Equities

Energy Stocks Up Almost 4% As WTI, Brent Crude Rally On OPEC+ Decision

Value outperformed growth and small caps outperformed large caps on a quiet day for US markets, which saw main indices close largely unchanged

Published ET

Market Caps in the Dow Jones Composite Average | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

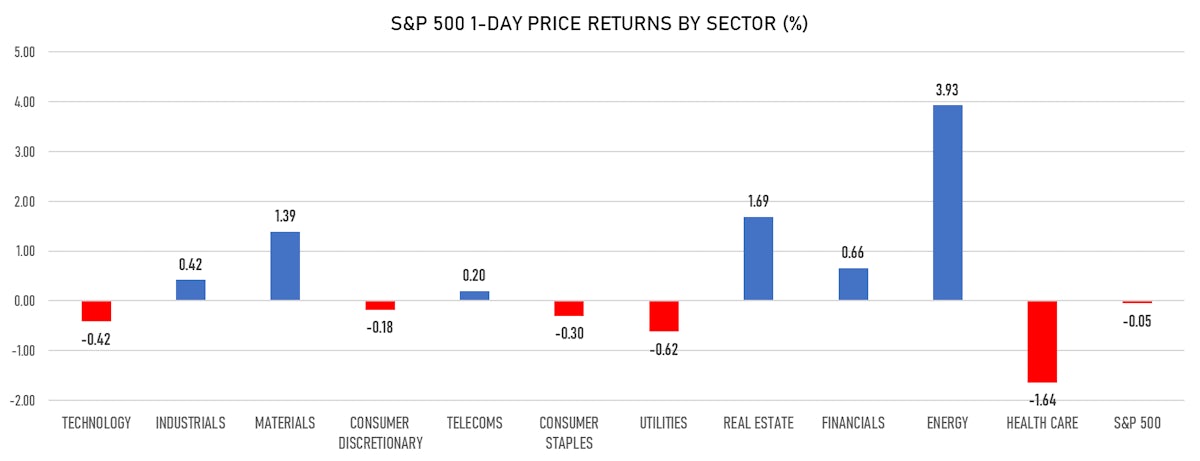

- Daily performance of US indices: S&P 500 down -0.05%; Nasdaq Composite down -0.09%; Wilshire 5000 up 0.11%

- 56.6% of S&P 500 stocks were up today, with 90.7% of stocks above their 200-day moving average (DMA) and 73.1% above their 50-DMA

- Top performing sectors: energy up 3.93% and real estate up 1.69%

- Bottom performing sectors: health care down -1.64% and utilities down -0.62%

- Daily performance of international indices: Europe Stoxx 600 up 0.75%; China CSI 300 down -0.46%; Japan up 0.77%; UK FTSE 100 up 0.82%

VOLATILITY

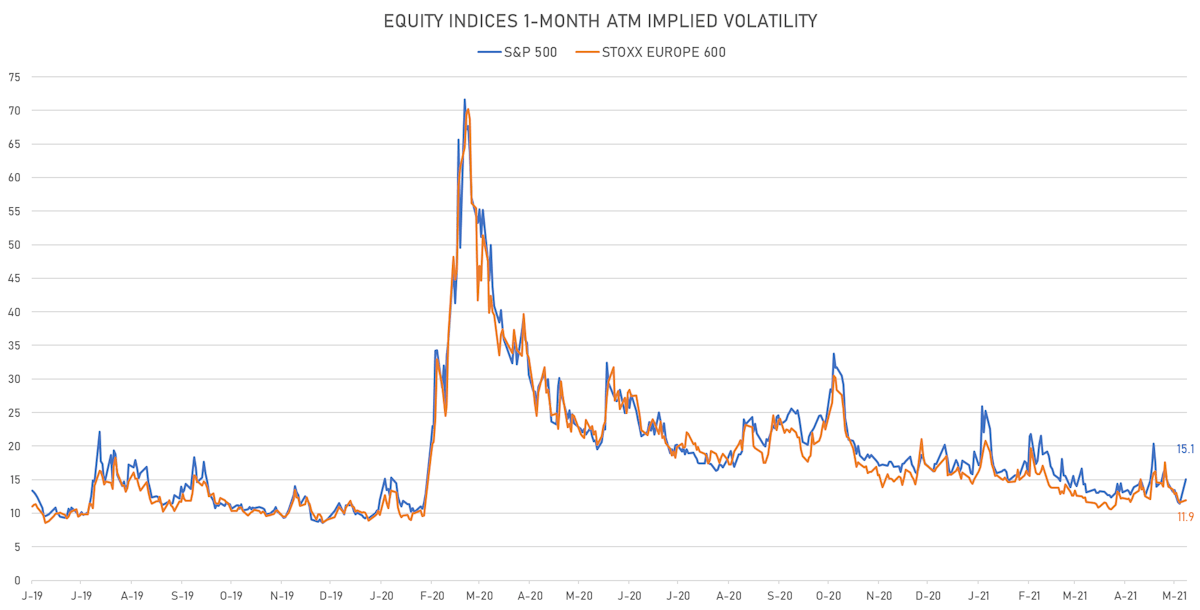

- 1-month at-the-money implied volatility on the S&P 500 at 15.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.9%, down from 12.1%

NOTABLE S&P 500 EARNINGS RELEASES

- HP Inc (Technology): beat on EPS (0.93 act. vs. 0.89 est.) and beat on revenue (15,877m act. vs. 15,020m est.)

TOP WINNERS

- Lexinfintech Holdings Ltd (LX), up 28.0% to $11.70 / YTD price return: +74.6% / 12-Month Price Range: $ 6.04-15.42 / Short interest (% of float): 1.2%; days to cover: 1.8

- Cloudera Inc (CLDR), up 23.9% to $15.93 / YTD price return: +14.5% / 12-Month Price Range: $ 9.34-19.35 / Short interest (% of float): 6.2%; days to cover: 5.7

- Uxin Ltd (UXIN), up 22.7% to $4.54 / YTD price return: +420.3% / 12-Month Price Range: $ .72-4.15 / Short interest (% of float): 4.6%; days to cover: 0.4

- AMC Entertainment Holdings Inc (AMC), up 22.7% to $32.04 / YTD price return: +1,411.3% / 12-Month Price Range: $ 1.91-36.72

- Canaan Inc (CAN), up 22.1% to $10.26 / YTD price return: +73.0% / 12-Month Price Range: $ 1.76-39.10

- 360 DigiTech Inc (QFIN), up 20.3% to $33.76 / YTD price return: +186.3% / 12-Month Price Range: $ 9.17-35.15 / Short interest (% of float): 3.0%; days to cover: 2.1

- Tenneco Inc (TEN), up 19.1% to $18.67 / YTD price return: +76.1% / 12-Month Price Range: $ 6.19-15.84

- C3Ai Inc (AI), up 16.3% to $71.76 / YTD price return: -48.3% / 12-Month Price Range: $ 47.22-183.90

- Singular Genomics Systems Inc (OMIC), up 15.4% to $31.17 / 12-Month Price Range: $ 25.50-32.08

- MicroVision Inc (MVIS), up 15.1% to $17.95 / YTD price return: +233.6% / 12-Month Price Range: $ .84-28.00

BIGGEST LOSERS

- Day One Biopharmaceuticals Inc (DAWN), down 10.1% to $21.30 / 12-Month Price Range: $ 22.43-27.04 (the stock is currently on the short sale restriction list)

- Abbott Laboratories (ABT), down 9.3% to $105.79 / YTD price return: -3.4% / 12-Month Price Range: $ 86.16-128.54 / Short interest (% of float): 0.8%; days to cover: 2.8

- MannKind Corp (MNKD), down 8.6% to $4.04 / YTD price return: +29.1% / 12-Month Price Range: $ 1.36-6.25 / Short interest (% of float): 15.8%; days to cover: 10.6

- PMV Pharmaceuticals Inc (PMVP), down 8.5% to $31.48 / YTD price return: -48.8% / 12-Month Price Range: $ 26.38-63.22 / Short interest (% of float): 8.4%; days to cover: 16.8 (the stock is currently on the short sale restriction list)

- PetIQ Inc (PETQ), down 8.4% to $37.63 / YTD price return: -2.1% / 12-Month Price Range: $ 24.42-46.00 / Short interest (% of float): 11.6%; days to cover: 7.3

- Cronos Group Inc (CRON), down 8.4% to $8.25 / YTD price return: +18.9% / 12-Month Price Range: $ 4.92-15.83 / Short interest (% of float): 11.0%; days to cover: 8.7

- Hims & Hers Health Inc (HIMS), down 8.4% to $13.20 / YTD price return: -9.6% / 12-Month Price Range: $ 8.09-25.40 / Short interest (% of float): 9.9%; days to cover: 11.5

- Loandepot Inc (LDI), down 8.0% to $15.60 / 12-Month Price Range: $ 12.05-38.68 / Short interest (% of float): 23.9%; days to cover: 3.6

- Humanigen Inc (HGEN), down 7.9% to $18.63 / YTD price return: +6.5% / 12-Month Price Range: $ 5.30-33.95 / Short interest (% of float): 23.0%; days to cover: 7.0

- Mind Medicine (MindMed) Inc (MNMD), down 7.6% to $3.14 / YTD price return: +3.0% / 12-Month Price Range: $ .29-5.77 / Short interest (% of float): 1.5%; days to cover: 0.5

NEW IPOs ANNOUNCED OR PRICED

- NX Filtration BV / Netherlands - Industrials / Listing Exchange: EuronextAM / Ticker: N/A / Gross proceeds (including overallotment): US$ 183.4m (offering in EURO) / Bookrunners: Berenberg, ABN AMRO Handelsbank

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Evergrande Property Services Group Ltd / China - Real Estate / Listing Exchange: Hong Kong / Ticker: 6666 / Gross proceeds (including overallotment): US$ 340.95m (offering in Hong Kong Dollar) / Bookrunners: UBS (Hong Kong), Huatai Securities Co Ltd, CMB International Capital Corp

- Hanwha Systems Co Ltd / South Korea - High Technology / Listing Exchange: Korea / Ticker: 272210 / Gross proceeds (including overallotment): US$ 209.78m (offering in Korean Won) / Bookrunners: Daishin Securities Co Ltd, Korea Investment & Securities Co Ltd, NH Investment & Securities Co Ltd, Mirae Asset Daewoo Co Ltd, KBI Securities Co Ltd

- Madrigal Pharmaceuticals Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: MDGL / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable