Equities

Stocks Edge Down, With Growth Overperforming Value And Small Caps Beating Large Caps

If boredom is good, the current state of equity markets is great: we're out of earnings season, volumes are low, implied volatility still going lower, and nothing much is happening; if rates volatility markets are right, we might get some late summer excitement around the time of the Jackson Hole symposium but that is almost 3 months away

Published ET

S&P 100 Market Caps | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.08%; Nasdaq Composite up 0.49%; Wilshire 5000 up 0.17%

- 33.3% of S&P 500 stocks were up today, with 89.9% of stocks still above their 200-day moving average (DMA) and 67.9% above their 50-DMA

- The volume of S&P 500 shares traded today was a low 1.7m (3-month z-score: -1.3); the 3-month average volume is 2.3m and the 12-month range is 0.8 - 5.1m

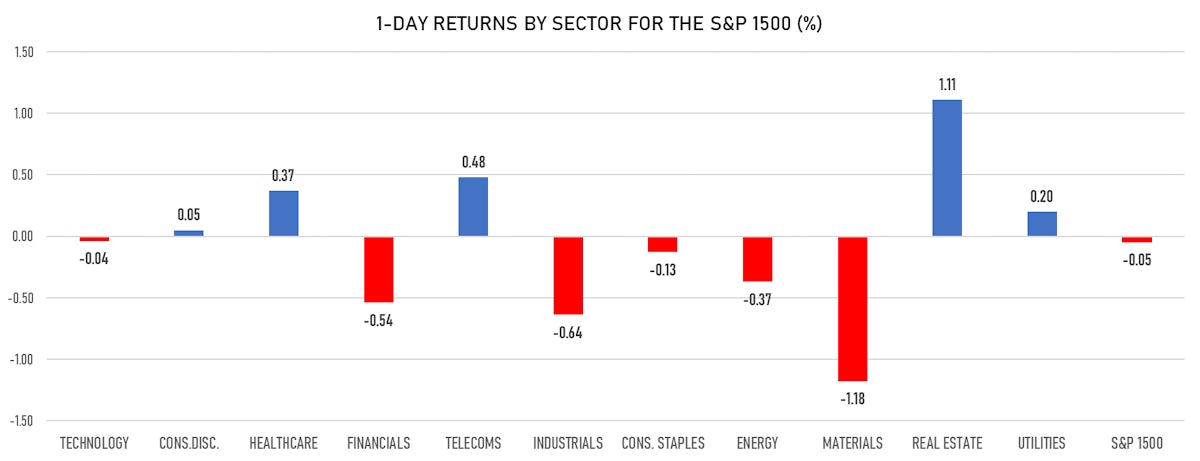

- Top performing sectors: real estate up 0.91% and telecoms up 0.48%

- Bottom performing sectors: materials down -1.23% and industrials down -0.69%

- The S&P 500 Value Index was down -0.3%, while the S&P 500 Growth Index was up 0.1%; the S&P small caps index was up 1.0% and mid caps were down -0.1%

- Daily performance of international indices: Europe Stoxx 600 unchanged; China CSI 300 down -0.50%; Japan up 0.03%; UK FTSE 100 up 0.12%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.6%, down from 12.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.2%, up from 11.9%

TOP WINNERS

- Biogen Inc (BIIB), up 38.3% to $395.85 / YTD price return: +61.7% / 12-Month Price Range: $ 223.25-363.92

- Clover Health Investments Corp (CLOV), up 32.4% to $11.92 / YTD price return: -28.9% / 12-Month Price Range: $ 6.31-17.45 / Short interest (% of float): 36.6%; days to cover: 1.2

- Prothena Corporation PLC (PRTA), up 29.9% to $37.23 / YTD price return: +210.0% / 12-Month Price Range: $ 9.25-31.05

- US Concrete Inc (USCR), up 29.3% to $73.87 / YTD price return: +84.8% / 12-Month Price Range: $ 20.77-78.99

- Bionano Genomics Inc (BNGO), up 22.3% to $8.40 / YTD price return: +172.7% / 12-Month Price Range: $ .43-15.69 / Short interest (% of float): 13.2%; days to cover: 1.4

- Mind Medicine (MindMed) Inc (MNMD), up 21.9% to $3.89 / YTD price return: +27.5% / 12-Month Price Range: $ .29-5.77 / Short interest (% of float): 1.5%; days to cover: 0.5

- QTS Realty Trust Inc (QTS), up 21.2% to $78.15 / YTD price return: +26.3% / 12-Month Price Range: $ 55.91-72.60

- Ocugen Inc (OCGN), up 18.1% to $10.30 / 12-Month Price Range: $ .19-18.77

- Blue Owl Capital Inc (OWL), up 17.5% to $16.30 / YTD price return: +43.2% / 12-Month Price Range: $ 9.35-13.98 / Short interest (% of float): 0.5%; days to cover: 4.0

- Nam Tai Property Inc (NTP), up 17.3% to $31.99 / 12-Month Price Range: $ 4.58-29.92

BIGGEST LOSERS

- MacroGenics Inc (MGNX), down 12.6% to $23.62 / YTD price return: +3.3% / 12-Month Price Range: $ 18.16-36.48 / Short interest (% of float): 8.4%; days to cover: 6.9 (the stock is currently on the short sale restriction list)

- Immunitybio Inc (IBRX), down 12.1% to $15.40 / 12-Month Price Range: $ 5.54-45.42 / Short interest (% of float): 12.0%; days to cover: 6.1 (the stock is currently on the short sale restriction list)

- Intercorp Financial Services Inc (IFS), down 11.6% to $27.09 / 12-Month Price Range: $ 19.23-35.96 / Short interest (% of float): 0.2%; days to cover: 2.0 (the stock is currently on the short sale restriction list)

- Custom Truck One Source Inc (CTOS), down 10.5% to $9.70 / YTD price return: +31.6% / 12-Month Price Range: $ 2.90-10.96 / Short interest (% of float): 4.3%; days to cover: 13.6 (the stock is currently on the short sale restriction list)

- Credicorp Ltd (BAP), down 9.9% to $134.64 / YTD price return: -17.9% / 12-Month Price Range: $ 110.47-172.12 (the stock is currently on the short sale restriction list)

- Valaris Ltd (VAL), down 9.9% to $26.44 / 12-Month Price Range: $ 20.25-29.76 (the stock is currently on the short sale restriction list)

- ArcBest Corp (ARCB), down 9.8% to $63.00 / YTD price return: +47.6% / 12-Month Price Range: $ 22.18-93.96 / Short interest (% of float): 2.3%; days to cover: 2.7

- RLX Technology Inc (RLX), down 9.1% to $9.00 / 12-Month Price Range: $ 7.89-35.00 / Short interest (% of float): 2.0%; days to cover: 3.8 (the stock is currently on the short sale restriction list)

- Transocean Ltd (RIG), down 8.8% to $4.03 / YTD price return: +74.5% / 12-Month Price Range: $ .65-4.81 (the stock is currently on the short sale restriction list)

- Tuya Inc (TUYA), down 8.3% to $23.31 / 12-Month Price Range: $ 15.70-27.65 / Short interest (% of float): 0.7%; days to cover: 3.4

NEW IPOs ANNOUNCED OR PRICED

- GoGreen Investments Corp / United States of America - Financials / Listing Exchange: New York / Ticker: GOGN.U / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Credit Suisse Securities (USA) LLC

- L Catterton Latin America Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: LCLA.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC

- Mount Rainier Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: RNERU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Alliance Global Partners

- Cherry AG / Germany - High Technology / Listing Exchange: Frankfurt / Ticker: N/A / Gross proceeds (including overallotment): US$ 170.31m (offering in EURO) / Bookrunners: MM Warburg und Co, ABN AMRO, Hauck & Aufhaeuser Corporate Finance GmbH

- Bike24 GmbH / Germany - Retail / Listing Exchange: Frankfurt / Ticker: N/A / Gross proceeds (including overallotment): US$ 121.65m (offering in EURO) / Bookrunners: Berenberg, JP Morgan GmbH

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Leslies Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: LESL / Gross proceeds (including overallotment): US$ 729.12m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC, Bofa Securities Inc

- Spring Airlines Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 601021 / Gross proceeds (including overallotment): US$ 547.35m (offering in Chinese Yuan) / Bookrunners: Not Applicable