Equities

Tech Rebounds As The Perspective Of Imminent Tapering Fades

Growth beat value and large caps beat small caps on low volume, low volatility trading day

Published ET

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.88%; Nasdaq Composite up 1.47%; Wilshire 5000 up 0.90%

- 67.3% of S&P 500 stocks were up today, with 90.5% of stocks above their 200-day moving average (DMA) and 72.9% above their 50-DMA

- The volume of S&P 500 shares traded today was 1.9m (3-month z-score: -1.0); the 3-month average volume is 2.3m and the 12-month range is 0.8 - 5.1m

- Top performing sectors: technology up 1.92% and telecoms up 1.36%

- Bottom performing sectors: utilities down -0.15% and real estate up 0.13%

- The S&P 500 Value Index was up 0.4%, while the S&P 500 Growth Index was up 1.4%; the S&P small caps index was up 0.2% and mid caps were up 0.5%

- Daily performance of international indices: Europe Stoxx 600 up 0.39%; China CSI 300 up 0.51%; Japan up 0.03%; UK FTSE 100 up 0.07%

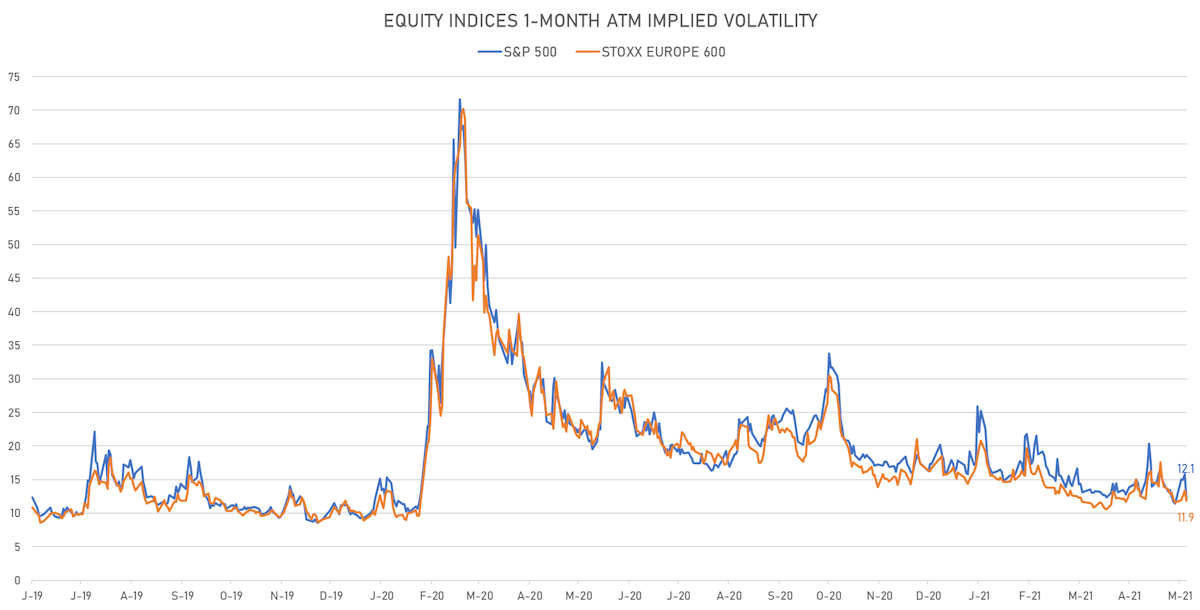

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.1%, down from 15.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.9%, down from 13.4%

TOP WINNERS

- Senseonics Holdings Inc (SENS), up 42.0% to $5.93 / YTD price return: +233.8% / 12-Month Price Range: $ 1.10-12.00 / Short interest (% of float): 1.2%; days to cover: 4.7

- Ehang Holdings Ltd (EH), up 19.8% to $20.60 / YTD price return: +54.4% / 12-Month Price Range: $ 6.19-21.55 / Short interest (% of float): 4.4%; days to cover: 2.5

- DocuSign Inc (DOCU), up 19.8% to $1.09 / YTD price return: +4.9% / 12-Month Price Range: $ .14-3.96 / Short interest (% of float): 13.9%; days to cover: 1.3

- AMC Networks Inc (AMCX), up 17.7% to $15.82 / YTD price return: +86.7% / 12-Month Price Range: $ 10.01-16.56 / Short interest (% of float): 11.5%; days to cover: 17.8

- 360 DigiTech Inc (QFIN), up 17.2% to $130.87 / YTD price return: +210.2% / 12-Month Price Range: $ 78.00-176.49 / Short interest (% of float): 14.0%; days to cover: 9.7

- MongoDB Inc (MDB), up 16.3% to $35.44 / YTD price return: -12.2% / 12-Month Price Range: $ 31.03-81.98 / Short interest (% of float): 1.9%; days to cover: 4.7

- Tuya Inc (TUYA), up 15.0% to $19.54 / 12-Month Price Range: $ 9.12-33.82 / Short interest (% of float): 9.6%; days to cover: 11.4 (the stock is currently on the short sale restriction list)

- Lexinfintech Holdings Ltd (LX), up 14.4% to $13.87 / YTD price return: +90.7% / 12-Month Price Range: $ 9.35-13.11 / Short interest (% of float): 6.5%; days to cover: 4.0

- Smart Share Global Ltd (EM), up 12.6% to $26.70 / 12-Month Price Range: $ 3.46-38.50 / Short interest (% of float): 4.9%; days to cover: 0.7

- MicroVision Inc (MVIS), up 12.4% to $9.93 / YTD price return: +276.4% / 12-Month Price Range: $ 9.22-53.75 / Short interest (% of float): 16.8%; days to cover: 10.2

BIGGEST LOSERS

- Sundial Growers Inc (SNDL), down 15.5% to $1.09 / YTD price return: +130.2% / 12-Month Price Range: $ .14-3.96 / Short interest (% of float): 13.9%; days to cover: 1.3 (the stock is currently on the short sale restriction list)

- PagerDuty Inc (PD), down 13.0% to $35.36 / YTD price return: -15.2% / 12-Month Price Range: $ 23.00-58.36 / Short interest (% of float): 13.2%; days to cover: 8.1 (the stock is currently on the short sale restriction list)

- BlackBerry Ltd (BB), down 12.7% to $13.86 / YTD price return: +109.0% / 12-Month Price Range: $ 4.37-28.77 / Short interest (% of float): 9.0%; days to cover: 5.5 (the stock is currently on the short sale restriction list)

- Pershing Square Tontine Holdings Ltd (PSTH), down 11.9% to $22.06 / YTD price return: -20.4% / 12-Month Price Range: $ 21.50-34.10 / Short interest (% of float): 2.5%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- Workhorse Group Inc (WKHS), down 11.6% to $13.05 / YTD price return: -34.0% / 12-Month Price Range: $ 2.96-42.96 / Short interest (% of float): 42.2%; days to cover: 4.0 (the stock is currently on the short sale restriction list)

- MacroGenics Inc (MGNX), down 11.0% to $27.01 / 12-Month Price Range: $ 18.16-36.48 / Short interest (% of float): 8.4%; days to cover: 6.9 (the stock is currently on the short sale restriction list)

- TAL Education Group (TAL), down 9.8% to $30.00 / YTD price return: -58.0% / 12-Month Price Range: $ 30.02-90.96 (the stock is currently on the short sale restriction list)

- ArcBest Corp (ARCB), down 9.2% to $69.83 / YTD price return: +63.7% / 12-Month Price Range: $ 22.18-93.96 (the stock is currently on the short sale restriction list)

- RLX Technology Inc (RLX), down 8.9% to $9.90 / 12-Month Price Range: $ 7.89-35.00 / Short interest (% of float): 2.0%; days to cover: 3.8

- Nuvation Bio Inc (NUVB), down 8.8% to $12.25 / 12-Month Price Range: $ 8.56-15.23 / Short interest (% of float): 2.9%; days to cover: 7.6 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- Social Capital Suvretta Holdings Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: DNAB / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- CleanSpark Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: CLSK / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Enviva Partners LP / United States of America - Materials / Listing Exchange: New York / Ticker: EVA / Gross proceeds (including overallotment): US$ 226.55m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, BMO Capital Markets, RBC Capital Markets LLC, HSBC Securities (USA) Inc, JP Morgan Securities LLC, Barclays Capital Inc

- Westport Fuel Systems Inc / Canada - Industrials / Listing Exchange: Toronto / Ticker: WPT / Gross proceeds (including overallotment): US$ 100.10m (offering in U.S. Dollar) / Bookrunners: RBC Capital Markets LLC, JP Morgan Securities LLC

- Hanwha Systems Co Ltd / South Korea - High Technology / Listing Exchange: Korea / Ticker: 272210 / Gross proceeds (including overallotment): US$ 831.67m (offering in Korean Won) / Bookrunners: Daishin Securities Co Ltd, Korea Investment & Securities Co Ltd, NH Investment & Securities Co Ltd, Mirae Asset Daewoo Co Ltd, KBI Securities Co Ltd

- Chengtun Mining Group Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 600711 / Gross proceeds (including overallotment): US$ 351.37m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Hygeia Healthcare Holdings Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 6078 / Gross proceeds (including overallotment): US$ 213.40m (offering in Hong Kong Dollar) / Bookrunners: JP Morgan & Co Inc, Morgan Stanley

- C&D International Investment Group Ltd / Hong Kong - Real Estate / Listing Exchange: Hong Kong / Ticker: 1908 / Gross proceeds (including overallotment): US$ 121.49m (offering in Hong Kong Dollar) / Bookrunners: China Industrial Securities International Capital Ltd

- Atlantic Sapphire ASA / Norway - Consumer Staples / Listing Exchange: Oslo / Ticker: ASA / Gross proceeds (including overallotment): US$ 120.61m (offering in Norwegian Krone) / Bookrunners: DnB Markets AS, Arctic Securities ASA, Bofa Securities Inc