Equities

US Stocks Edge Down, Energy And Industrials Worst Performing Sectors Today

In large caps earnings, both General Motors and Booking missed on EPS, leading the shares to fall 8.9% and 2.5% respectively

Published ET

Robinhood (HOOD) Intraday Prices Since Going Public At $38 | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.46%; Nasdaq Composite up 0.13%; Wilshire 5000 down -0.43%

- 24.0% of S&P 500 stocks were up today, with 82.0% of stocks above their 200-day moving average (DMA) and 52.5% above their 50-DMA

- Top performing sectors in the S&P 500: telecoms up 0.23% and technology up 0.19%

- Bottom performing sectors in the S&P 500: energy down -2.93% and industrials down -1.37%

- The number of shares in the S&P 500 traded today was 578m for a total turnover of US$ 65 bn

- The S&P 500 Value Index was down -1.1%, while the S&P 500 Growth Index was up 0.1%; the S&P small caps index was down -1.7% and mid caps were down -1.0%

- The volume on CME's INX (S&P 500 Index) was 2.3m (3-month z-score: 0.6); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.61%; UK FTSE 100 up 0.26%; tonight in Asia, China's CSI 300 is down -1.12% and Japan's TOPIX 500 up 0.24%

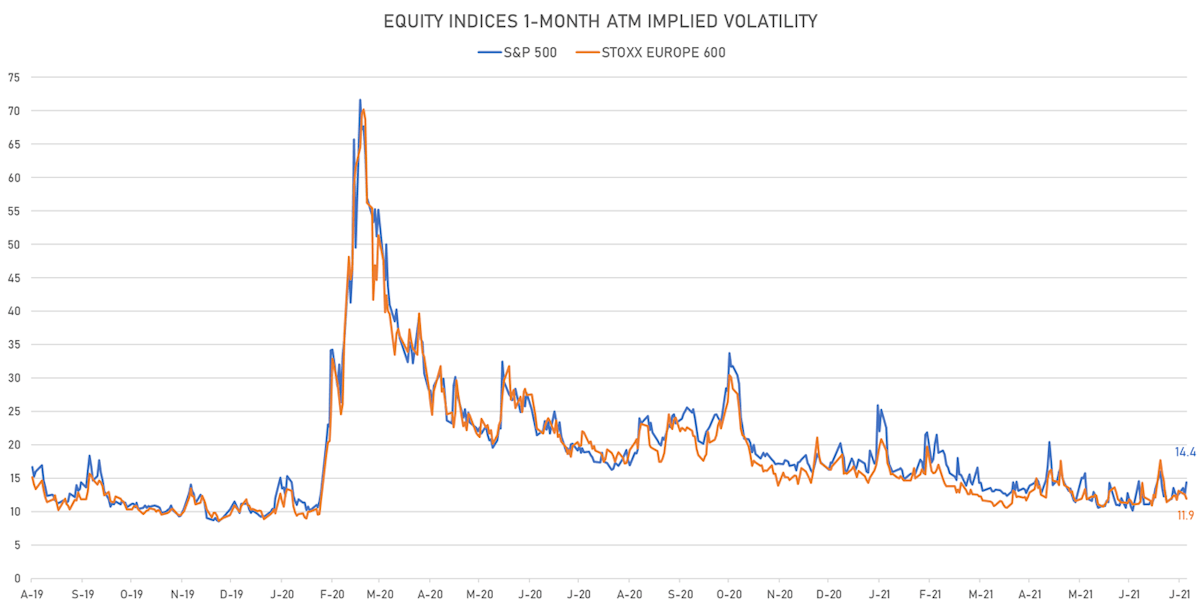

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 14.4%, up from 12.5%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.9%, down from 12.6%

NOTABLE S&P 500 EARNINGS RELEASES

- CVS Health Corp (Healthcare): beat on EPS (2.42 act. vs. 2.06 est.) and beat on revenue (72,616m act. vs. 70,299m est.)

- Booking Holdings Inc (Consumer Cyclicals): missed on EPS (-2.55 act. vs. -2.04 est.) and beat on revenue (2,160m act. vs. 1,901m est.)

- General Motors Co (Consumer Cyclicals): missed on EPS (1.97 act. vs. 2.23 est.) and beat on revenue (34,200m act. vs. 30,895m est.)

- Regeneron Pharmaceuticals Inc (Healthcare): beat on EPS (9.89 act. vs. 9.00 est.) and missed on revenue (2,529m act. vs. 2,551m est.)

- Emerson Electric Co (Industrials): beat on EPS (1.09 act. vs. 0.98 est.) and beat on revenue (4,697m act. vs. 4,595m est.)

- Public Storage (Real Estate): beat on EPS (1.97 act. vs. 1.87 est.) and missed on revenue (662m act. vs. 802m est.)

- Trane Technologies PLC (Industrials): beat on EPS (1.92 act. vs. 1.90 est.) and beat on revenue (3,800m act. vs. 3,770m est.)

- Exelon Corp (Utilities): beat on EPS (0.89 act. vs. 0.68 est.) and beat on revenue (7,915m act. vs. 6,991m est.)

- Kraft Heinz Co (Consumer Non-Cyclicals): beat on EPS (0.78 act. vs. 0.72 est.) and beat on revenue (6,615m act. vs. 6,551m est.)

- EOG Resources Inc (Energy): beat on EPS (1.73 act. vs. 1.56 est.) and beat on revenue (4,139m act. vs. 3,978m est.)

- Electronic Arts Inc (Technology): missed on EPS (0.61 act. vs. 0.67 est.) and beat on revenue (1,336m act. vs. 1,281m est.)

- Allstate Corp (Financials): beat on EPS (3.79 act. vs. 3.17 est.) and missed on revenue (10,323m act. vs. 10,510m est.)

- Xcel Energy Inc (Utilities): beat on EPS (0.58 act. vs. 0.56 est.) and beat on revenue (3,068m act. vs. 2,694m est.)

- ANSYS Inc (Technology): beat on EPS (1.85 act. vs. 0.84 est.) and beat on revenue (453m act. vs. 353m est.)

- Mckesson Corp (Consumer Non-Cyclicals): beat on EPS (5.56 act. vs. 4.15 est.) and beat on revenue (62,674m act. vs. 60,091m est.)

- WEC Energy Group Inc (Utilities): beat on EPS (0.87 act. vs. 0.79 est.) and beat on revenue (1,676m act. vs. 1,596m est.)

- CDW Corp (Technology): beat on EPS (2.02 act. vs. 1.80 est.) and beat on revenue (5,146m act. vs. 4,967m est.)

- Amerisourcebergen Corp (Healthcare): beat on EPS (2.16 act. vs. 2.05 est.) and beat on revenue (53,406m act. vs. 52,351m est.)

- ETSY Inc (Consumer Cyclicals): beat on EPS (0.68 act. vs. 0.63 est.) and beat on revenue (529m act. vs. 525m est.)

TOP WINNERS

- BeyondSpring Inc (BYSI), up 176.0% to $26.58 / YTD price return: +117.9% / 12-Month Price Range: $ 8.90-17.81 / Short interest (% of float): 13.5%; days to cover: 6.2

- Robinhood Markets Inc (HOOD), up 50.4% to $70.39 / 12-Month Price Range: $ 33.25-48.59

- eXp World Holdings Inc (EXPI), up 36.0% to $47.27 / YTD price return: +49.8% / 12-Month Price Range: $ 10.15-90.00

- Coursera Inc (COUR), up 21.4% to $43.31 / 12-Month Price Range: $ 32.59-62.53

- Cerus Corp (CERS), up 20.7% to $6.19 / YTD price return: -10.5% / 12-Month Price Range: $ 4.67-8.87

- Icosavax Inc (ICVX), up 20.4% to $33.37 / 12-Month Price Range: $ 21.70-49.99

- Global Blood Therapeutics Inc (GBT), up 20.0% to $32.26 / YTD price return: -25.5% / 12-Month Price Range: $ 26.15-70.43

- Novavax Inc (NVAX), up 18.7% to $223.81 / YTD price return: +100.7% / 12-Month Price Range: $ 76.59-331.68

- BioNTech SE (BNTX), up 17.8% to $414.44 / YTD price return: +408.4% / 12-Month Price Range: $ 54.10-354.08 / Short interest (% of float): 0.9%; days to cover: 0.9

- New Relic Inc (NEWR), up 15.4% to $78.83 / YTD price return: +20.5% / 12-Month Price Range: $ 51.52-81.10

BIGGEST LOSERS

- Cardlytics Inc (CDLX), down 27.6% to $84.26 / YTD price return: -41.0% / 12-Month Price Range: $ 55.89-161.47 (the stock is currently on the short sale restriction list)

- OneConnect Financial Technology Co Ltd (OCFT), down 27.3% to $5.42 / YTD price return: -72.5% / 12-Month Price Range: $ 7.36-26.59 / Short interest (% of float): 0.8%; days to cover: 1.9 (the stock is currently on the short sale restriction list)

- Avid Technology Inc (AVID), down 23.8% to $27.56 / YTD price return: +73.7% / 12-Month Price Range: $ 7.23-40.48 (the stock is currently on the short sale restriction list)

- Arcturus Therapeutics Holdings Inc (ARCT), down 23.2% to $44.76 / YTD price return: +3.2% / 12-Month Price Range: $ 24.87-129.71 / Short interest (% of float): 17.3%; days to cover: 7.2 (the stock is currently on the short sale restriction list)

- Tellurian Inc (TELL), down 17.7% to $2.89 / YTD price return: +125.8% / 12-Month Price Range: $ .68-5.76 (the stock is currently on the short sale restriction list)

- Callon Petroleum Co (CPE), down 16.9% to $31.51 / YTD price return: +139.4% / 12-Month Price Range: $ 4.50-60.51 (the stock is currently on the short sale restriction list)

- Absci Corp (ABSI), down 16.8% to $25.20 / 12-Month Price Range: $ 20.88-31.39 (the stock is currently on the short sale restriction list)

- Avis Budget Group Inc (CAR), down 16.6% to $74.95 / YTD price return: +100.9% / 12-Month Price Range: $ 25.14-95.10 (the stock is currently on the short sale restriction list)

- Surgery Partners Inc (SGRY), down 15.0% to $47.98 / YTD price return: +65.4% / 12-Month Price Range: $ 15.22-69.58 (the stock is currently on the short sale restriction list)

- Parsons Corp (PSN), down 14.8% to $32.00 / YTD price return: -12.1% / 12-Month Price Range: $ 30.08-45.01 (the stock is currently on the short sale restriction list)

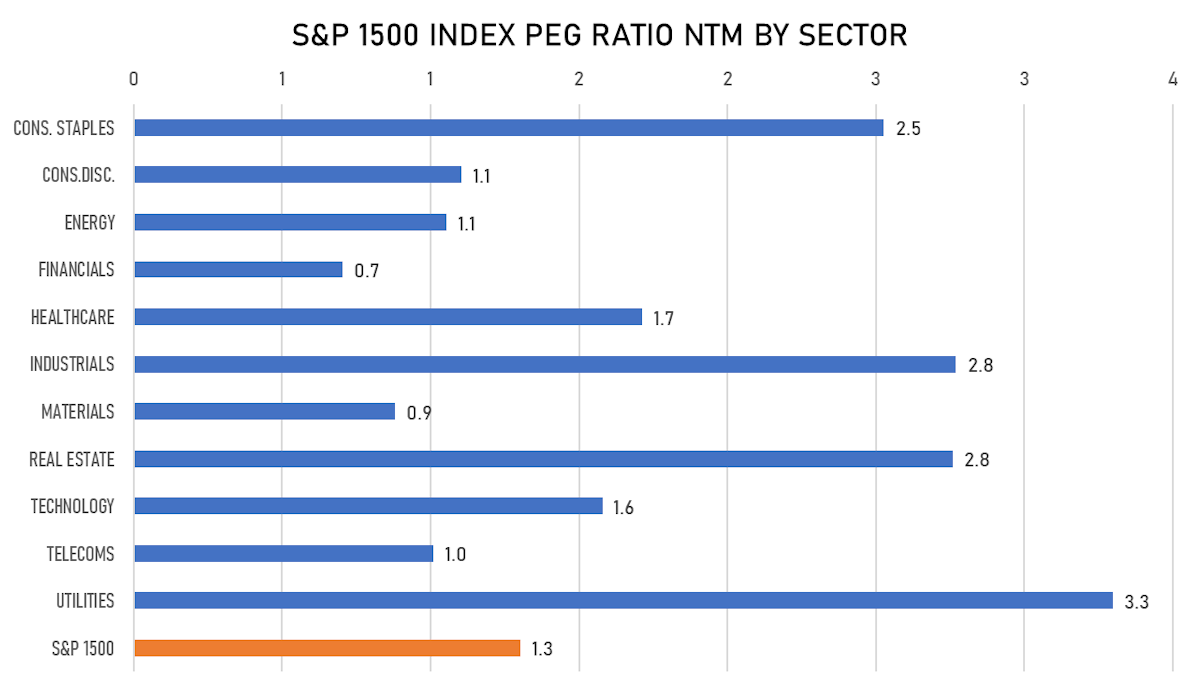

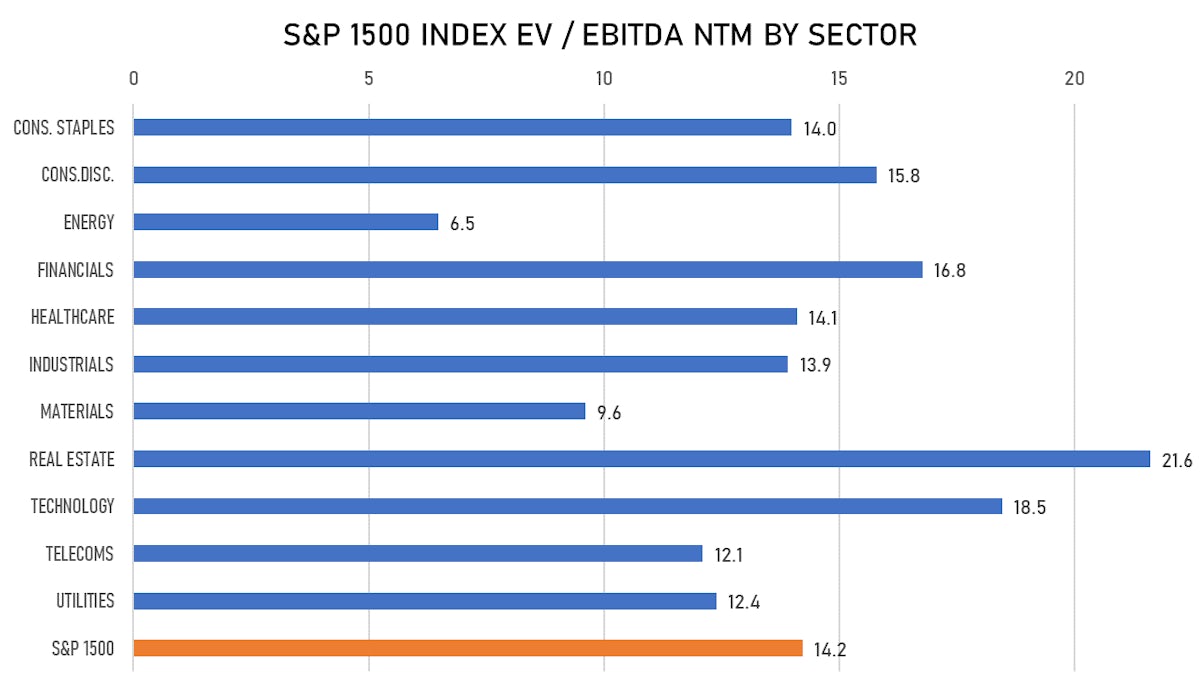

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- AMCI Acquisition Corp II / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: AMCIU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Evercore Group

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- ZoomInfo Technologies Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: ZI / Gross proceeds (including overallotment): US$ 1,491.75m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Ingersoll Rand Inc / United States of America - Industrials / Listing Exchange: New York / Ticker: IR / Gross proceeds (including overallotment): US$ 1,467.09m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC

- Cousins Properties Inc / United States of America - Real Estate / Listing Exchange: New York / Ticker: CUZ / Gross proceeds (including overallotment): US$ 500.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Option Care Health Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: OPCH / Gross proceeds (including overallotment): US$ 419.18m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co

- Avidity Biosciences Inc / United States of America - Healthcare / Listing Exchange: Nasdaq / Ticker: RNA / Gross proceeds (including overallotment): US$ 144.00m (offering in U.S. Dollar) / Bookrunners: Evercore Group, Wells Fargo Securities LLC, Cowen & Co, SVB Leerink LLC

- Tellurian Inc / United States of America - Energy and Power / Listing Exchange: Nasdaq / Ticker: TELL / Gross proceeds (including overallotment): US$ 105.00m (offering in U.S. Dollar) / Bookrunners: B Riley FBR

- Juewei Food Co Ltd / China - Consumer Staples / Listing Exchange: Shanghai / Ticker: 603517 / Gross proceeds (including overallotment): US$ 368.46m (offering in Chinese Yuan) / Bookrunners: Not Applicable

- Livanova PLC / United Kingdom - Healthcare / Listing Exchange: Nasdaq / Ticker: LIVN / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Barclays Capital Inc, UBS Securities LLC

- Atlantica Sustainable Infrastructure PLC / United Kingdom - Energy and Power / Listing Exchange: Nasdaq / Ticker: AY / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Jervois Mining Ltd / Australia - Materials / Listing Exchange: Australia / Ticker: JRV / Gross proceeds (including overallotment): US$ 131.55m (offering in Australian Dollar) / Bookrunners: UBS Australia Ltd, Clarksons Platou Securities AS, Jefferies (Australia) Pty Ltd

- Xiamen Port Development Co Ltd / China - Industrials / Listing Exchange: Shenzhen / Ticker: 000905 / Gross proceeds (including overallotment): US$ 123.65m (offering in Chinese Yuan) / Bookrunners: Not Applicable