Equities

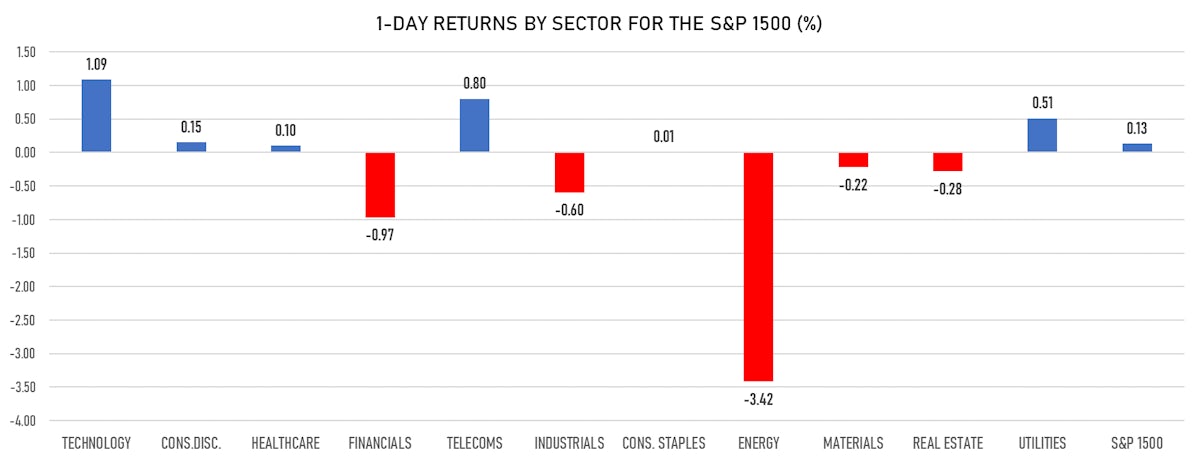

Tech And Telecoms Lead S&P 500 Up, While Energy Falls Big With Crude Rebound Seen Possibly Peaking

Value, small caps mid caps lagged badly large growth stocks as a majority of the market closed down today

Published ET

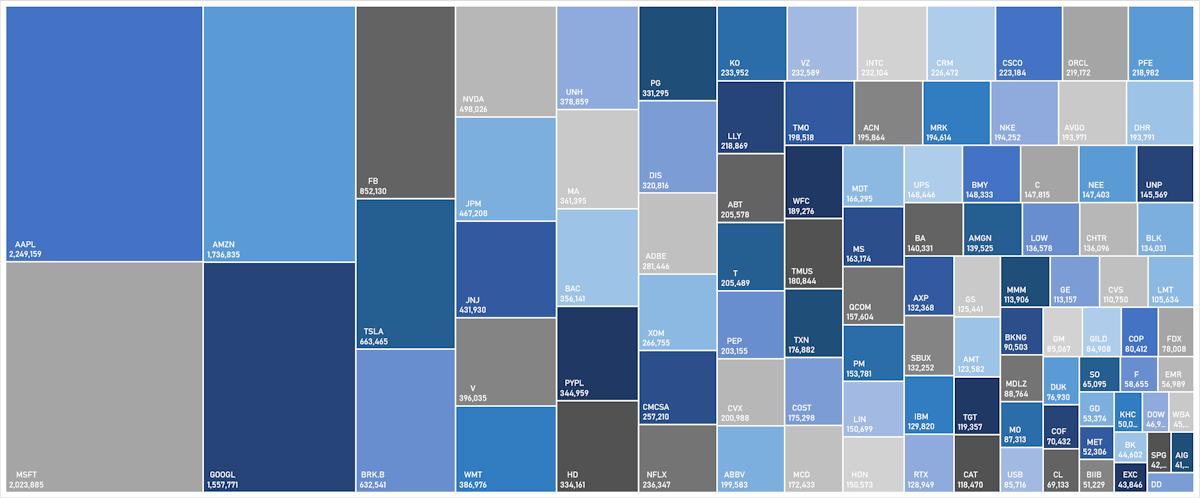

S&P 100 Market Caps | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.23%; Nasdaq Composite up 0.98%; Wilshire 5000 up 0.16%

- 41.0% of S&P 500 stocks were up today, with 90.3% of stocks above their 200-day moving average (DMA) and 48.7% above their 50-DMA

- The turnover of S&P 500 shares traded today was $62.7 bn, with 0.5 bn shares traded

- Top performing sectors: technology up 1.11% and telecoms up 0.83%

- Bottom performing sectors: energy down -3.33% and financials down -0.81%

- The S&P 500 Value Index was down -0.6%, while the S&P 500 Growth Index was up 1.0%; the S&P small caps index was down -1.0% and mid caps were down -1.0%

- The volume on the INX was slightly below average at 2.0m (3-month z-score: -0.5); the 3-month average volume is 2.2m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.59%; China CSI 300 down -0.06%; Japan down -0.76%; UK FTSE 100 down -0.88%

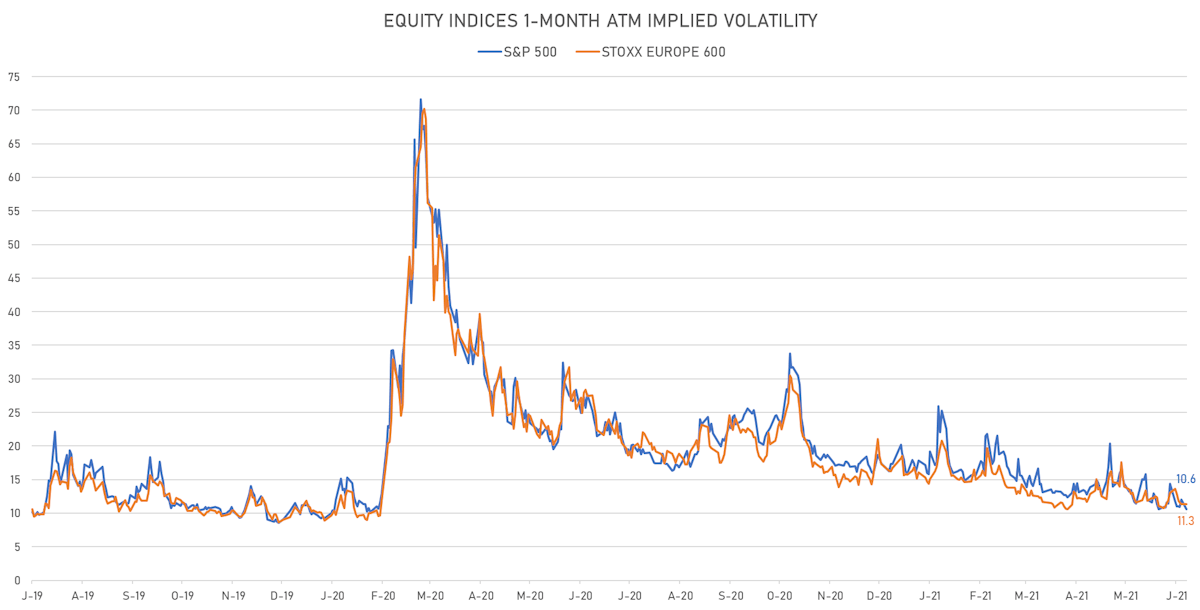

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 10.6%, down from 12.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.3%, down from 11.4%

TOP WINNERS

- JinkoSolar Holding Co Ltd (VINO), up 22.9% to $6.10 / YTD price return: -14.6% / 12-Month Price Range: $ 3.00-21.45 / Short interest (% of float): 0.2%

- Graphite Bio Inc (EVAX), up 22.7% to $7.94 / 12-Month Price Range: $ 5.16-10.34 / Short interest (% of float): 0.0%

- Mister Car Wash Inc (WTT), up 10.3% to $3.39 / 12-Month Price Range: $ .94-3.06 / Short interest (% of float): 0.3%; days to cover: 0.5

- Paysafe Ltd (CHPT), up 1.1% to $34.94 / YTD price return: -18.3% / 12-Month Price Range: $ 9.94-49.48 / Short interest (% of float): 11.4%; days to cover: 2.6

- Globalstar Inc (FVE), up 0.5% to $5.89 / YTD price return: +452.3% / 12-Month Price Range: $ 3.64-9.25 / Short interest (% of float): 5.9%; days to cover: 3.9

- Nike Inc (BSGM), up 1.3% to $4.16 / YTD price return: +7.7% / 12-Month Price Range: $ 2.79-9.77 / Short interest (% of float): 9.9%; days to cover: 13.7

- AST SpaceMobile Inc (BLCM), up 1.9% to $3.66 / YTD price return: -24.2% / 12-Month Price Range: $ 2.57-8.75 / Short interest (% of float): 12.7%; days to cover: 6.2

- Virgin Galactic Holdings Inc (AUUD), up 1.9% to $5.89 / YTD price return: +131.1% / 12-Month Price Range: $ 2.21-5.06 / Short interest (% of float): 0.4%; days to cover: 0.6

- Vimeo Inc (SLN), up 2.7% to $28.35 / 12-Month Price Range: $ 15.00-35.00 / Short interest (% of float): 0.0%; days to cover: 1.4

- Cricut Inc (GRPH), up 3.7% to $22.70 / 12-Month Price Range: $ 18.45-23.00

BIGGEST LOSERS

- Full Truck Alliance Co Ltd (GCI), down 9.7% to $5.41 / 12-Month Price Range: $ 1.03-6.33 / Short interest (% of float): 11.9%; days to cover: 7.5 (the stock is currently on the short sale restriction list)

- Missfresh Ltd (KRBP), down 8.5% to $7.99 / 12-Month Price Range: $ 4.95-18.50 / Short interest (% of float): 1.5%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- YPF SA (KMPH), down 4.1% to $13.20 / YTD price return: -.2% / 12-Month Price Range: $ 3.84-22.08 / Short interest (% of float): 15.2%; days to cover: 4.8 (the stock is currently on the short sale restriction list)

- Agiliti Inc (TRVN), down 2.3% to $1.80 / 12-Month Price Range: $ 1.34-3.68 / Short interest (% of float): 9.2%; days to cover: 6.0 (the stock is currently on the short sale restriction list)

- Allegheny Technologies Inc (DRQ), down 1.5% to $33.71 / YTD price return: +23.5% / 12-Month Price Range: $ 22.25-40.62 / Short interest (% of float): 6.3%; days to cover: 12.9

- Adecoagro SA (YMM), down 1.5% to $17.81 / YTD price return: +48.2% / 12-Month Price Range: $ 19.04-22.80 (the stock is currently on the short sale restriction list)

- NOW Inc (ECOR), down 0.9% to $1.58 / YTD price return: +32.3% / 12-Month Price Range: $ .78-3.63 / Short interest (% of float): 1.9%; days to cover: 1.7

- Sana Biotechnology Inc (TK), down 0.4% to $3.73 / 12-Month Price Range: $ 1.70-4.17 / Short interest (% of float): 3.1%; days to cover: 3.3

- IES Holdings Inc (SQBG), down 0.3% to $8.57 / YTD price return: +10.3% / 12-Month Price Range: $ 4.14-40.49 / Short interest (% of float): 13.0%; days to cover: 0.1

- Skywater Technology Inc (SOHO), down 0.1% to $3.05 / 12-Month Price Range: $ 1.48-4.49 / Short interest (% of float): 1.6%; days to cover: 0.6

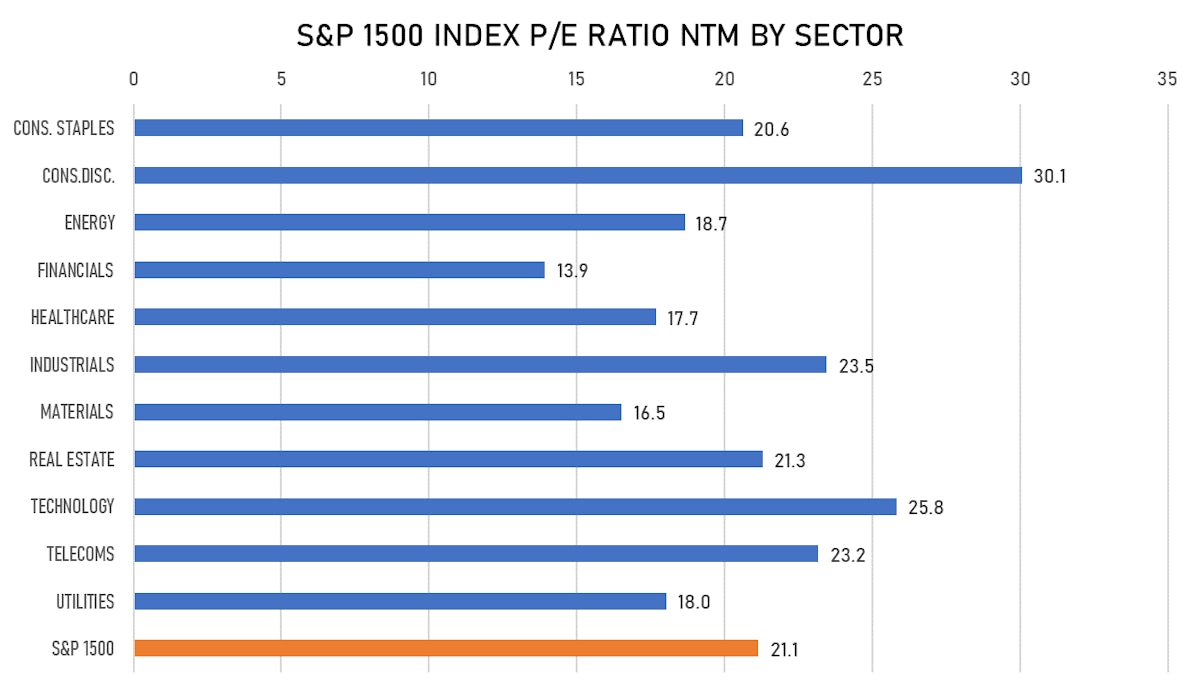

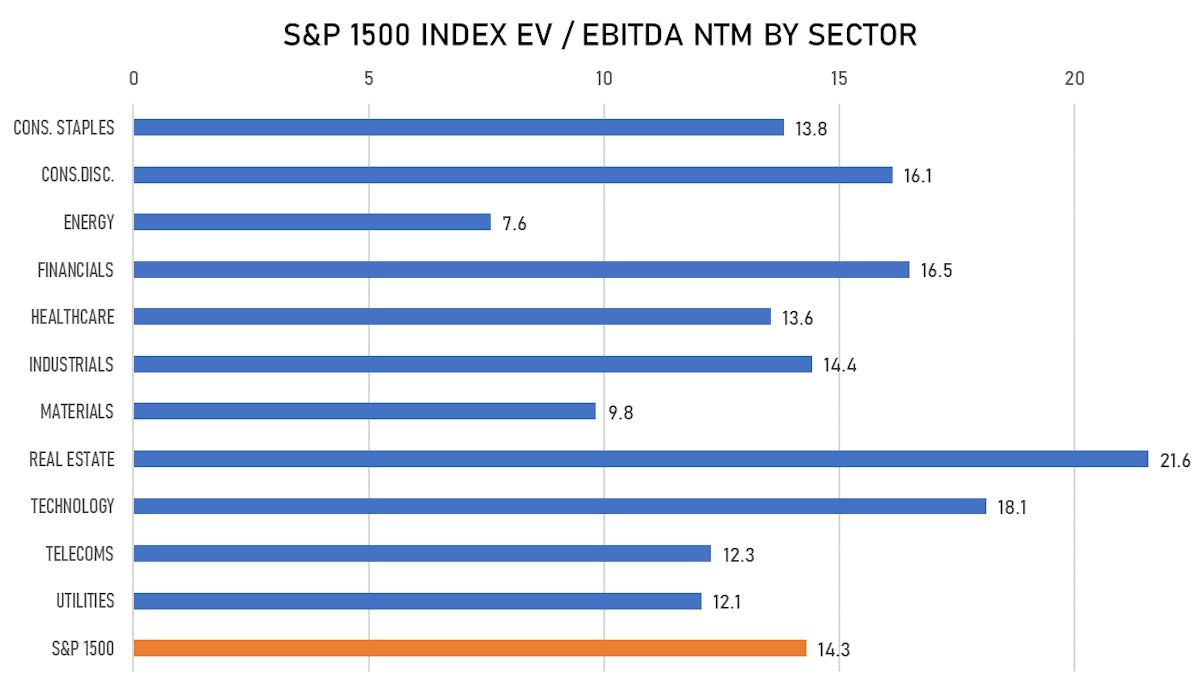

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- Williams Rowland Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: WRACU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Oppenheimer & Co Inc

- KakaoBank Corp / South Korea - Financials / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,149.75m (offering in U.S. Dollar) / Bookrunners: Credit Suisse, Citigroup, Korea Investment & Securities Co Ltd, Hana Financial Investment Co, KBI Securities Co Ltd, Hyundai Motor Securities Co Ltd

- Zylox-Tonbridge Medical Technology Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 2190 / Gross proceeds (including overallotment): US$ 150.09m (offering in Hong Kong Dollar) / Bookrunners: CLSA Asia-Pacific Markets Ltd, CMB International Capital Corp, ICBC International Capital Ltd, Essence International Securities (Hong Kong) Ltd, Morgan Stanley & Co International PLC, China Industrial Securities International Capital Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- XPO Logistics Inc / United States of America - Industrials / Listing Exchange: New York / Ticker: XPO / Gross proceeds (including overallotment): US$ 750.60m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, Barclays Capital Inc