Equities

S&P 500 Edges Higher To New Record To Close The First Half

A majority of stocks were up today, with small caps and value overperforming growth on below-average trading volumes and lower volatility

Published ET

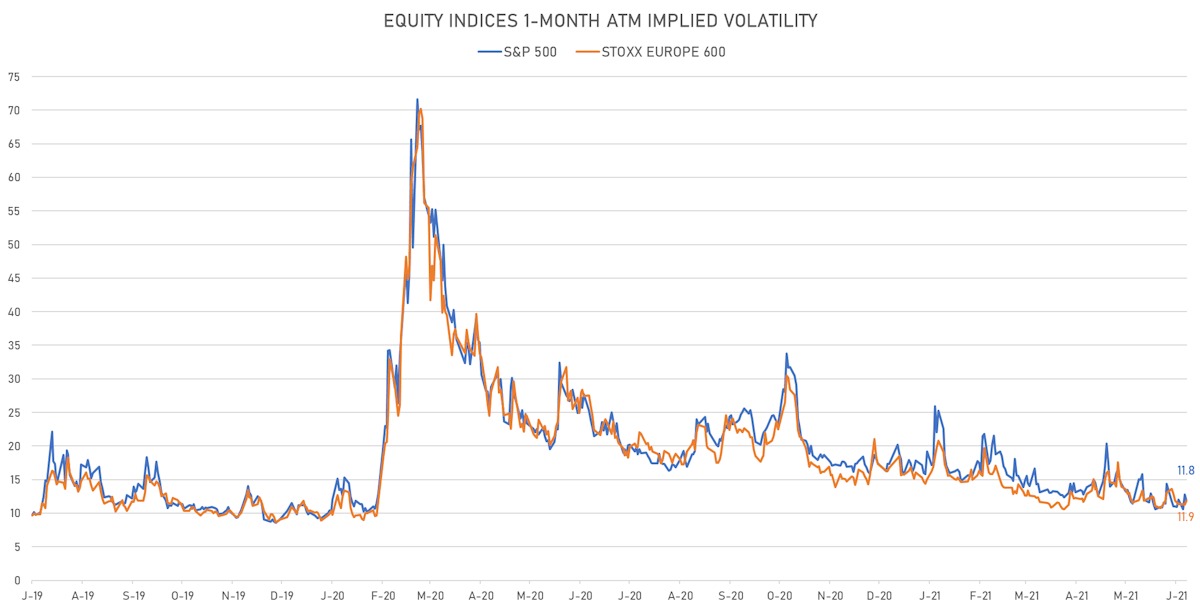

S&P 500 CME Options 1-Month Implied Volatilities | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.13%; Nasdaq Composite down -0.17%; Wilshire 5000 up 0.04%

- 58.2% of S&P 500 stocks were up today, with 89.7% of stocks above their 200-day moving average (DMA) and 48.3% above their 50-DMA

- The turnover of S&P 500 shares traded today was $66.0 bn, with 0.6 bn shares traded

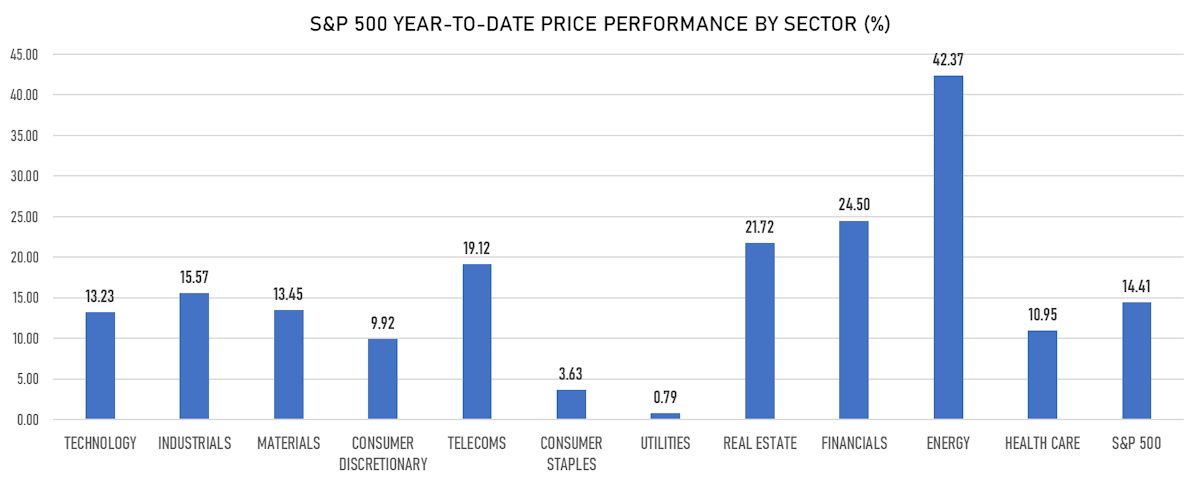

- Top performing sectors: energy up 1.31% and industrials up 0.84%

- Bottom performing sectors: real estate down -0.76% and telecoms down -0.23%

- The S&P 500 Value Index was up 0.4%, while the S&P 500 Growth Index was down -0.1%; the S&P small caps index was up 0.4% and mid caps were up 0.1%

- The volume on the INX was 2.0m (3-month z-score: -0.6); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.77%; China CSI 300 unchanged; Japan up 0.08%; UK FTSE 100 down -0.71%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.8%, down from 12.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.9%, up from 11.2%

TOP WINNERS

- Newegg Commerce Inc (NEGG), up 78.3% to $19.38 / YTD price return: +367.0% / 12-Month Price Range: $ 2.76-17.14 / Short interest (% of float): 0.4%; days to cover: 0.5

- Dingdong (Cayman) Ltd (DDL), up 62.8% to $38.30 / 12-Month Price Range: $ 22.70-29.99

- 1stdibs.Com Inc (DIBS), up 40.9% to $34.81 / 12-Month Price Range: $ 20.70-29.84 / Short interest (% of float): 0.6%; days to cover: 0.1

- Clear Secure Inc (YOU), up 29.0% to $40.00 on its IPO trading debut

- AST SpaceMobile Inc (ASTS), up 26.7% to $12.94 / YTD price return: -4.7% / 12-Month Price Range: $ 6.96-25.37 / Short interest (% of float): 7.9%; days to cover: 1.0

- Full Truck Alliance Co Ltd (YMM), up 26.2% to $20.38 / 12-Month Price Range: $ 15.38-22.80 (the stock is currently on the short sale restriction list)

- Nam Tai Property Inc (NTP), up 24.4% to $27.71 / 12-Month Price Range: $ 4.58-37.88 / Short interest (% of float): 5.4%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Editas Medicine Inc (EDIT), up 22.9% to $56.64 / YTD price return: -19.2% / 12-Month Price Range: $ 27.01-99.95 / Short interest (% of float): 15.3%; days to cover: 9.3

- SentinelOne Inc (S), up 21.4% to $42.50 on its IPO trading debut

- Lands End Inc (LE), up 19.8% to $41.05 / 12-Month Price Range: $ 7.67-39.79 / Short interest (% of float): 6.3%; days to cover: 3.3

BIGGEST LOSERS

- Cerevel Therapeutics Holdings Inc (CERE), down 13.7% to $25.62 after pricing a follow-on offering / YTD price return: +54.5% / 12-Month Price Range: $ 9.00-31.09 / Short interest (% of float): 10.4%; days to cover: 14.3 (the stock is currently on the short sale restriction list)

- Atea Pharmaceuticals Inc (AVIR), down 12.0% to $21.48 / 12-Month Price Range: $ 18.72-94.17 / Short interest (% of float): 7.8%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Sprinklr Inc (CXM), down 11.1% to $20.59 / 12-Month Price Range: $ 14.60-26.50 (the stock is currently on the short sale restriction list)

- DoubleVerify Holdings Inc (DV), down 10.0% to $42.34 / 12-Month Price Range: $ 27.16-48.42 / Short interest (% of float): 1.1%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- VBI Vaccines Inc (VBIV), down 9.9% to $3.35 / YTD price return: +21.8% / 12-Month Price Range: $ 2.07-6.93 / Short interest (% of float): 17.7%; days to cover: 10.0 (the stock is currently on the short sale restriction list)

- Applovin Corp (APP), down 9.8% to $75.17 / 12-Month Price Range: $ 49.41-90.03 / Short interest (% of float): 6.9%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- Global-E Online Ltd (GLBE), down 9.4% to $57.08 / 12-Month Price Range: $ 24.22-64.50 / Short interest (% of float): 0.4%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- SecureWorks Corp (SCWX), down 9.2% to $18.53 / 12-Month Price Range: $ 10.01-22.37 / Short interest (% of float): 8.7%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Vericel Corp (VCEL), down 9.1% to $52.50 / YTD price return: +70.0% / 12-Month Price Range: $ 13.26-68.94 / Short interest (% of float): 8.7%; days to cover: 10.5 (the stock is currently on the short sale restriction list)

- MicroVision Inc (MVIS), down 8.9% to $16.75 / YTD price return: +211.3% / 12-Month Price Range: $ 1.25-28.00 / Short interest (% of float): 17.5%; days to cover: 1.8

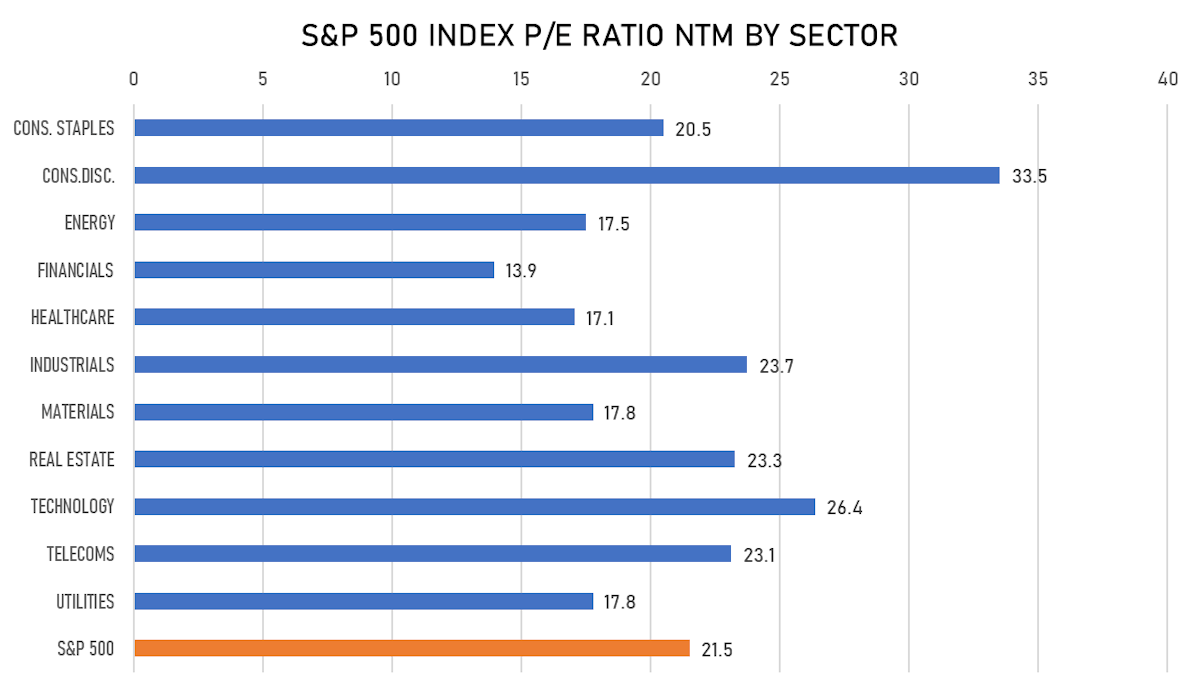

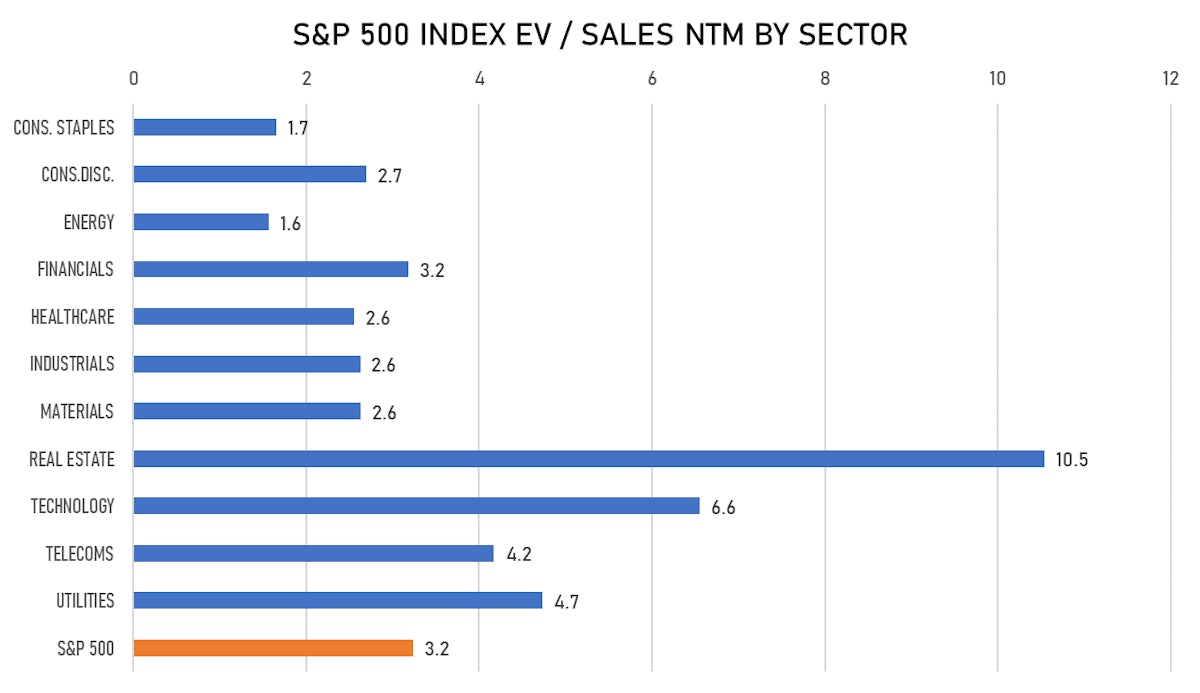

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- SentinelOne Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: S / Gross proceeds (including overallotment): US$ 1,225.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC

- Legalzoom.Com Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: LZ / Gross proceeds (including overallotment): US$ 535.39m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, JP Morgan Securities LLC

- Clear Secure Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: YOU / Gross proceeds (including overallotment): US$ 409.20m (offering in U.S. Dollar) / Bookrunners: Allen & Co Inc, Goldman Sachs & Co, Wells Fargo Securities LLC, JP Morgan Securities LLC

- Xometry Inc / United States of America - Industrials / Listing Exchange: Nasdaq / Ticker: XMTR / Gross proceeds (including overallotment): US$ 302.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC, UBS Securities LLC

- IntApp Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: INTA / Gross proceeds (including overallotment): US$ 273.00m (offering in U.S. Dollar) / Bookrunners: Credit Suisse Securities (USA) LLC, JP Morgan Securities LLC, Bofa Securities Inc

- Integral Ad Science Holding Corp / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: IAS / Gross proceeds (including overallotment): US$ 270.00m (offering in U.S. Dollar) / Bookrunners: Evercore Group, Jefferies LLC, Morgan Stanley & Co LLC, Barclays Capital Inc

- Thunder Bridge Capital Partners IV Inc / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: THCPU / Gross proceeds (including overallotment): US$ 225.00m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- CVRx Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: CVRX / Gross proceeds (including overallotment): US$ 126.00m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, JP Morgan Securities LLC, Piper Sandler & Co

- Aerovate Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: AVTE / Gross proceeds (including overallotment): US$ 121.55m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Evercore Group, Jefferies LLC

- Baltic Classifieds Group OU / Estonia - Retail / Listing Exchange: London / Ticker: BLT / Gross proceeds (including overallotment): US$ 456.56m (offering in British Pound) / Bookrunners: BNP Paribas SA, BofA Securities Europe SA

- HK innoN Corp / South Korea - Healthcare / Listing Exchange: KOSDAQ / Ticker: N/A / Gross proceeds (including overallotment): US$ 267.99m (offering in Korean Won) / Bookrunners: JP Morgan & Co Inc, Samsung Securities Co Ltd, Korea Investment & Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- MongoDB Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: MDB / Gross proceeds (including overallotment): US$ 912.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC

- Intellia Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: NTLA / Gross proceeds (including overallotment): US$ 600.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Jefferies LLC, SVB Leerink LLC, Barclays Capital Inc

- Cerevel Therapeutics Holdings Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: CERE / Gross proceeds (including overallotment): US$ 402.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Stifel Nicolaus & Co Inc, Jefferies LLC, JP Morgan Securities LLC

- Grid Dynamics Holdings Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: GDYN / Gross proceeds (including overallotment): US$ 182.21m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, William Blair & Co, JP Morgan Securities LLC

- Urban Logistics Reit PLC / United Kingdom - Real Estate / Listing Exchange: London AIM / Ticker: SHED / Gross proceeds (including overallotment): US$ 149.68m (offering in British Pound) / Bookrunners: Singer Capital Markets Ltd, Panmure Gordon (UK) Ltd, Alvarium Securities Ltd

- GLP J-REIT / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3281 / Gross proceeds (including overallotment): US$ 149.57m (offering in Japanese Yen) / Bookrunners: Nomura Securities Co Ltd, Mizuho Securities Co Ltd, Citigroup Global Markets Japan Inc, Mitsubishi UFJ Morgan Stanley Securities Co Ltd, SMBC Nikko Securities Inc

- Peker Gayrimenkul Yatirim Ortakligi AS / Turkey - Real Estate / Listing Exchange: Istanbul / Ticker: PEKGY / Gross proceeds (including overallotment): US$ 115.92m (offering in Turkish Lira) / Bookrunners: Not Applicable

- Crayon Group Holding ASA / Norway - High Technology / Listing Exchange: Oslo / Ticker: CRAYON / Gross proceeds (including overallotment): US$ 115.73m (offering in Norwegian Krone) / Bookrunners: SpareBank 1 Markets AS

- Shanghai Laimu Electronics Co Ltd / China - High Technology / Listing Exchange: Shanghai / Ticker: 603633 / Gross proceeds (including overallotment): US$ 108.30m (offering in Chinese Yuan) / Bookrunners: Not Applicable