Equities

Tech Stocks Rebound And Lead US Indices To End Broadly Unchanged Today

Chinese K12 educations stocks like TAL keep falling, as Reuters reported China will possibly unveil next week tougher rules on tutoring during the holidays and weekends

Published ET

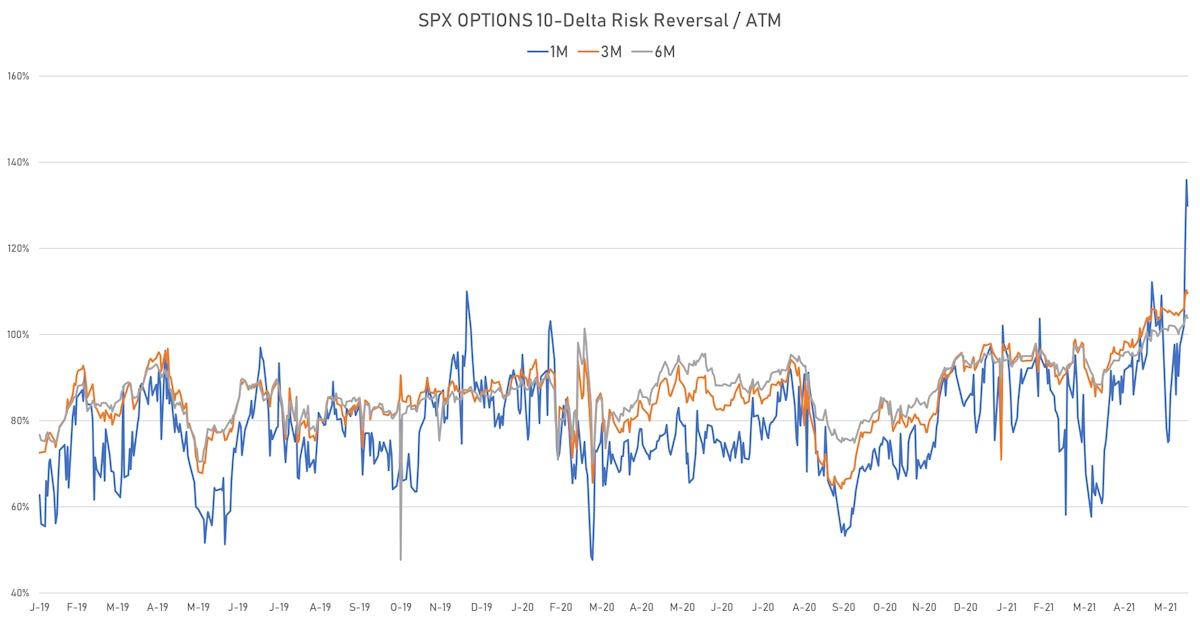

Short-term put options have been much more popular than calls this week | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.04%; Nasdaq Composite up 0.87%; Wilshire 5000 down -0.04%

- 35.8% of S&P 500 stocks were up today, with 89.9% of stocks above their 200-day moving average (DMA) and 44.4% above their 50-DMA

- The volume of S&P 500 shares traded today was 2.6m (3-month z-score: 0.9); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 5.1m

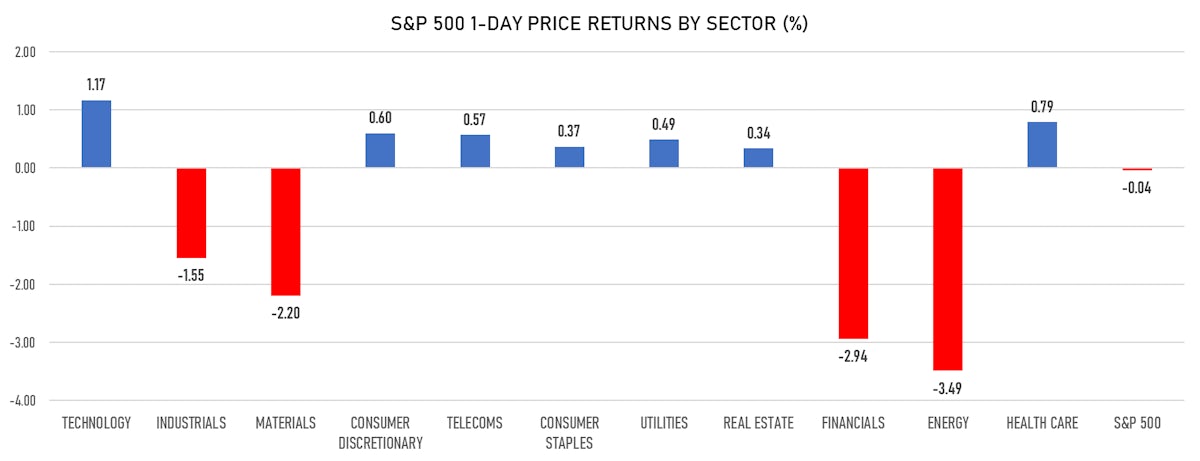

- Top performing sectors: technology up 1.17% and health care up 0.79%

- Bottom performing sectors: energy down -3.49% and financials down -2.94%

- The S&P 500 Value Index was down -1.2%, while the S&P 500 Growth Index was up 1.1%; the S&P small caps index was down -1.8% and mid caps were down -1.6%

- Daily performance of international indices: Europe Stoxx 600 down -0.12%; China CSI 300 up 0.06%; Japan down -0.21%; UK FTSE 100 down -0.44%

VOLATILITY

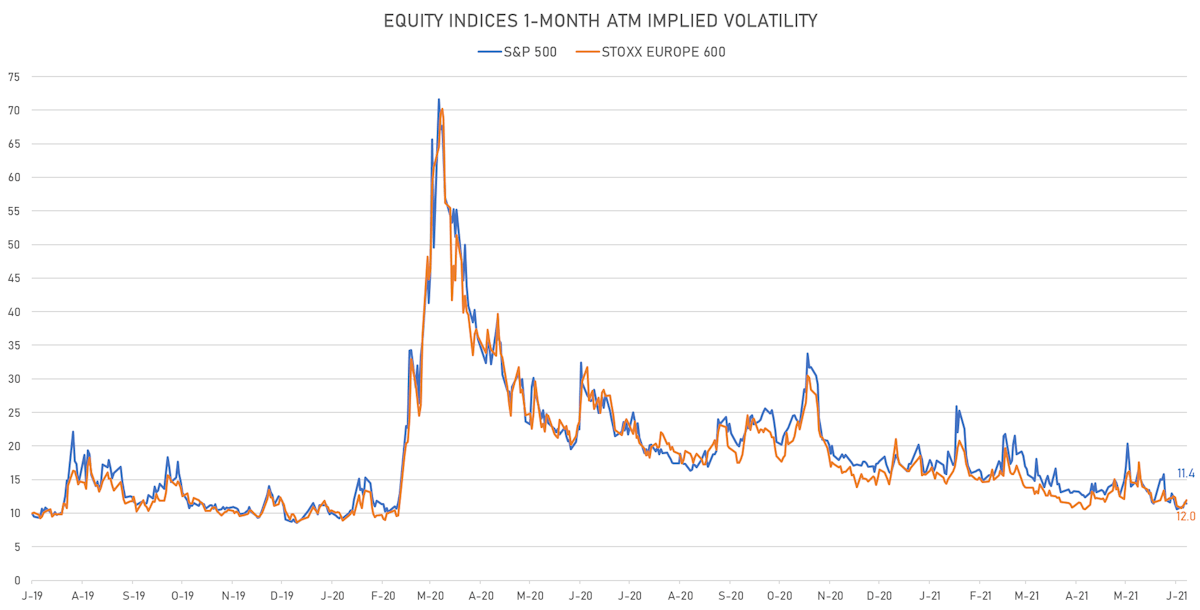

- 1-month at-the-money implied volatility on the S&P 500 at 11.4%, down from 11.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.0%, up from 11.4%

TOP WINNERS

- Knowbe4 Inc (KNBE), up 24.7% to $29.80 / 12-Month Price Range: $ 16.77-26.98 / Short interest (% of float): 8.5%; days to cover: 1.5

- Anterix Inc (ATEX), up 17.3% to $58.65 / YTD price return: +56.0% / 12-Month Price Range: $ 27.27-54.25 / Short interest (% of float): 7.1%; days to cover: 12.1

- Azure Power Global Ltd (AZRE), up 14.3% to $26.29 / YTD price return: -35.5% / 12-Month Price Range: $ 14.94-53.60 / Short interest (% of float): 2.9%; days to cover: 0.0

- ACM Research Inc (ACMR), up 13.4% to $106.74 / YTD price return: +31.4% / 12-Month Price Range: $ 56.23-144.81 / Short interest (% of float): 8.3%; days to cover: 3.6

- Skywater Technology Inc (SKYT), up 12.6% to $33.85 / 12-Month Price Range: $ 14.25-33.47 / Short interest (% of float): 1.8%; days to cover: 0.3

- Appian Corp (APPN), up 11.3% to $129.70 / YTD price return: -20.0% / 12-Month Price Range: $ 44.03-260.00 / Short interest (% of float): 21.5%; days to cover: 8.7

- Score Media and Gaming Inc (SCR), up 10.8% to $24.20 / YTD price return: +102.6% / 12-Month Price Range: $ 4.03-45.00 / Short interest (% of float): 0.6%; days to cover: 0.5

- AMC Entertainment Holdings Inc (AMC), up 10.1% to $60.73 / YTD price return: +2,764.6% / 12-Month Price Range: $ 1.91-72.62 / Short interest (% of float): 20.5%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Stem Inc (STEM), up 9.9% to $35.11 / YTD price return: +71.6% / 12-Month Price Range: $ 9.60-51.49 / Short interest (% of float): 9.4%; days to cover: 4.1

- Sunrun Inc (RUN), up 9.3% to $52.16 / YTD price return: -24.8% / 12-Month Price Range: $ 18.43-100.93 / Short interest (% of float): 16.9%; days to cover: 5.1

BIGGEST LOSERS

- CureVac NV (CVAC), down 39.0% to $57.83 / YTD price return: -28.7% / 12-Month Price Range: $ 36.15-151.80 / Short interest (% of float): 3.6%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Prothena Corporation PLC (PRTA), down 15.5% to $48.72 / YTD price return: +305.7% / 12-Month Price Range: $ 9.36-59.74 / Short interest (% of float): 3.9%; days to cover: 5.7 (the stock is currently on the short sale restriction list)

- TAL Education Group (TAL), down 14.0% to $20.62 / YTD price return: -71.2% / 12-Month Price Range: $ 23.57-90.96 / Short interest (% of float): 3.3%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- Waterdrop Inc (WDH), down 11.4% to $6.95 / 12-Month Price Range: $ 6.85-11.77 (the stock is currently on the short sale restriction list)

- Applied Molecular Transport Inc. (AMTI), down 10.9% to $44.53 / 12-Month Price Range: $ 20.02-78.22 / Short interest (% of float): 9.7%; days to cover: 13.3 (the stock is currently on the short sale restriction list)

- RPC Inc (RES), down 10.3% to $5.58 / YTD price return: +77.1% / 12-Month Price Range: $ 2.23-7.43 / Short interest (% of float): 11.0%; days to cover: 7.5 (the stock is currently on the short sale restriction list)

- Prometheus Biosciences Inc (RXDX), down 10.3% to $26.61 / 12-Month Price Range: $ 16.11-30.64 / Short interest (% of float): 1.4%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- Youdao Inc (DAO), down 9.3% to $21.82 / YTD price return: -17.8% / 12-Month Price Range: $ 19.58-47.70 / Short interest (% of float): 3.8%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- ProPetro Holding Corp (PUMP), down 9.3% to $10.49 / 12-Month Price Range: $ 3.58-13.99 / Short interest (% of float): 3.3%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Hecla Mining Co (HL), down 9.1% to $7.97 / YTD price return: +23.0% / 12-Month Price Range: $ 2.73-9.44 / Short interest (% of float): 2.1%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

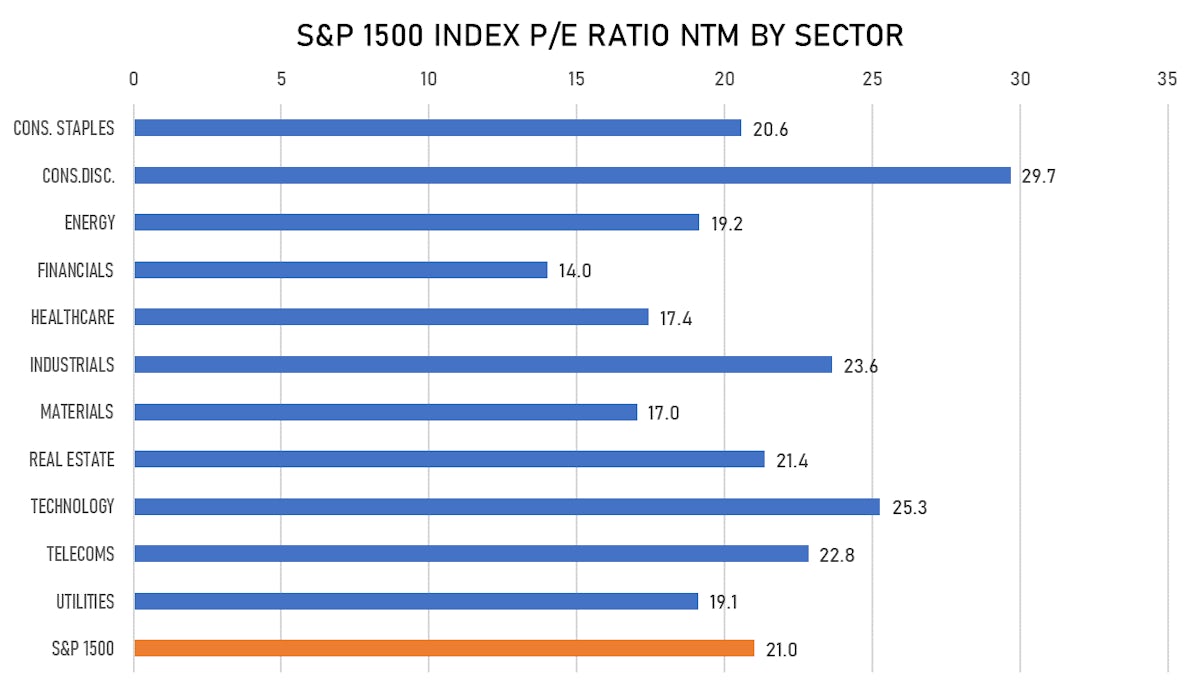

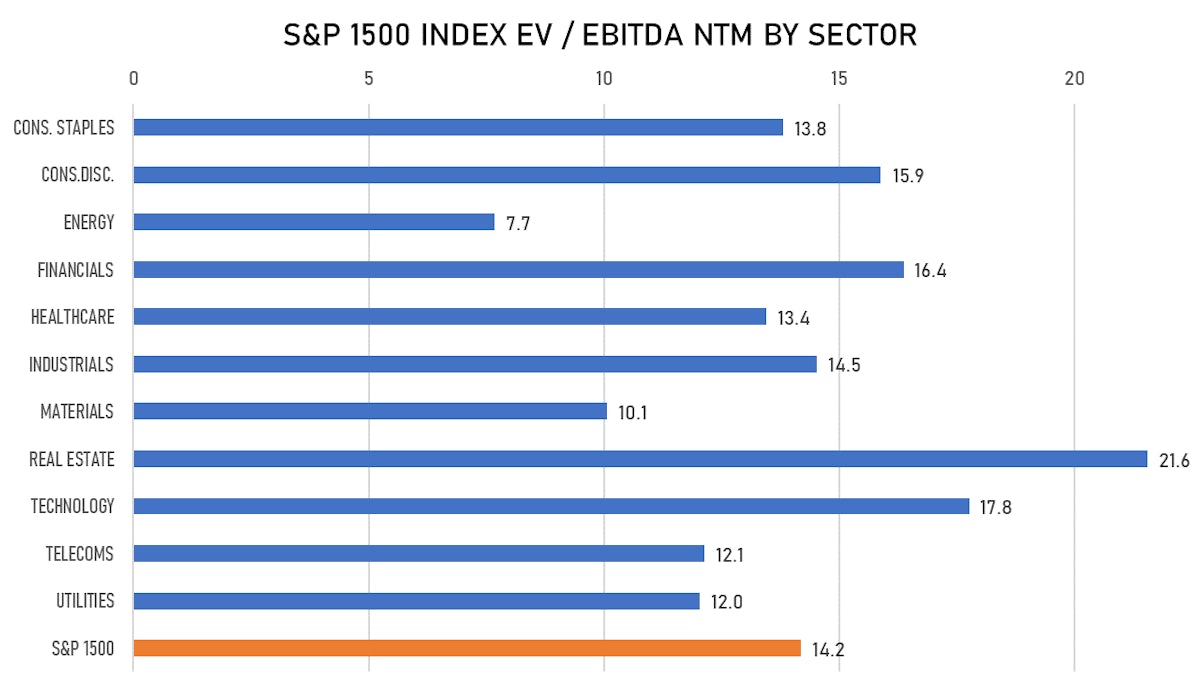

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- Verve Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: VERV / Gross proceeds (including overallotment): US$ 266.68m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, Guggenheim Securities LLC, Jefferies LLC, JP Morgan Securities LLC

- Northview Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: NA / Gross proceeds (including overallotment): US$ 180.00m (offering in U.S. Dollar) / Bookrunners: I-Bankers Securities Inc

- Corner Growth Acquisition Corp 2 / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: TRONU / Gross proceeds (including overallotment): US$ 175.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- Angel Oak Mortgage Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: AOMR / Gross proceeds (including overallotment): US$ 136.80m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Morgan Stanley & Co LLC, B Riley FBR, Bofa Securities Inc, UBS Securities LLC

- Elopak AS / Norway - Materials / Listing Exchange: Oslo / Ticker: ELO / Gross proceeds (including overallotment): US$ 246.54m (offering in Norwegian Krone) / Bookrunners: Goldman Sachs International, Carnegie AS, DnB Markets AS, ABG Sundal Collier, SEB

- Green Hydrogen Systems A/S / Denmark - Industrials / Listing Exchange: OMX Copen / Ticker: GREENH / Gross proceeds (including overallotment): US$ 177.43m (offering in Danish Krone) / Bookrunners: ABG Sundal Collier, Carnegie Investment Bank AB, JP Morgan AG

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- C4 Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: CCCC / Gross proceeds (including overallotment): US$ 157.25m (offering in U.S. Dollar) / Bookrunners: Evercore Group, BMO Capital Markets, Jefferies LLC, JP Morgan Securities LLC, UBS Securities LLC

- Auction Technology Group PLC / United Kingdom - Consumer Products and Services / Listing Exchange: - / Ticker: ATG / Gross proceeds (including overallotment): US$ 352.47m (offering in British Pound) / Bookrunners: Numis Securities Ltd, JP Morgan Cazenove