Equities

Low Volume, Low Volatility Snoozer For US Stocks

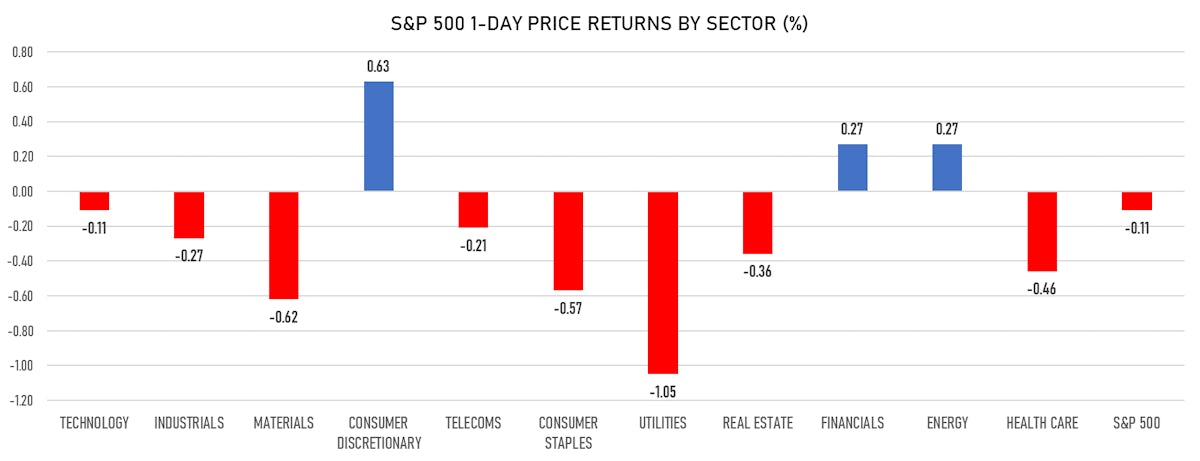

Slight overperformance of growth over value today, and small caps over large caps, with consumer discretionary the leading sector in the S&P 500

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.11%; Nasdaq Composite up 0.13%; Wilshire 5000 down -0.01%

- 40.0% of S&P 500 stocks were up today, with 87.7% of stocks above their 200-day moving average (DMA) and 42.2% above their 50-DMA

- The turnover of S&P 500 shares traded today was $55.5 bn, with 0.5 bn shares traded

- Top performing sectors: consumer discretionary up 0.63% and financials up 0.27%

- Bottom performing sectors: utilities down -1.05% and materials down -0.62%

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was unchanged; the S&P small caps index was up 0.1% and mid caps were up 0.1%

- The volume on the INX was very low at 1.8m (3-month z-score: -1.2); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.73%; China CSI 300 down 0.00%; Japan down -0.39%; UK FTSE 100 down -0.22%

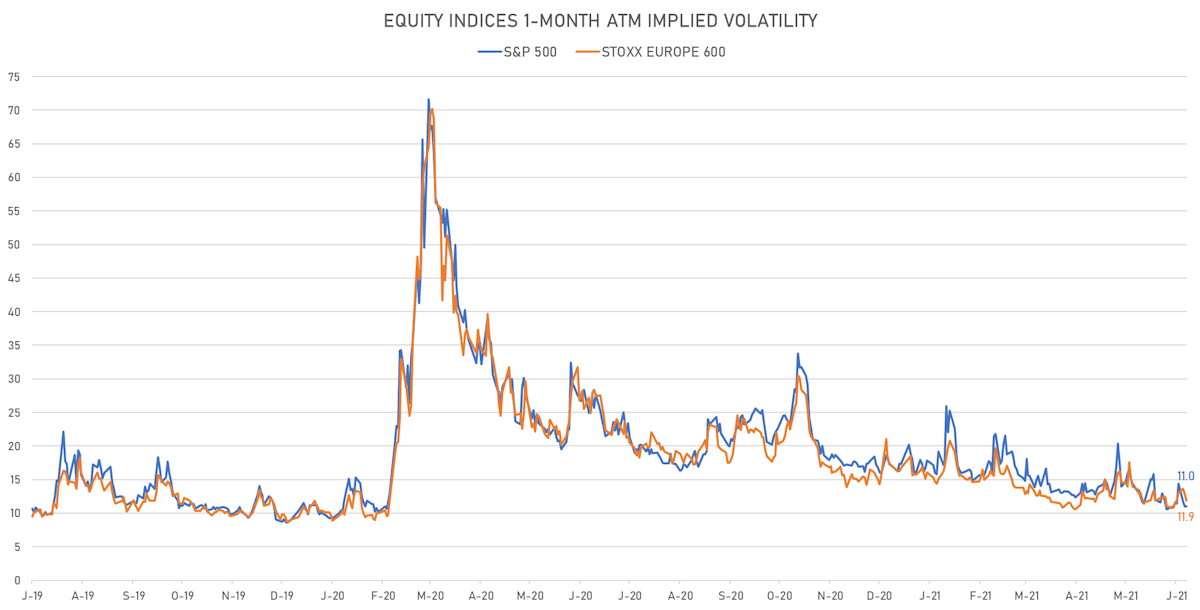

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 unchanged at 11.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.9%, down from 12.9%

NOTABLE S&P 500 EARNINGS RELEASES

- IHS Markit Ltd (Industrials): beat on EPS (0.81 act. vs. 0.70 est.) and beat on revenue (1,181m act. vs. 1,111m est.)

TOP WINNERS

- HUTCHMED (China) Ltd (HCM), up 16.0% to $30.02 / YTD price return: -6.2% / 12-Month Price Range: $ 23.67-37.00 / Short interest (% of float): 1.4%; days to cover: 4.1

- Sundial Growers Inc (SNDL), up 12.1% to $1.00 / YTD price return: +111.2% / 12-Month Price Range: $ .14-3.96

- FTC Solar Inc (FTCI), up 11.9% to $12.93 / 12-Month Price Range: $ 7.79-15.46

- TuSimple Holdings Inc (TSP), up 11.5% to $56.79 / 12-Month Price Range: $ 32.13-65.98

- Dlocal Ltd (DLO), up 11.3% to $45.07 / 12-Month Price Range: $ 29.57-43.10

- UP Fintech Holding Ltd (TIGR), up 10.5% to $26.62 / YTD price return: +235.3% / 12-Month Price Range: $ 4.02-38.50 / Short interest (% of float): 4.6%; days to cover: 0.7

- Ideanomics Inc (IDEX), up 10.5% to $3.15 / YTD price return: +58.3% / 12-Month Price Range: $ .80-5.53

- iStar Inc (STAR), up 10.1% to $20.47 / YTD price return: +37.8% / 12-Month Price Range: $ 11.10-18.87 / Short interest (% of float): 19.7%; days to cover: 17.7

- SEMrush Holdings Inc (SEMR), up 9.8% to $20.20 / 12-Month Price Range: $ 10.62-21.02 / Short interest (% of float): 4.0%; days to cover: 1.3

- Clover Health Investments Corp (CLOV), up 9.5% to $13.83 / YTD price return: -17.5% / 12-Month Price Range: $ 6.31-28.85 / Short interest (% of float): 37.3%; days to cover: 1.6

BIGGEST LOSERS

- Keros Therapeutics Inc (KROS), down 15.2% to $44.57 / YTD price return: -36.8% / 12-Month Price Range: $ 25.71-88.80 (the stock is currently on the short sale restriction list)

- Patterson Companies Inc (PDCO), down 11.8% to $30.97 / YTD price return: +4.5% / 12-Month Price Range: $ 19.89-37.37 (the stock is currently on the short sale restriction list)

- Score Media and Gaming Inc (SCR), down 11.2% to $21.55 / YTD price return: +80.4% / 12-Month Price Range: $ 4.03-45.00 / Short interest (% of float): 0.6%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Nov Inc (NOV), down 7.4% to $15.06 / YTD price return: +9.7% / 12-Month Price Range: $ 7.70-18.02 / Short interest (% of float): 4.4%; days to cover: 3.7

- Bentley Systems Inc (BSY), down 6.6% to $61.65 / YTD price return: +52.2% / 12-Month Price Range: $ 27.00-67.00

- Recursion Pharmaceuticals Inc (RXRX), down 6.2% to $33.51 / 12-Month Price Range: $ 19.68-37.85

- Equinox Gold Corp (EQX), down 6.1% to $7.20 / YTD price return: -30.4% / 12-Month Price Range: $ 7.60-13.66 / Short interest (% of float): 1.4%; days to cover: 2.6

- Neogames SARL (NGMS), down 6.1% to $65.46 / YTD price return: +72.3% / 12-Month Price Range: $ 18.67-73.54

- Centessa Pharmaceuticals PLC (CNTA), down 5.9% to $23.79 / 12-Month Price Range: $ 20.00-26.90

- Owens & Minor Inc (OMI), down 5.4% to $41.87 / YTD price return: +54.8% / 12-Month Price Range: $ 7.00-49.16

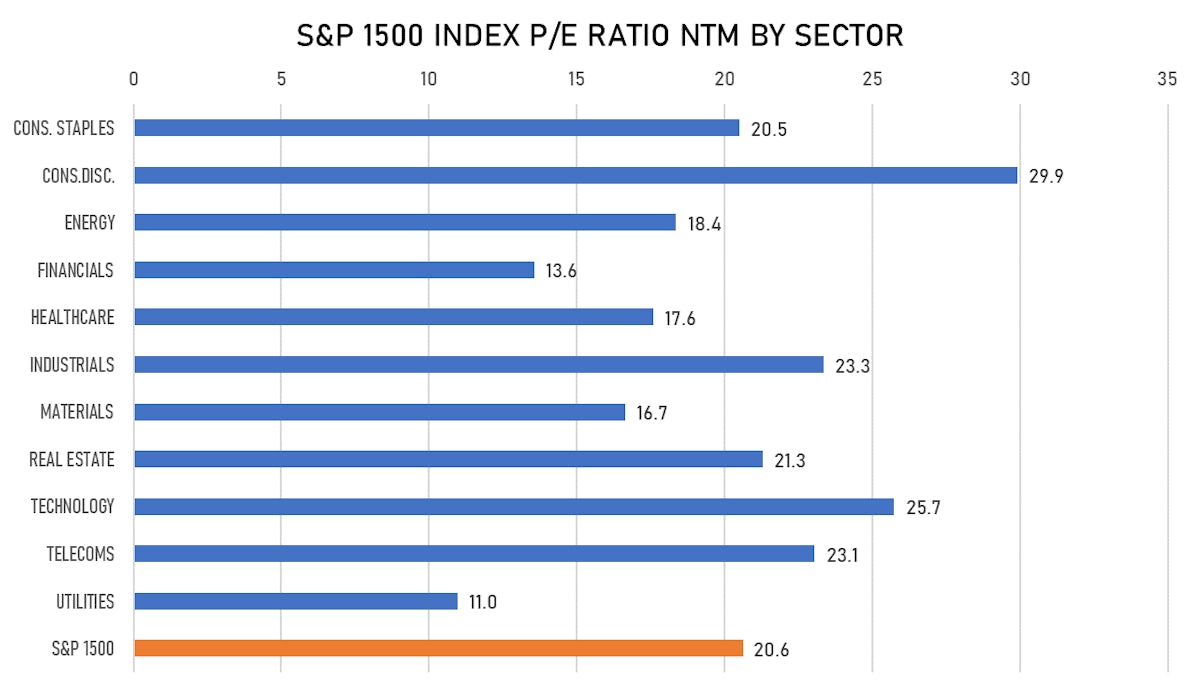

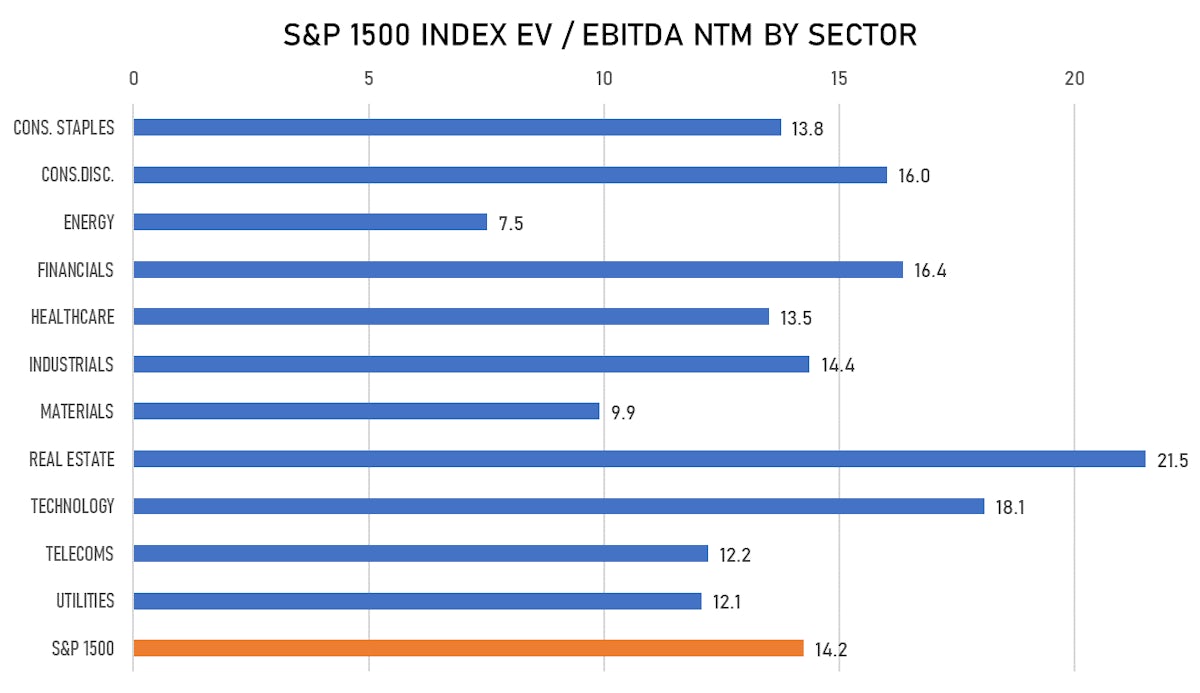

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- First Advantage Corp / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: FA / Gross proceeds (including overallotment): US$ 439.88m (offering in U.S. Dollar) / Bookrunners: Stifel Nicolaus & Co Inc, Evercore Group, Citigroup Global Markets Inc, RBC Capital Markets LLC, HSBC Securities (USA) Inc, Jefferies LLC, JP Morgan Securities LLC, Bofa Securities Inc, Barclays Capital Inc

- Sprinklr Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: CXM / Gross proceeds (including overallotment): US$ 266.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Wells Fargo Securities LLC, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Barclays Capital Inc

- Puuilo Oyj / Finland - Retail / Listing Exchange: OMXHelsink / Ticker: NA / Gross proceeds (including overallotment): US$ 283.07m (offering in EURO) / Bookrunners: Danske Bank, Nordea, Carnegie Investment Bank AB, OP Yrityspankki Oyj

- Spinnova Oyj / Finland - Consumer Staples / Listing Exchange: FinnFirNor / Ticker: N/A / Gross proceeds (including overallotment): US$ 119.38m (offering in EURO) / Bookrunners: Carnegie Investment Bank AB

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- GameStop Corp / United States of America - Retail / Listing Exchange: New York / Ticker: GME / Gross proceeds (including overallotment): US$ 1,126.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- BioXcel Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: BTAI / Gross proceeds (including overallotment): US$ 115.02m (offering in U.S. Dollar) / Bookrunners: Bofa Securities Inc

- Phoenix Group Holdings PLC / United Kingdom - Financials / Listing Exchange: London / Ticker: L53 / Gross proceeds (including overallotment): US$ 609.37m (offering in British Pound) / Bookrunners: Merrill Lynch International Ltd, HSBC Bank PLC, Citigroup Global Markets Ltd