Equities

Nasdaq Composite, S&P 500 Close With Small Losses, At The Highs Of The Day, After A Brutal Start

Ark Innovation ETF dropped another 1.7%, now down over 35% from its February high; Cathie Wood on Bloomberg TV talking about bitcoin market capitulation to reaffirm her $500k BTC price target, though it's unclear how that can help her credibility

Published ET

NASDAQ COmposite Intraday Prices | Source: Refinitiv

QUICK SUMMARY

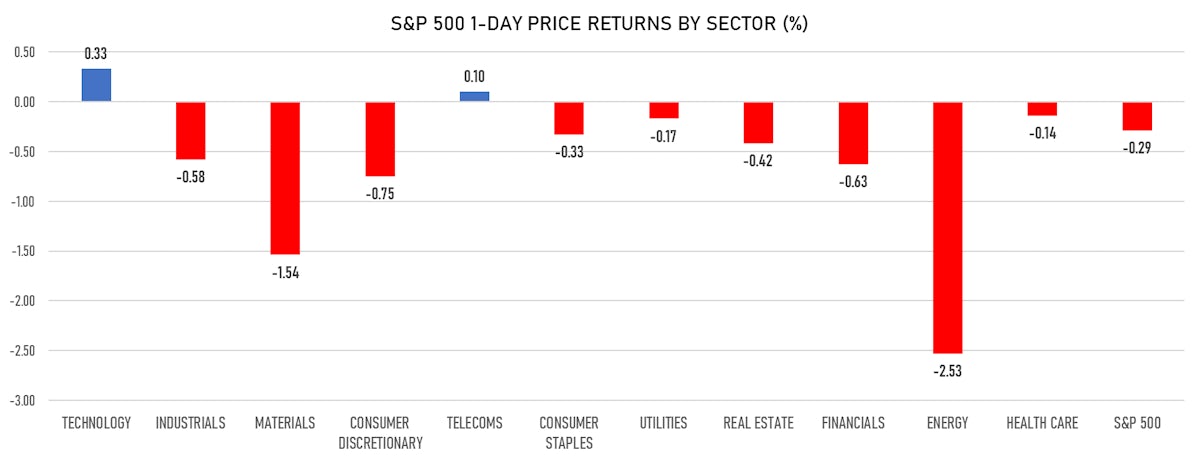

- Daily performance of US indices: S&P 500 down -0.29%; Nasdaq Composite down -0.03%; Wilshire 5000 down -0.35%

- Top performing sectors: technology up 0.33% and telecoms up 0.10%

- Bottom performing sectors: energy down -2.53% and materials down -1.54%

- Daily performance of international indices: Europe Stoxx 600 down -1.51%; China CSI 300 down 0.29%; Japan up 0.04%; UK FTSE 100 down -1.19%

VOLATILITY

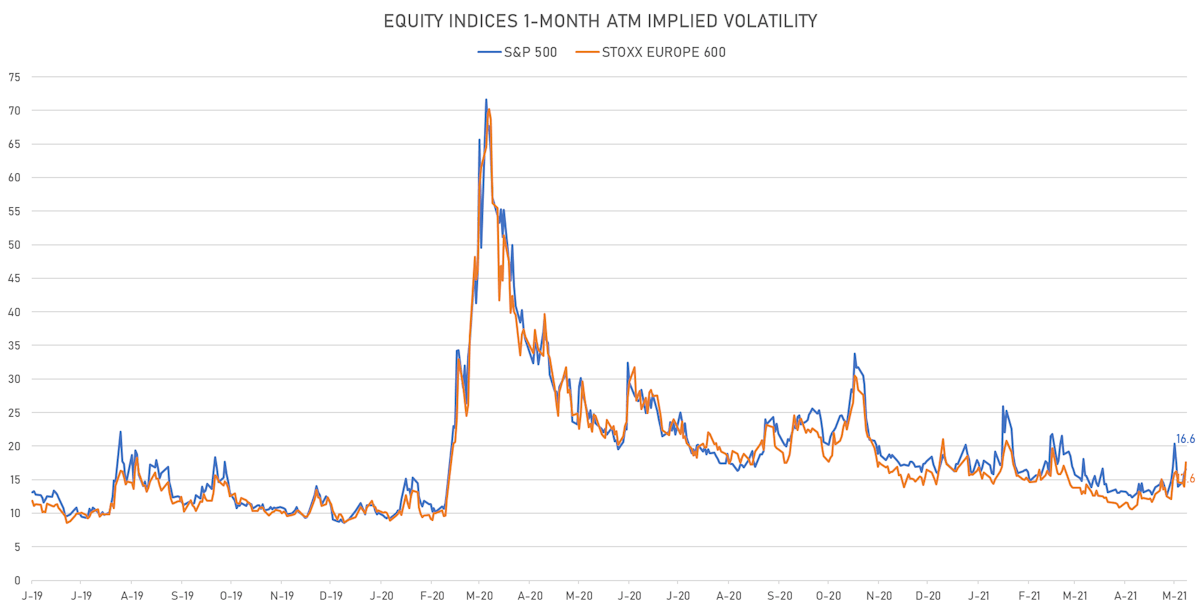

- 1-month at-the-money implied volatility on the S&P 500 at 16.6%, up from 15.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 17.6%, up from 14.0%

NOTABLE S&P 500 EARNINGS RELEASES

- CSX Corp (Industrials): missed on EPS (0.93 act. vs. 0.95 est.) and beat on revenue (2,813m act. vs. 2,779m est.)

- Thermo Fisher Scientific Inc (Healthcare): beat on EPS (7.21 act. vs. 6.65 est.) and beat on revenue (9,906m act. vs. 9,717m est.)

- Leidos Holdings Inc (Technology): beat on EPS (1.73 act. vs. 1.48 est.) and beat on revenue (3,315m act. vs. 3,250m est.)

- Kraft Heinz Co (Consumer Non-Cyclicals): beat on EPS (0.72 act. vs. 0.59 est.) and beat on revenue (6,394m act. vs. 6,241m est.)

- Southern Co (Utilities): beat on EPS (0.98 act. vs. 0.83 est.) and beat on revenue (5,910m act. vs. 5,488m est.)

- Lam Research Corp (Technology): beat on EPS (7.49 act. vs. 6.62 est.) and beat on revenue (3,848m act. vs. 3,696m est.)

- Analog Devices Inc (Technology): beat on EPS (1.54 act. vs. 1.45 est.) and beat on revenue (1,661m act. vs. 1,606m est.)

- Charles River Laboratories International Inc (Healthcare): beat on EPS (2.53 act. vs. 2.19 est.) and beat on revenue (825m act. vs. 798m est.)

- TJX Companies Inc (Consumer Cyclicals): beat on EPS (0.44 act. vs. 0.31 est.) and beat on revenue (10,087m act. vs. 8,617m est.)

- Parker-Hannifin Corp (Industrials): beat on EPS (4.11 act. vs. 3.78 est.) and beat on revenue (3,746m act. vs. 3,731m est.)

TOP WINNERS

- Reata Pharmaceuticals Inc (RETA), up 23.8% to $102.63 / YTD price return: -17.0% / 12-Month Price Range: $ 76.34-186.82

- Lordstown Motors Corp (RIDE), up 13.5% to $11.45 / YTD price return: -42.9% / 12-Month Price Range: $ 6.69-31.80 / Short interest (% of float): 28.2%; days to cover: 4.3

- View Inc (VIEW), up 12.2% to $8.21 / YTD price return: -25.5% / 12-Month Price Range: $ 6.02-13.31 / Short interest (% of float): 5.6%; days to cover: 8.3

- Cricut Inc (CRCT), up 11.4% to $27.68 / 12-Month Price Range: $ 14.88-29.00 / Short interest (% of float): 2.9%; days to cover: 0.4

- Upstart Holdings Inc (UPST), up 11.2% to $132.91 / YTD price return: +226.2% / 12-Month Price Range: $ 22.61-165.66 / Short interest (% of float): 5.7%; days to cover: 1.1

- ESSA Pharma Inc (EPIX), up 9.7% to $32.63 / YTD price return: +173.5% / 12-Month Price Range: $ 4.36-32.69 / Short interest (% of float): 0.7%; days to cover: 1.3

- Purecycle Technologies Inc (PCT), up 9.6% to $14.68 / YTD price return: -9.0% / 12-Month Price Range: $ 9.76-35.75 / Short interest (% of float): 4.2%; days to cover: 3.8

- ZIM Integrated Shipping Services Ltd (ZIM), up 9.0% to $45.45 / 12-Month Price Range: $ 11.34-42.99 / Short interest (% of float): 0.9%; days to cover: 0.5

- E2open Parent Holdings Inc (ETWO), up 8.8% to $12.19 / YTD price return: +12.5% / 12-Month Price Range: $ 8.26-11.97 / Short interest (% of float): 7.1%; days to cover: 5.6

- Avid Technology Inc (AVID), up 8.5% to $29.11 / YTD price return: +83.4% / 12-Month Price Range: $ 5.37-30.29

BIGGEST LOSERS

- Iovance Biotherapeutics Inc (IOVA), down 39.5% to $16.33 / YTD price return: -64.8% / 12-Month Price Range: $ 24.50-54.21 / Short interest (% of float): 13.8%; days to cover: 8.7 (the stock is currently on the short sale restriction list)

- Instil Bio Inc (TIL), down 14.6% to $17.28 / 12-Month Price Range: $ 14.42-29.49 / Short interest (% of float): 2.2%; days to cover: 3.5 (the stock is currently on the short sale restriction list)

- Canaan Inc (CAN), down 13.1% to $8.52 / YTD price return: +43.7% / 12-Month Price Range: $ 1.76-39.10 (the stock is currently on the short sale restriction list)

- Squarespace Inc (SQSP), down 12.7% to $43.65 on its trading debut

- Century Aluminum Co (CENX), down 11.7% to $13.66 / YTD price return: +23.8% / 12-Month Price Range: $ 4.72-19.60 (the stock is currently on the short sale restriction list)

- Vipshop Holdings Ltd (VIPS), down 11.3% to $21.89 / YTD price return: -22.1% / 12-Month Price Range: $ 14.36-46.00 (the stock is currently on the short sale restriction list)

- E-Home Household Service Holdings Ltd (EJH), down 11.1% to $36.91 / 12-Month Price Range: $ 16.60-80.93 (the stock is currently on the short sale restriction list)

- Sprout Social Inc (SPT), down 10.3% to $57.44 / YTD price return: +26.5% / 12-Month Price Range: $ 23.06-82.47 / Short interest (% of float): 3.4%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

- Teck Resources Ltd (TECK), down 10.1% to $23.48 / YTD price return: +29.4% / 12-Month Price Range: $ 9.09-26.72 / Short interest (% of float): 1.7%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- AMC Entertainment Holdings Inc (AMC), down 9.9% to $12.64 / YTD price return: +496.2% / 12-Month Price Range: $ 1.91-20.36 (the stock is currently on the short sale restriction list)

IPOs ANNOUNCED OR PRICED

- Huitongda Network Co Ltd / China - Industrials / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not yet, deal just announced

- SD Bio Sensor Inc / South Korea - Healthcare / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 573.09m (offering in Korean Won) / Bookrunners: Korea Investment & Securities Co Ltd, NH Investment & Securities Co

- hGears AG / Germany - Industrials / Listing Exchange: Frankfurt / Ticker: HGEA / Gross proceeds (including overallotment): US$ 216.05m (offering in EURO) / Bookrunners: ABN AMRO, Hauck & Aufhaeuser Corporate Finance GmbH

- Neighbourly Pharmacy Inc / Canada - Retail / Listing Exchange: Toronto / Ticker: NBLY / Gross proceeds (including overallotment): US$ 145.07m (offering in Canadian Dollar) / Bookrunners: Scotia Capital Inc, BMO Nesbitt Burns Inc, RBC Dominion Securities Inc

- Zhejiang Shaoxing Ruifeng Rural Commercial Bank Co Ltd / China - Financials / Listing Exchange: Shanghai / Ticker: 601528 / Gross proceeds (including overallotment): US$ 133.53m (offering in Chinese Yuan) / Bookrunners: China Securities Co Ltd

- Jiangsu Boiln Plastics Co Ltd / China - Materials / Listing Exchange: ShenzChNxt / Ticker: - / Gross proceeds (including overallotment): US$ 126.42m (offering in Chinese Yuan) / Bookrunners: Shengang Securities Co Ltd

- Aries I Acquisition Corp / Cayman Islands - Financials / Listing Exchange: Nasdaq / Ticker: RAMMU / Gross proceeds (including overallotment): US$ 125.00m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Kingswood Capital Markets LLC

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Axis Bank Ltd / India - Financials / Listing Exchange: National / Ticker: AXISBA / Gross proceeds (including overallotment): US$ 540.64m (offering in Indian Rupee) / Bookrunners: Citigroup Global Markets India, Morgan Stanley India Co Pvt, ICICI Securities Ltd