Equities

Meme Stocks Back On Top, AMC Entertainment Leading The Charge With An ATM Offering

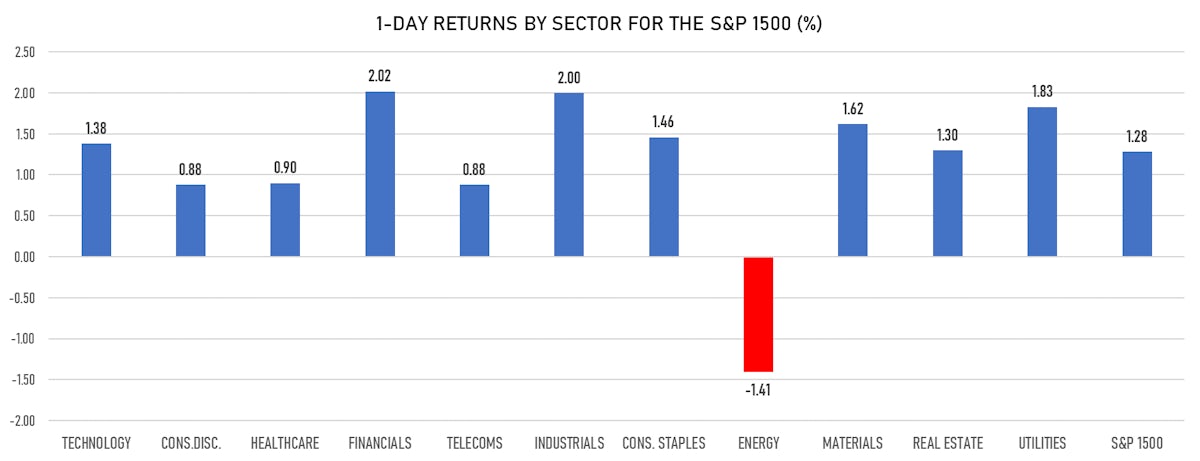

Financials and Industrials performed well today, while Energy was the only losing sector in the S&P500

Published ET

DOW JONES COMPOSITE MARKET CAP | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 1.22%; Nasdaq Composite up 0.72%; Wilshire 5000 up 1.06%

- Top performing sectors: industrials up 1.90% and financials up 1.87%

- Bottom performing sectors: energy down -1.35% and consumer discretionary up 0.69%

- Daily performance of international indices: Europe Stoxx 600 down -0.14%; China CSI 300 unchanged; Japan up 1.21%; UK FTSE 100 down -0.59%

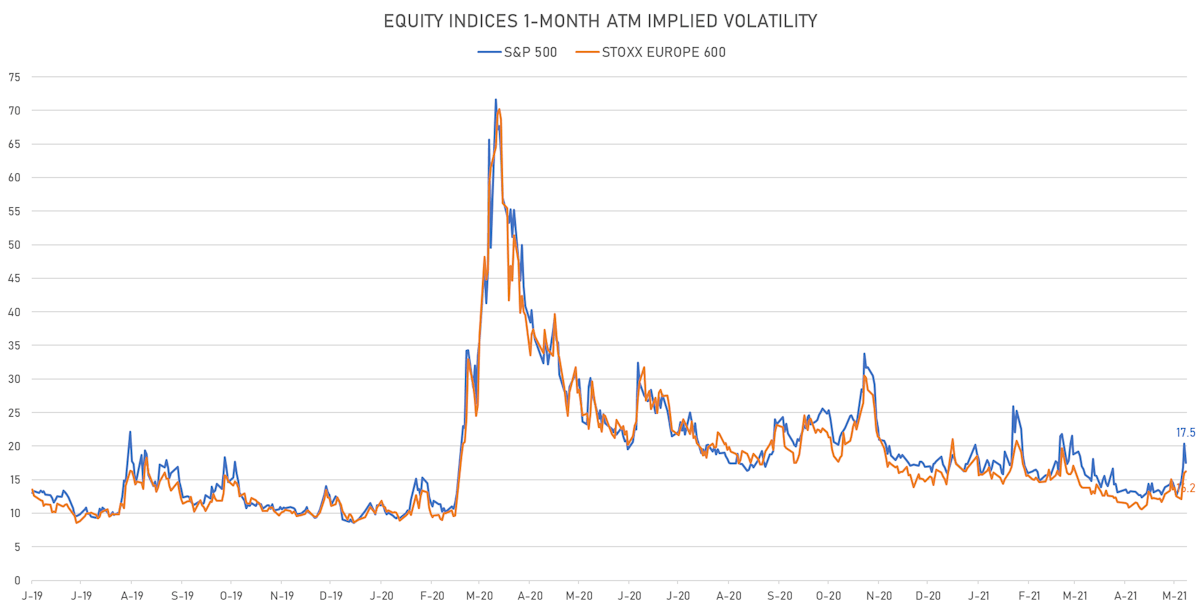

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 17.5%, down from 20.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 16.2%, up from 16.0%

NOTABLE S&P 500 EARNINGS RELEASES

- Discovery Inc (Consumer Cyclicals): missed on EPS (0.21 act. vs. 0.65 est.) and beat on revenue (2,792m act. vs. 2,775m est.)

TOP WINNERS

- AMC Entertainment Holdings Inc (AMC), up 23.7% to $12.77 / YTD price return: +502.4% / 12-Month Price Range: $ 1.91-20.36

- Multiplan Corp (MPLN), up 16.3% to $7.15 / YTD price return: -10.5% / 12-Month Price Range: $ 5.48-12.93 / Short interest (% of float): 3.5%; days to cover: 10.3 (the stock is currently on the short sale restriction list)

- Silvergate Capital Corp (SI), up 13.7% to $91.92 / YTD price return: +23.7% / 12-Month Price Range: $ 12.05-187.86

- GameStop Corp (GME), up 13.6% to $164.50 / YTD price return: +773.1% / 12-Month Price Range: $ 3.77-483.00

- Celsius Holdings Inc (CELH), up 12.1% to $51.70 / YTD price return: +2.8% / 12-Month Price Range: $ 5.60-70.66

- Abcellera Biologics Inc (ABCL), up 11.1% to $34.14 / YTD price return: -15.2% / 12-Month Price Range: $ 23.20-71.91 / Short interest (% of float): 5.0%; days to cover: 4.8

- CI Financial Corp (CIXX), up 11.0% to $17.26 / YTD price return: +39.1% / 12-Month Price Range: $ 10.38-17.55 / Short interest (% of float): 0.3%; days to cover: 15.5

- Grupo Simec SAB de CV (SIM), up 10.3% to $20.05 / YTD price return: +56.7% / 12-Month Price Range: $ 5.20-23.00 / Short interest (% of float): 0.0%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- International Game Technology PLC (IGT), up 10.1% to $22.10 / YTD price return: +30.5% / 12-Month Price Range: $ 5.57-21.14

- Cornerstone Building Brands Inc (CNR), up 9.9% to $14.85 / YTD price return: +60.0% / 12-Month Price Range: $ 3.60-15.64

BIGGEST LOSERS

- ContextLogic Inc (WISH), down 29.3% to $8.11 / YTD price return: -55.5% / 12-Month Price Range: $ 11.08-32.85 (the stock is currently on the short sale restriction list)

- Poshmark Inc (POSH), down 21.8% to $34.23 / 12-Month Price Range: $ 36.11-104.98 (the stock is currently on the short sale restriction list)

- American Well Corp (AMWL), down 21.6% to $10.05 / YTD price return: -60.3% / 12-Month Price Range: $ 11.89-43.75 / Short interest (% of float): 6.4%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Fluor Corp (FLR), down 20.4% to $18.93 / YTD price return: +18.5% / 12-Month Price Range: $ 7.43-25.08 (the stock is currently on the short sale restriction list)

- Curis Inc (CRIS), down 19.7% to $13.07 / YTD price return: +59.6% / 12-Month Price Range: $ .72-17.40 / Short interest (% of float): 13.6%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- Turquoise Hill Resources Ltd (TRQ), down 18.1% to $16.85 / YTD price return: +35.7% / 12-Month Price Range: $ 4.40-21.89 / Short interest (% of float): 2.7%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- 908 Devices Inc. (MASS), down 16.5% to $36.75 / YTD price return: -35.5% / 12-Month Price Range: $ 38.88-79.60 (the stock is currently on the short sale restriction list)

- Eargo Inc (EAR), down 16.3% to $32.66 / YTD price return: -27.1% / 12-Month Price Range: $ 32.58-76.75 (the stock is currently on the short sale restriction list)

- Riot Blockchain Inc (RIOT), down 16.2% to $22.23 / YTD price return: +30.8% / 12-Month Price Range: $ 1.60-79.50 (the stock is currently on the short sale restriction list)

- Butterfly Network Inc (BFLY), down 15.9% to $9.45 / YTD price return: -52.2% / 12-Month Price Range: $ 9.34-29.13 / Short interest (% of float): 9.6%; days to cover: 4.5 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- Alphawave IP Group PLC / United Kingdom - High Technology / Listing Exchange: London / Ticker: AWE / Gross proceeds (including overallotment): US$ 1,202.36m (offering in British Pound) / Bookrunners: BMO Capital Markets, Barclays Capital Securities Ltd, JP Morgan Securities Plc

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- China Evergrande New Energy Vehicle Group Ltd / China - Industrials / Listing Exchange: Hong Kong / Ticker: 708 / Gross proceeds (including overallotment): US$ 1,370.01m (offering in Hong Kong Dollar) / Bookrunners: Huatai Securities Co Ltd, Haitong International Securities Group Ltd, CMB International Finance Ltd

- KYB Corp / Japan - Industrials / Listing Exchange: Tokyo 1 / Ticker: 7242 / Gross proceeds (including overallotment): US$ 114.00m (offering in Japanese Yen) / Bookrunners: Directly Placed

- AMC Entertainment Holdings Inc. / US - Movie Theaters /Listing Exchange: NYSE / Ticker: AMC / Gross proceeds (including overallotment): US$ 428 million / At-the-market equity offering of 43 million shares at an average of $9.94 per share