Equities

Another Low Volume Rise In US Indices, With Earnings Season Kicking Off Tomorrow

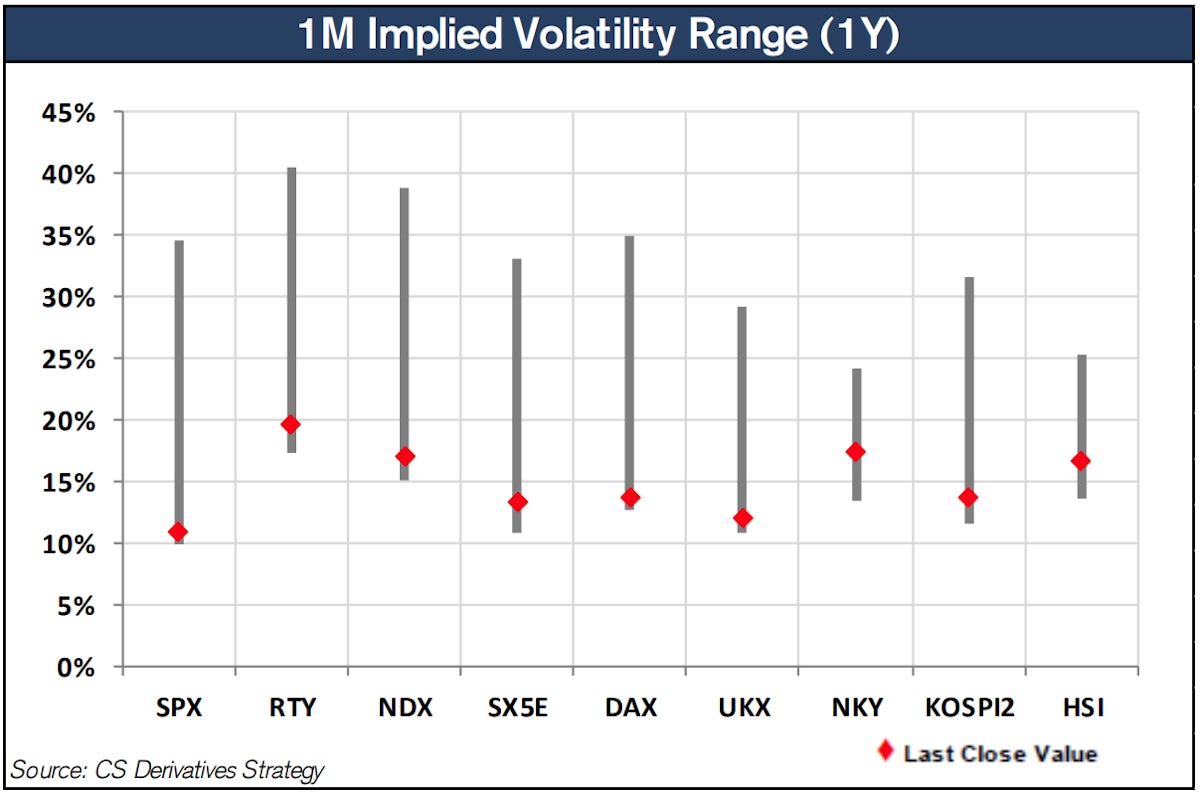

S&P 500 implied volatility is low, with the skewness in the volatility smile illustrating the growing willingness to hedge downside risk as prices rise ever higher

Published ET

The S&P 500 implied volatility smile has been increasingly skewed to the downside over the past weeks | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.35%; Nasdaq Composite up 0.21%; Wilshire 5000 up 0.23%

- 59.2% of S&P 500 stocks were up today, with 90.7% of stocks above their 200-day moving average (DMA) and 54.9% above their 50-DMA

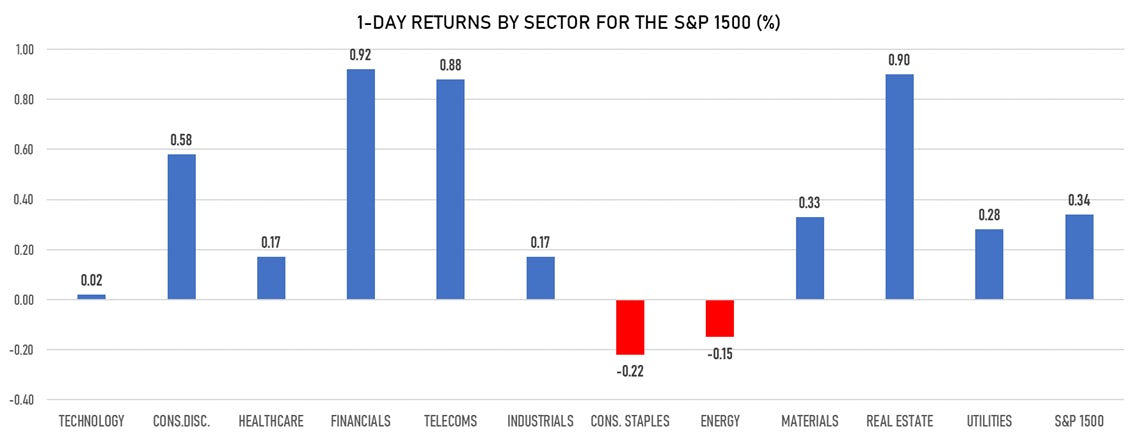

- Top performing sectors: financials up 0.96% and telecoms up 0.90%

- Bottom performing sectors: consumer staples down -0.21% and energy down -0.11%

- The number of shares in the S&P 500 traded today was 481m for a total turnover of US$ 57 bn

- The S&P 500 Value Index was up 0.4%, while the S&P 500 Growth Index was up 0.3%; the S&P small caps index was up 0.4% and mid caps were up 0.3%

- The volume on CME's INX (S&P 500 Index) was low at 1.7m (3-month z-score: -1.2); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.69%; China CSI 300 up 0.20%; Japan up 0.81%; UK FTSE 100 up 0.05%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.1%, unchanged today

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.8%, down from 12.2%

TOP WINNERS

- State Auto Financial Corp (STFC), up 191.0% to $50.22 / YTD price return: +183.1% / 12-Month Price Range: $ 12.07-20.98 / Short interest (% of float): 0.4%; days to cover: 3.8

- SGOCO Group Ltd (SGOC), up 104.3% to $20.00 / YTD price return: +1,279.3% / 12-Month Price Range: $ .77-18.80 / Short interest (% of float): 0.6%; days to cover: 6.4

- Celldex Therapeutics Inc (CLDX), up 25.5% to $40.67 / YTD price return: +132.1% / 12-Month Price Range: $ 9.59-35.69 / Short interest (% of float): 6.7%; days to cover: #N/A

- Inmode Ltd (INMD), up 12.5% to $108.20 / YTD price return: +127.6% / 12-Month Price Range: $ 28.07-98.12 / Short interest (% of float): 9.6%; days to cover: #N/A

- Alphatec Holdings Inc (ATEC), up 11.6% to $15.79 / YTD price return: +8.7% / 12-Month Price Range: $ 4.39-19.36 / Short interest (% of float): 3.6%; days to cover: 4.5

- ACM Research Inc (ACMR), up 11.3% to $92.10 / YTD price return: +13.5% / 12-Month Price Range: $ 58.03-144.81 / Short interest (% of float): 7.8%; days to cover: 3.0

- Lithium Americas Corp (LAC), up 10.7% to $15.90 / 12-Month Price Range: $ 4.87-28.75 / Short interest (% of float): 10.5%; days to cover: 4.2

- Companhia Energetica de Minas Gerais CEMIG (CIGc), up 10.4% to $2.98 / YTD price return: +2.5% / 12-Month Price Range: $ 1.59-3.55 / Short interest (% of float): 0.0%; days to cover: 0.4

- ThredUp Inc (TDUP), up 9.4% to $27.04 / 12-Month Price Range: $ 14.23-31.86 / Short interest (% of float): 29.1%; days to cover: 7.7

- JinkoSolar Holding Co Ltd (JKS), up 9.1% to $61.90 / YTD price return: +.0% / 12-Month Price Range: $ 18.56-90.20 / Short interest (% of float): 20.0%; days to cover: 5.2

BIGGEST LOSERS

- Newegg Commerce Inc (NEGG), down 18.6% to $37.99 / 12-Month Price Range: $ 2.76-79.07 / Short interest (% of float): 0.4%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Proterra Inc (PTRA), down 17.5% to $14.06 / YTD price return: +26.9% / 12-Month Price Range: $ 9.70-31.06 (the stock is currently on the short sale restriction list)

- Virgin Galactic Holdings Inc (SPCE), down 17.3% to $40.69 / YTD price return: +71.5% / 12-Month Price Range: $ 14.27-62.80 / Short interest (% of float): 20.3%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

- Meta Materials Inc (MMAT), down 17.1% to $3.94 / YTD price return: +181.4% / 12-Month Price Range: $ .42-21.76 / Short interest (% of float): 3.4%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- 3D Systems Corp (DDD), down 9.6% to $31.10 / YTD price return: +196.8% / 12-Month Price Range: $ 4.60-56.50 / Short interest (% of float): 15.4%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Grupo Simec SAB de CV (SIM), down 9.2% to $22.72 / YTD price return: +77.5% / 12-Month Price Range: $ 5.80-31.73 / Short interest (% of float): 0.0%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Knowbe4 Inc (KNBE), down 9.1% to $30.21 / 12-Month Price Range: $ 16.77-36.67 / Short interest (% of float): 11.1%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- Douyu International Holdings Ltd (DOYU), down 8.8% to $4.97 / YTD price return: -55.1% / 12-Month Price Range: $ 5.23-20.54 / Short interest (% of float): 2.5%; days to cover: 2.8

- Prothena Corporation PLC (PRTA), down 8.2% to $54.39 / 12-Month Price Range: $ 9.67-67.08 / Short interest (% of float): 4.8%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- Generation Bio Co (GBIO), down 8.2% to $23.87 / 12-Month Price Range: $ 17.00-55.72 / Short interest (% of float): 10.7%; days to cover: 14.8

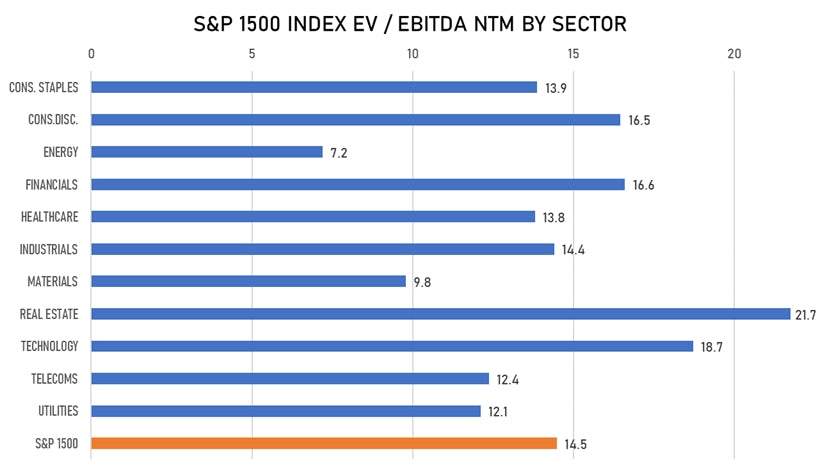

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- Good Works II Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: GWIIU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: I-Bankers Securities Inc

- Lotte Rental Co Ltd / South Korea - Consumer Products and Services / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 367.57m (offering in Korean Won) / Bookrunners: Samsung Securities Co Ltd, Korea Investment & Securities Co Ltd, Kiwoom Securities Co, Shinhan Investment Corp, NH Investment & Securities Co, Hana Financial Investment Co, Mirae Asset Daewoo Co Ltd, KBI Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Gresham House Energy Storage Fund PLC / United Kingdom - Energy and Power / Listing Exchange: London / Ticker: GRID / Gross proceeds (including overallotment): US$ 138.99m (offering in British Pound) / Bookrunners: Jefferies International Ltd