Equities

Technology Recovers After An Early Fall, Closes Almost Unchanged

Industrials, energy and financials lagged the market, as value underperformed

Published ET

Dow Jones Composite Average Breakdown By Market Cap | Sources: ϕpost, FactSet data

QUICK SUMMARY

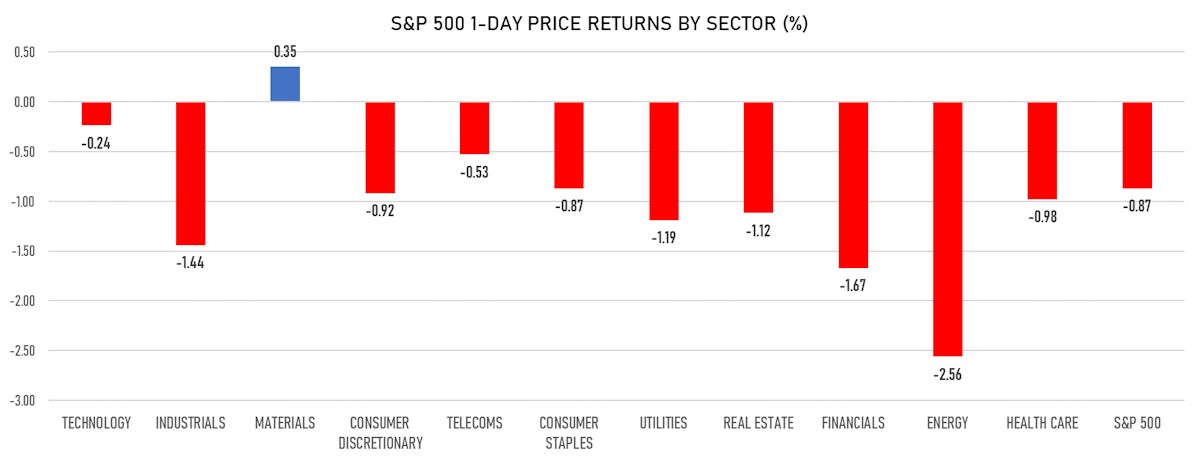

- Daily performance of US indices: S&P 500 down -0.87%; Nasdaq Composite down -0.09%; Wilshire 5000 down -0.68%

- Top performing sectors: materials up 0.35% and technology down -0.24%

- Bottom performing sectors: energy down -2.56% and financials down -1.67%

- Daily performance of international indices: Europe Stoxx 600 down 0.00%; China CSI 300 down -0.20%; Japan down -1.59%; UK FTSE 100 down -2.47%

NOTABLE S&P 500 EARNINGS RELEASES

- eBay Inc (Technology): beat on EPS (1.09 act. vs. 1.07 est.) and beat on revenue (3,023m act. vs. 2,972m est.)

- HCA Healthcare Inc (Healthcare): beat on EPS (4.14 act. vs. 3.32 est.) and beat on revenue (13,977m act. vs. 13,635m est.)

- Prudential Financial Inc (Financials): beat on EPS (4.11 act. vs. 2.76 est.) and missed on revenue (14,215m act. vs. 14,352m est.)

- Teledyne Technologies Inc (Technology): missed on EPS (2.23 act. vs. 2.59 est.) and beat on revenue (806m act. vs. 786m est.)

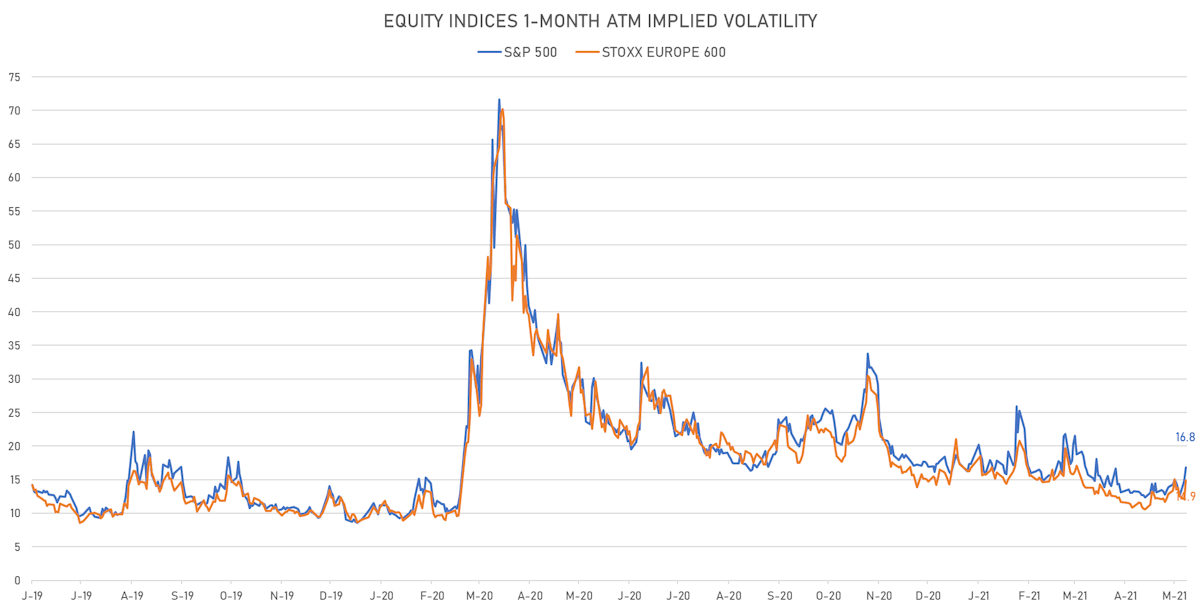

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 16.8%, up from 14.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 14.9%, up from 12.1%

TOP WINNERS

- 3D Systems Corp (DDD), up 35.2% to $24.03 / YTD price return: +129.3% / 12-Month Price Range: $ 4.60-56.50 / Short interest (% of float): 16.3%; days to cover: 6.1

- Ferro Corp (FOE), up 23.9% to $21.78 / YTD price return: +48.9% / 12-Month Price Range: $ 9.47-18.62 / Short interest (% of float): 5.3%; days to cover: 13.6

- Roblox Corp (RBLX), up 21.3% to $77.65 / 12-Month Price Range: $ 60.50-83.41 / Short interest (% of float): 1.2%; days to cover: 1.0

- Shockwave Medical Inc (SWAV), up 17.8% to $158.79 / YTD price return: +53.1% / 12-Month Price Range: $ 37.76-169.00

- Plug Power Inc (PLUG), up 17.6% to $23.60 / YTD price return: -30.4% / 12-Month Price Range: $ 3.80-75.49

- Domtar Corp (UFS), up 16.9% to $55.38 / YTD price return: +75.0% / 12-Month Price Range: $ 18.66-49.05 / Short interest (% of float): 9.4%; days to cover: 3.8

- International Game Technology PLC (IGT), up 16.7% to $20.37 / YTD price return: +20.2% / 12-Month Price Range: $ 5.57-20.30 / Short interest (% of float): 3.2%; days to cover: 1.7

- Grupo Simec SAB de CV (SIM), up 16.6% to $19.82 / YTD price return: +54.8% / 12-Month Price Range: $ 5.20-17.00 / Short interest (% of float): 0.0%; days to cover: 0.2

- Coursera Inc (COUR), up 16.3% to $40.46 / 12-Month Price Range: $ 33.67-62.53 / Short interest (% of float): 2.4%; days to cover: 1.5

- American National Group Inc (ANAT), up 16.1% to $142.28 / YTD price return: +48.0% / 12-Month Price Range: $ 64.27-124.18

BIGGEST LOSERS

- Rackspace Technology Inc (RXT), down 20.9% to $19.01 / YTD price return: -.3% / 12-Month Price Range: $ 15.25-26.43 (the stock is currently on the short sale restriction list)

- PMV Pharmaceuticals Inc (PMVP), down 19.6% to $28.01 / YTD price return: -54.5% / 12-Month Price Range: $ 29.45-63.22 (the stock is currently on the short sale restriction list)

- RealReal Inc (REAL), down 19.1% to $16.43 / YTD price return: -15.9% / 12-Month Price Range: $ 11.43-30.22 (the stock is currently on the short sale restriction list)

- Nano-X Imaging Ltd (NNOX), down 18.6% to $21.30 / YTD price return: -53.4% / 12-Month Price Range: $ 20.26-94.81 (the stock is currently on the short sale restriction list)

- Novavax Inc (NVAX), down 13.9% to $138.18 / YTD price return: +23.9% / 12-Month Price Range: $ 19.62-331.68 (the stock is currently on the short sale restriction list)

- Hanes Brands Inc (HBI), down 12.0% to $19.28 / YTD price return: +32.2% / 12-Month Price Range: $ 7.71-22.82 / Short interest (% of float): 4.9%; days to cover: 4.2 (the stock is currently on the short sale restriction list)

- Paysafe Ltd (PSFE), down 11.9% to $11.95 / YTD price return: -20.9% / 12-Month Price Range: $ 9.60-19.57 / Short interest (% of float): 3.3%; days to cover: 3.9 (the stock is currently on the short sale restriction list)

- Danaos Corp (DAC), down 11.3% to $56.52 / YTD price return: +163.7% / 12-Month Price Range: $ 3.33-68.75 / Short interest (% of float): 9.5%; days to cover: 2.2 (the stock is currently on the short sale restriction list)

- ZIM Integrated Shipping Services Ltd (ZIM), down 10.8% to $34.42 / 12-Month Price Range: $ 11.34-42.99 / Short interest (% of float): 0.9%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- 8x8 Inc (EGHT), down 10.5% to $25.19 / YTD price return: -26.9% / 12-Month Price Range: $ 13.51-39.17 / Short interest (% of float): 18.7%; days to cover: 21.4 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- SF Real Estate Investment Trust / Hong Kong - Real Estate / Listing Exchange: Hong Kong / Ticker: 2191 / Gross proceeds (including overallotment): US$ 249.60m (offering in Hong Kong Dollar) / Bookrunners: DBS Asia Capital Ltd, Credit Suisse (Hong Kong) Ltd, JP Morgan Securities Plc

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Evolution Gaming Group AB / Sweden - Media and Entertainment / Listing Exchange: OMX Stock / Ticker: EVO / Gross proceeds (including overallotment): US$ 753.98m (offering in Swedish Krona) / Bookrunners: JP Morgan & Co Inc

- THG PLC / United Kingdom - Retail / Listing Exchange: London / Ticker: THG / Gross proceeds (including overallotment): US$ 320.34m (offering in British Pound) / Bookrunners: Barclays Bank PLC, Goldman Sachs International, Jefferies International Ltd, Citigroup Global Markets Ltd