Equities

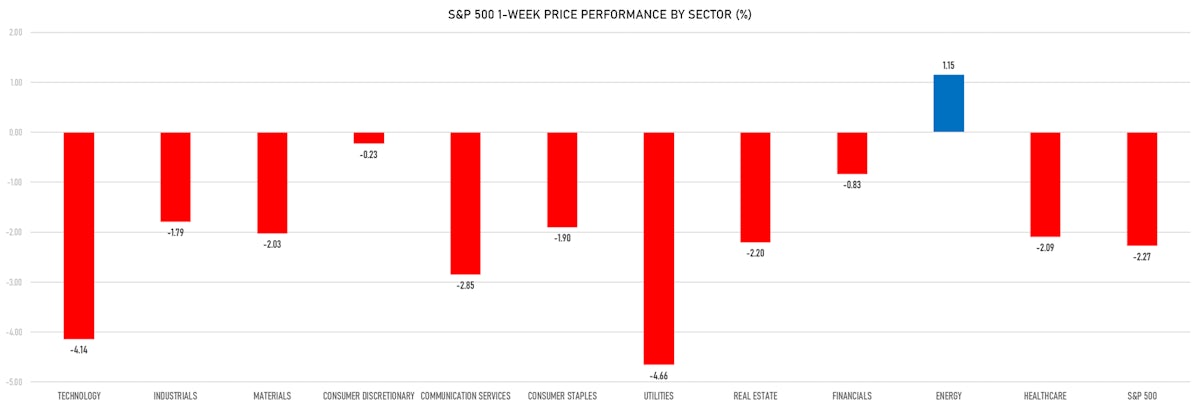

Stretched Sentiment And Positioning, Lower Summer Liquidity, Facilitate Short-Term Consolidation

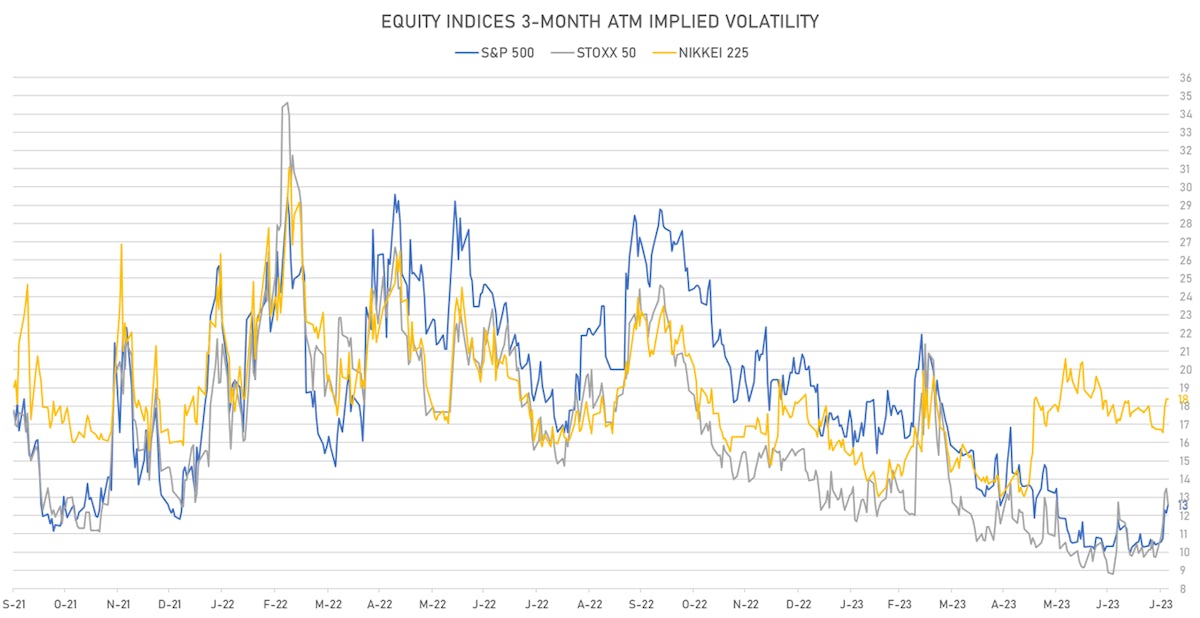

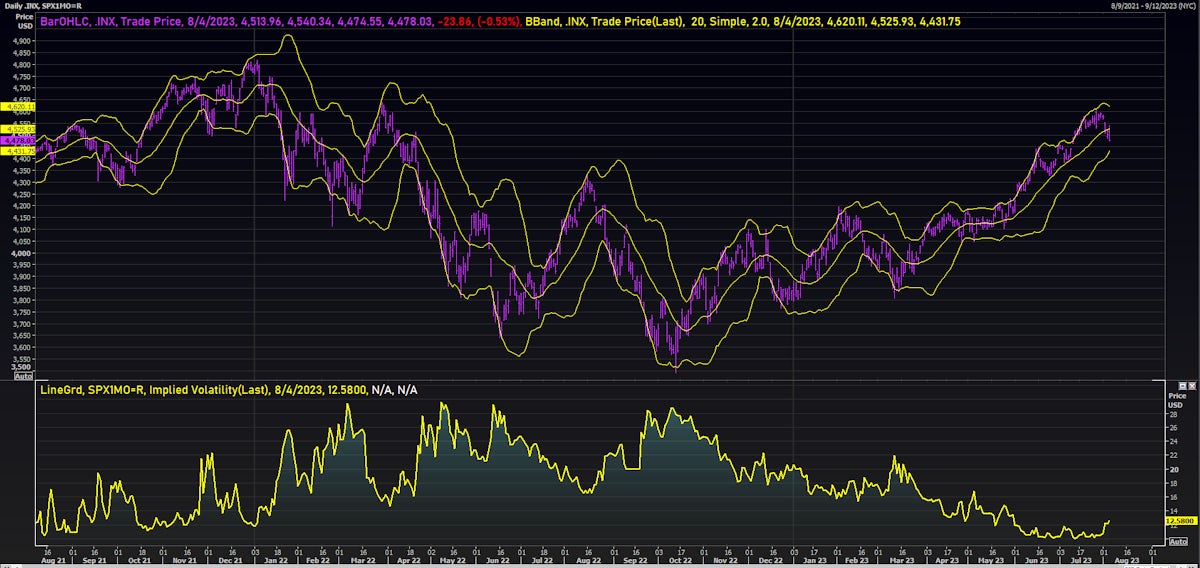

The low level of realized (and implied) volatility this year can largely be explained by the rise in dispersion (fall of correlation) of performance across single stocks and sectors

Published ET

S&P 500 Price Index & 1M ATM Implied Volatility | Source: Refinitiv

DAILY SUMMARY

- Daily performance of US indices: S&P 500 down -0.53%; Nasdaq Composite down -0.36%; Wilshire 5000 down -0.07%

- 31.8% of S&P 500 stocks were up today, with 62.0% of stocks above their 200-day moving average (DMA) and 61.2% above their 50-DMA

- Top performing sectors in the S&P 500: consumer discretionary up 1.91% and energy up 0.03%

- Bottom performing sectors in the S&P 500: technology down -1.49% and utilities down -1.21%

- The number of shares in the S&P 500 traded today was 635m for a total turnover of US$ 72 bn

- The S&P 500 Value Index Index was down -0.1%, while the S&P 500 Growth Index Index was down -0.9%; the S&P small caps index was up 0.1% and mid caps were down -0.2%

- The volume on CME's INX (S&P 500 Index) was 2,386.7m (3-month z-score: -0.1); the 3-month average volume is 2,428.0m and the 12-month range is 903.0 - 5,761.3m

- Daily performance of international indices: Europe Stoxx 600 up 0.29%; UK FTSE 100 up 0.47%; Hang Seng SH-SZ-HK 300 Index up 0.59%; Japan's TOPIX 500 up 0.26%

VOLATILITY TODAY

- 3-month at-the-money implied volatility on the S&P 500 at 12.6%, up from 12.2%

- 3-month at-the-money implied volatility on the STOXX Europe 600 at 13.4%, down from 14.1%

TOP WINNERS TODAY

- United States Cellular Corp (USM), up 92.9% to $33.76 / YTD price return: +61.9% / 12-Month Price Range: $ 13.79-33.76 / Short interest (% of float): 4.8%; days to cover: 1.5

- Telephone and Data Systems Inc (TDS), up 87.8% to $14.84 / YTD price return: +41.5% / 12-Month Price Range: $ 6.44-17.42 / Short interest (% of float): 5.7%; days to cover: 2.1

- Applied Optoelectronics Inc (AAOI), up 67.1% to $11.01 / YTD price return: +482.5% / 12-Month Price Range: $ 1.60-11.48 / Short interest (% of float): 21.5%; days to cover: 1.9

- Alector Inc (ALEC), up 32.4% to $8.77 / YTD price return: -5.0% / 12-Month Price Range: $ 5.65-13.50 / Short interest (% of float): 7.9%; days to cover: 11.1

- OraSure Technologies Inc (OSUR), up 32.3% to $5.94 / YTD price return: +23.2% / 12-Month Price Range: $ 3.11-7.82 / Short interest (% of float): 2.7%; days to cover: 3.2

- SunCar Technology Group Inc (SDA), up 32.2% to $17.18 / YTD price return: +66.0% / 12-Month Price Range: $ 3.80-45.73 / Short interest (% of float): 0.9%; days to cover: 0.1

- Dream Finders Homes Inc (DFH), up 26.9% to $30.38 / YTD price return: +250.8% / 12-Month Price Range: $ 8.17-30.38 / Short interest (% of float): 22.2%; days to cover: 13.7

- Bigcommerce Holdings Inc (BIGC), up 26.8% to $12.08 / YTD price return: +38.2% / 12-Month Price Range: $ 6.81-21.80 / Short interest (% of float): 8.8%

- Amneal Pharmaceuticals Inc (AMRX), up 22.3% to $4.11 / YTD price return: +106.5% / 12-Month Price Range: $ 1.24-4.11 / Short interest (% of float): 3.4%; days to cover: 3.5

- Willdan Group Inc (WLDN), up 20.9% to $24.48 / YTD price return: +37.1% / 12-Month Price Range: $ 10.98-29.71 / Short interest (% of float): 2.5%; days to cover: 8.6

BIGGEST LOSERS TODAY

- Mesoblast Ltd (MESO), down 58.9% to $1.64 / YTD price return: -43.6% / 12-Month Price Range: $ 1.64-5.12 / Short interest (% of float): 0.5%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- Assertio Holdings Inc (ASRT), down 45.6% to $2.91 / YTD price return: -32.3% / 12-Month Price Range: $ 2.07-8.01 / Short interest (% of float): 12.1%; days to cover: 6.6 (the stock is currently on the short sale restriction list)

- Nikola Corp (NKLA), down 26.4% to $2.50 / YTD price return: +15.7% / 12-Month Price Range: $ .52-8.97 / Short interest (% of float): 20.9%; days to cover: 1.4 (the stock is currently on the short sale restriction list)

- Opendoor Technologies Inc (OPEN), down 26.3% to $3.54 / YTD price return: +205.2% / 12-Month Price Range: $ .92-6.39 / Short interest (% of float): 11.6%; days to cover: 2.2 (the stock is currently on the short sale restriction list)

- Fortinet Inc (FTNT), down 25.1% to $56.77 / YTD price return: +16.1% / 12-Month Price Range: $ 42.61-81.24 / Short interest (% of float): 1.6%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- DigitalOcean Holdings Inc (DOCN), down 24.8% to $35.11 / YTD price return: +37.8% / 12-Month Price Range: $ 23.38-53.88 / Short interest (% of float): 22.6%; days to cover: 8.1 (the stock is currently on the short sale restriction list)

- Redfin Corp (RDFN), down 24.4% to $10.85 / YTD price return: +155.9% / 12-Month Price Range: $ 3.08-17.68 (the stock is currently on the short sale restriction list)

- WW International Inc (WW), down 23.3% to $8.20 / YTD price return: +112.4% / 12-Month Price Range: $ 3.28-12.13 / Short interest (% of float): 15.3%; days to cover: 3.9 (the stock is currently on the short sale restriction list)

- Liberty Media Corp (LSXMB), down 23.3% to $25.40 / YTD price return: -34.9% / 12-Month Price Range: $ 25.35-47.43 / Short interest (% of float): 0.1%; days to cover: 4.5

- GrafTech International Ltd (EAF), down 22.6% to $4.05 / YTD price return: -14.9% / 12-Month Price Range: $ 3.75-7.87 / Short interest (% of float): 2.6%; days to cover: 4.2 (the stock is currently on the short sale restriction list)

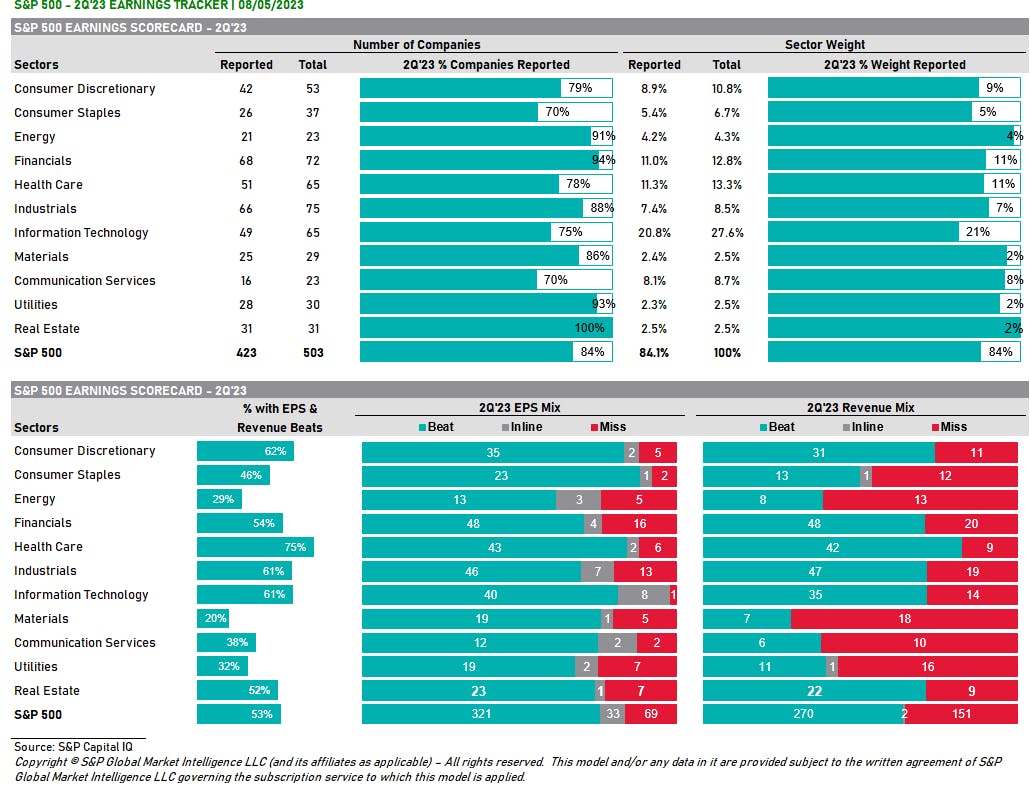

2Q 2023 EARNINGS DASHBOARD

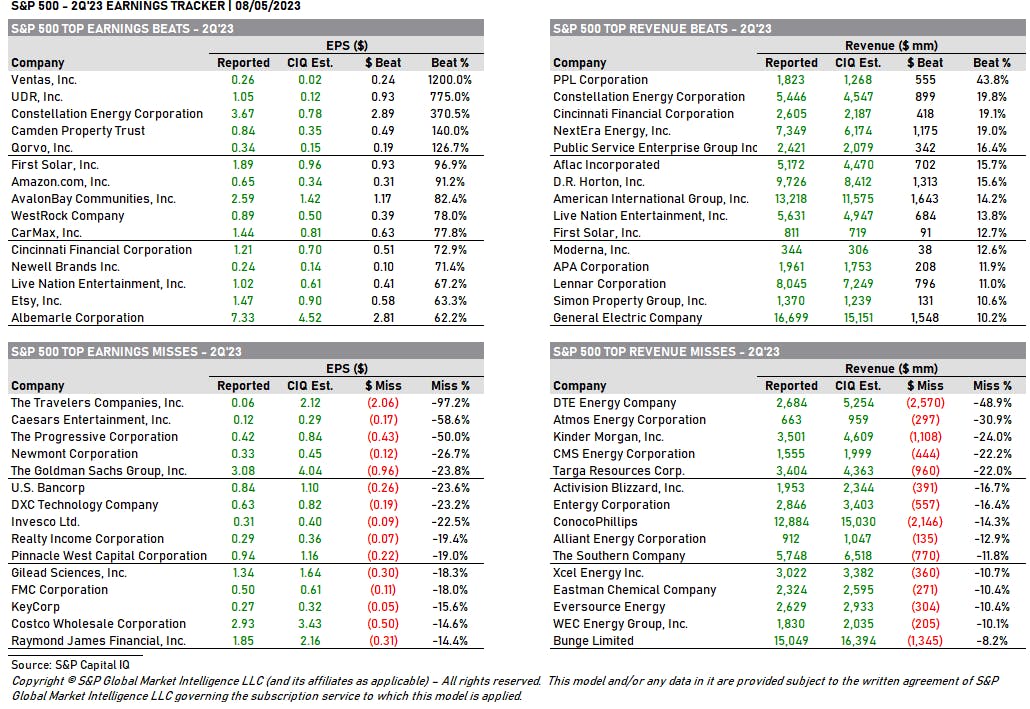

2Q 2023 EARNINGS BEATS & MISSES

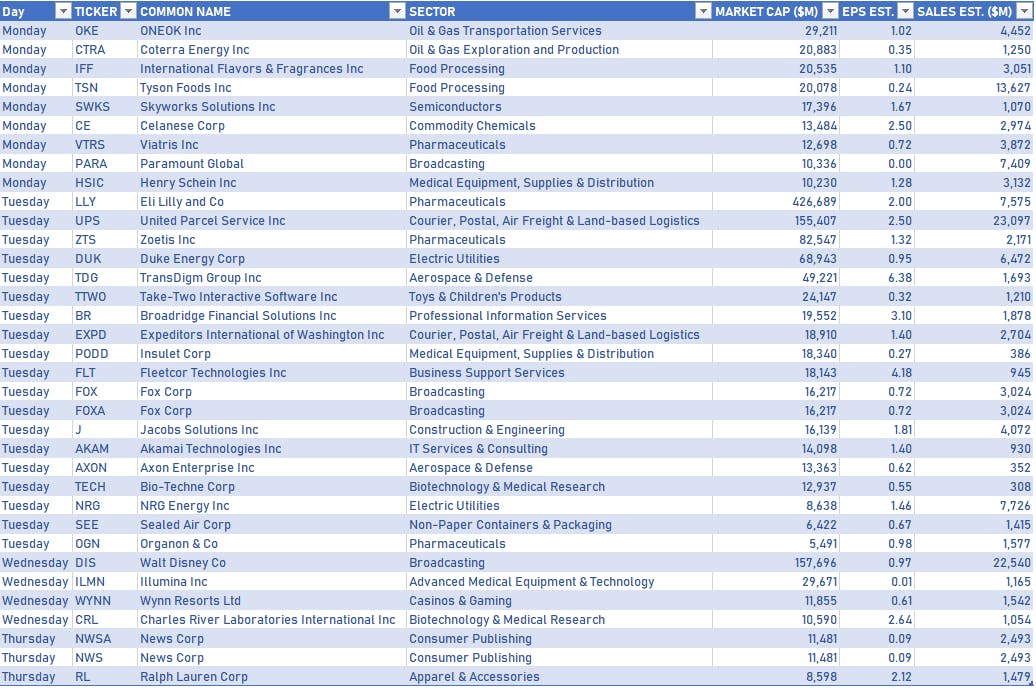

NOTABLE US EARNINGS RELEASES IN THE WEEK AHEAD

TOP S&P 500 PERFORMERS THIS WEEK

- Arista Networks Inc (ANET), up 18.8% to $179.60 / YTD price return: +47.9% / 12-Month Price Range: $ 98.81-190.60 / Short interest (% of float): 1.8%; days to cover: 1.4

- Global Payments Inc (GPN), up 12.6% to $122.65 / YTD price return: +23.5% / 12-Month Price Range: $ 92.27-136.84 / Short interest (% of float): 1.5%; days to cover: 1.5

- Warner Bros Discovery Inc (WBD), up 9.1% to $13.97 / YTD price return: +47.3% / 12-Month Price Range: $ 8.83-17.65 / Short interest (% of float): 3.8%; days to cover: 3.5

- Constellation Energy Corp (CEG), up 8.6% to $103.94 / YTD price return: +20.6% / 12-Month Price Range: $ 65.51-103.94 / Short interest (% of float): 2.2%; days to cover: 3.1

- Cognizant Technology Solutions Corp (CTSH), up 8.0% to $71.00 / YTD price return: +24.1% / 12-Month Price Range: $ 51.33-71.78 / Short interest (% of float): 1.5%; days to cover: 2.1

- DaVita Inc (DVA), up 7.7% to $108.81 / YTD price return: +45.7% / 12-Month Price Range: $ 65.28-108.81 / Short interest (% of float): 3.2%; days to cover: 4.8

- Epam Systems Inc (EPAM), up 7.0% to $246.97 / YTD price return: -24.6% / 12-Month Price Range: $ 199.35-462.72 / Short interest (% of float): 2.2%; days to cover: 1.6

- Humana Inc (HUM), up 6.8% to $484.28 / YTD price return: -5.4% / 12-Month Price Range: $ 423.35-571.30 / Short interest (% of float): 2.5%; days to cover: 1.8

- Clorox Co (CLX), up 6.6% to $164.01 / YTD price return: +16.9% / 12-Month Price Range: $ 124.59-178.20 / Short interest (% of float): 3.5%; days to cover: 4.2

- Assurant Inc (AIZ), up 6.4% to $141.78 / YTD price return: +13.4% / 12-Month Price Range: $ 104.54-172.86 / Short interest (% of float): 1.5%; days to cover: 1.9

BOTTOM S&P 500 PERFORMERS THIS WEEK

- DXC Technology Co (DXC), down 30.3% to $19.32 / YTD price return: -27.1% / 12-Month Price Range: $ 18.61-30.25 / Short interest (% of float): 3.4%; days to cover: 3.8 (the stock is currently on the short sale restriction list)

- Fortinet Inc (FTNT), down 26.1% to $56.77 / YTD price return: +16.1% / 12-Month Price Range: $ 42.69-81.23 / Short interest (% of float): 1.6%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Generac Holdings Inc (GNRC), down 24.0% to $113.95 / YTD price return: +13.2% / 12-Month Price Range: $ 86.33-281.14 / Short interest (% of float): 7.7%; days to cover: 3.4

- Solaredge Technologies Inc (SEDG), down 22.9% to $182.65 / YTD price return: -35.5% / 12-Month Price Range: $ 182.65-345.75 / Short interest (% of float): 6.7%; days to cover: 3.6

- Paycom Software Inc (PAYC), down 21.2% to $290.42 / YTD price return: -6.4% / 12-Month Price Range: $ 262.23-402.63 / Short interest (% of float): 3.4%; days to cover: 3.3

- Resmed Inc (RMD), down 19.7% to $179.25 / YTD price return: -13.9% / 12-Month Price Range: $ 179.25-247.53 / Short interest (% of float): 0.9%; days to cover: 2.1 (the stock is currently on the short sale restriction list)

- ETSY Inc (ETSY), down 18.1% to $81.59 / YTD price return: -31.9% / 12-Month Price Range: $ 80.45-149.84 / Short interest (% of float): 9.4%; days to cover: 3.5

- Norwegian Cruise Line Holdings Ltd (NCLH), down 16.7% to $17.95 / YTD price return: +46.7% / 12-Month Price Range: $ 10.84-22.68 / Short interest (% of float): 8.2%; days to cover: 2.2

- Zebra Technologies Corp (ZBRA), down 16.0% to $251.41 / YTD price return: -1.9% / 12-Month Price Range: $ 225.14-351.55 / Short interest (% of float): 1.8%; days to cover: 2.6

- PayPal Holdings Inc (PYPL), down 15.2% to $62.75 / YTD price return: -11.9% / 12-Month Price Range: $ 58.96-103.02 / Short interest (% of float): 1.8%; days to cover: 1.1

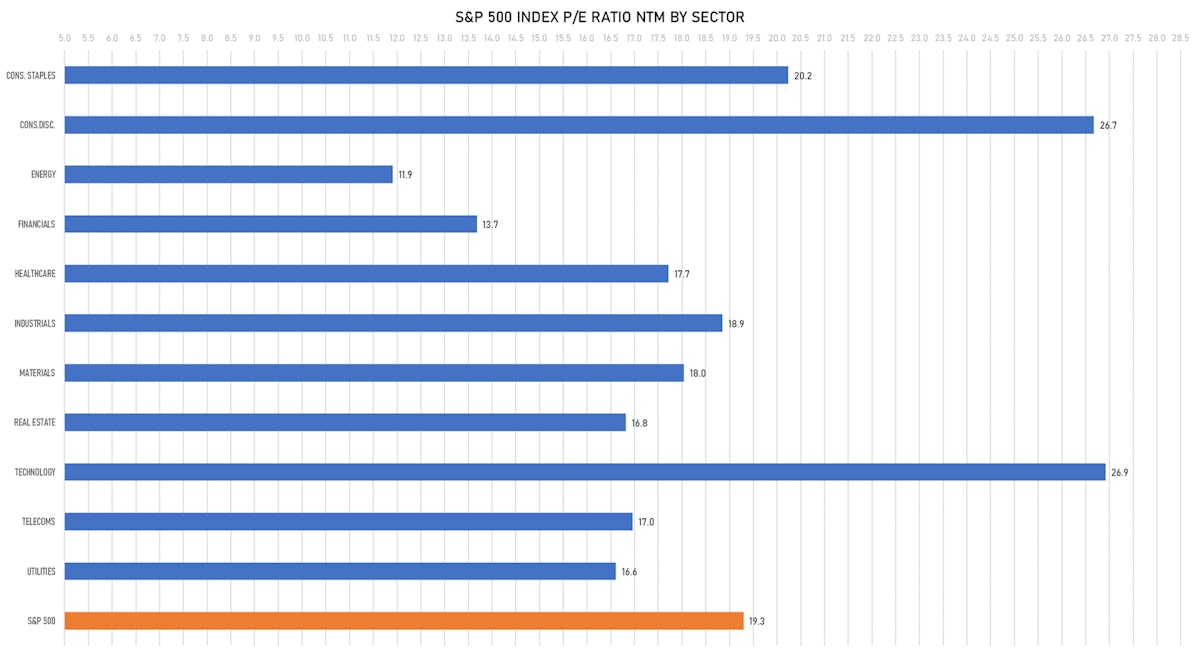

VALUATION MULTIPLES BY SECTORS

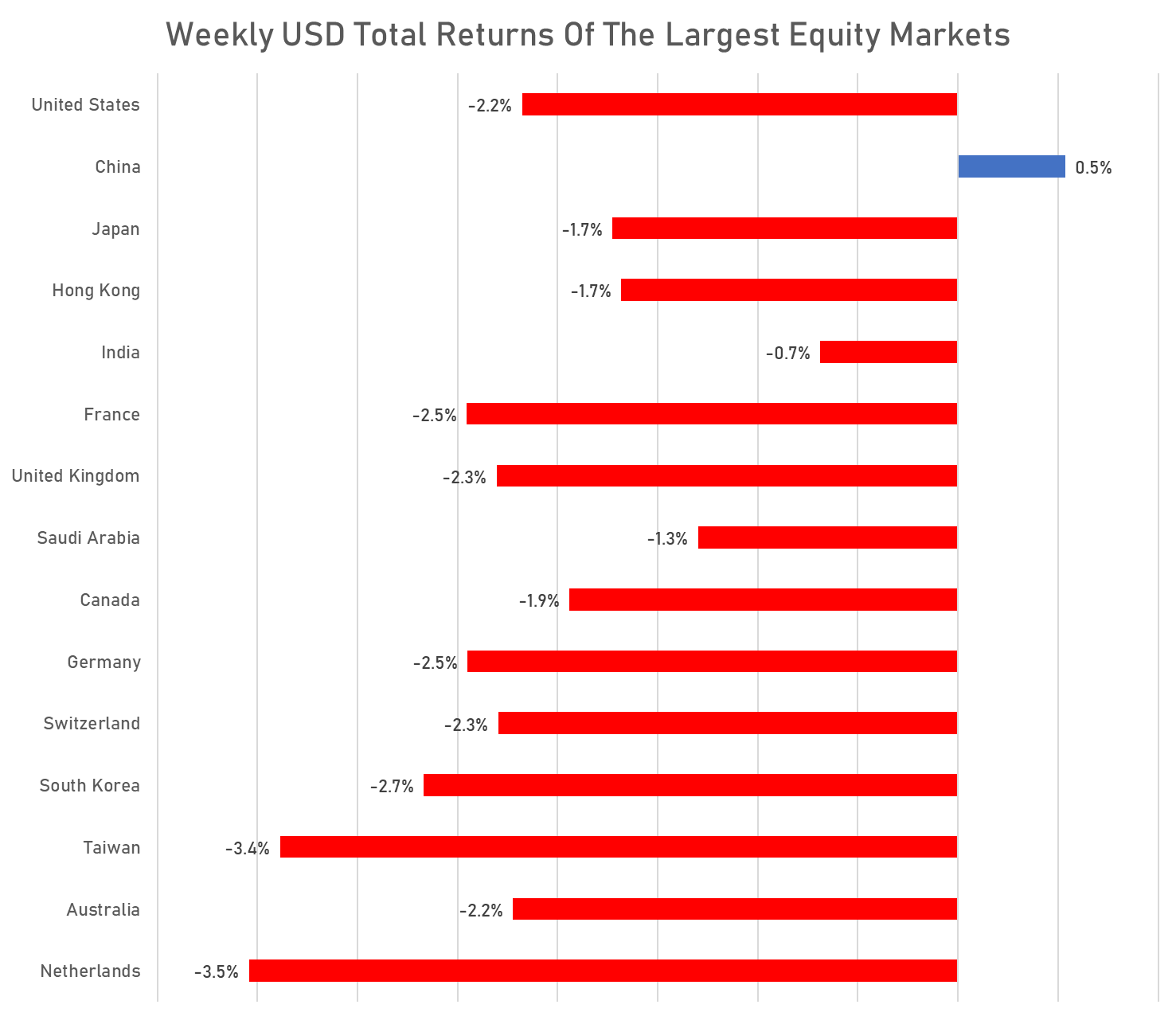

WEEKLY TOTAL RETURNS OF MAJOR GLOBAL EQUITY MARKETS

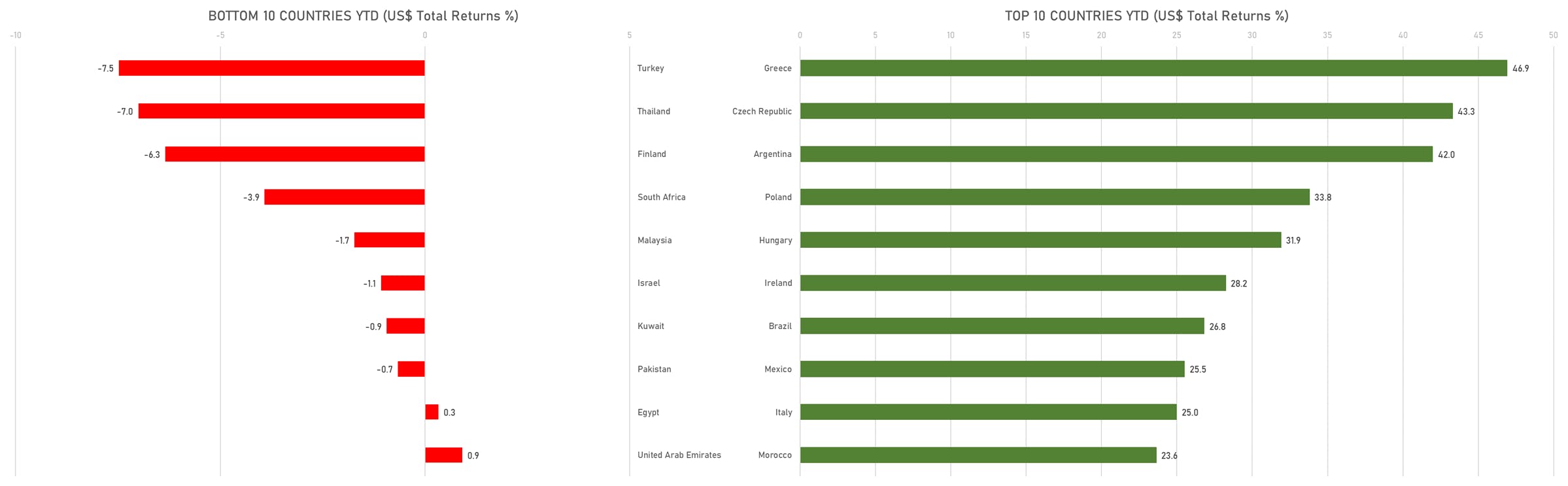

TOP / BOTTOM PERFORMING WORLD MARKETS YTD

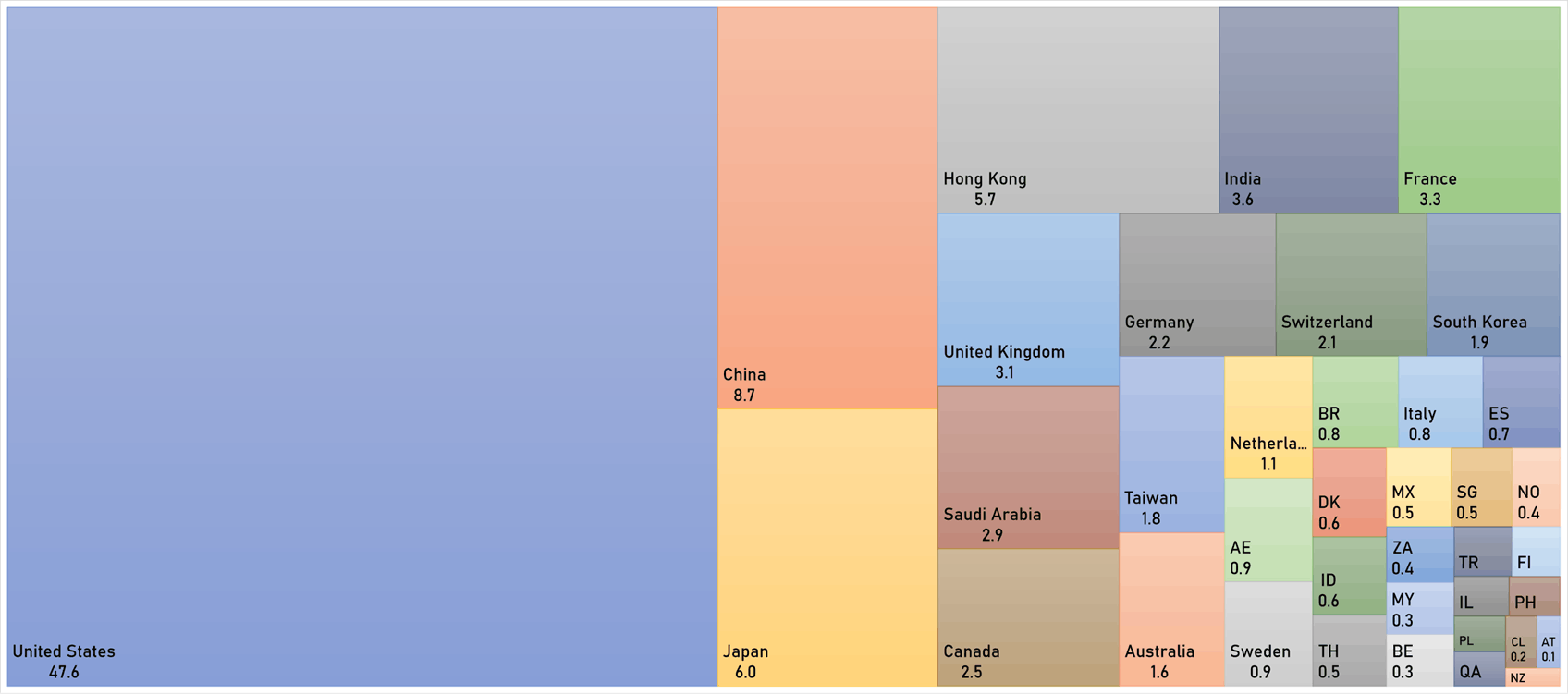

WORLD MARKET CAPITALIZATION (US$ Trillion)

IPOs RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- Nabors Energy Transition Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: NETD / Gross proceeds (including overallotment): US$ 305.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Wells Fargo Securities LLC

- Apogee Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: APGE / Gross proceeds (including overallotment): US$ 300.05m (offering in U.S. Dollar) / Bookrunners: Stifel Nicolaus & Co Inc, Guggenheim Securities LLC, Cowen & Co, Jefferies LLC

- Haymaker Acquisition Corp 4 / United States of America - Financials / Listing Exchange: New York / Ticker: HYAC / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, Cantor Fitzgerald & Co

- Keen Vision Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: KVACU / Gross proceeds (including overallotment): US$ 130.00m (offering in U.S. Dollar) / Bookrunners: Brookline Capital Markets, EF Hutton

IPOs RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- Societatea de Producere a Energiei Electrice in Hidrocentrale Hidroelectrica SA / Romania - Energy and Power / Listing Exchange: Bucharest / Ticker: H2O / Gross proceeds (including overallotment): US$ 1,904.98m (offering in Romanian Lei) / Bookrunners: Barclays Bank (Ireland), Erste Group Bank AG, Banca Comerciala Romana, Wood & Co, UniCredit Bank AG, UBS Europe SE, BofA Securities Inc, Citigroup Global Markets Europe AG, Jefferies GmbH, Morgan Stanley Europe SE

- PT Amman Mineral Internasional Tbk / Indonesia - Materials / Listing Exchange: Indonesia / Ticker: AMMN / Gross proceeds (including overallotment): US$ 715.56m (offering in U.S. Dollar) / Bookrunners: BNI Securities, DBS Vickers Sec Indonesia PT, Pt Clsa Sekuritas Indonesia, Mandiri Securities PTE LTD

- Thyssenkrupp Nucera AG & Co KGaA / Germany - Industrials / Listing Exchange: Frankfurt / Ticker: NCH2 / Gross proceeds (including overallotment): US$ 664.96m (offering in EURO) / Bookrunners: UniCredit FR, Commerzbank AG, Societe Generale SA, Deutsche Bank, Citigroup

- Baimtec Material Co Ltd / China - Industrials / Listing Exchange: SSES / Ticker: 688563 / Gross proceeds (including overallotment): US$ 561.50m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

- Genesis Medtech International Pte Ltd / Singapore - Healthcare / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- WuXi XDC Cayman Inc / China - Healthcare / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities (Asia) Ltd (Hong Kong), Goldman Sachs (Asia), Morgan Stanley (Asia) Ltd

- ODDITY Tech Ltd / Israel - High Technology / Listing Exchange: Nasdaq / Ticker: ODD / Gross proceeds (including overallotment): US$ 487.24m (offering in U.S. Dollar) / Bookrunners: Allen & Co Inc, Goldman Sachs & Co, Morgan Stanley & Co

- Huaqin Technology Co Ltd / China - High Technology / Listing Exchange: Shanghai / Ticker: 603296 / Gross proceeds (including overallotment): US$ 473.99m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd

- Societatea de Producere a Energiei Electrice in Hidrocentrale Hidroelectrica SA / Romania - Energy and Power / Listing Exchange: Bucharest / Ticker: H2O / Gross proceeds (including overallotment): US$ 409.48m (offering in Romanian Lei) / Bookrunners: Barclays Bank (Ireland), Erste Group Bank AG, Banca Comerciala Romana, Wood & Co, UniCredit Bank AG, UBS Europe SE, BofA Securities Inc, Citigroup Global Markets Europe AG, Jefferies GmbH, Morgan Stanley Europe SE

- CAB Payments Holdings Ltd / United Kingdom - High Technology / Listing Exchange: London / Ticker: CABP / Gross proceeds (including overallotment): US$ 371.31m (offering in British Pound) / Bookrunners: JP Morgan Cazenove, Liberum Capital, Canaccord Genuity Ltd, Peel Hunt LLP, Barclays Capital Inc

SECONDARIES RECENTLY ANNOUNCED OR PRICED IN NORTH AMERICA

- ONEOK Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: OKE / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Carvana Co / United States of America - Retail / Listing Exchange: New York / Ticker: CVNA / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- PTC Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: PMTC / Gross proceeds (including overallotment): US$ 826.53m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- MicroStrategy Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: MSTR / Gross proceeds (including overallotment): US$ 750.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- GSI Technology Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: GSIT / Gross proceeds (including overallotment): US$ 750.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Aurora Innovation Inc / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: AUR / Gross proceeds (including overallotment): US$ 600.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Hayward Holdings Inc / United States of America - Industrials / Listing Exchange: New York / Ticker: HAYW / Gross proceeds (including overallotment): US$ 473.02m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- Independence Realty Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: IRT / Gross proceeds (including overallotment): US$ 450.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Blackstone Secured Lending Fund / United States of America - Financials / Listing Exchange: NYSE Amex / Ticker: BXSL / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- QuantumScape Corp / United States of America - Energy and Power / Listing Exchange: New York / Ticker: QS / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Evercore Group, Morgan Stanley & Co LLC

- Aurora Innovation Inc / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: AUR / Gross proceeds (including overallotment): US$ 253.00m (offering in U.S. Dollar) / Bookrunners: Allen & Co Inc, Goldman Sachs & Co

- Gaw Gateway Real Estate Fund VII / United States of America - Financials / Listing Exchange: No Listing / Ticker: - / Gross proceeds (including overallotment): US$ 225.30m (offering in U.S. Dollar) / Bookrunners: Mercury Capital Advisors LLC

- Gossamer Bio Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: GOSS / Gross proceeds (including overallotment): US$ 211.85m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Enliven Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ELVN / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Iovance Biotherapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: IOVA / Gross proceeds (including overallotment): US$ 172.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Jefferies LLC

- Procept Biorobotics Corp / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PRCT / Gross proceeds (including overallotment): US$ 149.96m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, BofA Securities Inc, Piper Sandler & Co

- Celestica Inc / Canada - High Technology / Listing Exchange: New York / Ticker: CLS / Gross proceeds (including overallotment): US$ 148.52m (offering in U.S. Dollar) / Bookrunners: BofA Securities Inc

- Caribou Biosciences Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: CRBU / Gross proceeds (including overallotment): US$ 143.75m (offering in U.S. Dollar) / Bookrunners: Evercore Group, RBC Capital Markets, Leerink Partners LLC, BofA Securities Inc

- HighPeak Energy Inc / United States of America - Energy and Power / Listing Exchange: Nasdaq / Ticker: HPK / Gross proceeds (including overallotment): US$ 135.45m (offering in U.S. Dollar) / Bookrunners: Roth Capital Partners Inc

- Acumen Pharmaceuticals Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ABOS / Gross proceeds (including overallotment): US$ 130.00m (offering in U.S. Dollar) / Bookrunners: Stifel Nicolaus & Co Inc, Citigroup Global Markets Inc, BofA Securities Inc

SECONDARIES RECENTLY ANNOUNCED OR PRICED INTERNATIONALLY

- Vietnam Prosperity Joint Stock Commercial Bank / Vietnam - Financials / Listing Exchange: HoChiMinh / Ticker: VPB / Gross proceeds (including overallotment): US$ 1,517.51m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Trina Solar Co Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 688599 / Gross proceeds (including overallotment): US$ 1,503.18m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Hua Hong Semiconductor Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 1347 / Gross proceeds (including overallotment): US$ 1,475.28m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd, Guotai Junan Securities, China Development Bank Securities Co Ltd, Haitong Securities Co Ltd, Orient Securities Investment Banking Co Ltd

- Socionext Inc / Japan - High Technology / Listing Exchange: TOKPR / Ticker: 6526 / Gross proceeds (including overallotment): US$ 1,319.23m (offering in Japanese Yen) / Bookrunners: Nomura International PLC

- Coloplast A/S / Denmark - Healthcare / Listing Exchange: OMX Copen / Ticker: COLO B / Gross proceeds (including overallotment): US$ 1,315.89m (offering in Danish Krone) / Bookrunners: Not Applicable

- Hua Hong Semiconductor Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 1347 / Gross proceeds (including overallotment): US$ 1,032.70m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd, Guotai Junan Securities, China Development Bank Securities Co Ltd, Haitong Securities Co Ltd, Orient Securities Investment Banking Co Ltd

- argenx SE / Netherlands - Healthcare / Listing Exchange: Nasdaq / Ticker: AGNX / Gross proceeds (including overallotment): US$ 939.68m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Cowen & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC, BofA Securities Inc

- Companhia Paranaense De Energia / Brazil - Energy and Power / Listing Exchange: BMFBOVESPA / Ticker: CPLE3 / Gross proceeds (including overallotment): US$ 907.62m (offering in Brazilian Real) / Bookrunners: Banco Bradesco SA, Banco Itau-BBA SA, Banco BTG Pactual SA, Banco Morgan Stanley SA, UBS Brasil Corretora De Cambio Titulos

- Flat Glass Group Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 6865 / Gross proceeds (including overallotment): US$ 834.95m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, Guotai Junan Securities

- Atos SE / France - High Technology / Listing Exchange: Euro Paris / Ticker: ATO / Gross proceeds (including overallotment): US$ 790.70m (offering in EURO) / Bookrunners: JP Morgan & Co Inc, BNP Paribas SA

- BRF SA / Brazil - Consumer Staples / Listing Exchange: BOVESPA / Ticker: BRFS3 / Gross proceeds (including overallotment): US$ 713.54m (offering in Brazilian Real) / Bookrunners: Banco Safra SA, Banco JP Morgan SA, Bradesco BBI, Citigroup Global Markets Brasil Corretora de Cambio, Banco BTG Pactual SA, XP Investimentos, Banco Itau BBA International SA London Branch, UBS Brasil Corretora De Cambio Titulos

- Shenzhen Expressway Corp Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 0548 / Gross proceeds (including overallotment): US$ 698.85m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Biwin Storage Technology Co Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 688525 / Gross proceeds (including overallotment): US$ 622.75m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Zhongtai Securities Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 600918 / Gross proceeds (including overallotment): US$ 528.73m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- China Ruyi Holdings Ltd / Hong Kong - High Technology / Listing Exchange: Hong Kong / Ticker: 0136 / Gross proceeds (including overallotment): US$ 510.80m (offering in Hong Kong Dollar) / Bookrunners: Not Applicable

- China Aerospace Times Electronics Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 600879 / Gross proceeds (including overallotment): US$ 506.45m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

- Vedanta Ltd / India - Materials / Listing Exchange: National / Ticker: SSLT / Gross proceeds (including overallotment): US$ 499.82m (offering in Indian Rupee) / Bookrunners: JP Morgan Chase & Co

- Tianjin Troila Information Technology Co Ltd / China - Real Estate / Listing Exchange: Shanghai / Ticker: 600225 / Gross proceeds (including overallotment): US$ 473.79m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Hua Hong Semiconductor Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 1347 / Gross proceeds (including overallotment): US$ 442.58m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp, CITIC Securities Co Ltd, Guotai Junan Securities, China Development Bank Securities Co Ltd, Haitong Securities Co Ltd, Orient Securities Investment Banking Co Ltd

- China CIFCO Investment Co Ltd / China - Financials / Listing Exchange: Shenzhen / Ticker: 000996 / Gross proceeds (including overallotment): US$ 414.37m (offering in Chinese Yuan) / Bookrunners: Not Applicable