Equities

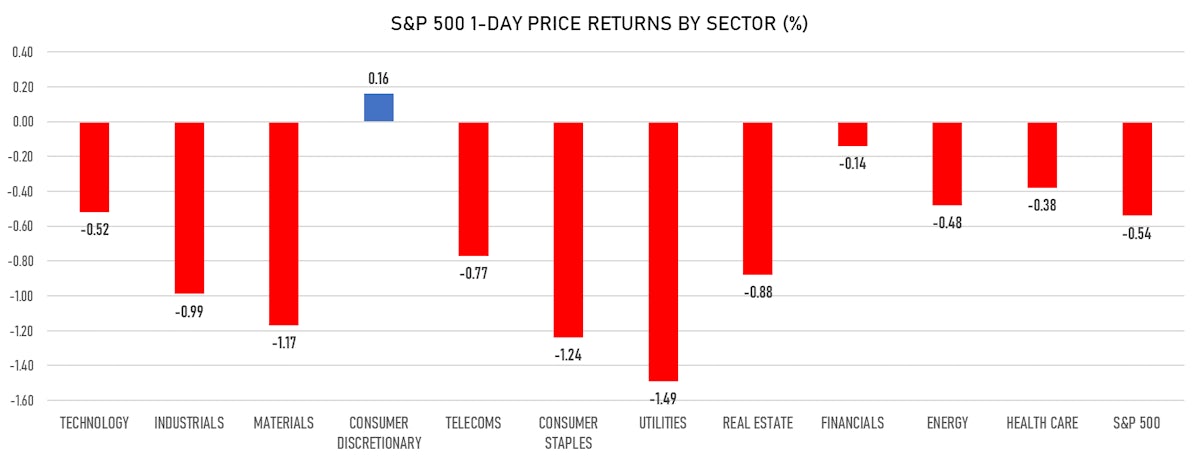

US Equities Fall, With Rate-Sensitive Sectors Like Utilities Leading The Way

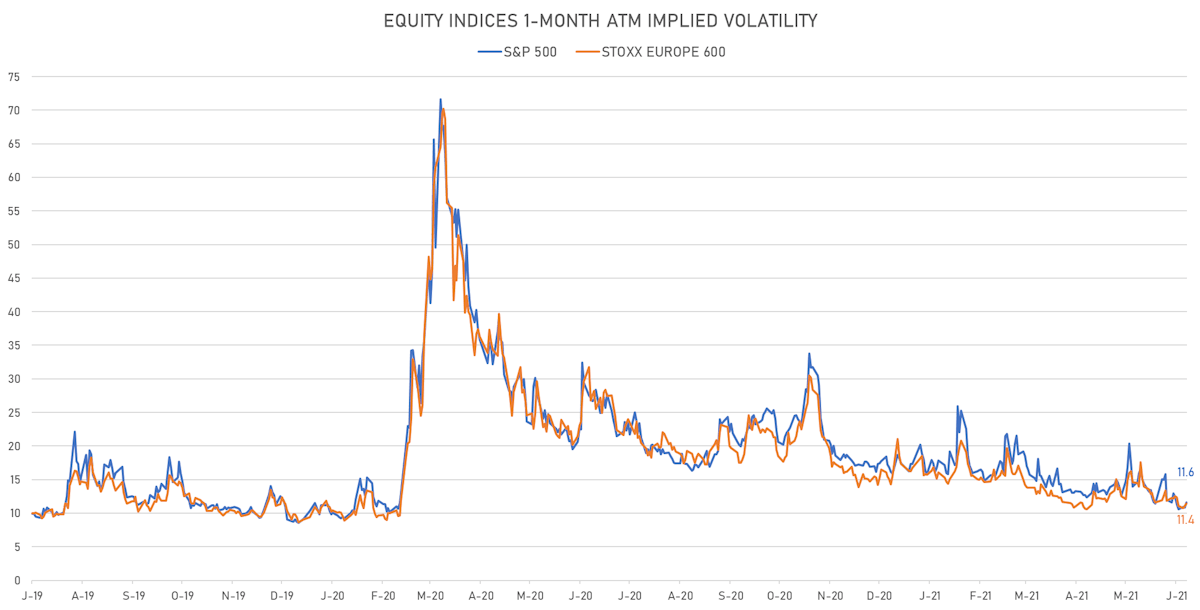

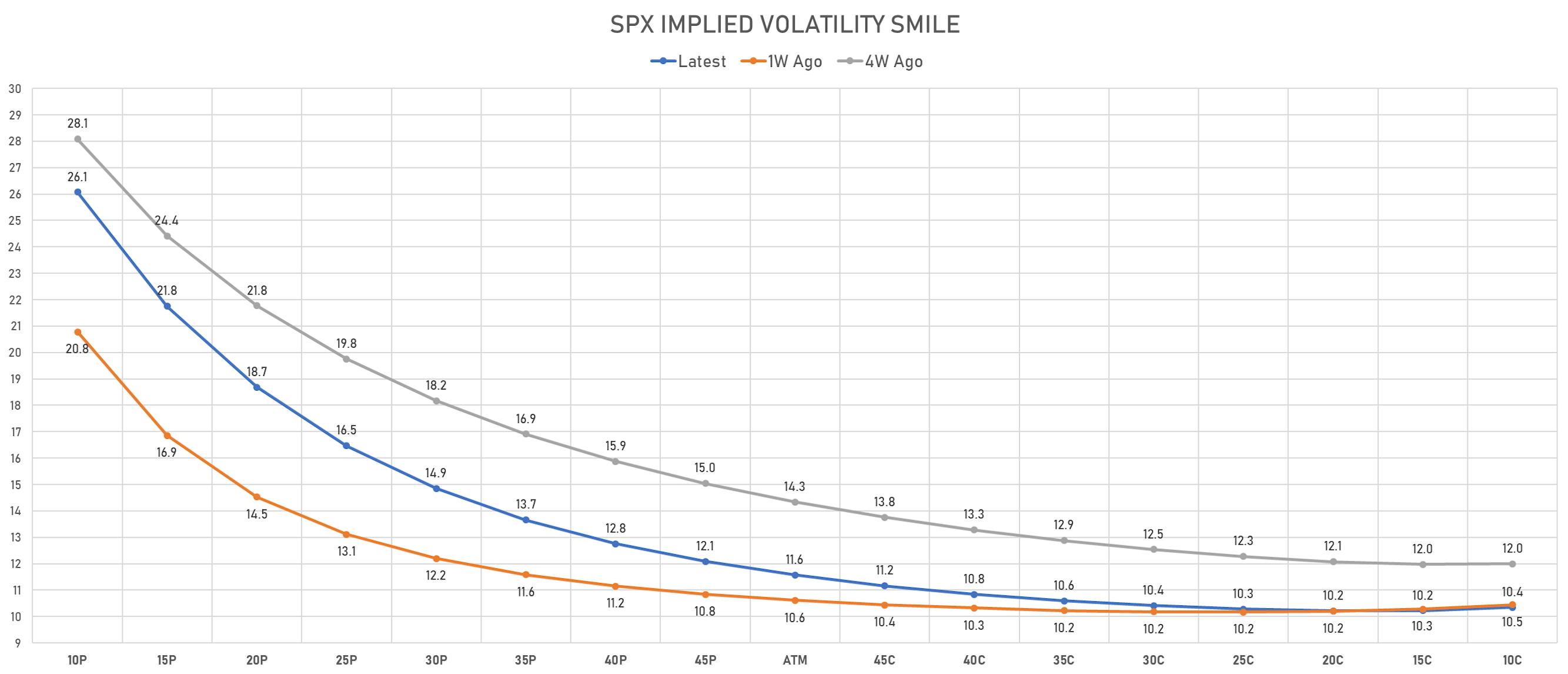

Out-of-the-money puts implied volatilities rose sharply as equity speculators were caught flat-footed, despite recent warnings from sell-side analysts to hedge the FOMC

Published ET

E-Mini S&P 500 front-month future intraday | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.54%; Nasdaq Composite down -0.24%; Wilshire 5000 down -0.46%

- 20.0% of S&P 500 stocks were up today, with 89.5% of stocks above their 200-day moving average (DMA) and 55.0% above their 50-DMA

- The volume of S&P 500 shares traded today was 2.2m (3-month z-score: 0.0); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 5.1m

- Top performing sectors: consumer discretionary up 0.16% and financials down -0.14%

- Bottom performing sectors: utilities down -1.49% and consumer staples down -1.24%

- The S&P 500 Value Index was down -0.7%, while the S&P 500 Growth Index was down -0.4%; the S&P small caps index was down -0.1% and mid caps were down -0.7%

- Daily performance of international indices: Europe Stoxx 600 up 0.23%; China CSI 300 down -0.07%; Japan down -0.61%; UK FTSE 100 up 0.17%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.6%, up from 10.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.4%, up from 11.1%

NOTABLE S&P 500 EARNINGS RELEASES

- Progressive Corp (Financials): matched estimates on EPS (1.72 act. vs. 1.72 est.) and beat on revenue (11,729m act. vs. 11,232m est.)

TOP WINNERS

- Anavex Life Sciences Corp (AVXL), up 21.5% to $21.06 / YTD price return: +290.0% / 12-Month Price Range: $ 3.65-28.70 / Short interest (% of float): 9.7%; days to cover: 8.6

- Cassava Sciences Inc (SAVA), up 11.3% to $80.27 / YTD price return: +1,077.0% / 12-Month Price Range: $ 2.58-117.54

- Maxar Technologies Inc (MAXR), up 11.2% to $39.99 / YTD price return: +3.6% / 12-Month Price Range: $ 14.94-58.75 / Short interest (% of float): 8.1%; days to cover: 4.0

- Prothena Corporation PLC (PRTA), up 10.9% to $57.65 / YTD price return: +380.0% / 12-Month Price Range: $ 9.36-52.41 / Short interest (% of float): 3.9%; days to cover: 5.7

- Sunrun Inc (RUN), up 10.6% to $47.73 / YTD price return: -31.2% / 12-Month Price Range: $ 18.43-100.93 / Short interest (% of float): 16.9%; days to cover: 5.1

- Arrival SA (ARVL), up 10.4% to $21.96 / YTD price return: -21.9% / 12-Month Price Range: $ 9.78-37.18

- Prometheus Biosciences Inc (RXDX), up 9.8% to $29.65 / 12-Month Price Range: $ 16.11-30.62 / Short interest (% of float): 1.4%; days to cover: 2.3

- Star Bulk Carriers Corp (SBLK), up 9.7% to $24.37 / YTD price return: +176.0% / 12-Month Price Range: $ 5.87-23.29 / Short interest (% of float): 1.2%; days to cover: 0.5

- Atara Biotherapeutics Inc (ATRA), up 9.7% to $15.36 / YTD price return: -21.8% / 12-Month Price Range: $ 9.90-28.20

- Protagonist Therapeutics Inc (PTGX), up 9.3% to $41.71 / YTD price return: +106.9% / 12-Month Price Range: $ 14.16-41.22

BIGGEST LOSERS

- TAL Education Group (TAL), down 16.9% to $23.97 / YTD price return: -66.5% / 12-Month Price Range: $ 25.25-90.96 (the stock is currently on the short sale restriction list)

- Uxin Ltd (UXIN), down 12.6% to $3.94 / YTD price return: +351.6% / 12-Month Price Range: $ .72-5.82 / Short interest (% of float): 4.0%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- Gaotu Techedu Inc (GOTU), down 12.5% to $13.71 / YTD price return: -73.5% / 12-Month Price Range: $ 12.81-149.05 / Short interest (% of float): 11.4%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- New Oriental Education & Technology Group Inc (EDU), down 12.3% to $8.37 / YTD price return: -55.0% / 12-Month Price Range: $ 7.71-19.97 (the stock is currently on the short sale restriction list)

- La-Z-Boy Inc (LZB), down 11.7% to $37.34 / YTD price return: -6.3% / 12-Month Price Range: $ 25.53-46.74 (the stock is currently on the short sale restriction list)

- Nexa Resources SA (NEXA), down 11.3% to $8.67 / YTD price return: -10.1% / 12-Month Price Range: $ 5.08-12.58 / Short interest (% of float): 0.5%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- E-Home Household Service Holdings Ltd (EJH), down 11.1% to $35.60 / 12-Month Price Range: $ 16.60-80.93 / Short interest (% of float): 0.2%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- Intellia Therapeutics Inc (NTLA), down 10.6% to $79.24 / YTD price return: +45.7% / 12-Month Price Range: $ 16.54-92.00 (the stock is currently on the short sale restriction list)

- Petco Health and Wellness Company Inc (WOOF), down 10.1% to $22.85 / 12-Month Price Range: $ 17.86-31.08 / Short interest (% of float): 8.8%; days to cover: 8.1 (the stock is currently on the short sale restriction list)

- TuSimple Holdings Inc (TSP), down 9.5% to $50.28 / 12-Month Price Range: $ 32.13-65.98 / Short interest (% of float): 4.6%; days to cover: 6.3 (the stock is currently on the short sale restriction list)

NEW IPOs ANNOUNCED OR PRICED

- Lyell Immunopharma / United States of America / Biotechnology / IPO priced at US$17 / share, for total gross proceeds to US$ 425m

- China Youran Dairy / China / Dairy Producer / IPO priced at HK$ 6.98 / share for total gross proceeds of US$ 529m

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Consolidated Edison Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: ED / Gross proceeds (including overallotment): US$ 785.28m (offering in U.S. Dollar) / Bookrunners: Barclays Capital Inc

- Novavax Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: NVAX / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- PennyMac Mortgage Investment Trust / United States of America - Real Estate / Listing Exchange: New York / Ticker: PMT / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- RAPT Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RAPT / Gross proceeds (including overallotment): US$ 125.00m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, SVB Leerink LLC, Piper Sandler & Co

- Protagonist Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: PTGX / Gross proceeds (including overallotment): US$ 115.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, JP Morgan Securities LLC, Piper Sandler & Co

- Helios Towers PLC / United Kingdom - Telecommunications / Listing Exchange: London / Ticker: HTWS / Gross proceeds (including overallotment): US$ 106.58m (offering in British Pound) / Bookrunners: Merrill Lynch International Ltd, Jefferies International Ltd, Numis Securities Ltd, Citigroup Global Markets Ltd