Equities

Equities Summary - 26 March 2021

A good day to end of the week, after performance stalled for several sessions

Published ET

Source: Refinitiv Eikon

IN A NUTSHELL

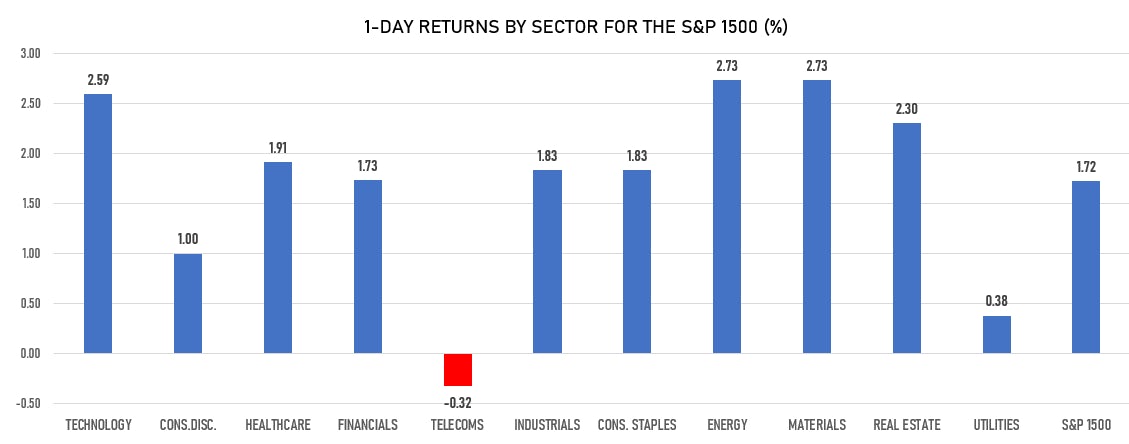

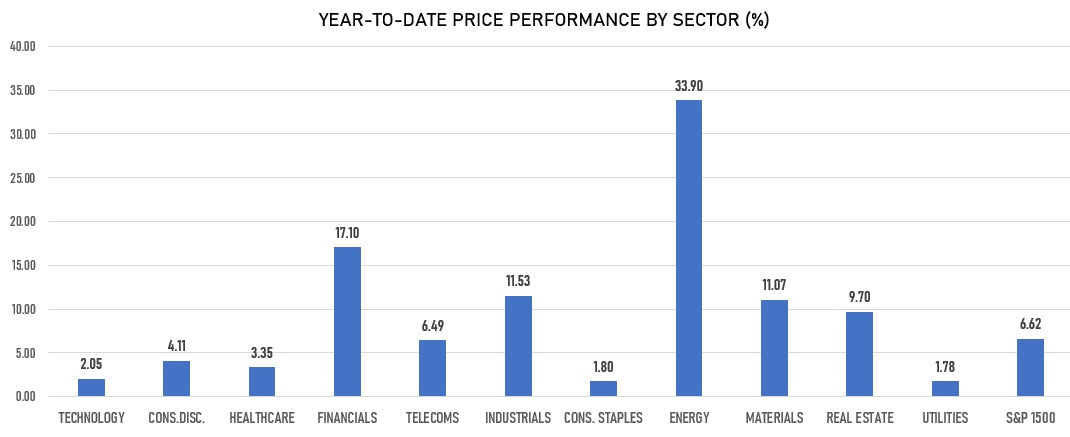

- Daily performance of US indices: S&P 500 up 1.66%, Dow Jones Industrial up 0.62%, Nasdaq Composite up 0.68%, Wilshire up 1.59%

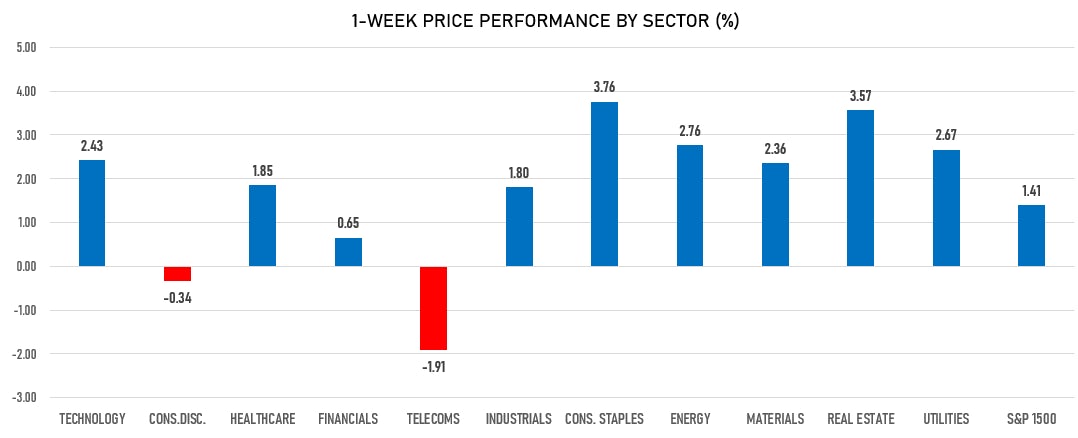

- Weekly performance of US indices: S&P 500 up 1.62%, Dow Jones Industrial down 0.74%, Nasdaq Composite down 0.58%, Wilshire up 0.67%

- Weekly performance of international indices: Europe Stoxx 600 up 0.85%, China CSI300 up 0.62%, Japan Nikkei down 4.92%, Korea KOSPI down 1.88% , UK FTSE up 0.48%

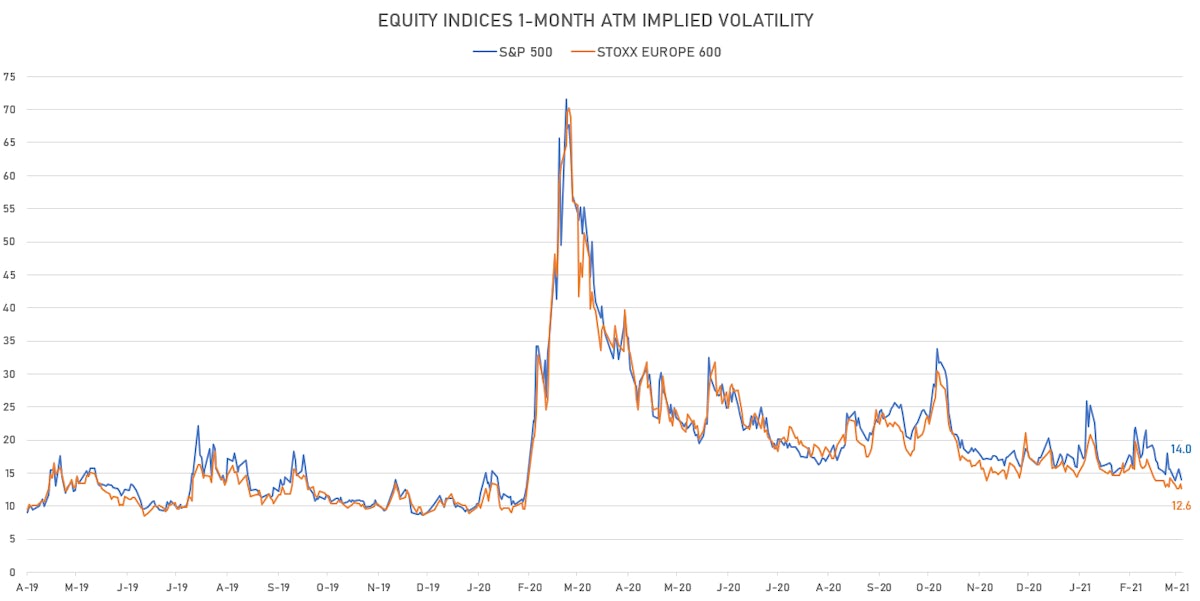

- Option implied volatility at lowest level since early 2020

For a more complete view of returns in various countries, have a look at our world map (updated weekly).

NOTABLE WINNERS TODAY

- Ikena Oncology (IKNA), a company focused on developing cancer therapies, closes up 100% (first day of trading post IPO)

- Tuya (TUYA), a company developing an Internet of things (IoT) cloud platform, up 28.7% (American Depositary Shares IPO)

- MagnaChip Semiconductor (MX), a designer and manufacturer of semiconductor solutions, up 27.4% (take-private transaction for $29.00 in cash per share)

- Telos Corporation (TLS), which provides cloud security and enterprise security solutions, up 22.6% (earnings beat)

- Banco Santander Mexico (BSMX), a Mexico-based financial institution, up 15.5% (Santander offers to acquires the 8.3% outstanding minority shareholdings in Santander Mexico)

- Ubiquiti (UI), a networking technology company, up 14.1% (new 52-week high)

- United States Steel (X), an integrated steel producer, up 11.7% (announced a new sustainable steel line)

NOTABLE LOSERS TODAY

- GSX TECHEDU (GSX), a Chinese technology platform for education, down 41.6% (block trade being offered)

- Discovery (DISCK), a global media company, down 29.5% (downgraded by Wells Fargo and profit taking after a good run)

- ViacomCBS (VIAC), a global media and entertainment company, down 27.3% (profit taking, a downgrade by Wells Fargo, and a 35M share block trade offered through Goldman)

- Rubius Therapeutics (RUBY), a biotechnology company, down 22.5%

- Cloopen Group Holding (RAAS), a Chinese cloud-based communications company, down 18.5% (first earnings release since February IPO)

- Science Applications International (SAIC), a defense technology company, down 16.6% (earnings guidance lower than consensus by about 15%)

- fuboTV (FUBO), a sports-first live television (TV) streaming platform, down 15.5% (quarterly earnings update + another shareholder lawsuit was filed)

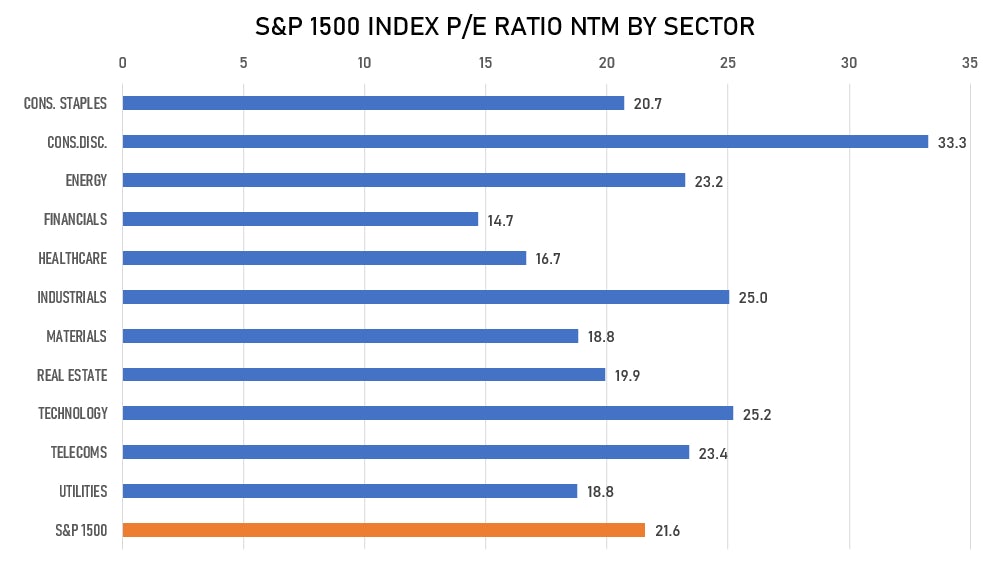

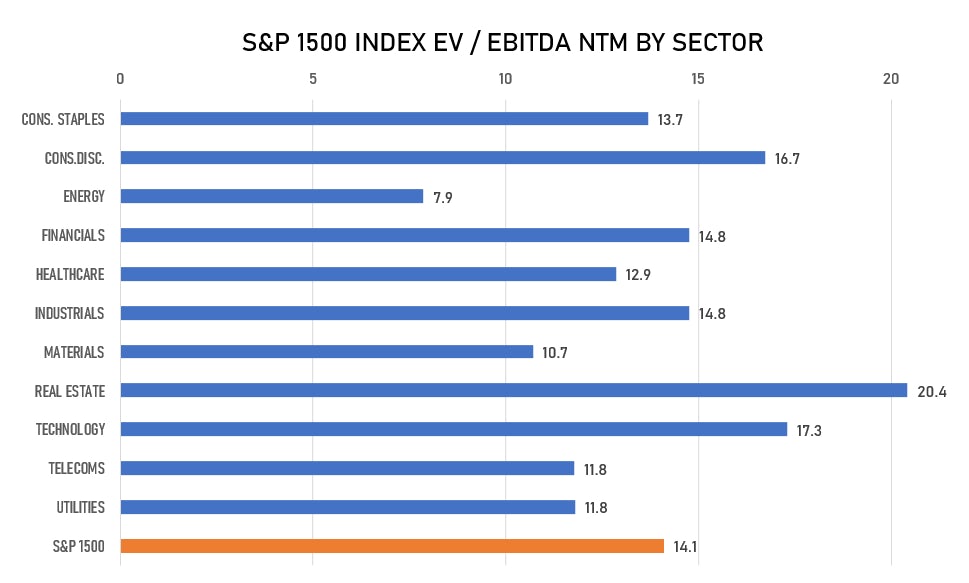

VALUATION METRICS

Not that it matters much in the current context, but worth keeping an eye on:

NOTABLE ECM ACTIVITY TODAY

- Akoya Biosciences (Healthcare Equipment / Supplies) IPO raised $US 115m

- Chrysalis Investments Ltd (Guernsey-based Investment Services) raised US$ 291m in a London follow-on

- Hathway Cable & Datacom (India Media / Publishing) raised US$ 117.45m in a secondary offering

- The Restaurant Group PLC (United Kingdom Hotels / Entertainment Services) follow-on of US$ 109m

- Froy ASA (Norway, salmon farming) IPO of US$ 157m

- Digital 9 Infrastructure PLC (United Kingdom, communications infrastructure assets) IPO of $US 367m

- Total US activity for the week excluding SPAC $16.2bn, and SPAC IPOs $6.5bn.