Equities

Uneventful Day In US Stocks, With Indices Closing Nearly Unchanged

S&P 500 implied volatility down for the first time in a week, as markets continue to absorb the avalanche of earnings

Published ET

Sources: ϕpost, Refinitiv

QUICK SUMMARY

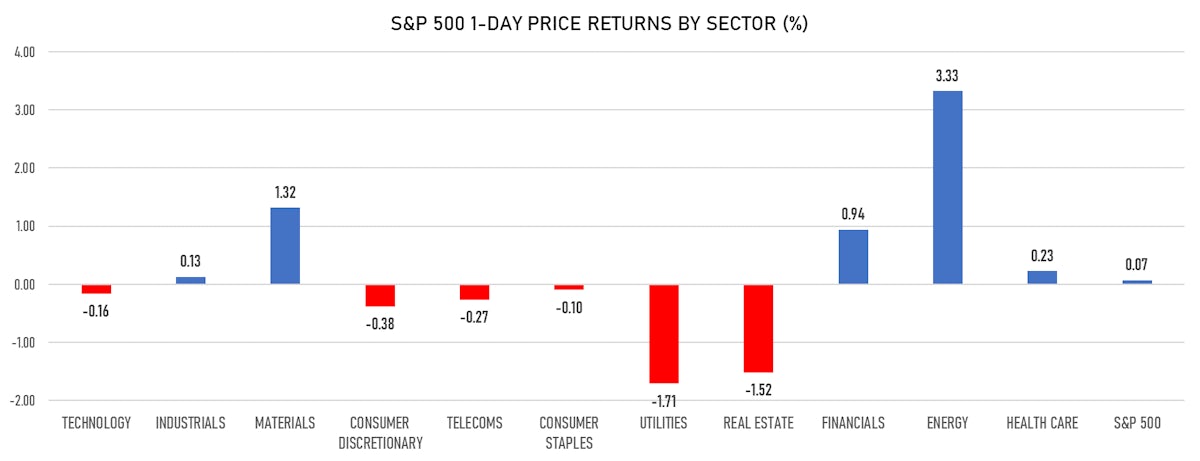

- Daily performance of US indices: S&P 500 up 0.07%; Nasdaq Composite down -0.37%; Wilshire 5000 down -0.11%

- Top performing sectors: energy up 3.33% and materials up 1.32%

- Bottom performing sectors: utilities down -1.71% and real estate down -1.52%

- FactSet reports that "over 75% of S&P 500 companies have reported with 87% beating consensus earnings expectations and earnings beating expectations by 23%"

- They further comment that "inflation is still the big buzzword from both an earnings and macro perspective. Focus continues to revolve around supply chain constraints (particularly the semi shortage) and higher raw materials and freight costs. Lack of workers in some epicenter industries has also received attention."

- Daily performance of international indices: Europe Stoxx 600 up 1.82%; UK FTSE 100 up 1.68%

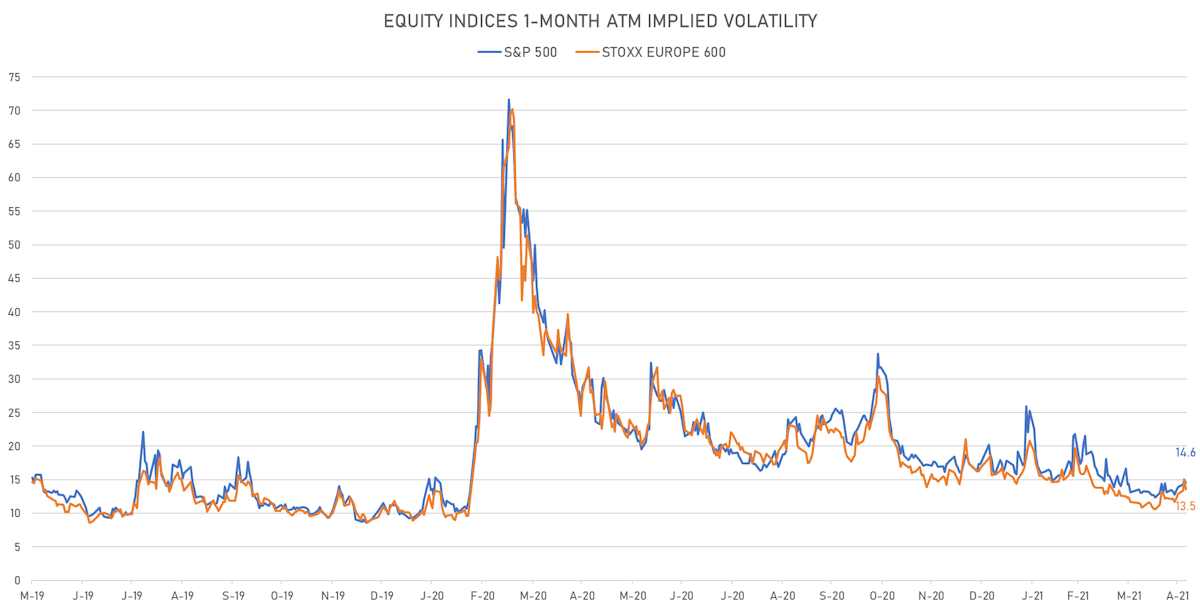

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.6%, down from 14.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.5%, down from 15.0%

SELECTION OF S&P 500 EARNINGS RELEASES

- PayPal Holdings Inc (Technology): beat on EPS (1.22 act. vs. 1.00 est.) and missed on revenue (6,033m act. vs. 6,092m est.)

- Booking Holdings Inc (Consumer Cyclicals): missed on EPS (-5.26 act. vs. -4.28 est.) and missed on revenue (1,141m act. vs. 1,180m est.)

- General Motors Co (Consumer Cyclicals): beat on EPS (2.25 act. vs. 1.60 est.) and missed on revenue (32,500m act. vs. 36,118m est.)

- MetLife Inc (Financials): beat on EPS (2.20 act. vs. 1.52 est.) and missed on revenue (15,562m act. vs. 16,338m est.)

- Emerson Electric Co (Industrials): beat on EPS (0.97 act. vs. 0.68 est.) and beat on revenue (4,431m act. vs. 3,976m est.)

- Cognizant Technology Solutions Corp (Technology): beat on EPS (0.97 act. vs. 0.90 est.) and beat on revenue (4,401m act. vs. 4,246m est.)

- Trane Technologies PLC (Industrials): beat on EPS (1.01 act. vs. 0.92 est.) and missed on revenue (3,018m act. vs. 3,077m est.)

- Exelon Corp (Utilities): missed on EPS (-0.06 act. vs. 0.69 est.) and beat on revenue (9,890m act. vs. 7,902m est.)

- Sempra Energy (Utilities): beat on EPS (2.95 act. vs. 1.56 est.) and missed on revenue (3,259m act. vs. 3,363m est.)

- Microchip Technology Inc (Technology): beat on EPS (1.62 act. vs. 1.58 est.) and missed on revenue (1,352m act. vs. 1,359m est.)

TOP WINNERS

- Hayward Holdings Inc (HAYW), up 24.3% to $24.11 / 12-Month Price Range: $ 15.61-20.50 / Short interest (% of float): 0.5%; days to cover: 0.8

- Fresh Del Monte Produce Inc (FDP), up 20.0% to $34.63 / YTD price return: +43.9% / 12-Month Price Range: $ 20.25-30.89

- Oceaneering International Inc (OII), up 18.2% to $13.91 / YTD price return: +75.0% / 12-Month Price Range: $ 3.31-15.40

- KAR Auction Services Inc (KAR), up 16.0% to $16.83 / YTD price return: -9.6% / 12-Month Price Range: $ 10.28-20.85

- Nexgen Energy Ltd (NXE), up 13.3% to $4.61 / YTD price return: +67.0% / 12-Month Price Range: $ 1.22-4.38 / Short interest (% of float): 3.6%; days to cover: 6.5

- Medifast Inc (MED), up 12.1% to $252.28 / YTD price return: +28.5% / 12-Month Price Range: $ 74.39-279.46

- Belden Inc (BDC), up 11.9% to $48.22 / YTD price return: +15.1% / 12-Month Price Range: $ 26.48-54.80

- Cryoport Inc (CYRX), up 11.6% to $61.60 / YTD price return: +40.4% / 12-Month Price Range: $ 18.88-84.97

- Global Blue Group Holding Ltd (GB), up 11.3% to $11.72 / YTD price return: -9.8% / 12-Month Price Range: $ 6.67-15.93 / Short interest (% of float): 1.0%; days to cover: 11.1

- XP Inc (XP), up 11.3% to $42.77 / YTD price return: +7.8% / 12-Month Price Range: $ 22.33-52.94

BIGGEST LOSERS

- Brooklyn Immunotherapeutics Inc (BTX), down 21.9% to $43.09 / YTD price return: +861.8% / 12-Month Price Range: $ 1.88-80.67 / Short interest (% of float): 2.9%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Systemax Inc (SYX), down 21.8% to $33.38 / YTD price return: -7.0% / 12-Month Price Range: $ 16.04-45.97 (the stock is currently on the short sale restriction list)

- Mercury Systems Inc (MRCY), down 17.8% to $57.69 / YTD price return: -34.5% / 12-Month Price Range: $ 59.88-92.98 (the stock is currently on the short sale restriction list)

- Cardlytics Inc (CDLX), down 17.0% to $106.34 / YTD price return: -25.5% / 12-Month Price Range: $ 45.09-161.47 (the stock is currently on the short sale restriction list)

- Bottomline Technologies (DE) Inc (EPAY), down 16.8% to $38.55 / YTD price return: -26.9% / 12-Month Price Range: $ 39.04-55.63 (the stock is currently on the short sale restriction list)

- Silk Road Medical Inc (SILK), down 14.8% to $52.33 / YTD price return: -16.9% / 12-Month Price Range: $ 33.71-75.80 (the stock is currently on the short sale restriction list)

- Alector Inc (ALEC), down 14.7% to $15.71 / YTD price return: +3.8% / 12-Month Price Range: $ 9.12-34.89 (the stock is currently on the short sale restriction list)

- Peloton Interactive Inc (PTON), down 14.6% to $82.62 / YTD price return: -45.5% / 12-Month Price Range: $ 34.25-171.09 (the stock is currently on the short sale restriction list)

- Deciphera Pharmaceuticals Inc (DCPH), down 14.5% to $37.02 / YTD price return: -35.1% / 12-Month Price Range: $ 39.42-68.40 (the stock is currently on the short sale restriction list)

- Astec Industries Inc (ASTE), down 14.4% to $65.95 / YTD price return: +13.9% / 12-Month Price Range: $ 34.50-80.00 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- Pepco Group BV / United Kingdom - Retail / Listing Exchange: Warsaw / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,138.12m (offering in Polish Zloty) / Bookrunners: Powszechna Kasa Oszczednosci Bank Polski SA, Barclays Bank (Ireland), Santander Bank Polska SA, JP Morgan AG, Goldman Sachs Bank Europe SE

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- American Tower Corp / United States of America - Real Estate / Listing Exchange: New York / Ticker: AMT / Gross proceeds (including overallotment): US$ 2,165.55m (offering in U.S. Dollar) / Bookrunners: RBC Capital Markets, Citigroup Global Markets Inc, Morgan Stanley & Co LLC, BofA Securities Inc, Barclays Capital Inc

- Daimler AG / Germany - Industrials / Listing Exchange: Frankfurt / Ticker: DAI / Gross proceeds (including overallotment): US$ 1,380.20m (offering in EURO) / Bookrunners: Société Générale SA, Merrill Lynch International Ltd

- Alstom SA / France - Industrials / Listing Exchange: Euro Paris / Ticker: ALSMY / Gross proceeds (including overallotment): US$ 608.08m (offering in EURO) / Bookrunners: JP Morgan & Co Inc, UBS, Citigroup, BofA Securities Inc

- Ascendas Real Estate Investment Trust / Singapore - Real Estate / Listing Exchange: Singapore / Ticker: A17U / Gross proceeds (including overallotment): US$ 314.37m (offering in Singapore Dollar) / Bookrunners: DBS Bank Ltd, Citigroup Global Markets Singapore Pte Ltd

- Coronado Global Resources Inc / Australia - Materials / Listing Exchange: Australia / Ticker: CRN / Gross proceeds (including overallotment): US$ 101.44m (offering in Australian Dollar) / Bookrunners: Citigroup Global Markets Australia, Credit Suisse Australia Ltd