Equities

Growth Stocks Lead Equity Indices To A Positive Close, Even Though A Majority Of Stocks End Day Down

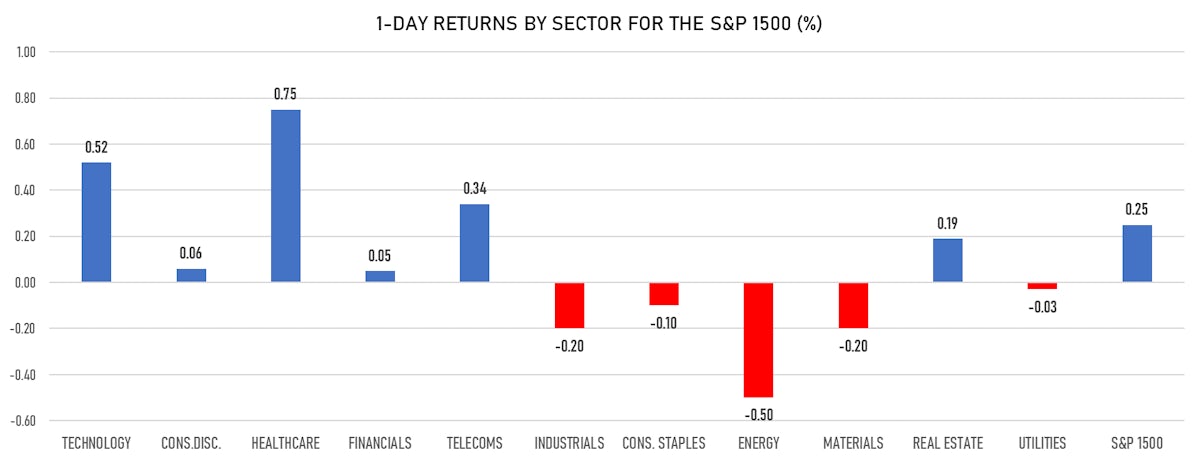

Energy and industrials were the worst-performing sectors on a low-volume session dominated by growth and large caps

Published ET

KnowBe4 (KNBE) Jumped Following Secondary Offering Priced at $20.75/Share | Source: Refinitiv

QUICK SUMMARY

- Daily performance of US indices: S&P 500 up 0.30%; Nasdaq Composite up 0.35%; Wilshire 5000 up 0.25%

- 47.1% of S&P 500 stocks were up today, with 84.6% of stocks above their 200-day moving average (DMA) and 67.3% above their 50-DMA

- Top performing sectors in the S&P 500: health care up 0.77% and technology up 0.59%

- Bottom performing sectors in the S&P 500: energy down -0.49% and industrials down -0.23%

- The number of shares in the S&P 500 traded today was 425m for a total turnover of US$ 52 bn

- The S&P 500 Value Index was unchanged, while the S&P 500 Growth Index was up 0.6%; the S&P small caps index was down -0.5% and mid caps were down -0.2%

- The volume on CME's INX (S&P 500 Index) was 1.6m (3-month z-score: -1.2); the 3-month average volume is 2.1m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.11%; UK FTSE 100 down -0.37%; tonight in Asia, China's CSI 300 up +0.15%, Japan's TOPIX 500 up 0.28%

VOLATILITY

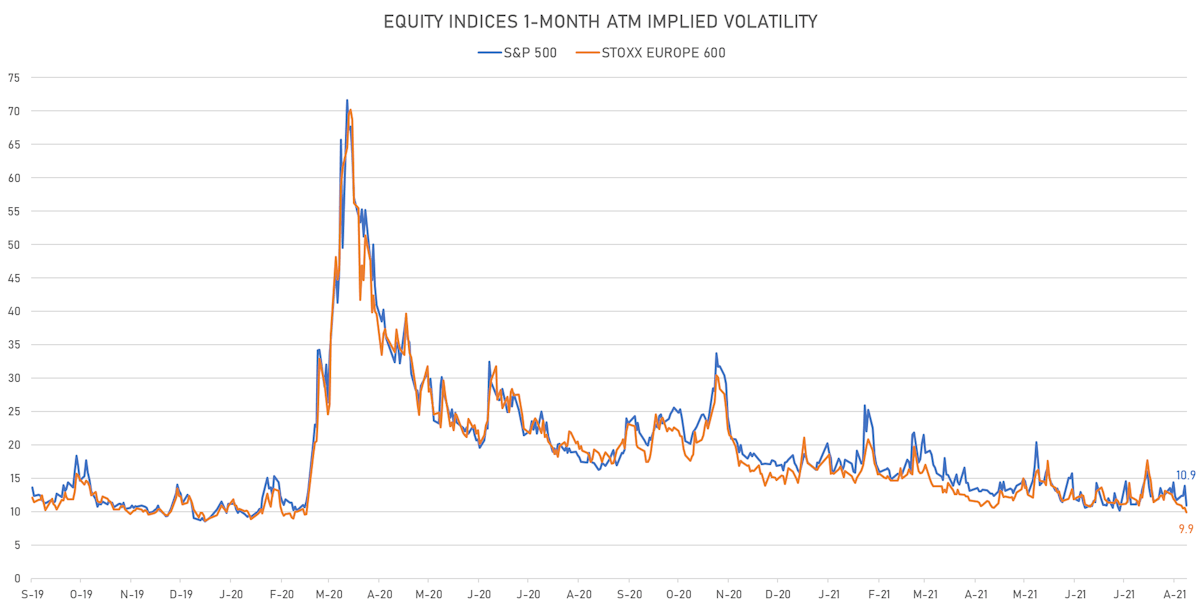

- 1-month at-the-money implied volatility on the S&P 500 at 10.9%, down from 13.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 9.9%, down from 10.6%

NOTABLE S&P 500 EARNINGS RELEASES

- Walt Disney Co (Consumer Cyclicals): beat on EPS (0.80 act. vs. 0.55 est.) and beat on revenue (17,022m act. vs. 16,761m est.)

- Organon & Co (Healthcare): beat on EPS (1.68 act. vs. 1.40 est.) and beat on revenue (1,595m act. vs. 1,533m est.)

- Broadridge Financial Solutions Inc (Technology): missed on EPS (2.19 act. vs. 2.19 est.) and beat on revenue (1,532m act. vs. 1,473m est.)

TOP WINNERS

- Knowbe4 Inc (KNBE), up 25.9% to $26.48 / 12-Month Price Range: $ 16.77-36.67

- Opendoor Technologies Inc (OPEN), up 24.0% to $17.98 / YTD price return: -20.9% / 12-Month Price Range: $ 10.55-39.24

- Goodrx Holdings Inc (GDRX), up 14.9% to $35.53 / YTD price return: -11.9% / 12-Month Price Range: $ 26.66-64.22

- First Advantage Corp (FA), up 14.5% to $22.68 / 12-Month Price Range: $ 17.58-21.37

- Amarin Corporation PLC (AMRN), up 14.4% to $5.64 / YTD price return: +15.3% / 12-Month Price Range: $ 3.36-9.25 / Short interest (% of float): 3.5%; days to cover: 3.9

- Inovio Pharmaceuticals Inc (INO), up 13.3% to $9.69 / YTD price return: +9.5% / 12-Month Price Range: $ 5.81-19.00

- Doximity Inc (DOCS), up 13.0% to $79.54 / 12-Month Price Range: $ 41.17-70.67 / Short interest (% of float): 6.5%; days to cover: 0.7

- Array Technologies Inc (ARRY), up 12.9% to $17.30 / YTD price return: -59.9% / 12-Month Price Range: $ 12.72-54.78 / Short interest (% of float): 4.6%; days to cover: 1.6

- Liberty Global PLC (LBTYB), up 12.4% to $30.18 / 12-Month Price Range: $ 19.51-38.89 / Short interest (% of float): 0.0%; days to cover: 0.9

- Organon & Co (OGN), up 11.9% to $33.50 / 12-Month Price Range: $ 27.25-38.75

BIGGEST LOSERS

- Lifestance Health Group Inc (LFST), down 46.5% to $11.71 / 12-Month Price Range: $ 19.55-29.81 (the stock is currently on the short sale restriction list)

- Gohealth Inc (GOCO), down 42.8% to $4.69 / YTD price return: -65.7% / 12-Month Price Range: $ 8.04-19.50 (the stock is currently on the short sale restriction list)

- Vroom Inc (VRM), down 20.0% to $30.38 / YTD price return: -25.8% / 12-Month Price Range: $ 26.96-75.49 (the stock is currently on the short sale restriction list)

- SelectQuote Inc (SLQT), down 19.7% to $13.87 / YTD price return: -33.2% / 12-Month Price Range: $ 16.59-33.00 (the stock is currently on the short sale restriction list)

- Root Inc (ROOT), down 19.4% to $5.54 / YTD price return: -64.7% / 12-Month Price Range: $ 6.62-29.48 (the stock is currently on the short sale restriction list)

- Fisker Inc (FSR), down 17.2% to $15.15 / YTD price return: +3.4% / 12-Month Price Range: $ 8.70-31.96 (the stock is currently on the short sale restriction list)

- GrowGeneration Corp (GRWG), down 17.1% to $35.72 / YTD price return: -11.2% / 12-Month Price Range: $ 8.55-67.75 (the stock is currently on the short sale restriction list)

- Reinvent Technology Partners (JOBY), down 15.6% to $11.31 / YTD price return: -2.2% / 12-Month Price Range: $ 9.26-17.00 (the stock is currently on the short sale restriction list)

- Neogames SARL (NGMS), down 14.7% to $47.71 / YTD price return: +25.6% / 12-Month Price Range: $ 18.67-73.54 / Short interest (% of float): 2.7%; days to cover: 1.4 (the stock is currently on the short sale restriction list)

- Rackspace Technology Inc (RXT), down 14.2% to $14.31 / YTD price return: -24.9% / 12-Month Price Range: $ 15.44-26.43 (the stock is currently on the short sale restriction list)

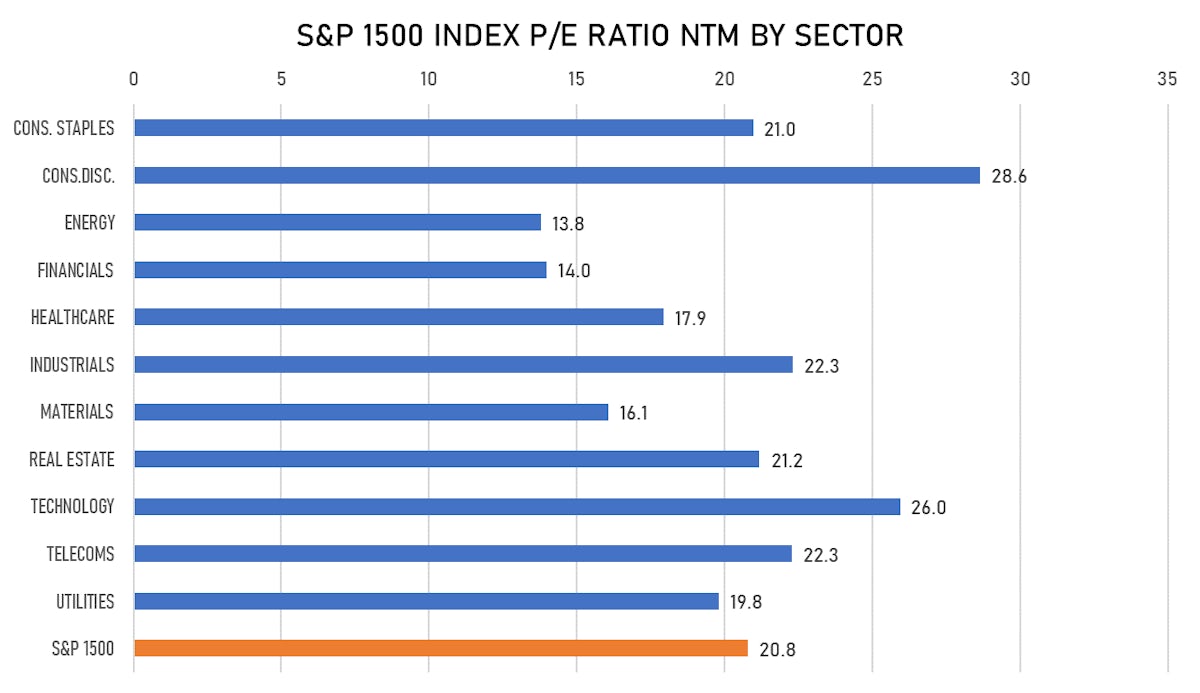

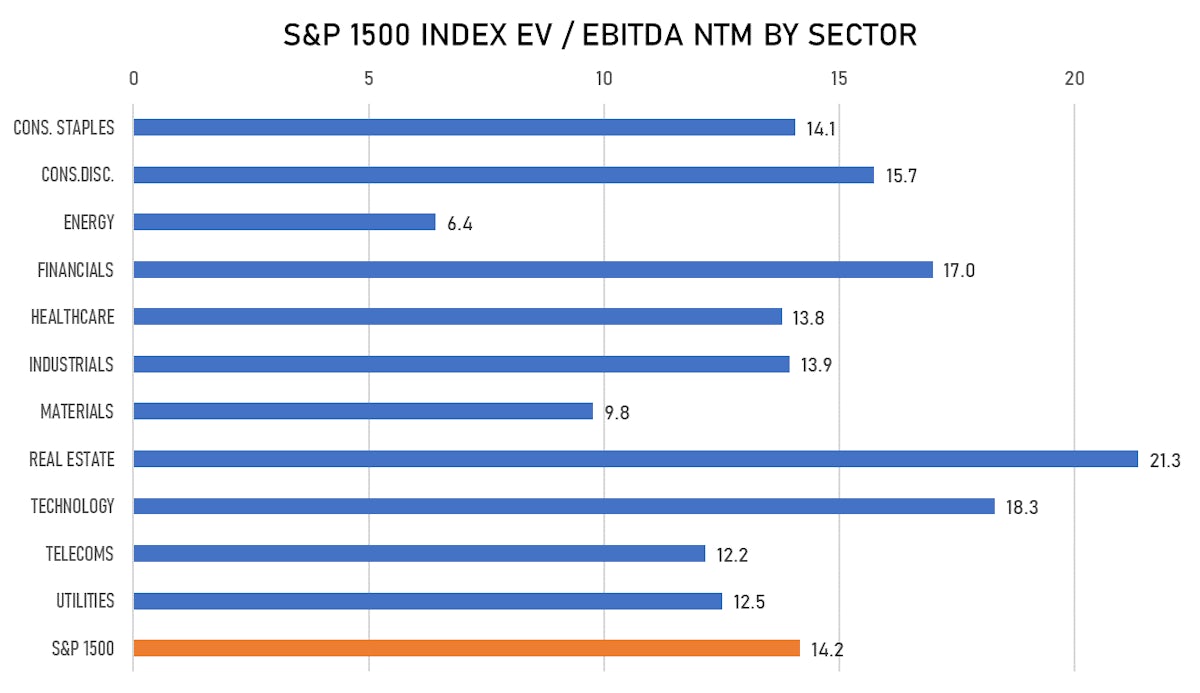

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Afternext Healthtech Acquisition Corp / United States of America - Financials / Listing Exchange: New York / Ticker: AFTR.U / Gross proceeds (including overallotment): US$ 250.00m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Deutsche Bank Securities Inc, BofA Securities Inc

- Kora Saude Participacoes SA / Brazil - Healthcare / Listing Exchange: BOVESPA / Ticker: KRSA3 / Gross proceeds (including overallotment): US$ 147.54m (offering in Brazilian Real) / Bookrunners: Banco JP Morgan SA, Banco Santander Brasil SA, Banco Itau-BBA SA, Bradesco BBI, XP Investimentos, Banco J Safra SA, Ubs Brasil Administradora de Valores Mobiliarios Ltda

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- KnowBe4 Inc / United States of America - High Technology / Listing Exchange: Nasdaq / Ticker: KNBE / Gross proceeds (including overallotment): US$ 216.44m (offering in U.S. Dollar) / Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, KKR Capital Markets LLC, Morgan Stanley & Co LLC, BofA Securities Inc

- Keppel DC REIT / Singapore - Real Estate / Listing Exchange: Singapore / Ticker: AJBU / Gross proceeds (including overallotment): US$ 149.15m (offering in Singapore Dollar) / Bookrunners: Oversea-Chinese Banking Corp Ltd, DBS Bank Ltd, Credit Suisse (Singapore) Ltd, Citigroup Global Markets Singapore Pte Ltd