Equities

US Equity Indices End Mixed On Mediocre Volume

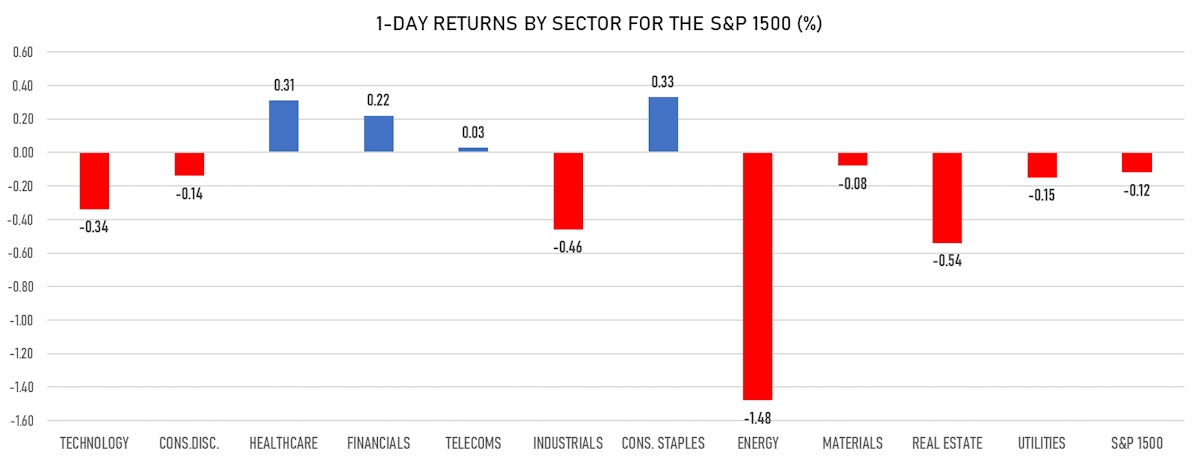

The energy sector was the worst performer, as stocks followed crude oil prices down; otherwise nothing spectacular: growth and large caps slightly overperformed value and small caps

Published ET

FactSet World Indices Year To Date Total Returns | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.09%; Nasdaq Composite up 0.16%; Wilshire 5000 down -0.04%

- 35.6% of S&P 500 stocks were up today, with 82.8% of stocks above their 200-day moving average (DMA) and 60.0% above their 50-DMA

- Top performing sectors in the S&P 500: health care up 0.38% and consumer staples up 0.32%

- Bottom performing sectors in the S&P 500: energy down -1.48% and real estate down -0.42%

- The number of shares in the S&P 500 traded today was 447m for a total turnover of US$ 52 bn

- The S&P 500 Value Index was down -0.2%, while the S&P 500 Growth Index was unchanged; the S&P small caps index was down -0.9% and mid caps were down -0.3%

- The volume on CME's INX (S&P 500 Index) was 1.7m (3-month z-score: -1.0); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: UK FTSE 100 up 0.13%; tonight in Asia, China CSI 300 is down -0.55% and Japan's TOPIX 500 up 0.53%

VOLATILITY

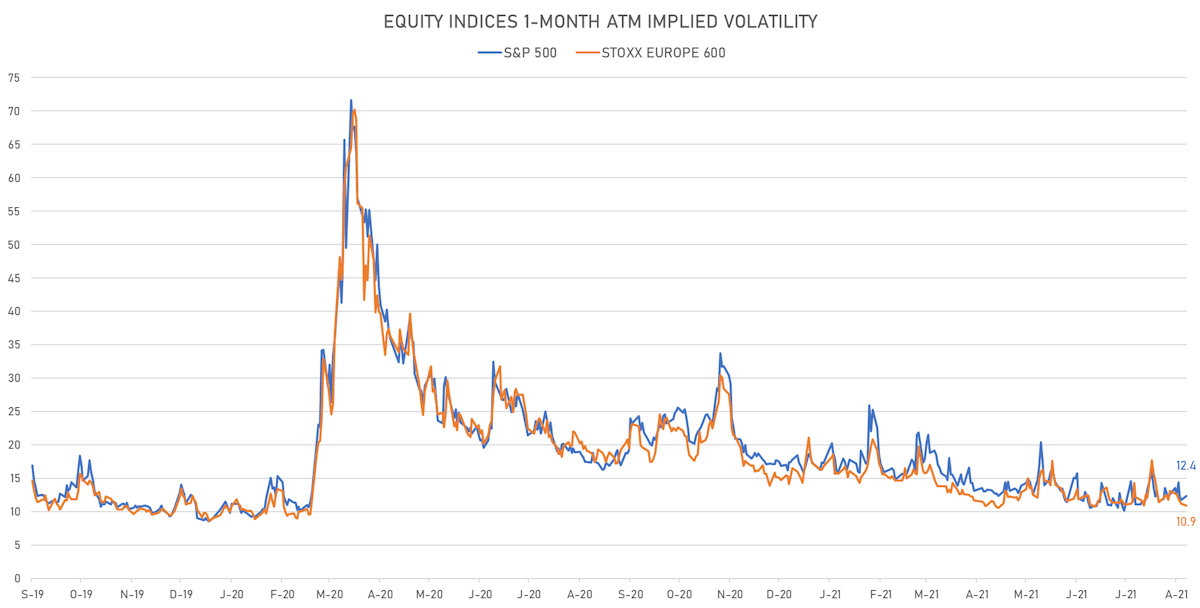

- 1-month at-the-money implied volatility on the S&P 500 at 12.4%, up from 11.8%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 10.9%, down from 11.2%

NOTABLE S&P 500 EARNINGS RELEASES

- Air Products and Chemicals Inc (Basic Materials): missed on EPS (2.31 act. vs. 2.37 est.) and beat on revenue (2,605m act. vs. 2,499m est.)

- Tyson Foods Inc (Consumer Non-Cyclicals): beat on EPS (2.70 act. vs. 1.62 est.) and beat on revenue (12,478m act. vs. 11,491m est.)

- DISH Network Corp (Consumer Cyclicals): beat on EPS (1.06 act. vs. 0.89 est.) and beat on revenue (4,490m act. vs. 4,429m est.)

- Steris plc (Healthcare): missed on EPS (1.76 act. vs. 1.78 est.) and beat on revenue (968m act. vs. 876m est.)

- Viatris Inc (Healthcare): beat on EPS (0.98 act. vs. 0.87 est.) and beat on revenue (4,578m act. vs. 4,378m est.)

- CF Industries Holdings Inc (Basic Materials): beat on EPS (1.15 act. vs. 0.60 est.) and beat on revenue (1,588m act. vs. 1,090m est.)

TOP WINNERS

- Microvast Holdings Inc (ANY), up 17.6% to $5.40 / YTD price return: -19.9% / 12-Month Price Range: $ 1.23-5.61 / Short interest (% of float): 4.8%; days to cover: 0.1

- Bitfarms Ltd (CRBU), up 11.1% to $26.13 / YTD price return: +247.9% / 12-Month Price Range: $ 15.00-25.99

- Canaan Inc (EVGN), up 10.9% to $2.95 / YTD price return: +68.3% / 12-Month Price Range: $ 1.10-10.24 / Short interest (% of float): 1.9%; days to cover: 1.8

- Adagio Therapeutics Inc (LMNL), up 10.4% to $3.65 / 12-Month Price Range: $ 2.80-20.20 / Short interest (% of float): 3.9%; days to cover: 0.2

- Aurinia Pharmaceuticals Inc (SIC), up 8.8% to $14.29 / YTD price return: +13.4% / 12-Month Price Range: $ 5.27-12.27 / Short interest (% of float): 0.1%; days to cover: 0.1

- Weber Inc (DLO), up 8.2% to $49.69 / 12-Month Price Range: $ 29.57-57.00 / Short interest (% of float): 0.6%; days to cover: 0.3

- Confluent Inc (STRR), up 6.6% to $3.58 / 12-Month Price Range: $ 2.31-5.40

- Marathon Digital Holdings Inc (AUPH), up 5.1% to $15.69 / YTD price return: +244.6% / 12-Month Price Range: $ 9.72-20.50 / Short interest (% of float): 11.4%; days to cover: 4.5

- Atea Pharmaceuticals Inc (CGA), up 3.6% to $9.76 / YTD price return: -22.8% / 12-Month Price Range: $ 1.77-17.73 / Short interest (% of float): 2.4%; days to cover: 5.8

- Codexis Inc (BFLY), up 3.3% to $11.70 / YTD price return: +19.8% / 12-Month Price Range: $ 9.20-29.13 / Short interest (% of float): 11.6%; days to cover: 4.3

BIGGEST LOSERS

- Axsome Therapeutics Inc (AXSM), down 46.5% to $27.37 / YTD price return: -66.4% / 12-Month Price Range: $ 48.34-90.00 (the stock is currently on the short sale restriction list)

- bluebird bio Inc (BLUE), down 27.4% to $18.16 / YTD price return: -58.0% / 12-Month Price Range: $ 24.24-66.12 (the stock is currently on the short sale restriction list)

- Elanco Animal Health Inc (ELAN), down 16.1% to $29.67 / YTD price return: -3.3% / 12-Month Price Range: $ 24.32-37.49 (the stock is currently on the short sale restriction list)

- Dicerna Pharmaceuticals Inc (DRNA), down 12.6% to $23.83 / YTD price return: +8.2% / 12-Month Price Range: $ 16.50-40.14 (the stock is currently on the short sale restriction list)

- WideOpenWest Inc (WOW), down 9.8% to $21.39 / YTD price return: +100.5% / 12-Month Price Range: $ 4.72-23.93

- Kaltura Inc (KLTR), down 9.3% to $12.35 / 12-Month Price Range: $ 10.19-13.98 (the stock is currently on the short sale restriction list)

- RadNet Inc (RDNT), down 8.3% to $34.98 / YTD price return: +78.7% / 12-Month Price Range: $ 13.49-38.84

- Instructure Holdings Inc (INST), down 7.7% to $19.45 / 12-Month Price Range: $ 18.52-23.75

- Sophia Genetics SA (SOPH), down 7.4% to $16.82 / 12-Month Price Range: $ 14.88-18.74

- N-Able Inc (NABL), down 6.7% to $13.57 / 12-Month Price Range: $ 11.66-16.00

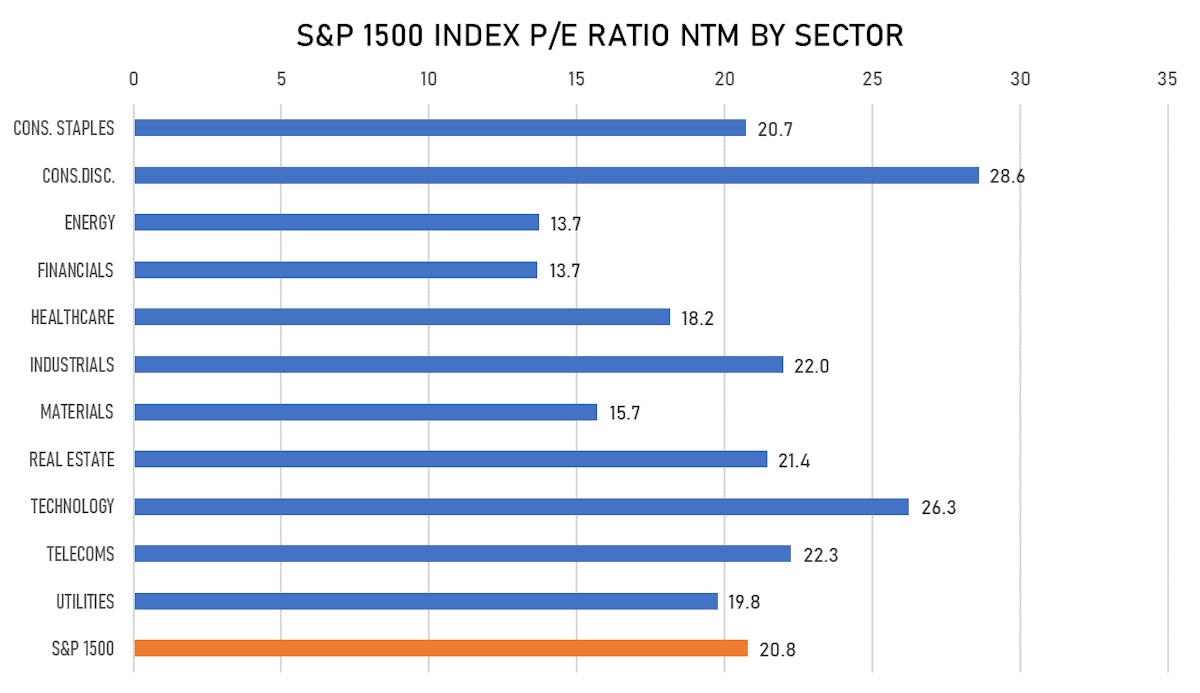

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Banyan Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: BYN.U / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: BTIG LLC

- AltEnergy Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: AEAEU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: B Riley Securities Inc

- ThinkGeek Network Technology Co Ltd / China - Media and Entertainment / Listing Exchange: Hong Kong / Ticker: N/A / Gross proceeds (including overallotment): US$ 1,000.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Oncoclinicas do Brasil Servicos Medicos SA / Brazil - Healthcare / Listing Exchange: BOVESPA / Ticker: ONCO3 / Gross proceeds (including overallotment): US$ 510.07m (offering in Brazilian Real) / Bookrunners: Banco JP Morgan SA, Banco Santander Brasil SA, Banco Itau-BBA SA, Citigroup Global Markets Brasil Corretora de Cambio, Goldman Sachs do Brasil Banco Multiplo SA, Ubs Brasil Administradora de Valores Mobiliarios Ltda

- LOTTE Rental Co Ltd / South Korea - Consumer Products and Services / Listing Exchange: Korea / Ticker: N/A / Gross proceeds (including overallotment): US$ 408.75m (offering in Korean Won) / Bookrunners: Samsung Securities Co Ltd, Korea Investment & Securities Co Ltd, Kiwoom Securities Co, Shinhan Investment Corp, NH Investment & Securities Co, Hana Financial Investment Co, Mirae Asset Daewoo Co Ltd, KBI Securities Co Ltd

- Puya Semiconductor (Shanghai) Co Ltd / China - High Technology / Listing Exchange: SSES / Ticker: 688766 / Gross proceeds (including overallotment): US$ 123.79m (offering in Chinese Yuan) / Bookrunners: CITIC Securities Co Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- ZoomInfo Technologies Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: ZI / Gross proceeds (including overallotment): US$ 1,290.80m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC

- Shuangliang Eco-Energy Systems Co Ltd / China - Industrials / Listing Exchange: Shanghai / Ticker: 600481 / Gross proceeds (including overallotment): US$ 539.92m (offering in Chinese Yuan) / Bookrunners: Not Applicable