Equities

Mixed Day For US Stocks Though Indices Edge Higher; S&P 500 On Longest Streak Since 1997

The materials and energy sectors had the best performances, volatility was up slightly, and about 55% of S&P 500 ended up today

Published ET

Very few SPACs have successfully completed an acquisition this year | Source: S&P Capital IQ

QUICK SUMMARY

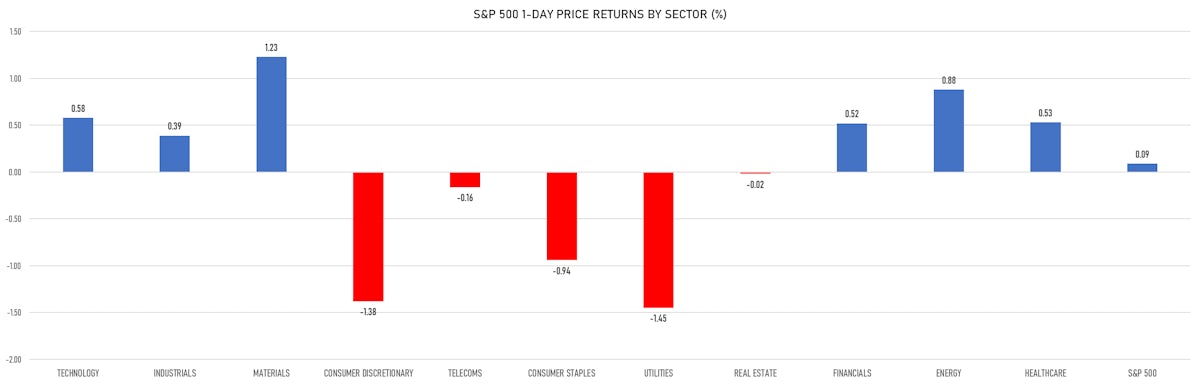

- Daily performance of US indices: S&P 500 up 0.09%; Nasdaq Composite up 0.07%; Wilshire 5000 up 0.17%

- 54.9% of S&P 500 stocks were up today, with 73.5% of stocks above their 200-day moving average (DMA) and 72.9% above their 50-DMA

- Top performing sectors in the S&P 500: materials up 1.23% and energy up 0.88%

- Bottom performing sectors in the S&P 500: utilities down -1.45% and consumer discretionary down -1.38%

- The number of shares in the S&P 500 traded today was 541m for a total turnover of US$ 73 bn

- The S&P 500 Value Index was up 0.1%, while the S&P 500 Growth Index was up 0.1%; the S&P small caps index was unchanged and mid caps were up 0.1%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.6); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.04%; UK FTSE 100 down -0.05%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -0.21%, Japan's TOPIX 500 down -0.53%

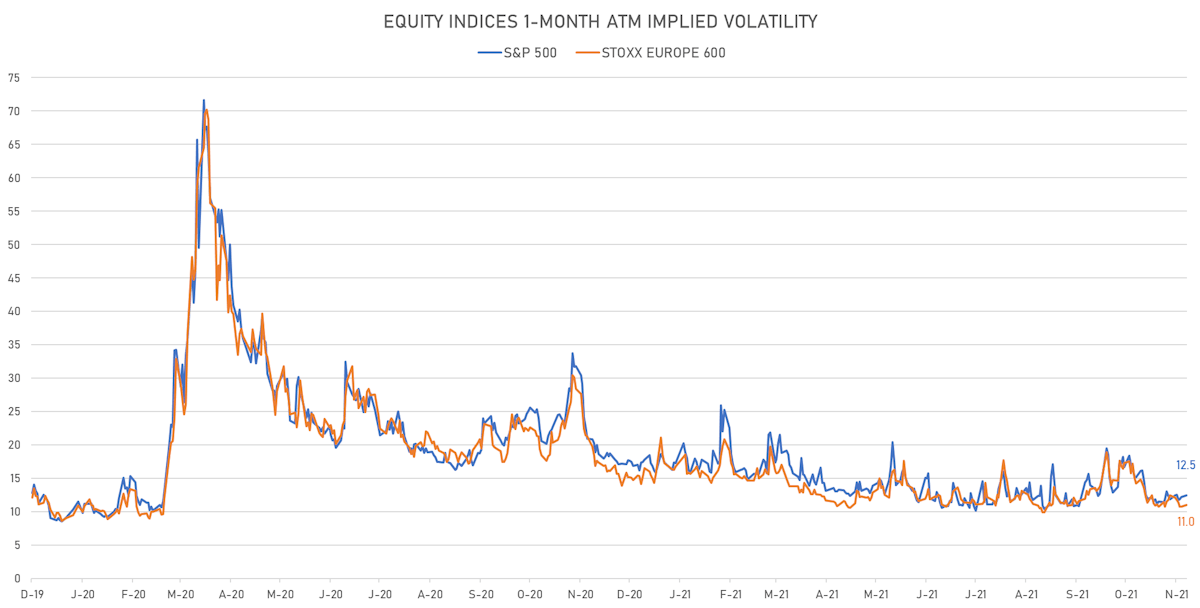

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.5%, up from 12.2%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.0%, up from 10.7%

NOTABLE S&P 500 EARNINGS RELEASES

- PayPal Holdings Inc (PYPL | Technology): beat EPS median estimate (1.11 act. vs. 1.07 est.) and missed revenue median estimate (6,182m act. vs. 6,233m est.), up 1.61% today, closed at 229.42 and at 217.90 (-5.02%) after hours

- Roblox Corp (RBLX | Technology): matched EPS median estimate (-0.13 act. vs. -0.13 est.) and beat revenue median estimate (638m act. vs. 628m est.), down -1.27% today, closed at 77.00 and at 98.60 (+28.05%) after hours

- Trade Desk Inc (TTD | Technology): beat EPS median estimate (0.18 act. vs. 0.15 est.) and beat revenue median estimate (301m act. vs. 283m est.), up 29.47% today, closed at 88.75 and at 88.20 (-0.62%) after hours

- International Flavors & Fragrances Inc (IFF | Consumer Non-Cyclicals): missed EPS median estimate (1.50 act. vs. 1.51 est.) and beat revenue median estimate (3,089m act. vs. 2,979m est.), up 2.74% today, closed at 147.53 and at 150.00 (+1.67%) after hours

- Hormel Foods Corp (HRL | Consumer Non-Cyclicals): missed EPS median estimate (0.39 act. vs. 0.40 est.) and beat revenue median estimate (2,864m act. vs. 2,751m est.), up 0.76% today, closed at 43.54 and at 43.54 (unchanged) after hours

- AMC Entertainment Holdings Inc (AMC | Consumer Cyclicals): beat EPS median estimate (-0.44 act. vs. -0.55 est.) and beat revenue median estimate (763m act. vs. 728m est.), up 8.06% today, closed at 45.06 and at 43.06 (-4.44%) after hours

- Viatris Inc (VTRS | Healthcare): beat EPS median estimate (0.99 act. vs. 0.88 est.) and beat revenue median estimate (4,537m act. vs. 4,392m est.), up 6.92% today, closed at 14.68 and at 14.67 (-0.07%) after hours

- Trex Company Inc (TREX | Consumer Cyclicals): beat EPS median estimate (0.64 act. vs. 0.58 est.) and beat revenue median estimate (336m act. vs. 325m est.), up 1.34% today, closed at 115.79 and at 119.59 (+3.28%) after hours

- Jack Henry & Associates Inc (JKHY | Technology): beat EPS median estimate (1.38 act. vs. 1.32 est.) and missed revenue median estimate (488m act. vs. 489m est.), up 1.74% today, closed at 161.10 and at 155.00 (-3.79%) after hours

- Black Knight Inc (BKI | Technology): beat EPS median estimate (0.60 act. vs. 0.57 est.) and beat revenue median estimate (378m act. vs. 370m est.), up 6.46% today, closed at 74.83 and at 74.83 (unchanged) after hours

TOP WINNERS

- Newegg Commerce Inc (NEGG), up 59.0% to $18.82 / YTD price return: +353.5% / 12-Month Price Range: $ 3.30-79.07

- EVgo Inc (EVGO), up 34.6% to $13.43 / 12-Month Price Range: $ 7.17-24.34

- Trade Desk Inc (TTD), up 29.5% to $88.75 / YTD price return: +10.8% / 12-Month Price Range: $ 46.71-97.28 / Short interest (% of float): 3.3%; days to cover: 4.3

- Cronos Group Inc (CRON), up 25.7% to $6.71 / YTD price return: -3.3% / 12-Month Price Range: $ 5.11-15.83 / Short interest (% of float): 9.2%; days to cover: 10.3

- Blink Charging Co (BLNK), up 24.3% to $39.07 / YTD price return: -8.6% / 12-Month Price Range: $ 8.74-64.50

- Quantumscape Corp (QS), up 21.3% to $37.63 / YTD price return: -55.4% / 12-Month Price Range: $ 13.10-132.73

- Fuelcell Energy Inc (FCEL), up 20.8% to $10.81 / YTD price return: -3.2% / 12-Month Price Range: $ 2.33-29.44

- Centrus Energy Corp (LEU), up 19.5% to $76.69 / 12-Month Price Range: $ 9.04-79.26 / Short interest (% of float): 5.6%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- Volta Inc (VLTA), up 19.1% to $11.22 / 12-Month Price Range: $ 6.63-18.33 / Short interest (% of float): 2.7%; days to cover: 1.6

- Marathon Digital Holdings Inc (MARA), up 18.0% to $75.30 / YTD price return: +621.3% / 12-Month Price Range: $ 2.06-65.77

BIGGEST LOSERS

- 51job Inc (JOBS), down 19.2% to $54.22 / YTD price return: -22.5% / 12-Month Price Range: $ 59.16-79.00 (the stock is currently on the short sale restriction list)

- ViaSat Inc (VSAT), down 16.9% to $55.65 / YTD price return: +70.4% / 12-Month Price Range: $ 29.82-68.76 / Short interest (% of float): 11.9%; days to cover: 20.9 (the stock is currently on the short sale restriction list)

- Singular Genomics Systems Inc (OMIC), down 12.9% to $14.34 / 12-Month Price Range: $ 10.80-33.37 (the stock is currently on the short sale restriction list)

- Alignment Healthcare Inc (ALHC), down 12.2% to $19.40 / 12-Month Price Range: $ 15.00-28.59 (the stock is currently on the short sale restriction list)

- Compass Pathways PLC (CMPS), down 12.1% to $43.06 / YTD price return: -9.6% / 12-Month Price Range: $ 28.58-61.69 (the stock is currently on the short sale restriction list)

- Janux Therapeutics Inc (JANX), down 11.1% to $24.28 / 12-Month Price Range: $ 16.32-37.99 (the stock is currently on the short sale restriction list)

- ESS Tech Inc (GWH), down 9.7% to $16.93 / 12-Month Price Range: $ 7.22-28.92 / Short interest (% of float): 2.7%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Sculptor Capital Management Inc (SCU), down 9.6% to $22.69 / YTD price return: +49.3% / 12-Month Price Range: $ 11.60-28.90 / Short interest (% of float): 1.7%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Nerdwallet Inc (NRDS), down 9.1% to $23.54 / 12-Month Price Range: $ 23.40-34.44 (the stock is currently on the short sale restriction list)

- Pactiv Evergreen Inc (PTVE), down 8.4% to $14.23 / YTD price return: -21.6% / 12-Month Price Range: $ 10.57-19.61

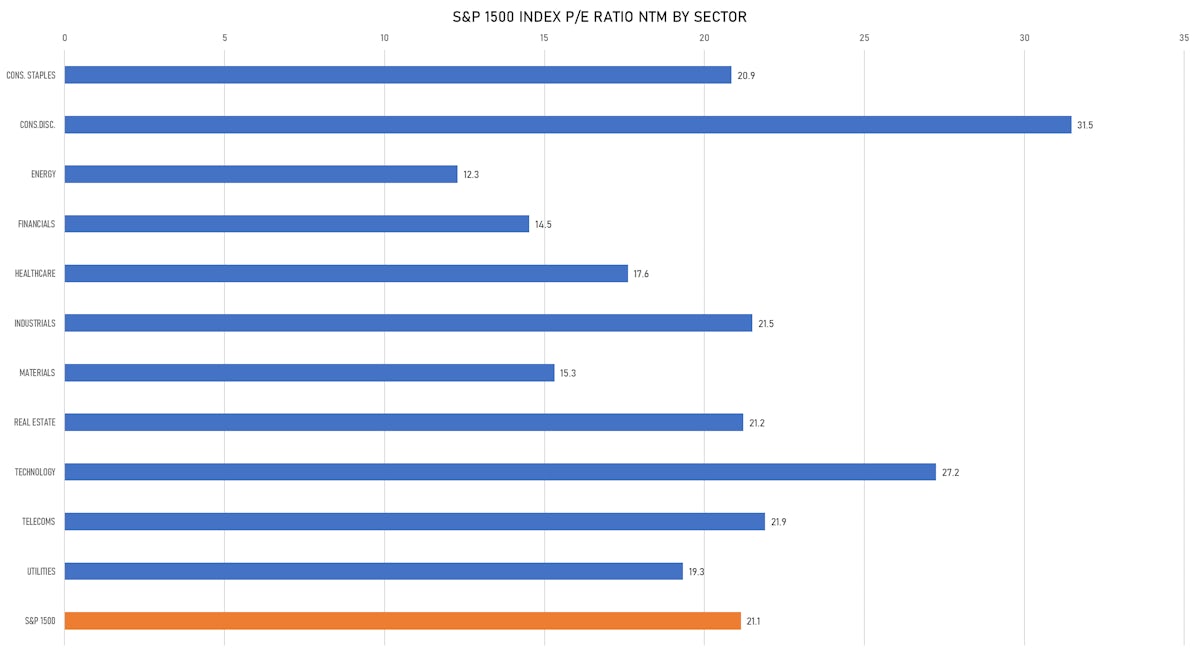

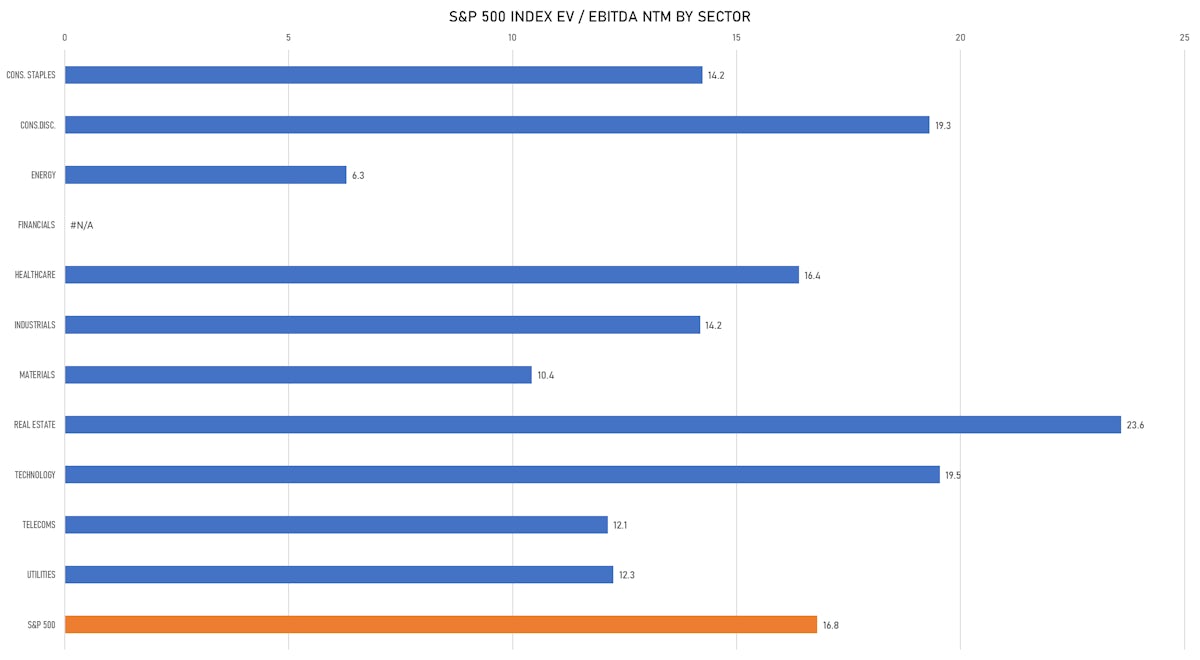

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Legato Merger Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: LGTOU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Earlybirdcapital Inc

- Onewo Space-Tech Service Co Ltd / China - Real Estate / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 2,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Europa Growth Acquisition Co / Switzerland - Financials / Listing Exchange: Nasdaq / Ticker: EGACU / Gross proceeds (including overallotment): US$ 235.00m (offering in U.S. Dollar) / Bookrunners: Barclays Capital Inc

- Games & Esports Experience Acquisition Corp / Cayman Islands - Financials / Listing Exchange: Nasdaq / Ticker: GEEXU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, JP Morgan Securities LLC

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- The Mosaic Co / United States of America - Materials / Listing Exchange: New York / Ticker: MOS / Gross proceeds (including overallotment): US$ 1,269.66m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Healthcare Realty Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: HR / Gross proceeds (including overallotment): US$ 750.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Sirius Real Estate Ltd / Guernsey - Real Estate / Listing Exchange: London / Ticker: SRE / Gross proceeds (including overallotment): US$ 196.05m (offering in British Pound) / Bookrunners: HSBC Bank PLC, Peel Hunt LLP, Panmure Gordon (UK) Ltd, Joh Berenberg Gossler & Co KG(London Branch)

- Create Restaurants Holdings Inc / Japan - Retail / Listing Exchange: Tokyo 1 / Ticker: 3387 / Gross proceeds (including overallotment): US$ 158.89m (offering in Japanese Yen) / Bookrunners: Mizuho Securities Co Ltd, Daiwa Securities Co Ltd