Equities

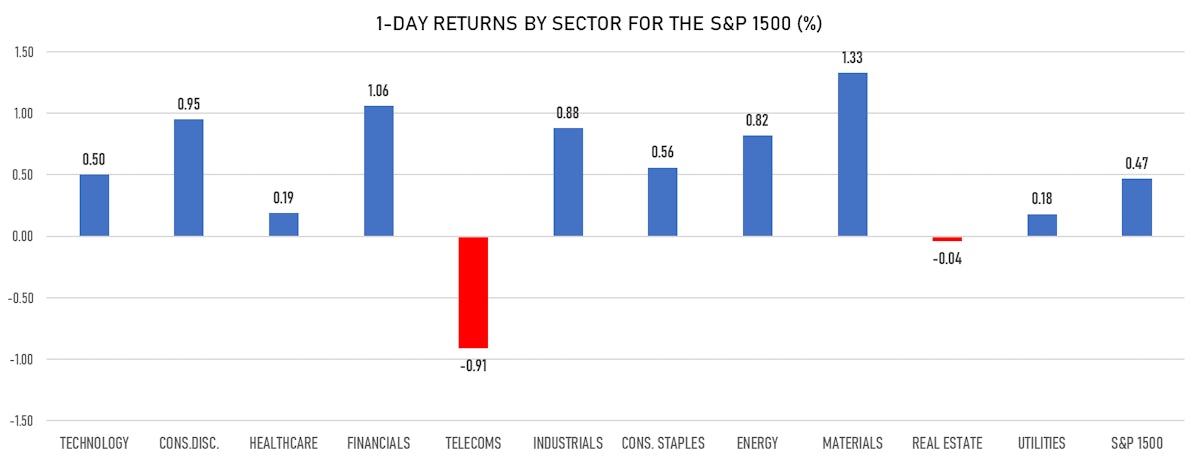

US Equity Indices Rise, Led By Materials And Financials

A mixed bag for today's IPOs: Robinhood was (unsurprisingly) priced too high and dropped 8.4% on its debut, while Icosavax was priced too low and rose 133%

Published ET

S&P 500 Options Less Skewed To The Downside Than Before The Start Of Earnings Season | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.42%; Nasdaq Composite up 0.11%; Wilshire 5000 up 0.38%

- 77.0% of S&P 500 stocks were up today, with 88.7% of stocks above their 200-day moving average (DMA) and 58.2% above their 50-DMA

- Top performing sectors in the S&P 500: materials up 1.08% and financials up 1.07%

- Bottom performing sectors in the S&P 500: telecoms down -0.91% and real estate down -0.24%

- The number of shares in the S&P 500 traded today was 492m for a total turnover of US$ 63 bn

- The S&P 500 Value Index was up 0.7%, while the S&P 500 Growth Index was up 0.2%; the S&P small caps index was up 1.2% and mid caps were up 1.0%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: -0.3); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.46%; UK FTSE 100 up 0.88%; tonight in Asia, China CSI 300 down -1.65% and Japan's TOPIX 500 down -1.10%

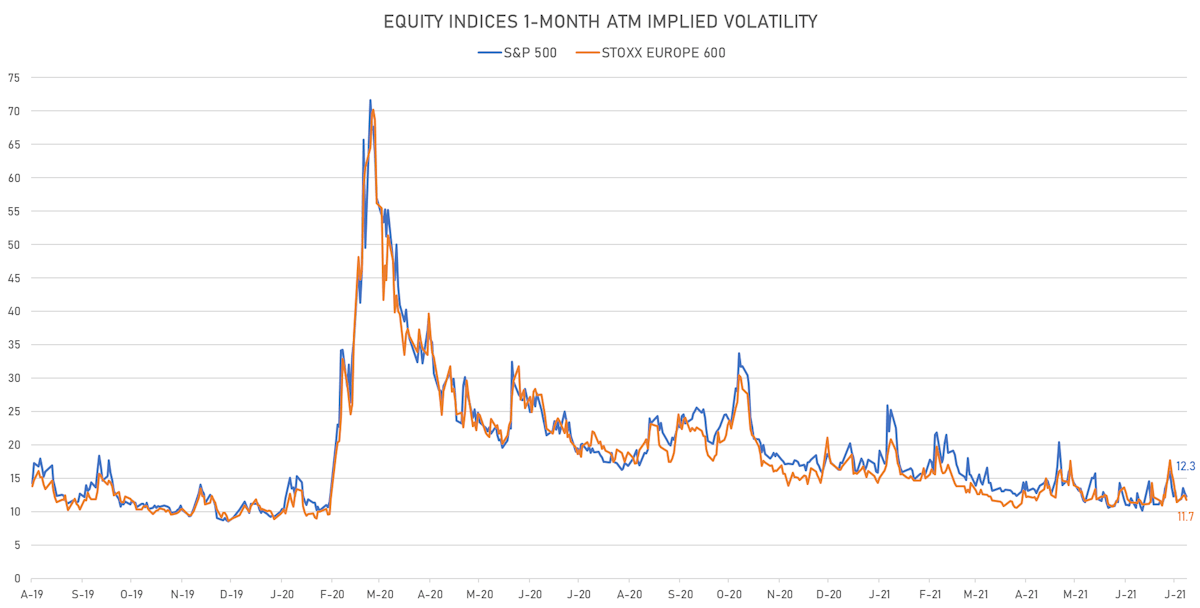

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.3%, down from 12.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.7%, down from 12.5%

NOTABLE S&P 500 EARNINGS RELEASES

- Amazon.com Inc (Consumer Cyclicals): beat on EPS (15.12 act. vs. 12.30 est.) and missed on revenue (113,080m act. vs. 115,201m est.)

- Mastercard Inc (Technology): beat on EPS (1.95 act. vs. 1.75 est.) and beat on revenue (4,528m act. vs. 4,366m est.)

- Comcast Corp (Consumer Cyclicals): beat on EPS (0.84 act. vs. 0.67 est.) and beat on revenue (28,546m act. vs. 27,175m est.)

- Merck & Co Inc (Healthcare): beat on EPS (1.31 act. vs. 1.31 est.) and beat on revenue (11,402m act. vs. 11,095m est.)

- T-Mobile US Inc (Technology): beat on EPS (0.78 act. vs. 0.53 est.) and beat on revenue (19,950m act. vs. 19,344m est.)

- American Tower Corp (Real Estate): beat on EPS (1.65 act. vs. 1.29 est.) and beat on revenue (2,299m act. vs. 2,206m est.)

- S&P Global Inc (Industrials): beat on EPS (3.62 act. vs. 3.27 est.) and beat on revenue (2,106m act. vs. 1,994m est.)

- Altria Group Inc (Consumer Non-Cyclicals): beat on EPS (1.23 act. vs. 1.18 est.) and beat on revenue (5,614m act. vs. 5,378m est.)

- Gilead Sciences Inc (Healthcare): beat on EPS (1.87 act. vs. 1.73 est.) and beat on revenue (6,217m act. vs. 6,070m est.)

- Edwards Lifesciences Corp (Healthcare): beat on EPS (0.64 act. vs. 0.47 est.) and beat on revenue (1,376m act. vs. 1,164m est.)

- Southern Co (Utilities): beat on EPS (0.84 act. vs. 0.79 est.) and beat on revenue (5,198m act. vs. 5,045m est.)

- Intercontinental Exchange Inc (Financials): beat on EPS (1.16 act. vs. 1.16 est.) and beat on revenue (1,707m act. vs. 1,707m est.)

- Northrop Grumman Corp (Industrials): beat on EPS (6.42 act. vs. 5.84 est.) and beat on revenue (9,151m act. vs. 8,769m est.)

- Vertex Pharmaceuticals Inc (Healthcare): beat on EPS (3.11 act. vs. 2.51 est.) and beat on revenue (1,793m act. vs. 1,718m est.)

- KLA Corp (Technology): beat on EPS (4.43 act. vs. 3.99 est.) and beat on revenue (1,925m act. vs. 1,873m est.)

- Carrier Global Corp (Industrials): beat on EPS (0.64 act. vs. 0.55 est.) and beat on revenue (5,440m act. vs. 4,936m est.)

- T Rowe Price Group Inc (Financials): beat on EPS (3.31 act. vs. 3.21 est.) and beat on revenue (1,929m act. vs. 1,898m est.)

- Dexcom Inc (Healthcare): beat on EPS (0.76 act. vs. 0.44 est.) and beat on revenue (595m act. vs. 551m est.)

- Fortinet Inc (Technology): beat on EPS (0.95 act. vs. 0.74 est.) and beat on revenue (801m act. vs. 681m est.)

- Digital Realty Trust Inc (Real Estate): beat on EPS (0.45 act. vs. 0.29 est.) and beat on revenue (1,093m act. vs. 1,051m est.)

TOP WINNERS

- LendingClub Corp (LC), up 47.8% to $24.02 / YTD price return: +127.5% / 12-Month Price Range: $ 4.32-22.68

- Riskified Ltd (RSKD), up 23.8% to $26.00 on its trading debut

- Traeger Inc (COOK), up 22.2% to $22.00 on its trading debut

- Absci Corp (ABSI), up 16.5% to $28.54 / 12-Month Price Range: $ 20.88-24.81

- Uxin Ltd (UXIN), up 16.0% to $3.77 / YTD price return: +332.1% / 12-Month Price Range: $ .72-5.82 / Short interest (% of float): 3.7%; days to cover: 1.1

- Tempur Sealy International Inc (TPX), up 15.4% to $43.44 / YTD price return: +60.6% / 12-Month Price Range: $ 18.80-42.60

- Dream Finders Homes Inc (DFH), up 15.0% to $24.12 / 12-Month Price Range: $ 17.55-36.60

- Gentherm Inc (THRM), up 12.9% to $81.48 / YTD price return: +24.9% / 12-Month Price Range: $ 38.19-81.98

- Maxlinear Inc (MXL), up 12.3% to $48.15 / YTD price return: +26.1% / 12-Month Price Range: $ 20.91-44.05 / Short interest (% of float): 3.5%; days to cover: 5.5

- Clear Channel Outdoor Holdings Inc (CCO), up 11.7% to $2.67 / YTD price return: +61.8% / 12-Month Price Range: $ .86-3.05

BIGGEST LOSERS

- Cassava Sciences Inc (SAVA), down 23.6% to $103.35 / YTD price return: +1,415.4% / 12-Month Price Range: $ 2.78-142.75 (the stock is currently on the short sale restriction list)

- Alector Inc (ALEC), down 21.1% to $24.07 / YTD price return: +59.1% / 12-Month Price Range: $ 9.12-43.32 (the stock is currently on the short sale restriction list)

- 360 DigiTech Inc (QFIN), down 17.4% to $21.98 / YTD price return: +86.5% / 12-Month Price Range: $ 9.67-45.00 / Short interest (% of float): 3.3%; days to cover: 0.8 (the stock is currently on the short sale restriction list)

- Nikola Corporation (NKLA), down 15.2% to $12.03 / YTD price return: -21.3% / 12-Month Price Range: $ 9.37-54.56 (the stock is currently on the short sale restriction list)

- Anavex Life Sciences Corp (AVXL), down 14.4% to $18.29 / YTD price return: +238.7% / 12-Month Price Range: $ 3.65-31.50 (the stock is currently on the short sale restriction list)

- Ke Holdings Inc (BEKE), down 13.7% to $23.15 / YTD price return: -62.4% / 12-Month Price Range: $ 21.50-79.40 / Short interest (% of float): 1.4%; days to cover: 2.1 (the stock is currently on the short sale restriction list)

- Citrix Systems Inc (CTXS), down 13.6% to $99.00 / YTD price return: -23.9% / 12-Month Price Range: $ 111.26-148.47 / Short interest (% of float): 1.9%; days to cover: 2.2 (the stock is currently on the short sale restriction list)

- Cimpress PLC (CMPR), down 11.0% to $104.02 / YTD price return: +18.6% / 12-Month Price Range: $ 68.27-128.87 / Short interest (% of float): 3.9%; days to cover: 7.6 (the stock is currently on the short sale restriction list)

- EQT Corp (EQT), down 9.9% to $18.69 / YTD price return: +46.9% / 12-Month Price Range: $ 12.27-23.24 / Short interest (% of float): 5.5%; days to cover: 4.0 (the stock is currently on the short sale restriction list)

- Danimer Scientific Inc (DNMR), down 9.9% to $16.74 / YTD price return: -28.8% / 12-Month Price Range: $ 9.75-66.30 (the stock is currently on the short sale restriction list)

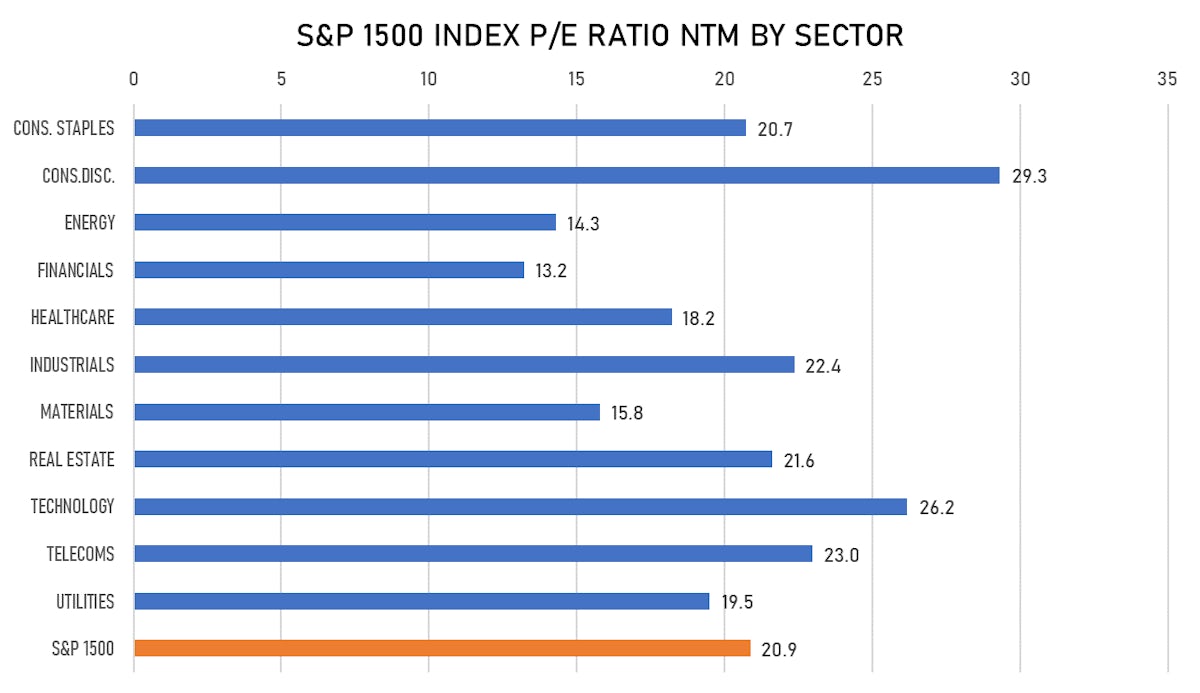

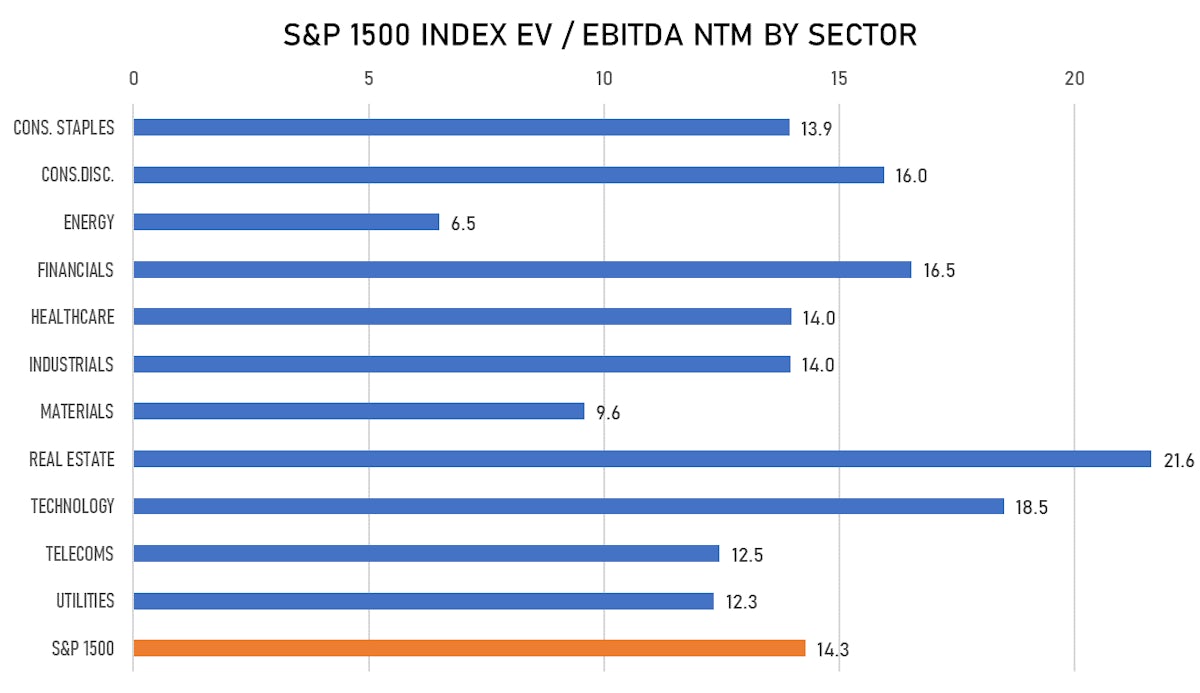

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Robinhood Markets Inc / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: HOOD / Gross proceeds (including overallotment): US$ 2,090.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC

- Traeger Inc / United States of America - Consumer Staples / Listing Exchange: New York / Ticker: COOK / Gross proceeds (including overallotment): US$ 423.53m (offering in U.S. Dollar) / Bookrunners: Robert W Baird & Co Inc, William Blair & Co, Jefferies LLC, Morgan Stanley & Co LLC

- Metals Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: MTAL.U / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Citigroup Global Markets Inc

- Software Acquisition Group Inc III / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: SWAGU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC

- International Media Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: IMAQU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Chardan Capital Markets LLC

- Icosavax Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: ICVX / Gross proceeds (including overallotment): US$ 182.00m (offering in U.S. Dollar) / Bookrunners: William Blair & Co, Evercore Group, Cowen & Co, Jefferies LLC

- Krafton Inc / South Korea - High Technology / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 2,060.73m (offering in U.S. Dollar) / Bookrunners: Credit Suisse, JP Morgan & Co Inc, Samsung Securities Co Ltd, Citigroup Global Markets Inc, NH Investment & Securities Co, Mirae Asset Daewoo Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Nusasiri PCL / Thailand - Real Estate / Listing Exchange: Thailand / Ticker: NUSA / Gross proceeds (including overallotment): US$ 691.44m (offering in Thai Baht) / Bookrunners: Not Applicable

- CNSIG Inner Mongolia Chemical Industry Co Ltd / China - Materials / Listing Exchange: Shanghai / Ticker: 600328 / Gross proceeds (including overallotment): US$ 431.40m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- PointsBet Holdings Ltd / Australia - Media and Entertainment / Listing Exchange: Australia / Ticker: PBH / Gross proceeds (including overallotment): US$ 158.63m (offering in Australian Dollar) / Bookrunners: Goldman Sachs (Australia), MST Financial Services Pty Ltd