Equities

Stocks Slide, Tech The Only Winning Sector In The S&P 500 Today

JP Morgan, Pepsico, Goldman Sachs released earnings for Q2 today, all easily beating consensus estimates by a wide margin on revenue and profits

Published ET

Goldman Sachs (GS) closed down 1.2% after releasing blow-out earnings for the quarter | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.35%; Nasdaq Composite down -0.38%; Wilshire 5000 down -0.60%

- 14.5% of S&P 500 stocks were up today, with 89.3% of stocks above their 200-day moving average (DMA) and 48.9% above their 50-DMA

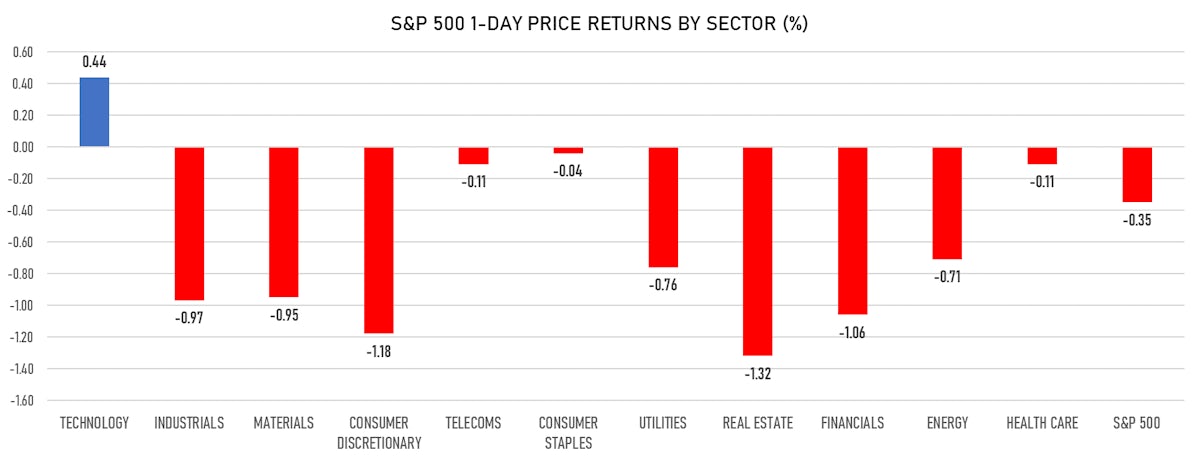

- Top performing sectors: technology up 0.44% and consumer staples down -0.04%

- Bottom performing sectors: real estate down -1.32% and consumer discretionary down -1.18%

- The number of shares in the S&P 500 traded today was 448m for a total turnover of US$ 54 bn

- The S&P 500 Value Index was down -0.7%, while the S&P 500 Growth Index was unchanged; the S&P small caps index was down -1.9% and mid caps were down -1.5%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -1.0); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.03%; China CSI 300 unchanged; Japan up 0.04%; UK FTSE 100 down -0.01%

VOLATILITY

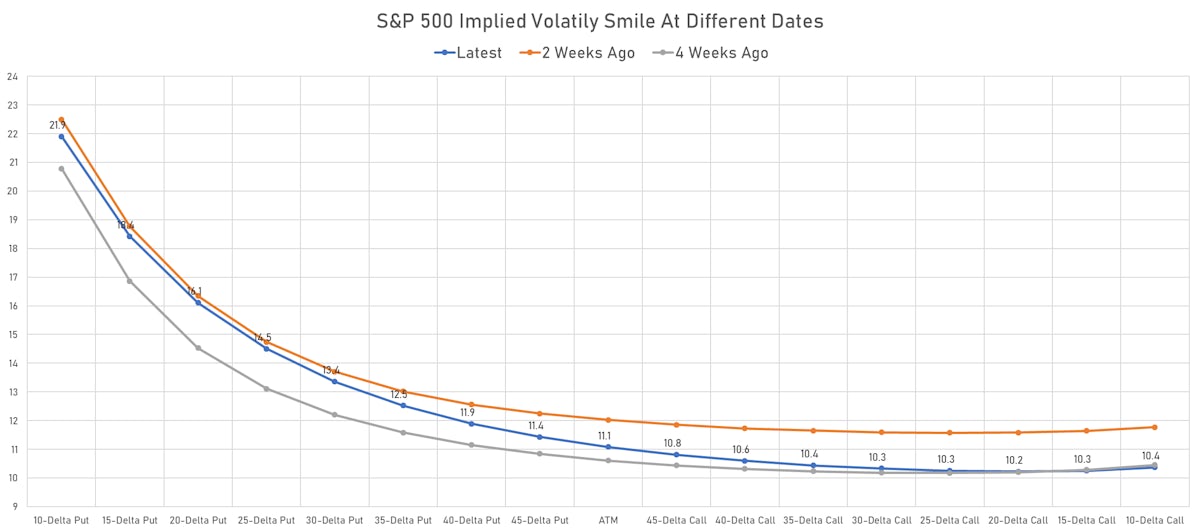

- 1-month at-the-money implied volatility on the S&P 500 at 11.6%, up from 11.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.6%, down from 11.8%

NOTABLE S&P 500 EARNINGS RELEASES

- Fastenal Co (Industrials): beat on EPS (0.42 act. vs. 0.41 est.) and beat on revenue (1,508m act. vs. 1,507m est.)

- First Republic Bank (Financials): beat on EPS (1.95 act. vs. 1.73 est.) and beat on revenue (1,200m act. vs. 1,182m est.)

- Goldman Sachs Group Inc (Financials): beat on EPS (15.02 act. vs. 10.24 est.) and beat on revenue (15,388m act. vs. 12,174m est.)

- JPMorgan Chase & Co (Financials): beat on EPS (3.78 act. vs. 3.21 est.) and beat on revenue (31,395m act. vs. 29,966m est.)

- PepsiCo Inc (Consumer Non-Cyclicals): beat on EPS (1.72 act. vs. 1.53 est.) and beat on revenue (19,217m act. vs. 17,960m est.)

TOP WINNERS

- Middlesex Water Co (MSEX), up 13.7% to $96.86 / YTD price return: +33.7% / 12-Month Price Range: $ 59.61-88.61

- Full Truck Alliance Co Ltd (YMM), up 11.3% to $17.57 / 12-Month Price Range: $ 14.89-22.80

- DiDi Global Inc (DIDI), up 11.3% to $12.42 / 12-Month Price Range: $ 11.00-18.01

- Verve Therapeutics Inc (VERV), up 10.3% to $53.15 / 12-Month Price Range: $ 29.50-73.80 / Short interest (% of float): 2.8%; days to cover: 1.1

- Celldex Therapeutics Inc (CLDX), up 9.7% to $44.60 / YTD price return: +154.6% / 12-Month Price Range: $ 9.59-45.39 / Short interest (% of float): 6.7%; days to cover: 4.5

- Nokia Oyj (NOK), up 9.5% to $5.88 / YTD price return: +50.4% / 12-Month Price Range: $ 3.21-9.79 / Short interest (% of float): 0.5%; days to cover: 0.7

- ThredUp Inc (TDUP), up 9.2% to $29.52 / 12-Month Price Range: $ 14.23-31.86 / Short interest (% of float): 29.1%; days to cover: 7.7

- Uxin Ltd (UXIN), up 8.9% to $3.66 / YTD price return: +319.5% / 12-Month Price Range: $ .72-5.82 / Short interest (% of float): 3.5%; days to cover: 0.8

- JOYY Inc (YY), up 7.3% to $62.08 / YTD price return: -22.4% / 12-Month Price Range: $ 57.51-148.88 / Short interest (% of float): 10.2%; days to cover: 4.7

- Duck Creek Technologies Inc (DCT), up 6.8% to $43.49 / YTD price return: +.4% / 12-Month Price Range: $ 33.91-59.40 / Short interest (% of float): 5.3%; days to cover: 9.1

BIGGEST LOSERS

- Newegg Commerce Inc (NEGG), down 16.5% to $31.74 / YTD price return: +664.8% / 12-Month Price Range: $ 2.76-79.07 / Short interest (% of float): 0.4%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Shoals Technologies Group Inc (SHLS), down 14.4% to $13.17 / 12-Month Price Range: $ 9.70-31.06 / Short interest (% of float): 0.9%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Apollo Medical Holdings Inc (AMEH), down 13.3% to $37.76 / YTD price return: +332.5% / 12-Month Price Range: $ 14.27-62.80 / Short interest (% of float): 20.3%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

- ACM Research Inc (ACMR), down 11.9% to $3.99 / YTD price return: -.1% / 12-Month Price Range: $ .42-21.76 / Short interest (% of float): 3.4%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Olink Holding AB (publ) (OLK), down 10.9% to $29.46 / 12-Month Price Range: $ 4.60-56.50 / Short interest (% of float): 15.4%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Affirm Holdings Inc (AFRM), down 10.4% to $23.89 / 12-Month Price Range: $ 5.80-31.73 / Short interest (% of float): 0.0%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- ChargePoint Holdings Inc (CHPT), down 9.5% to $30.19 / YTD price return: -34.9% / 12-Month Price Range: $ 16.77-36.67 / Short interest (% of float): 11.1%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- Quantum-Si Inc (QSI), down 9.4% to $5.21 / 12-Month Price Range: $ 4.93-20.54 / Short interest (% of float): 2.5%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- Tellurian Inc (TELL), down 9.2% to $52.34 / YTD price return: +214.8% / 12-Month Price Range: $ 9.67-67.08 / Short interest (% of float): 4.8%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- Two Harbors Investment Corp (TWO), down 9.1% to $22.96 / YTD price return: +4.6% / 12-Month Price Range: $ 17.00-55.72 / Short interest (% of float): 10.7%; days to cover: 14.8 (the stock is currently on the short sale restriction list)

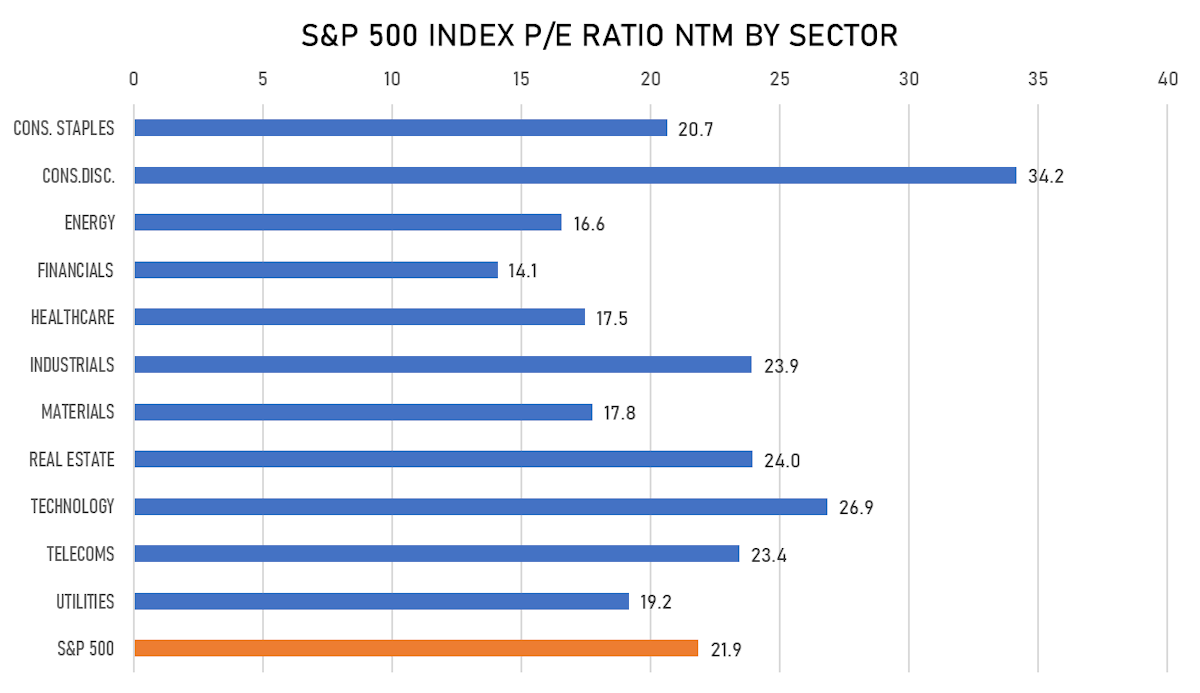

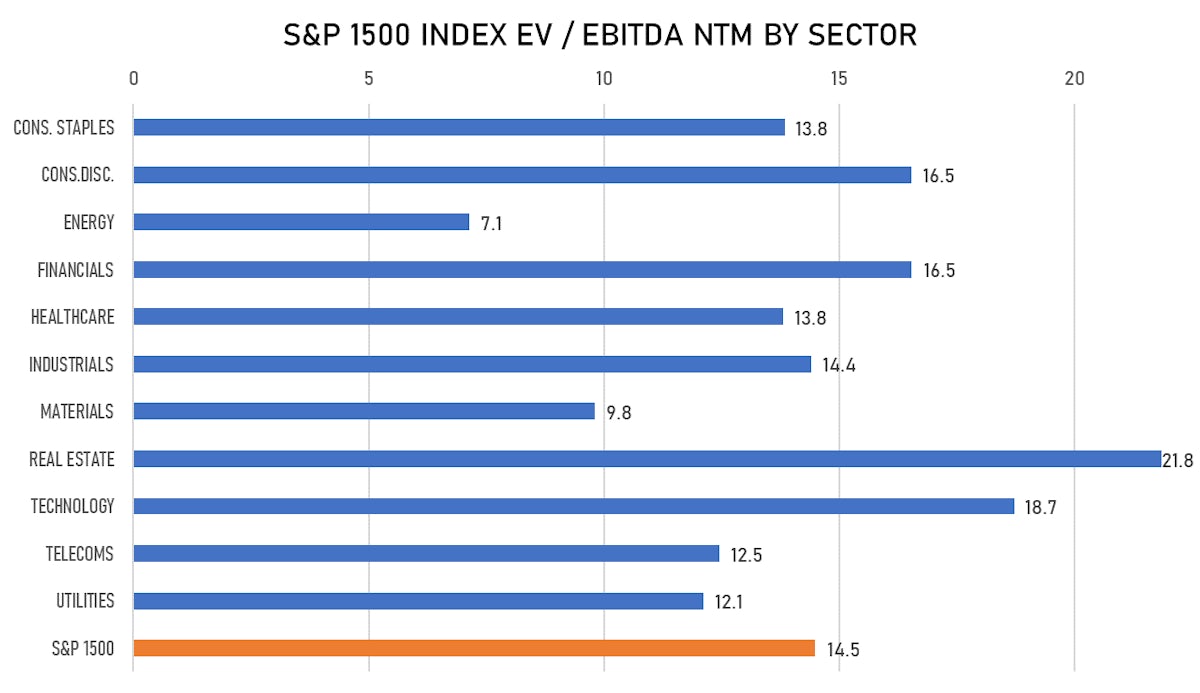

VALUATION METRICS CHARTS

NEW IPOs ANNOUNCED OR PRICED

- Greenroad Technologies Inc / United States of America - High Technology / Listing Exchange: Tel Aviv / Ticker: N/A / Gross proceeds (including overallotment): US$ 152.43m (offering in Israeli Shekel) / Bookrunners: Not Applicable

- Global Technology Acquisition Corp I / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: GTACU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc

- Arya Sciences Acquisition Corp V / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ARYE / Gross proceeds (including overallotment): US$ 149.50m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Jefferies LLC

- Cadre Holdings Inc / United States of America - Healthcare / Listing Exchange: New York / Ticker: CDRE / Gross proceeds (including overallotment): US$ 143.75m (offering in U.S. Dollar) / Bookrunners: Raymond James & Associates Inc, Stifel Nicolaus & Co Inc, Truist Securities Inc

- Revolution Beauty Group PLC / United Kingdom - Retail / Listing Exchange: London AIM / Ticker: REVB / Gross proceeds (including overallotment): US$ 414.24m (offering in British Pound) / Bookrunners: Zeus Capital Ltd

- Seraphine Group PLC / United Kingdom - Retail / Listing Exchange: London / Ticker: N/A / Gross proceeds (including overallotment): US$ 104.86m (offering in British Pound) / Bookrunners: Numis Securities Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Shoals Technologies Group Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: SHLS / Gross proceeds (including overallotment): US$ 473.53m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Chargepoint Holdings Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: CHPT / Gross proceeds (including overallotment): US$ 334.80m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Oppenheimer & Co Inc, Bofa Securities Inc

- Celldex Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: CLDX / Gross proceeds (including overallotment): US$ 175.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, SVB Leerink LLC

- Yang Ming Marine Transport Corp / Taiwan - Industrials / Listing Exchange: Taiwan / Ticker: 2609 / Gross proceeds (including overallotment): US$ 936.47m (offering in Taiwanese Dollar) / Bookrunners: Yuanta Securities Co Ltd

- Smartfit Escola de Ginastica e Danca SA / Brazil - Media and Entertainment / Listing Exchange: BOVESPA / Ticker: SMFT3 / Gross proceeds (including overallotment): US$ 444.62m (offering in Brazilian Real) / Bookrunners: Banco ABC-Brasil SA, Banco Santander Brasil SA, Banco Itau-BBA SA, Banco BTG Pactual SA, Banco Morgan Stanley SA

- Zhongsheng Group Holdings Ltd / China - Retail / Listing Exchange: Hong Kong / Ticker: 881 / Gross proceeds (including overallotment): US$ 385.73m (offering in Hong Kong Dollar) / Bookrunners: Not Applicable

- Olink Holding AB / Sweden - Healthcare / Listing Exchange: Nasdaq / Ticker: OLK / Gross proceeds (including overallotment): US$ 247.80m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, Goldman Sachs Bank Europe SE

- Nations Technologies Inc / China - High Technology / Listing Exchange: ShenzChNxt / Ticker: 300077 / Gross proceeds (including overallotment): US$ 185.33m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Grupo de Moda Soma SA / Brazil - Retail / Listing Exchange: BOVESPA / Ticker: SOMA3 / Gross proceeds (including overallotment): US$ 142.64m (offering in Brazilian Real) / Bookrunners: Banco Santander Brasil SA, Banco Itau-BBA SA, Banco BTG Pactual SA, XP Investimentos, Bank of America Merrill Lynch Banco Multiplo SA

- Gresham House Energy Storage Fund PLC / United Kingdom - Energy and Power / Listing Exchange: London / Ticker: GRID / Gross proceeds (including overallotment): US$ 138.99m (offering in British Pound) / Bookrunners: Jefferies International Ltd