Equities

Tech And Healthcare Lead US Indices Up, Though Most Stocks Closed Down

A slightly flatter US yield curve took financials down, while small /value lost out to large / growth stocks

Published ET

SPX Implied Volatility Skewness Is Coming Back To More Normal Levels | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.20%; Nasdaq Composite up 0.36%; Wilshire 5000 up 0.06%

- 39.2% of S&P 500 stocks were up today, with 84.2% of stocks above their 200-day moving average (DMA) and 46.9% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 0.71% and healthcare up 0.66%

- Bottom performing sectors in the S&P 500: energy down -1.13% and financials down -1.04%

- The number of shares in the S&P 500 traded today was 458m for a total turnover of US$ 51 bn

- The S&P 500 Value Index was down -0.5%, while the S&P 500 Growth Index was up 0.8%; the S&P small caps index was down -1.8% and mid caps were down -0.9%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.7); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.56%; UK FTSE 100 down -0.43%; tonight in Asia, China CSI 300 down -0.01%

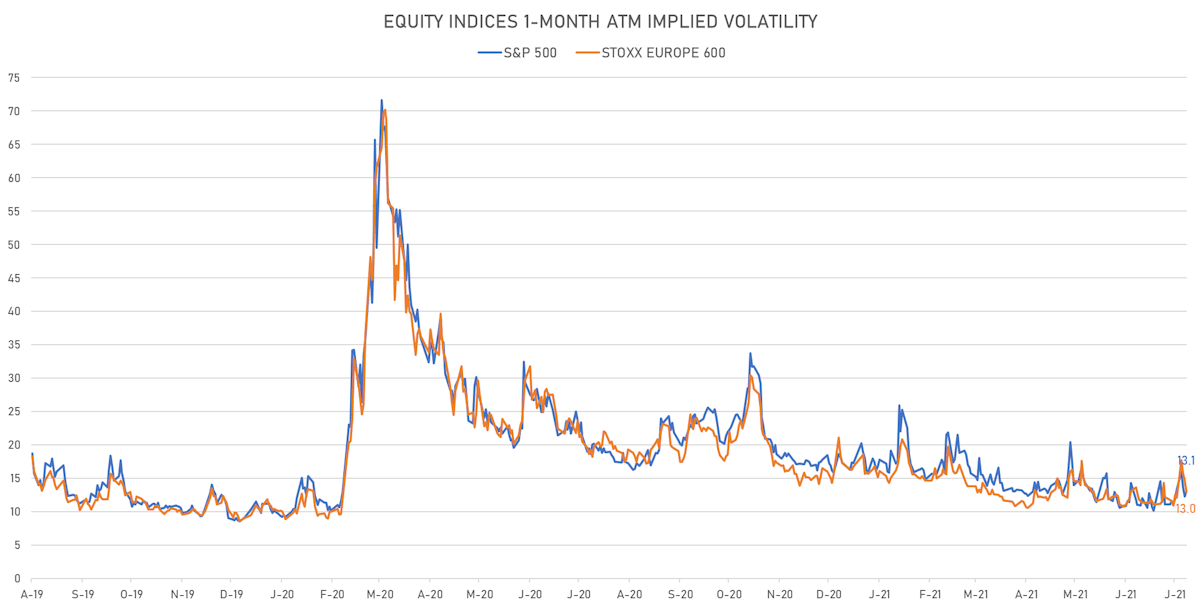

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 13.1%, up from 12.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.0%, down from 14.6%

NOTABLE S&P 500 EARNINGS RELEASES

- American Airlines Group Inc (Industrials): beat on EPS (-1.69 act. vs. -1.96 est.) and beat on revenue (7,478m act. vs. 7,342m est.)

- Abbott Laboratories (Healthcare): beat on EPS (1.17 act. vs. 1.02 est.) and beat on revenue (10,223m act. vs. 9,690m est.)

- American Electric Power Company Inc (Utilities): beat on EPS (1.18 act. vs. 1.14 est.) and missed on revenue (3,800m act. vs. 3,885m est.)

- Alaska Air Group Inc (Industrials): beat on EPS (-0.30 act. vs. -0.44 est.) and beat on revenue (1,527m act. vs. 1,516m est.)

- Allegion PLC (Technology): matched on EPS (1.32 act. vs. 1.32 est.) and beat on revenue (747m act. vs. 715m est.)

- Biogen Inc (Healthcare): beat on EPS (5.68 act. vs. 4.54 est.) and beat on revenue (2,775m act. vs. 2,605m est.)

- Celanese Corp (Basic Materials): beat on EPS (5.02 act. vs. 4.46 est.) and beat on revenue (2,198m act. vs. 1,958m est.)

- Capital One Financial Corp (Financials): beat on EPS (7.71 act. vs. 4.64 est.) and beat on revenue (7,374m act. vs. 7,117m est.)

- Quest Diagnostics Inc (Healthcare): beat on EPS (3.18 act. vs. 2.87 est.) and beat on revenue (2,550m act. vs. 2,376m est.)

- D R Horton Inc (Consumer Cyclicals): beat on EPS (3.06 act. vs. 2.81 est.) and beat on revenue (7,285m act. vs. 7,185m est.)

- Danaher Corp (Healthcare): beat on EPS (2.46 act. vs. 2.05 est.) and beat on revenue (7,218m act. vs. 6,724m est.)

- Dow Inc (Basic Materials): beat on EPS (2.72 act. vs. 2.45 est.) and beat on revenue (13,885m act. vs. 13,067m est.)

- Domino's Pizza Inc (Consumer Cyclicals): beat on EPS (3.12 act. vs. 2.87 est.) and beat on revenue (1,032m act. vs. 972m est.)

- Freeport-McMoRan Inc (Basic Materials): beat on EPS (0.77 act. vs. 0.76 est.) and missed on revenue (5,748m act. vs. 5,767m est.)

- FirstEnergy Corp (Utilities): beat on EPS (0.59 act. vs. 0.57 est.) and missed on revenue (2,600m act. vs. 2,646m est.)

- Fifth Third Bancorp (Financials): beat on EPS (0.94 act. vs. 0.81 est.) and beat on revenue (1,952m act. vs. 1,942m est.)

- Genuine Parts Co (Consumer Cyclicals): beat on EPS (1.74 act. vs. 1.54 est.) and beat on revenue (4,784m act. vs. 4,333m est.)

- Intel Corp (Technology): beat on EPS (1.28 act. vs. 1.06 est.) and beat on revenue (18,533m act. vs. 17,804m est.)

- Southwest Airlines Co (Industrials): missed on EPS (-0.35 act. vs. -0.23 est.) and beat on revenue (4,008m act. vs. 3,939m est.)

- Marsh & McLennan Companies Inc (Financials): beat on EPS (1.75 act. vs. 1.43 est.) and beat on revenue (5,017m act. vs. 4,526m est.)

- Newmont Corporation (Basic Materials): beat on EPS (0.83 act. vs. 0.78 est.) and missed on revenue (3,065m act. vs. 3,142m est.)

- Nucor Corp (Basic Materials): beat on EPS (5.15 act. vs. 4.79 est.) and beat on revenue (8,789m act. vs. 8,257m est.)

- Pool Corp (Consumer Cyclicals): beat on EPS (6.18 act. vs. 5.48 est.) and beat on revenue (1,788m act. vs. 1,734m est.)

- Robert Half International Inc (Industrials): beat on EPS (1.33 act. vs. 1.05 est.) and beat on revenue (1,581m act. vs. 1,478m est.)

- SVB Financial Group (Financials): beat on EPS (9.09 act. vs. 6.50 est.) and beat on revenue (1,489m act. vs. 1,137m est.)

- Snap-On Inc (Industrials): beat on EPS (3.76 act. vs. 3.22 est.) and beat on revenue (1,081m act. vs. 976m est.)

- AT&T Inc (Technology): beat on EPS (0.89 act. vs. 0.79 est.) and beat on revenue (44,045m act. vs. 42,665m est.)

- Twitter Inc (Technology): beat on EPS (0.20 act. vs. 0.07 est.) and beat on revenue (1,190m act. vs. 1,066m est.)

- Union Pacific Corp (Industrials): beat on EPS (2.72 act. vs. 2.52 est.) and beat on revenue (5,504m act. vs. 5,343m est.)

- Verisign Inc (Technology): beat on EPS (1.55 act. vs. 1.33 est.) and beat on revenue (329m act. vs. 329m est.)

- W R Berkley Corp (Financials): beat on EPS (1.17 act. vs. 1.00 est.) and missed on revenue (1,972m act. vs. 2,161m est.)

TOP WINNERS

- Absci Corp (ABSI), up 34.9% to $21.59 on its trading debut

- Couchbase Inc (BASE), up 26.7% to $30.40 on its trading debut

- VTEX (VTEX), up 17.2% to $26.00 / 12-Month Price Range: $ 22.10-25.85

- Beachbody Company Inc (BODY), up 17.2% to $10.72 / 12-Month Price Range: $ 7.19-18.20 / Short interest (% of float): 4.0%; days to cover: 2.7

- Ryan Specialty Group Holdings Inc (RYAN), up 17.0% to $27.50 on its trading debut

- Domino's Pizza Inc (DPZ), up 14.6% to $538.82 / YTD price return: +40.5% / 12-Month Price Range: $ 319.71-491.42

- Dlocal Ltd (DLO), up 12.2% to $51.78 / 12-Month Price Range: $ 29.57-57.00 / Short interest (% of float): 1.5%; days to cover: 0.6

- Holley Inc (HLLY), up 11.9% to $10.94 / YTD price return: +9.3% / 12-Month Price Range: $ 9.24-10.91

- F45 Training Holdings Inc (FXLV), up 10.3% to $15.70 / 12-Month Price Range: $ 13.50-17.75

- Crocs Inc (CROX), up 10.0% to $131.93 / YTD price return: +110.5% / 12-Month Price Range: $ 35.14-120.92 / Short interest (% of float): 5.0%; days to cover: 1.9

BIGGEST LOSERS

- Daqo New Energy Corp (DQ), down 14.8% to $67.67 / YTD price return: +18.0% / 12-Month Price Range: $ 18.22-130.33 / Short interest (% of float): 10.0%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- SGOCO Group Ltd (SGOC), down 12.3% to $9.87 / YTD price return: +580.7% / 12-Month Price Range: $ .77-29.00 / Short interest (% of float): 0.7%; days to cover: 5.2 (the stock is currently on the short sale restriction list)

- Gaotu Techedu Inc (GOTU), down 11.5% to $9.58 / YTD price return: -81.5% / 12-Month Price Range: $ 9.70-149.05 (the stock is currently on the short sale restriction list)

- DiDi Global Inc (DIDI), down 11.3% to $10.20 / 12-Month Price Range: $ 10.69-18.01 (the stock is currently on the short sale restriction list)

- PBF Energy Inc (PBF), down 10.7% to $9.34 / YTD price return: +31.5% / 12-Month Price Range: $ 4.06-18.78 (the stock is currently on the short sale restriction list)

- Iamgold Corp (IAG), down 10.3% to $2.52 / YTD price return: -31.3% / 12-Month Price Range: $ 2.67-5.35 / Short interest (% of float): 1.9%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- Community Health Systems Inc (CYH), down 9.9% to $14.28 / YTD price return: +92.2% / 12-Month Price Range: $ 3.73-17.04

- NETGEAR Inc (NTGR), down 9.5% to $33.53 / YTD price return: -17.5% / 12-Month Price Range: $ 27.17-46.38 (the stock is currently on the short sale restriction list)

- AMC Entertainment Holdings Inc (AMC), down 8.7% to $37.24 / YTD price return: +1,656.6% / 12-Month Price Range: $ 1.91-72.62

- Full Truck Alliance Co Ltd (YMM), down 8.5% to $15.15 / 12-Month Price Range: $ 14.89-22.80 / Short interest (% of float): 0.3%; days to cover: 0.2

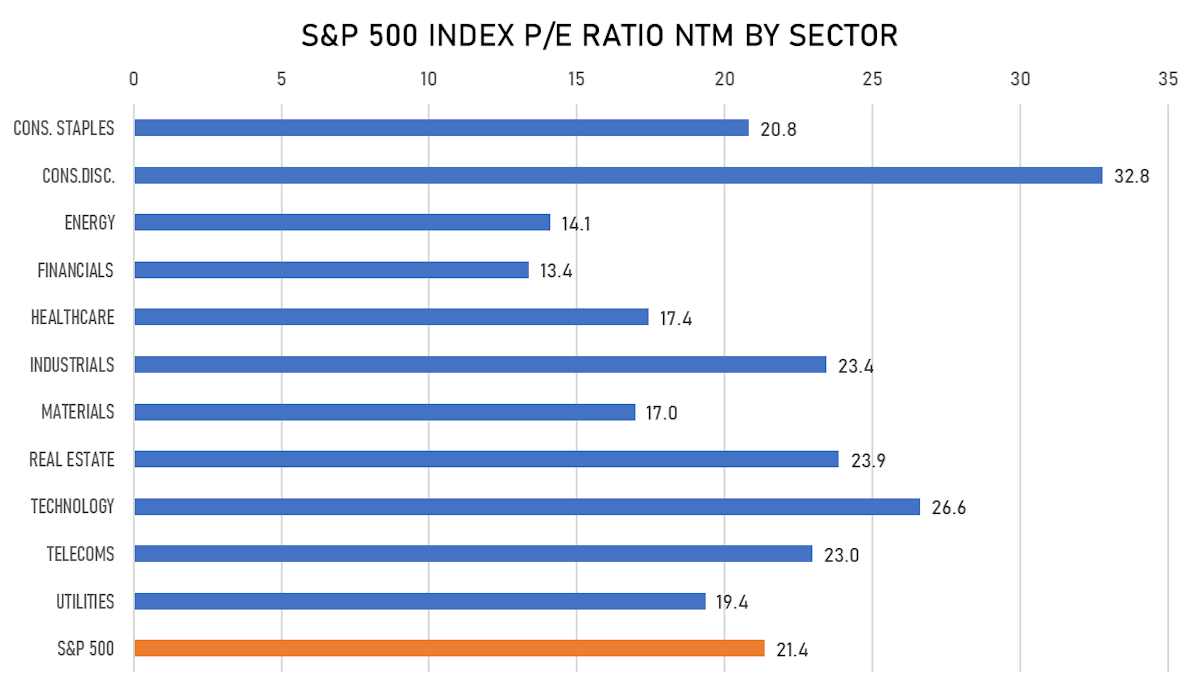

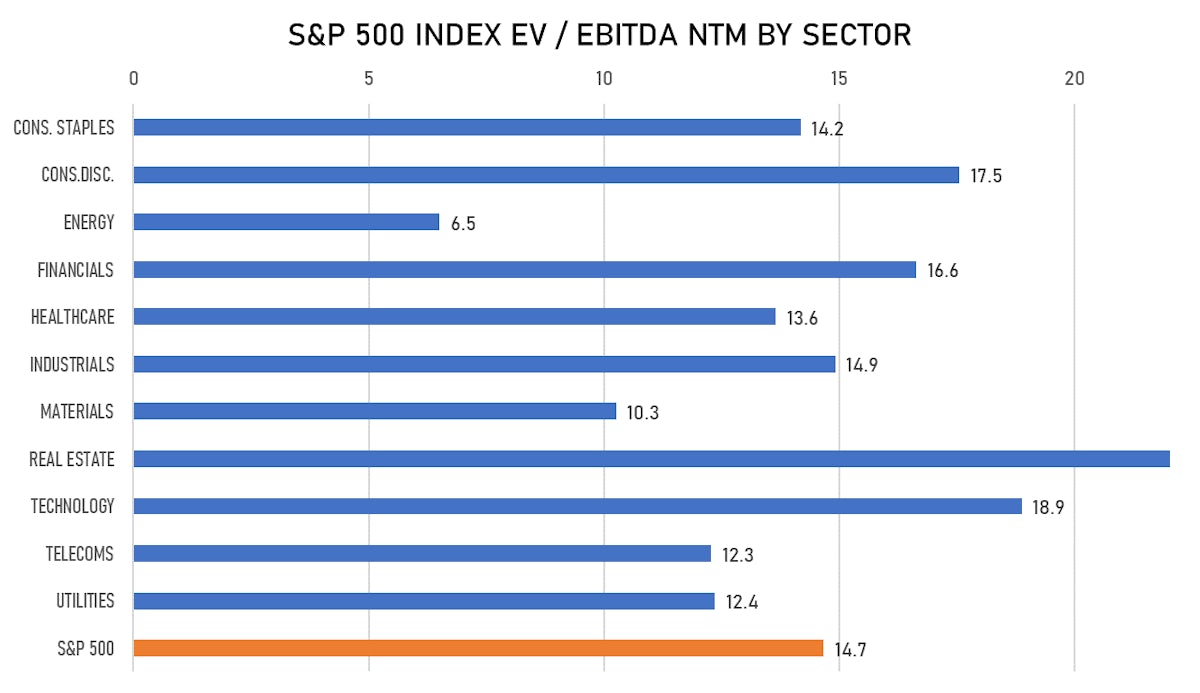

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Argus Capital Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ARGUU / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC

- KakaoBank Corp / South Korea - Financials / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,221.52m (offering in U.S. Dollar) / Bookrunners: Credit Suisse, Citigroup, Korea Investment & Securities Co Ltd, Hana Financial Investment Co, KBI Securities Co Ltd, Hyundai Motor Securities Co Ltd

- Zhuhai Raysharp Technology Co Ltd / China - High Technology / Listing Exchange: ShenzChNxt / Ticker: N/A / Gross proceeds (including overallotment): US$ 111.48m (offering in Chinese Yuan) / Bookrunners: Minsheng Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Natera Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: NTRA / Gross proceeds (including overallotment): US$ 508.50m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Goldman Sachs & Co, Morgan Stanley & Co LLC, SVB Leerink LLC

- Evolution Mining Ltd / Australia - Materials / Listing Exchange: Australia / Ticker: EVN / Gross proceeds (including overallotment): US$ 294.32m (offering in Australian Dollar) / Bookrunners: Not Applicable

- Woori Financial Group Inc / South Korea - Financials / Listing Exchange: Korea / Ticker: 316140 / Gross proceeds (including overallotment): US$ 262.88m (offering in Korean Won) / Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc