Equities

Broad, High-Volume Fall In US Equities

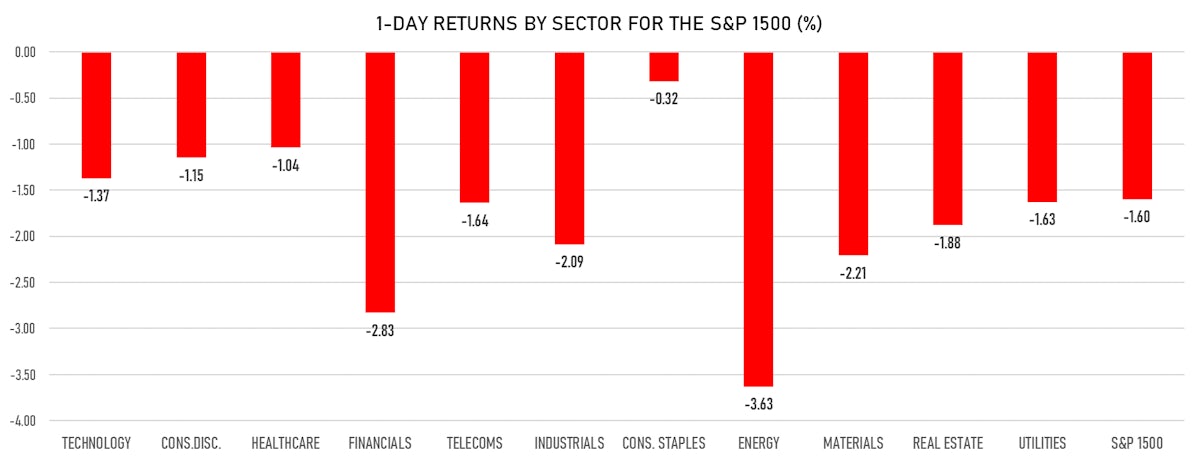

Growth and large caps overperformed value and small caps, with the energy and financials sectors seeing the worst losses today

Published ET

Implied Volatility Smile Skewness (To The Downside) Much Higher Today | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -1.59%; Nasdaq Composite down -1.06%; Wilshire 5000 down -1.44%

- 11.9% of S&P 500 stocks were up today, with 79.0% of stocks above their 200-day moving average (DMA) and 36.0% above their 50-DMA

- Top performing sectors in the S&P 500: consumer staples down -0.31% and health care down -1.07%

- Bottom performing sectors in the S&P 500: energy down -3.59% and financials down -2.80%

- The number of shares in the S&P 500 traded today was 725m for a total turnover of US$ 77 bn

- The S&P 500 Value Index was down -2.0%, while the S&P 500 Growth Index was down -1.2%; the S&P small caps index was down -1.9% and mid caps were down -1.8%

- The volume on CME's INX (S&P 500 Index) was 2.8m (3-month z-score: 2.0); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -2.30%; UK FTSE 100 down -2.34%; tonight in China CSI 300 down -0.35% and Japan down -0.64%

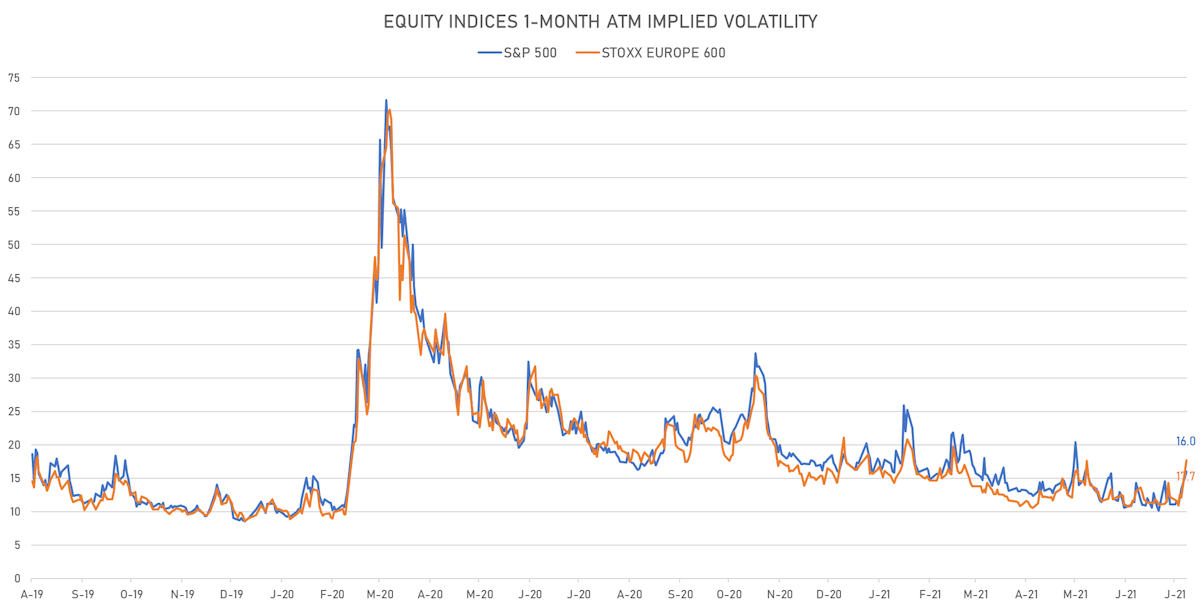

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 16.0%, up from 13.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 17.7%, up from 12.1%

NOTABLE S&P 500 EARNINGS RELEASES

- International Business Machines Corp (Technology): beat on EPS (2.33 act. vs. 2.29 est.) and beat on revenue (18,745m act. vs. 18,294m est.)

TOP WINNERS

- Cytokinetics Inc (CYTK), up 40.4% to $27.00 / YTD price return: +29.9% / 12-Month Price Range: $ 14.71-30.14

- SPX FLOW Inc (FLOW), up 22.3% to $75.93 / YTD price return: +31.0% / 12-Month Price Range: $ 36.87-71.62 / Short interest (% of float): 1.3%; days to cover: 3.7

- ProShares Ultra VIX Short-Term Futures ETF (UVXY), up 21.4% to $35.65 / YTD price return: -66.5% / 12-Month Price Range: $ 25.95-321.80 / Short interest (% of float): 15.7%; days to cover: 0.3

- Ocugen Inc (OCGN), up 12.9% to $7.52 / YTD price return: +310.9% / 12-Month Price Range: $ .21-18.77

- Novavax Inc (NVAX), up 12.8% to $210.51 / YTD price return: +88.8% / 12-Month Price Range: $ 76.59-331.68

- Connect Biopharma Holdings Ltd (CNTB), up 12.6% to $24.77 / 12-Month Price Range: $ 14.02-25.00 / Short interest (% of float): 1.4%; days to cover: 14.5

- SGOCO Group Ltd (SGOC), up 11.9% to $13.88 / YTD price return: +857.2% / 12-Month Price Range: $ .77-29.00 / Short interest (% of float): 0.7%; days to cover: 5.2

- Beachbody Company Inc (BODY), up 10.7% to $8.79 / 12-Month Price Range: $ 7.81-18.20 / Short interest (% of float): 4.0%; days to cover: 2.7

- Prelude Therapeutics Inc (PRLD), up 10.5% to $31.37 / YTD price return: -56.2% / 12-Month Price Range: $ 23.69-95.38 / Short interest (% of float): 7.8%; days to cover: 15.1

- Amyris Inc (AMRS), up 10.2% to $14.39 / YTD price return: +133.0% / 12-Month Price Range: $ 1.88-23.42

BIGGEST LOSERS

- Newegg Commerce Inc (NEGG), down 15.7% to $25.76 / YTD price return: +520.7% / 12-Month Price Range: $ 2.76-79.07 / Short interest (% of float): 0.3%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- F45 Training Holdings Inc (FXLV), down 14.6% to $13.75 / 12-Month Price Range: $ 15.50-17.75 (the stock is currently on the short sale restriction list)

- Blend Labs Inc (BLND), down 14.2% to $17.93 / 12-Month Price Range: $ 19.20-21.04 (the stock is currently on the short sale restriction list)

- Membership Collective Group Inc (MCG), down 13.6% to $10.80 / 12-Month Price Range: $ 11.67-13.59 (the stock is currently on the short sale restriction list)

- ProShares Ultra Bloomberg Crude Oil (UCO), down 13.1% to $65.99 / YTD price return: +81.9% / 12-Month Price Range: $ 21.73-82.59 / Short interest (% of float): 2.3%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Schnitzer Steel Industries Inc (SCHN), down 10.0% to $46.08 / YTD price return: +44.4% / 12-Month Price Range: $ 16.82-59.34 (the stock is currently on the short sale restriction list)

- Kite Realty Group Trust (KRG), down 10.0% to $18.75 / YTD price return: +25.3% / 12-Month Price Range: $ 9.27-23.14 (the stock is currently on the short sale restriction list)

- New Oriental Education & Technology Group Inc (EDU), down 9.6% to $5.84 / YTD price return: -68.6% / 12-Month Price Range: $ 6.10-19.97 (the stock is currently on the short sale restriction list)

- Yalla Group Ltd (YALA), down 9.6% to $15.23 / YTD price return: +6.3% / 12-Month Price Range: $ 6.26-41.35 / Short interest (% of float): 4.4%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- Matador Resources Co (MTDR), down 9.5% to $28.75 / YTD price return: +138.4% / 12-Month Price Range: $ 6.29-38.05 / Short interest (% of float): 11.2%; days to cover: 8.1 (the stock is currently on the short sale restriction list)

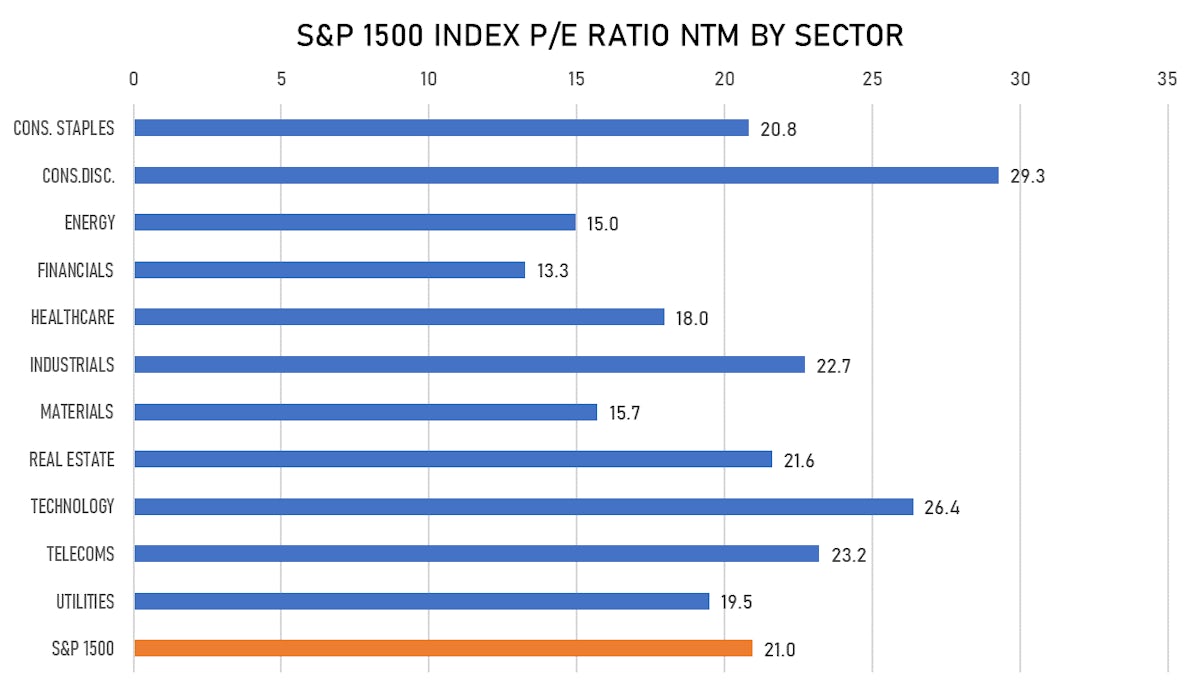

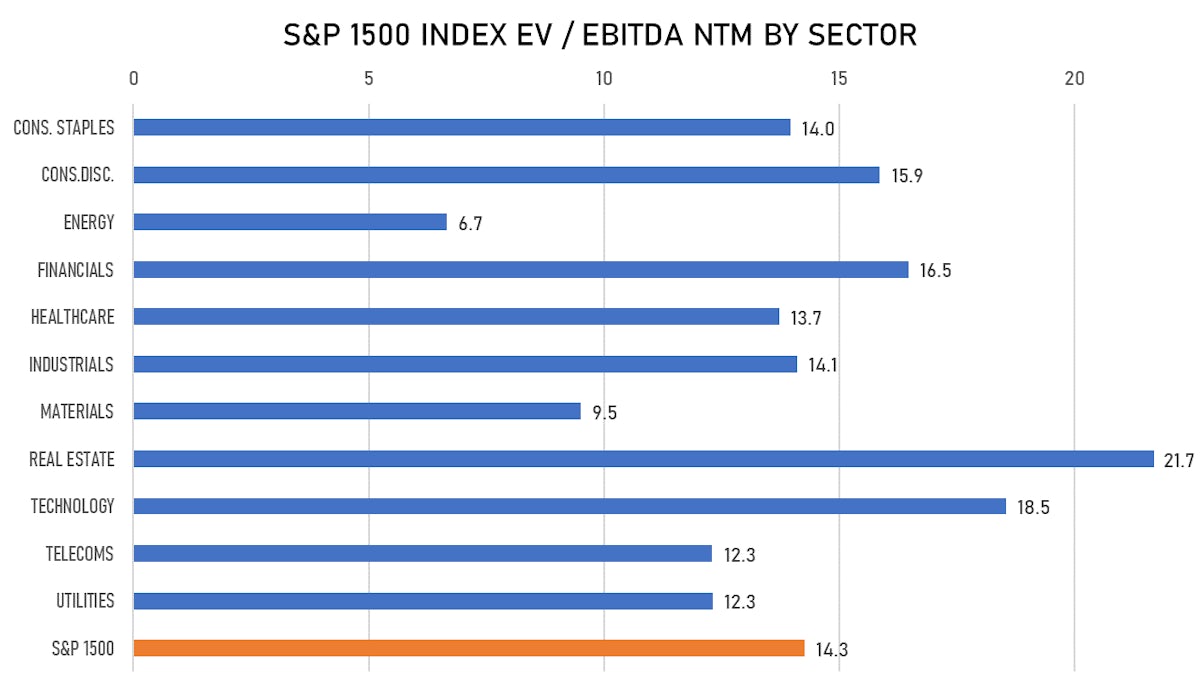

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Kensington Capital Acquisition Corp V / United States of America - Financials / Listing Exchange: New York / Ticker: KCGI.U / Gross proceeds (including overallotment): US$ 260.00m (offering in U.S. Dollar) / Bookrunners: UBS Securities LLC

- Thorne Healthtech Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: THRN / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Evercore Group, Bofa Securities Inc

- Jiangsu Recbio Technology Co Ltd / China - Healthcare / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- I2PO SA / France - Financials / Listing Exchange: Euro Paris / Ticker: I2PO / Gross proceeds (including overallotment): US$ 295.13m (offering in EURO) / Bookrunners: Societe Generale SA, JP Morgan & Co Inc, Deutsche Bank

- VAM Investments SPAC BV / Italy - Financials / Listing Exchange: EuronextAM / Ticker: VAMT / Gross proceeds (including overallotment): US$ 295.13m (offering in EURO) / Bookrunners: Societe Generale SA, UniCredit Bank AG, JP Morgan AG, Citigroup Global Markets Europe AG

- Energy Transition Partners BV / Netherlands - Financials / Listing Exchange: EuronextAM / Ticker: ENTPA / Gross proceeds (including overallotment): US$ 206.59m (offering in EURO) / Bookrunners: JP Morgan AG

- ONDE SA / Poland - Energy and Power / Listing Exchange: Warsaw / Ticker: OND / Gross proceeds (including overallotment): US$ 114.58m (offering in Polish Zloty) / Bookrunners: Trigon Dom Maklerski SA

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Chargepoint Holdings Inc / United States of America - Energy and Power / Listing Exchange: New York / Ticker: CHPT / Gross proceeds (including overallotment): US$ 282.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Oppenheimer & Co Inc, Morgan Stanley & Co LLC, Bofa Securities Inc

- Gatos Silver Inc / United States of America - Materials / Listing Exchange: New York / Ticker: GATO / Gross proceeds (including overallotment): US$ 116.48m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, RBC Capital Markets, BMO Capital Markets

- Inari Amertron Bhd / Malaysia - High Technology / Listing Exchange: Kuala Lump / Ticker: INARI / Gross proceeds (including overallotment): US$ 245.38m (offering in Malaysian Ringgit) / Bookrunners: M and A Securities Sdn Berhad, CIMB Investment Bank Bhd

- Create Restaurants Holdings Inc / Japan - Retail / Listing Exchange: Tokyo 1 / Ticker: 3387 / Gross proceeds (including overallotment): US$ 181.69m (offering in Japanese Yen) / Bookrunners: Not Applicable