Equities

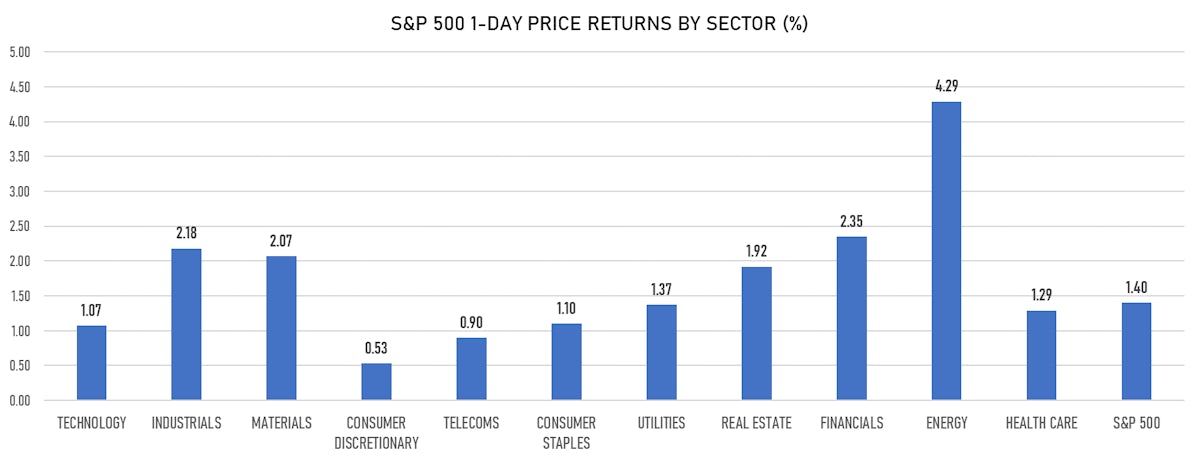

Broad Rebound In US Stocks, With Energy Up 4% And Financials Up 2% On Steeper Rates Curve

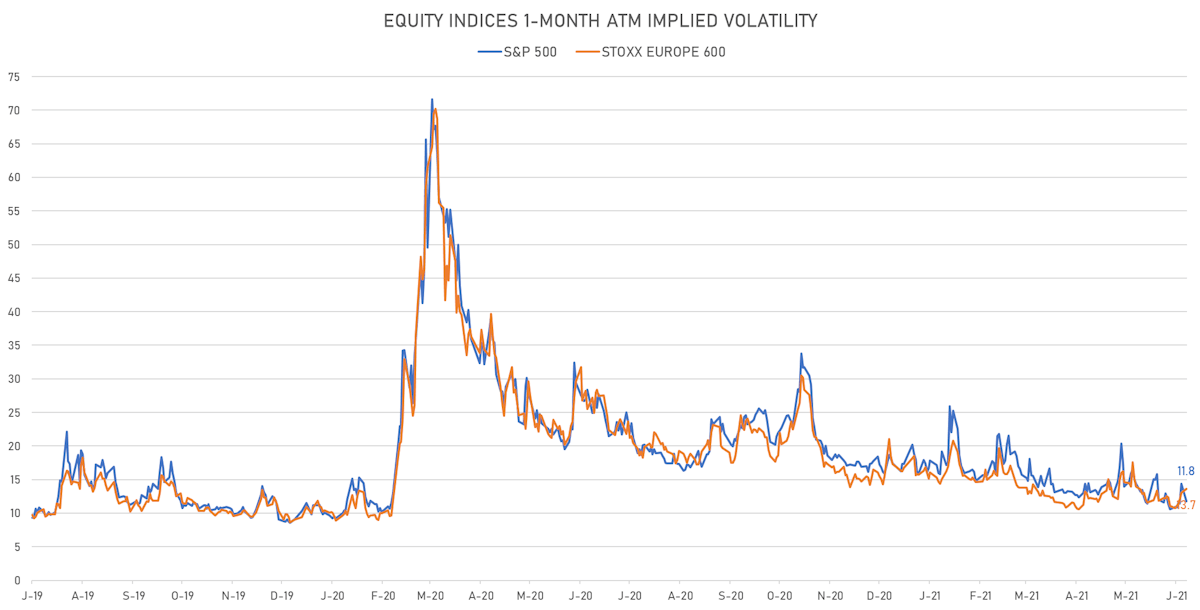

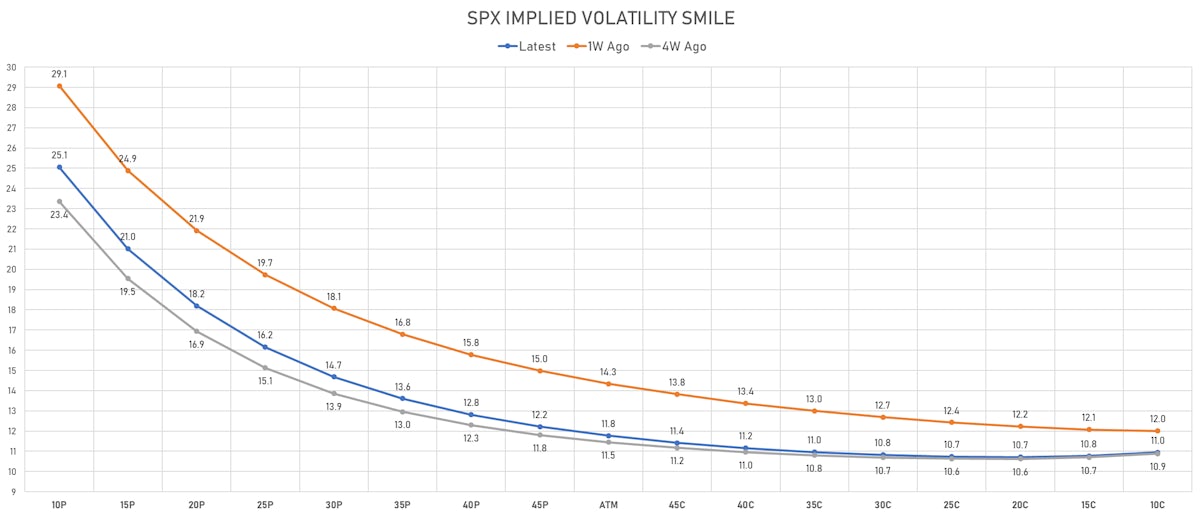

Implied volatilities dropped significantly and are pretty much back to where they were one month ago, with the exception of far out-of-the-money puts

Published ET

FactSet Country Indices YTD Total Returns | Sources: ϕpost, FactSet data

SUMMARY

- Daily performance of US indices: S&P 500 up 1.40%; Nasdaq Composite up 0.79%; Wilshire 5000 up 1.36%

- 95.4% of S&P 500 stocks were up today, with 88.5% of stocks above their 200-day moving average (DMA) and 45.3% above their 50-DMA

- The turnover of S&P 500 shares traded today was $66.9 bn, with 0.6 bn shares traded

- Top performing sectors: energy up 4.29% and financials up 2.35%

- Bottom performing sectors: consumer discretionary up 0.53% and telecoms up 0.90%

- The S&P 500 Value Index was up 1.9%, while the S&P 500 Growth Index was up 0.9%; the S&P small caps index was up 2.3% and mid caps were up 2.3%

- The volume on the INX was a pedestrian 2.0m (3-month z-score: -0.4); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.70%; China CSI 300 up 0.27%; Japan up 2.84%; UK FTSE 100 up 0.64%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.8%, down from 14.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.7%, up from 13.0%

WINNERS

- Lydall Inc (LDL), up 85.4% to $61.72 / YTD price return: +105.5% / 12-Month Price Range: $ 11.15-42.06

- Torchlight Energy Resources Inc (TRCH), up 58.2% to $9.92 / YTD price return: +1,317.1% / 12-Month Price Range: $ .21-6.76

- Raven Industries Inc (RAVN), up 49.3% to $57.65 / YTD price return: +74.2% / 12-Month Price Range: $ 19.84-47.43

- Kosmos Energy Ltd (KOS), up 19.1% to $3.68 / 12-Month Price Range: $ .90-3.69

- Smith & Wesson Brands Inc (SWBI), up 18.5% to $27.68 / YTD price return: +55.9% / 12-Month Price Range: $ 13.53-23.62 / Short interest (% of float): 10.8%; days to cover: 3.6

- ContextLogic Inc (WISH), up 18.4% to $13.50 / YTD price return: -26.0% / 12-Month Price Range: $ 7.52-32.85

- Figs Inc (FIGS), up 17.1% to $42.61 / 12-Month Price Range: $ 28.25-38.50

- Globalstar Inc (GSAT), up 17.1% to $1.51 / YTD price return: +346.0% / 12-Month Price Range: $ .29-2.98

- Anavex Life Sciences Corp (AVXL), up 13.7% to $25.17 / YTD price return: +366.1% / 12-Month Price Range: $ 3.65-28.70

- Cassava Sciences Inc (SAVA), up 12.6% to $89.72 / YTD price return: +1,215.5% / 12-Month Price Range: $ 2.61-117.54

BIGGEST LOSERS

- AiHuiShou International Co Ltd (RERE), down 15.4% to $14.56 / 12-Month Price Range: $ 14.56 -18.49 (the stock is currently on the short sale restriction list)

- Azure Power Global Ltd (AZRE), down 11.2% to $22.93 / YTD price return: -43.8% / 12-Month Price Range: $ 15.09-53.60 / Short interest (% of float): 2.9%; days to cover: 4.5 (the stock is currently on the short sale restriction list)

- HUTCHMED (China) Ltd (HCM), down 10.1% to $26.24 / YTD price return: -18.1% / 12-Month Price Range: $ 23.59-37.00 / Short interest (% of float): 1.4%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- Skywater Technology Inc (SKYT), down 10.0% to $28.02 / 12-Month Price Range: $ 14.25-34.43 (the stock is currently on the short sale restriction list)

- Microstrategy Inc (MSTR), down 9.7% to $583.67 / YTD price return: +50.2% / 12-Month Price Range: $ 113.55-1,315.00 (the stock is currently on the short sale restriction list)

- Monday.Com Ltd (MNDY), down 9.1% to $211.24 / 12-Month Price Range: $ 155.01-237.50 (the stock is currently on the short sale restriction list)

- FinVolution Group (FINV), down 9.1% to $9.00 / YTD price return: +237.1% / 12-Month Price Range: $ 1.57-10.61 / Short interest (% of float): 3.0%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- Sana Biotechnology Inc (SANA), down 8.8% to $20.52 / 12-Month Price Range: $ 16.28-44.60

- WM Technology Inc (MAPS), down 8.5% to $18.27 / YTD price return: +43.1% / 12-Month Price Range: $ 9.99-29.50 / Short interest (% of float): 1.4%; days to cover: 6.9 (the stock is currently on the short sale restriction list)

- UP Fintech Holding Ltd (TIGR), down 8.1% to $23.01 / YTD price return: +189.8% / 12-Month Price Range: $ 4.02-38.50 / Short interest (% of float): 4.6%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

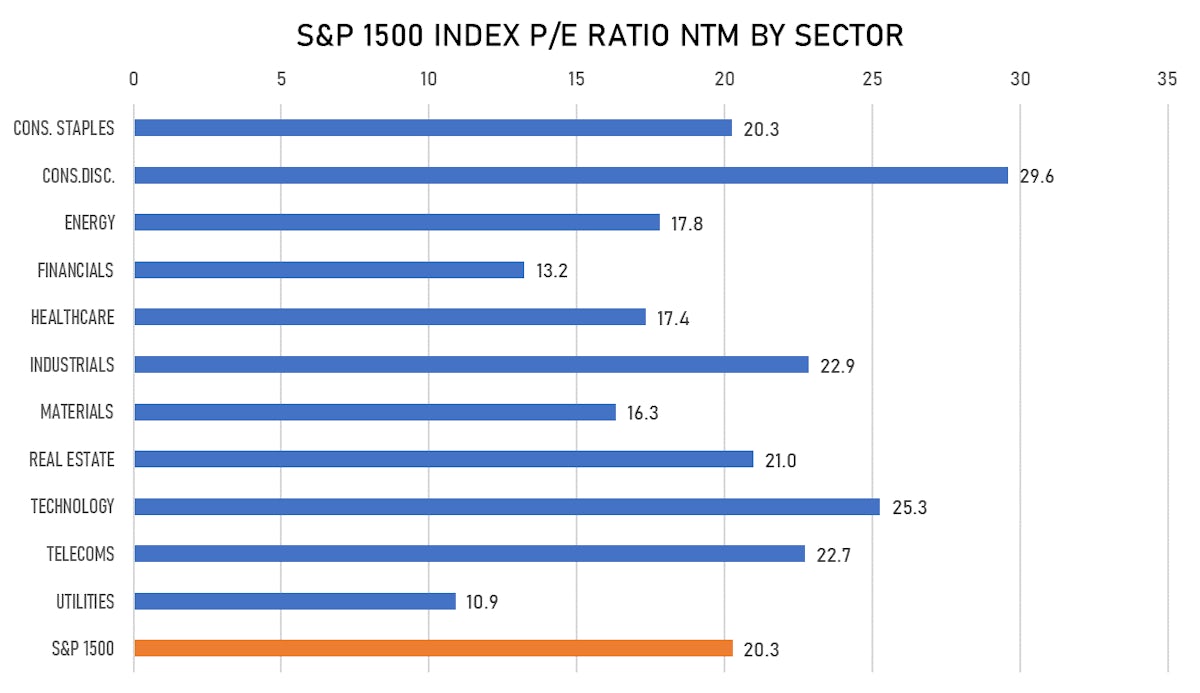

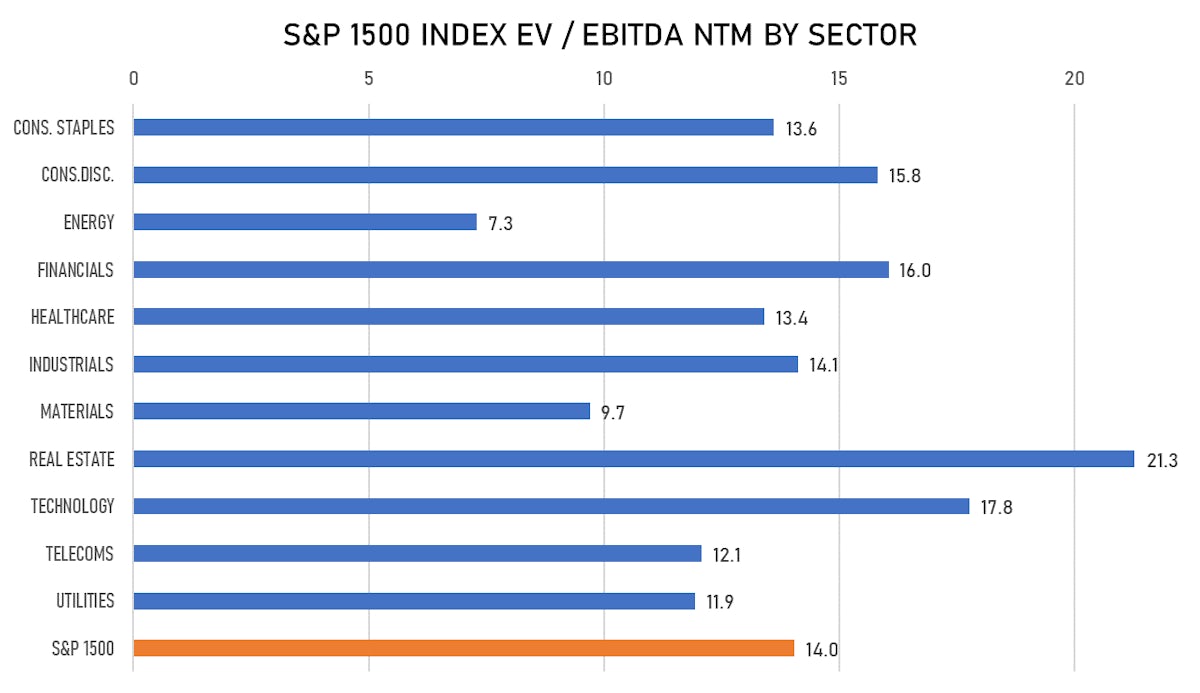

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- Anaergia Inc / Canada - Energy and Power / Listing Exchange: Toronto / Ticker: ANRG / Gross proceeds (including overallotment): US$ 140.43m (offering in Canadian Dollar) / Bookrunners: TD Securities Inc, Barclays Capital Canada Inc

- PCGI Intermediate Holdings Ltd / Cayman Islands - Financials / Listing Exchange: No Listing / Ticker: - / Gross proceeds (including overallotment): US$ 2,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Aramis Group SAS / France - Retail / Listing Exchange: Euro Paris / Ticker: ARAMI / Gross proceeds (including overallotment): US$ 432.77m (offering in EURO) / Bookrunners: Societe Generale SA, Citigroup Inc, BNP Paribas SA, Credit Agricole Corporate & Investment Bank, Morgan Stanley Europe SE

- Victorian Plumbing Group Ltd / United Kingdom - Consumer Products and Services / Listing Exchange: London AIM / Ticker: N/A / Gross proceeds (including overallotment): US$ 414.09m (offering in British Pound) / Bookrunners: Barclays Bank PLC, Numis Securities Ltd

- Elopak AS / Norway - Materials / Listing Exchange: Oslo / Ticker: ELO / Gross proceeds (including overallotment): US$ 357.50m (offering in Norwegian Krone) / Bookrunners: Goldman Sachs International, Carnegie AS, DnB Markets AS, ABG Sundal Collier, SEB

- Zhejiang Publishing & Media Co Ltd / China - Media and Entertainment / Listing Exchange: Shanghai / Ticker: 601921 / Gross proceeds (including overallotment): US$ 248.01m (offering in Chinese Yuan) / Bookrunners: Caitong Securities Co Ltd

- AiHuiShou International Co Ltd / China - Retail / Listing Exchange: New York / Ticker: RERE / Gross proceeds (including overallotment): US$ 227.26m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs (Asia), China Renaissance Securities(Hong Kong)Ltd, Bofa Securities Inc

- ATAI Life Sciences BV / Germany - Healthcare / Listing Exchange: Nasdaq / Ticker: ATAI / Gross proceeds (including overallotment): US$ 225.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Cowen & Co, Credit Suisse Securities (USA) LLC, Berenberg Capital Markets LLC

- Komplett AS / Norway - High Technology / Listing Exchange: Oslo / Ticker: KOMPL / Gross proceeds (including overallotment): US$ 186.02m (offering in Norwegian Krone) / Bookrunners: DnB Markets AS, ABG Sundal Collier, Pareto Securities, SEB

- Shandong Weigao Orthopaedic Device Co Ltd / China - Healthcare / Listing Exchange: SSES / Ticker: 688161 / Gross proceeds (including overallotment): US$ 131.12m (offering in Chinese Yuan) / Bookrunners: Huatai United Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Focus Financial Partners Inc / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: FOCS / Gross proceeds (including overallotment): US$ 373.22m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- C&C Group PLC / Republic of Ireland - Consumer Staples / Listing Exchange: London / Ticker: GCC / Gross proceeds (including overallotment): US$ 198.16m (offering in British Pound) / Bookrunners: Davy, Barclays Bank PLC, HSBC Bank PLC, Numis Securities Ltd

- Frontier Real Estate Investment Corp / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 8964 / Gross proceeds (including overallotment): US$ 135.09m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Daiwa Securities Co Ltd, SMBC Nikko Securities Inc