Equities

Broad Indices Edge Up On Low-Volume Snoozer For US Equities

Chinese K12 education stocks are again the leading losers today, with DAO, EDU, TAL now down (respectively) 68%, 90%, 94% year to date

Published ET

FactSet World Indices Year-To-Date Total Returns | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.24%; Nasdaq Composite up 0.03%; Wilshire 5000 up 0.22%

- 55.2% of S&P 500 stocks were up today, with 87.3% of stocks above their 200-day moving average (DMA) and 53.7% above their 50-DMA

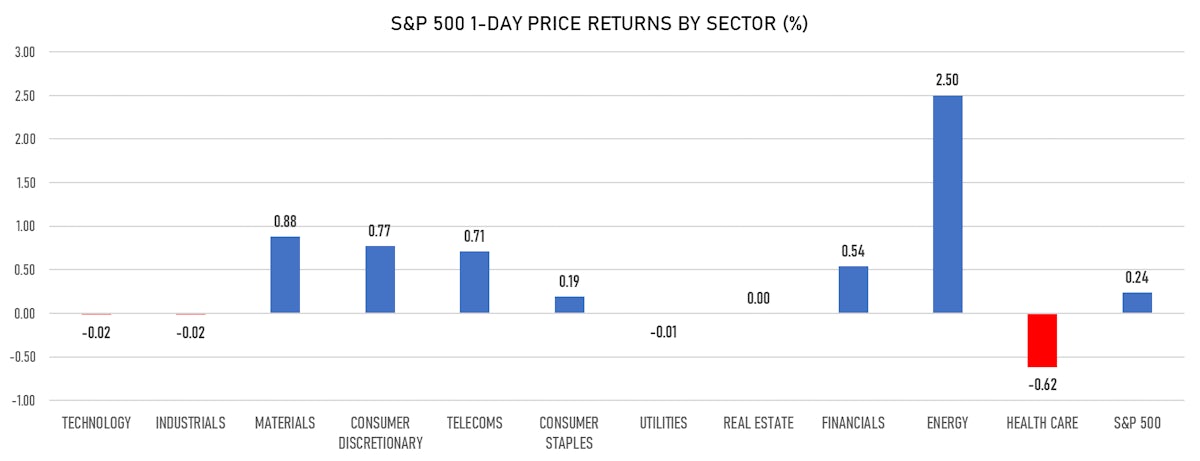

- Top performing sectors in the S&P 500: energy up 2.50% and materials up 0.88%

- Bottom performing sectors in the S&P 500: health care down -0.62% and technology down -0.02%

- The number of shares in the S&P 500 traded today was 498m for a total turnover of US$ 59 bn

- The S&P 500 Value Index was up 0.4%, while the S&P 500 Growth Index was up 0.1%; the S&P small caps index was up 0.9% and mid caps were up 0.1%

- The volume on CME's INX (S&P 500 Index) was 1.8m (3-month z-score: -0.8); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.08%; UK FTSE 100 down -0.03%; tonight in Asia, China CSI 300 down -0.54% and Japan's TOPIX 500 up 0.57%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.0%, up from 11.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.1%, up from 11.4%

NOTABLE S&P 500 EARNINGS RELEASES

- Alexandria Real Estate Equities Inc (Real Estate): beat on EPS (0.73 act. vs. 0.63 est.) and beat on revenue (508m act. vs. 411m est.)

- F5 Networks Inc (Technology): beat on EPS (2.76 act. vs. 2.46 est.) and beat on revenue (652m act. vs. 638m est.)

- Ameriprise Financial Inc (Financials): beat on EPS (5.27 act. vs. 5.21 est.) and beat on revenue (3,420m act. vs. 3,367m est.)

- Lockheed Martin Corp (Industrials): missed on EPS (6.52 act. vs. 6.53 est.) and beat on revenue (17,029m act. vs. 16,939m est.)

- Cadence Design Systems Inc (Technology): beat on EPS (0.86 act. vs. 0.76 est.) and beat on revenue (728m act. vs. 720m est.)

- Universal Health Services Inc (Healthcare): beat on EPS (3.76 act. vs. 2.70 est.) and beat on revenue (3,198m act. vs. 3,012m est.)

- Hasbro Inc (Consumer Cyclicals): beat on EPS (1.05 act. vs. 0.47 est.) and beat on revenue (1,322m act. vs. 1,159m est.)

- Tesla Inc (Consumer Cyclicals): beat on EPS (1.45 act. vs. 0.98 est.) and beat on revenue (11,958m act. vs. 11,299m est.)

TOP WINNERS

- Microstrategy Inc (MSTR), up 26.5% to $682.50 / YTD price return: +75.7% / 12-Month Price Range: $ 115.87-1,315.00 / Short interest (% of float): 27.5%; days to cover: 2.2

- Studio City International Holdings Ltd (MSC), up 22.9% to $11.29 / YTD price return: -4.9% / 12-Month Price Range: $ 8.53-27.00 / Short interest (% of float): 0.0%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Riot Blockchain Inc (RIOT), up 21.0% to $34.00 / YTD price return: +100.1% / 12-Month Price Range: $ 2.35-79.50 / Short interest (% of float): 34.1%; days to cover: 1.2

- Marathon Digital Holdings Inc (MARA), up 20.0% to $29.58 / YTD price return: +183.3% / 12-Month Price Range: $ 1.27-57.75 / Short interest (% of float): 18.1%; days to cover: 1.1

- RBC Bearings Inc (ROLL), up 16.2% to $240.00 / YTD price return: +34.0% / 12-Month Price Range: $ 113.40-208.11 / Short interest (% of float): 1.2%; days to cover: 2.6

- Canaan Inc (CAN), up 16.0% to $6.68 / YTD price return: +12.6% / 12-Month Price Range: $ 1.80-39.10 / Short interest (% of float): 5.4%; days to cover: 0.9

- Translate Bio Inc (TBIO), up 14.7% to $34.42 / YTD price return: +86.8% / 12-Month Price Range: $ 11.91-34.64 / Short interest (% of float): 9.7%; days to cover: 7.9

- Hasbro Inc (HAS), up 12.2% to $103.72 / YTD price return: +10.9% / 12-Month Price Range: $ 70.78-101.24 / Short interest (% of float): 2.7%; days to cover: 5.4

- Hyzon Motors Inc (HYZN), up 11.3% to $8.10 / YTD price return: -23.6% / 12-Month Price Range: $ 7.24-19.95 / Short interest (% of float): 0.4%; days to cover: 2.6

- Lucid Group Inc (LCID), up 10.6% to $26.83 / YTD price return: +168.0% / 12-Month Price Range: $ 9.60-64.86 / Short interest (% of float): 13.6%; days to cover: 2.8

BIGGEST LOSERS

- New Oriental Education & Technology Group Inc (EDU), down 33.8% to $1.94 / YTD price return: -89.6% / 12-Month Price Range: $ 2.45-19.97 / Short interest (% of float): 3.3%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Youdao Inc (DAO), down 33.4% to $8.45 / YTD price return: -68.1% / 12-Month Price Range: $ 12.17-47.70 / Short interest (% of float): 2.9%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- Ke Holdings Inc (BEKE), down 27.7% to $24.44 / YTD price return: -60.3% / 12-Month Price Range: $ 26.15-79.40 / Short interest (% of float): 1.5%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- TAL Education Group (TAL), down 26.7% to $4.40 / YTD price return: -93.8% / 12-Month Price Range: $ 5.96-90.96 / Short interest (% of float): 3.6%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Genetron Holdings Ltd (GTH), down 19.1% to $14.99 / YTD price return: +7.1% / 12-Month Price Range: $ 9.03-31.54 / Short interest (% of float): 0.5%; days to cover: 1.5 (the stock is currently on the short sale restriction list)

- Burning Rock Biotech Ltd (BNR), down 18.3% to $21.73 / YTD price return: -5.9% / 12-Month Price Range: $ 18.64-39.75 / Short interest (% of float): 1.8%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- Missfresh Ltd (MF), down 16.3% to $5.60 / 12-Month Price Range: $ 6.38-11.00 / Short interest (% of float): 0.5%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Rocket Pharmaceuticals Inc (RCKT), down 15.4% to $38.98 / YTD price return: -28.9% / 12-Month Price Range: $ 21.95-67.48 / Short interest (% of float): 13.2%; days to cover: 27.8 (the stock is currently on the short sale restriction list)

- Denali Therapeutics Inc (DNLI), down 15.3% to $54.14 / YTD price return: -35.4% / 12-Month Price Range: $ 22.75-93.94 / Short interest (% of float): 5.5%; days to cover: 7.1 (the stock is currently on the short sale restriction list)

- I-Mab (IMAB), down 14.1% to $62.93 / YTD price return: +33.5% / 12-Month Price Range: $ 28.29-85.40 / Short interest (% of float): 3.0%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

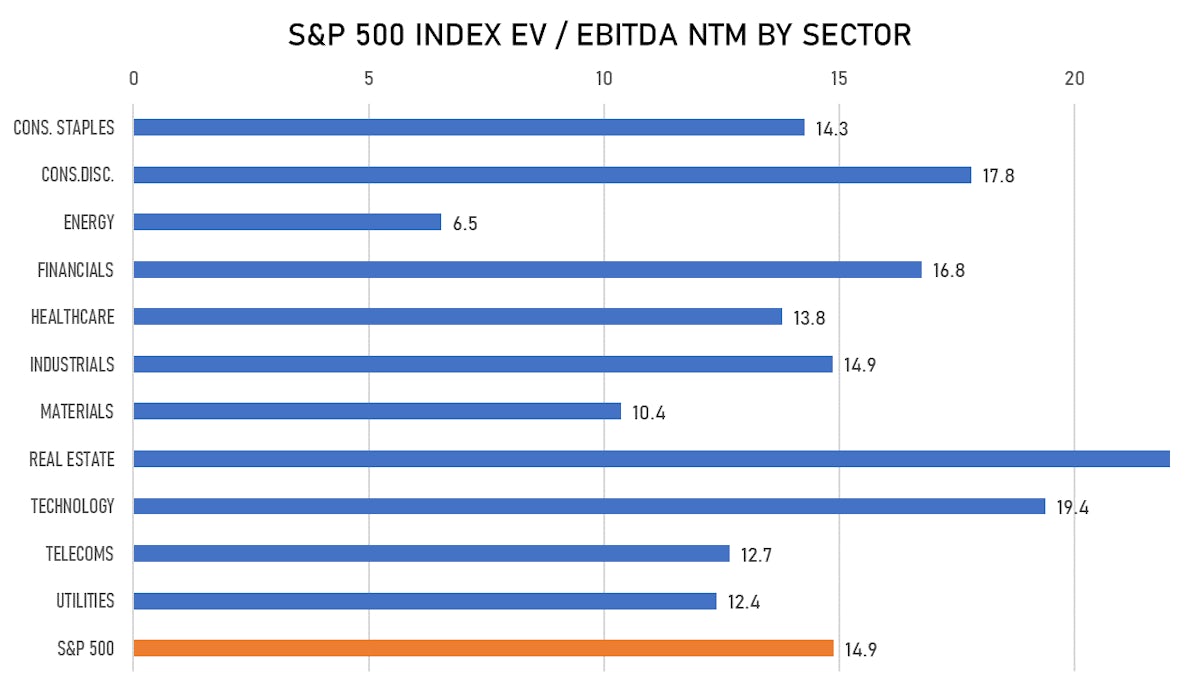

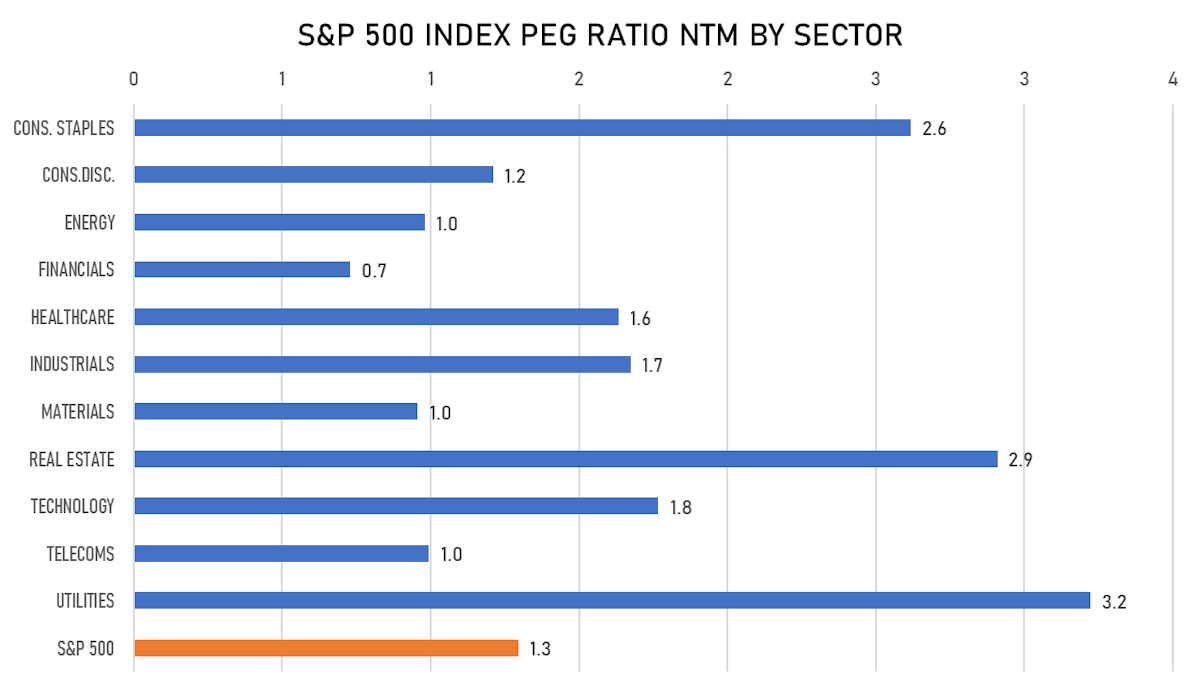

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Alpha Healthcare Acquisition Corp III / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ALPAU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: PJT Partners LP, Bofa Securities Inc

- BRK Ambiental Participacoes SA / Brazil - Energy and Power / Listing Exchange: BOVESPA / Ticker: - / Gross proceeds (including overallotment): US$ 576.86m (offering in Brazilian Real) / Bookrunners: Not Applicable

- Unifique Telecomunicacoes Ltda / Brazil - Telecommunications / Listing Exchange: BOVESPA / Ticker: FIQE3 / Gross proceeds (including overallotment): US$ 157.30m (offering in Brazilian Real) / Bookrunners: Banco Itau-BBA SA, Banco BTG Pactual SA, XP Investimentos

- XTC New Energy Materials (Xiamen) Co Ltd / China - Energy and Power / Listing Exchange: SSES / Ticker: 688778 / Gross proceeds (including overallotment): US$ 141.47m (offering in Chinese Yuan) / Bookrunners: Industrial Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- ThredUp Inc / United States of America - Retail / Listing Exchange: Nasdaq / Ticker: TDUP / Gross proceeds (including overallotment): US$ 176.93m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Morgan Stanley & Co LLC

- Jonjee Hi-Tech Industrial & Commercial Holding Co Ltd / China - Consumer Staples / Listing Exchange: Shanghai / Ticker: 600872 / Gross proceeds (including overallotment): US$ 1,202.18m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Li Auto Inc / China - Industrials / Listing Exchange: Hong Kong / Ticker: LI / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable