Equities

US Equity Indices Mixed Today, With A Majority Of S&P 500 Stocks Closing Down

A number of large IPOs priced in the last couple of days, including a US$ 520bn offering from Duolingo (DUOL), which closed up 36% on its trading debut

Published ET

S&P 500 Market Cap By Sector | Sources: ϕpost, FactSet data

QUICK SUMMARY

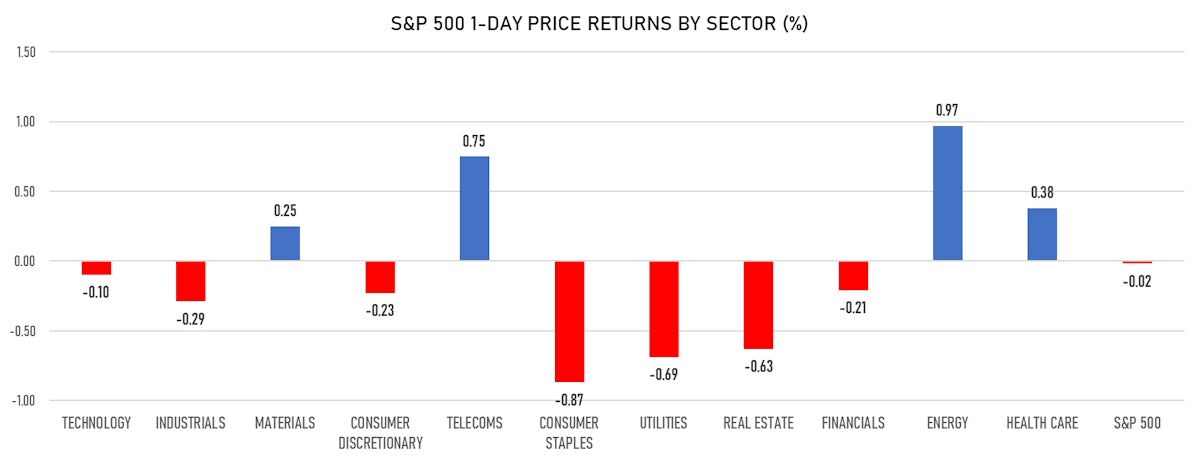

- Daily performance of US indices: S&P 500 down -0.02%; Nasdaq Composite up 0.70%; Wilshire 5000 up 0.19%

- 44.4% of S&P 500 stocks were up today, with 88.3% of stocks above their 200-day moving average (DMA) and 53.1% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 0.97% and telecoms up 0.75%

- Bottom performing sectors in the S&P 500: consumer staples down -0.87% and utilities down -0.69%

- The number of shares in the S&P 500 traded today was 534m for a total turnover of US$ 65 bn

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was up 0.1%; the S&P small caps index was up 0.8% and mid caps were up 0.7%

- The volume on CME's INX (S&P 500 Index) was 2.1m (3-month z-score: 0.0); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.66%; UK FTSE 100 up 0.29%; tonight in Asia, China CSI 300 down -0.03% and Japan's TOPIX 500 up 0.50%

NOTABLE S&P 500 EARNINGS RELEASES

- Facebook Inc (Technology): beat on EPS (3.61 act. vs. 2.37 est.) and beat on revenue (28,095m act. vs. 23,670m est.)

- PayPal Holdings Inc (Technology): beat on EPS (1.15 act. vs. 1.01 est.) and beat on revenue (6,238m act. vs. 5,904m est.)

- Pfizer Inc (Healthcare): beat on EPS (1.07 act. vs. 0.77 est.) and beat on revenue (18,977m act. vs. 13,509m est.)

- Thermo Fisher Scientific Inc (Healthcare): missed on EPS (5.60 act. vs. 6.65 est.) and missed on revenue (9,273m act. vs. 9,717m est.)

- Mcdonald's Corp (Consumer Cyclicals): beat on EPS (2.37 act. vs. 1.81 est.) and beat on revenue (5,888m act. vs. 5,032m est.)

- Qualcomm Inc (Technology): beat on EPS (1.92 act. vs. 1.67 est.) and beat on revenue (7,995m act. vs. 7,620m est.)

- Bristol-Myers Squibb Co (Healthcare): beat on EPS (1.93 act. vs. 1.82 est.) and beat on revenue (11,703m act. vs. 11,120m est.)

- Boeing Co (Industrials): beat on EPS (0.40 act. vs. -1.16 est.) and beat on revenue (16,998m act. vs. 15,024m est.)

- ServiceNow Inc (Technology): beat on EPS (1.42 act. vs. 1.34 est.) and beat on revenue (1,409m act. vs. 1,336m est.)

- Lam Research Corp (Technology): beat on EPS (8.09 act. vs. 6.62 est.) and beat on revenue (4,145m act. vs. 3,696m est.)

- Automatic Data Processing Inc (Technology): missed on EPS (1.20 act. vs. 1.82 est.) and missed on revenue (3,737m act. vs. 4,084m est.)

- CME Group Inc (Financials): missed on EPS (1.64 act. vs. 1.75 est.) and missed on revenue (1,179m act. vs. 1,257m est.)

- Equinix Inc (Real Estate): missed on EPS (0.76 act. vs. 1.71 est.) and beat on revenue (1,658m act. vs. 1,597m est.)

- Moody's Corp (Industrials): beat on EPS (3.22 act. vs. 2.82 est.) and beat on revenue (1,553m act. vs. 1,433m est.)

- Norfolk Southern Corp (Industrials): beat on EPS (3.28 act. vs. 2.54 est.) and beat on revenue (2,800m act. vs. 2,616m est.)

- Humana Inc (Healthcare): missed on EPS (6.89 act. vs. 7.06 est.) and beat on revenue (20,645m act. vs. 20,496m est.)

- General Dynamics Corp (Industrials): beat on EPS (2.61 act. vs. 2.30 est.) and beat on revenue (9,220m act. vs. 8,884m est.)

- Ford Motor Co (Consumer Cyclicals): missed on EPS (0.13 act. vs. 0.21 est.) and missed on revenue (26,752m act. vs. 32,227m est.)

- Align Technology Inc (Healthcare): beat on EPS (3.04 act. vs. 2.02 est.) and beat on revenue (1,011m act. vs. 818m est.)

- TE Connectivity Ltd (Industrials): beat on EPS (1.79 act. vs. 1.48 est.) and beat on revenue (3,845m act. vs. 3,519m est.)

VOLATILITY

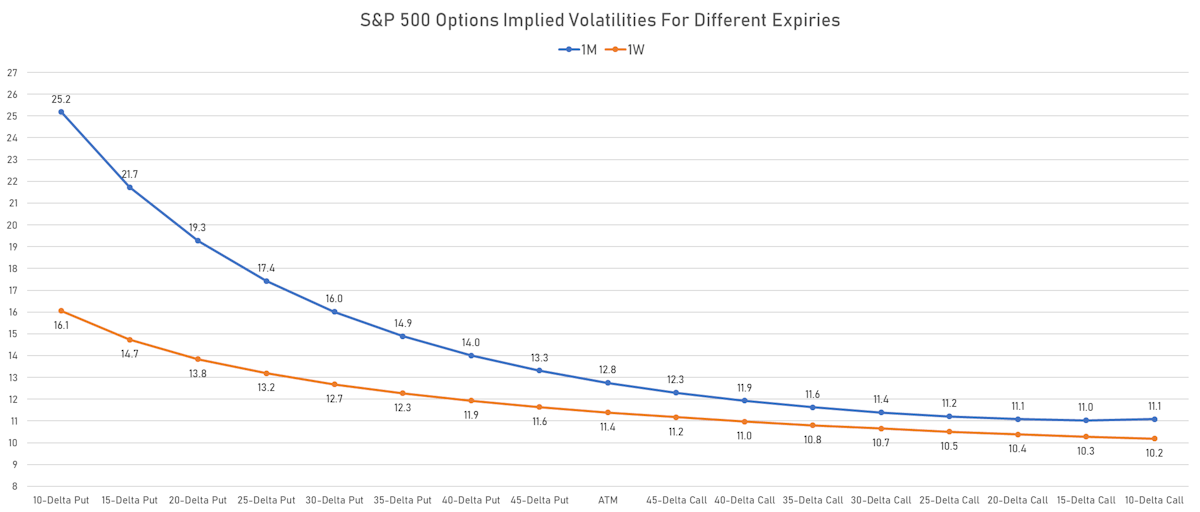

- 1-month at-the-money implied volatility on the S&P 500 at 12.8%, down from 13.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 12.5%, up from 12.4%

TOP WINNERS

- Duolingo Inc (DUOL), up 36.3% to $139.01 on its post-IPO trading debut

- Youdao Inc (DAO), up 30.0% to $9.44 / YTD price return: -64.4% / 12-Month Price Range: $ 7.02-47.70 / Short interest (% of float): 2.9%; days to cover: 2.4 (the stock is currently on the short sale restriction list)

- Tilray Inc (TLRY), up 25.8% to $16.01 / YTD price return: +93.8% / 12-Month Price Range: $ 4.41-67.00 / Short interest (% of float): 7.4%; days to cover: 1.2

- Aurinia Pharmaceuticals Inc (AUPH), up 23.8% to $14.24 / YTD price return: +3.0% / 12-Month Price Range: $ 9.72-20.50 / Short interest (% of float): 11.4%; days to cover: 4.5

- Zai Lab Ltd (ZLAB), up 23.0% to $142.63 / YTD price return: +5.4% / 12-Month Price Range: $ 71.79-193.54 / Short interest (% of float): 3.0%; days to cover: 5.3

- I-Mab (IMAB), up 21.5% to $73.76 / YTD price return: +56.4% / 12-Month Price Range: $ 28.29-85.40 / Short interest (% of float): 3.0%; days to cover: 2.9

- Canaan Inc (CAN), up 18.4% to $7.07 / YTD price return: +19.2% / 12-Month Price Range: $ 1.80-39.10 / Short interest (% of float): 5.4%; days to cover: 0.9

- MINISO Group Holding Ltd (MNSO), up 17.8% to $17.68 / YTD price return: -33.0% / 12-Month Price Range: $ 14.82-35.21 / Short interest (% of float): 1.0%; days to cover: 2.8 (the stock is currently on the short sale restriction list)

- UP Fintech Holding Ltd (TIGR), up 17.4% to $17.06 / YTD price return: +114.9% / 12-Month Price Range: $ 4.30-38.50 / Short interest (% of float): 4.1%; days to cover: 0.5

- 21Vianet Group Inc (VNET), up 17.1% to $17.15 / YTD price return: -50.6% / 12-Month Price Range: $ 14.11-44.45 / Short interest (% of float): 5.4%; days to cover: 2.9

BIGGEST LOSERS

- Newegg Commerce Inc (NEGG), down 15.4% to $19.85 / YTD price return: +378.3% / 12-Month Price Range: $ 2.76-79.07 / Short interest (% of float): 11.5%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Cheesecake Factory Inc (CAKE), down 13.2% to $47.75 / YTD price return: +28.8% / 12-Month Price Range: $ 22.75-65.81 / Short interest (% of float): 12.9%; days to cover: 4.1 (the stock is currently on the short sale restriction list)

- Monro Inc (MNRO), down 11.0% to $56.59 / YTD price return: +6.2% / 12-Month Price Range: $ 39.39-72.67 / Short interest (% of float): 8.8%; days to cover: 16.8 (the stock is currently on the short sale restriction list)

- Berkshire Grey Inc (BGRY), down 10.3% to $8.52 / 12-Month Price Range: $ 8.50-13.45 / Short interest (% of float): 5.7%; days to cover: 4.6 (the stock is currently on the short sale restriction list)

- Evolv Technologies Holdings Inc (EVLV), down 10.0% to $8.21 / YTD price return: -18.0% / 12-Month Price Range: $ 8.09-12.90 / Short interest (% of float): 0.3%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Applied Molecular Transport Inc. (AMTI), down 8.3% to $29.36 / YTD price return: -4.6% / 12-Month Price Range: $ 20.50-78.22 / Short interest (% of float): 10.6%; days to cover: 16.2

- Snap One Holdings Corp (SNPO), down 8.1% to $16.55 on its trading debut

- Ree Automotive Holding Inc (REE), down 7.7% to $9.20 / 12-Month Price Range: $ 9.45-16.66 / Short interest (% of float): 1.0%; days to cover: 11.1 (the stock is currently on the short sale restriction list)

- Affiliated Managers Group Inc (AMG), down 7.0% to $155.83 / YTD price return: +53.2% / 12-Month Price Range: $ 62.19-180.97 / Short interest (% of float): 2.6%; days to cover: 3.7

- Bloomin' Brands Inc (BLMN), down 6.6% to $24.94 / YTD price return: +28.4% / 12-Month Price Range: $ 10.34-32.81 / Short interest (% of float): 14.7%; days to cover: 7.8

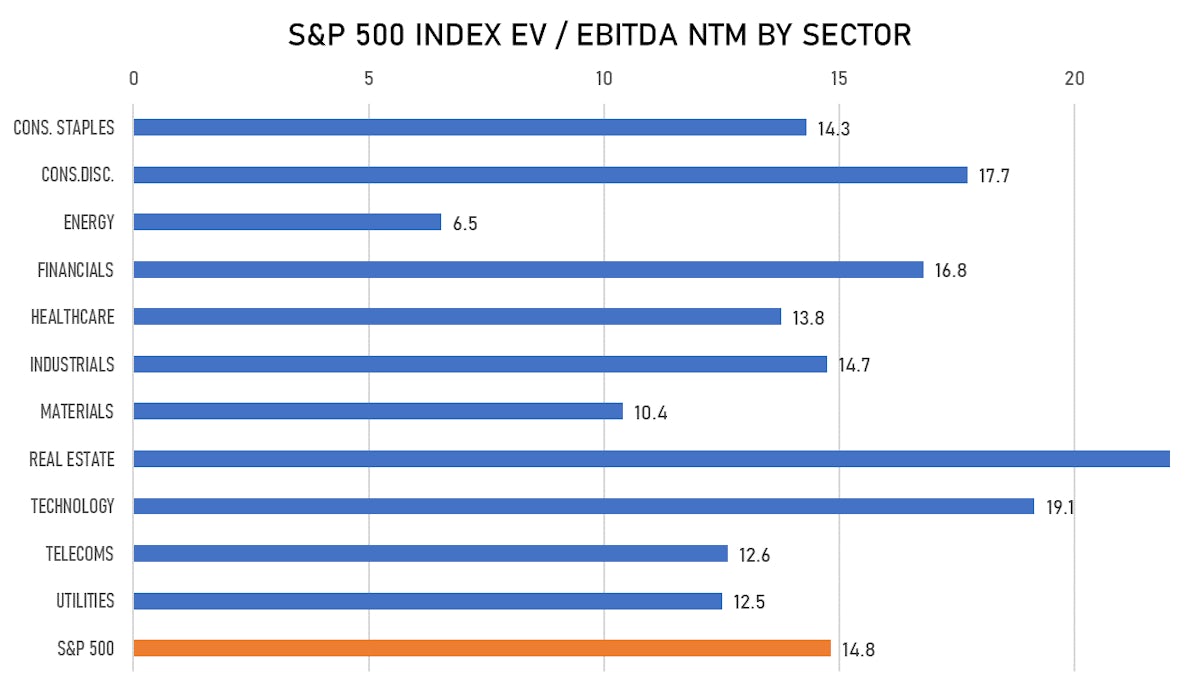

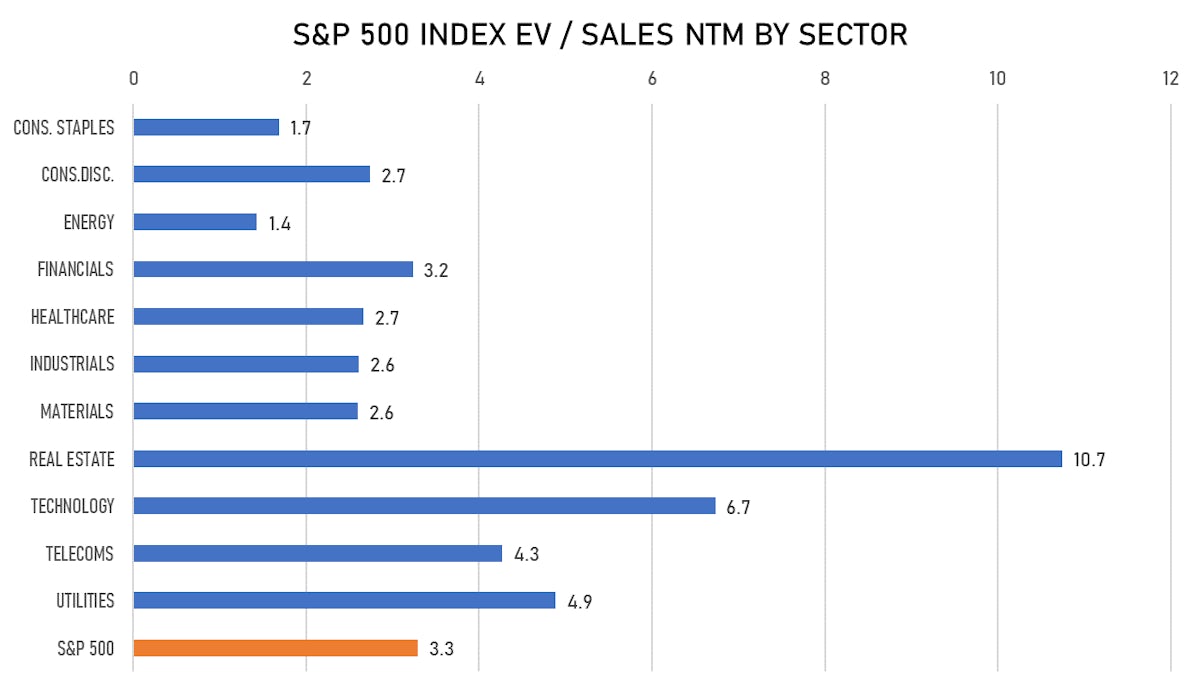

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- PowerSchool Holdings Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: PWSC / Gross proceeds (including overallotment): US$ 710.53m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Credit Suisse Securities (USA) LLC, RBC Capital Markets LLC, Macquarie Capital (USA) Inc, Jefferies LLC, BofA Securities Inc, Barclays Capital Inc, UBS Securities LLC

- Duolingo Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: DUOL / Gross proceeds (including overallotment): US$ 520.82m (offering in U.S. Dollar) / Bookrunners: Allen & Co Inc, Goldman Sachs & Co, William Blair & Co, Evercore Group, BofA Securities Inc, Barclays Capital Inc

- MeridianLink Inc / United States of America - High Technology / Listing Exchange: New York / Ticker: MLNK / Gross proceeds (including overallotment): US$ 343.20m (offering in U.S. Dollar) / Bookrunners: Raymond James & Associates Inc, Citigroup Global Markets Inc, Credit Suisse Securities (USA) LLC, BofA Securities Inc, Barclays Capital Inc

- Snap One Holdings Corp / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: SNPO / Gross proceeds (including overallotment): US$ 249.30m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Morgan Stanley & Co LLC, JP Morgan Securities LLC, UBS Securities LLC

- Da32 Life Science Tech Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: DALS / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, JP Morgan Securities LLC

- HK innoN Corp / South Korea - Healthcare / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 284.42m (offering in Korean Won) / Bookrunners: JP Morgan & Co Inc, Samsung Securities Co Ltd, Korea Investment & Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Independence Realty Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: IRT / Gross proceeds (including overallotment): US$ 248.50m (offering in U.S. Dollar) / Bookrunners: Robert W Baird & Co Inc, Citigroup Global Markets Inc, BMO Capital Markets, KeyBanc Capital Markets Inc, Jefferies LLC, Bofa Securities Inc, Barclays Capital Inc, Capital One Securities Inc, Truist Securities Inc

- Ascential PLC / United Kingdom - Consumer Products and Services / Listing Exchange: London / Ticker: ASCL / Gross proceeds (including overallotment): US$ 212.77m (offering in British Pound) / Bookrunners: Numis Securities Ltd, JP Morgan Cazenove

- Anhui Great Wall Military Industry Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 601606 / Gross proceeds (including overallotment): US$ 122.88m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- TietoEVRY Oyj / Finland - High Technology / Listing Exchange: OMXHelsink / Ticker: TIETO / Gross proceeds (including overallotment): US$ 115.78m (offering in EURO) / Bookrunners: Morgan Stanley & Co. International plc

- Hangzhou Huawang New Material Technology Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 605377 / Gross proceeds (including overallotment): US$ 110.59m (offering in Chinese Yuan) / Bookrunners: Not Applicable