Equities

US Equities End The Week With A Strong Rebound, Led By Technology And Consumer Discretionary Stocks

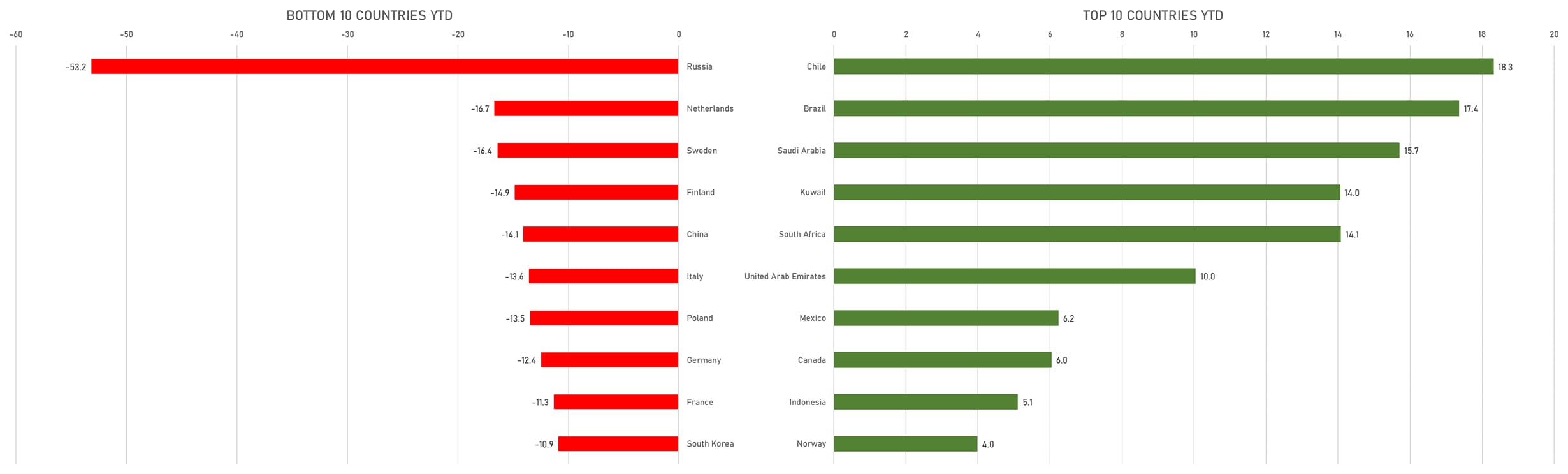

Commodities-focused emerging markets are clocking the best performances (US$ total returns) year-to-date, with Chile up 18%, Brazil up 17%, and Saudi Arabia up nearly 16%

Published ET

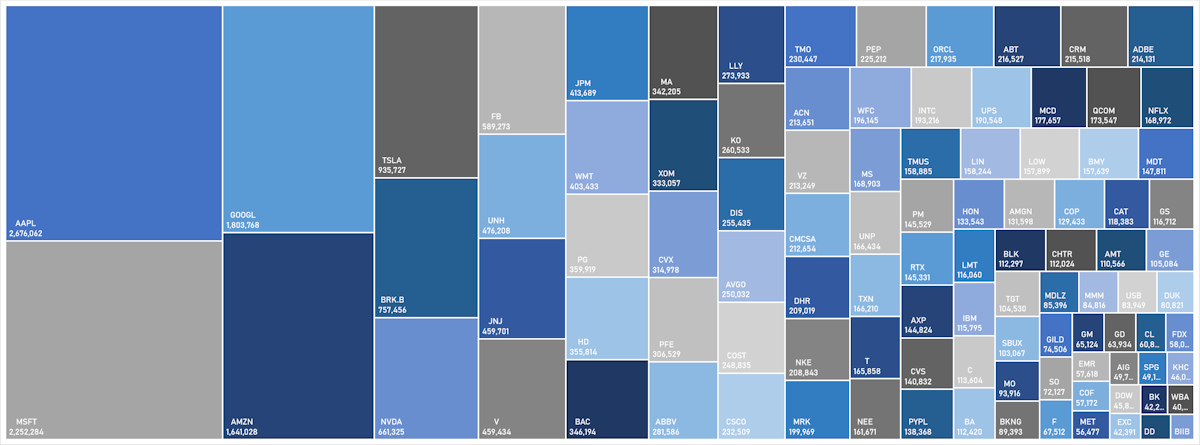

S&P 100 Market Caps ($m) | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 1.17%; Nasdaq Composite up 2.05%; Wilshire 5000 up 1.31%

- 69.7% of S&P 500 stocks were up today, with 49.1% of stocks above their 200-day moving average (DMA) and 55.2% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 2.19% and consumer discretionary up 2.18%

- Bottom performing sectors in the S&P 500: utilities down -0.90% and energy up 0.09%

- The number of shares in the S&P 500 traded today was 2125m for a total turnover of US$ 228 bn

- The S&P 500 Value Index was up 0.4%, while the S&P 500 Growth Index was up 2.0%; the S&P small caps index was up 0.6% and mid-caps were up 0.8%

- The volume on CME's INX (S&P 500 Index) was 4.2m (3-month z-score: 2.6); the 3-month average volume is 2.6m and the 12-month range is 1.3 - 4.6m

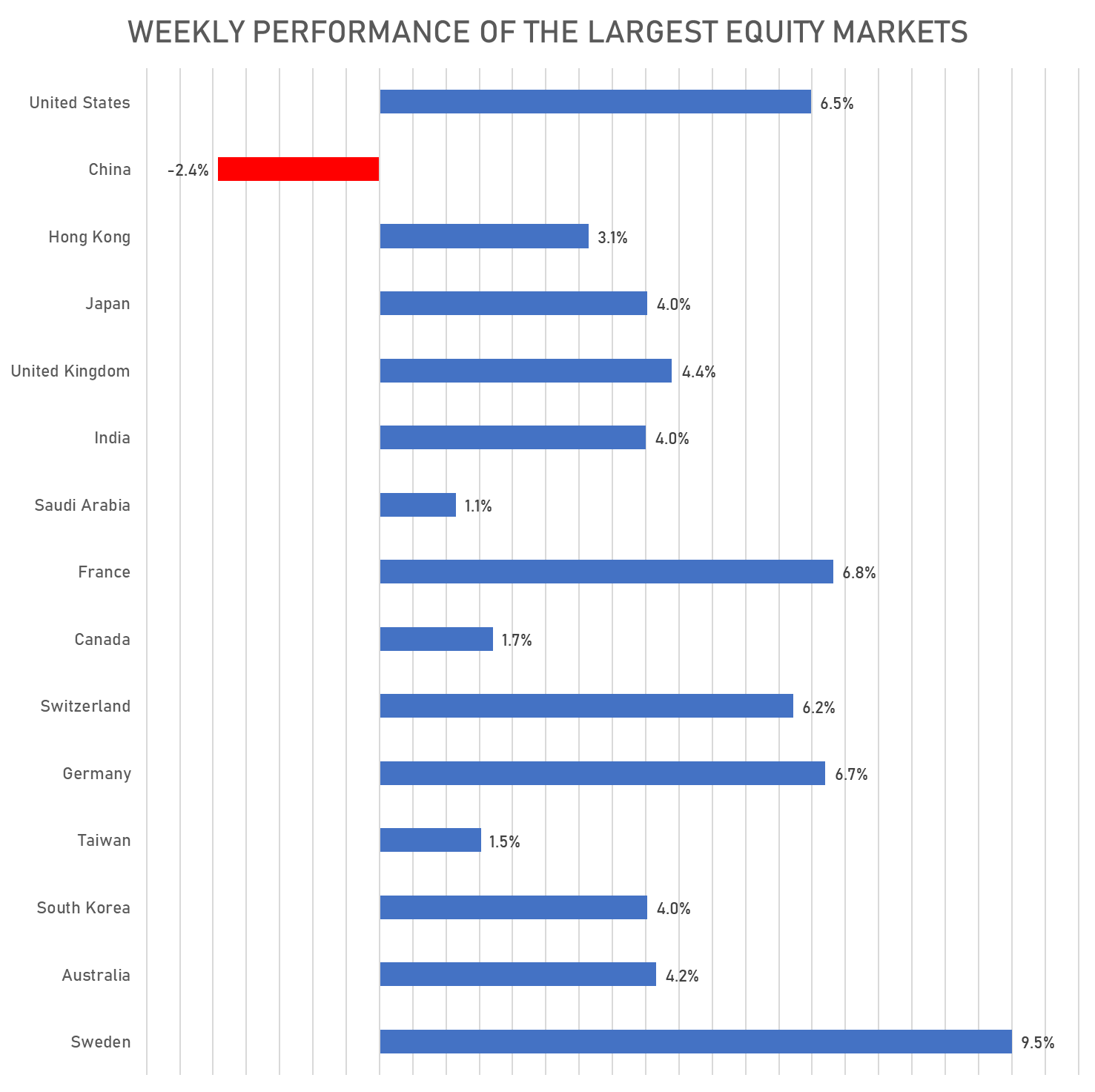

- Daily performance of international indices: Europe Stoxx 600 up 0.91%; UK FTSE 100 up 0.26%; Hang Seng SH-SZ-HK 300 Index down -0.02%; Japan's TOPIX 500 up 0.54%

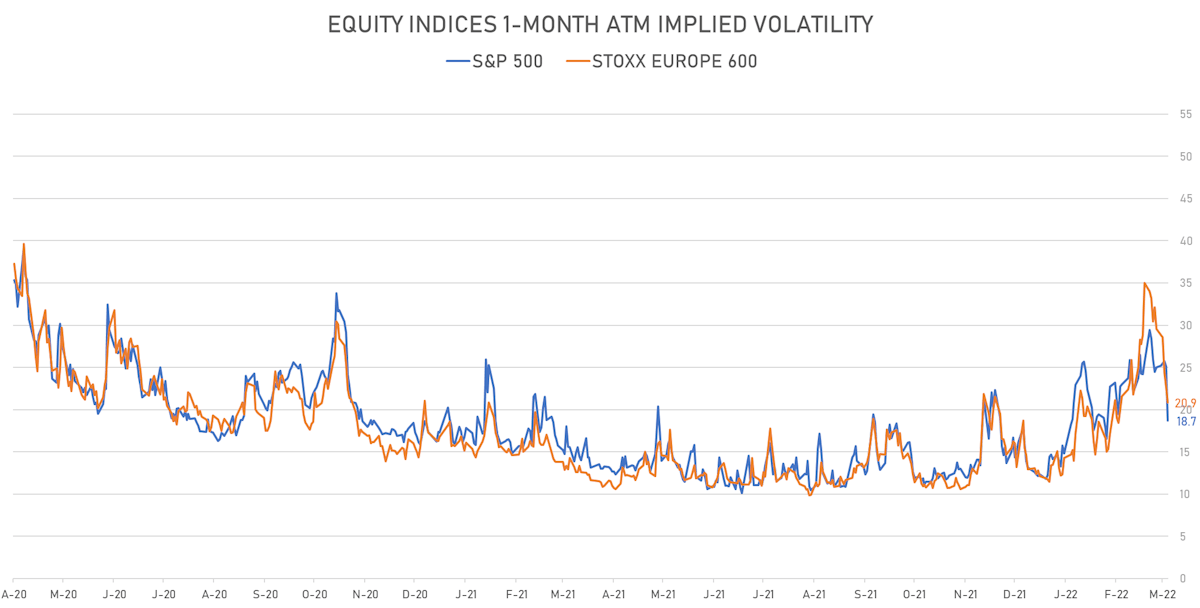

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 18.7%, down from 25.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 20.9%, down from 22.7%

TOP WINNERS TODAY

- DiDi Global Inc (DIDI), up 59.8% to $4.09 / YTD price return: -17.9% / 12-Month Price Range: $ 1.71-18.01 / Short interest (% of float): 0.7%; days to cover: 1.2

- Zhihu Inc (ZH), up 54.9% to $3.16 / YTD price return: -43.0% / 12-Month Price Range: $ 1.39-13.85 / Short interest (% of float): 3.1%; days to cover: 8.0 (the stock is currently on the short sale restriction list)

- StoneCo Ltd (STNE), up 42.0% to $13.65 / YTD price return: -19.0% / 12-Month Price Range: $ 8.05-71.08

- Tuya Inc (TUYA), up 35.2% to $3.80 / YTD price return: -39.2% / 12-Month Price Range: $ 1.75-27.65 / Short interest (% of float): 2.4%; days to cover: 6.0 (the stock is currently on the short sale restriction list)

- GitLab Inc (GTLB), up 27.1% to $62.79 / YTD price return: -27.8% / 12-Month Price Range: $ 30.74-137.00 / Short interest (% of float): 18.1%; days to cover: 4.6

- Dave Inc (DAVE), up 27.0% to $10.11 / 12-Month Price Range: $ 3.95-15.35 / Short interest (% of float): 0.8%; days to cover: 1.3

- Sky Harbour Group Corp (SKYH), up 24.7% to $35.72 / YTD price return: +251.2% / 12-Month Price Range: $ 5.25-33.16 / Short interest (% of float): 3.4%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- PagSeguro Digital Ltd (PAGS), up 22.5% to $17.85 / YTD price return: -31.9% / 12-Month Price Range: $ 11.76-61.65 / Short interest (% of float): 4.2%; days to cover: 3.9

- VEON Ltd (VEON), up 22.1% to $.65 / 12-Month Price Range: $ .24-2.38 / Short interest (% of float): 0.6%; days to cover: 0.9

- Tencent Music Entertainment Group (TME), up 20.8% to $5.06 / YTD price return: -26.1% / 12-Month Price Range: $ 2.95-32.25 / Short interest (% of float): 5.0%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

BIGGEST LOSERS TODAY

- Nymox Pharmaceutical Corp (NYMX), down 28.9% to $1.35 / 12-Month Price Range: $ .94-2.87 / Short interest (% of float): 4.7%; days to cover: 18.9 (the stock is currently on the short sale restriction list)

- Ambac Financial Group Inc (AMBC), down 22.5% to $9.16 / YTD price return: -42.9% / 12-Month Price Range: $ 11.68-18.58 / Short interest (% of float): 7.3%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- AgileThought Inc (AGIL), down 14.0% to $4.30 / YTD price return: -8.9% / 12-Month Price Range: $ 3.95-36.13 / Short interest (% of float): 2.4%; days to cover: 13.1 (the stock is currently on the short sale restriction list)

- Golden Matrix Group Inc (GMGI), down 13.5% to $7.49 / 12-Month Price Range: $ 4.65-14.05 (the stock is currently on the short sale restriction list)

- Tailwind Two Acquisition Corp (TWNT), down 13.5% to $8.40 / YTD price return: -15.1% / 12-Month Price Range: $ 8.79-10.10 / Short interest (% of float): 3.6%; days to cover: 5.7 (the stock is currently on the short sale restriction list)

- Singularity Future Technology Ltd (SGLY), down 13.1% to $8.90 / YTD price return: +86.6% / 12-Month Price Range: $ 2.09-11.46 / Short interest (% of float): 7.0%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Cellectis SA (CLLS), down 12.9% to $4.06 / YTD price return: -50.0% / 12-Month Price Range: $ 3.43-22.20 / Short interest (% of float): 5.1%; days to cover: 6.7 (the stock is currently on the short sale restriction list)

- Battalion Oil Corp (BATL), down 11.5% to $16.31 / YTD price return: +66.4% / 12-Month Price Range: $ 7.31-23.33 / Short interest (% of float): 1.4%; days to cover: 6.1 (the stock is currently on the short sale restriction list)

- Kala Pharmaceuticals Inc (KALA), down 11.4% to $1.56 / YTD price return: +28.9% / 12-Month Price Range: $ .59-8.38 / Short interest (% of float): 6.3%; days to cover: 7.4 (the stock is currently on the short sale restriction list)

- 5E Advanced Materials Inc (FEAM), down 11.3% to $26.00 / 12-Month Price Range: $ 27.03-49.50 (the stock is currently on the short sale restriction list)

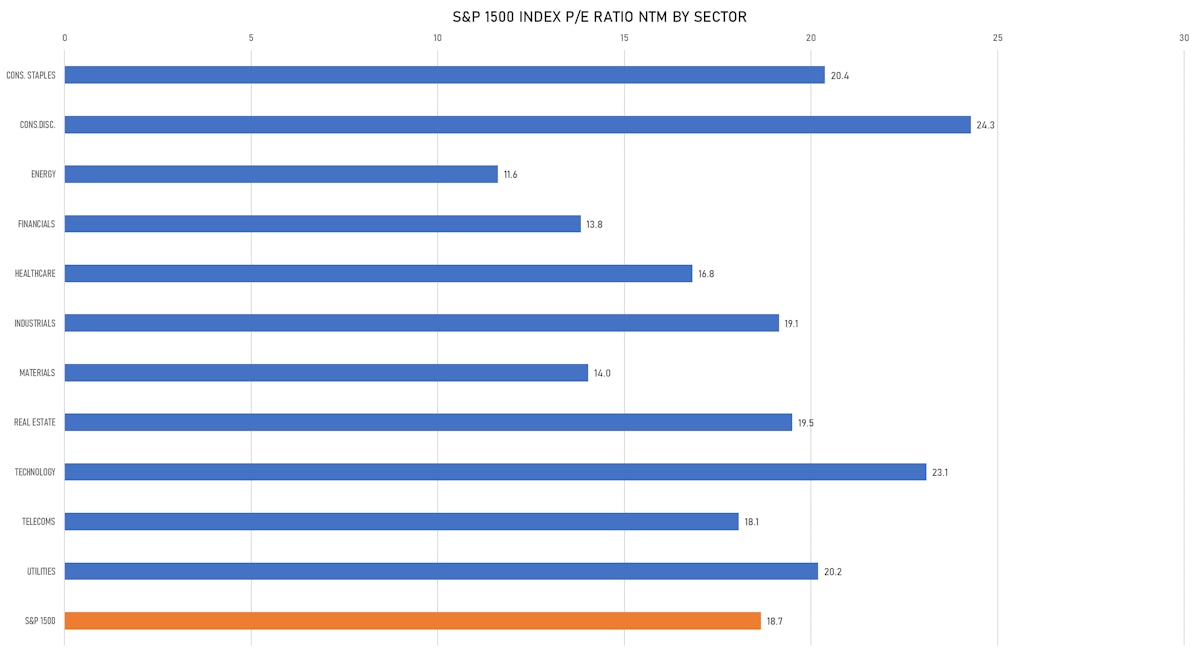

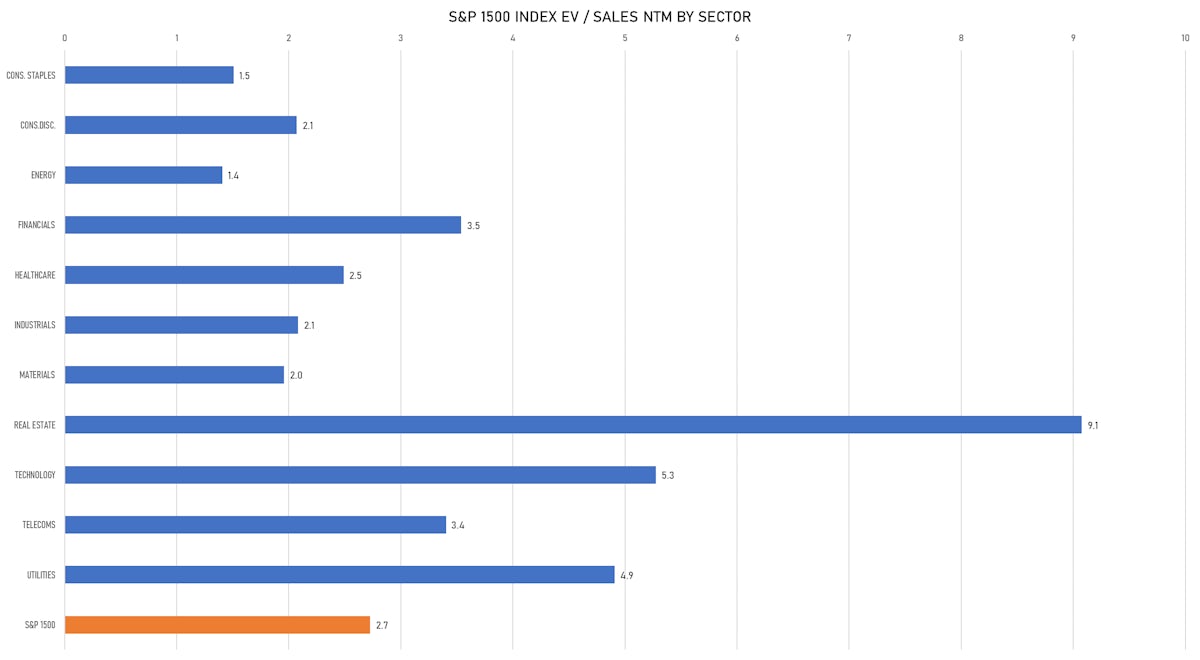

VALUATION MULTIPLES BY SECTORS

IPOs RECENTLY ANNOUNCED OR PRICED

- Israel Acquisitions Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ISRLU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: BTIG LLC

- Zhejiang Leapmotor Technology Co Ltd / China - Industrials / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar)

- Wankai New Materials Co Ltd (Chemicals | Haining, China (Mainland)), raised US$ 481 M, placing 86 M class a ordinary shares. Financial advisors on the transaction: China International Capital Corp

RECENT SECONDARIES / FOLLOW-ONS

- Arbor Realty Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: ABR / Gross proceeds (including overallotment): US$ 108.88m (offering in U.S. Dollar) / Bookrunners: Raymond James & Associates Inc, JMP Securities LLC, JP Morgan Securities LLC

- Wuxi Chipown Micro-Electronics Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 688508 / Gross proceeds (including overallotment): US$ 173.16m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Hunan Kaimeite Gases Co Ltd / China - Materials / Listing Exchange: Shenzhen / Ticker: 002549 / Gross proceeds (including overallotment): US$ 157.58m (offering in Chinese Yuan) / Bookrunners: Not Applicable

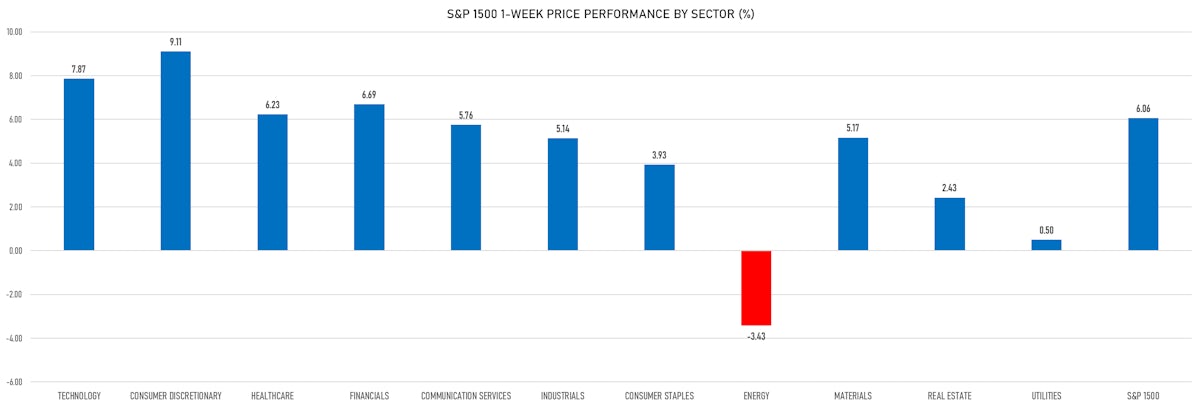

WEEKLY PERFORMANCE OF THE LARGEST GLOBAL EQUITY MARKETS

TOP / BOTTOM PERFORMING COUNTRIES YEAR-TO-DATE

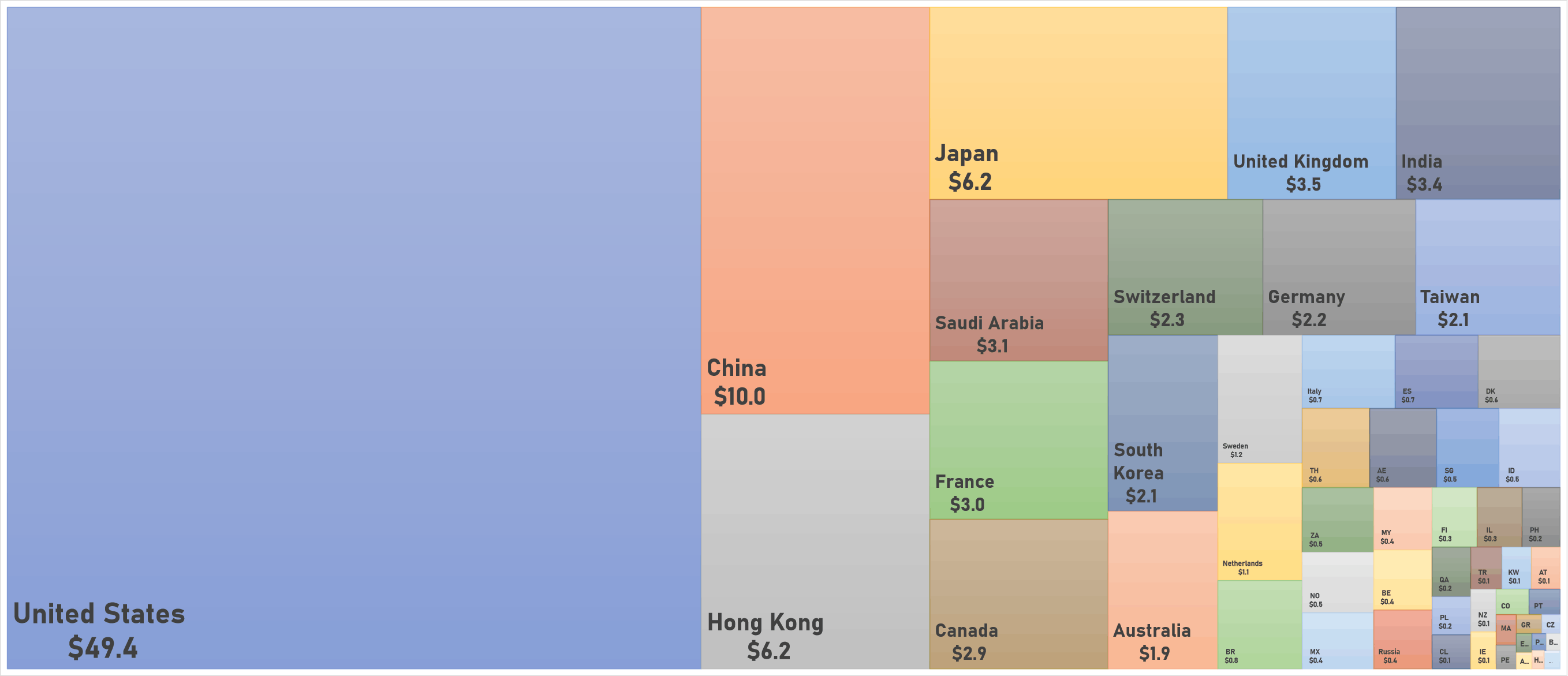

WORLD MARKET CAPITALIZATION (US$ Trillion)