Equities

Average Volume, Higher Volatility As Stocks Roll Back Yesterday's Gains And More

Consumer discretionary, technology and some of the recent meme darlings were the worst performers

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

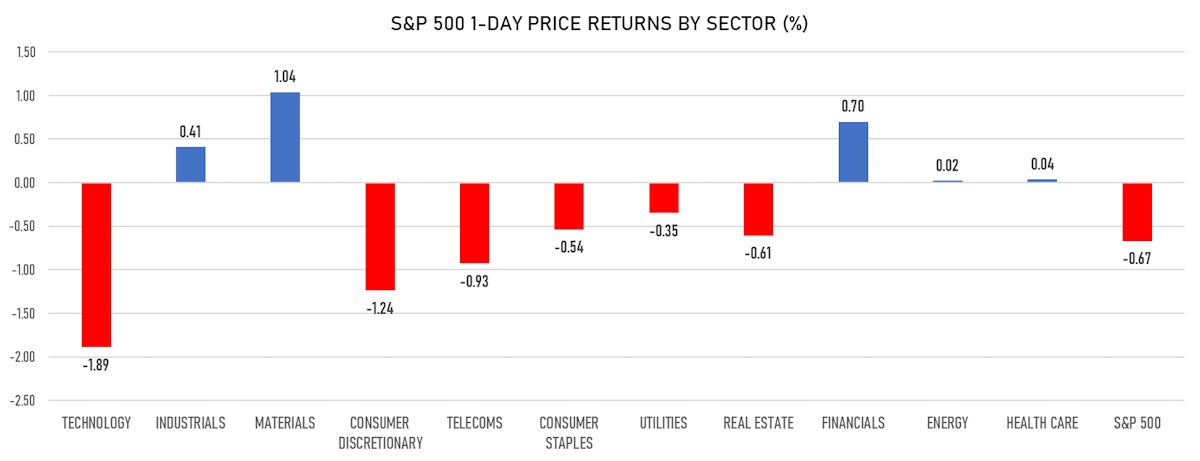

- Daily performance of US indices: S&P 500 down -0.67%; Nasdaq Composite down -1.88%; Wilshire 5000 down -0.85%

- Top performing sectors: materials up 1.04% and financials up 0.70%

- Bottom performing sectors: technology down -1.89% and consumer discretionary down -1.24%

- Daily performance of international indices: Europe Stoxx 600 down -1.42%; UK FTSE 100 down -0.67%

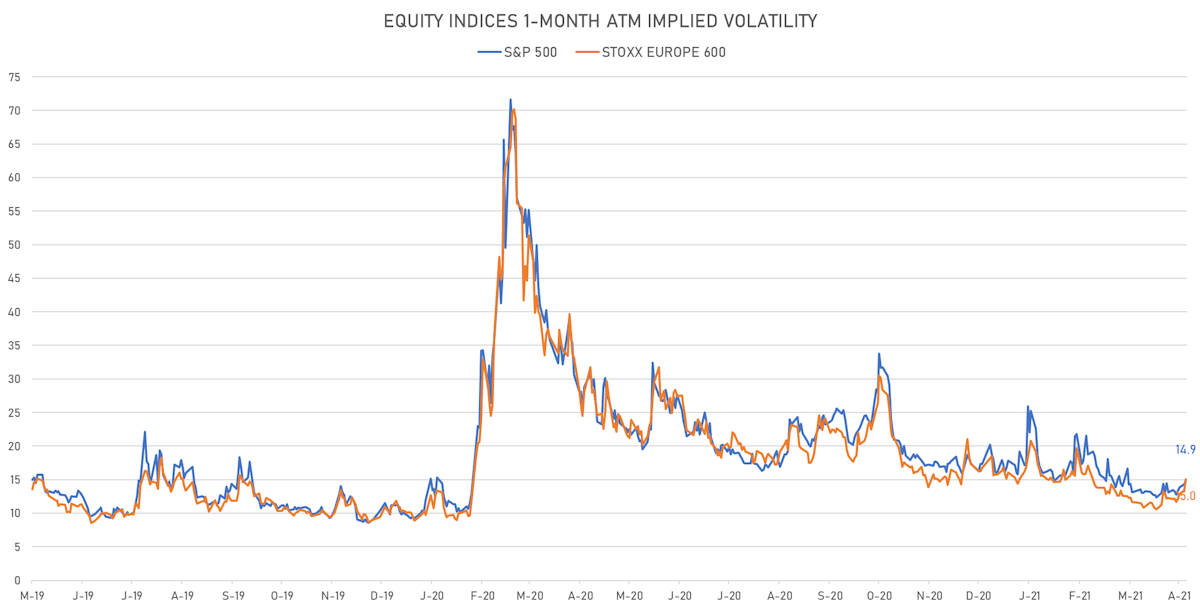

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.9%, up from 14.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 15.0%, up from 13.4%

S&P 500 EARNINGS RELEASES

- Pfizer Inc (Healthcare): beat on EPS (0.93 act. vs. 0.77 est.) and beat on revenue (14,582m act. vs. 13,509m est.)

- T-Mobile US Inc (Technology): beat on EPS (0.74 act. vs. 0.51 est.) and missed on revenue (19,759m act. vs. 19,929m est.)

- CVS Health Corp (Healthcare): beat on EPS (2.04 act. vs. 1.72 est.) and beat on revenue (69,097m act. vs. 68,387m est.)

- ConocoPhillips (Energy): beat on EPS (0.69 act. vs. 0.51 est.) and beat on revenue (8,844m act. vs. 8,069m est.)

- Activision Blizzard Inc (Technology): missed on EPS (0.84 act. vs. 1.18 est.) and missed on revenue (1,983m act. vs. 2,833m est.)

- Dominion Energy Inc (Utilities): beat on EPS (1.09 act. vs. 0.80 est.) and missed on revenue (3,870m act. vs. 4,243m est.)

- Global Payments Inc (Industrials): beat on EPS (1.82 act. vs. 1.76 est.) and beat on revenue (1,812m act. vs. 1,759m est.)

- Progressive Corp (Financials): missed on EPS (1.72 act. vs. 1.72 est.) and beat on revenue (11,729m act. vs. 11,232m est.)

- Eaton Corporation PLC (Industrials): beat on EPS (1.44 act. vs. 1.23 est.) and beat on revenue (4,692m act. vs. 4,546m est.)

- IDEXX Laboratories Inc (Healthcare): beat on EPS (2.35 act. vs. 1.71 est.) and beat on revenue (778m act. vs. 737m est.)

NOTABLE WINNERS

- Arconic Corp (PITTSBURGH) (ARNC), up 19.2% to $35.00 / YTD price return: +17.4% / 12-Month Price Range: $ 7.79-31.85 / Short interest (% of float): 3.9%; days to cover: 4.0

- Domtar Corp (UFS), up 19.2% to $48.30 / YTD price return: +52.6% / 12-Month Price Range: $ 18.66-41.18 / Short interest (% of float): 8.3%; days to cover: 6.2

- Gartner Inc (IT), up 14.2% to $225.49 / YTD price return: +40.9% / 12-Month Price Range: $ 106.57-200.37 / Short interest (% of float): 1.4%; days to cover: 1.7

- Plby Group Inc (PLBY), up 13.6% to $59.60 / YTD price return: +467.1% / 12-Month Price Range: $ 9.85-55.55 / Short interest (% of float): 19.5%; days to cover: 1.3

- Renewable Energy Group Inc (REGI), up 12.7% to $59.20 / YTD price return: -16.4% / 12-Month Price Range: $ 21.65-117.00 / Short interest (% of float): 12.1%; days to cover: 3.3

- Cleveland-Cliffs Inc (CLF), up 11.8% to $20.36 / YTD price return: +39.8% / 12-Month Price Range: $ 3.80-20.87 / Short interest (% of float): 9.2%; days to cover: 2.1

- Bancorp Inc (TBBK), up 11.3% to $24.57 / YTD price return: +80.0% / 12-Month Price Range: $ 5.29-24.52 / Short interest (% of float): 2.1%; days to cover: 2.0

- 51job Inc (JOBS), up 11.2% to $68.19 / YTD price return: -2.6% / 12-Month Price Range: $ 55.13-80.50 / Short interest (% of float): 5.4%; days to cover: 8.1

- MicroVision Inc (MVIS), up 11.1% to $15.40 / YTD price return: +186.2% / 12-Month Price Range: $ .55-28.00 / Short interest (% of float): 20.1%; days to cover: 2.5

- Camping World Holdings Inc (CWH), up 10.0% to $48.43 / YTD price return: +85.9% / 12-Month Price Range: $ 7.27-46.81 / Short interest (% of float): 15.6%; days to cover: 4.8

NOTABLE LOSERS

- ChemoCentryx Inc (CCXI), down 45.5% to $26.63 / YTD price return: -57.0% / 12-Month Price Range: $ 44.28-70.29 / Short interest (% of float): 6.7%; days to cover: 7.4 (the stock is currently on the short sale restriction list)

- Brooklyn Immunotherapeutics Inc (BTX), down 29.7% to $55.19 / YTD price return: +1,131.9% / 12-Month Price Range: $ 1.88-80.67 / Short interest (% of float): 2.9%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Maxar Technologies Inc (MAXR), down 25.9% to $29.08 / YTD price return: -24.6% / 12-Month Price Range: $ 8.65-58.75 / Short interest (% of float): 7.3%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- Ocugen Inc (OCGN), down 20.2% to $12.51 / YTD price return: +583.6% / 12-Month Price Range: $ .17-18.77 / Short interest (% of float): 18.0%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- Ballard Power Systems Inc (BLDP), down 19.7% to $16.26 / YTD price return: -30.5% / 12-Month Price Range: $ 8.87-42.28 / Short interest (% of float): 7.6%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- SmileDirectClub Inc (SDC), down 19.0% to $8.61 / YTD price return: -27.9% / 12-Month Price Range: $ 6.31-16.08 / Short interest (% of float): 28.3%; days to cover: 6.2 (the stock is currently on the short sale restriction list)

- Applied Molecular Transport Inc. (AMTI), down 17.6% to $48.66 / YTD price return: +58.1% / 12-Month Price Range: $ 17.05-78.22 / Short interest (% of float): 7.3%; days to cover: 5.1 (the stock is currently on the short sale restriction list)

- Solaredge Technologies Inc (SEDG), down 16.0% to $218.57 / YTD price return: -31.5% / 12-Month Price Range: $ 101.19-377.00 / Short interest (% of float): 3.8%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- BioNTech SE (BNTX), down 15.3% to $176.88 / YTD price return: +117.0% / 12-Month Price Range: $ 44.36-211.65 / Short interest (% of float): 2.0%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Sabre Corp (SABR), down 14.3% to $12.91 / YTD price return: +7.4% / 12-Month Price Range: $ 5.33-16.88 / Short interest (% of float): 20.4%; days to cover: 8.6 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- Australian Venue Co Ltd / Australia - Real Estate / Listing Exchange: Australia / Gross proceeds (including overallotment): US$ 273.19m (offering in Australian Dollar) / Bookrunners: Goldman Sachs & Co, KKR Capital Markets LLC, Citigroup Australia Limited

- PetroReconcavo SA / Brazil - Energy and Power / Listing Exchange: BOVESPA / Ticker: RECV3 / Gross proceeds (including overallotment): US$ 218.19m (offering in Brazilian Real) / Bookrunners: Banco Safra SA, Banco Itau-BBA SA, Goldman Sachs do Brasil Banco Multiplo SA, Banco Morgan Stanley SA

- Valor Latitude Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: VLATU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: BofA Securities Inc, Barclays Capital Inc

- Summit Healthcare Acquisition Corp / Hong Kong - Financials / Listing Exchange: Nasdaq / Ticker: SMIHU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: BofA Securities Inc

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Delivery Hero SE / Germany - Retail / Listing Exchange: Frankfurt / Ticker: DHER / Gross proceeds (including overallotment): US$ 1,455.02m (offering in EURO) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co