Equities

The S&P 500 Fell Today, Though A Majority of Stocks Were Up, With Small Caps And Value Stocks Outperforming

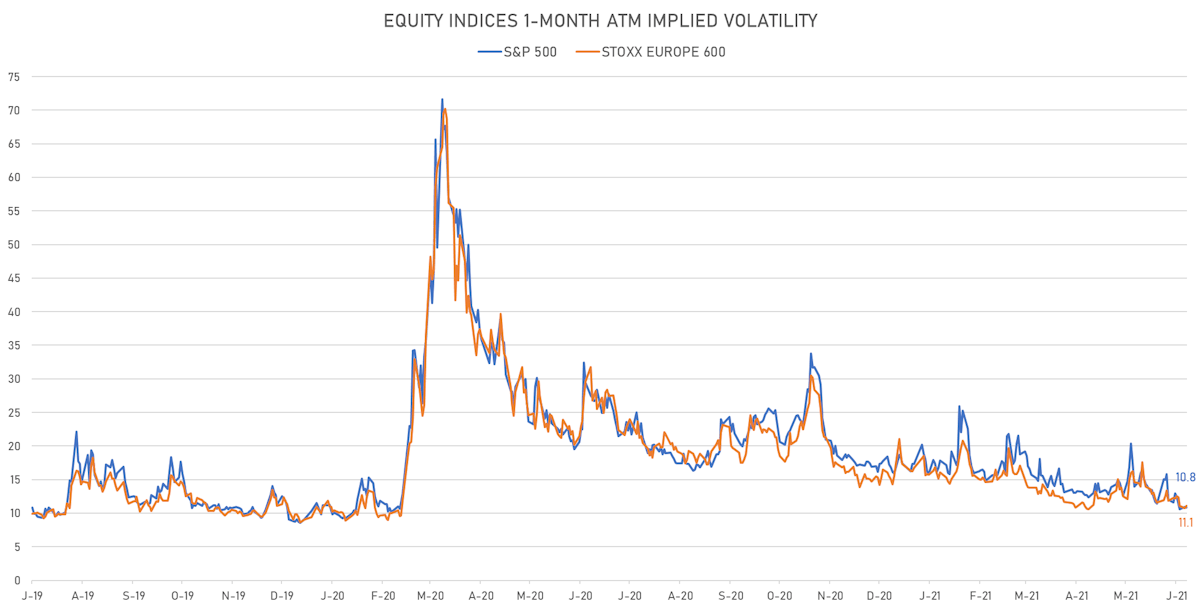

Options-implied volatilities indicate that US equity markets are very relaxed about the FOMC, with downside protection having come down a lot since last month

Published ET

S&P 500 Options Implied Volatility | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.20%; Nasdaq Composite down -0.71%; Wilshire 5000 down -0.31%

- 54.7% of S&P 500 stocks were up today, with 91.1% of stocks above their 200-day moving average (DMA) and 62.6% above their 50-DMA

- The volume of S&P 500 shares traded today was a low 1.8m (3-month z-score: -0.9); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 5.1m

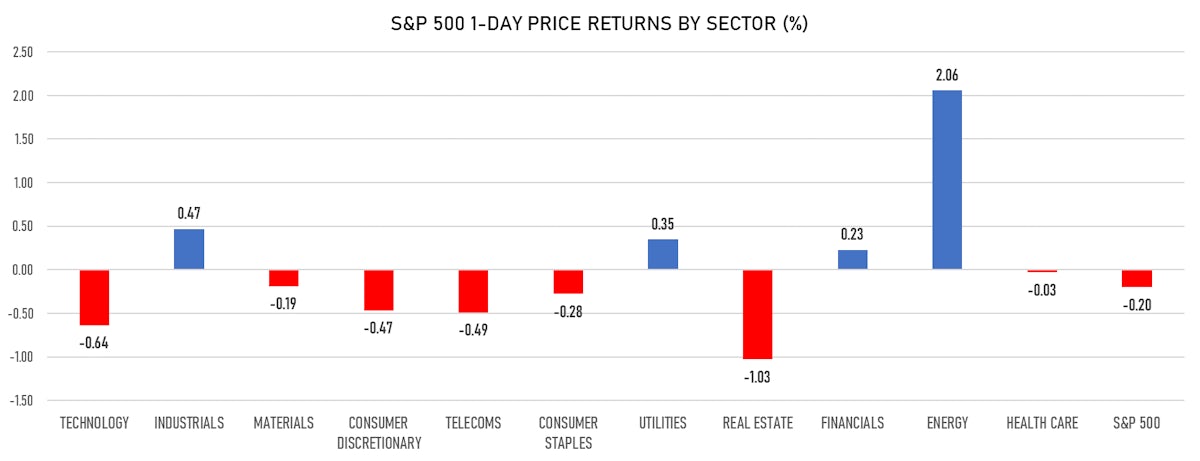

- Top performing sectors: energy up 2.06% and industrials up 0.47%

- Bottom performing sectors: real estate down -1.03% and technology down -0.64%

- The S&P 500 Value Index was up 0.1%, while the S&P 500 Growth Index was down -0.5%; the S&P small caps index was up 0.2% and mid caps were down -0.1%

- Daily performance of international indices: Europe Stoxx 600 up 0.11%; China CSI 300 unchanged; Japan up 0.24%; UK FTSE 100 up 0.36%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 10.8%, down from 11.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.1%, up from 10.8%

NOTABLE S&P 500 EARNINGS RELEASES

- Oracle Corp (Technology) beat on EPS (1.54 act. vs. 1.11 est.) and beat on revenue (11,227m act. vs. 10,069m est.). The stock fell 1.19% today.

TOP WINNERS

- Canoo Inc (GOEV), up 16.8% to $11.05 / YTD price return: -19.9% / 12-Month Price Range: $ 6.51-24.90

- Prometheus Biosciences Inc (RXDX), up 14.9% to $27.00 / 12-Month Price Range: $ 16.11-30.62 / Short interest (% of float): 1.4%; days to cover: 2.3

- Goosehead Insurance Inc (GSHD), up 12.2% to $112.61 / YTD price return: -9.7% / 12-Month Price Range: $ 62.17-174.80

- Lordstown Motors Corp (RIDE), up 11.3% to $10.31 / YTD price return: -48.6% / 12-Month Price Range: $ 6.69-31.80 / Short interest (% of float): 31.1%; days to cover: 3.5

- Prothena Corporation PLC (PRTA), up 9.1% to $51.97 / YTD price return: +332.7% / 12-Month Price Range: $ 9.25-48.42 / Short interest (% of float): 3.9%; days to cover: 5.7

- Centennial Resource Development Inc (CDEV), up 8.7% to $6.87 / YTD price return: +358.0% / 12-Month Price Range: $ .51-6.89

- Weatherford International PLC (WFRD), up 8.5% to $18.99 / YTD price return: +216.5% / 12-Month Price Range: $ 1.31-17.83

- Nabors Industries Ltd (NBR), up 8.0% to $126.34 / YTD price return: +117.0% / 12-Month Price Range: $ 21.66-133.61 / Short interest (% of float): 5.6%; days to cover: 2.9

- Instil Bio Inc (TIL), up 7.4% to $17.76 / 12-Month Price Range: $ 14.42-29.49 / Short interest (% of float): 4.6%; days to cover: 11.8

- Kosmos Energy Ltd (KOS), up 7.0% to $3.35 / YTD price return: +42.6% / 12-Month Price Range: $ .90-3.69

BIGGEST LOSERS

- SAGE Therapeutics Inc (SAGE), down 19.3% to $58.80 / YTD price return: -32.0% / 12-Month Price Range: $ 34.62-98.39 / Short interest (% of float): 8.2%; days to cover: 8.7 (the stock is currently on the short sale restriction list)

- Anavex Life Sciences Corp (AVXL), down 17.4% to $17.34 / YTD price return: +221.1% / 12-Month Price Range: $ 3.61-28.70 / Short interest (% of float): 9.7%; days to cover: 8.6 (the stock is currently on the short sale restriction list)

- UP Fintech Holding Ltd (TIGR), down 16.3% to $23.90 / YTD price return: +201.0% / 12-Month Price Range: $ 3.76-38.50 / Short interest (% of float): 4.6%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Uxin Ltd (UXIN), down 12.9% to $4.51 / YTD price return: +416.9% / 12-Month Price Range: $ .72-5.47 / Short interest (% of float): 4.0%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- Vroom Inc (VRM), down 11.5% to $40.01 / YTD price return: -2.3% / 12-Month Price Range: $ 26.96-75.49 / Short interest (% of float): 9.7%; days to cover: 4.5 (the stock is currently on the short sale restriction list)

- 908 Devices Inc. (MASS), down 11.2% to $38.71 / 12-Month Price Range: $ 33.71-79.60 / Short interest (% of float): 13.5%; days to cover: 9.8 (the stock is currently on the short sale restriction list)

- JinkoSolar Holding Co Ltd (JKS), down 11.0% to $40.31 / YTD price return: -34.8% / 12-Month Price Range: $ 15.27-90.20 (the stock is currently on the short sale restriction list)

- Stem Inc (STEM), down 11.0% to $31.58 / YTD price return: +54.4% / 12-Month Price Range: $ 9.60-51.49 / Short interest (% of float): 9.3%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- C4 Therapeutics Inc (CCCC), down 10.6% to $37.66 / YTD price return: +13.7% / 12-Month Price Range: $ 22.40-48.98 / Short interest (% of float): 7.2%; days to cover: 7.7 (the stock is currently on the short sale restriction list)

- Rubius Therapeutics Inc (RUBY), down 10.1% to $25.55 / YTD price return: +236.6% / 12-Month Price Range: $ 4.20-38.71 / Short interest (% of float): 5.9%; days to cover: 9.0 (the stock is currently on the short sale restriction list)

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Shanghai Junshi Biosciences Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 1877 / Gross proceeds (including overallotment): US$ 280.10m (offering in Hong Kong Dollar) / Bookrunners: JP Morgan & Co Inc

- Kaspi.kz JSC / Kazakhstan - Financials / Listing Exchange: London / Ticker: KSPI / Gross proceeds (including overallotment): US$ 129.38m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs International