Equities

Volatility Drops Further As Stocks Reach New Record Highs

Disappointing NFP data lit a fire under the market, as participants now expect the Fed to support the economy for longer

Published ET

S&P 500 MONTHLY PRICES SINCE 1928 | SOURCE: Refinitiv

QUICK SUMMARY

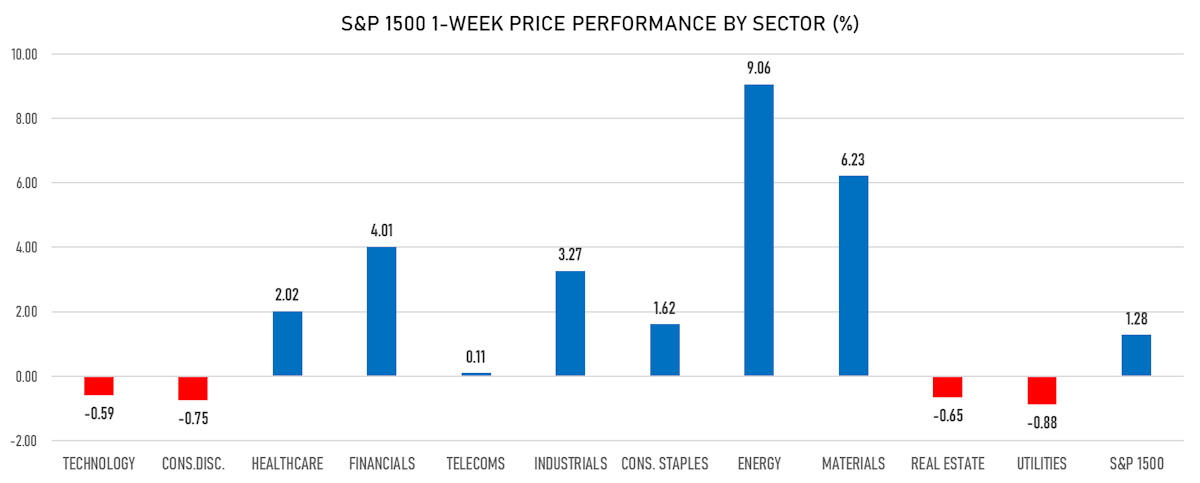

- Daily performance of US indices: S&P 500 up 0.74%; Nasdaq Composite up 0.88%; Wilshire 5000 up 0.83%

- Top performing sectors: energy up 1.89% and real estate up 1.21%

- Bottom performing sectors: consumer staples up 0.01% and utilities up 0.25%

- Daily performance of international indices: Europe Stoxx 600 up 0.89%; China CSI 300 down -1.29%; Japan up 0.24%; UK FTSE 100 up 0.76%

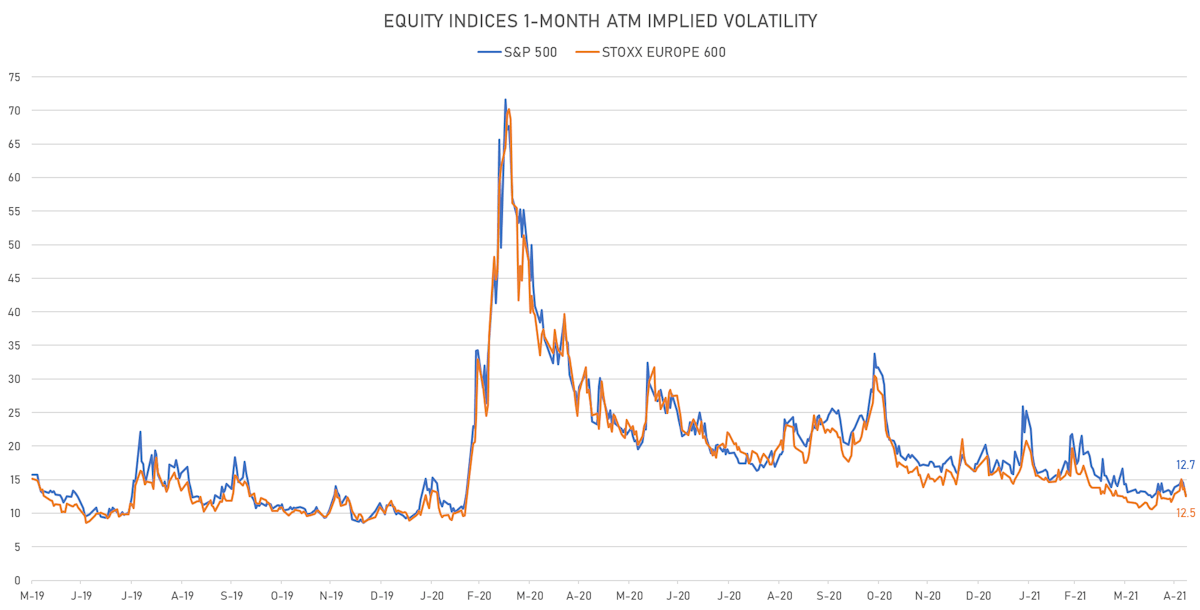

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.7%, down from 13.7%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.5%, down from 13.8%

TOP WINNERS

- MEDNAX Inc (MD), up 20.0% to $32.10 / YTD price return: +30.8% / 12-Month Price Range: $ 11.62-29.26 / Short interest (% of float): 10.6%; days to cover: 10.0

- Funko Inc (FNKO), up 19.9% to $25.45 / YTD price return: +145.2% / 12-Month Price Range: $ 3.78-25.07 / Short interest (% of float): 16.6%; days to cover: 0.8

- Y-mAbs Therapeutics Inc (YMAB), up 19.4% to $34.20 / YTD price return: -30.9% / 12-Month Price Range: $ 24.78-55.22 / Short interest (% of float): 10.1%; days to cover: 8.7

- Bill.com Holdings Inc (BILL), up 18.3% to $154.23 / YTD price return: +13.0% / 12-Month Price Range: $ 61.75-195.95 / Short interest (% of float): 8.1%; days to cover: 4.9

- Golden Entertainment Inc (GDEN), up 17.2% to $41.91 / YTD price return: +110.7% / 12-Month Price Range: $ 7.11-36.50 / Short interest (% of float): 2.5%; days to cover: 2.7

- Qurate Retail Inc (QRTEA), up 15.9% to $13.70 / YTD price return: +24.9% / 12-Month Price Range: $ 3.46-13.76 / Short interest (% of float): 5.7%; days to cover: 6.1

- PubMatic Inc (PUBM), up 14.9% to $44.62 / YTD price return: +59.6% / 12-Month Price Range: $ 22.42-76.96 / Short interest (% of float): 41.9%; days to cover: 4.3

- Tilray Inc (TLRY), up 14.3% to $16.18 / YTD price return: +95.9% / 12-Month Price Range: $ 4.41-67.00 / Short interest (% of float): 7.5%; days to cover: 1.4

- iHeartMedia Inc (IHRT), up 14.0% to $22.64 / YTD price return: +74.4% / 12-Month Price Range: $ 5.76-20.35 / Short interest (% of float): 3.5%; days to cover: 2.4

- IGM Biosciences Inc (IGMS), up 14.0% to $66.97 / YTD price return: -24.1% / 12-Month Price Range: $ 41.41-133.00 / Short interest (% of float): 20.7%; days to cover: 12.6

BIGGEST LOSERS

- Centerra Gold Inc (CGAU), down 29.8% to $6.92 / YTD price return: -40.3% / 12-Month Price Range: $ 8.46-14.66 / Short interest (% of float): 0.5%; days to cover: 55.9 (the stock is currently on the short sale restriction list)

- Waterdrop Inc (WDH), down 19.2% to $9.70 / 12-Month Price Range: $ .00-.00

- Aurinia Pharmaceuticals Inc (AUPH), down 17.8% to $10.15 / YTD price return: -26.6% / 12-Month Price Range: $ 11.60-20.50 / Short interest (% of float): 7.2%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- Teradata Corp (TDC), down 16.3% to $40.54 / YTD price return: +80.4% / 12-Month Price Range: $ 17.99-59.58 / Short interest (% of float): 8.0%; days to cover: 7.6 (the stock is currently on the short sale restriction list)

- Shake Shack Inc (SHAK), down 15.3% to $89.48 / YTD price return: +5.5% / 12-Month Price Range: $ 45.51-138.38 / Short interest (% of float): 12.3%; days to cover: 6.8 (the stock is currently on the short sale restriction list)

- Travere Therapeutics Inc (TVTX), down 14.9% to $20.01 / YTD price return: -26.6% / 12-Month Price Range: $ 14.50-33.09 / Short interest (% of float): 8.5%; days to cover: 10.2 (the stock is currently on the short sale restriction list)

- Jfrog Ltd (FROG), down 14.6% to $35.91 / YTD price return: -42.8% / 12-Month Price Range: $ 40.25-95.20 / Short interest (% of float): 5.7%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

- Loandepot Inc (LDI), down 12.2% to $14.94 / 12-Month Price Range: $ 13.59-38.68 / Short interest (% of float): 10.3%; days to cover: 1.5 (the stock is currently on the short sale restriction list)

- Appian Corp (APPN), down 10.8% to $88.27 / YTD price return: -45.5% / 12-Month Price Range: $ 43.30-260.00 / Short interest (% of float): 16.6%; days to cover: 7.2 (the stock is currently on the short sale restriction list)

- Globalstar Inc (GSAT), down 10.6% to $1.10 / YTD price return: +224.9% / 12-Month Price Range: $ .28-2.98 / Short interest (% of float): 5.6%; days to cover: 3.0 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- World Quantum Growth Acquisition Corp / Cayman Islands - Financials / Listing Exchange: New York / Ticker: WQGA.U / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC

- Liontrust ESG Trust PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: N/A / Gross proceeds (including overallotment): US$ 208.28m (offering in British Pound) / Bookrunners: Winterflood Securities Ltd

- B Riley Principal 250 Merger Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: BRIVU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: B Riley & Company

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- SBI Life Insurance Co Ltd / India - Financials / Listing Exchange: National / Ticker: SBILIF / Gross proceeds (including overallotment): US$ 534.78m (offering in Indian Rupee) / Bookrunners: JP Morgan & Co Inc

- Federal Realty Investment Trust / United States of America - Real Estate / Listing Exchange: New York / Ticker: FRT / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Beijing Dami Technology Co Ltd / China - High Technology / Listing Exchange: No Listing / Ticker: - / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- HomeCo Daily Needs REIT / Australia - Real Estate / Listing Exchange: Australia / Ticker: HDN / Gross proceeds (including overallotment): US$ 132.01m (offering in Australian Dollar) / Bookrunners: Goldman Sachs (Australia)

- US Solar Fund PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: USF / Gross proceeds (including overallotment): US$ 122.39m (offering in U.S. Dollar) / Bookrunners: Jefferies International Ltd, Cenkos Securities PLC