Equities

S&P 500 Closes Down Just 0.2% After A Solid Afternoon Bounce

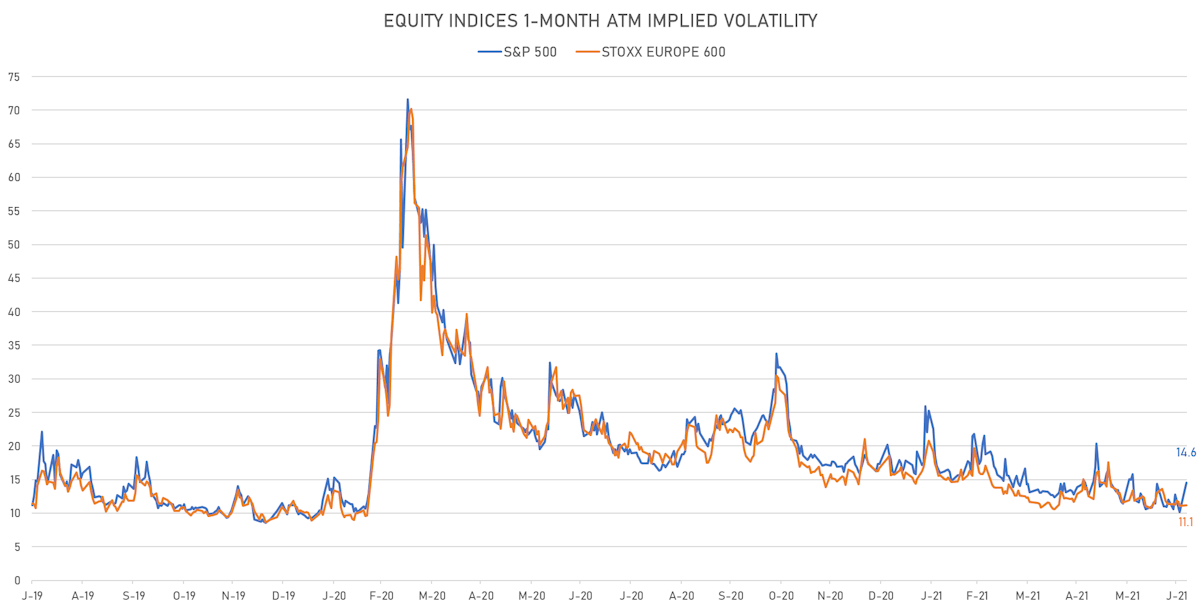

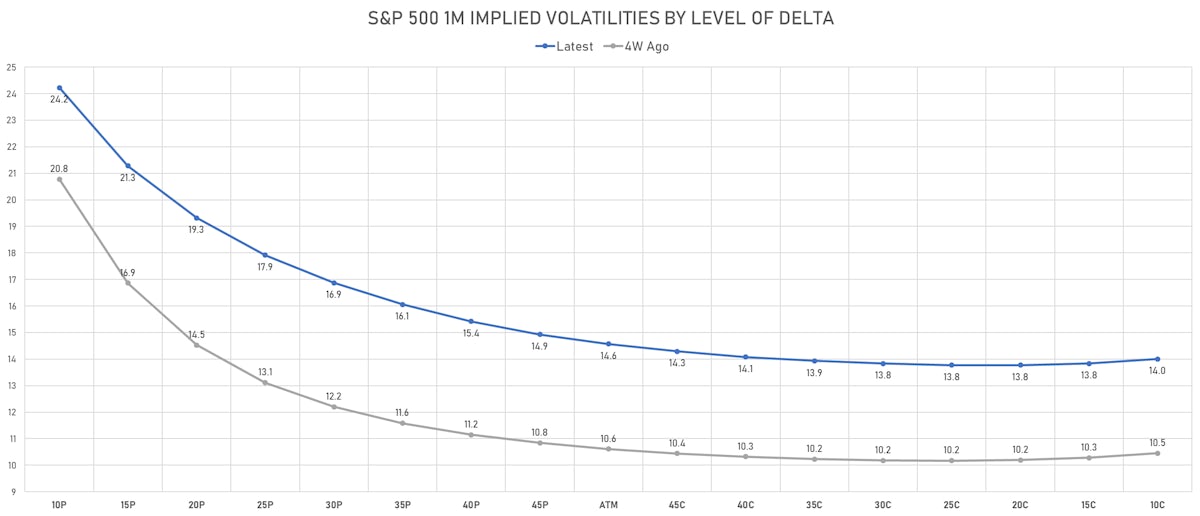

Growth and large caps overperformed value and small caps; volatility rose, but with a flatter curve and still at low levels, while volumes were essentially average

Published ET

S&P 500 1-Month Options Implied Volatilities | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.20%; Nasdaq Composite up 0.17%; Wilshire 5000 down -0.24%

- 30.5% of S&P 500 stocks were up today, with 89.9% of stocks above their 200-day moving average (DMA) and 47.7% above their 50-DMA

- The turnover of S&P 500 shares traded today was $68.5 bn, with 0.6 bn shares traded

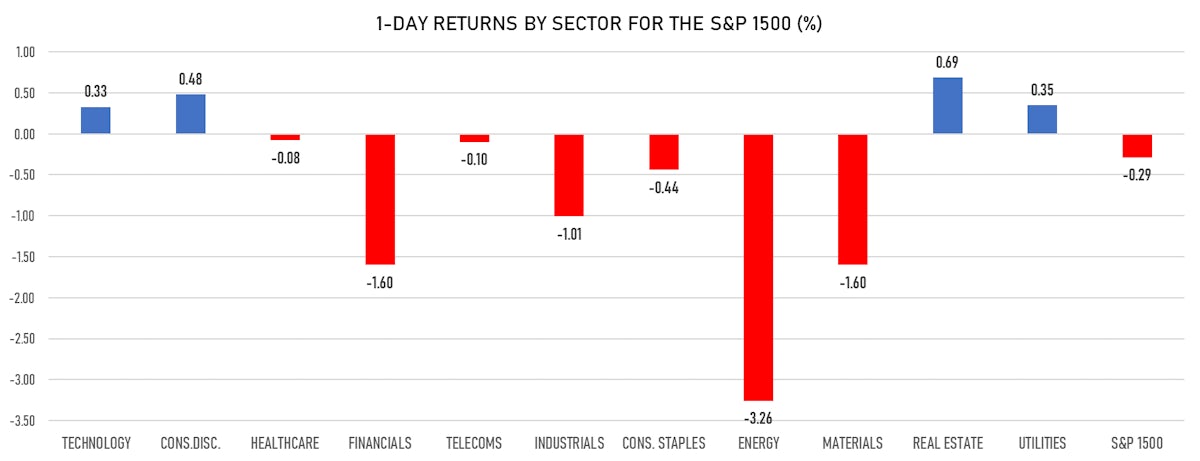

- Top performing sectors: real estate up 0.85% and consumer discretionary up 0.75%

- Bottom performing sectors: energy down -3.20% and financials down -1.55%

- The S&P 500 Value Index was down -1.0%, while the S&P 500 Growth Index was up 0.5%; the S&P small caps index was down -1.5% and mid caps were down -1.1%

- The volume on the INX was 2.1m (3-month z-score: -0.2); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.52%; China CSI 300 up 0.30%; Japan down -0.84%; UK FTSE 100 down -0.89%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.6%, up from 10.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.1%, up from 11.1%

TOP WINNERS

- Newegg Commerce Inc (NEGG), up 41.7% to $27.20 / YTD price return: +555.4% / 12-Month Price Range: $ 2.76-23.45 / Short interest (% of float): 0.4%; days to cover: 0.5

- Kraton Corp (KRA), up 14.9% to $36.37 / YTD price return: +30.9% / 12-Month Price Range: $ 12.92-45.89

- Alector Inc (ALEC), up 12.0% to $39.44 / YTD price return: +160.7% / 12-Month Price Range: $ 9.12-43.32 / Short interest (% of float): 9.6%; days to cover: 11.5

- Apollo Medical Holdings Inc (AMEH), up 11.7% to $74.15 / YTD price return: +305.9% / 12-Month Price Range: $ 15.11-67.24

- Connect Biopharma Holdings Ltd (CNTB), up 11.5% to $21.98 / 12-Month Price Range: $ 14.02-23.29 / Short interest (% of float): 1.4%; days to cover: 15.6

- SentinelOne Inc (S), up 11.0% to $49.50 / 12-Month Price Range: $ 39.94-46.50

- ALX Oncology Holdings Inc (ALXO), up 9.7% to $61.32 / YTD price return: -28.9% / 12-Month Price Range: $ 28.01-117.45 / Short interest (% of float): 8.5%; days to cover: 11.4

- Welbilt Inc (WBT), up 7.9% to $25.02 / YTD price return: +89.5% / 12-Month Price Range: $ 5.21-25.19

- JinkoSolar Holding Co Ltd (JKS), up 7.8% to $54.35 / YTD price return: -12.2% / 12-Month Price Range: $ 18.56-90.20 / Short interest (% of float): 20.0%; days to cover: 5.2

- Knowbe4 Inc (KNBE), up 7.7% to $29.55 / 12-Month Price Range: $ 16.77-36.67 / Short interest (% of float): 11.1%; days to cover: 4.1

BIGGEST LOSERS

- DiDi Global Inc (DIDI), down 19.6% to $12.49 / 12-Month Price Range: $ 14.10-18.01 (the stock is currently on the short sale restriction list)

- Astra Space Inc (ASTR), down 19.4% to $12.47 / YTD price return: +23.3% / 12-Month Price Range: $ 9.53-22.47 / Short interest (% of float): 3.8%; days to cover: 1.6 (the stock is currently on the short sale restriction list)

- Douyu International Holdings Ltd (DOYU), down 16.4% to $5.55 / YTD price return: -49.8% / 12-Month Price Range: $ 6.56-20.54 / Short interest (% of float): 2.5%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- Kanzhun Ltd (BZ), down 15.9% to $30.52 / 12-Month Price Range: $ 33.26-44.96 / Short interest (% of float): 0.0%; days to cover: 0.0 (the stock is currently on the short sale restriction list)

- Zhihu Inc (ZH), down 15.3% to $10.60 / 12-Month Price Range: $ 6.81-13.85 / Short interest (% of float): 0.9%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Clover Health Investments Corp (CLOV), down 14.6% to $10.00 / YTD price return: -40.4% / 12-Month Price Range: $ 6.31-28.85 / Short interest (% of float): 37.4%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- UP Fintech Holding Ltd (TIGR), down 14.4% to $21.89 / YTD price return: +175.7% / 12-Month Price Range: $ 4.30-38.50 / Short interest (% of float): 5.3%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Beam Therapeutics Inc (BEAM), down 13.2% to $112.97 / YTD price return: +38.4% / 12-Month Price Range: $ 18.76-138.52 (the stock is currently on the short sale restriction list)

- Purecycle Technologies Inc (PCT), down 12.4% to $19.86 / YTD price return: +23.1% / 12-Month Price Range: $ 9.76-35.75 / Short interest (% of float): 12.3%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- Replimune Group Inc (REPL), down 12.4% to $34.64 / YTD price return: -9.2% / 12-Month Price Range: $ 18.40-54.85 (the stock is currently on the short sale restriction list)

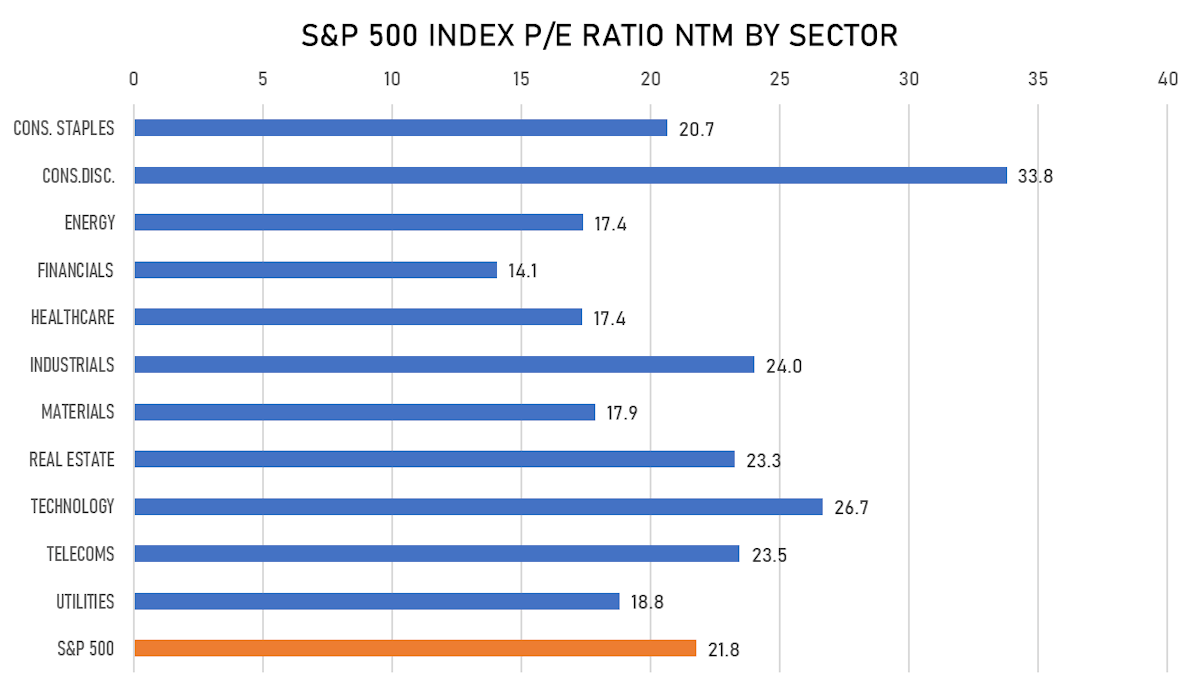

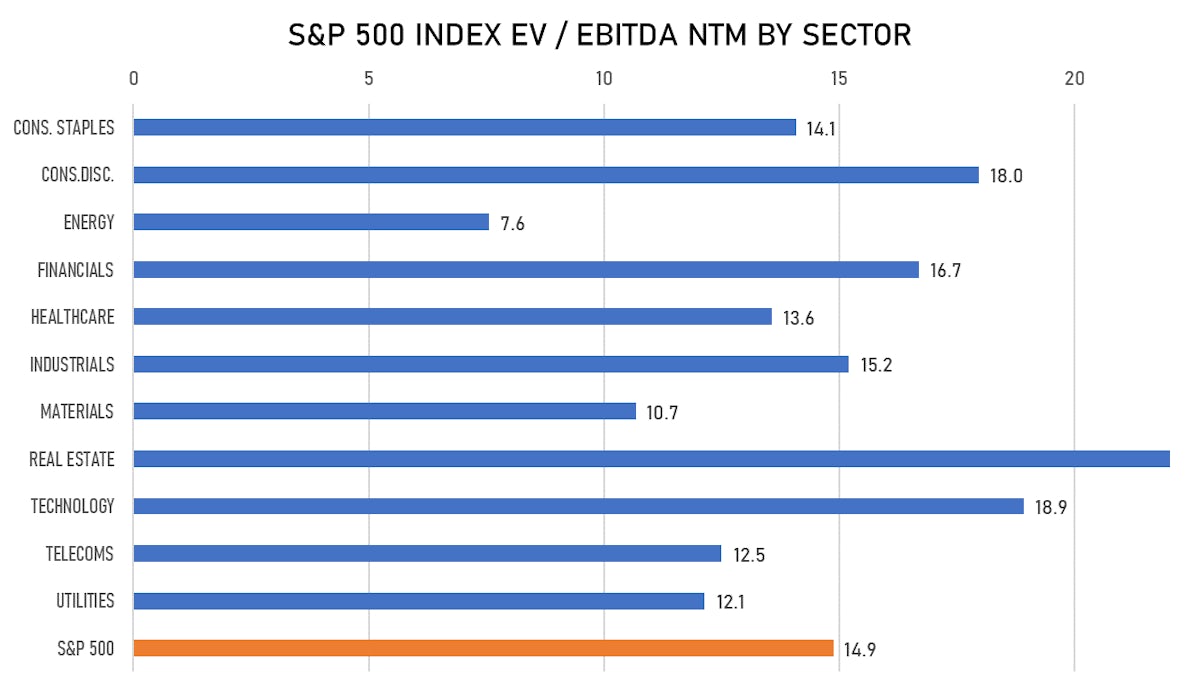

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- Conyers Park III Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: CPAAU / Gross proceeds (including overallotment): US$ 350.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Deutsche Bank Securities Inc, JP Morgan Securities LLC

- Da32 Life Science Tech Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: DALS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, JP Morgan Securities LLC

- Chaoju Eye Care Holdings Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 2219 / Gross proceeds (including overallotment): US$ 116.64m (offering in Hong Kong Dollar) / Bookrunners: Huatai Financial holdings (Hong Kong) Ltd, Haitong International Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Shanghai Titan Scientific Co Ltd / China - Materials / Listing Exchange: SSES / Ticker: 688133 / Gross proceeds (including overallotment): US$ 163.14m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd