Equities

Stocks Shot Up Today, Led By Industrials And Financials

Very broad equities rebound (90% of S&P 500 stocks up), with small caps and value stocks overperforming large caps and growth stocks

Published ET

S&P 1500 Market Caps By Sector | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 1.52%; Nasdaq Composite up 1.57%; Wilshire 5000 up 1.75%

- 89.3% of S&P 500 stocks were up today, with 84.6% of stocks above their 200-day moving average (DMA) and 46.1% above their 50-DMA

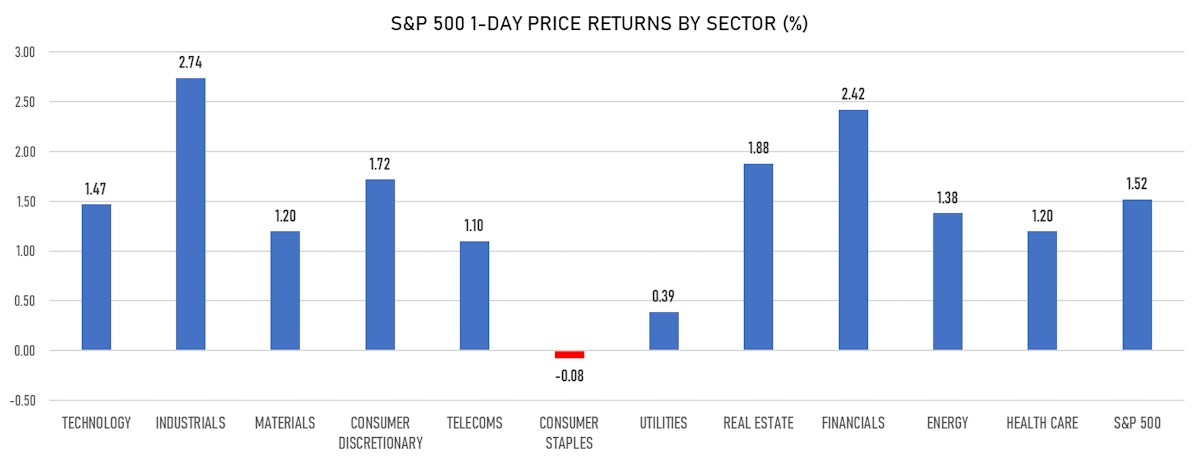

- Top performing sectors in the S&P 500: industrials up 2.74% and financials up 2.42%

- Bottom performing sectors in the S&P 500: consumer staples down -0.08% and utilities up 0.39%

- The number of shares in the S&P 500 traded today was 693m for a total turnover of US$ 81 bn

- The S&P 500 Value Index was up 1.7%, while the S&P 500 Growth Index was up 1.3%; the S&P small caps index was up 2.9% and mid caps were up 2.8%

- The volume on CME's INX (S&P 500 Index) was 2.4m (3-month z-score: 0.8); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.52%; UK FTSE 100 up 0.54%; tonight in Asia, China CSI 300 down -0.04% and Japan up 1.50%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.6%, down from 16.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 15.7%, down from 17.7%

NOTABLE S&P 500 EARNINGS RELEASES

- United Airlines Holdings Inc (Industrials): beat on EPS (-3.91 act. vs. -3.91 est.) and beat on revenue (5,471m act. vs. 5,370m est.)

- Alexion Pharmaceuticals Inc (Healthcare): beat on EPS (3.52 act. vs. 3.16 est.) and beat on revenue (1,637m act. vs. 1,583m est.)

- Amphenol Corp (Technology): beat on EPS (0.52 act. vs. 0.47 est.) and beat on revenue (2,377m act. vs. 2,180m est.)

- Citizens Financial Group Inc (Financials): beat on EPS (1.44 act. vs. 1.11 est.) and missed on revenue (1,609m act. vs. 1,628m est.)

- Chipotle Mexican Grill Inc (Consumer Cyclicals): beat on EPS (7.46 act. vs. 6.52 est.) and beat on revenue (1,893m act. vs. 1,882m est.)

- Dover Corp (Industrials): beat on EPS (2.06 act. vs. 1.84 est.) and beat on revenue (2,032m act. vs. 1,897m est.)

- Halliburton Co (Energy): beat on EPS (0.26 act. vs. 0.23 est.) and missed on revenue (3,707m act. vs. 3,735m est.)

- HCA Healthcare Inc (Healthcare): beat on EPS (4.37 act. vs. 3.16 est.) and beat on revenue (14,435m act. vs. 13,620m est.)

- Intuitive Surgical Inc (Healthcare): beat on EPS (3.92 act. vs. 3.07 est.) and beat on revenue (1,464m act. vs. 1,265m est.)

- KeyCorp (Financials): beat on EPS (0.72 act. vs. 0.54 est.) and beat on revenue (1,773m act. vs. 1,733m est.)

- Netflix Inc (Technology): missed on EPS (2.97 act. vs. 3.16 est.) and beat on revenue (7,342m act. vs. 7,324m est.)

- NVR Inc (Consumer Cyclicals): beat on EPS (63.21 act. vs. 63.01 est.) and missed on revenue (1,964m act. vs. 2,076m est.)

- Omnicom Group Inc (Consumer Cyclicals): beat on EPS (1.74 act. vs. 1.38 est.) and beat on revenue (3,572m act. vs. 3,376m est.)

- Philip Morris International Inc (Consumer Non-Cyclicals): beat on EPS (1.57 act. vs. 1.55 est.) and beat on revenue (7,840m act. vs. 7,687m est.)

- Synchrony Financial (Financials): beat on EPS (2.12 act. vs. 1.43 est.) and missed on revenue (2,395m act. vs. 3,475m est.)

- Travelers Companies Inc (Financials): beat on EPS (3.45 act. vs. 2.39 est.) and beat on revenue (8,135m act. vs. 7,717m est.)

TOP WINNERS

- AMC Entertainment Holdings Inc (AMC), up 24.5% to $43.09 / YTD price return: +1,932.5% / 12-Month Price Range: $ 1.91-72.62 (the stock is currently on the short sale restriction list)

- HCA Healthcare Inc (HCA), up 14.4% to $248.90 / YTD price return: +51.3% / 12-Month Price Range: $ 103.17-221.71 / Short interest (% of float): 1.3%; days to cover: 2.7

- SolarWinds Corp (SWI), up 14.3% to $10.20 / YTD price return: +29.4% / 12-Month Price Range: $ 13.98-24.34 / Short interest (% of float): 20.0%; days to cover: 20.1

- Silvergate Capital Corp (SI), up 14.3% to $98.75 / YTD price return: +32.9% / 12-Month Price Range: $ 13.13-187.86

- Evgo Inc (EVGO), up 12.4% to $12.89 / YTD price return: +20.4% / 12-Month Price Range: $ 9.75-24.34 / Short interest (% of float): 0.8%; days to cover: 0.0

- Newegg Commerce Inc (NEGG), up 12.3% to $28.93 / YTD price return: +597.1% / 12-Month Price Range: $ 2.76-79.07 / Short interest (% of float): 0.3%; days to cover: 0.4

- Duckhorn Portfolio Inc (NAPA), up 12.2% to $22.65 / 12-Month Price Range: $ 16.16-24.55 / Short interest (% of float): 5.7%; days to cover: 3.4

- Sight Sciences Inc (SGHT), up 12.0% to $35.06 / 12-Month Price Range: $ 27.13-37.13

- Zhihu Inc (ZH), up 11.7% to $12.59 / 12-Month Price Range: $ 6.81-13.85 / Short interest (% of float): 1.0%; days to cover: 2.6

- MiMedx Group Inc (MDXG), up 11.7% to $11.45 / YTD price return: +26.1% / 12-Month Price Range: $ 4.95-13.02

BIGGEST LOSERS

- N-Able Inc (NABL), down 21.9% to $12.50 / 12-Month Price Range: $ 12.50-16.00 (the stock is currently on the short sale restriction list)

- Glaukos Corp (GKOS), down 14.9% to $47.93 / YTD price return: -36.3% / 12-Month Price Range: $ 39.33-99.00 / Short interest (% of float): 8.4%; days to cover: 12.3 (the stock is currently on the short sale restriction list)

- Singular Genomics Systems Inc (OMIC), down 13.3% to $17.43 / 12-Month Price Range: $ 18.53-33.37 / Short interest (% of float): 0.5%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Membership Collective Group Inc (MCG), down 10.5% to $9.67 / 12-Month Price Range: $ 10.64-13.59 (the stock is currently on the short sale restriction list)

- Hims & Hers Health Inc (HIMS), down 9.1% to $8.69 / YTD price return: -40.5% / 12-Month Price Range: $ 8.09-25.40 / Short interest (% of float): 7.6%; days to cover: 6.8 (the stock is currently on the short sale restriction list)

- SGOCO Group Ltd (SGOC), down 7.9% to $12.79 / YTD price return: +782.1% / 12-Month Price Range: $ .77-29.00 / Short interest (% of float): 0.7%; days to cover: 5.2

- Graphite Bio Inc (GRPH), down 7.4% to $25.51 / 12-Month Price Range: $ 18.45-34.00 / Short interest (% of float): 2.0%; days to cover: 0.4

- Oi SA em Recuperacao Judicial (OIBRc), down 6.4% to $1.31 / YTD price return: -35.5% / 12-Month Price Range: $ 1.09-2.41 / Short interest (% of float): 0.1%; days to cover: 2.2 (the stock is currently on the short sale restriction list)

- Grupo Simec SAB de CV (SIM), down 6.0% to $21.92 / YTD price return: +71.3% / 12-Month Price Range: $ 5.82-31.73 / Short interest (% of float): 0.0%; days to cover: 1.4 (the stock is currently on the short sale restriction list)

- Fortuna Silver Mines Inc (FSM), down 5.7% to $4.33 / YTD price return: -47.5% / 12-Month Price Range: $ 4.54-9.85 / Short interest (% of float): 7.9%; days to cover: 7.2

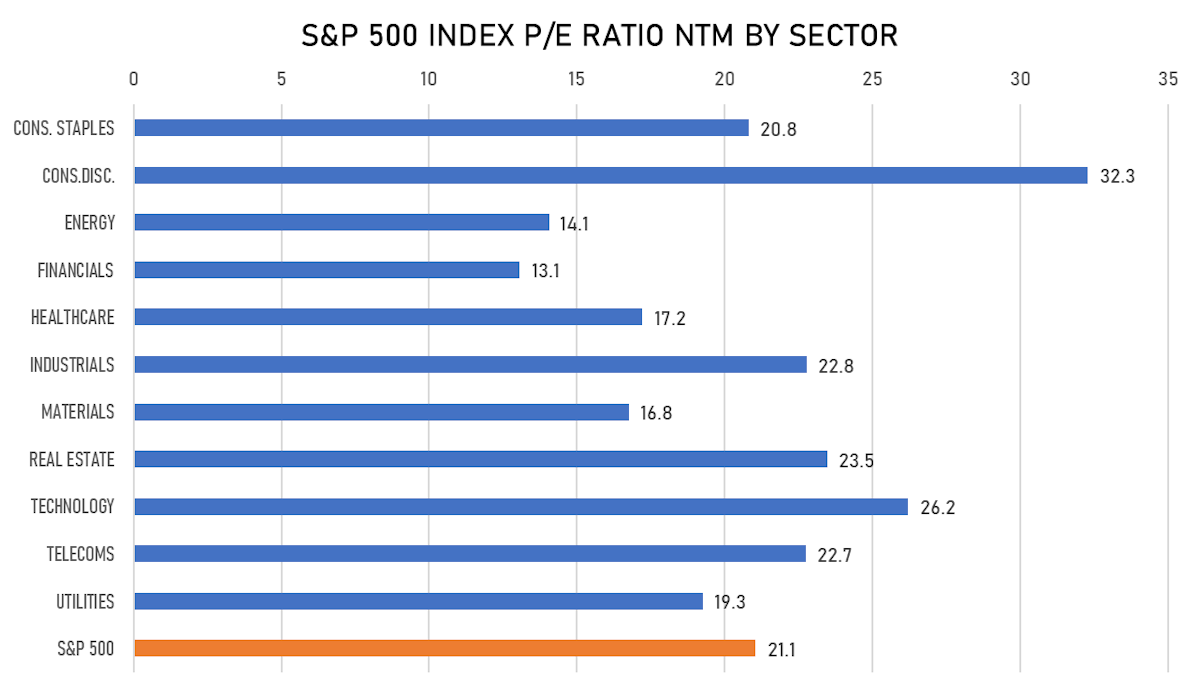

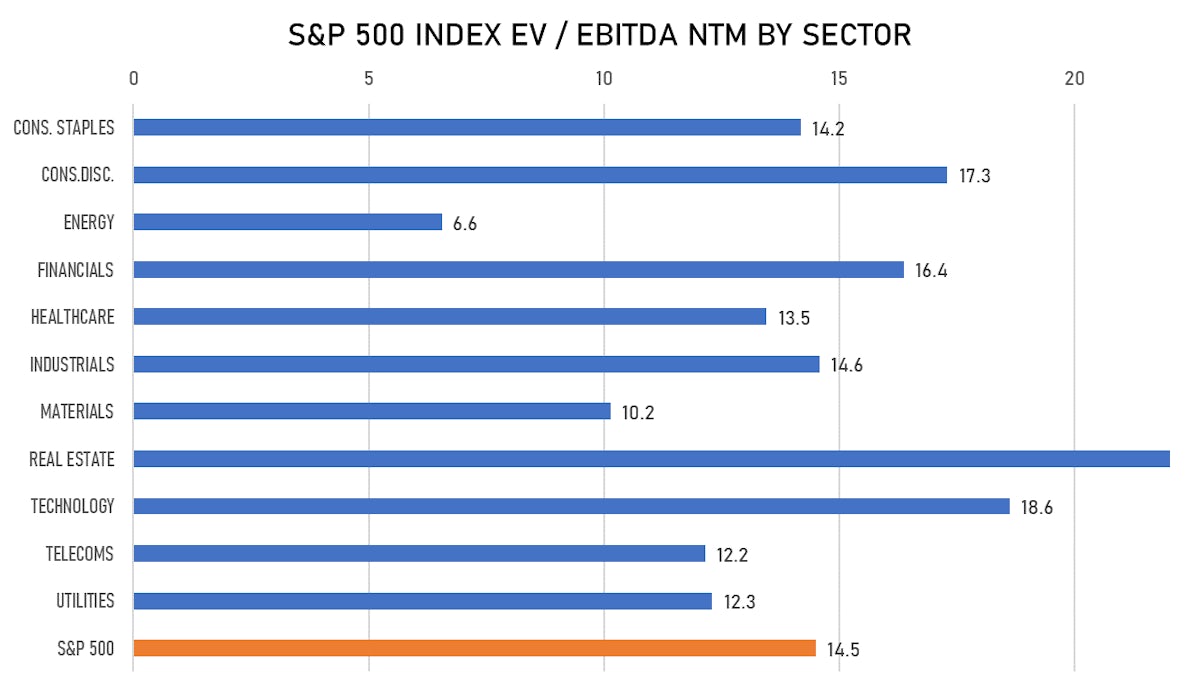

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- TortoiseEcofin Acquisition Corp III / United States of America - Financials / Listing Exchange: New York / Ticker: TRTL.U / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Cantor Fitzgerald & Co, Barclays Capital Inc

- BioPlus Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: BIOS.U / Gross proceeds (including overallotment): US$ 220.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- Seaport Calibre Materials Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: SCMAU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Sea Port Group Securities LLC

- Clover Leaf Capital Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: CLOEU / Gross proceeds (including overallotment): US$ 125.00m (offering in U.S. Dollar) / Bookrunners: Maxim Group LLC

- SK REITS Co Ltd / South Korea - Real Estate / Listing Exchange: Korea / Ticker: - / Gross proceeds (including overallotment): US$ 202.07m (offering in Korean Won) / Bookrunners: To Be Announced

- Doubledown Interactive Co Ltd / South Korea - High Technology / Listing Exchange: Nasdaq / Ticker: DDI / Gross proceeds (including overallotment): US$ 120.00m (offering in U.S. Dollar) / Bookrunners: B Riley FBR

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Cytokinetics Inc / United States of America - Healthcare / Listing Exchange: NasdqDubai / Ticker: CYTK / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC, JP Morgan Securities LLC

- WuXi Biologics (Cayman) Inc / China - Healthcare / Listing Exchange: Hong Kong / Ticker: 2269 / Gross proceeds (including overallotment): US$ 1,294.86m (offering in Hong Kong Dollar) / Bookrunners: Morgan Stanley