Equities

Broad Rise In US Equities, With Small Caps Leading The Way

The S&P 500 hit a new all-time high on a low-volume trading day headed by financials, who all passed their stress tests and will soon be able to pay dividends again

Published ET

The implied volatility spread between puts and calls is reverting to the mean | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.58%; Nasdaq Composite up 0.69%; Wilshire 5000 up 0.66%

- 75.2% of S&P 500 stocks were up today, with 89.1% of stocks above their 200-day moving average (DMA) and 46.3% above their 50-DMA

- The turnover of S&P 500 shares traded today was $60.2 bn, with 0.5 bn shares traded

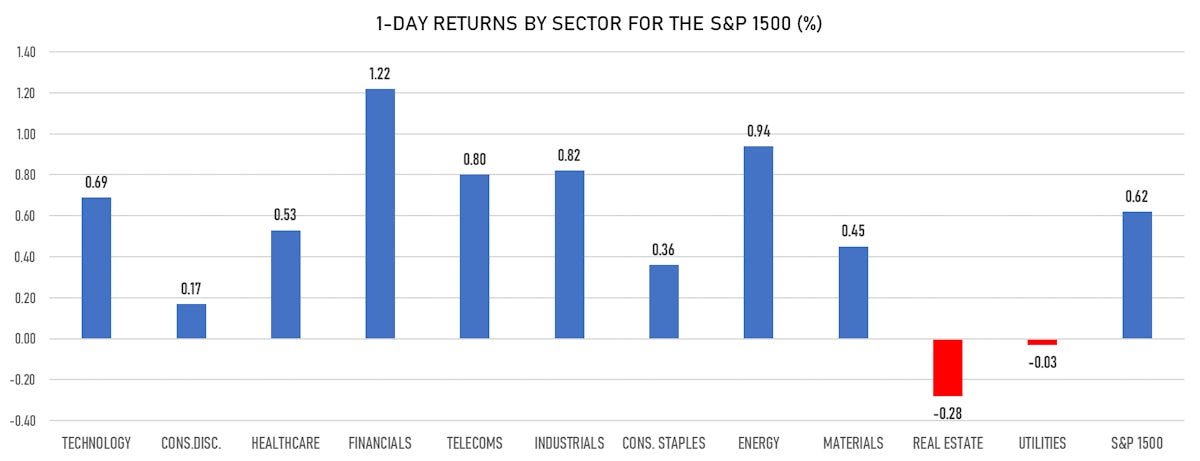

- Top performing sectors: financials up 1.21% and energy up 0.85%

- Bottom performing sectors: real estate down -0.45% and utilities down -0.10%

- The S&P 500 Value Index was up 0.7%, while the S&P 500 Growth Index was up 0.5%; the S&P small caps index was up 1.4% and mid caps were up 0.9%

- The volume on the INX was a mediocre 1.9m (3-month z-score: -0.9); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.87%; China CSI 300 unchanged; Japan up 0.58%; UK FTSE 100 up 0.51%

VOLATILITY

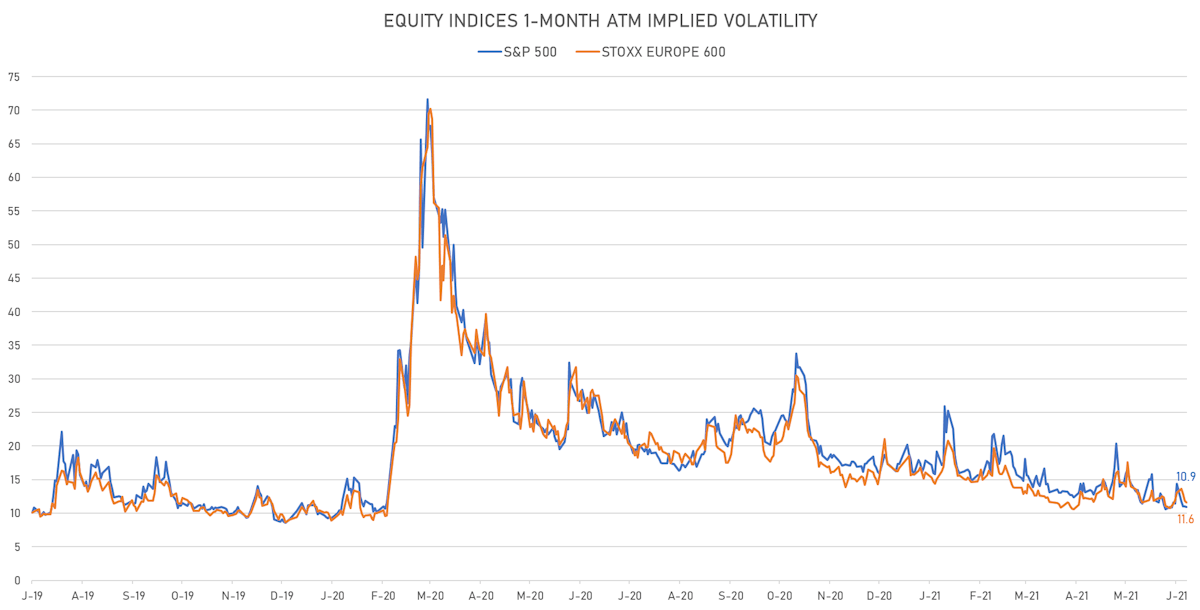

- 1-month at-the-money implied volatility on the S&P 500 at 10.9%, down from 11.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.6%, down from 11.9%

NOTABLE S&P 500 EARNINGS RELEASES

- Accenture PLC (Technology): beat on EPS (2.40 act. vs. 1.90 est.) and beat on revenue (13,264m act. vs. 11,828m est.)

- Carnival Corp (Consumer Cyclicals): missed on EPS (-1.67 act. vs. -1.54 est.) and missed on revenue (138m act. vs. 197m est.)

TOP WINNERS

- Trade Desk Inc (TTD), up 16.0% to $75.88 / YTD price return: -5.3% / 12-Month Price Range: $ 38.80-97.28 / Short interest (% of float): 3.9%; days to cover: 1.4

- SEMrush Holdings Inc (SEMR), up 15.5% to $23.34 / 12-Month Price Range: $ 10.62-21.02 / Short interest (% of float): 4.0%; days to cover: 1.3

- Arcus Biosciences Inc (RCUS), up 15.5% to $27.02 / YTD price return: +4.1% / 12-Month Price Range: $ 16.69-42.36 / Short interest (% of float): 14.4%; days to cover: 12.2

- PubMatic Inc (PUBM), up 13.0% to $40.48 / YTD price return: +44.8% / 12-Month Price Range: $ 22.42-76.96 / Short interest (% of float): 44.3%; days to cover: 5.9

- Criteo SA (CRTO), up 12.3% to $43.51 / YTD price return: +112.1% / 12-Month Price Range: $ 10.81-44.28 / Short interest (% of float): 5.5%; days to cover: 4.7

- Ashford Hospitality Trust Inc (AHT), up 12.1% to $5.02 / YTD price return: +93.8% / 12-Month Price Range: $ 1.27-9.20 / Short interest (% of float): 3.6%; days to cover: 0.2

- ViewRay Inc (VRAY), up 11.7% to $6.61 / 12-Month Price Range: $ 1.94-7.36 / Short interest (% of float): 7.3%; days to cover: 9.3

- Sorrento Therapeutics Inc (SRNE), up 10.6% to $10.00 / YTD price return: +46.5% / 12-Month Price Range: $ 5.03-19.39 / Short interest (% of float): 19.5%; days to cover: 8.1

- Ecopetrol SA (EC), up 10.0% to $14.68 / YTD price return: +13.7% / 12-Month Price Range: $ 8.50-14.47 / Short interest (% of float): 3.2%; days to cover: 6.5

- Uxin Ltd (UXIN), up 9.9% to $4.11 / YTD price return: +371.1% / 12-Month Price Range: $ .72-5.82 / Short interest (% of float): 4.0%; days to cover: 0.4

BIGGEST LOSERS

- Douyu International Holdings Ltd (DOYU), down 9.8% to $7.11 / YTD price return: -35.7% / 12-Month Price Range: $ 7.08-20.54 / Short interest (% of float): 2.8%; days to cover: 3.5 (the stock is currently on the short sale restriction list)

- Figs Inc (FIGS), down 6.8% to $43.37 / 12-Month Price Range: $ 28.25-49.74

- KB Home (KBH), down 6.7% to $40.45 / YTD price return: +20.7% / 12-Month Price Range: $ 27.51-52.48 / Short interest (% of float): 6.0%; days to cover: 3.9

- Talos Energy Inc (TALO), down 6.4% to $17.45 / YTD price return: +111.8% / 12-Month Price Range: $ 5.39-18.93 / Short interest (% of float): 7.1%; days to cover: 6.8

- Discovery Inc (DISCB), down 6.4% to $64.90 / YTD price return: +100.3% / 12-Month Price Range: $ 26.00-150.72 / Short interest (% of float): 3.3%; days to cover: 0.9

- Sunnova Energy International Inc (NOVA), down 6.3% to $35.31 / YTD price return: -21.8% / 12-Month Price Range: $ 15.89-57.70 / Short interest (% of float): 8.5%; days to cover: 3.0

- Agiliti Inc (AGTI), down 6.2% to $23.47 / 12-Month Price Range: $ 13.56-26.36 / Short interest (% of float): 0.2%; days to cover: 0.1

- Biogen Inc (BIIB), down 6.1% to $349.16 / YTD price return: +42.6% / 12-Month Price Range: $ 223.25-468.55 / Short interest (% of float): 2.1%; days to cover: 3.1

- Sunrun Inc (RUN), down 5.4% to $52.84 / YTD price return: -23.8% / 12-Month Price Range: $ 18.43-100.93 / Short interest (% of float): 16.9%; days to cover: 5.1

- Sabre Corp (SABR), down 5.1% to $13.25 / YTD price return: +10.2% / 12-Month Price Range: $ 5.50-16.88 / Short interest (% of float): 19.7%; days to cover: 8.2

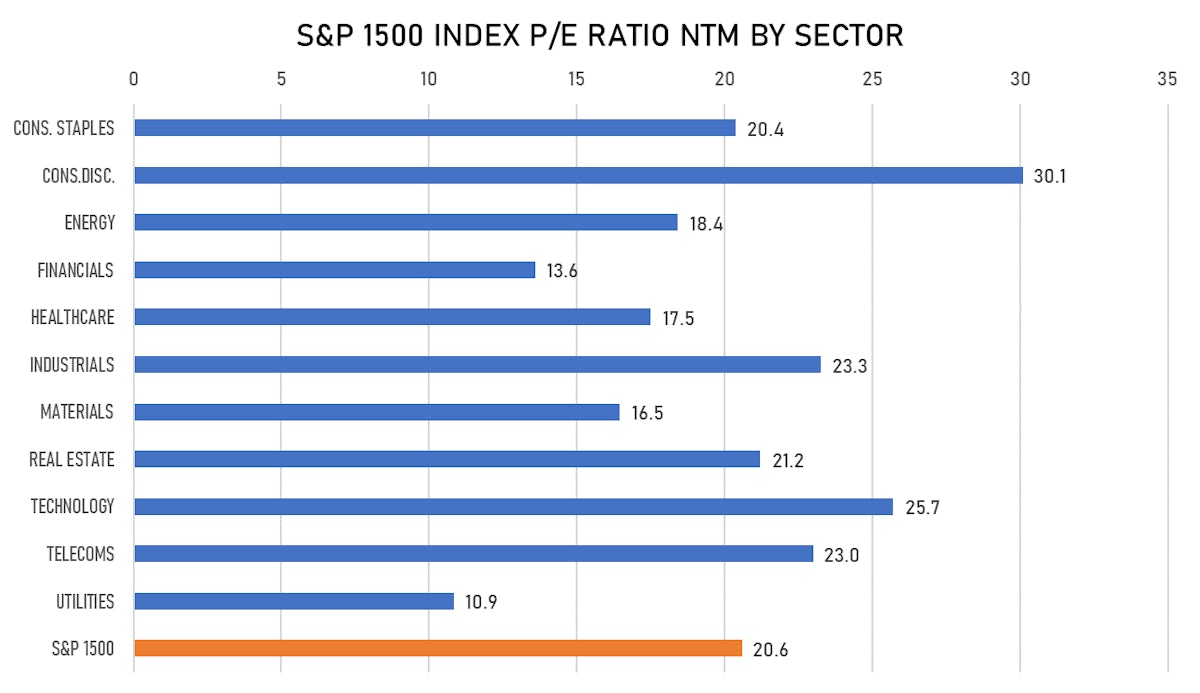

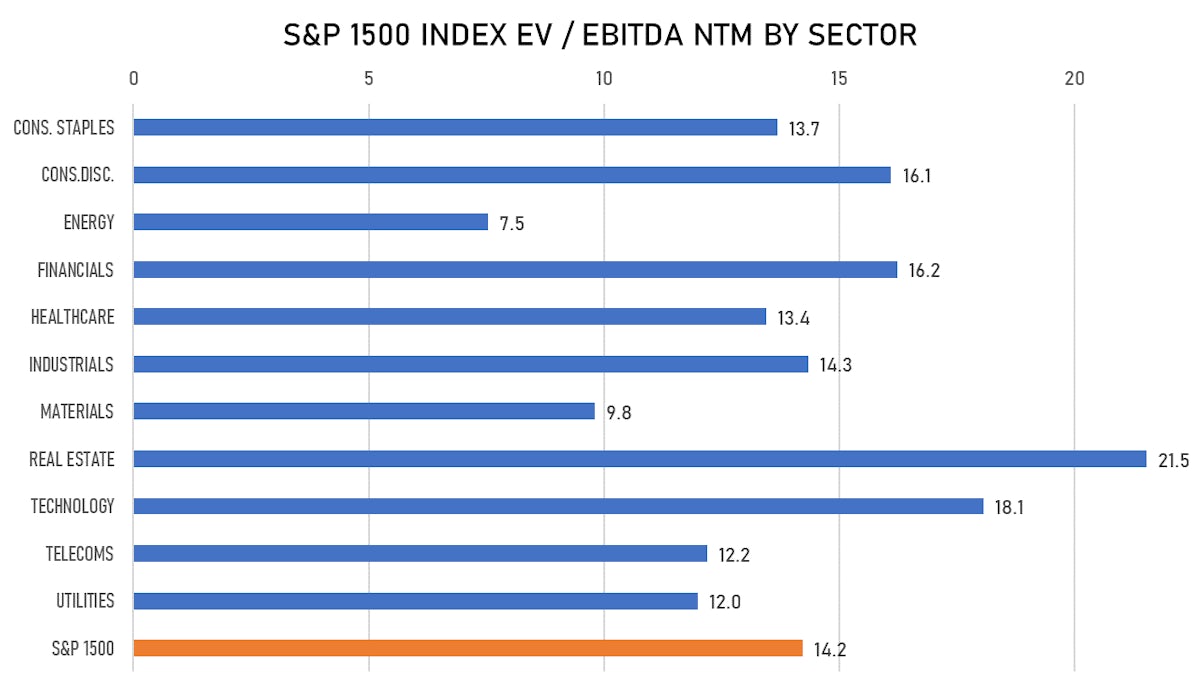

12-MONTH FORWARD VALUATION MULTIPLES

NEW IPOs ANNOUNCED OR PRICED

- Bright Health Group Inc / United States of America - Healthcare / Listing Exchange: New York / Ticker: BHG / Gross proceeds (including overallotment): US$ 924.30m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Barclays Capital Inc

- Confluent Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: CFLT / Gross proceeds (including overallotment): US$ 828.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Bofa Securities Inc

- Doximity Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: DOCS / Gross proceeds (including overallotment): US$ 605.80m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC, JP Morgan Securities LLC

- Pet Valu Holdings Ltd / Canada - Retail / Listing Exchange: Toronto / Ticker: PET / Gross proceeds (including overallotment): US$ 223.49m (offering in Canadian Dollar) / Bookrunners: CIBC World Markets Inc, RBC Dominion Securities Inc, Barclays Capital Canada Inc

- Monte Rosa Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: GLUE / Gross proceeds (including overallotment): US$ 222.30m (offering in U.S. Dollar) / Bookrunners: Guggenheim Securities LLC, Cowen & Co, JP Morgan Securities LLC, Piper Sandler & Co

- FinTech Acquisition Corp VI / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: FTVIU / Gross proceeds (including overallotment): US$ 220.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- Vero SA / Brazil - High Technology / Listing Exchange: BOVESPA / Ticker: - / Gross proceeds (including overallotment): US$ 302.01m (offering in Brazilian Real) / Bookrunners: Not Applicable

- Healthium MedTech Pvt Ltd / India - Healthcare / Listing Exchange: Unknown / Ticker: N/A / Gross proceeds (including overallotment): US$ 202.32m (offering in Indian Rupee) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Broadstone Net Lease Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: BNL / Gross proceeds (including overallotment): US$ 230.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, BMO Capital Markets

- Sembcorp Marine Ltd / Singapore - Industrials / Listing Exchange: Singapore / Ticker: S51 / Gross proceeds (including overallotment): US$ 477.25m (offering in Singapore Dollar) / Bookrunners: DBS Bank Ltd

- TINAVI Medical Technologies Co Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 688277 / Gross proceeds (including overallotment): US$ 207.02m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Big Yellow Group PLC / United Kingdom - Industrials / Listing Exchange: London / Ticker: BYG / Gross proceeds (including overallotment): US$ 139.59m (offering in British Pound) / Bookrunners: JP Morgan Cazenove

- Frontier Real Estate Investment Corp / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 8964 / Gross proceeds (including overallotment): US$ 138.77m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Daiwa Securities Co Ltd, SMBC Nikko Securities Inc