Equities

US Equity Indices Close The Week At New Record Highs

The session was another low-volume summer snoozer, marked by a further fall in implied volatility and a slight overperformance of growth over value

Published ET

FactSet Country Indices Performance Year To Date | Sources: ϕpost, FactSet data

QUICK SUMMARY

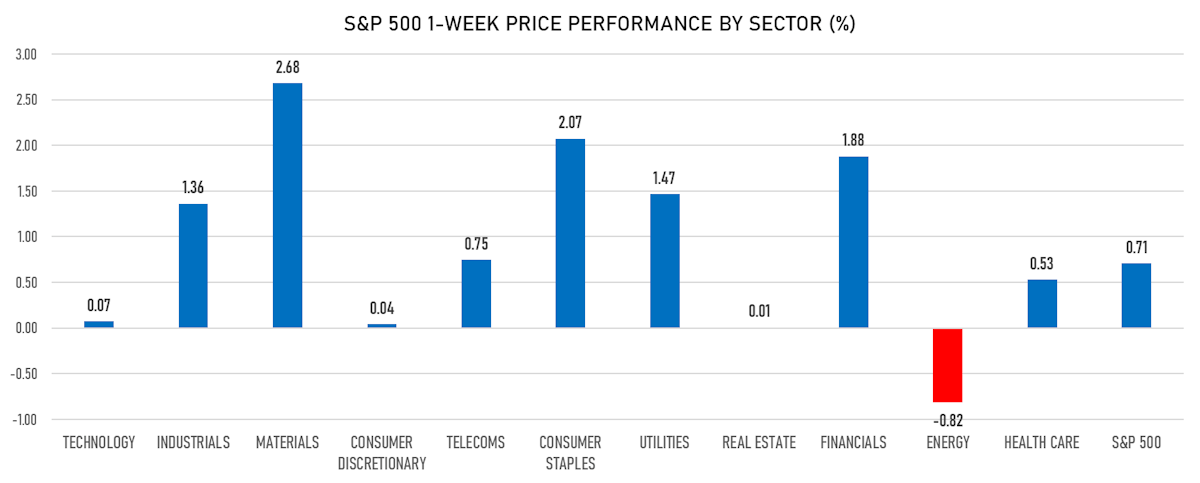

- Daily performance of US indices: S&P 500 up 0.16%; Nasdaq Composite up 0.04%; Wilshire 5000 up 0.03%

- 53.9% of S&P 500 stocks were up today, with 84.6% of stocks above their 200-day moving average (DMA) and 67.1% above their 50-DMA

- Top performing sectors in the S&P 500: consumer staples up 0.81% and real estate up 0.68%

- Bottom performing sectors in the S&P 500: energy down -1.29% and financials down -0.73%

- The number of shares in the S&P 500 traded today was 377m for a total turnover of US$ 45 bn

- The S&P 500 Value Index was down -0.1%, while the S&P 500 Growth Index was up 0.3%; the S&P small caps index was down -0.7% and mid caps were down -0.2%

- The volume on CME's INX (S&P 500 Index) was 1.5m (3-month z-score: -1.4); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.21%; UK FTSE 100 up 0.35%; China's CSI 300 down -0.55%; Japan's TOPIX 500 up 0.15%

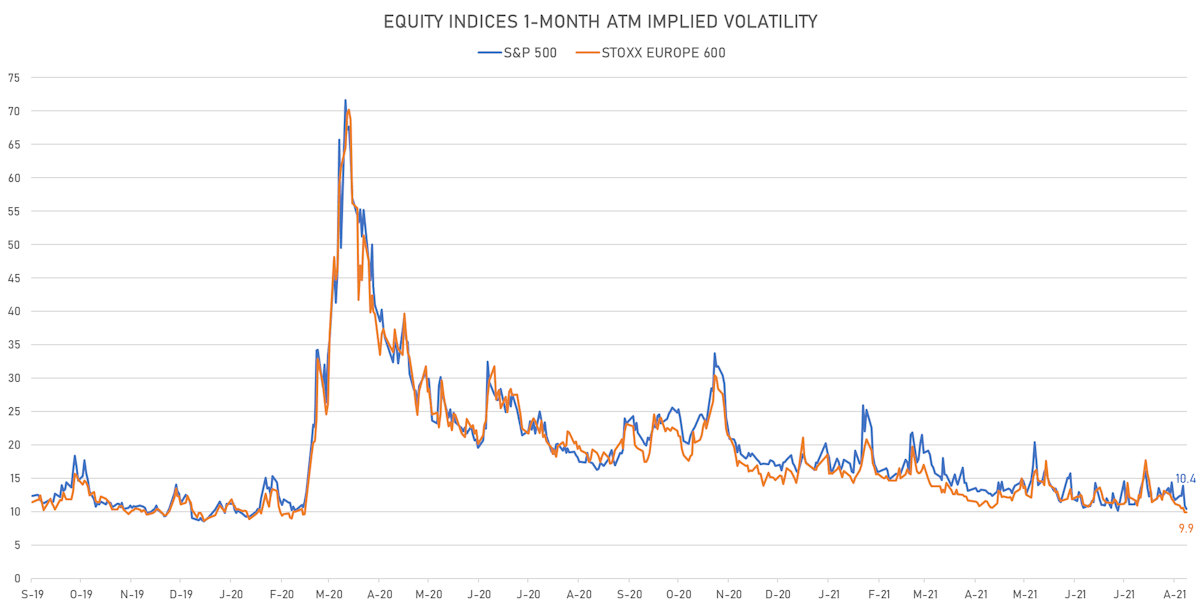

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 10.4%, down from 10.9%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 unchanged at 9.9%

TOP WINNERS

- Pilgrims Pride Corp (PPC), up 20.5% to $27.34 / YTD price return: +39.4% / 12-Month Price Range: $ 14.06-26.28

- Abcellera Biologics Inc (ABCL), up 17.8% to $17.89 / YTD price return: -55.5% / 12-Month Price Range: $ 14.51-71.91 / Short interest (% of float): 4.6%; days to cover: 4.1

- Pretium Resources Inc (PVG), up 16.6% to $9.85 / YTD price return: -14.2% / 12-Month Price Range: $ 8.29-14.55 / Short interest (% of float): 4.4%; days to cover: 7.0

- Lifestance Health Group Inc (LFST), up 14.9% to $13.45 / 12-Month Price Range: $ 10.71-29.81 / Short interest (% of float): 0.9%; days to cover: 4.2

- Upstart Holdings Inc (UPST), up 14.1% to $203.29 / YTD price return: +398.9% / 12-Month Price Range: $ 22.61-191.89

- Integral Ad Science Holding Corp (IAS), up 11.6% to $18.21 / 12-Month Price Range: $ 16.23-22.50

- Couchbase Inc (BASE), up 10.6% to $34.62 / 12-Month Price Range: $ 28.00-37.37

- Beauty Health Co (SKIN), up 10.5% to $22.80 / YTD price return: +101.6% / 12-Month Price Range: $ 9.71-20.70

- Rocket Companies Inc (RKT), up 10.2% to $19.26 / YTD price return: -.3% / 12-Month Price Range: $ 16.22-41.10

- Seer Inc (SEER), up 8.8% to $32.47 / YTD price return: -42.2% / 12-Month Price Range: $ 26.48-86.55

BIGGEST LOSERS

- ContextLogic Inc (WISH), down 19.8% to $7.55 / YTD price return: -58.6% / 12-Month Price Range: $ 7.52-32.85 (the stock is currently on the short sale restriction list)

- Cricut Inc (CRCT), down 18.2% to $28.23 / 12-Month Price Range: $ 14.88-47.36 (the stock is currently on the short sale restriction list)

- Latch Inc (LTCH), down 17.2% to $9.93 / YTD price return: -1.9% / 12-Month Price Range: $ 9.86-19.70 (the stock is currently on the short sale restriction list)

- Tattooed Chef Inc (TTCF), down 16.2% to $17.01 / YTD price return: -25.7% / 12-Month Price Range: $ 14.09-28.64 (the stock is currently on the short sale restriction list)

- JinkoSolar Holding Co Ltd (JKS), down 14.3% to $45.74 / 12-Month Price Range: $ 18.94-90.20 / Short interest (% of float): 15.7%; days to cover: 2.3 (the stock is currently on the short sale restriction list)

- Dingdong (Cayman) Ltd (DDL), down 14.2% to $18.38 / 12-Month Price Range: $ 18.87-46.00 / Short interest (% of float): 0.1%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- SoFi Technologies Inc (SOFI), down 14.1% to $14.99 / YTD price return: +20.5% / 12-Month Price Range: $ 10.10-28.26 (the stock is currently on the short sale restriction list)

- Gohealth Inc (GOCO), down 13.2% to $4.07 / YTD price return: -70.2% / 12-Month Price Range: $ 4.61-19.50 / Short interest (% of float): 7.1%; days to cover: 4.4 (the stock is currently on the short sale restriction list)

- Xometry Inc (XMTR), down 12.6% to $70.10 / 12-Month Price Range: $ 57.50-97.57 (the stock is currently on the short sale restriction list)

- Adecoagro SA (AGRO), down 12.2% to $9.05 / YTD price return: +33.1% / 12-Month Price Range: $ 4.55-11.77 / Short interest (% of float): 3.5%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

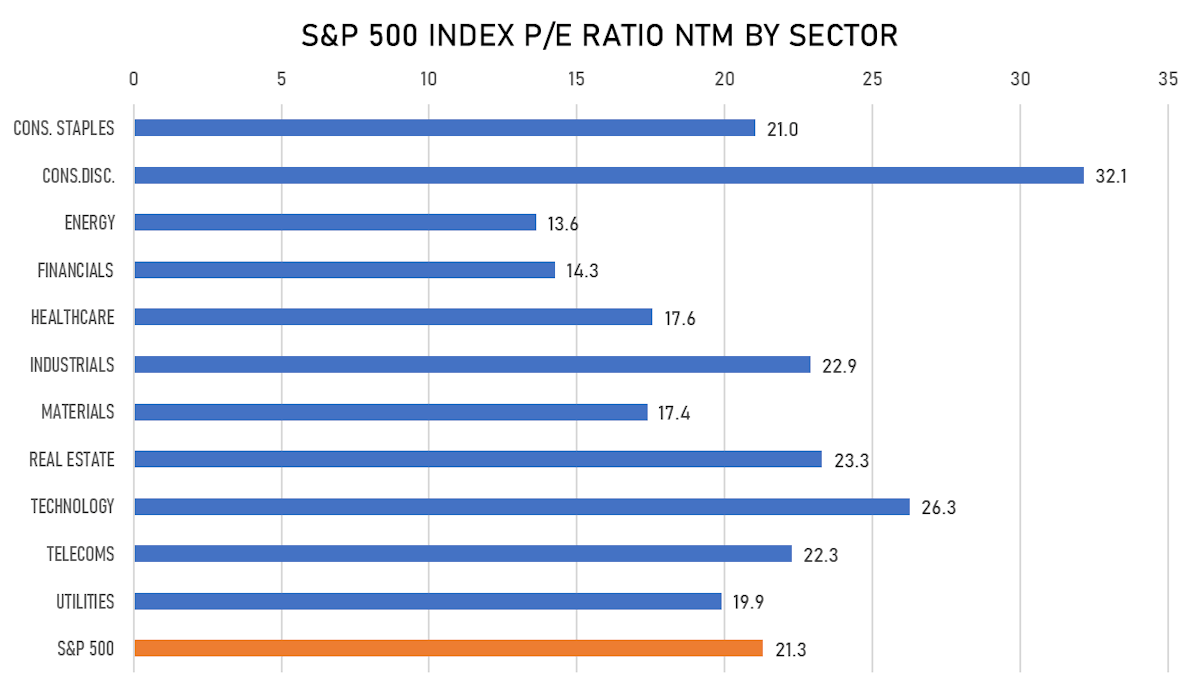

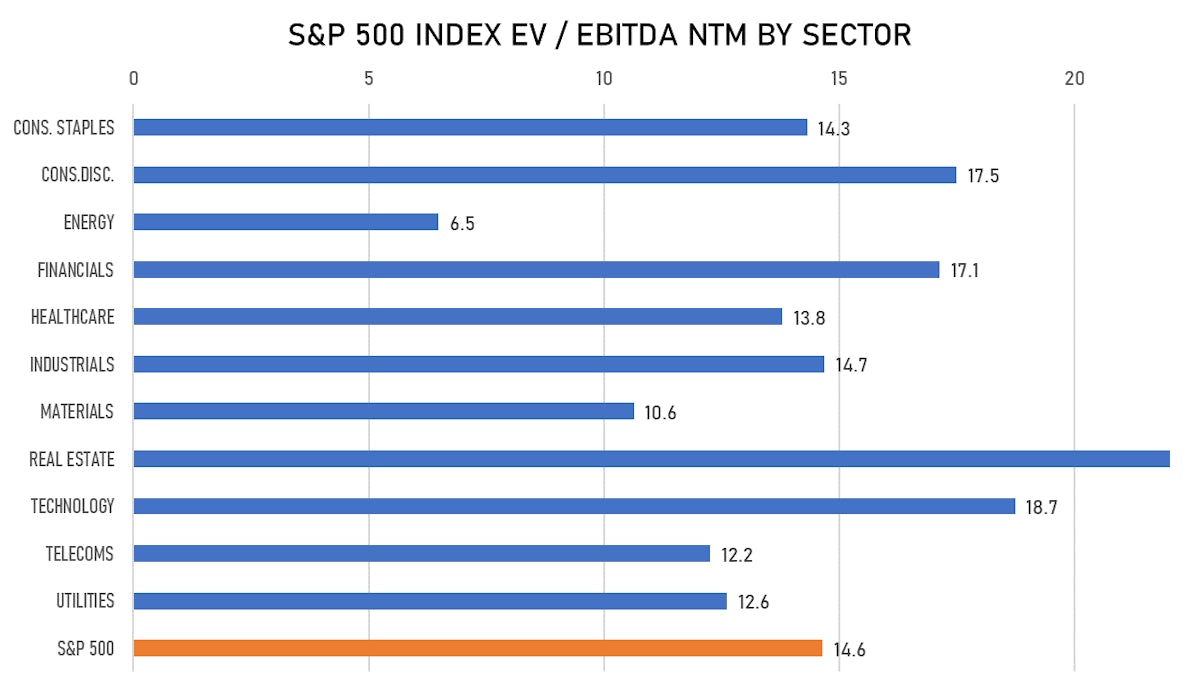

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- DTRT Health Acquisition Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: DTRTU / Gross proceeds (including overallotment): US$ 200.00m (offering in U.S. Dollar) / Bookrunners: Cantor Fitzgerald & Co

- CENAQ Energy Corp / United States of America - Financials / Listing Exchange: Nasdaq / Ticker: CENQU / Gross proceeds (including overallotment): US$ 150.00m (offering in U.S. Dollar) / Bookrunners: Imperial Capital LLC, I-Bankers Securities Inc

- Tidewater Renewables Ltd / Canada - Energy and Power / Listing Exchange: Toronto / Ticker: LCFS / Gross proceeds (including overallotment): US$ 119.76m (offering in Canadian Dollar) / Bookrunners: CIBC World Markets Inc, National Bank Financial Inc

- Aiways Automobile Co Ltd / China - Industrials / Listing Exchange: - / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Hesai Optoelectronics Technology Co Ltd / China - High Technology / Listing Exchange: - / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

- Le Travenues Technology Ltd / India - High Technology / Listing Exchange: National / Ticker: - / Gross proceeds (including overallotment): US$ 215.31m (offering in Indian Rupee) / Bookrunners: Kotak Mahindra Capital Co, Nomura Finl Advisory & Sec, ICICI Securities Ltd, Axis Capital Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Takara Leben Real Estate Investment Corp / Japan - Real Estate / Listing Exchange: Tokyo / Ticker: 3492 / Gross proceeds (including overallotment): US$ 128.42m (offering in Japanese Yen) / Bookrunners: Mizuho Securities Co Ltd, SMBC Nikko Securities Inc