Equities

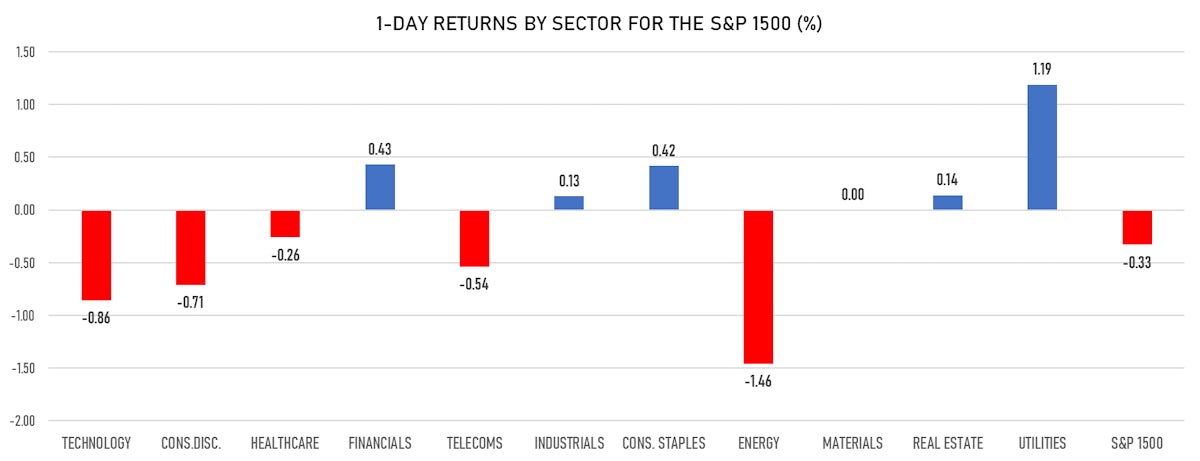

US Equity Indices Dragged Down By Energy And Tech Stocks

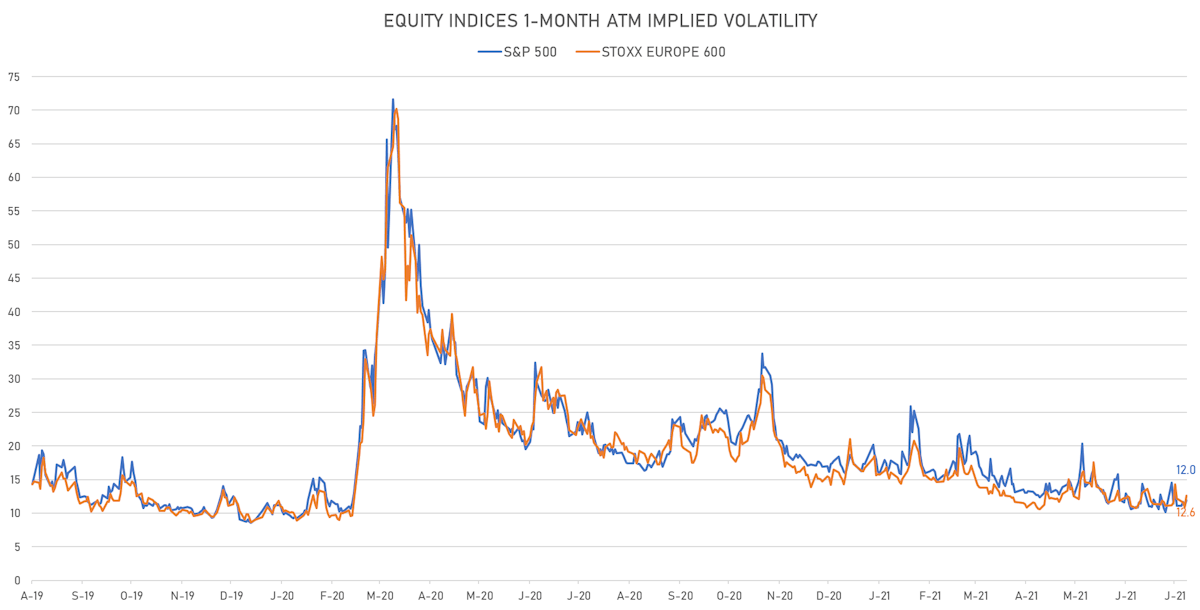

Equity implied volatilities have dropped since last month, but the skewness remains high as many market participants still expect a late-summer correction

Published ET

SPX 1-Month Implied Volatility Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.33%; Nasdaq Composite down -0.70%; Wilshire 5000 down -0.36%

- 47.3% of S&P 500 stocks were up today, with 88.5% of stocks above their 200-day moving average (DMA) and 49.5% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 1.19% and consumer staples up 0.42%

- Bottom performing sectors in the S&P 500: energy down -1.41% and technology down -0.84%

- The number of shares in the S&P 500 traded today was 515m for a total turnover of US$ 60 bn

- The S&P 500 Value Index was unchanged, while the S&P 500 Growth Index was down -0.6%; the S&P small caps index was down -0.5% and mid caps were down -0.3%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: -0.4); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.95%; Japan down -0.25%; UK FTSE 100 down -1.12%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.0%, up from 11.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.6%, up from 11.0%

NOTABLE S&P 500 EARNINGS RELEASES

- Bank of New York Mellon Corp (Financials): beat on EPS (1.13 act. vs. 0.87 est.) and beat on revenue (3,960m act. vs. 3,847m est.)

- Morgan Stanley (Financials): beat on EPS (1.89 act. vs. 1.70 est.) and beat on revenue (14,759m act. vs. 14,089m est.)

- US Bancorp (Financials): beat on EPS (1.28 act. vs. 0.96 est.) and beat on revenue (5,783m act. vs. 5,519m est.)

- UnitedHealth Group Inc (Healthcare): beat on EPS (4.70 act. vs. 4.38 est.) and beat on revenue (71,321m act. vs. 69,217m est.)

TOP WINNERS

- Evgo Inc (EVGO), up 14.2% to $12.08 / YTD price return: +12.8% / 12-Month Price Range: $ 9.75-24.34

- Sciplay Corp (SCPL), up 10.5% to $16.98 / 12-Month Price Range: $ 11.76-21.74 / Short interest (% of float): 10.4%; days to cover: 9.1

- Lordstown Motors Corp (RIDE), up 10.0% to $8.89 / YTD price return: -55.7% / 12-Month Price Range: $ 6.69-31.80 / Short interest (% of float): 26.9%; days to cover: 1.8

- Prelude Therapeutics Inc (PRLD), up 8.7% to $28.02 / 12-Month Price Range: $ 23.69-95.38 / Short interest (% of float): 7.8%

- Enstar Group Ltd (ESGR), up 8.6% to $252.77 / YTD price return: +23.4% / 12-Month Price Range: $ 148.56-269.12

- AMC Entertainment Holdings Inc (AMC), up 7.7% to $36.00 / YTD price return: +1,598.1% / 12-Month Price Range: $ 1.91-72.62 / Short interest (% of float): 15.1%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Endeavor Group Holdings Inc (EDR), up 7.1% to $24.82 / 12-Month Price Range: $ 22.02-33.20 / Short interest (% of float): 3.7%; days to cover: 5.1

- Silverback Therapeutics Inc (SBTX), up 6.9% to $30.01 / 12-Month Price Range: $ 23.69-63.41 / Short interest (% of float): 10.0%; days to cover: 24.7

- Green Plains Inc (GPRE), up 6.5% to $32.83 / 12-Month Price Range: $ 11.63-35.00

- Doximity Inc (DOCS), up 6.3% to $52.91 / 12-Month Price Range: $ 41.17-65.42 / Short interest (% of float): 1.8%; days to cover: 0.1

BIGGEST LOSERS

- SGOCO Group Ltd (SGOC), down 15.6% to $11.14 / YTD price return: +668.3% / 12-Month Price Range: $ .77-29.00 / Short interest (% of float): 0.6%; days to cover: 6.4 (the stock is currently on the short sale restriction list)

- Cassava Sciences Inc (SAVA), down 15.0% to $82.43 / 12-Month Price Range: $ 2.78-117.54 (the stock is currently on the short sale restriction list)

- Galapagos NV (GLPG), down 13.0% to $57.23 / 12-Month Price Range: $ 65.52-214.36 (the stock is currently on the short sale restriction list)

- Meta Materials Inc (MMAT), down 11.2% to $3.79 / YTD price return: +170.7% / 12-Month Price Range: $ .42-21.76 / Short interest (% of float): 3.4%; days to cover: 0.7 (the stock is currently on the short sale restriction list)

- Repare Therapeutics Inc (RPTX), down 10.6% to $29.28 / 12-Month Price Range: $ 21.45-46.44 / Short interest (% of float): 2.0%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- Itau Corpbanca (ITCB), down 10.5% to $3.51 / 12-Month Price Range: $ 3.63-7.38 / Short interest (% of float): 0.3%; days to cover: 6.2 (the stock is currently on the short sale restriction list)

- Just Eat Takeaway.com NV (GRUB), down 10.0% to $15.78 / YTD price return: -30.9% / 12-Month Price Range: $ 16.88-36.00 / Short interest (% of float): 1.3%; days to cover: 3.7 (the stock is currently on the short sale restriction list)

- Coupa Software Inc (COUP), down 9.9% to $226.09 / YTD price return: -33.3% / 12-Month Price Range: $ 215.00-377.04 (the stock is currently on the short sale restriction list)

- Teleflex Inc (TFX), down 9.8% to $376.20 / YTD price return: -8.6% / 12-Month Price Range: $ 312.33-449.38 / Short interest (% of float): 1.0%; days to cover: 2.0 (the stock is currently on the short sale restriction list)

- Apollo Medical Holdings Inc (AMEH), down 9.8% to $78.05 / YTD price return: +327.2% / 12-Month Price Range: $ 15.11-92.74 / Short interest (% of float): 4.1%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

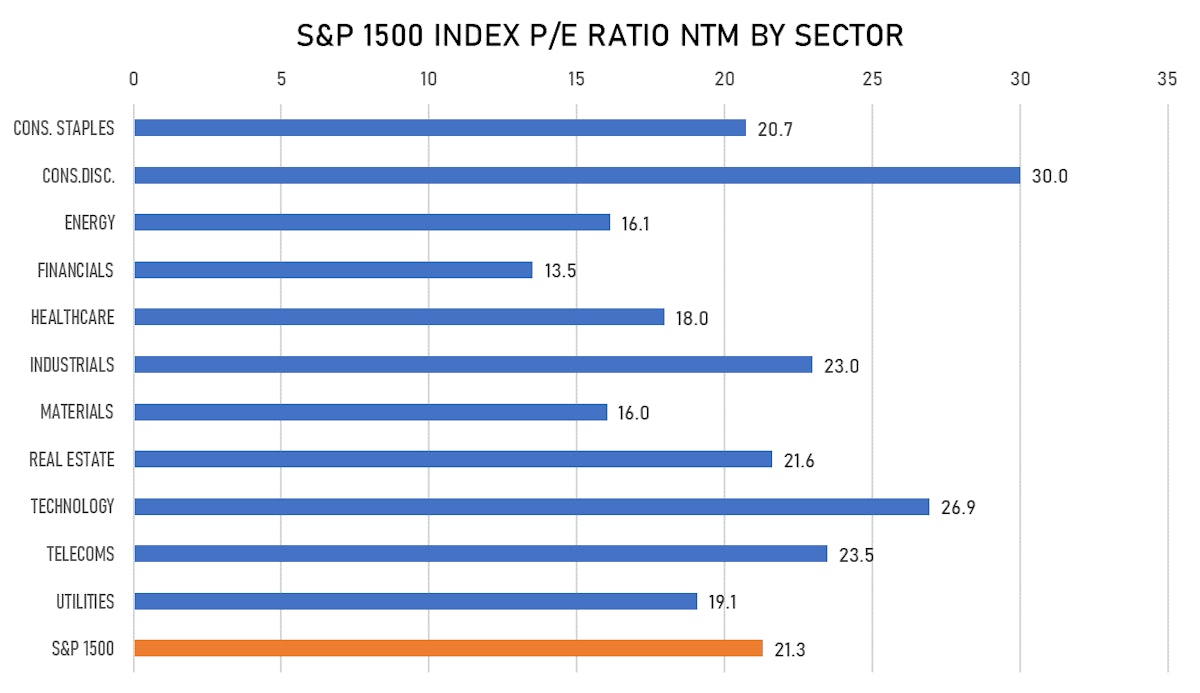

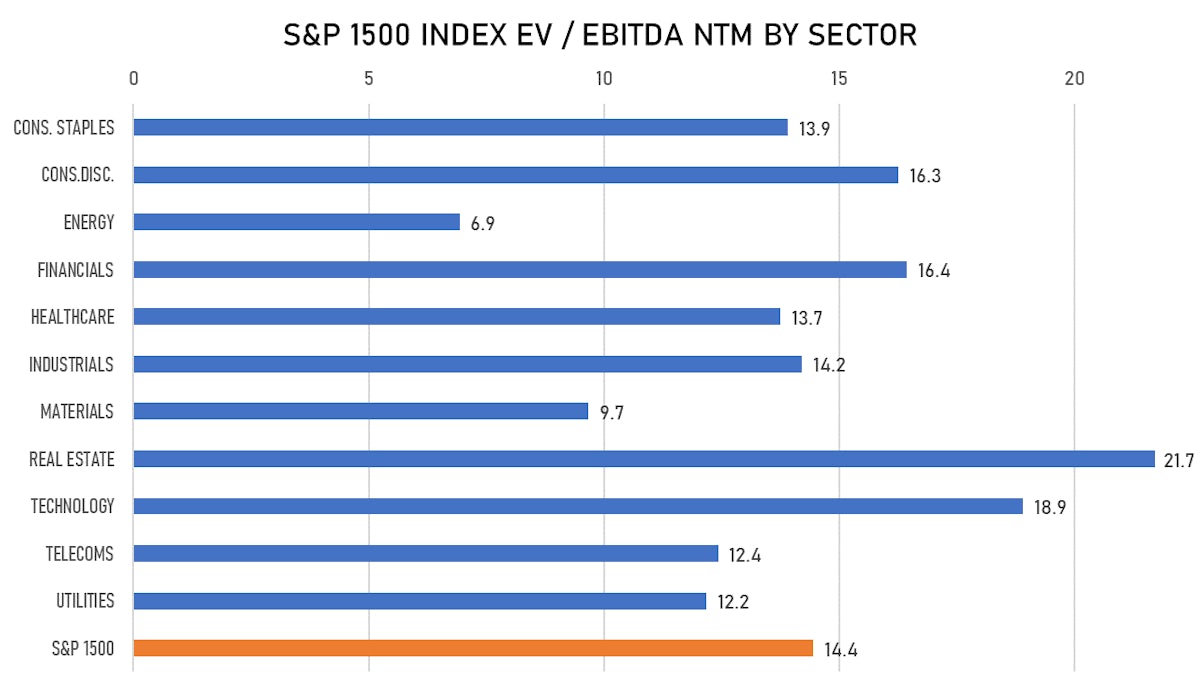

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Membership Collective Group Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: MCG / Gross proceeds (including overallotment): US$ 420.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, HSBC Securities (USA) Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Bofa Securities Inc

- F45 Training Holdings Inc / United States of America - Media and Entertainment / Listing Exchange: New York / Ticker: FXLV / Gross proceeds (including overallotment): US$ 325.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Sight Sciences Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: SGHT / Gross proceeds (including overallotment): US$ 240.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, Morgan Stanley & Co LLC, Bofa Securities Inc, Piper Sandler & Co

- Rapid Micro Biosystems Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RPID / Gross proceeds (including overallotment): US$ 158.40m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co, Stifel Nicolaus & Co Inc, Cowen & Co, JP Morgan Securities LLC

- CleanTech Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: CTAQU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Chardan Capital Markets LLC

- United Medical Group CY PLC / Cyprus - Healthcare / Listing Exchange: MICEX-RTS / Ticker: N/A / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Ltd, VTB Capital, JP Morgan AG

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- L Brands Inc / United States of America - Retail / Listing Exchange: New York / Ticker: LB / Gross proceeds (including overallotment): US$ 1,493.10m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC

- Phillips Edison & Co Inc / United States of America - Real Estate / Listing Exchange: Nasdaq / Ticker: PHEC / Gross proceeds (including overallotment): US$ 476.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Wells Fargo Securities LLC, BMO Capital Markets, KeyBanc Capital Markets Inc, Mizuho Securities USA Inc, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Bofa Securities Inc

- Shoals Technologies Group Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: SHLS / Gross proceeds (including overallotment): US$ 374.76m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Guggenheim Securities LLC, Credit Suisse Securities (USA) LLC, Morgan Stanley & Co LLC, JP Morgan Securities LLC, Barclays Capital Inc, UBS Securities LLC

- Chargepoint Holdings Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: CHPT / Gross proceeds (including overallotment): US$ 282.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Oppenheimer & Co Inc, Morgan Stanley & Co LLC, Bofa Securities Inc

- BBGI Global Infrastructure SA / Luxembourg - Financials / Listing Exchange: London / Ticker: BBGI / Gross proceeds (including overallotment): US$ 103.92m (offering in British Pound) / Bookrunners: Jefferies International Ltd, Winterflood Securities Ltd