Equities

US Equities Follow Chinese Technology Stocks Down

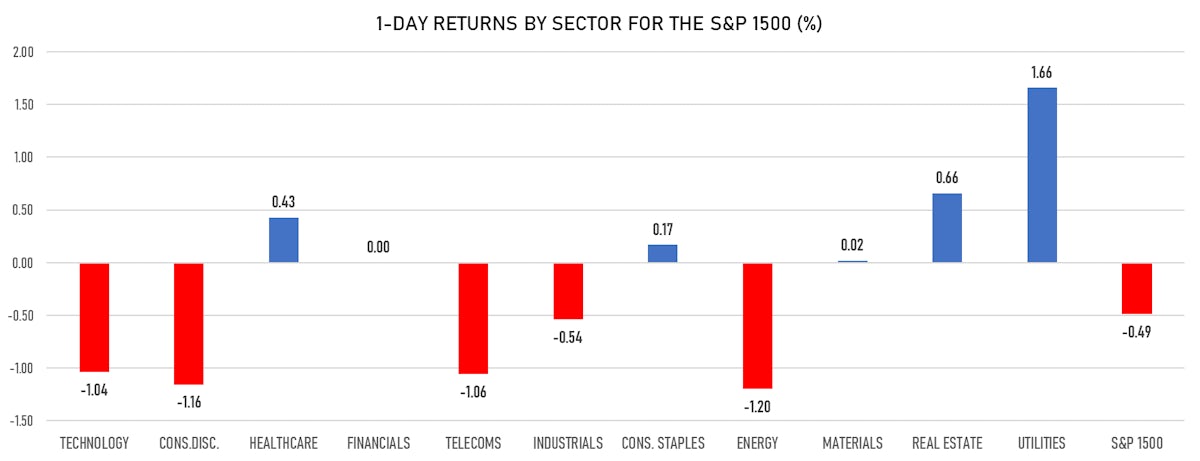

Utilities and real estate were the best-performing sectors with lower US interest rates today, and value overperformed growth

Published ET

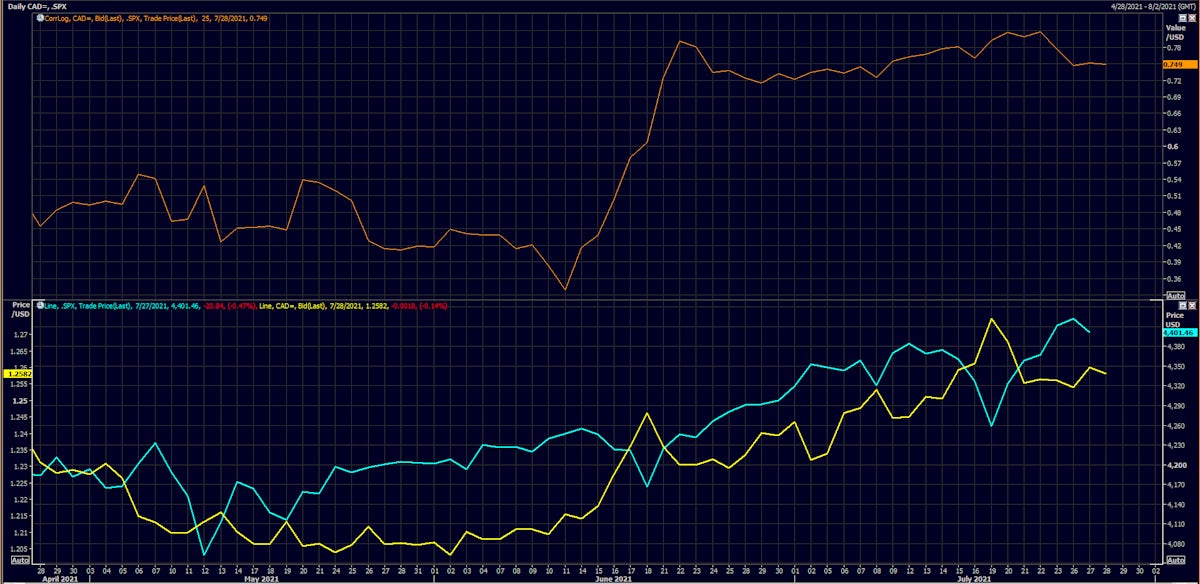

Recent log correlation between the S&P 500 and Canadian dollar Over 75% | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.47%; Nasdaq Composite down -1.21%; Wilshire 5000 down -0.64%

- 47.7% of S&P 500 stocks were up today, with 88.7% of stocks above their 200-day moving average (DMA) and 55.0% above their 50-DMA

- Top performing sectors in the S&P 500: utilities up 1.72% and real estate up 0.81%

- Bottom performing sectors in the S&P 500: consumer discretionary down -1.16% and telecoms down -1.06%

- The number of shares in the S&P 500 traded today was 532m for a total turnover of US$ 67 bn

- The S&P 500 Value Index was up 0.1%, while the S&P 500 Growth Index was down -0.9%; the S&P small caps index was down -0.9% and mid caps were down -0.6%

- The volume on CME's INX (S&P 500 Index) was 2.1m (3-month z-score: -0.1); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.54%; UK FTSE 100 down -0.42%; tonight in Asia, China CSI 300 down -0.61% and Japan's TOPIX 500 down -0.87%

VOLATILITY

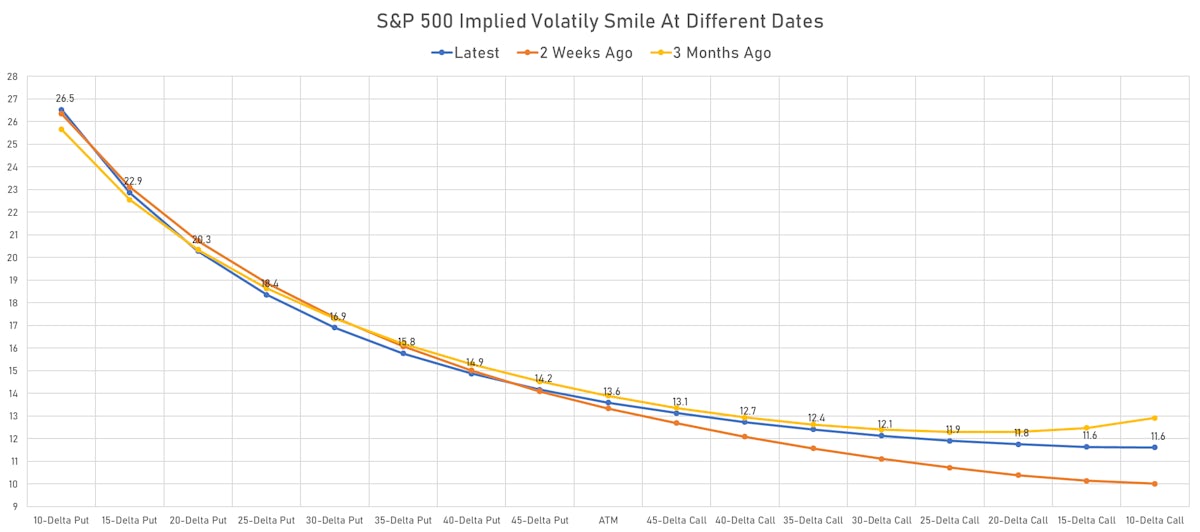

- 1-month at-the-money implied volatility on the S&P 500 at 13.6%, up from 12.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.4%, up from 12.1%

NOTABLE S&P 500 EARNINGS RELEASES

- Apple Inc (Technology): beat on EPS (1.30 act. vs. 1.01 est.) and beat on revenue (81,434m act. vs. 73,297m est.)

- Microsoft Corp (Technology): beat on EPS (2.17 act. vs. 1.92 est.) and beat on revenue (46,152m act. vs. 44,243m est.)

- Alphabet Inc (Technology): beat on EPS (27.26 act. vs. 19.34 est.) and beat on revenue (61,880m act. vs. 56,156m est.)

- Visa Inc (Technology): beat on EPS (1.49 act. vs. 1.35 est.) and beat on revenue (6,130m act. vs. 5,875m est.)

- United Parcel Service Inc (Industrials): beat on EPS (3.06 act. vs. 2.82 est.) and missed on revenue (23,142m act. vs. 23,243m est.)

- Starbucks Corp (Consumer Cyclicals): beat on EPS (1.01 act. vs. 0.78 est.) and beat on revenue (7,497m act. vs. 7,295m est.)

- Raytheon Technologies Corp (Industrials): beat on EPS (1.03 act. vs. 0.93 est.) and beat on revenue (15,880m act. vs. 15,836m est.)

- 3M Co (Consumer Non-Cyclicals): beat on EPS (2.59 act. vs. 2.28 est.) and beat on revenue (8,950m act. vs. 8,565m est.)

- General Electric Co (Consumer Non-Cyclicals): beat on EPS (0.05 act. vs. 0.03 est.) and missed on revenue (16,917m act. vs. 18,145m est.)

- Advanced Micro Devices Inc (Technology): beat on EPS (0.63 act. vs. 0.54 est.) and beat on revenue (3,850m act. vs. 3,622m est.)

- Stryker Corp (Healthcare): beat on EPS (2.25 act. vs. 2.13 est.) and beat on revenue (4,294m act. vs. 4,143m est.)

- Mondelez International Inc (Consumer Non-Cyclicals): missed on EPS (0.62 act. vs. 0.65 est.) and beat on revenue (6,642m act. vs. 6,424m est.)

- Sherwin-Williams Co (Basic Materials): missed on EPS (2.65 act. vs. 2.68 est.) and beat on revenue (5,380m act. vs. 5,380m est.)

- Fiserv Inc (Industrials): beat on EPS (1.37 act. vs. 1.28 est.) and beat on revenue (3,855m act. vs. 3,731m est.)

- Chubb Ltd (Financials): beat on EPS (3.62 act. vs. 3.01 est.) and beat on revenue (9,546m act. vs. 8,330m est.)

- Boston Scientific Corp (Healthcare): beat on EPS (0.40 act. vs. 0.37 est.) and beat on revenue (3,077m act. vs. 2,939m est.)

- Ecolab Inc (Basic Materials): beat on EPS (1.22 act. vs. 1.21 est.) and beat on revenue (3,163m act. vs. 3,117m est.)

- Waste Management Inc (Industrials): beat on EPS (1.27 act. vs. 1.19 est.) and beat on revenue (4,476m act. vs. 4,233m est.)

- MSCI Inc (Industrials): beat on EPS (2.45 act. vs. 2.30 est.) and beat on revenue (498m act. vs. 486m est.)

- IQVIA Holdings Inc (Healthcare): beat on EPS (2.13 act. vs. 2.08 est.) and beat on revenue (3,438m act. vs. 3,271m est.)

TOP WINNERS

- SGOCO Group Ltd (SGOC), up 29.6% to $11.00 / YTD price return: +658.6% / 12-Month Price Range: $ .77-29.00 / Short interest (% of float): 2.3%; days to cover: 0.1

- TAL Education Group (TAL), up 25.2% to $5.51 / YTD price return: -92.3% / 12-Month Price Range: $ 4.03-90.96 / Short interest (% of float): 3.6%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- US Physical Therapy Inc (USPH), up 17.4% to $119.50 / YTD price return: -.6% / 12-Month Price Range: $ 74.79-143.67 / Short interest (% of float): 5.1%; days to cover: 12.8

- Celestica Inc (CLS), up 15.3% to $8.60 / YTD price return: +6.6% / 12-Month Price Range: $ 5.77-9.38 / Short interest (% of float): 0.8%; days to cover: 2.7

- Inovalon Holdings Inc (INOV), up 13.0% to $36.95 / YTD price return: +103.4% / 12-Month Price Range: $ 17.56-34.47 / Short interest (% of float): 5.4%; days to cover: 11.9

- New Oriental Education & Technology Group Inc (EDU), up 12.9% to $2.19 / YTD price return: -88.2% / 12-Month Price Range: $ 1.94-19.97 / Short interest (% of float): 3.3%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Dingdong (Cayman) Ltd (DDL), up 12.4% to $22.40 / 12-Month Price Range: $ 18.87-46.00 / Short interest (% of float): 0.1%; days to cover: 0.2 (the stock is currently on the short sale restriction list)

- Repligen Corp (RGEN), up 9.9% to $226.38 / YTD price return: +18.1% / 12-Month Price Range: $ 135.23-228.84 / Short interest (% of float): 3.1%; days to cover: 4.5

- APi Group Corp (APG), up 9.4% to $22.26 / YTD price return: +22.6% / 12-Month Price Range: $ 12.74-23.26 / Short interest (% of float): 2.5%

- Aaron's Company Inc (AAN), up 8.7% to $30.13 / YTD price return: +58.9% / 12-Month Price Range: $ 16.20-37.49

BIGGEST LOSERS

- Faraday Future Intelligent Electric Inc (FFIE), down 17.0% to $11.45 / YTD price return: +14.5% / 12-Month Price Range: $ 9.65-20.75 / Short interest (% of float): 31.8%; days to cover: 7.6 (the stock is currently on the short sale restriction list)

- Waterdrop Inc (WDH), down 15.4% to $4.28 / 12-Month Price Range: $ 4.91-11.77 / Short interest (% of float): 0.1%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- AiHuiShou International Co Ltd (RERE), down 15.1% to $11.09 / 12-Month Price Range: $ 13.00-18.49 / Short interest (% of float): 0.0%; days to cover: 0.0 (the stock is currently on the short sale restriction list)

- Xpeng Inc (XPEV), down 14.8% to $34.70 / YTD price return: -19.0% / 12-Month Price Range: $ 17.11-74.49 / Short interest (% of float): 3.5%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Peabody Energy Corp (BTU), down 14.7% to $10.26 / YTD price return: +325.7% / 12-Month Price Range: $ .80-12.24 / Short interest (% of float): 10.2%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

- Futu Holdings Ltd (FUTU), down 14.5% to $98.74 / YTD price return: +115.8% / 12-Month Price Range: $ 27.15-204.25 / Short interest (% of float): 4.4%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

- Li Auto Inc (LI), down 13.9% to $26.48 / YTD price return: -8.2% / 12-Month Price Range: $ 14.31-47.70 (the stock is currently on the short sale restriction list)

- JinkoSolar Holding Co Ltd (JKS), down 13.8% to $46.24 / YTD price return: -25.3% / 12-Month Price Range: $ 18.56-90.20 / Short interest (% of float): 15.8%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- Smart Share Global Ltd (EM), down 13.7% to $4.16 / 12-Month Price Range: $ 4.69-10.00 / Short interest (% of float): 0.0%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Studio City International Holdings Ltd (MSC), down 13.6% to $9.75 / YTD price return: -17.9% / 12-Month Price Range: $ 8.53-27.00 / Short interest (% of float): 0.0%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

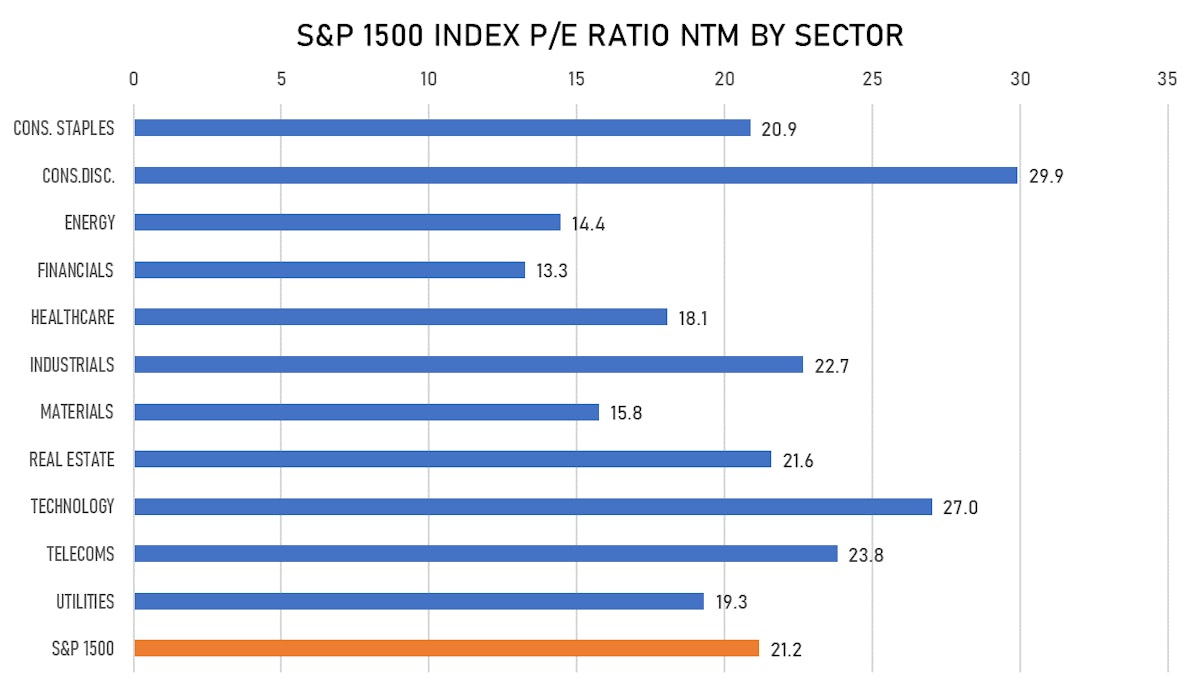

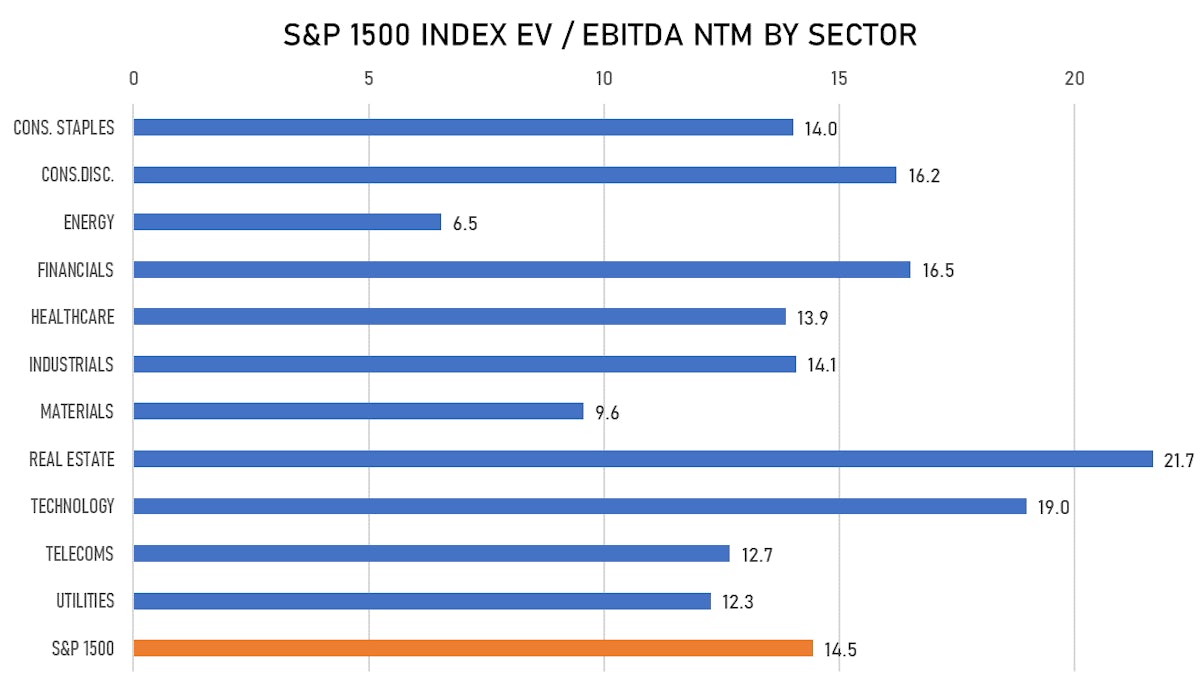

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Williams Rowland Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: WRAC.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Oppenheimer & Co Inc

- Alpha Healthcare Acquisition Corp III / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: ALPAU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: PJT Partners LP, Bofa Securities Inc

- Tanmiah Food Co / Saudi Arabia - Consumer Staples / Listing Exchange: Saudi Exch / Ticker: N/A / Gross proceeds (including overallotment): US$ 107.19m (offering in Saudi Arabian Riyal) / Bookrunners: Saudi Fransi Capital

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Ascential PLC / United Kingdom - Consumer Products and Services / Listing Exchange: London / Ticker: ASCL / Gross proceeds (including overallotment): US$ 211.88m (offering in British Pound) / Bookrunners: Numis Securities Ltd, JP Morgan Cazenove

- Anhui Great Wall Military Industry Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 601606 / Gross proceeds (including overallotment): US$ 123.41m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Hangzhou Huawang New Material Technology Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 605377 / Gross proceeds (including overallotment): US$ 111.07m (offering in Chinese Yuan) / Bookrunners: Not Applicable