Equities

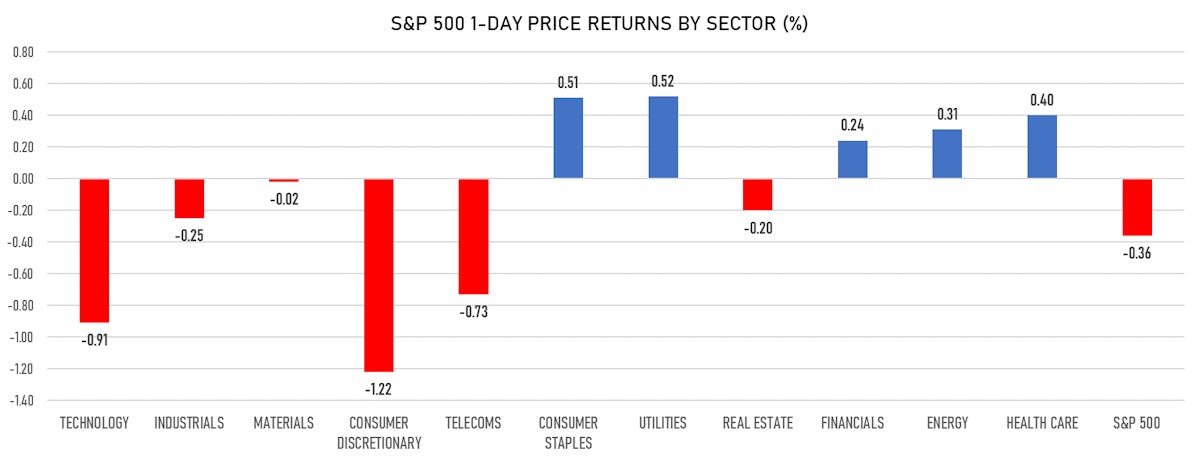

Consumer Discretionary And Tech Drop The Most, While Value Stocks Do Relatively Better

Chinese K12 education stocks fall by double digits again, on heightened concern about a government ban of after-school tutoring during weekends and holidays; finalized policies could be announced before July according to Credit Suisse analysts

Published ET

AMC stock intraday prices | Source" Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.36%; Nasdaq Composite down -1.03%; Wilshire 5000 down -0.55%

- 48.3% of S&P 500 stocks were up today, with 89.1% of stocks above their 200-day moving average (DMA) and 70.3% above their 50-DMA

- The volume of S&P 500 shares traded today was 2.2m, close to the 3-month average volume of 2.3m (12-month volume range is 0.8 - 5.1m)

- Top performing sectors: utilities up 0.52% and consumer staples up 0.51%

- Bottom performing sectors: consumer discretionary down -1.22% and technology down -0.91%

- The S&P 500 Value Index was unchanged, while the S&P 500 Growth Index was down -0.8%; the S&P small caps index was down -0.8% and mid caps were down -0.5%

- Daily performance of international indices: Europe Stoxx 600 unchanged; China CSI 300 down -0.05%; Japan down -0.01%; UK FTSE 100 down -0.61%

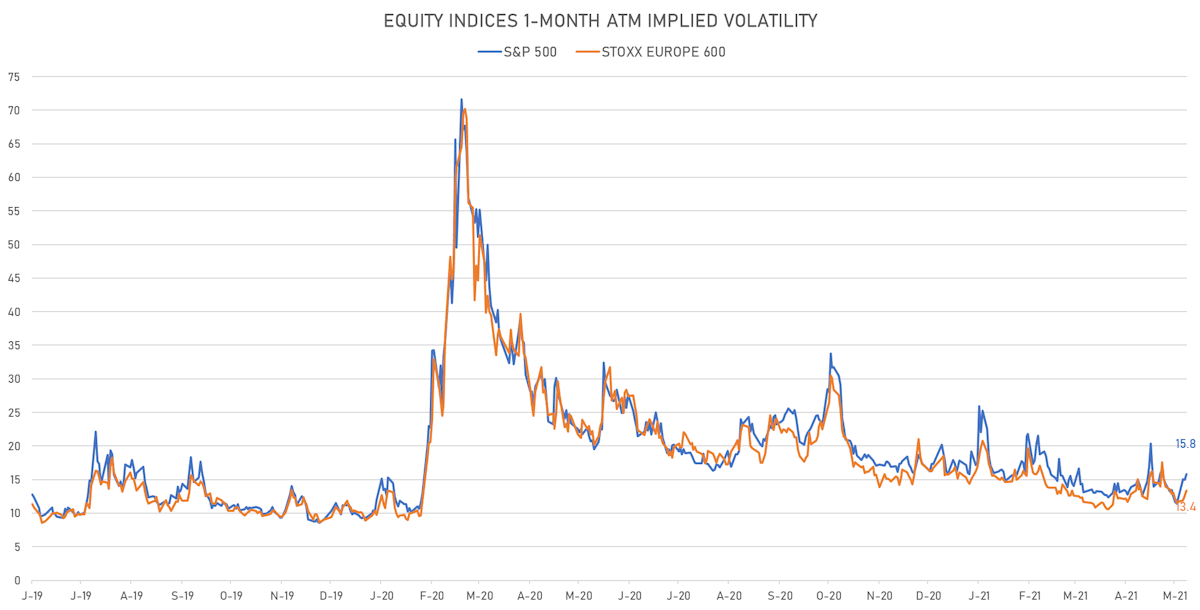

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 15.8%, up from 15.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.4%, up from 12.6%

NOTABLE S&P 500 EARNINGS RELEASES

- ConocoPhillips (Energy): beat on EPS (0.69 act. vs. 0.51 est.) and beat on revenue (10,559m act. vs. 8,069m est.)

- Schlumberger NV (Energy): beat on EPS (0.21 act. vs. 0.19 est.) and beat on revenue (5,223m act. vs. 5,093m est.)

- Avery Dennison Corp (Basic Materials): beat on EPS (2.40 act. vs. 2.03 est.) and beat on revenue (2,051m act. vs. 1,927m est.)

TOP WINNERS

- Workhorse Group Inc (WKHS), up 28.2% to $14.77 / YTD price return: -25.3% / 12-Month Price Range: $ 2.73-42.96 / Short interest (% of float): 42.2%; days to cover: 4.0

- Pyrogenesis Canada Inc (PYR), up 22.2% to $6.34 / YTD price return: +124.4% / 12-Month Price Range: $ 1.10-12.00 / Short interest (% of float): 1.2%; days to cover: 4.7

- Tellurian Inc (TELL), up 19.2% to $5.16 / YTD price return: +303.1% / 12-Month Price Range: $ .68-5.47 / Short interest (% of float): 8.8%; days to cover: 3.3

- Tenneco Inc (TEN), up 15.0% to $21.13 / YTD price return: +99.3% / 12-Month Price Range: $ 6.19-19.15 / Short interest (% of float): 4.4%; days to cover: 2.5

- Sundial Growers Inc (SNDL), up 14.2% to $1.29 / YTD price return: +172.4% / 12-Month Price Range: $ .14-3.96 / Short interest (% of float): 13.9%; days to cover: 1.3

- SecureWorks Corp (SCWX), up 12.2% to $16.47 / YTD price return: +15.8% / 12-Month Price Range: $ 10.01-16.31 / Short interest (% of float): 11.5%; days to cover: 17.8

- Clean Energy Fuels Corp (CLNE), up 12.2% to $9.12 / YTD price return: +16.0% / 12-Month Price Range: $ 2.01-19.79 / Short interest (% of float): 7.3%; days to cover: 1.4

- Elastic NV (ESTC), up 10.0% to $129.84 / YTD price return: -11.1% / 12-Month Price Range: $ 78.00-176.49 / Short interest (% of float): 14.0%; days to cover: 9.7

- ON24 Inc (ONTF), up 9.4% to $35.53 / 12-Month Price Range: $ 31.03-81.98 / Short interest (% of float): 1.9%; days to cover: 4.7

- AST SpaceMobile Inc (ASTS), up 9.3% to $8.09 / YTD price return: -40.4% / 12-Month Price Range: $ 6.96-25.37 / Short interest (% of float): 9.5%; days to cover: 2.4

BIGGEST LOSERS

- Bed Bath & Beyond Inc (BBBY), down 27.8% to $31.90 / YTD price return: +79.6% / 12-Month Price Range: $ 7.30-53.90 / Short interest (% of float): 31.3%; days to cover: 7.5 (the stock is currently on the short sale restriction list)

- AMC Entertainment Holdings Inc (AMC), down 17.9% to $51.34 / YTD price return: +2,321.7% / 12-Month Price Range: $ 1.91-72.62 / Short interest (% of float): 21.1%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- FireEye Inc (FEYE), down 17.6% to $18.56 / YTD price return: -19.5% / 12-Month Price Range: $ 11.38-25.53 / Short interest (% of float): 7.6%; days to cover: 3.9 (the stock is currently on the short sale restriction list)

- Credit Acceptance Corp (CACC), down 16.2% to $385.26 / YTD price return: +11.3% / 12-Month Price Range: $ 266.74-539.00 / Short interest (% of float): 16.5%; days to cover: 23.9 (the stock is currently on the short sale restriction list)

- Day One Biopharmaceuticals Inc (DAWN), down 14.3% to $19.00 / 12-Month Price Range: $ 19.07-27.04 (the stock is currently on the short sale restriction list)

- GSX Techedu Inc (GOTU), down 13.8% to $14.95 / YTD price return: -71.1% / 12-Month Price Range: $ 16.13-149.05 / Short interest (% of float): 12.8%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- TAL Education Group (TAL), down 13.2% to $33.27 / YTD price return: -53.5% / 12-Month Price Range: $ 34.26-90.96 / Short interest (% of float): 3.5%; days to cover: 3.3 (the stock is currently on the short sale restriction list)

- Tuya Inc (TUYA), down 12.6% to $22.11 / 12-Month Price Range: $ 15.70-27.65 / Short interest (% of float): 0.7%; days to cover: 3.4 (the stock is currently on the short sale restriction list)

- Centessa Pharmaceuticals PLC (CNTA), down 12.1% to $22.06 / 12-Month Price Range: $ 20.00-25.82 (the stock is currently on the short sale restriction list)

- New Oriental Education & Technology Group Inc (EDU), down 12.1% to $9.32 / YTD price return: -49.8% / 12-Month Price Range: $ 9.05-19.97 / Short interest (% of float): 2.9%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Hygeia Healthcare Holdings Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 6078 / Gross proceeds (including overallotment): US$ 213.96m (offering in Hong Kong Dollar) / Bookrunners: Morgan Stanley

- Westport Fuel Systems Inc / Canada - Industrials / Listing Exchange: Toronto / Ticker: WPT / Gross proceeds (including overallotment): US$ 100.10m (offering in U.S. Dollar) / Bookrunners: RBC Capital Markets LLC, JP Morgan Securities LLC