Equities

Large Caps Overperform As Stock Indices Edge Higher

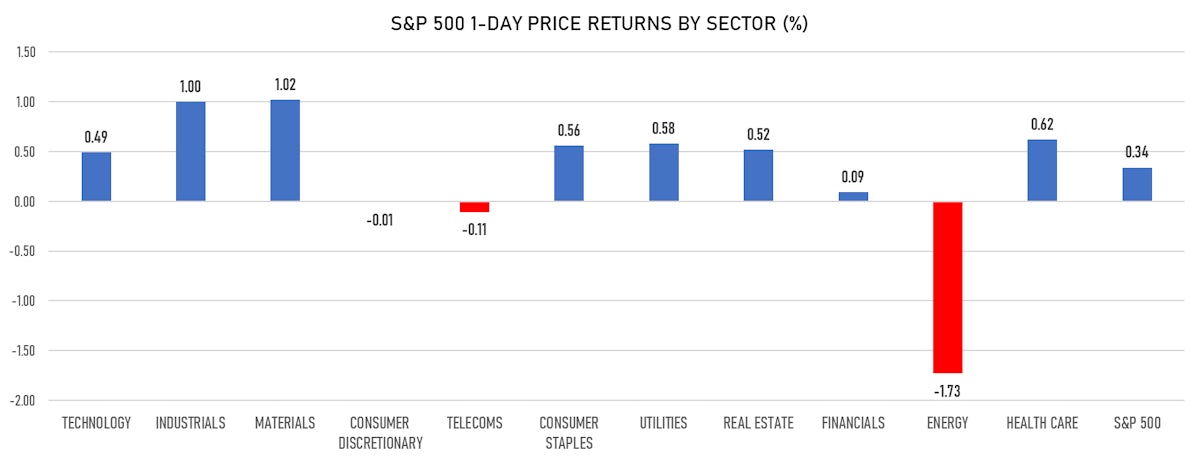

The S&P 500 was led by industrials and materials stocks, while energy and telecoms were the worst-performing sectors today

Published ET

Implied Volatility Spread Between S&P 500 1-Month 10-delta puts and calls | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.34%; Nasdaq Composite up 0.01%; Wilshire 5000 up 0.11%

- 66.1% of S&P 500 stocks were up today, with 90.3% of stocks above their 200-day moving average (DMA) and 49.3% above their 50-DMA

- The turnover of S&P 500 shares traded today was $60.9 bn, with 0.5 bn shares traded

- Top performing sectors: materials up 1.02% and industrials up 1.00%

- Bottom performing sectors: energy down -1.73% and telecoms down -0.11%

- The S&P 500 Value Index was up 0.2%, while the S&P 500 Growth Index was up 0.5%; the S&P small caps index was down -0.6% and mid caps were up 0.1%

- The volume on the INX was 1.9m (3-month z-score: -0.5); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.78%; China CSI 300 up 0.17%; Japan down -0.16%; UK FTSE 100 up 0.71%

VOLATILITY

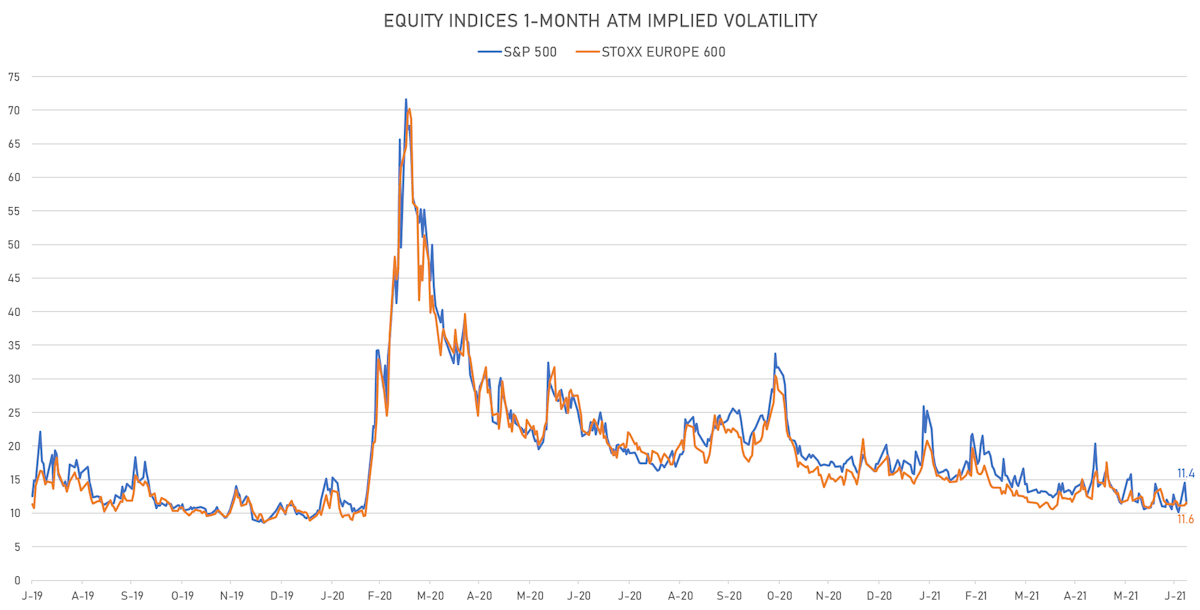

- 1-month at-the-money implied volatility on the S&P 500 at 11.4%, down from 14.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.6%, up from 11.1%

TOP WINNERS

- Newegg Commerce Inc (NEGG), up 148.4% to $67.57 / YTD price return: +1,528.2% / 12-Month Price Range: $ 2.76-29.69 / Short interest (% of float): 0.4%; days to cover: 0.5

- Smart Global Holdings Inc (SGH), up 17.8% to $56.02 / YTD price return: +48.9% / 12-Month Price Range: $ 23.54-57.69 / Short interest (% of float): 9.4%; days to cover: 7.4

- Biohaven Pharmaceutical Holding Company Ltd (BHVN), up 13.6% to $112.25 / YTD price return: +31.0% / 12-Month Price Range: $ 57.66-106.57 / Short interest (% of float): 11.2%; days to cover: 9.1

- JinkoSolar Holding Co Ltd (JKS), up 10.7% to $60.14 / YTD price return: -2.8% / 12-Month Price Range: $ 18.56-90.20 / Short interest (% of float): 20.0%; days to cover: 5.2

- WM Technology Inc (MAPS), up 10.0% to $18.29 / YTD price return: +43.2% / 12-Month Price Range: $ 9.99-29.50 / Short interest (% of float): 1.5%; days to cover: 6.9

- CareMax Inc (CMAX), up 9.7% to $13.80 / 12-Month Price Range: $ 9.90-18.42 / Short interest (% of float): 2.0%; days to cover: 15.7

- Knowbe4 Inc (KNBE), up 9.2% to $32.28 / 12-Month Price Range: $ 16.77-36.67 / Short interest (% of float): 11.1%; days to cover: 4.1

- Astra Space Inc (ASTR), up 9.1% to $13.60 / YTD price return: +34.5% / 12-Month Price Range: $ 9.53-22.47 / Short interest (% of float): 3.8%; days to cover: 1.6

- Apollo Medical Holdings Inc (AMEH), up 8.9% to $80.75 / YTD price return: +342.0% / 12-Month Price Range: $ 15.11-74.49 / Short interest (% of float): 1.8%; days to cover: 1.7

- Sundial Growers Inc (SNDL), up 7.6% to $.96 / YTD price return: +102.3% / 12-Month Price Range: $ .14-3.96 / Short interest (% of float): 12.8%; days to cover: 1.0

BIGGEST LOSERS

- Meta Materials Inc (MMAT), down 19.3% to $5.80 / YTD price return: +314.3% / 12-Month Price Range: $ .42-21.76 / Short interest (% of float): 2.8%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- ACM Research Inc (ACMR), down 13.9% to $84.23 / YTD price return: +3.7% / 12-Month Price Range: $ 58.03-144.81 / Short interest (% of float): 7.8%; days to cover: 3.0 (the stock is currently on the short sale restriction list)

- Novavax Inc (NVAX), down 13.7% to $185.78 / YTD price return: +66.6% / 12-Month Price Range: $ 76.59-331.68 (the stock is currently on the short sale restriction list)

- Beam Therapeutics Inc (BEAM), down 13.1% to $98.14 / YTD price return: +20.2% / 12-Month Price Range: $ 18.76-138.52 / Short interest (% of float): 10.7%; days to cover: 8.5 (the stock is currently on the short sale restriction list)

- Sorrento Therapeutics Inc (SRNE), down 12.9% to $8.27 / YTD price return: +21.2% / 12-Month Price Range: $ 5.17-19.39 (the stock is currently on the short sale restriction list)

- Zhihu Inc (ZH), down 12.7% to $9.25 / 12-Month Price Range: $ 6.81-13.85 / Short interest (% of float): 0.9%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- TuSimple Holdings Inc (TSP), down 12.6% to $55.20 / 12-Month Price Range: $ 32.13-79.84 / Short interest (% of float): 4.4%; days to cover: 6.7 (the stock is currently on the short sale restriction list)

- ALX Oncology Holdings Inc (ALXO), down 11.3% to $54.39 / YTD price return: -36.9% / 12-Month Price Range: $ 28.01-117.45 / Short interest (% of float): 8.5%; days to cover: 11.4 (the stock is currently on the short sale restriction list)

- Ehang Holdings Ltd (EH), down 11.2% to $34.00 / YTD price return: +61.1% / 12-Month Price Range: $ 7.59-129.80 (the stock is currently on the short sale restriction list)

- Tuya Inc (TUYA), down 11.0% to $20.37 / 12-Month Price Range: $ 15.70-27.65 / Short interest (% of float): 0.6%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

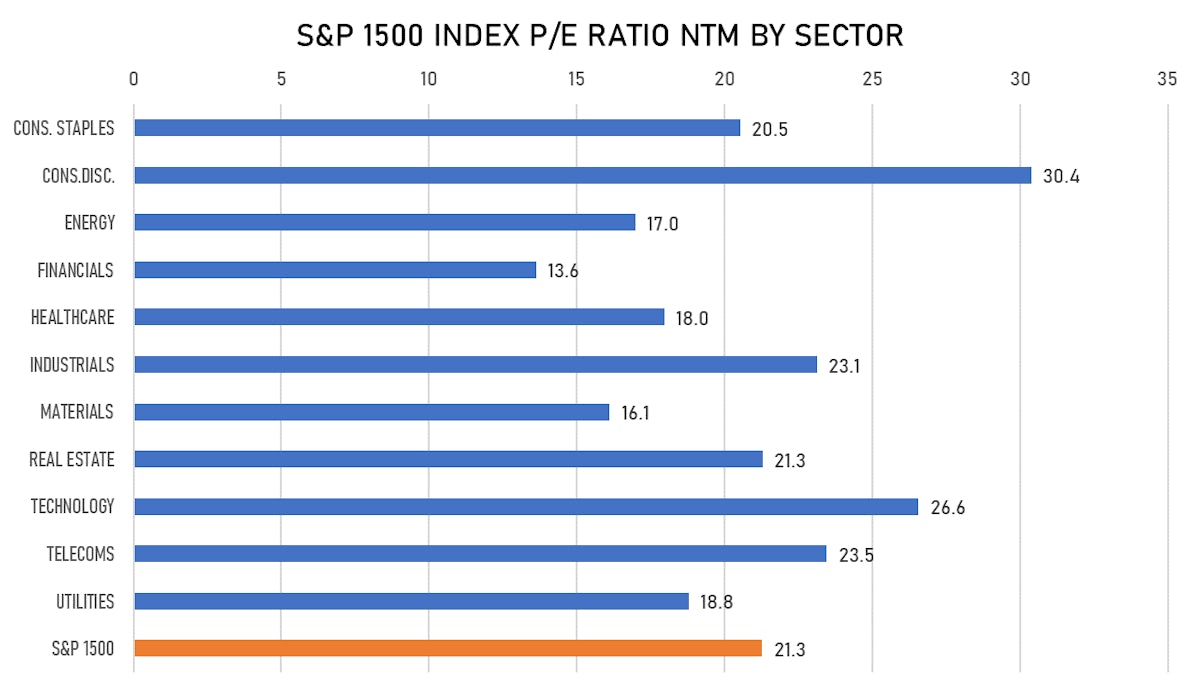

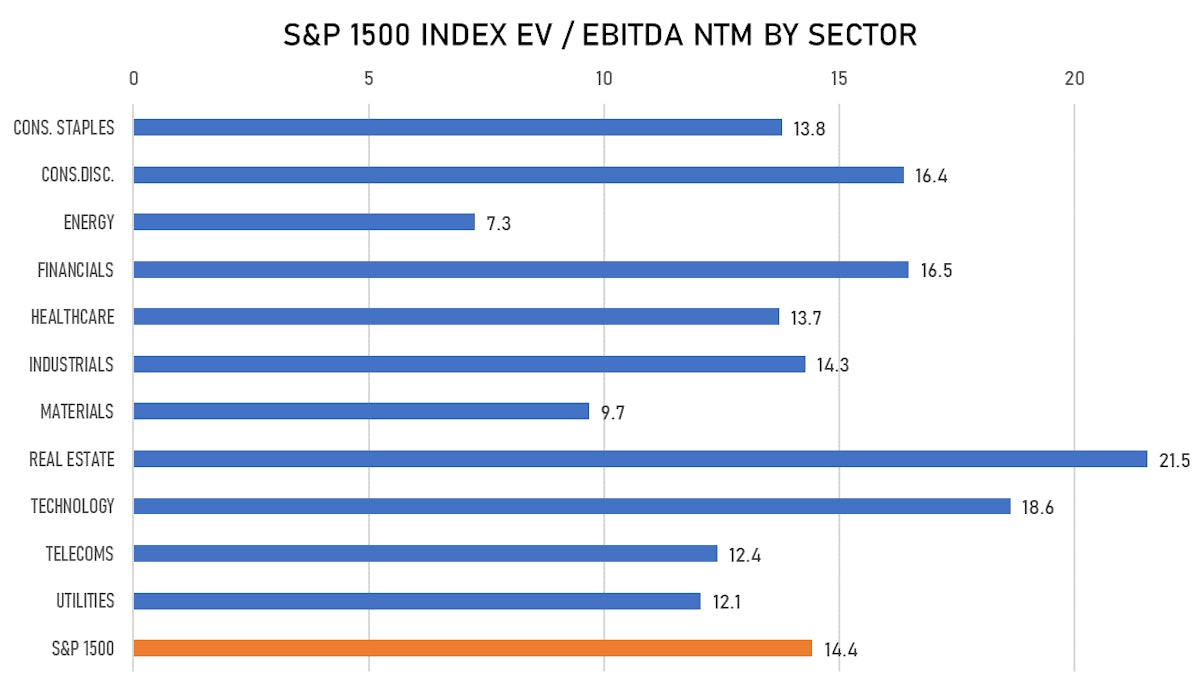

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- SD Bio Sensor Inc / South Korea - Healthcare / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 313.04m (offering in Korean Won) / Bookrunners: Korea Investment & Securities Co Ltd, NH Investment & Securities Co

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Hipgnosis Songs Fund Ltd / Guernsey - Financials / Listing Exchange: London AIM / Ticker: SONG / Gross proceeds (including overallotment): US$ 214.78m (offering in British Pound) / Bookrunners: JP Morgan Cazenove, N+1 Singer Capital Markets Ltd, RBC Europe Ltd

- Shanghai Titan Scientific Co Ltd / China - Materials / Listing Exchange: SSES / Ticker: 688133 / Gross proceeds (including overallotment): US$ 163.14m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd