Equities

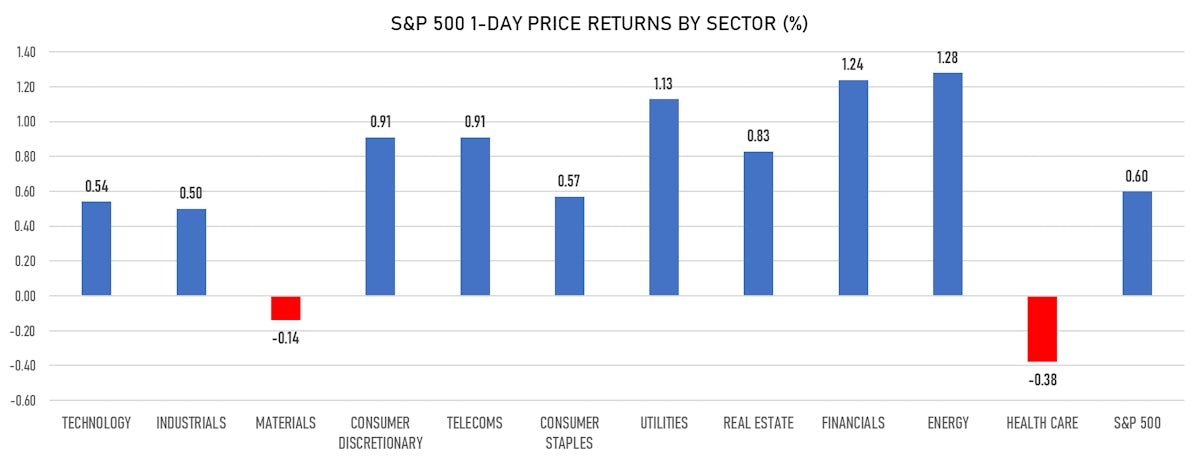

Good Day For US Equities As Almost All Sectors Rose

Small caps and value stocks overperformed slightly, with energy and financials being the top gainers

Published ET

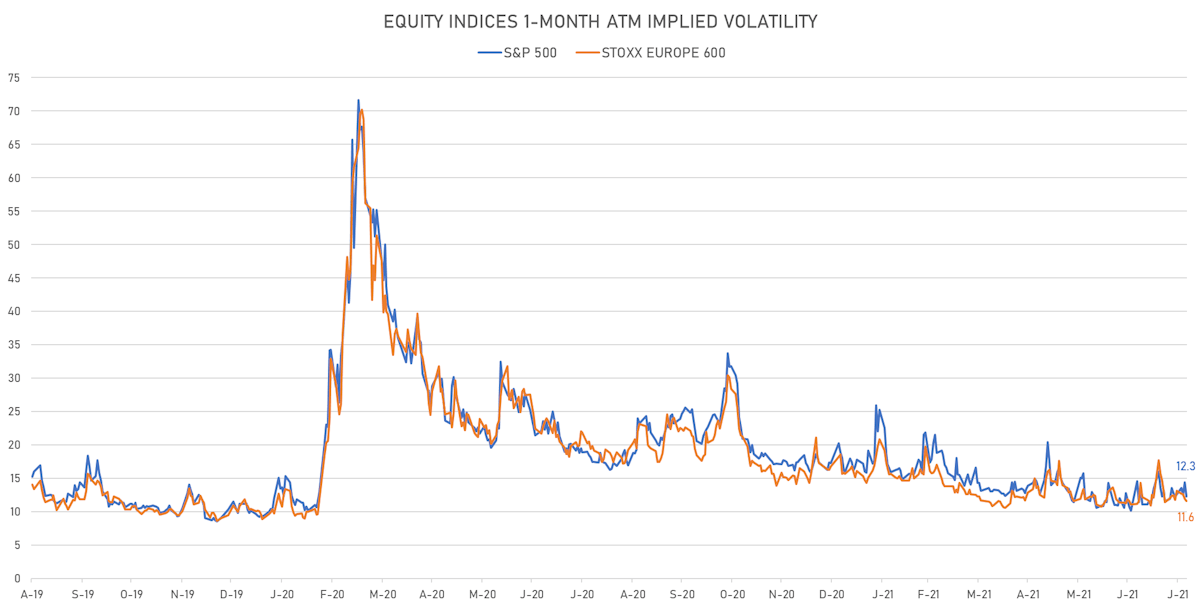

The skewness of the S&P 500 Implied Volatility Smile Has Dropped Significantly | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.60%; Nasdaq Composite up 0.78%; Wilshire 5000 up 0.75%

- 71.5% of S&P 500 stocks were up today, with 82.4% of stocks above their 200-day moving average (DMA) and 56.2% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 1.28% and financials up 1.24%

- Bottom performing sectors in the S&P 500: health care down -0.38% and materials down -0.14%

- The number of shares in the S&P 500 traded today was 489m for a total turnover of US$ 56 bn

- The S&P 500 Value Index was up 0.7%, while the S&P 500 Growth Index was up 0.6%; the S&P small caps index was up 1.4% and mid caps were up 0.9%

- The volume on CME's INX (S&P 500 Index) was 2.0m (3-month z-score: -0.4); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.37%; UK FTSE 100 down -0.05%; tonight in Asia, China CSI 300 down -0.65% and Japan's TOPIX 500 down -0.11%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 12.3%, down from 14.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.6%, down from 11.9%

NOTABLE S&P 500 EARNINGS RELEASES

- Moderna Inc (Healthcare): beat on EPS (6.46 act. vs. 5.96 est.) and beat on revenue (4,354m act. vs. 4,207m est.)

- Zoetis Inc (Healthcare): beat on EPS (1.19 act. vs. 1.08 est.) and beat on revenue (1,948m act. vs. 1,824m est.)

- Regeneron Pharmaceuticals Inc (Healthcare): beat on EPS (25.80 act. vs. 17.53 est.) and beat on revenue (5,139m act. vs. 3,917m est.)

- Monster Beverage Corp (Consumer Non-Cyclicals): beat on EPS (0.75 act. vs. 0.61 est.) and beat on revenue (1,462m act. vs. 1,222m est.)

- Resmed Inc (Healthcare): beat on EPS (1.35 act. vs. 1.30 est.) and beat on revenue (876m act. vs. 796m est.)

- Parker-Hannifin Corp (Industrials): beat on EPS (4.38 act. vs. 4.33 est.) and beat on revenue (3,959m act. vs. 3,929m est.)

- Motorola Solutions Inc (Technology): beat on EPS (2.07 act. vs. 1.92 est.) and beat on revenue (1,971m act. vs. 1,938m est.)

- PPL Corp (Utilities): missed on EPS (0.19 act. vs. 0.24 est.) and missed on revenue (1,288m act. vs. 1,420m est.)

- News Corp (Consumer Cyclicals): beat on EPS (0.16 act. vs. 0.04 est.) and beat on revenue (2,492m act. vs. 2,249m est.)

- Quanta Services Inc (Industrials): beat on EPS (1.06 act. vs. 1.04 est.) and beat on revenue (3,000m act. vs. 2,981m est.)

- Penn National Gaming Inc (Consumer Cyclicals): beat on EPS (1.17 act. vs. 0.92 est.) and beat on revenue (1,546m act. vs. 1,455m est.)

- Regency Centers Corp (Real Estate): beat on EPS (0.56 act. vs. 0.17 est.) and beat on revenue (264m act. vs. 255m est.)

- NRG Energy Inc (Utilities): beat on EPS (4.40 act. vs. 1.38 est.) and beat on revenue (5,243m act. vs. 3,049m est.)

- Pinnacle West Capital Corp (Utilities): beat on EPS (1.91 act. vs. 1.65 est.) and beat on revenue (1,000m act. vs. 948m est.)

TOP WINNERS

- Score Media and Gaming Inc (SCR), up 79.9% to $32.64 / YTD price return: +173.3% / 12-Month Price Range: $ 4.03-45.00 / Short interest (% of float): 3.7%; days to cover: 1.8

- Zymergen Inc (ZY), up 75.2% to $14.45 / 12-Month Price Range: $ 7.85-52.00 / Short interest (% of float): 2.2%; days to cover: 5.5

- SiTime Corp (SITM), up 31.2% to $185.00 / YTD price return: +65.3% / 12-Month Price Range: $ 56.08-151.78 / Short interest (% of float): 3.7%; days to cover: 3.5

- Veoneer Inc (VNE), up 28.5% to $40.15 / YTD price return: +88.5% / 12-Month Price Range: $ 9.70-32.70 / Short interest (% of float): 6.8%; days to cover: 16.3

- Astra Space Inc (ASTR), up 23.9% to $10.22 / YTD price return: +1.1% / 12-Month Price Range: $ 8.12-22.47 / Short interest (% of float): 2.8%; days to cover: 1.5

- Newegg Commerce Inc (NEGG), up 22.4% to $20.33 / YTD price return: +389.9% / 12-Month Price Range: $ 2.76-79.07 / Short interest (% of float): 11.5%; days to cover: 0.3

- Microvast Holdings Inc (MVST), up 20.6% to $10.47 / YTD price return: -38.8% / 12-Month Price Range: $ 7.83-25.20 / Short interest (% of float): 0.9%; days to cover: 3.1

- Arcturus Therapeutics Holdings Inc (ARCT), up 20.5% to $53.93 / YTD price return: +24.3% / 12-Month Price Range: $ 24.87-129.71 / Short interest (% of float): 17.3%; days to cover: 7.2

- STAAR Surgical Co (STAA), up 20.4% to $155.05 / YTD price return: +95.7% / 12-Month Price Range: $ 45.47-161.71

- Caribou Biosciences Inc (CRBU), up 20.2% to $21.70 / 12-Month Price Range: $ 15.00-19.68

BIGGEST LOSERS

- Robinhood Markets Inc (HOOD), down 27.6% to $50.97 / 12-Month Price Range: $ 33.25-85.00 (the stock is currently on the short sale restriction list)

- Inogen Inc (INGN), down 26.7% to $60.29 / YTD price return: +34.9% / 12-Month Price Range: $ 26.57-82.35 / Short interest (% of float): 1.7%; days to cover: 2.9 (the stock is currently on the short sale restriction list)

- Itron Inc (ITRI), down 26.4% to $71.84 / YTD price return: -25.1% / 12-Month Price Range: $ 53.49-122.31 / Short interest (% of float): 3.8%; days to cover: 6.2 (the stock is currently on the short sale restriction list)

- Fiverr International Ltd (FVRR), down 24.1% to $175.06 / YTD price return: -10.3% / 12-Month Price Range: $ 102.42-336.00 / Short interest (% of float): 6.9%; days to cover: 3.8 (the stock is currently on the short sale restriction list)

- Nevro Corp (NVRO), down 22.2% to $115.07 / YTD price return: -33.5% / 12-Month Price Range: $ 128.70-188.14 / Short interest (% of float): 9.7%; days to cover: 7.7 (the stock is currently on the short sale restriction list)

- Amedisys Inc (AMED), down 21.9% to $200.13 / YTD price return: -31.8% / 12-Month Price Range: $ 216.20-325.12 / Short interest (% of float): 2.2%; days to cover: #N/A (the stock is currently on the short sale restriction list)

- CommScope Holding Company Inc (COMM), down 20.7% to $16.41 / YTD price return: +22.5% / 12-Month Price Range: $ 8.25-22.18 / Short interest (% of float): 3.5%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

- Latham Group Inc (SWIM), down 18.1% to $21.62 / 12-Month Price Range: $ 23.58-34.73 / Short interest (% of float): 4.3%; days to cover: 7.1 (the stock is currently on the short sale restriction list)

- Revolve Group Inc (RVLV), down 14.9% to $60.68 / YTD price return: +94.7% / 12-Month Price Range: $ 16.12-74.82 / Short interest (% of float): 10.7%; days to cover: 3.1 (the stock is currently on the short sale restriction list)

- CMC Materials Inc (CCMP), down 14.4% to $124.79 / YTD price return: -17.5% / 12-Month Price Range: $ 133.01-198.61 / Short interest (% of float): 1.5%; days to cover: #N/A (the stock is currently on the short sale restriction list)

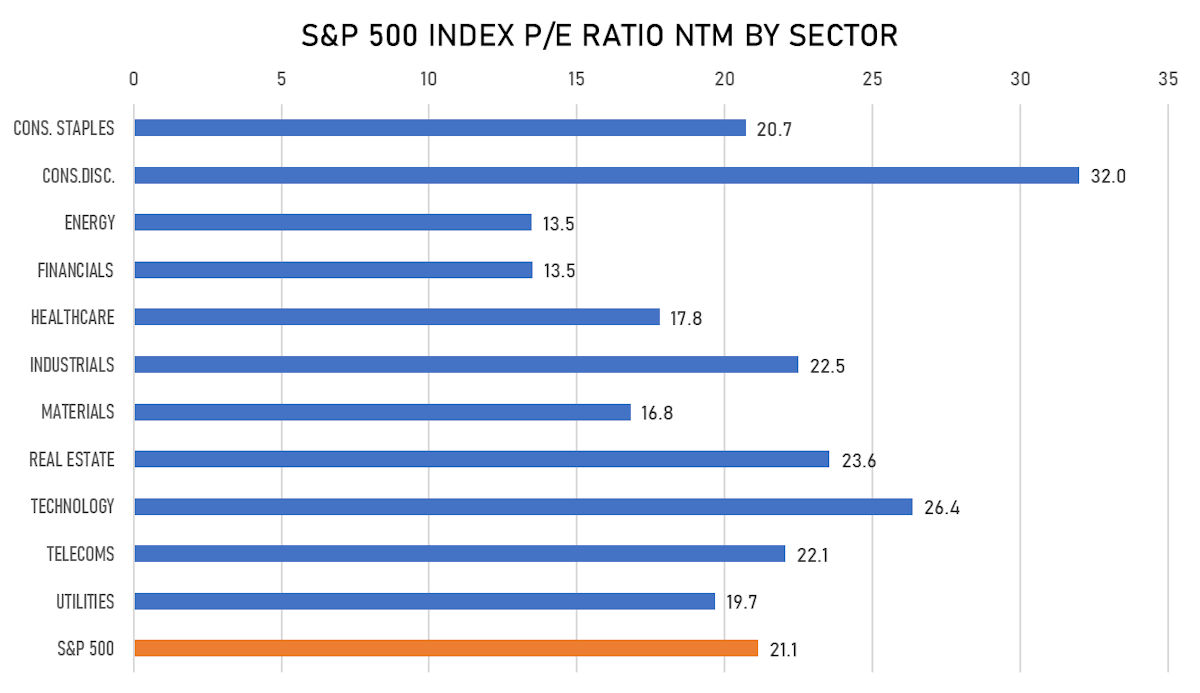

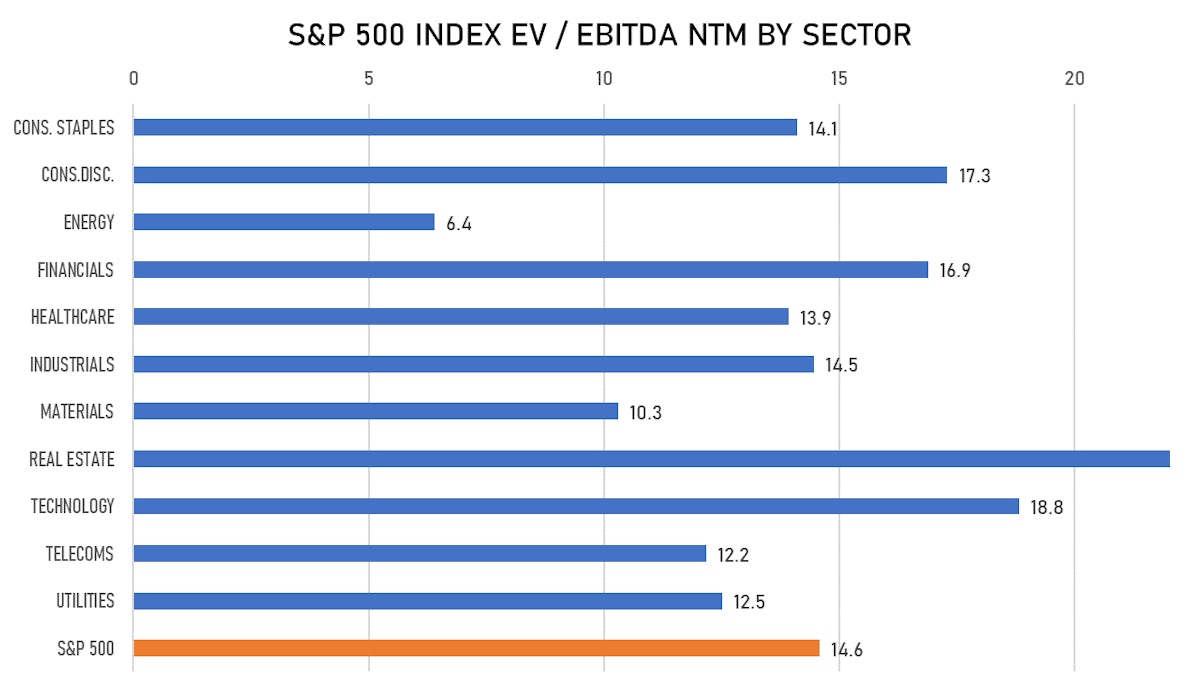

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Weber Inc / United States of America - Consumer Staples / Listing Exchange: New York / Ticker: WEBR / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, JP Morgan Securities LLC, Bofa Securities Inc

- European Wax Center Inc / United States of America - Consumer Products and Services / Listing Exchange: Nasdaq / Ticker: EWCZ / Gross proceeds (including overallotment): US$ 180.20m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Morgan Stanley & Co LLC, Bofa Securities Inc

- China Railway Special Cargo Logistics Co Ltd / China - Industrials / Listing Exchange: Shenzhen / Ticker: 001213 / Gross proceeds (including overallotment): US$ 190.55m (offering in Chinese Yuan) / Bookrunners: China International Capital Corp

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Green Plains Inc / United States of America - Materials / Listing Exchange: Nasdaq / Ticker: GPRE / Gross proceeds (including overallotment): US$ 152.00m (offering in U.S. Dollar) / Bookrunners: Jefferies LLC, Bofa Securities Inc

- Money Forward Inc / Japan - High Technology / Listing Exchange: Tokyo 1 / Ticker: 3994 / Gross proceeds (including overallotment): US$ 300.81m (offering in Japanese Yen) / Bookrunners: Goldman Sachs International, Merrill Lynch International Ltd, Mizuho International PLC

- Xinte Energy Co Ltd / China - Energy and Power / Listing Exchange: Hong Kong / Ticker: 1799 / Gross proceeds (including overallotment): US$ 133.05m (offering in Hong Kong Dollar) / Bookrunners: China International Capital Corp