Equities

US Equities Fall On Friday, S&P 500 Still Up 2.2% For The Month

Small overperformance of value over growth and midcaps over large caps on decent volume to close the week

Published ET

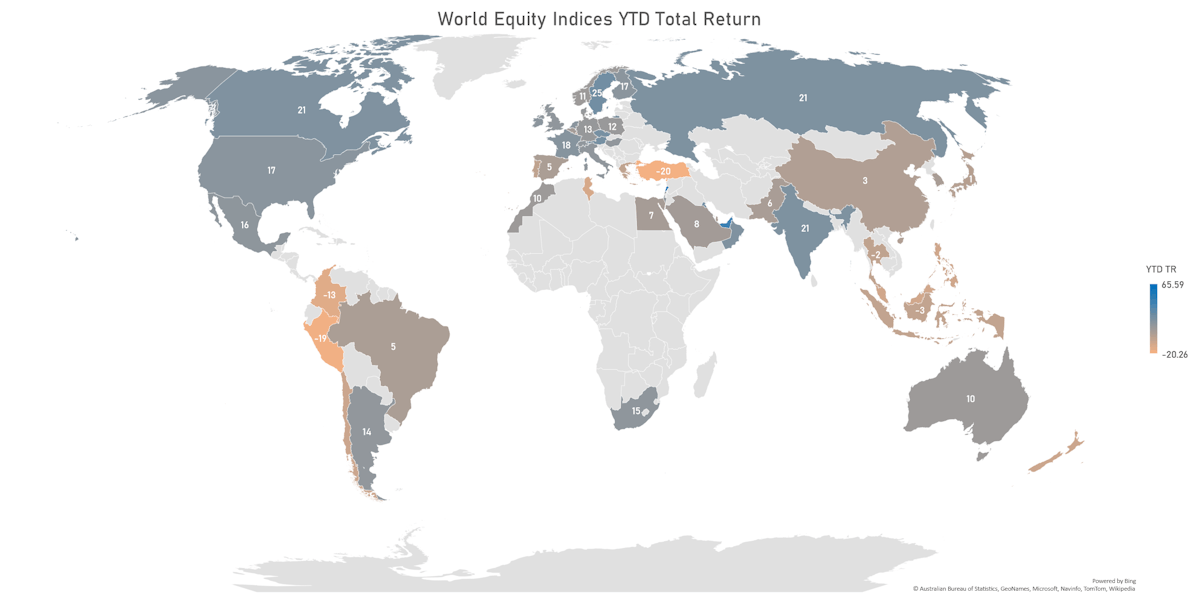

FactSet Country Indices Year-To-Date Total Returns (USD) | Sources: ϕpost, FactSet data

QUICK SUMMARY

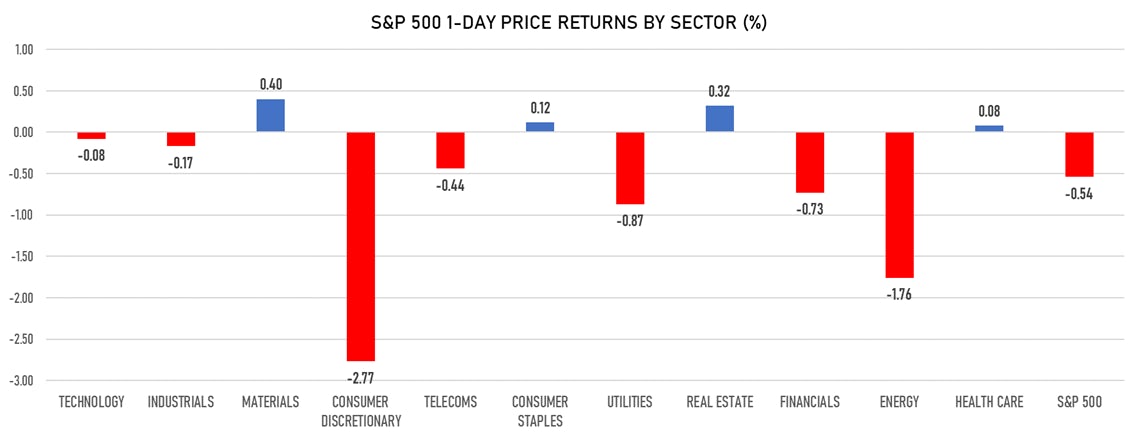

- Daily performance of US indices: S&P 500 down -0.54%; Nasdaq Composite down -0.71%; Wilshire 5000 down -0.64%

- 42.0% of S&P 500 stocks were up today, with 87.3% of stocks above their 200-day moving average (DMA) and 55.0% above their 50-DMA

- Top performing sectors in the S&P 500: materials up 0.40% and real estate up 0.32%

- Bottom performing sectors in the S&P 500: consumer discretionary down -2.77% and energy down -1.76%

- The number of shares in the S&P 500 traded today was 705m for a total turnover of US$ 81 bn

- The S&P 500 Value Index was down -0.4%, while the S&P 500 Growth Index was down -0.6%; the S&P small caps index was down -0.3% and mid caps were down -0.1%

- The volume on CME's INX (S&P 500 Index) was 2.2m (3-month z-score: 0.4); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 down -0.45%; UK FTSE 100 down -0.65%; China CSI 300 down -0.81%; Japan's TOPIX 500 down -1.37%

VOLATILITY

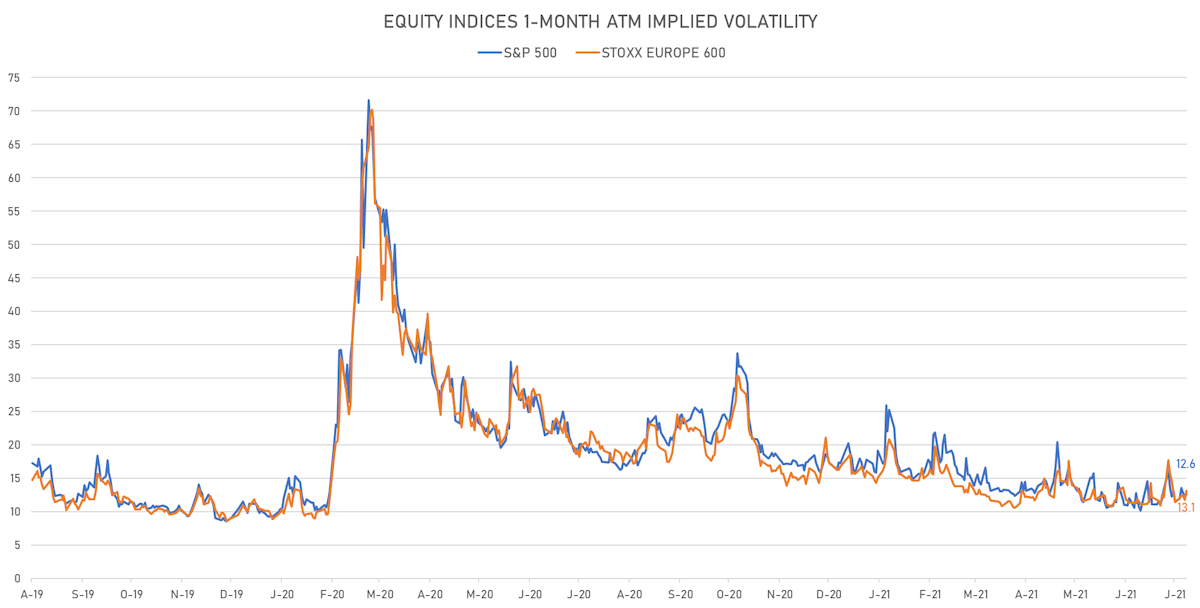

- 1-month at-the-money implied volatility on the S&P 500 at 12.6%, up from 12.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 13.1%, up from 11.7%

NOTABLE S&P 500 EARNINGS RELEASES

- Procter & Gamble Co (Consumer Non-Cyclicals): beat on EPS (1.13 act. vs. 1.08 est.) and beat on revenue (18,946m act. vs. 18,407m est.)

- Exxon Mobil Corp (Energy): beat on EPS (1.10 act. vs. 0.99 est.) and beat on revenue (67,742m act. vs. 66,808m est.)

- Abbvie Inc (Healthcare): beat on EPS (3.11 act. vs. 3.09 est.) and beat on revenue (13,959m act. vs. 13,637m est.)

- Chevron Corp (Energy): beat on EPS (1.71 act. vs. 1.59 est.) and beat on revenue (37,597m act. vs. 35,941m est.)

- Charter Communications Inc (Technology): beat on EPS (5.29 act. vs. 4.78 est.) and beat on revenue (12,802m act. vs. 12,612m est.)

- Linde PLC (Basic Materials): beat on EPS (2.70 act. vs. 2.54 est.) and beat on revenue (7,584m act. vs. 7,347m est.)

- Caterpillar Inc (Industrials): beat on EPS (2.60 act. vs. 2.40 est.) and beat on revenue (12,889m act. vs. 12,580m est.)

- Illinois Tool Works Inc (Consumer Non-Cyclicals): beat on EPS (2.10 act. vs. 2.09 est.) and beat on revenue (3,676m act. vs. 3,567m est.)

- Colgate-Palmolive Co (Consumer Non-Cyclicals): beat on EPS (0.80 act. vs. 0.80 est.) and beat on revenue (4,260m act. vs. 4,246m est.)

- Aon PLC (Financials): beat on EPS (2.29 act. vs. 1.86 est.) and beat on revenue (2,886m act. vs. 2,693m est.)

- IDEXX Laboratories Inc (Healthcare): beat on EPS (2.34 act. vs. 2.03 est.) and beat on revenue (826m act. vs. 786m est.)

- Johnson Controls International PLC (Industrials): missed on EPS (0.83 act. vs. 0.83 est.) and beat on revenue (6,344m act. vs. 6,256m est.)

- LyondellBasell Industries NV (Basic Materials): beat on EPS (6.13 act. vs. 5.57 est.) and beat on revenue (11,561m act. vs. 11,056m est.)

- VF Corp (Consumer Cyclicals): beat on EPS (0.27 act. vs. 0.11 est.) and beat on revenue (2,195m act. vs. 2,156m est.)

- Weyerhaeuser Co (Real Estate): missed on EPS (1.37 act. vs. 1.41 est.) and beat on revenue (3,144m act. vs. 3,091m est.)

- Cerner Corp (Healthcare): beat on EPS (0.80 act. vs. 0.76 est.) and beat on revenue (1,457m act. vs. 1,439m est.)

- W W Grainger Inc (Industrials): missed on EPS (4.27 act. vs. 4.61 est.) and missed on revenue (3,207m act. vs. 3,224m est.)

- Church & Dwight Co Inc (Consumer Non-Cyclicals): beat on EPS (0.76 act. vs. 0.70 est.) and beat on revenue (1,271m act. vs. 1,259m est.)

- Cboe Global Markets Inc (Financials): beat on EPS (1.38 act. vs. 1.36 est.) and beat on revenue (351m act. vs. 348m est.)

- Newell Brands Inc (Consumer Cyclicals): beat on EPS (0.56 act. vs. 0.45 est.) and beat on revenue (2,709m act. vs. 2,551m est.)

TOP WINNERS

- MaxCyte Inc (MXCT), up 30.8% to $17.00 / 12-Month Price Range: $ 5.85-9.37

- Atlassian Corporation PLC (TEAM), up 21.9% to $325.12 / YTD price return: +39.0% / 12-Month Price Range: $ 160.01-275.67 / Short interest (% of float): 2.9%; days to cover: 3.4

- Silicon Motion Technology Corp (SIMO), up 16.6% to $74.99 / YTD price return: +55.7% / 12-Month Price Range: $ 35.13-74.10 / Short interest (% of float): 2.3%; days to cover: 3.3

- Power Integrations Inc (POWI), up 14.1% to $96.99 / YTD price return: +18.5% / 12-Month Price Range: $ 50.34-99.05

- Veracyte Inc (VCYT), up 13.6% to $44.56 / YTD price return: -8.9% / 12-Month Price Range: $ 28.82-86.03

- Dexcom Inc (DXCM), up 13.0% to $515.51 / YTD price return: +39.4% / 12-Month Price Range: $ 305.63-466.21

- Silk Road Medical Inc (SILK), up 12.9% to $50.18 / YTD price return: -20.3% / 12-Month Price Range: $ 43.11-75.80

- Capri Holdings Ltd (CPRI), up 12.5% to $56.31 / YTD price return: +34.1% / 12-Month Price Range: $ 13.80-59.60 / Short interest (% of float): 2.8%; days to cover: 2.6

- Innoviz Technologies Ltd (INVZ), up 11.3% to $9.25 / 12-Month Price Range: $ 7.72-17.75 / Short interest (% of float): 1.9%; days to cover: 5.9

- Grid Dynamics Holdings Inc (GDYN), up 10.4% to $21.05 / 12-Month Price Range: $ 6.45-21.13

BIGGEST LOSERS

- Cassava Sciences Inc (SAVA), down 32.7% to $69.53 / YTD price return: +919.5% / 12-Month Price Range: $ 2.78-146.16 / Short interest (% of float): 11.8%; days to cover: 1.4 (the stock is currently on the short sale restriction list)

- Translate Bio Inc (TBIO), down 22.4% to $27.64 / YTD price return: +50.0% / 12-Month Price Range: $ 11.91-36.98 (the stock is currently on the short sale restriction list)

- Pinterest Inc (PINS), down 18.2% to $58.90 / YTD price return: -10.6% / 12-Month Price Range: $ 24.41-89.90 (the stock is currently on the short sale restriction list)

- Credicorp Ltd (BAP), down 16.3% to $100.96 / YTD price return: -38.4% / 12-Month Price Range: $ 110.47-169.50 (the stock is currently on the short sale restriction list)

- Newegg Commerce Inc (NEGG), down 14.7% to $17.20 / 12-Month Price Range: $ 2.76-79.07 (the stock is currently on the short sale restriction list)

- IGM Biosciences Inc (IGMS), down 13.6% to $68.01 / YTD price return: -23.0% / 12-Month Price Range: $ 41.41-133.00 (the stock is currently on the short sale restriction list)

- Zendesk Inc (ZEN), down 13.3% to $130.53 / YTD price return: -8.8% / 12-Month Price Range: $ 85.19-166.60 (the stock is currently on the short sale restriction list)

- Waterdrop Inc (WDH), down 12.1% to $4.22 / 12-Month Price Range: $ 4.17-11.77 / Short interest (% of float): 0.1%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Apollo Medical Holdings Inc (AMEH), down 10.8% to $88.37 / 12-Month Price Range: $ 16.21-114.55 (the stock is currently on the short sale restriction list)

- Intercorp Financial Services Inc (IFS), down 10.1% to $20.35 / 12-Month Price Range: $ 19.23-35.96 / Short interest (% of float): 0.1%; days to cover: 0.9 (the stock is currently on the short sale restriction list)

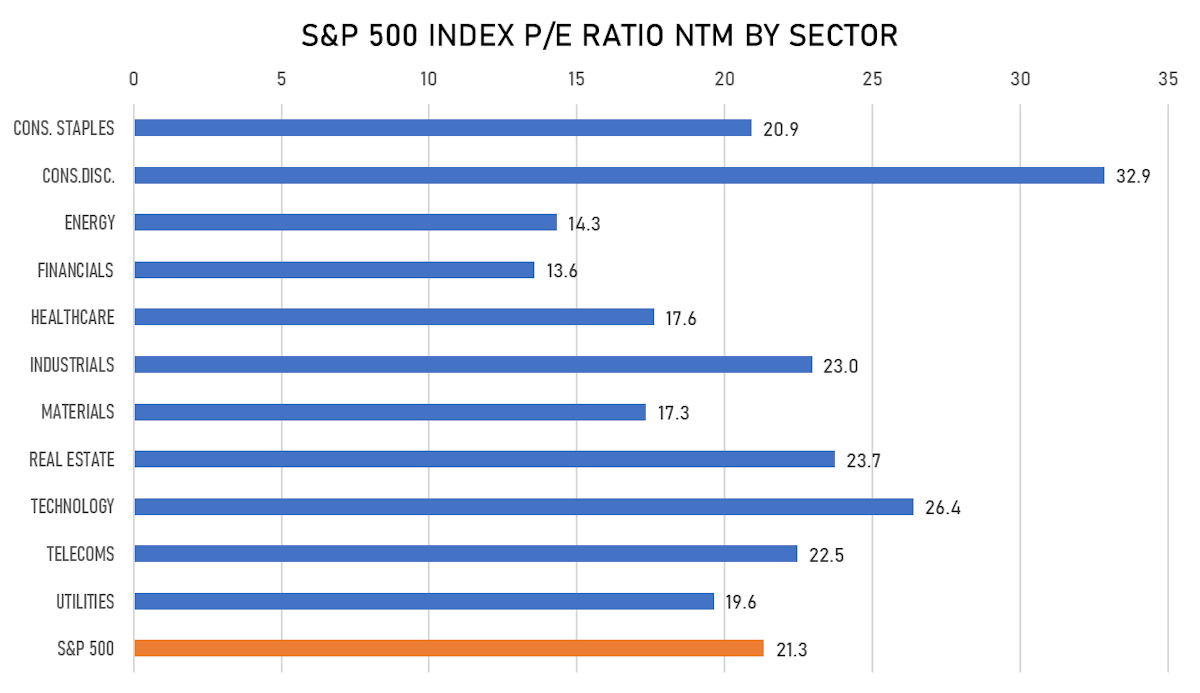

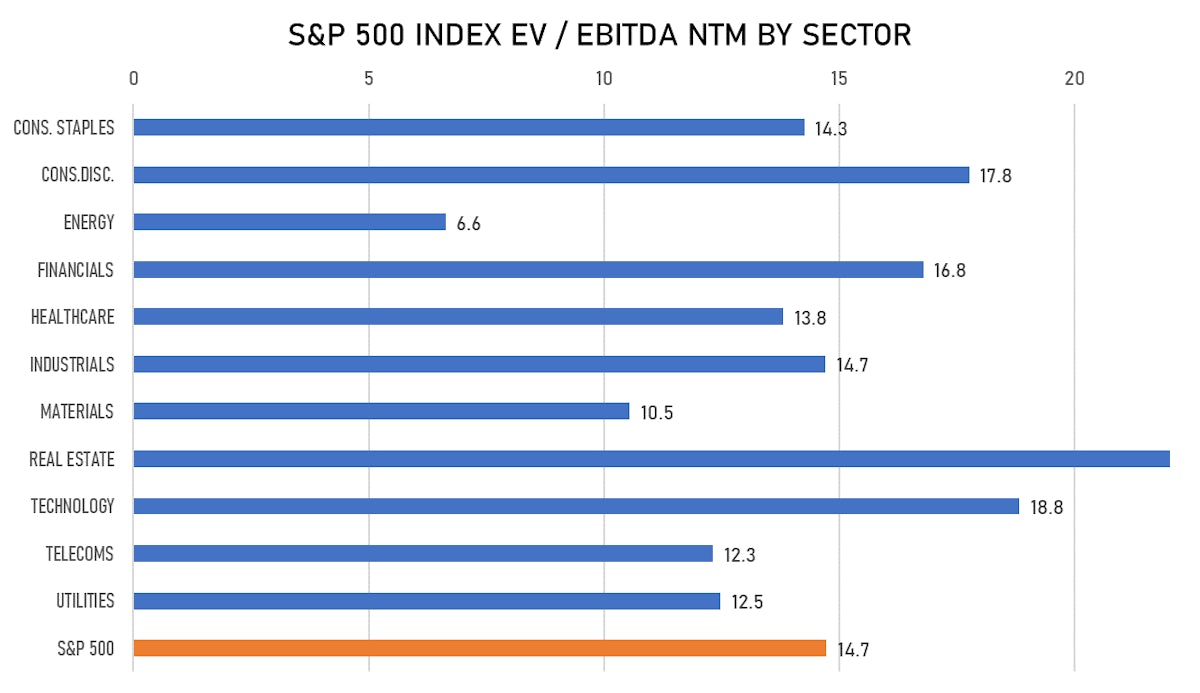

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Kimbell Tiger Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: TGR.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: UBS Securities LLC

- Hawks Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: HWKZ.U / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: BTIG LLC, Mizuho Securities USA LLC

- Tenaya Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: TNYA / Gross proceeds (including overallotment): US$ 180.00m (offering in U.S. Dollar) / Bookrunners: Cowen & Co, Morgan Stanley & Co LLC, Piper Sandler & Co

- Omega Therapeutics Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: OMGA / Gross proceeds (including overallotment): US$ 125.80m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Wedbush Securities, Inc., Jefferies LLC, Piper Sandler & Co

- RxSight Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RXST / Gross proceeds (including overallotment): US$ 117.60m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC, SVB Leerink LLC, Bofa Securities Inc

- Immuneering Corp / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: IMRX / Gross proceeds (including overallotment): US$ 112.50m (offering in U.S. Dollar) / Bookrunners: Guggenheim Securities LLC, Cowen & Co, Jefferies LLC, Morgan Stanley & Co LLC

- Sino Biological Inc / China - Healthcare / Listing Exchange: ShenzChNxt / Ticker: 301047 / Gross proceeds (including overallotment): US$ 771.30m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

- S.P.I Landscape Design Co Ltd / China - Industrials / Listing Exchange: ShenzChNxt / Ticker: 300844 / Gross proceeds (including overallotment): US$ 125.51m (offering in Chinese Yuan) / Bookrunners: Minsheng Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Essential Properties Realty Trust Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: EPRT / Gross proceeds (including overallotment): US$ 350.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Technip Energies NV / France - Energy and Power / Listing Exchange: Euro Paris / Ticker: TE / Gross proceeds (including overallotment): US$ 213.00m (offering in EURO) / Bookrunners: Societe Generale SA, Morgan Stanley & Co International PLC

- PointsBet Holdings Ltd / Australia - Media and Entertainment / Listing Exchange: Australia / Ticker: PBH / Gross proceeds (including overallotment): US$ 159.04m (offering in Australian Dollar) / Bookrunners: Goldman Sachs (Australia), MST Financial Services Pty Ltd