Equities

S&P 500 Notches Another Record Close On Lower Rates

Meme stocks took a tumble today: GME down 27% (still up > 1000% YTD), AMC down 13% (also still up > 1000% YTD) and Clover Health Investments down 15% (now down 14% YTD)

Published ET

Clover Health Investments (CLOV) | Source: Refinitiv

QUICK SUMMARY

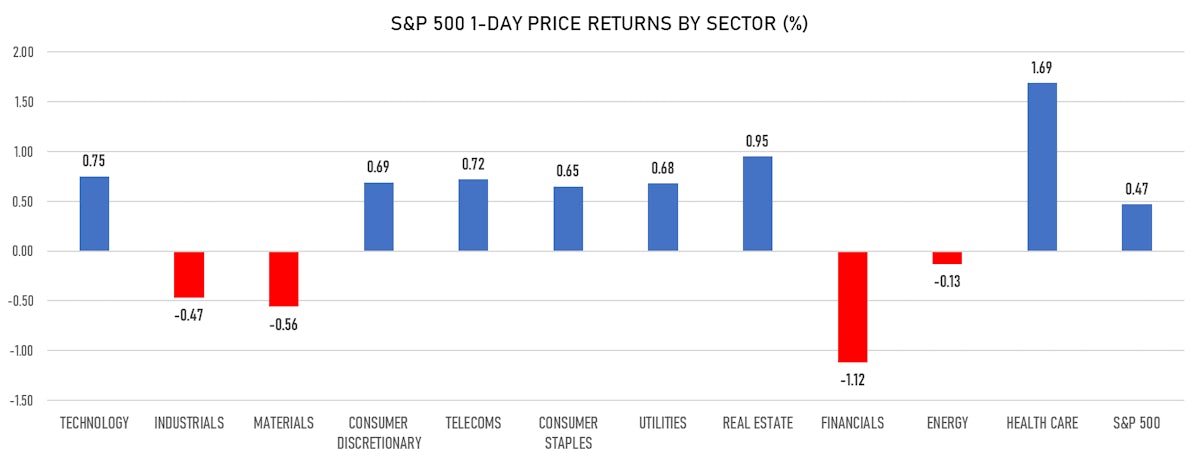

- Daily performance of US indices: S&P 500 up 0.47%; Nasdaq Composite up 0.78%; Wilshire 5000 up 0.42%

- 55.8% of S&P 500 stocks were up today, with 90.7% of stocks above their 200-day moving average (DMA) and 63.8% above their 50-DMA

- The volume of S&P 500 shares traded today was a mediocre 2.0m (3-month z-score: -0.7); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 5.1m

- Top performing sectors: health care up 1.69% and real estate up 0.95%

- Bottom performing sectors: financials down -1.12% and materials down -0.56%

- The S&P 500 Value Index was down unchanged, while the S&P 500 Growth Index was up 0.9%; the S&P small caps index was down -1.4% and mid caps were down -0.1%

- Daily performance of international indices: Europe Stoxx 600 up 0.03%; China CSI 300 down -0.04%; Japan down -0.10%; UK FTSE 100 up 0.10%

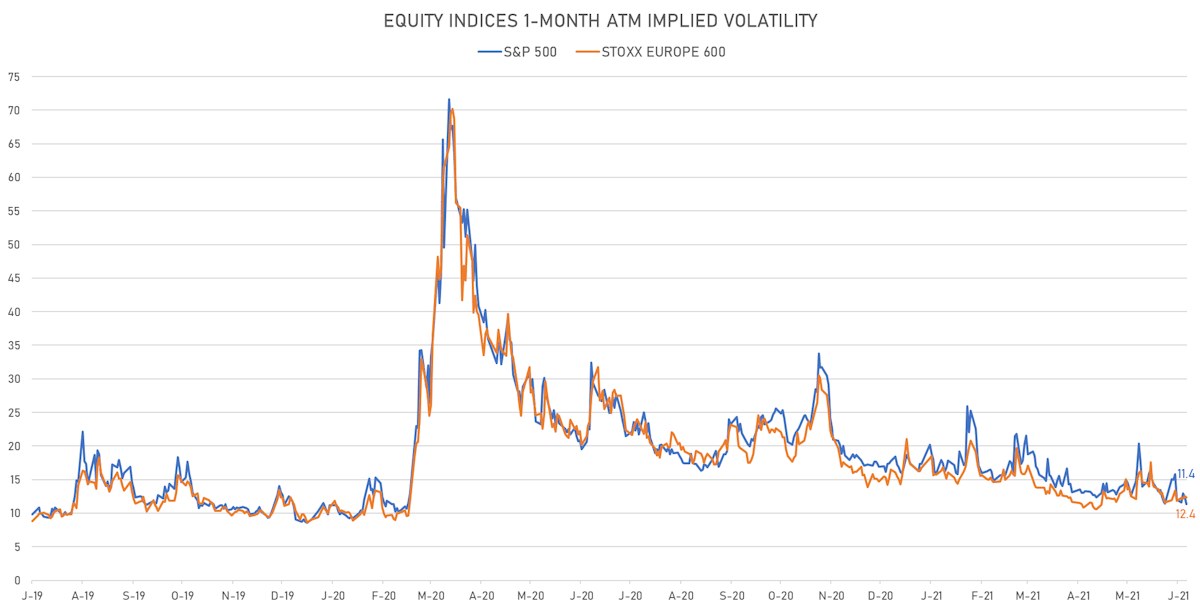

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.4%, down from 12.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.4%, down from 12.5%

TOP WINNERS

- 1stdibs.Com Inc (DIBS), up 42.5% to $28.50 on its trading debut

- Senseonics Holdings Inc (SENS), up 17.9% to $3.62 / YTD price return: +315.2% / 12-Month Price Range: $ .35-5.56 / Short interest (% of float): 20.2%; days to cover: 5.4 (the stock is currently on the short sale restriction list)

- RH (RH), up 15.7% to $707.14 / YTD price return: +58.0% / 12-Month Price Range: $ 226.82-733.05 / Short interest (% of float): 14.8%; days to cover: 5.5

- Embraer SA (ERJ), up 15.3% to $15.72 / 12-Month Price Range: $ 3.96-15.72 / Short interest (% of float): 3.5%; days to cover: 2.2

- Prothena Corporation PLC (PRTA), up 14.3% to $44.52 / YTD price return: +270.7% / 12-Month Price Range: $ 9.25-44.52

- Churchill Capital Corp II (CCX), up 14.2% to $11.61 / YTD price return: +12.2% / 12-Month Price Range: $ 9.92-11.99 / Short interest (% of float): 3.8%; days to cover: 2.9

- Signet Jewelers Ltd (SIG), up 14.0% to $69.58 / YTD price return: +155.2% / 12-Month Price Range: $ 9.71-69.58

- Iovance Biotherapeutics Inc (IOVA), up 12.1% to $23.14 / YTD price return: -50.1% / 12-Month Price Range: $ 15.88-54.21 / Short interest (% of float): 15.6%; days to cover: 4.6

- Bioatla Inc (BCAB), up 11.7% to $51.00 / YTD price return: +50.0% / 12-Month Price Range: $ 27.15-76.63 / Short interest (% of float): 13.0%; days to cover: 24.8

- Asana Inc (ASAN), up 11.6% to $45.94 / YTD price return: +55.5% / 12-Month Price Range: $ 20.57-45.94 / Short interest (% of float): 8.7%; days to cover: 7.4

BIGGEST LOSERS

- Ocugen Inc (OCGN), down 28.1% to $6.69 / 12-Month Price Range: $ .19-18.77 (the stock is currently on the short sale restriction list)

- GameStop Corp (GME), down 27.2% to $220.39 / YTD price return: +1,069.8% / 12-Month Price Range: $ 3.77-483.00 (the stock is currently on the short sale restriction list)

- Materialise NV (MTLS), down 18.3% to $22.89 / YTD price return: -57.8% / 12-Month Price Range: $ 20.76-87.40 / Short interest (% of float): 2.6%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- REV Group Inc (REVG), down 17.6% to $16.00 / YTD price return: +81.6% / 12-Month Price Range: $ 5.10-22.23 / Short interest (% of float): 3.5%; days to cover: 3.5 (the stock is currently on the short sale restriction list)

- Plby Group Inc (PLBY), down 16.1% to $42.97 / YTD price return: +308.8% / 12-Month Price Range: $ 9.85-63.04 / Short interest (% of float): 20.5%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

- Clean Energy Fuels Corp (CLNE), down 15.6% to $10.99 / YTD price return: +39.8% / 12-Month Price Range: $ 2.01-19.79 / Short interest (% of float): 5.8%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

- Clover Health Investments Corp (CLOV), down 15.2% to $14.34 / YTD price return: -14.5% / 12-Month Price Range: $ 6.31-28.85 / Short interest (% of float): 37.3%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Celsius Holdings Inc (CELH), down 15.1% to $61.75 / YTD price return: +22.7% / 12-Month Price Range: $ 8.61-83.00 (the stock is currently on the short sale restriction list)

- Metromile Inc (MILE), down 14.1% to $10.39 / YTD price return: -33.2% / 12-Month Price Range: $ 6.48-20.39 / Short interest (% of float): 15.7%; days to cover: 6.2 (the stock is currently on the short sale restriction list)

- AMC Entertainment Holdings Inc (AMC), down 13.2% to $42.81 / YTD price return: +1,919.3% / 12-Month Price Range: $ 1.91-72.62 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- Zeta Global Holdings Corp / United States of America - High Technology / Listing Exchange: New York / Ticker: ZETA / Gross proceeds (including overallotment): US$ 215.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC, Morgan Stanley & Co LLC, Bofa Securities Inc, Barclays Capital Inc

- 1stdibs.com Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: DIBS / Gross proceeds (including overallotment): US$ 115.00m (offering in U.S. Dollar) / Bookrunners: Allen & Co Inc, Evercore Group, BofA Securities Inc, Barclays Capital Inc

- monday.com Ltd / Israel - High Technology / Listing Exchange: Nasdaq / Ticker: MNDY / Gross proceeds (including overallotment): US$ 573.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Believe Sas / France - Media and Entertainment / Listing Exchange: Euro Paris / Ticker: N/A / Gross proceeds (including overallotment): US$ 338.99m (offering in EURO) / Bookrunners: Union Bank of Switzerland, Goldman Sachs & Co, Societe Generale SA, HSBC Holdings PLC (United Kingdom), Citigroup Inc, BNP Paribas SA, JP Morgan Chase & Co

- Gobi Acquisition Corp / Hong Kong - Financials / Listing Exchange: Nasdaq / Ticker: GOBI / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs (Asia), Citigroup Global Markets Inc, UBS Securities LLC

- Chengdu Quanyuantang Pharmacy Chain Joint Stock Co Ltd / China - Retail / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar)

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Leslies Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: LESL / Gross proceeds (including overallotment): US$ 677.18m (offering in U.S. Dollar) / Bookrunners: Nomura Securities International Inc, Goldman Sachs & Co, Jefferies LLC, Morgan Stanley & Co LLC, Bofa Securities Inc

- Celsius Holdings Inc / United States of America - Consumer Staples / Listing Exchange: Nasdaq / Ticker: CSUH / Gross proceeds (including overallotment): US$ 407.39m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, UBS Securities LLC

- JAMF Holding Corp / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: JAMF / Gross proceeds (including overallotment): US$ 280.50m (offering in U.S. Dollar) / Bookrunners: RBC Capital Markets, HSBC Securities (USA) Inc, JP Morgan Securities LLC, Mizuho Securities USA LLC, Bofa Securities Inc, Barclays Capital Inc

- Granite Real Estate Investment Trust / Canada - Real Estate / Listing Exchange: Toronto / Ticker: GRT.UN / Gross proceeds (including overallotment): US$ 261.24m (offering in Canadian Dollar) / Bookrunners: TD Securities Inc, BMO Capital Markets

- Apria Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: APR / Gross proceeds (including overallotment): US$ 121.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc

- Ganfeng Lithium Co Ltd / China - Materials / Listing Exchange: Hong Kong / Ticker: 002460 / Gross proceeds (including overallotment): US$ 627.54m (offering in Hong Kong Dollar) / Bookrunners: Merrill Lynch International (Asia), UBS (Hong Kong), CLSA Asia-Pacific Markets Ltd

- Jiangsu Etern Co Ltd / China - High Technology / Listing Exchange: Shanghai / Ticker: 600105 / Gross proceeds (including overallotment): US$ 169.11m (offering in Chinese Yuan) / Bookrunners: Not Applicable