Equities

Broad Rise In US Indices, With Telecoms And Utilities Leading The Way

Chinese education stocks EDU and TAL were battered badly, as it emerged that the government is thinking of turning after-school tutoring into a non-profit sector

Published ET

Rough ride: TAL And EDU are down 92% and 84% respectively this year | Source: Refinitiv

QUICK SUMMARY

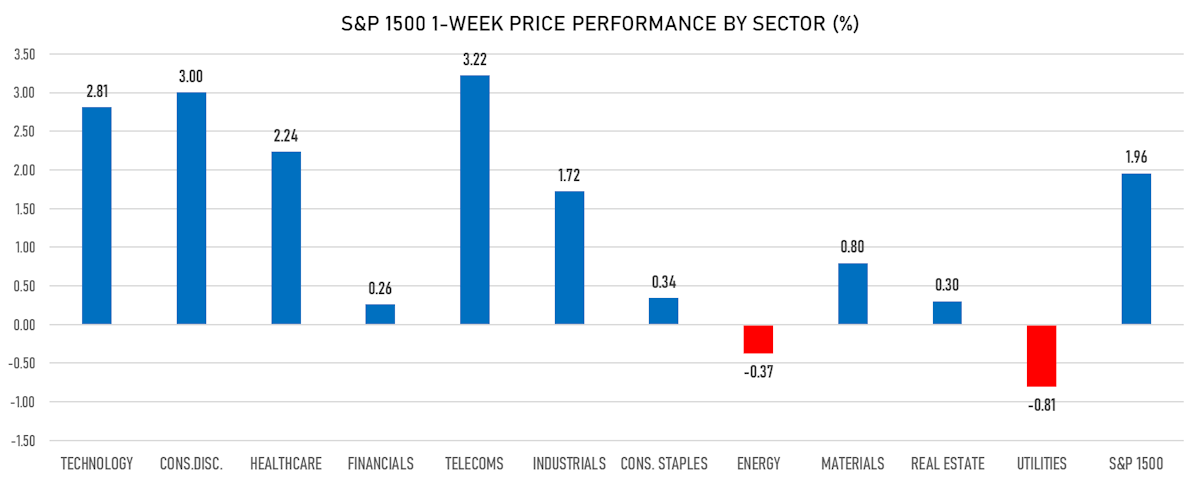

- Daily performance of US indices: S&P 500 up 1.01%; Nasdaq Composite up 1.04%; Wilshire 5000 up 0.99%

- 81.6% of S&P 500 stocks were up today, with 86.3% of stocks above their 200-day moving average (DMA) and 53.5% above their 50-DMA

- Top performing sectors in the S&P 500: telecoms up 2.65% and utilities up 1.28%

- Bottom performing sectors in the S&P 500: energy down -0.43% and financials up 0.13%

- The number of shares in the S&P 500 traded today was 444m for a total turnover of US$ 54 bn

- The S&P 500 Value Index was up 0.6%, while the S&P 500 Growth Index was up 1.4%; the S&P small caps index was up 0.7% and mid caps were up 0.9%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.9); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 1.09%; UK FTSE 100 up 0.85%; China CSI 300 down -1.21% and Japan was closed for the start of the Olympics

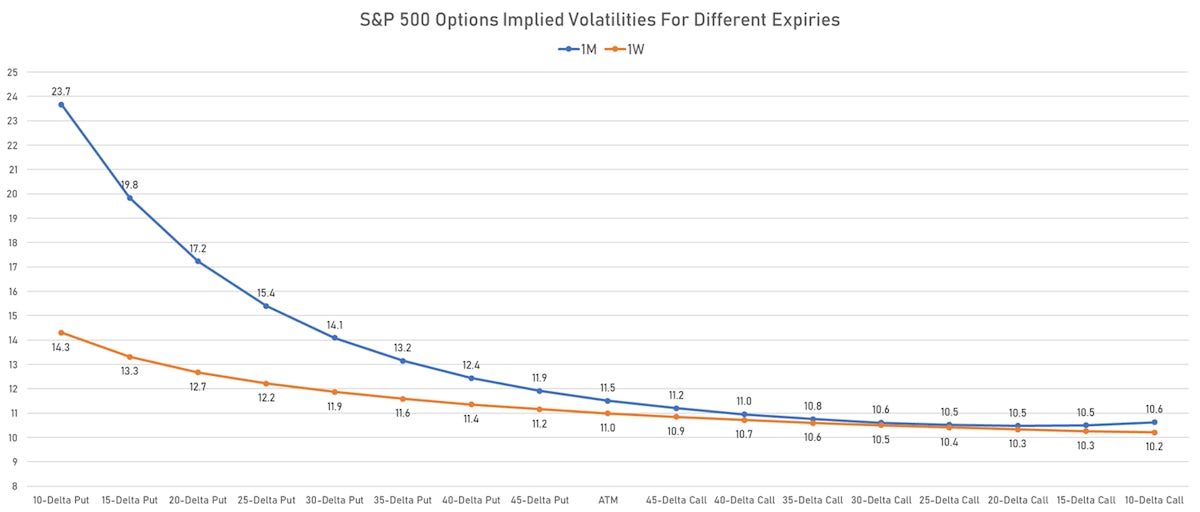

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 11.5%, down from 13.1%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.4%, down from 13.0%

NOTABLE S&P 500 EARNINGS RELEASES

- American Express Co (Financials): beat on EPS (2.80 act. vs. 1.67 est.) and beat on revenue (10,243m act. vs. 9,577m est.)

- Honeywell International Inc (Consumer Non-Cyclicals): beat on EPS (2.02 act. vs. 1.94 est.) and beat on revenue (8,808m act. vs. 8,640m est.)

- Kimberly-Clark Corp (Consumer Non-Cyclicals): missed on EPS (1.47 act. vs. 1.71 est.) and missed on revenue (4,722m act. vs. 4,762m est.)

- Nextera Energy Inc (Utilities): beat on EPS (0.71 act. vs. 0.70 est.) and missed on revenue (3,927m act. vs. 4,985m est.)

- Regions Financial Corp (Financials): beat on EPS (0.77 act. vs. 0.53 est.) and beat on revenue (1,563m act. vs. 1,553m est.)

- Roper Technologies Inc (Technology): beat on EPS (3.76 act. vs. 3.67 est.) and beat on revenue (1,588m act. vs. 1,580m est.)

- Schlumberger NV (Energy): beat on EPS (0.30 act. vs. 0.26 est.) and beat on revenue (5,634m act. vs. 5,515m est.)

TOP WINNERS

- Veoneer Inc (VNE), up 56.4% to $31.17 / YTD price return: +46.3% / 12-Month Price Range: $ 9.56-30.71 / Short interest (% of float): 6.2%; days to cover: 15.6

- NRX Pharmaceuticals Inc (NRXP), up 50.6% to $24.77 / 12-Month Price Range: $ 8.39-76.99 / Short interest (% of float): 1.3%; days to cover: 0.6

- Snap Inc (SNAP), up 23.8% to $77.97 / YTD price return: +55.8% / 12-Month Price Range: $ 20.61-73.59 / Short interest (% of float): 4.2%

- Core & Main Inc (CNM), up 18.5% to $23.70 on its trading debut

- Prelude Therapeutics Inc (PRLD), up 16.4% to $34.06 / YTD price return: -52.4% / 12-Month Price Range: $ 23.69-95.38 / Short interest (% of float): 7.8%; days to cover: 15.1

- Apollo Medical Holdings Inc (AMEH), up 15.8% to $112.84 / 12-Month Price Range: $ 16.21-103.58 / Short interest (% of float): 4.1%; days to cover: 2.7

- Taboola.com Ltd (TBLA), up 14.4% to $10.30 / 12-Month Price Range: $ 8.37-17.20 / Short interest (% of float): 0.4%; days to cover: 3.6

- Arvinas Inc (ARVN), up 13.0% to $95.47 / YTD price return: +12.4% / 12-Month Price Range: $ 19.68-92.77 / Short interest (% of float): 7.1%; days to cover: 5.5

- Roku Inc (ROKU), up 12.6% to $473.65 / YTD price return: +42.7% / 12-Month Price Range: $ 143.21-486.72 / Short interest (% of float): 3.3%

- FREYR Battery SA (FREY), up 12.0% to $8.94 / 12-Month Price Range: $ 7.71-15.28

BIGGEST LOSERS

- TAL Education Group (TAL), down 70.8% to $6.00 / YTD price return: -91.6% / 12-Month Price Range: $ 17.30-90.96 / Short interest (% of float): 3.6%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- New Oriental Education & Technology Group Inc (EDU), down 54.2% to $2.93 / YTD price return: -84.2% / 12-Month Price Range: $ 5.75-19.97 / Short interest (% of float): 3.3%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Youdao Inc (DAO), down 42.8% to $12.69 / YTD price return: -52.2% / 12-Month Price Range: $ 18.62-47.70 / Short interest (% of float): 2.9%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- Full Truck Alliance Co Ltd (YMM), down 28.4% to $10.85 / 12-Month Price Range: $ 14.89-22.80 / Short interest (% of float): 0.3%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Boston Beer Company Inc (SAM), down 26.0% to $701.00 / YTD price return: -29.5% / 12-Month Price Range: $ 653.06-1,349.98 / Short interest (% of float): 10.6%; days to cover: #N/A (the stock is currently on the short sale restriction list)

- Studio City International Holdings Ltd (MSC), down 24.5% to $9.19 / YTD price return: -22.6% / 12-Month Price Range: $ 8.53-27.00 / Short interest (% of float): 0.0%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Agora Inc (API), down 21.4% to $26.01 / YTD price return: -34.3% / 12-Month Price Range: $ 32.59-114.97 / Short interest (% of float): 9.4%; days to cover: 5.8 (the stock is currently on the short sale restriction list)

- DiDi Global Inc (DIDI), down 21.0% to $8.06 / 12-Month Price Range: $ 10.17-18.01 (the stock is currently on the short sale restriction list)

- Baozun Inc (BZUN), down 16.8% to $26.52 / YTD price return: -22.8% / 12-Month Price Range: $ 30.00-57.00 / Short interest (% of float): 9.2%; days to cover: 8.6 (the stock is currently on the short sale restriction list)

- 21Vianet Group Inc (VNET), down 13.9% to $15.80 / YTD price return: -54.5% / 12-Month Price Range: $ 16.94-44.45 / Short interest (% of float): 5.8%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

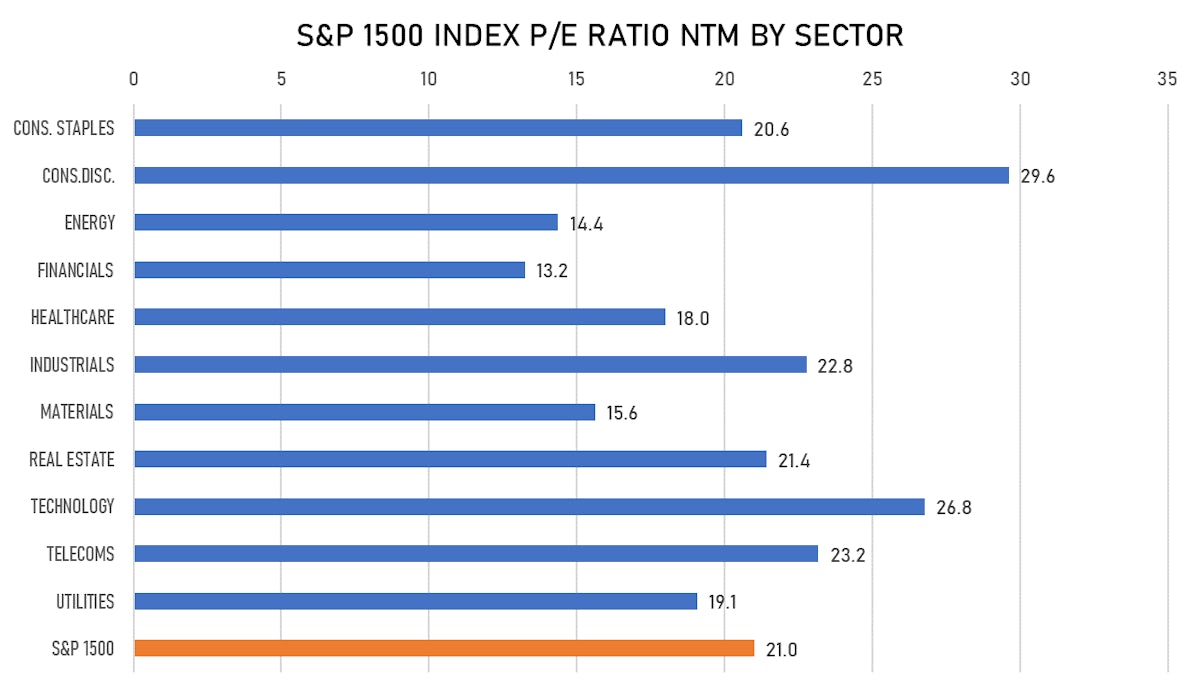

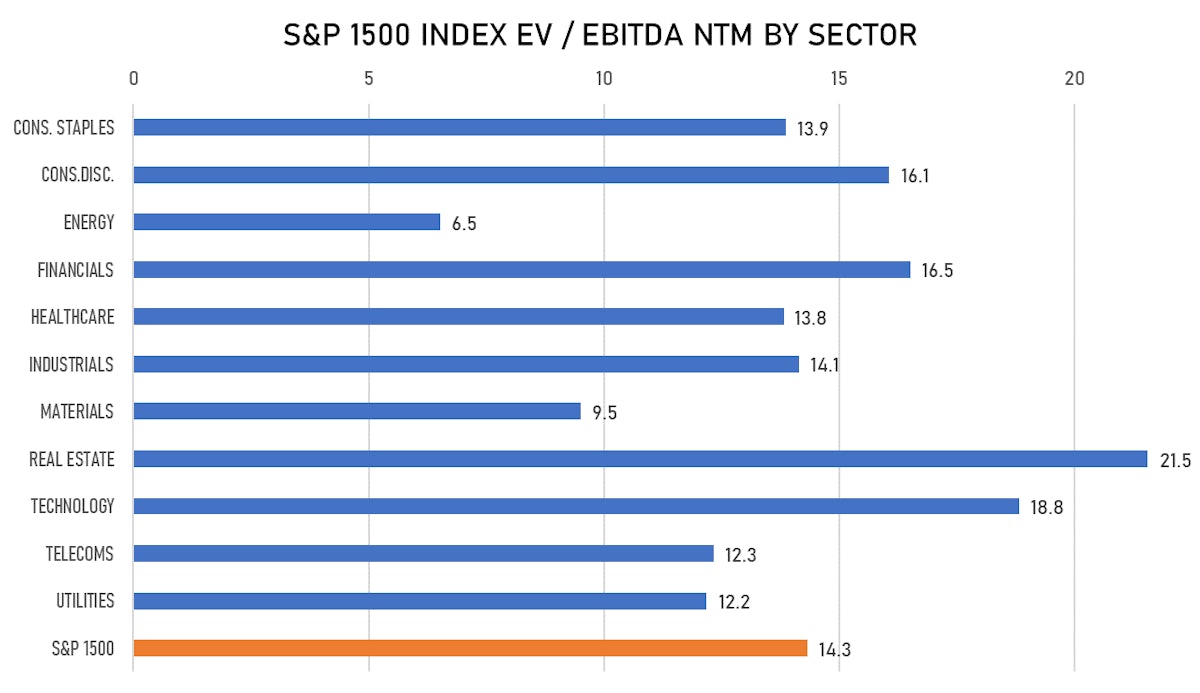

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Core & Main Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: CNM / Gross proceeds (including overallotment): US$ 697.67m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Credit Suisse Securities (USA) LLC, JP Morgan Securities LLC

- Caribou Biosciences Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: CRBU / Gross proceeds (including overallotment): US$ 304.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc, SVB Leerink LLC, Bofa Securities Inc

- Argus Capital Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ARGUU / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC

- Cytek Biosciences Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: CTKB / Gross proceeds (including overallotment): US$ 284.74m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Cowen & Co, Morgan Stanley & Co LLC, Piper Sandler & Co

- Outbrain Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: OB / Gross proceeds (including overallotment): US$ 160.00m (offering in U.S. Dollar) / Bookrunners: Evercore Group, Citigroup Global Markets Inc, Jefferies LLC, Barclays Capital Inc

- Belong Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: BLNGU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Loop Capital Markets, Wells Fargo Securities LLC

- Zhuhai Raysharp Technology Co Ltd / China - High Technology / Listing Exchange: ShenzChNxt / Ticker: N/A / Gross proceeds (including overallotment): US$ 111.48m (offering in Chinese Yuan) / Bookrunners: Minsheng Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Natera Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: NTRA / Gross proceeds (including overallotment): US$ 508.50m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Goldman Sachs & Co, Morgan Stanley & Co LLC, SVB Leerink LLC

- Evolution Mining Ltd / Australia - Materials / Listing Exchange: Australia / Ticker: EVN / Gross proceeds (including overallotment): US$ 295.12m (offering in Australian Dollar) / Bookrunners: Not Applicable