 est.) and missed revenue median estimate (4,229m act. vs. 4,518m est.), up 2.91% today, closed at 230.54 and now at 231.41 (+0.38%) after hours

- Phillips 66 (PSX | Energy): beat EPS median estimate (3.18 act. vs. 1.95 est.) and beat revenue median estimate (31,472m act. vs. 26,240m est.), down -2.57% today, closed at 74.78 and now at 74.70 (-0.11%) after hours

- LyondellBasell Industries NV (LYB | Basic Materials): missed EPS median estimate (5.25 act. vs. 5.72 est.) and beat revenue median estimate (12,700m act. vs. 11,421m est.), down -3.65% today, closed at 92.82 and now at 93.00 (+0.19%) after hours

- Weyerhaeuser Co (WY | Real Estate): beat EPS median estimate (0.60 act. vs. 0.58 est.) and beat revenue median estimate (2,345m act. vs. 2,339m est.), down -1.87% today, closed at 35.72 and now at 35.72 (unchanged) after hours

- W W Grainger Inc (GWW | Industrials): beat EPS median estimate (5.65 act. vs. 5.30 est.) and beat revenue median estimate (3,372m act. vs. 3,328m est.), up 7.51% today, closed at 463.11 and now at 492.34 (+6.31%) after hours

- Royal Caribbean Cruises Ltd (RCL | Consumer Cyclicals): missed EPS median estimate (-4.91 act. vs. -4.32 est.) and missed revenue median estimate (457m act. vs. 566m est.), up 0.21% today, closed at 84.43 and now at 84.60 (+0.20%) after hours

- Church & Dwight Co Inc (CHD | Consumer Non-Cyclicals): beat EPS median estimate (0.92 act. vs. 0.70 est.) and beat revenue median estimate (1,311m act. vs. 1,282m est.), up 2.43% today, closed at 87.36 and now at 87.36 (unchanged) after hours

- Cerner Corp (CERN | Healthcare): beat EPS median estimate (0.86 act. vs. 0.82 est.) and beat revenue median estimate (1,468m act. vs. 1,451m est.), up 5.12% today, closed at 74.29 and now at 73.50 (-1.06%) after hours

- CBOE Global Markets Inc (CBOE | Financials): beat EPS median estimate (1.45 act. vs. 1.44 est.) and beat revenue median estimate (370m act. vs. 365m est.), up 0.59% today, closed at 131.94 and now at 131.94 (unchanged) after hours

- Newell Brands Inc (NWL | Consumer Cyclicals): beat EPS median estimate (0.54 act. vs. 0.50 est.) and beat revenue median estimate (2,787m act. vs. 2,782m est.), up 5.14% today, closed at 22.89 and now at 22.79 (-0.44%) after hours

TOP WINNERS

- Bakkt Holdings Inc (BKKT), up 66.1% to $42.52 / YTD price return: +321.8% / 12-Month Price Range: $ 8.00-37.49 / Short interest (% of float): 40.1%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- A10 Networks Inc (ATEN), up 34.9% to $18.69 / YTD price return: +89.6% / 12-Month Price Range: $ 6.68-15.02

- Greenidge Generation Holdings Inc (GREE), up 33.8% to $27.19 / 12-Month Price Range: $ 19.50-60.00 / Short interest (% of float): 7.0%; days to cover: 0.2

- GH Research PLC (GHRS), up 22.9% to $25.31 / 12-Month Price Range: $ 12.38-26.91 / Short interest (% of float): 3.0%; days to cover: 33.2

- Arqit Quantum Inc (ARQQ), up 21.9% to $21.87 / 12-Month Price Range: $ 8.00-41.52 / Short interest (% of float): 1.7%; days to cover: 0.4

- Matterport Inc (MTTR), up 18.2% to $22.45 / 12-Month Price Range: $ 10.45-28.00

- Berkshire Grey Inc (BGRY), up 18.2% to $6.90 / 12-Month Price Range: $ 5.43-13.45

- Aspen Aerogels Inc (ASPN), up 17.8% to $54.46 / 12-Month Price Range: $ 10.50-51.57

- Vicarious Surgical Inc (RBOT), up 16.0% to $13.07 / 12-Month Price Range: $ 9.50-15.79 / Short interest (% of float): 2.9%; days to cover: 2.4

- Live Oak Bancshares Inc (LOB), up 14.6% to $89.18 / 12-Month Price Range: $ 34.21-78.31 / Short interest (% of float): 5.8%; days to cover: 8.5

BIGGEST LOSERS

- CareDx Inc (CDNA), down 27.5% to $51.00 / YTD price return: -29.6% / 12-Month Price Range: $ 45.96-99.83 (the stock is currently on the short sale restriction list)

- MicroVision Inc (MVIS), down 15.4% to $7.61 / YTD price return: +41.4% / 12-Month Price Range: $ 1.52-28.00 (the stock is currently on the short sale restriction list)

- Zendesk Inc (ZEN), down 14.5% to $101.80 / YTD price return: -28.9% / 12-Month Price Range: $ 103.28-166.60 (the stock is currently on the short sale restriction list)

- Monte Rosa Therapeutics Inc (GLUE), down 13.6% to $23.45 / 12-Month Price Range: $ 17.39-45.56 (the stock is currently on the short sale restriction list)

- SPS Commerce Inc (SPSC), down 11.8% to $152.73 / 12-Month Price Range: $ 83.05-174.42 (the stock is currently on the short sale restriction list)

- Tuya Inc (TUYA), down 11.1% to $6.48 / 12-Month Price Range: $ 6.93-27.65 (the stock is currently on the short sale restriction list)

- Mohawk Industries Inc (MHK), down 11.0% to $177.21 / YTD price return: +25.7% / 12-Month Price Range: $ 90.98-231.80 (the stock is currently on the short sale restriction list)

- Frontdoor Inc (FTDR), down 10.9% to $37.28 / YTD price return: -25.8% / 12-Month Price Range: $ 38.77-58.94 (the stock is currently on the short sale restriction list)

- Kemper Corp (KMPR), down 10.0% to $63.48 / 12-Month Price Range: $ 60.00-83.98 (the stock is currently on the short sale restriction list)

- Rani Therapeutics Holdings Inc (RANI), down 9.9% to $23.00 / 12-Month Price Range: $ 9.24-29.40 / Short interest (% of float): 3.5%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

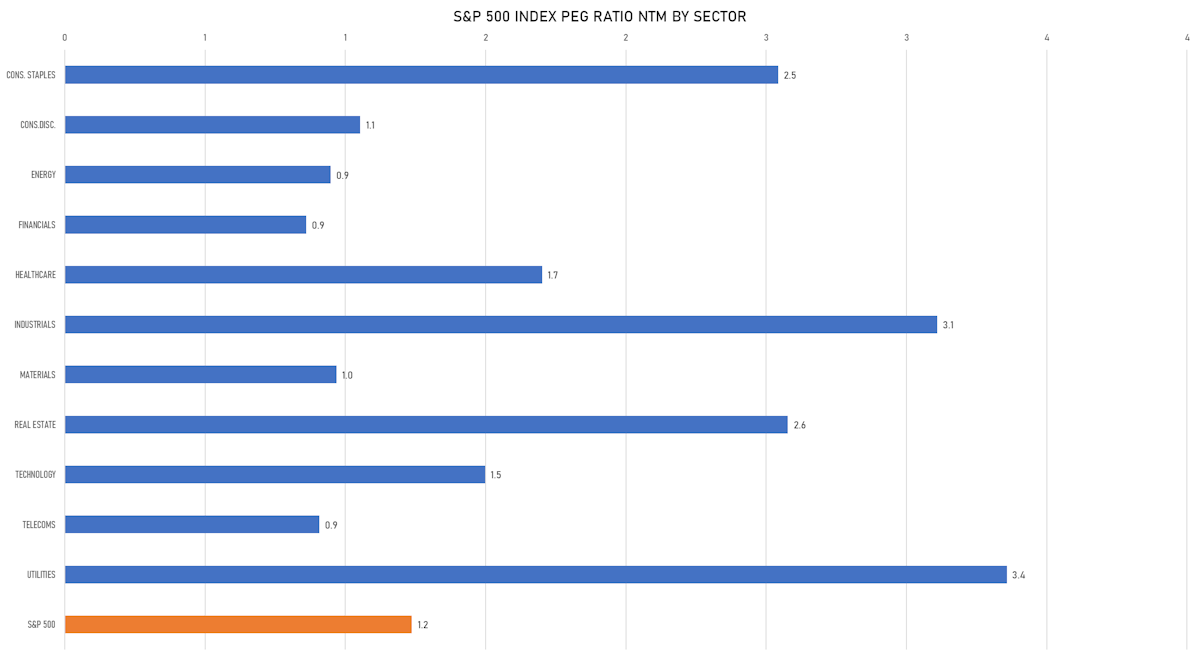

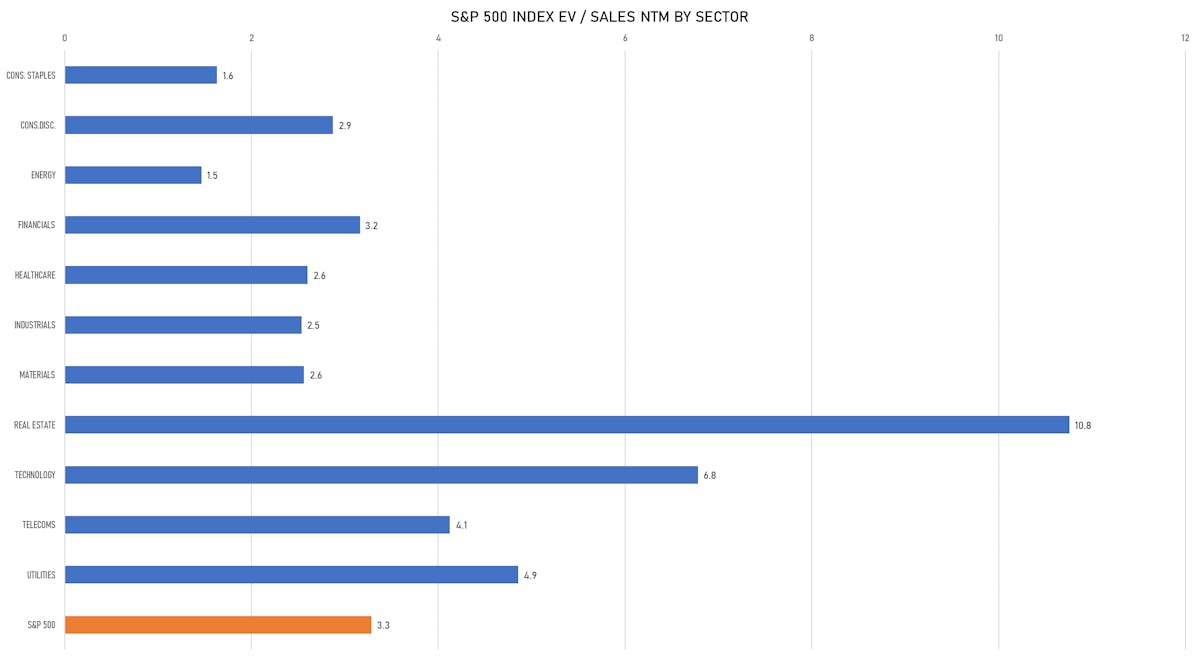

VALUATION MULTIPLES BY SECTORS

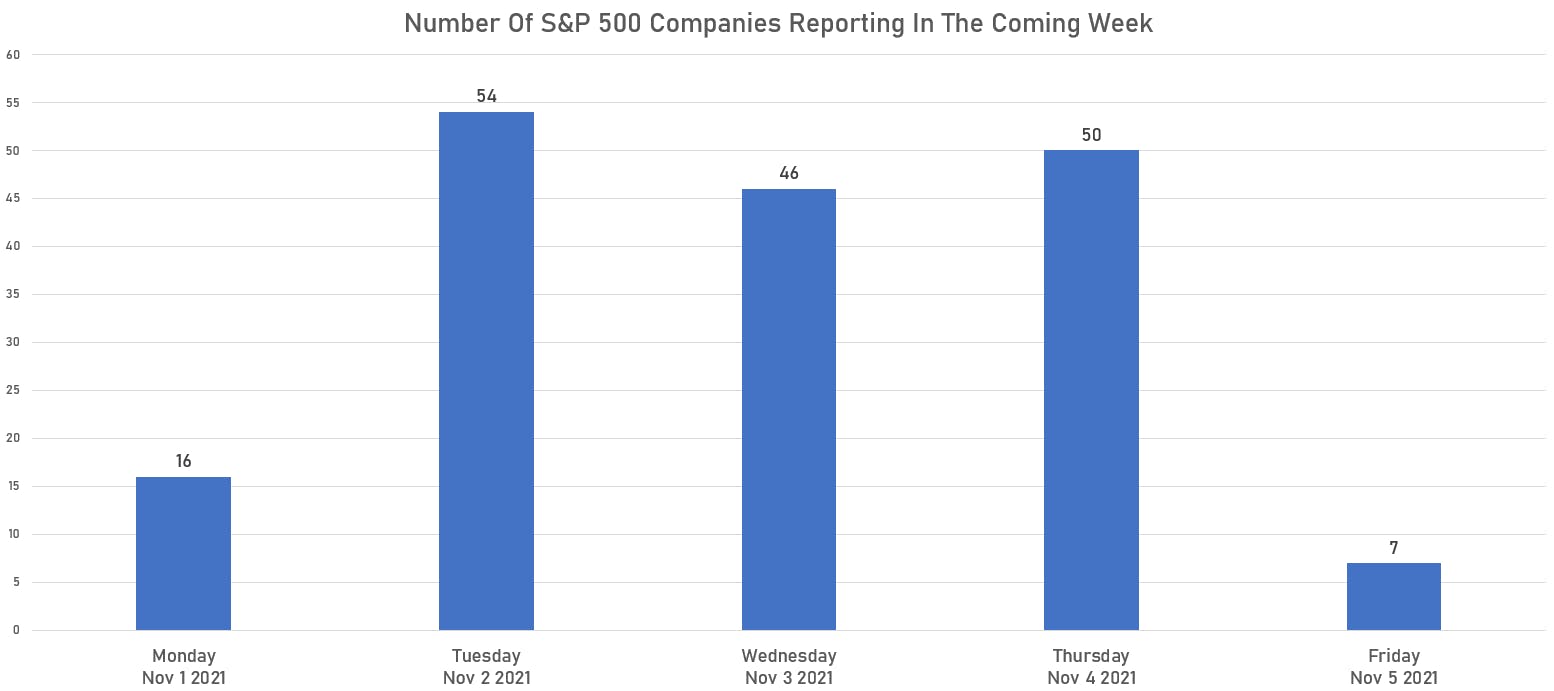

1/3 OF THE S&P 500 WILL RELEASE EARNINGS NEXT WEEK

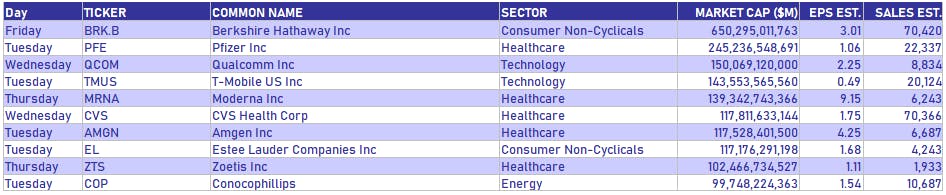

TOP COMPANIES REPORTING NEXT WEEK

Source: Refinitiv median estimates for EPS and Revenue

NEW IPOs ANNOUNCED OR PRICED

- Hireright Holdings Corp / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: HRT / Gross proceeds (including overallotment): US$ 422.22m (offering in U.S. Dollar) / Bookrunners: Robert W Baird & Co Inc, Goldman Sachs & Co, Stifel Nicolaus & Co Inc, William Blair & Co, Credit Suisse Securities (USA) LLC, KeyBanc Capital Markets Inc, RBC Capital Markets LLC, Jefferies LLC, Barclays Capital Inc, Truist Securities Inc

- Project Energy Reimagined Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: PEGRU / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, Bofa Securities Inc

- Entrada Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: TRDA / Gross proceeds (including overallotment): US$ 181.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Evercore Group, Cowen & Co

- Cactus Acquisition Corp 1 Ltd / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: CCTSU / Gross proceeds (including overallotment): US$ 110.00m (offering in U.S. Dollar) / Bookrunners: Oppenheimer & Co Inc, Moelis & Co

- Volvo Car AB / Sweden - Industrials / Listing Exchange: OMX Stock / Ticker: VOLCAR / Gross proceeds (including overallotment): US$ 2,328.64m (offering in Swedish Krona) / Bookrunners: Morgan Stanley & Co, BNP Paribas SA, Nordea, SEB, JP Morgan AG, Goldman Sachs Bank Europe SE, HSBC Continental Europe SA

- x + bricks SA / Luxembourg - Real Estate / Listing Exchange: Frankfurt / Ticker: N/A / Gross proceeds (including overallotment): US$ 583.95m (offering in EURO) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- 4D Molecular Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: FDMT / Gross proceeds (including overallotment): US$ 118.75m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Evercore Group, SVB Leerink LLC

- Kadokawa Corp / Japan - High Technology / Listing Exchange: Tokyo 1 / Ticker: 9468 / Gross proceeds (including overallotment): US$ 263.16m (offering in Japanese Yen) / Bookrunners: Directly Placed

- Septeni Holdings Co Ltd (Advertising & Marketing | Shinjuku-Ku, Tokyo, Japan), raised US$ 287 M, placing 70 M ordinary or common shares. Financial advisors on the transaction: Directly Placed