Equities

Telecoms And Technology Lead US Stocks Higher On Very Quiet Monday

Chinese K12 education stocks drop as regulator aims to further reduce burden of students' work, after new rules to ease pressure on school children were brought about last week; the reforms aim to boost the country's birth rate by diminishing the use of afterschool private tutoring and generally lowering family living costs

Published ET

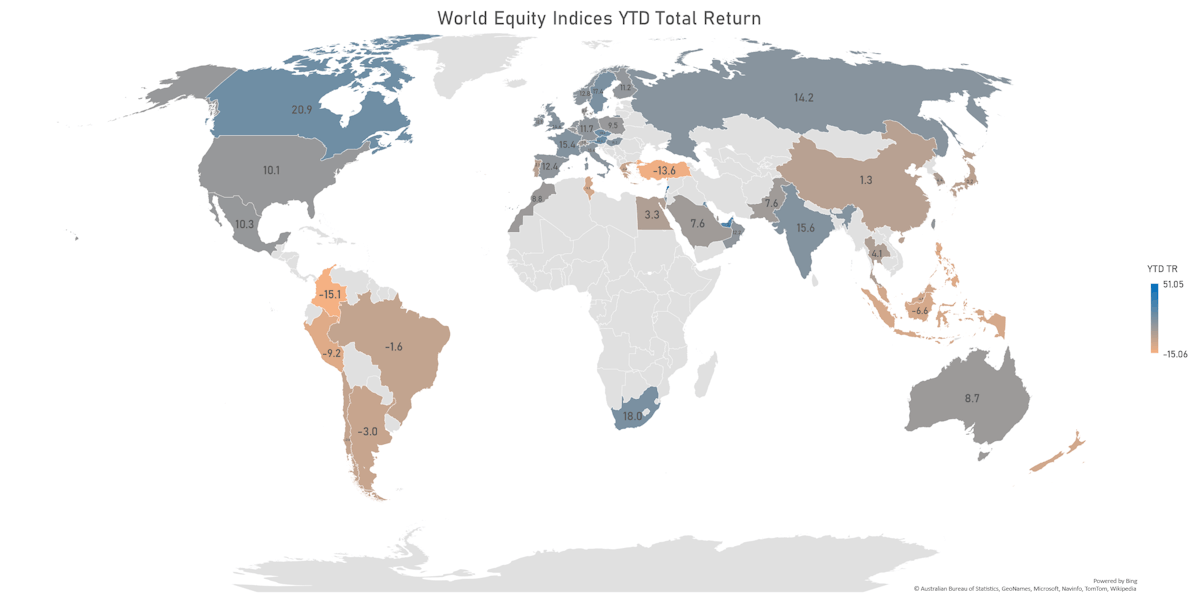

World Equities Returns Year To Date | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.99%; Nasdaq Composite up 1.41%; Wilshire 5000 up 0.99%

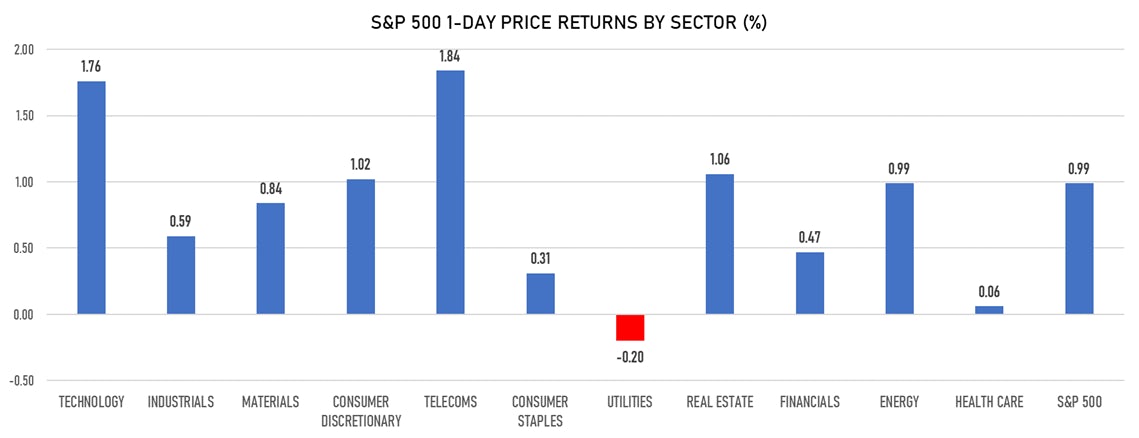

- Top performing sectors: telecoms up 1.84% and technology up 1.76%

- Bottom performing sectors: utilities down -0.20% and health care up 0.06%

- Daily performance of international indices: Europe Stoxx 600 unchanged; China CSI 300 up 1.80%; Japan up 0.28%; UK FTSE 100 up 0.48%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.2%, down from 14.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.6%, down from 14.0%

TOP WINNERS

- Virgin Galactic Holdings Inc (SPCE), up 27.6% to $18.42 / YTD price return: +13.3% / 12-Month Price Range: $ 9.75-33.70 / Short interest (% of float): 0.6%; days to cover: 3.9

- Riot Blockchain Inc (RIOT), up 13.6% to $4.94 / YTD price return: +52.7% / 12-Month Price Range: $ 2.85-5.17 / Short interest (% of float): 1.0%; days to cover: 2.5

- AMC Entertainment Holdings Inc (AMC), up 13.2% to $12.04 / YTD price return: +545.3% / 12-Month Price Range: $ 8.09-25.40 / Short interest (% of float): 8.3%; days to cover: 7.9

- Himax Technologies Inc (HIMX), up 10.9% to $16.42 / YTD price return: +55.5% / 12-Month Price Range: $ 9.76-35.75 / Short interest (% of float): 4.3%; days to cover: 3.8

- Stem Inc (STEM), up 10.8% to $20.73 / YTD price return: +19.6% / 12-Month Price Range: $ 19.99-23.25

- Marathon Digital Holdings Inc (MARA), up 10.8% to $24.53 / YTD price return: +121.7% / 12-Month Price Range: $ 19.68-35.78 / Short interest (% of float): 1.1%; days to cover: 1.3

- Skywater Technology Inc (SKYT), up 10.1% to $139.77 / 12-Month Price Range: $ 22.61-165.66 / Short interest (% of float): 5.7%; days to cover: 1.1

- Beyond Meat Inc (BYND), up 10.0% to $13.90 / YTD price return: -6.2% / 12-Month Price Range: $ 4.32-22.68 / Short interest (% of float): 4.4%; days to cover: 1.2

- Squarespace Inc (SQSP), up 9.6% to $32.32 / 12-Month Price Range: $ 27.15-39.58

- OneConnect Financial Technology Co Ltd (OCFT), up 9.2% to $27.91 / YTD price return: -7.0% / 12-Month Price Range: $ 4.60-56.50 / Short interest (% of float): 16.3%; days to cover: 6.1

BIGGEST LOSERS

- NGM Biopharmaceuticals Inc (NGM), down 40.8% to $19.05 / YTD price return: -44.5% / 12-Month Price Range: $ 19.39-149.05 / Short interest (% of float): 12.7%; days to cover: 0.0 (the stock is currently on the short sale restriction list)

- New Oriental Education & Technology Group Inc (EDU), down 18.3% to $28.51 / YTD price return: -51.2% / 12-Month Price Range: $ 26.57-59.85 / Short interest (% of float): 6.1%; days to cover: 6.5 (the stock is currently on the short sale restriction list)

- TAL Education Group (TAL), down 17.1% to $35.57 / YTD price return: -50.3% / 12-Month Price Range: $ 42.25-90.96 / Short interest (% of float): 3.0%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- ContextLogic Inc (WISH), down 12.2% to $3.24 / YTD price return: -55.2% / 12-Month Price Range: $ .29-5.77 / Short interest (% of float): 0.9%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- GSX Techedu Inc (GOTU), down 12.0% to $7.41 / YTD price return: -63.2% / 12-Month Price Range: $ 1.76-39.10 (the stock is currently on the short sale restriction list)

- Youdao Inc (DAO), down 9.2% to $76.61 / YTD price return: -17.6% / 12-Month Price Range: $ 55.52-90.79 / Short interest (% of float): 2.1%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- Upstart Holdings Inc (UPST), down 9.2% to $29.98 / YTD price return: +243.0% / 12-Month Price Range: $ 26.48-86.55 / Short interest (% of float): 8.9%; days to cover: 7.5 (the stock is currently on the short sale restriction list)

- Itau Corpbanca (ITCB), down 8.9% to $21.20 / YTD price return: -9.1% / 12-Month Price Range: $ 9.95-47.80 / Short interest (% of float): 17.5%; days to cover: 4.6

- Burning Rock Biotech Ltd (BNR), down 8.6% to $26.43 / YTD price return: +45.7% / 12-Month Price Range: $ 26.56-31.33

- Studio City International Holdings Ltd (MSC), down 8.5% to $42.49 / YTD price return: -3.5% / 12-Month Price Range: $ 9.85-63.04 / Short interest (% of float): 17.1%; days to cover: 0.7

NEW IPOs ANNOUNCED OR PRICED

- Fifth Wall Acquisition Corp III / Cayman Islands - Financials / Listing Exchange: Nasdaq / Ticker: FWAC / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Deutsche Bank Securities Inc, Bofa Securities Inc

- Taylor Maritime Investments Ltd / United Kingdom - Financials / Listing Exchange: London / Ticker: TMI / Gross proceeds (including overallotment): US$ 160.00m (offering in U.S. Dollar) / Bookrunners: Jefferies International Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Country Garden Services Holdings Co Ltd / China - Real Estate / Listing Exchange: Hong Kong / Ticker: 6098 / Gross proceeds (including overallotment): US$ 1,007.76m (offering in Hong Kong Dollar) / Bookrunners: UBS (Hong Kong), Morgan Stanley International Hong Kong, China International Capital Corp HK Securities Ltd

- Weimob Inc / China - High Technology / Listing Exchange: Hong Kong / Ticker: 2013 / Gross proceeds (including overallotment): US$ 252.16m (offering in Hong Kong Dollar) / Bookrunners: Morgan Stanley International Hong Kong, Credit Suisse (Hong Kong) Ltd, China International Capital Corp HK Securities Ltd