Equities

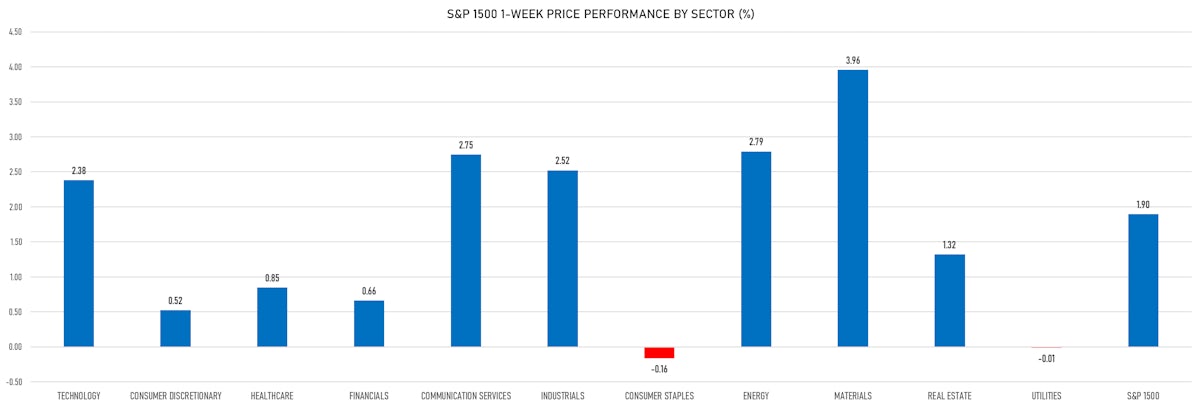

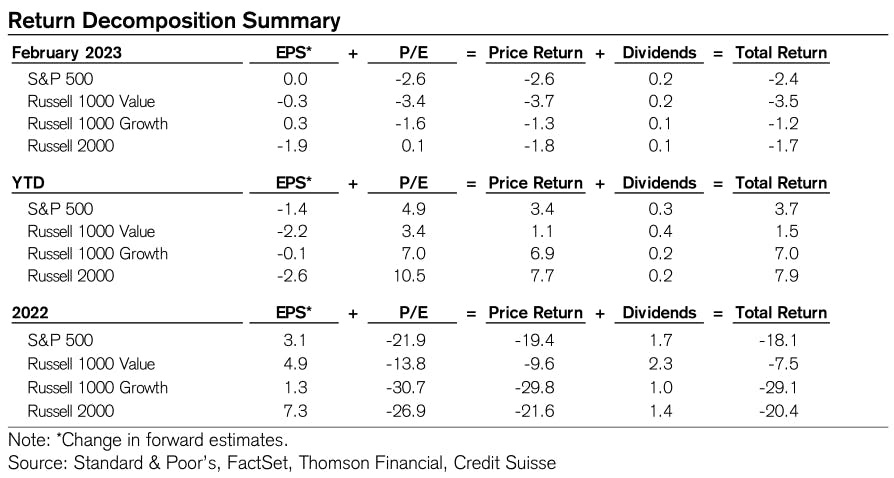

Broad Rebound For US Equities This Week, Though S&P 500 Ends February Down 2.6%

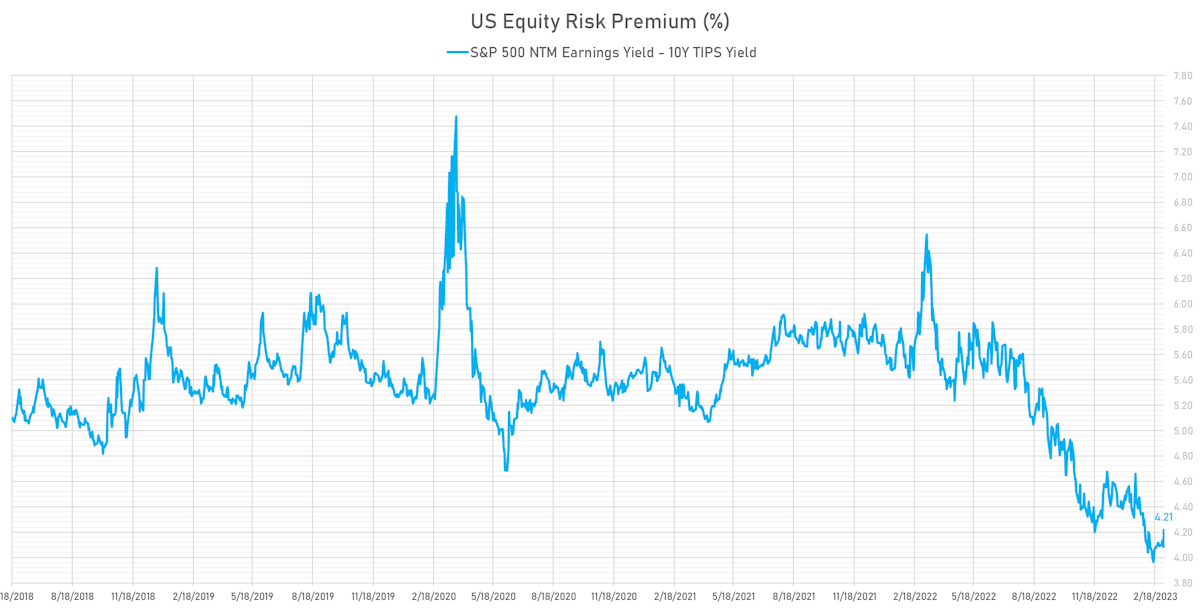

The story of equities so far this year has been one of resilient revenue, declining margins and expanding valuations on the back of more positive than expected growth; as such, the greatest risk to the market remains that of recession and growth downgrades

Published ET

US Equity Risk Premium | Sources: phipost.com, Refinitiv & FactSet data

DAILY SUMMARY

- Daily performance of US indices: S&P 500 up 1.61%; Nasdaq Composite up 1.97%; Wilshire 5000 up 1.35%

- 88.5% of S&P 500 stocks were up today, with 60.6% of stocks above their 200-day moving average (DMA) and 52.1% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 2.14% and consumer discretionary up 2.12%

- Bottom performing sectors in the S&P 500: consumer staples up 0.08% and industrials up 1.06%

- The number of shares in the S&P 500 traded today was 618m for a total turnover of US$ 63 bn

- The S&P 500 Value Index Index was up 1.6%, while the S&P 500 Growth Index Index was up 1.7%; the S&P small caps index was up 1.2% and mid caps were up 1.0%

- The volume on CME's INX (S&P 500 Index) was 2,228.3m (3-month z-score: -0.4); the 3-month average volume is 2,417.5m and the 12-month range is 903.0 - 5,089.5m

- Daily performance of international indices: Europe Stoxx 600 up 0.92%; UK FTSE 100 up 0.04%; Hang Seng SH-SZ-HK 300 Index up 0.59%; Japan's TOPIX 500 up 1.28%

VOLATILITY TODAY

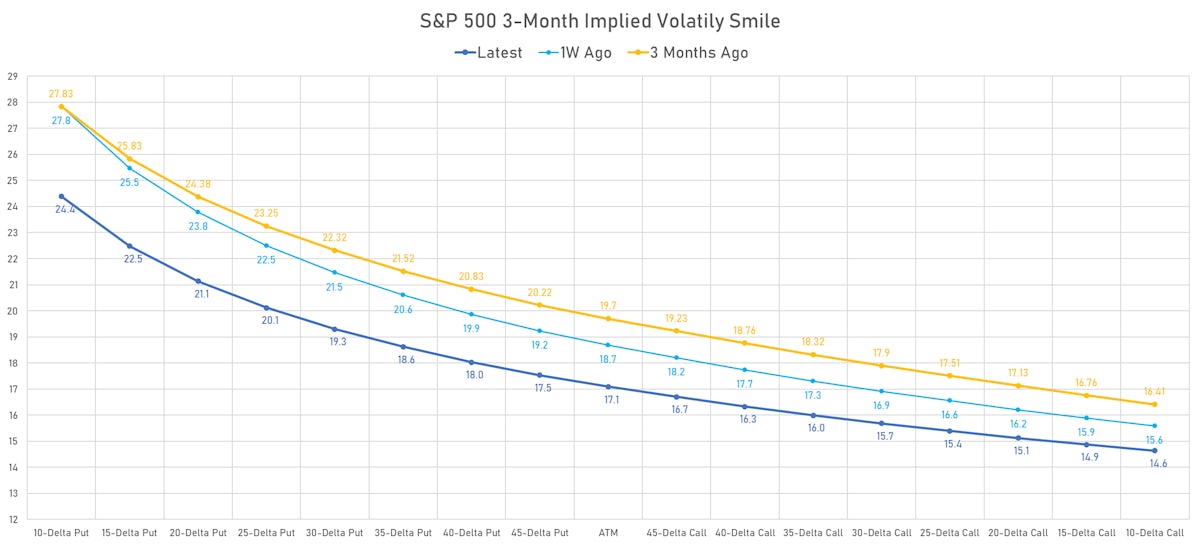

- 3-month at-the-money implied volatility on the S&P 500 at 17.1%, down from 17.8%

- 3-month at-the-money implied volatility on the STOXX Europe 600 at 13.3%, down from 14.2%

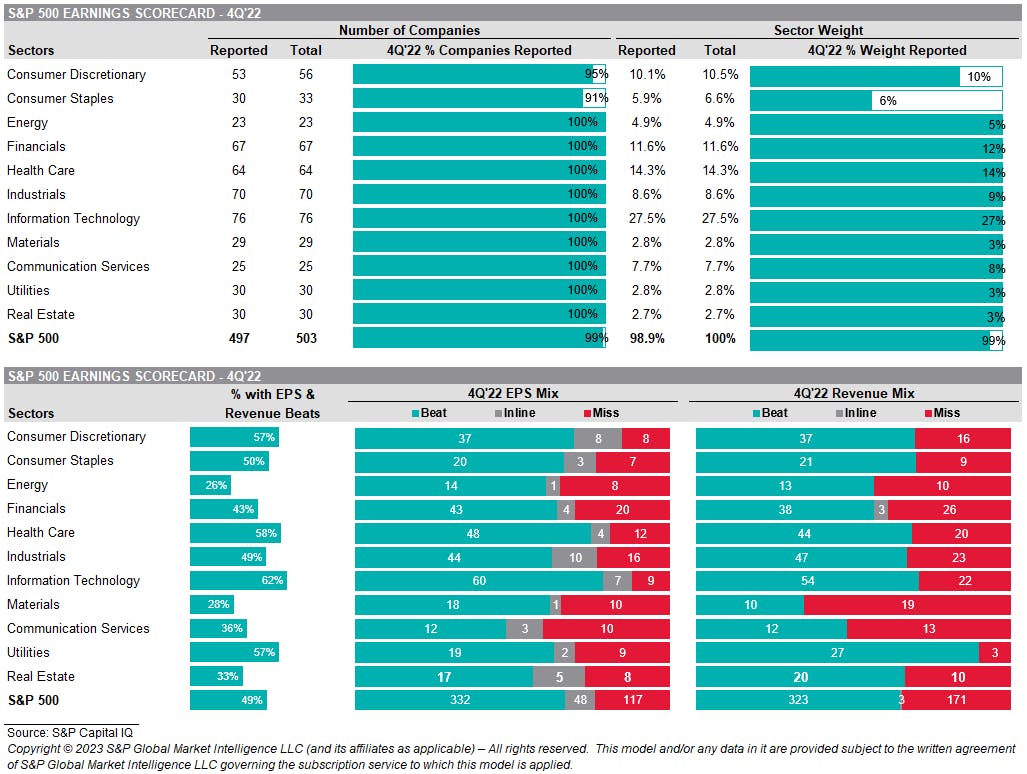

4Q22 EARNINGS DASHBOARD

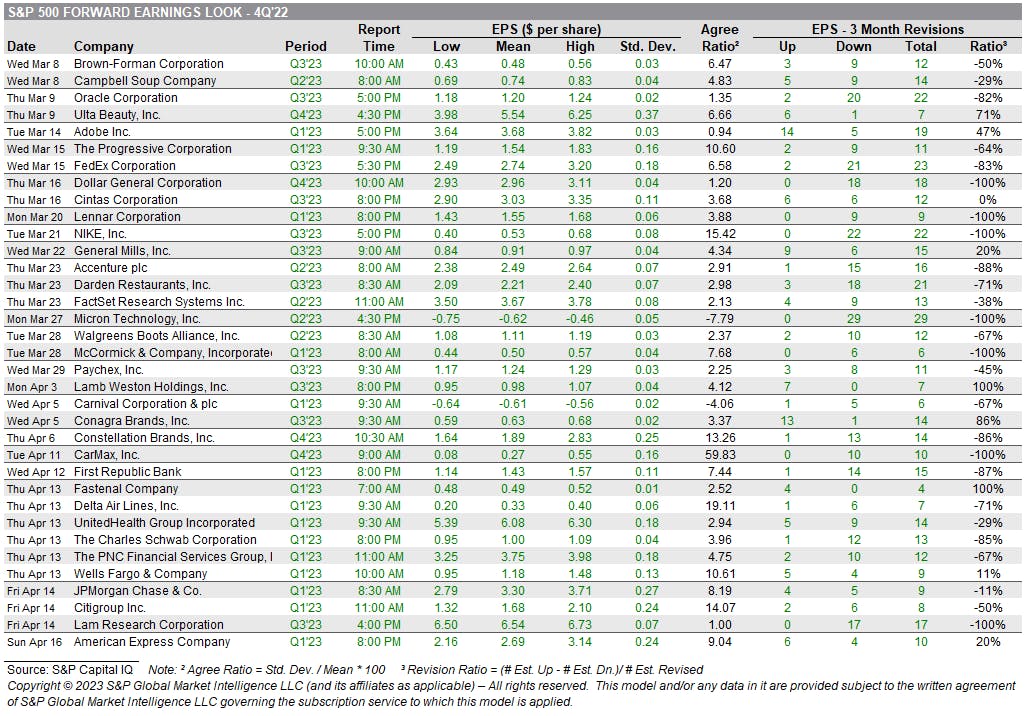

S&P 500 EARNINGS IN WEEKS TO COME

TOP WINNERS TODAY

- C3.ai Inc (AI), up 33.6% to $28.48 / YTD price return: +154.5% / 12-Month Price Range: $ 10.16-30.92 / Short interest (% of float): 23.2%; days to cover: 1.1

- Ardelyx Inc (ARDX), up 32.2% to $3.82 / YTD price return: +34.0% / 12-Month Price Range: $ 0.49-3.82 / Short interest (% of float): 5.5%; days to cover: 1.7

- Seer Inc (SEER), up 29.5% to $5.45 / YTD price return: -6.0% / 12-Month Price Range: $ 3.60-16.53 / Short interest (% of float): 5.3%; days to cover: 7.8

- SoundHound AI Inc (SOUN), up 24.5% to $3.15 / YTD price return: +78.0% / 12-Month Price Range: $ 0.93-18.14 / Short interest (% of float): 11.7%; days to cover: 0.9

- Lexicon Pharmaceuticals Inc (LXRX), up 22.9% to $2.68 / YTD price return: +40.3% / 12-Month Price Range: $ 1.31-3.48 / Short interest (% of float): 2.2%; days to cover: 13.1

- LivePerson Inc (LPSN), up 19.4% to $11.50 / YTD price return: +13.4% / 12-Month Price Range: $ 7.96-26.66

- Gaotu Techedu Inc (GOTU), up 17.5% to $5.16 / YTD price return: +118.6% / 12-Month Price Range: $ 0.64-5.16 / Short interest (% of float): 7.7%; days to cover: 2.0

- Veritone Inc (VERI), up 17.0% to $7.44 / YTD price return: +40.4% / 12-Month Price Range: $ 4.57-20.25 / Short interest (% of float): 13.3%; days to cover: 4.2

- Structure Therapeutics Inc (GPCR), up 16.3% to $26.55 / 12-Month Price Range: $ 20.80-30.00

- Xponential Fitness Inc (XPOF), up 16.1% to $29.32 / YTD price return: +27.9% / 12-Month Price Range: $ 11.20-29.32 / Short interest (% of float): 16.0%; days to cover: 5.8

BIGGEST LOSERS TODAY

- Summit Therapeutics Inc (SMMT), down 21.0% to $1.54 / YTD price return: -63.8% / 12-Month Price Range: $ .66-5.78 / Short interest (% of float): 15.6%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- CareDx Inc (CDNA), down 16.7% to $8.97 / YTD price return: -21.4% / 12-Month Price Range: $ 8.97-41.50 / Short interest (% of float): 9.5%; days to cover: 5.8 (the stock is currently on the short sale restriction list)

- Eagle Bulk Shipping Inc (EGLE), down 15.7% to $55.39 / YTD price return: +10.9% / 12-Month Price Range: $ 40.13-78.75 / Short interest (% of float): 9.8%; days to cover: 6.3 (the stock is currently on the short sale restriction list)

- Viemed Healthcare Inc (VMD), down 12.2% to $7.90 / YTD price return: +4.5% / 12-Month Price Range: $ 3.56-9.41 / Short interest (% of float): 0.4%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Zscaler Inc (ZS), down 11.1% to $119.24 / YTD price return: +6.6% / 12-Month Price Range: $ 99.64-256.41 (the stock is currently on the short sale restriction list)

- Proterra Inc (PTRA), down 10.6% to $3.71 / YTD price return: -1.6% / 12-Month Price Range: $ 3.48-8.02 / Short interest (% of float): 5.7%; days to cover: 9.3 (the stock is currently on the short sale restriction list)

- Rhythm Pharmaceuticals Inc (RYTM), down 10.6% to $21.77 / YTD price return: -25.2% / 12-Month Price Range: $ 3.04-34.99 / Short interest (% of float): 14.5%; days to cover: 14.9 (the stock is currently on the short sale restriction list)

- Bumble Inc (BMBL), down 8.8% to $22.38 / YTD price return: +6.3% / 12-Month Price Range: $ 15.41-39.33 / Short interest (% of float): 4.7%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- TPB Acquisition Corporation I (LVRO), down 8.8% to $8.76 / YTD price return: -12.7% / 12-Month Price Range: $ 7.56-12.29 / Short interest (% of float): 0.4%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- V2X Inc (VVX), down 8.6% to $45.32 / YTD price return: +9.8% / 12-Month Price Range: $ 29.55-50.16 (the stock is currently on the short sale restriction list)

TOP S&P 500 PERFORMERS THIS WEEK

- First Solar Inc (FSLR), up 29.6% to $210.11 / YTD price return: +40.3% / 12-Month Price Range: $ 59.60-210.11 / Short interest (% of float): 3.5%; days to cover: 1.6

- Salesforce Inc (CRM), up 14.9% to $186.43 / YTD price return: +40.6% / 12-Month Price Range: $ 126.34-222.13 / Short interest (% of float): 1.1%; days to cover: 1.2

- Steel Dynamics Inc (STLD), up 14.8% to $136.06 / YTD price return: +39.3% / 12-Month Price Range: $ 62.44-136.06 / Short interest (% of float): 2.7%; days to cover: 2.6

- DENTSPLY SIRONA Inc (XRAY), up 12.8% to $38.74 / YTD price return: +21.7% / 12-Month Price Range: $ 26.48-53.48 / Short interest (% of float): 4.4%; days to cover: 4.5

- Illumina Inc (ILMN), up 12.5% to $221.21 / YTD price return: +9.4% / 12-Month Price Range: $ 173.48-370.98 / Short interest (% of float): 2.6%; days to cover: 3.0

- Dexcom Inc (DXCM), up 11.7% to $122.92 / YTD price return: +8.5% / 12-Month Price Range: $ 66.94-134.50 / Short interest (% of float): 3.4%; days to cover: 4.9

- Mosaic Co (MOS), up 10.9% to $57.14 / YTD price return: +30.2% / 12-Month Price Range: $ 41.92-79.25 / Short interest (% of float): 2.5%; days to cover: 2.2

- Solaredge Technologies Inc (SEDG), up 10.3% to $326.83 / YTD price return: +15.4% / 12-Month Price Range: $ 190.15-375.14 / Short interest (% of float): 4.4%; days to cover: 2.1

- Ford Motor Co (F), up 10.1% to $13.08 / YTD price return: +18.2% / 12-Month Price Range: $ 10.10-17.34 / Short interest (% of float): 3.3%; days to cover: 2.0

- Nucor Corp (NUE), up 9.7% to $178.37 / YTD price return: +35.3% / 12-Month Price Range: $ 100.23-187.90 / Short interest (% of float): 2.4%; days to cover: 3.1

BOTTOM S&P 500 PERFORMERS THIS WEEK

- DISH Network Corp (DISH), down 15.4% to $11.23 / YTD price return: -20.0% / 12-Month Price Range: $ 10.65-33.72 / Short interest (% of float): 11.9%; days to cover: 7.0

- Universal Health Services Inc (UHS), down 13.5% to $127.12 / YTD price return: -9.8% / 12-Month Price Range: $ 82.52-158.24 / Short interest (% of float): 2.4%; days to cover: 2.7

- Lumen Technologies Inc (LUMN), down 11.0% to $3.17 / YTD price return: -39.3% / 12-Month Price Range: $ 3.13-12.54 / Short interest (% of float): 14.5%; days to cover: 4.8

- Hormel Foods Corp (HRL), down 9.9% to $40.63 / YTD price return: -10.8% / 12-Month Price Range: $ 40.63-55.11 / Short interest (% of float): 3.1%; days to cover: 5.5

- Alexandria Real Estate Equities Inc (ARE), down 5.2% to $143.83 / YTD price return: -1.3% / 12-Month Price Range: $ 126.75-206.76 / Short interest (% of float): 1.1%; days to cover: 2.7

- CVS Health Corp (CVS), down 4.6% to $81.81 / YTD price return: -12.2% / 12-Month Price Range: $ 81.36-109.67 / Short interest (% of float): 1.1%; days to cover: 1.4

- Gen Digital Inc (GEN), down 4.5% to $19.26 / YTD price return: -10.1% / 12-Month Price Range: $ 19.03-30.30 / Short interest (% of float): 2.3%; days to cover: 4.0

- Organon & Co (OGN), down 4.0% to $24.56 / YTD price return: -12.1% / 12-Month Price Range: $ 22.88-39.20 / Short interest (% of float): 2.2%; days to cover: 3.1

- Charles Schwab Corp (SCHW), down 4.0% to $77.41 / YTD price return: -7.0% / 12-Month Price Range: $ 59.35-93.14 / Short interest (% of float): 0.6%; days to cover: 1.2

- Genuine Parts Co (GPC), down 3.9% to $171.80 / YTD price return: -1.0% / 12-Month Price Range: $ 118.17-187.69 / Short interest (% of float): 2.3%; days to cover: 3.3

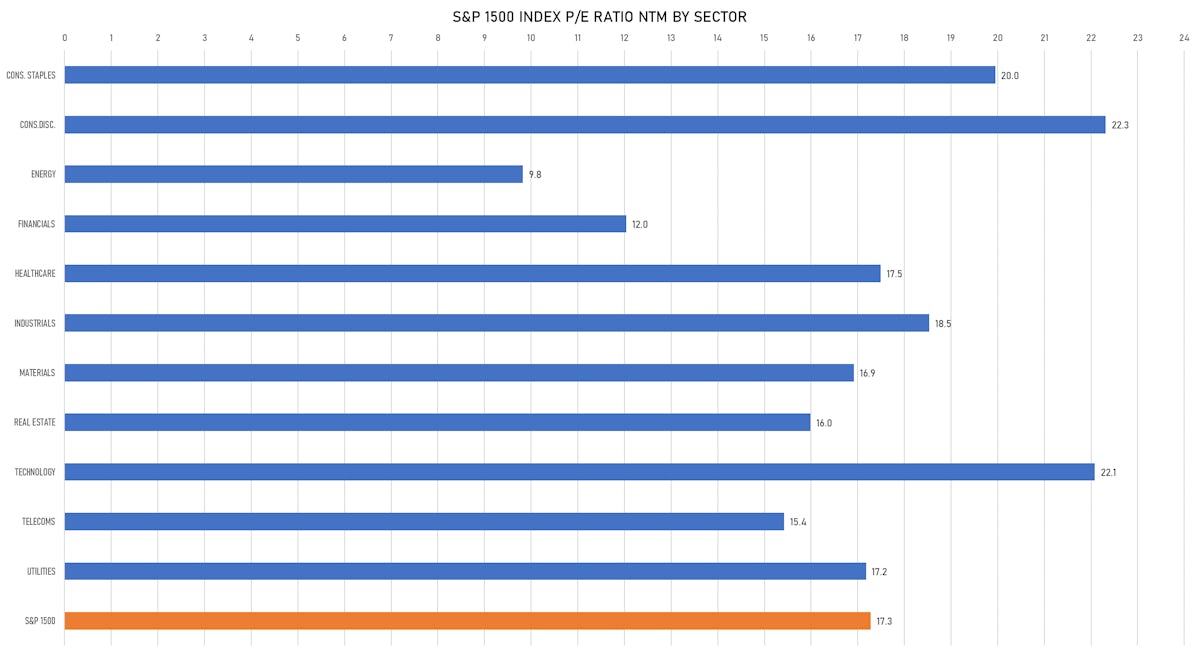

VALUATION MULTIPLES BY SECTORS

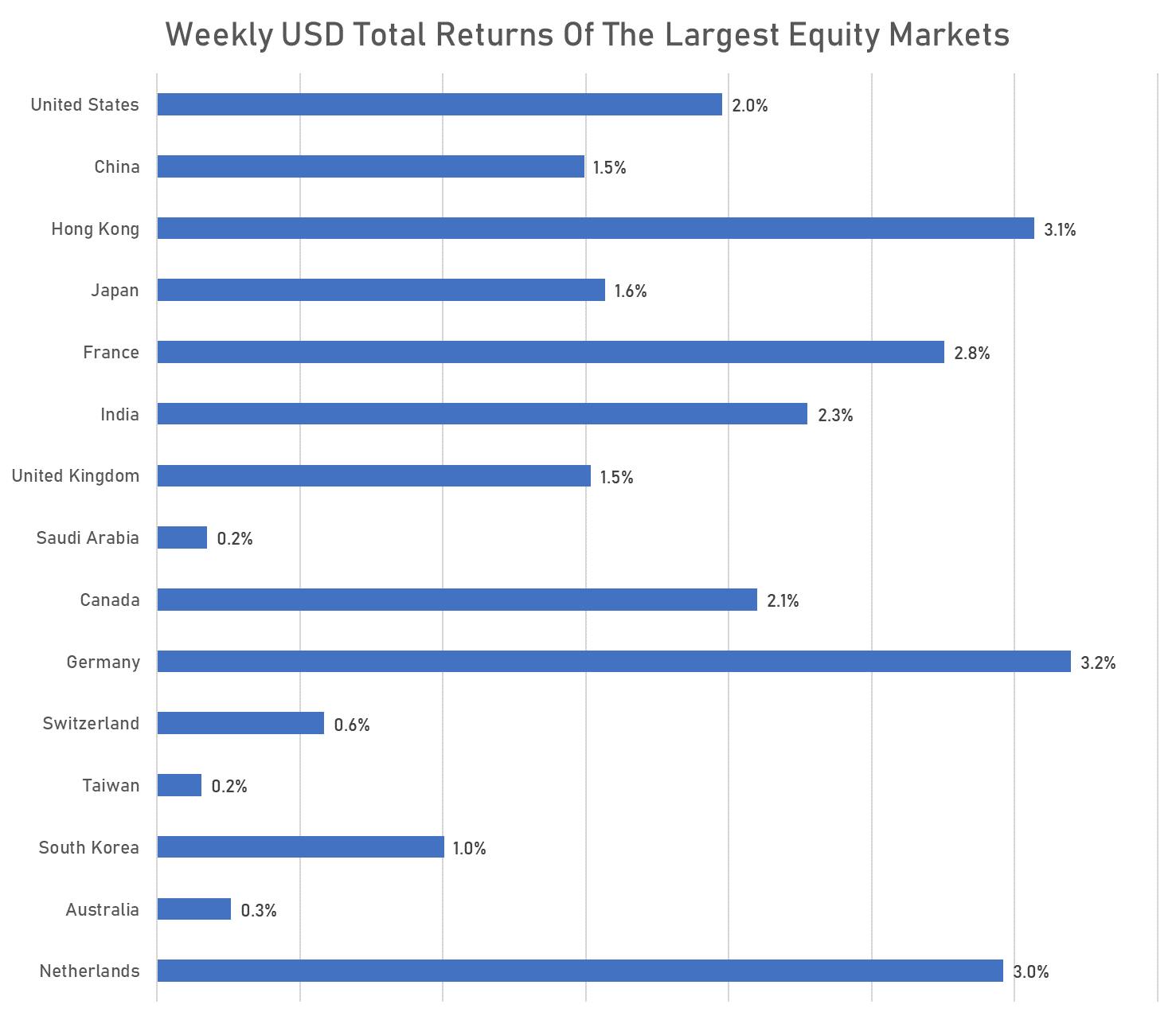

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

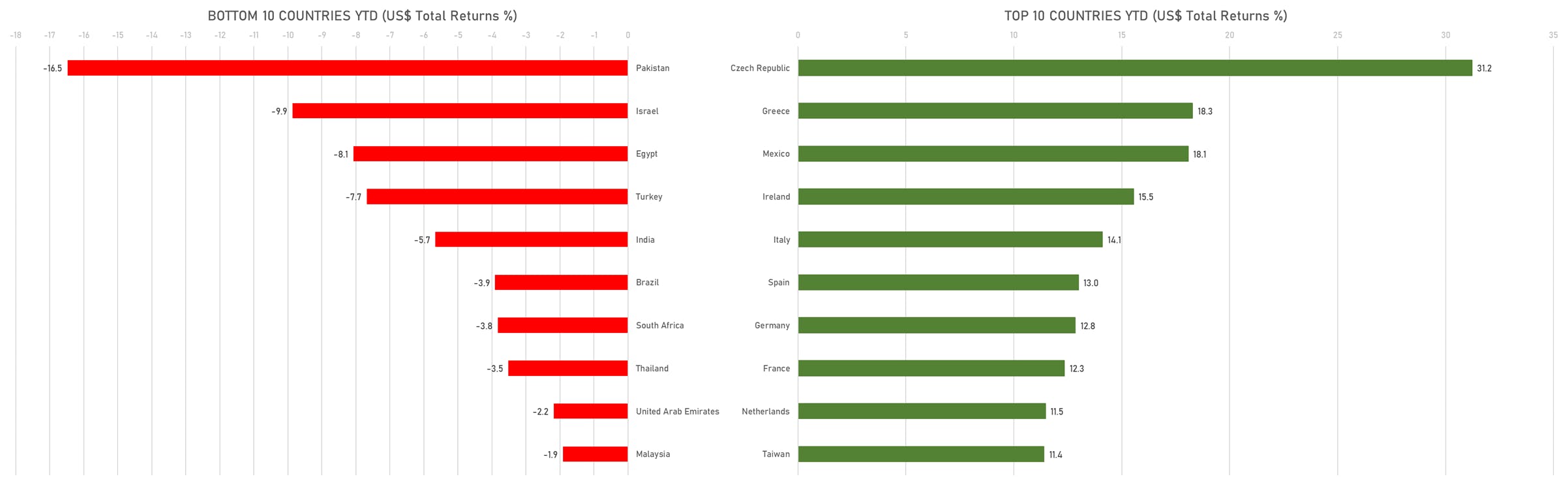

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

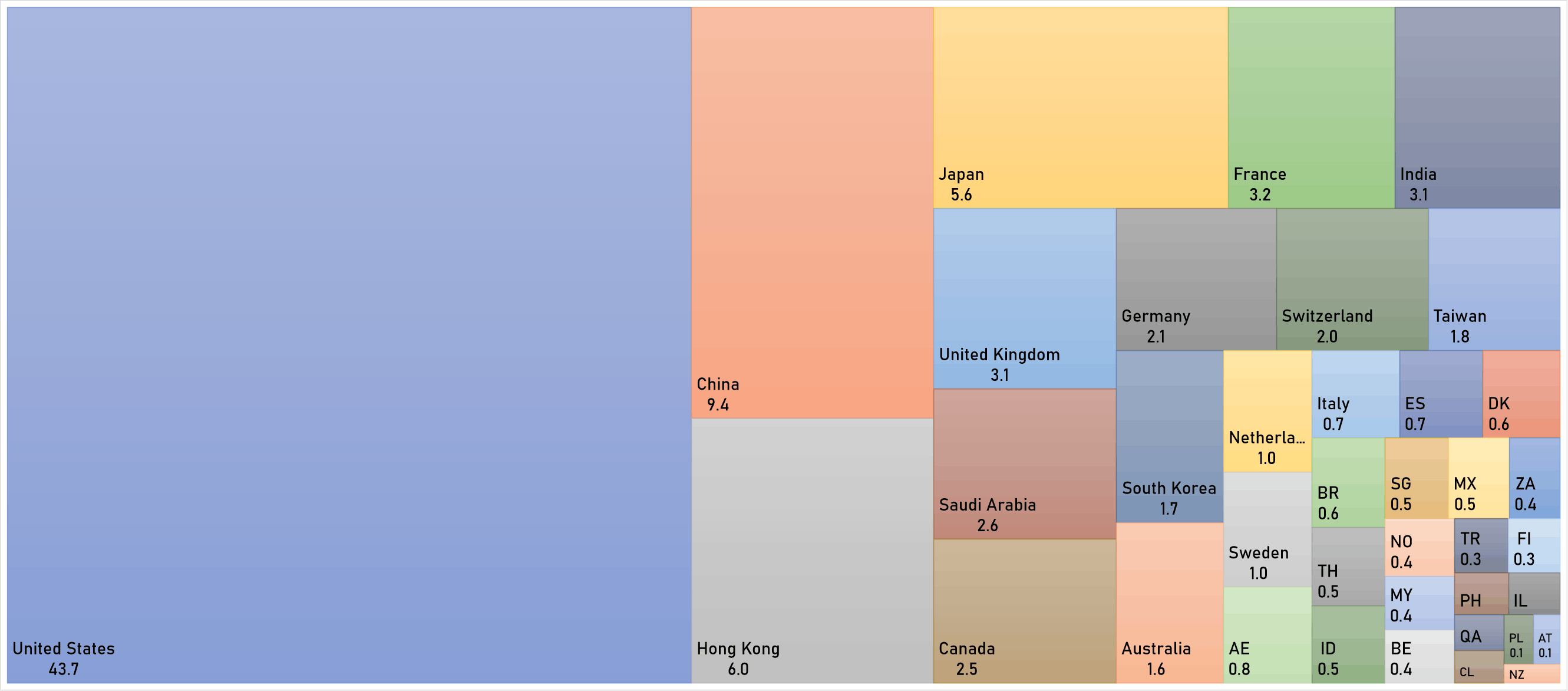

WORLD MARKET CAPITALIZATION (US$ Trillion)

IPOs RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- NEXTracker Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: NXT / Gross proceeds (including overallotment): US$ 638.40m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, JP Morgan Securities LLC, BofA Securities Inc, Barclays Capital Inc

- Mineralys Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: MLYS / Gross proceeds (including overallotment): US$ 192.00m (offering in U.S. Dollar) / Bookrunners: Stifel Nicolaus & Co Inc, Evercore Group, BofA Securities Inc

- Structure Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: GPCR / Gross proceeds (including overallotment): US$ 185.27m (offering in U.S. Dollar) / Bookrunners: Guggenheim Securities LLC, BMO Capital Markets, Jefferies LLC, SVB Securities LLC

- Keen Vision Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: N/A / Gross proceeds (including overallotment): US$ 130.00m (offering in U.S. Dollar) / Bookrunners: Brookline Capital Markets, EF Hutton

- SilverBox Corp III / United States of America - Financials / Listing Exchange: New York / Ticker: SBXC / Gross proceeds (including overallotment): US$ 120.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC

IPOs RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- PT Amman Mineral Internasional / Indonesia - Materials / Listing Exchange: Indonesia / Ticker: - / Gross proceeds (including overallotment): US$ 987.81m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- PT Pertamina Geothermal Energy Tbk / Indonesia - Energy and Power / Listing Exchange: Indonesia / Ticker: PGEO / Gross proceeds (including overallotment): US$ 597.65m (offering in U.S. Dollar) / Bookrunners: PT Mandiri Sekuritas, Credit Suisse Sec Indonesia, Pt Clsa Sekuritas Indonesia

- Zhongran Smart Living E-Commerce Co Ltd / Hong Kong - Retail / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Guizhou Guotai Liquor Co Ltd / China - Consumer Staples / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- IONOS Group SE / Germany - High Technology / Listing Exchange: Frankfurt / Ticker: IOS / Gross proceeds (including overallotment): US$ 479.08m (offering in EURO) / Bookrunners: Barclays Bank (Ireland), Deutsche Bank, BNP Paribas SA, Joh Berenberg Gossler & Co KG(London Branch), Goldman Sachs Bank Europe SE, JP Morgan SE

- Eurogroup Laminations SpA / Italy - Energy and Power / Listing Exchange: Milan / Ticker: N/A / Gross proceeds (including overallotment): US$ 420.36m (offering in EURO) / Bookrunners: BNP Paribas SA, IMI - Intesa Sanpaolo, UniCredit Bank AG, JP Morgan SE

- Bounty Agro Ventures Inc / Philippines - Consumer Staples / Listing Exchange: Philippine / Ticker: - / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Lifestyles Healthcare Pte Ltd / Singapore - Healthcare / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Chuzhou Duoli Automotive Technology Co Ltd / China - Industrials / Listing Exchange: Shenzhen / Ticker: 001311 / Gross proceeds (including overallotment): US$ 289.04m (offering in Chinese Yuan) / Bookrunners: Guotai Junan Securities

- Seacrest Petroleo BV / Bermuda - Energy and Power / Listing Exchange: Oslo / Ticker: SEAPT / Gross proceeds (including overallotment): US$ 257.03m (offering in Norwegian Krone) / Bookrunners: ABG Sundal Collier, Pareto Securities, SpareBank 1 Markets AS

SECONDARIES RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- VICI Properties Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: VICI / Gross proceeds (including overallotment): US$ 1,500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- American Water Works Co Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: AWK / Gross proceeds (including overallotment): US$ 1,490.50m (offering in U.S. Dollar) / Bookrunners: RBC Capital Markets, Wells Fargo Securities LLC, BofA Securities Inc

- Rexford Industrial Realty Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: REXR / Gross proceeds (including overallotment): US$ 1,250.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- First Industrial Realty Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: FR / Gross proceeds (including overallotment): US$ 800.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Dynatrace Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: DT / Gross proceeds (including overallotment): US$ 683.25m (offering in U.S. Dollar) / Bookrunners: BofA Securities Inc

- Pimco Dynamic Income Opportunities Fund / United States of America - Financials / Listing Exchange: NYSE Alter / Ticker: PDO / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Summit Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: SUMM / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- MicroStrategy Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: MSTR / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Sabra Health Care REIT Inc / United States of America - Real Estate / Listing Exchange: Nasdaq / Ticker: SBRA / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- First Republic Bank,San Francisco,California / United States of America - Financials / Listing Exchange: New York / Ticker: FRC / Gross proceeds (including overallotment): US$ 402.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co, JP Morgan & Co Inc, BofA Securities Inc

- Vaxcyte Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PCVX / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Cousins Properties Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: CUZ / Gross proceeds (including overallotment): US$ 394.95m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Terreno Realty Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: TRNO / Gross proceeds (including overallotment): US$ 322.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, KeyBanc Capital Markets Inc

- Highwoods Properties Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: HIW / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- One Gas Inc / United States of America - Energy and Power / Listing Exchange: NYSE MKT / Ticker: OGS / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Invesco Mortgage Capital Inc / United States of America - Real Estate / Listing Exchange: NYSE MKT / Ticker: IVR / Gross proceeds (including overallotment): US$ 209.60m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Aclaris Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ACRS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Hillman Solutions Corp / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: HLMN / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Robert W Baird & Co Inc, Jefferies LLC

- Apellis Pharmaceuticals Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: APLS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Evercore Group, JP Morgan Securities LLC

- Arcus Biosciences Inc / United States of America - Healthcare / Listing Exchange: New York / Ticker: RCUS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

SECONDARIES RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- Japan Post Bank Co Ltd / Japan - Financials / Listing Exchange: TOKPR / Ticker: 7182 / Gross proceeds (including overallotment): US$ 6,429.85m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mizuho Securities Co Ltd, Goldman Sachs Japan Co., Ltd., Daiwa Securities Co Ltd, Mitsubishi UFJ Morgan Stanley Securities Co Ltd

- Link Real Estate Investment Trust / Hong Kong - Real Estate / Listing Exchange: Hong Kong / Ticker: 823 / Gross proceeds (including overallotment): US$ 2,396.66m (offering in Hong Kong Dollar) / Bookrunners: Hongkong & Shanghai Banking Corp Ltd

- China Vanke Co Ltd / China - Industrials / Listing Exchange: Shenzhen / Ticker: 000002 / Gross proceeds (including overallotment): US$ 2,203.61m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- BNP Paribas SA / France - Financials / Listing Exchange: Euro Paris / Ticker: BNP / Gross proceeds (including overallotment): US$ 1,539.26m (offering in EURO) / Bookrunners: Goldman Sachs & Co, Merrill Lynch International Ltd

- Hangzhou First Applied Material Co Ltd / China - Materials / Listing Exchange: Swiss Exch / Ticker: 603806 / Gross proceeds (including overallotment): US$ 1,380.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Heineken NV / Netherlands - Consumer Staples / Listing Exchange: EuronextAM / Ticker: HEIA / Gross proceeds (including overallotment): US$ 1,274.54m (offering in EURO) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co, BofA Securities Inc

- Heineken Holding NV / Netherlands - Consumer Staples / Listing Exchange: EuronextAM / Ticker: HEIO / Gross proceeds (including overallotment): US$ 1,102.69m (offering in EURO) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co, BofA Securities Inc

- GN Store Nord A/S / Denmark - Healthcare / Listing Exchange: OMX Copen / Ticker: GN / Gross proceeds (including overallotment): US$ 1,008.17m (offering in Danish Krone) / Bookrunners: JP Morgan & Co Inc, Nordea, BNP Paribas Securities Corp, SEB

- Beijer Ref AB / Sweden - Industrials / Listing Exchange: OMX Stock / Ticker: BEIJ B / Gross proceeds (including overallotment): US$ 886.58m (offering in Swedish Krona) / Bookrunners: Handelsbanken AS, Nordea, Citi

- PharmaEssentia Corp / Taiwan - Healthcare / Listing Exchange: Taiwan OTC / Ticker: 6446 / Gross proceeds (including overallotment): US$ 804.14m (offering in Taiwanese Dollar) / Bookrunners: Not Applicable

- CNNC Hua Yuan Titanium Dioxide Co Ltd / China - Materials / Listing Exchange: Shenzhen / Ticker: 002145 / Gross proceeds (including overallotment): US$ 770.92m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd, Zhongtai Securities Co Ltd, Morgan Stanley Securities (China) Co Ltd

- BNP Paribas SA / France - Financials / Listing Exchange: Euro Paris / Ticker: BNP / Gross proceeds (including overallotment): US$ 769.63m (offering in EURO) / Bookrunners: BNP Paribas SA