Equities

Broad US Equity Indices End The Session Largely Unchanged

The majority of S&P 500 stocks were down, but the relative overperformance of large growth stocks pulled the index up

Published ET

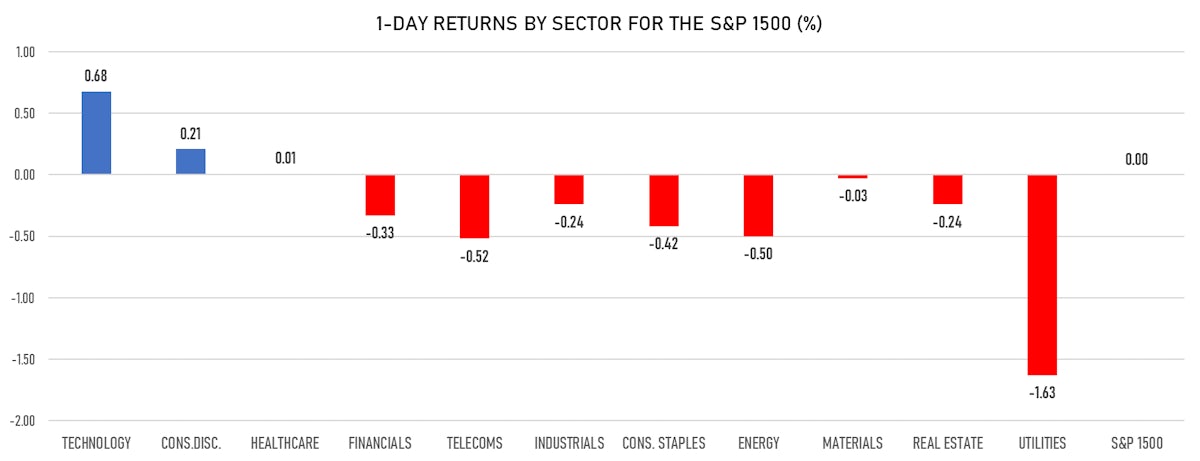

S&P 1500 Sectors Performance Year To Date | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.03%; Nasdaq Composite up 0.19%; Wilshire 5000 down -0.03%

- 45.1% of S&P 500 stocks were up today, with 89.3% of stocks above their 200-day moving average (DMA) and 46.1% above their 50-DMA

- The turnover of S&P 500 shares traded today was $52.8 bn, with 0.5 bn shares traded

- Top performing sectors: technology up 0.70% and consumer discretionary up 0.23%

- Bottom performing sectors: utilities down -1.65% and telecoms down -0.52%

- The S&P 500 Value Index was down -0.3%, while the S&P 500 Growth Index was up 0.3%; the S&P small caps index was down -0.4% and mid caps were down -0.2%

- The volume on the INX was low today at 1.8m (3-month z-score: -0.9); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.31%; China CSI 300 down -0.05%; Japan up 0.13%; UK FTSE 100 up 0.21%

VOLATILITY

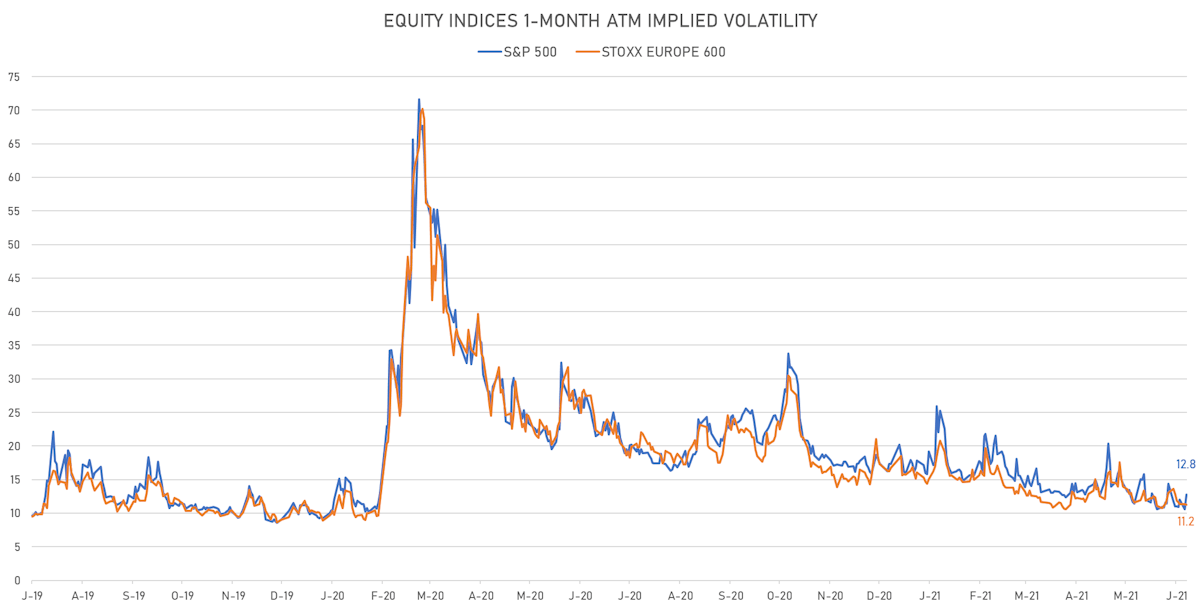

- 1-month at-the-money implied volatility on the S&P 500 at 12.8%, up from 10.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.2%, down from 11.3%

TOP WINNERS

- Cerevel Therapeutics Holdings Inc (CERE), up 136.2% to $5.70 / YTD price return: +79.1% / 12-Month Price Range: $ 3.00-21.45 / Short interest (% of float): 0.2%

- Graphite Bio Inc (GRPH), up 21.6% to $7.69 / 12-Month Price Range: $ 5.16-10.34

- Verve Therapeutics Inc (VERV), up 20.6% to $3.36 / 12-Month Price Range: $ .94-3.90 / Short interest (% of float): 0.3%; days to cover: 0.5

- Intellia Therapeutics Inc (NTLA), up 13.6% to $35.69 / YTD price return: +178.7% / 12-Month Price Range: $ 9.94-49.48 / Short interest (% of float): 11.4%; days to cover: 2.6

- Century Therapeutics Inc (IPSC), up 13.4% to $5.69 / 12-Month Price Range: $ 3.64-9.25 / Short interest (% of float): 5.9%; days to cover: 3.9

- Translate Bio Inc (TBIO), up 12.5% to $4.12 / YTD price return: +39.2% / 12-Month Price Range: $ 2.79-9.77 / Short interest (% of float): 9.9%; days to cover: 13.7

- Zhihu Inc (ZH), up 11.1% to $3.43 / 12-Month Price Range: $ 2.57-8.75 / Short interest (% of float): 12.7%; days to cover: 6.2

- Coupang Inc (CPNG), up 10.2% to $7.01 / 12-Month Price Range: $ 2.21-6.45 / Short interest (% of float): 0.4%; days to cover: 0.6

- Day One Biopharmaceuticals Inc (DAWN), up 10.1% to $28.35 / 12-Month Price Range: $ 15.00-35.00 / Short interest days to cover: 1.4

- Original BARK Co (BARK), up 9.8% to $27.60 / YTD price return: -27.0% / 12-Month Price Range: $ 18.45-24.40

BIGGEST LOSERS

- Anavex Life Sciences Corp (AVXL), down 18.1% to $5.34 / YTD price return: +337.6% / 12-Month Price Range: $ 1.03-6.33 / Short interest (% of float): 11.9%; days to cover: 7.5 (the stock is currently on the short sale restriction list)

- Montauk Renewables Inc (MNTK), down 16.6% to $6.64 / 12-Month Price Range: $ 4.95-18.50 / Short interest (% of float): 1.5%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- Vericel Corp (VCEL), down 14.8% to $13.19 / YTD price return: +87.1% / 12-Month Price Range: $ 3.84-22.08 / Short interest (% of float): 15.2%; days to cover: 4.8 (the stock is currently on the short sale restriction list)

- Virgin Galactic Holdings Inc (SPCE), down 14.3% to $1.78 / YTD price return: +98.1% / 12-Month Price Range: $ 1.34-3.68 / Short interest (% of float): 9.2%; days to cover: 6.0 (the stock is currently on the short sale restriction list)

- Kymera Therapeutics Inc (KYMR), down 9.6% to $33.93 / YTD price return: -31.2% / 12-Month Price Range: $ 22.25-40.62 / Short interest (% of float): 6.3%; days to cover: 12.9 (the stock is currently on the short sale restriction list)

- Privia Health Group Inc (PRVA), down 9.5% to $16.15 / 12-Month Price Range: $ 17.01-22.80 (the stock is currently on the short sale restriction list)

- Full Truck Alliance Co Ltd (YMM), down 9.3% to $1.49 / 12-Month Price Range: $ .78-3.63 / Short interest (% of float): 1.9%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- Karuna Therapeutics Inc (KRTX), down 8.9% to $3.78 / YTD price return: +9.6% / 12-Month Price Range: $ 1.70-4.17 / Short interest (% of float): 3.1%; days to cover: 3.3

- Uxin Ltd (UXIN), down 8.6% to $8.35 / YTD price return: +339.0% / 12-Month Price Range: $ 4.14-40.49 / Short interest (% of float): 13.0%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- Sciplay Corp (SCPL), down 7.9% to $3.00 / YTD price return: +25.1% / 12-Month Price Range: $ 1.48-4.49 / Short interest (% of float): 1.6%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

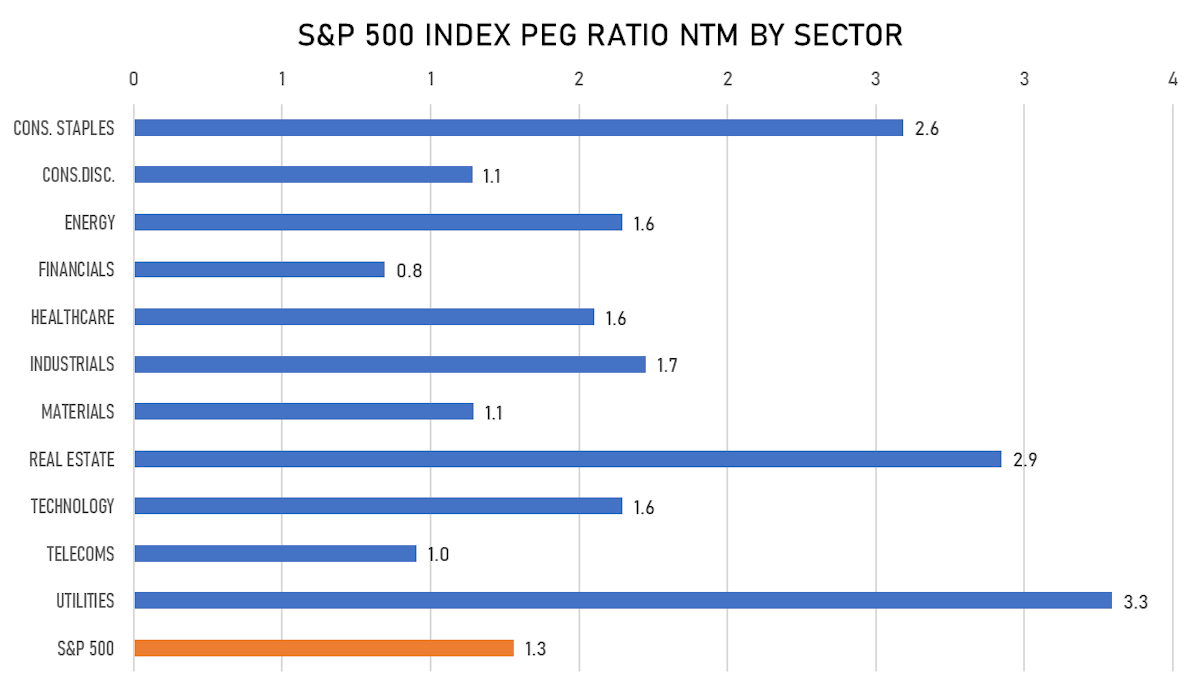

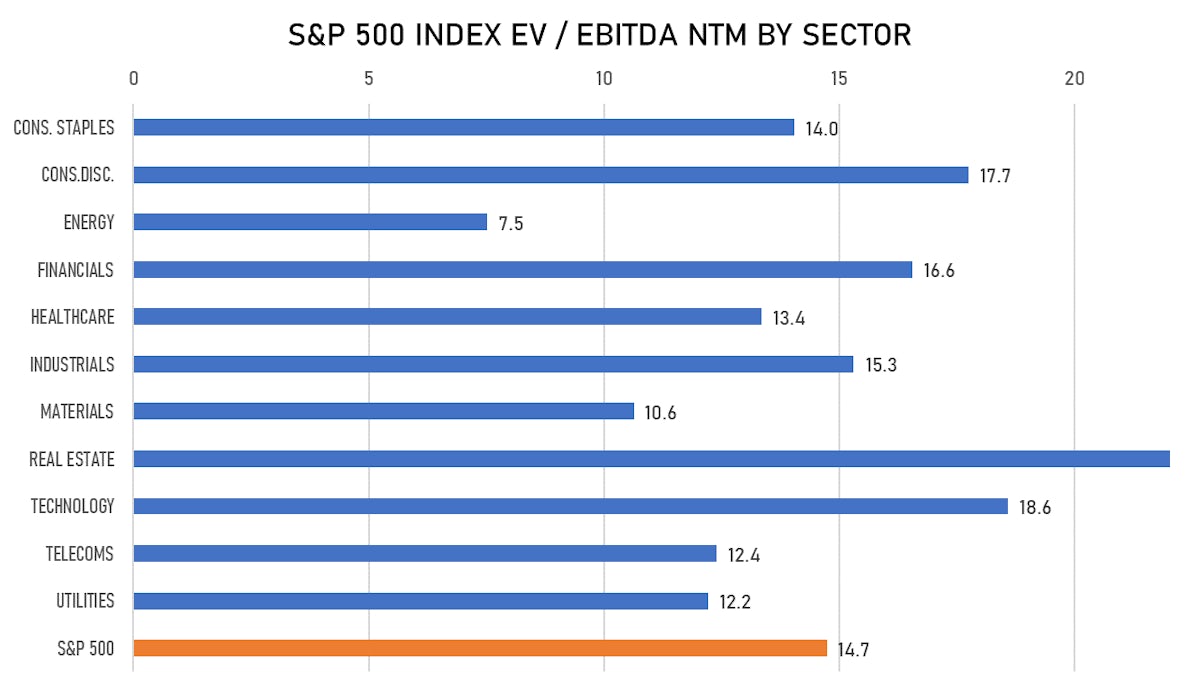

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- Elliott Opportunity II Corp / United States of America - Financials / Listing Exchange: New York / Ticker: EOCW.U / Gross proceeds (including overallotment): US$ 530.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Credit Suisse Securities (USA) LLC, UBS Securities LLC

- Navigation Capital Acquisition VIII Corp / United States of America - Financials / Listing Exchange: New York / Ticker: NA / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Mizuho Securities USA Inc

- Navigation Capital Acquisition IX Corp / United States of America - Financials / Listing Exchange: New York / Ticker: NA / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Mizuho Securities USA Inc

- Navigation Capital Acquisition VI Corp / United States of America - Financials / Listing Exchange: New York / Ticker: N/A / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Mizuho Securities USA LLC

- Navigation Capital Acquisition VII Corp / United States of America - Financials / Listing Exchange: New York / Ticker: N/A / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Wells Fargo Securities LLC, Mizuho Securities USA LLC

- Bridgepoint Advisers Ltd / United Kingdom - Financials / Listing Exchange: London / Ticker: N/A / Gross proceeds (including overallotment): US$ 416.49m (offering in British Pound) / Bookrunners: Merrill Lynch International Ltd, BNP Paribas SA, Citigroup Global Markets Ltd, Morgan Stanley & Co. International plc, JP Morgan Securities Plc

- Nayuki Holdings Ltd / China - Retail / Listing Exchange: Hong Kong / Ticker: 2150 / Gross proceeds (including overallotment): US$ 328.12m (offering in Hong Kong Dollar) / Bookrunners: JP Morgan Securities (Asia) Ltd (Hong Kong), CMB International Capital Corp, Huatai Financial holdings (Hong Kong) Ltd, Haitong International Securities Co Ltd, ABCI Capital Ltd

- Nayuki Holdings Ltd / China - Retail / Listing Exchange: Hong Kong / Ticker: 2150 / Gross proceeds (including overallotment): US$ 173.27m (offering in Hong Kong Dollar) / Bookrunners: CMB International Capital Corp, Huatai Financial holdings (Hong Kong) Ltd, JP Morgan Securities Plc, Haitong International Securities Co Ltd, ABCI Capital Ltd

- Nayuki Holdings Ltd / China - Retail / Listing Exchange: Hong Kong / Ticker: 2150 / Gross proceeds (including overallotment): US$ 154.85m (offering in Hong Kong Dollar) / Bookrunners: CMB International Capital Corp, Huatai Financial holdings (Hong Kong) Ltd, JP Morgan Securities Plc, Haitong International Securities Co Ltd, ABCI Capital Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- XPO Logistics Inc / United States of America - Industrials / Listing Exchange: New York / Ticker: XPO / Gross proceeds (including overallotment): US$ 690.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, Barclays Capital Inc

- Carnival Corp / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: CCL / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Intellia Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: NTLA / Gross proceeds (including overallotment): US$ 400.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Jefferies LLC, SVB Leerink LLC, Barclays Capital Inc

- The GEO Group Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: GEO / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Luminar Technologies Inc / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: LAZR / Gross proceeds (including overallotment): US$ 218.43m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Kymera Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: KYMR / Gross proceeds (including overallotment): US$ 177.52m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Morgan Stanley & Co, JP Morgan Securities LLC

- Zentalis Pharmaceuticals Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ZNTL / Gross proceeds (including overallotment): US$ 150.35m (offering in U.S. Dollar) / Bookrunners: Guggenheim Securities LLC, Jefferies LLC, Morgan Stanley & Co LLC, SVB Leerink LLC

- BTRS Holdings Inc / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: BTRS / Gross proceeds (including overallotment): US$ 123.66m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, Citigroup Global Markets Inc, JP Morgan Securities LLC, Bofa Securities Inc

- Aligos Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ALGS / Gross proceeds (including overallotment): US$ 107.16m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, JP Morgan Securities LLC, Piper Sandler & Co

- HDFC Life Insurance Co Ltd / India - Financials / Listing Exchange: National / Ticker: HDFCLI / Gross proceeds (including overallotment): US$ 912.25m (offering in Indian Rupee) / Bookrunners: BankAmerica Corp, JP Morgan & Co Inc

- Hybe Co Ltd / South Korea - Media and Entertainment / Listing Exchange: Korea / Ticker: 352820 / Gross proceeds (including overallotment): US$ 720.46m (offering in Korean Won) / Bookrunners: Citigroup, Korea Investment & Securities Co Ltd

- Stadler Rail AG / Switzerland - Industrials / Listing Exchange: Swiss Exch / Ticker: SRAIL / Gross proceeds (including overallotment): US$ 197.03m (offering in Swiss Franc) / Bookrunners: Credit Suisse, Citigroup

- Bluefield Solar Income Fund Ltd / Guernsey - Financials / Listing Exchange: London / Ticker: BSIF / Gross proceeds (including overallotment): US$ 138.76m (offering in British Pound) / Bookrunners: Not Applicable