Equities

Low-Volume Fall In US Equities After Disappointing Retail Sales

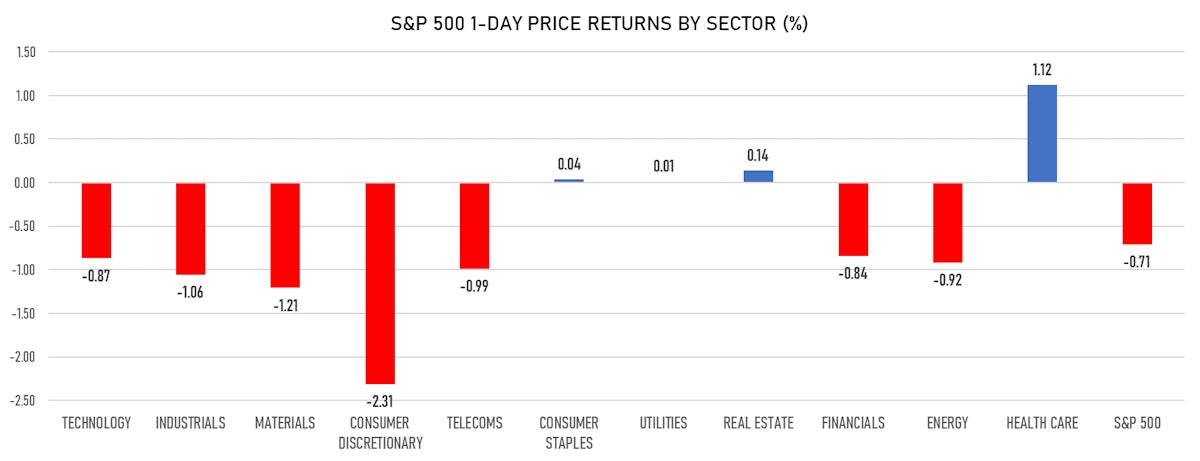

Just 30% of S&P 500 stocks closed up today, with consumer discretionary and materials the worst-performing sectors

Published ET

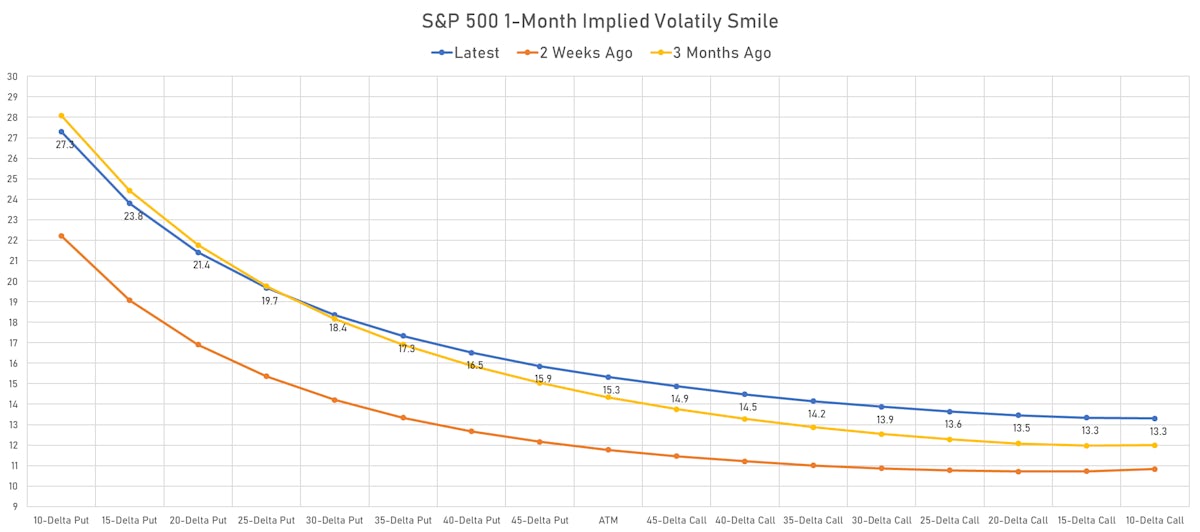

Implied volatility on CME S&P 500 options rose sharply today from a low level | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -0.71%; Nasdaq Composite down -0.93%; Wilshire 5000 down -0.78%

- 29.7% of S&P 500 stocks were up today, with 81.4% of stocks above their 200-day moving average (DMA) and 63.2% above their 50-DMA

- Top performing sectors in the S&P 500: healthcare up 1.12% and real estate up 0.14%

- Bottom performing sectors in the S&P 500: consumer discretionary down -2.31% and materials down -1.21%

- The number of shares in the S&P 500 traded today was 472m for a total turnover of US$ 58 bn

- The S&P 500 Value Index was down -0.5%, while the S&P 500 Growth Index was down -0.9%; the S&P small caps index was down -1.5% and mid caps were down -1.2%

- The volume on CME's INX (S&P 500 Index) was 1.9m (3-month z-score: -0.3); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.07%; UK FTSE 100 up 0.38%; tonight in Asia, China's CSI 300 up 0.72% and Japan's TOPIX 500 up 0.66%

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 15.3%, up from 11.0%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 10.9%, down from 11.4%

NOTABLE S&P 500 EARNINGS RELEASES

- Walmart Inc (Consumer Non-Cyclicals): beat on EPS (1.78 act. vs. 1.57 est.) and beat on revenue (141,048m act. vs. 137,165m est.)

- Home Depot Inc (Consumer Cyclicals): beat on EPS (4.53 act. vs. 4.44 est.) and beat on revenue (41,118m act. vs. 40,789m est.)

- Agilent Technologies Inc (Healthcare): beat on EPS (1.10 act. vs. 0.83 est.) and beat on revenue (1,580m act. vs. 1,397m est.)

- Amcor PLC (Basic Materials): beat on EPS (0.26 act. vs. 0.17 est.) and beat on revenue (3,454m act. vs. 3,250m est.)

- Jack Henry & Associates Inc (Technology): beat on EPS (1.04 act. vs. 0.86 est.) and beat on revenue (450m act. vs. 440m est.)

TOP WINNERS

- Monday.com Ltd (MNDY), up 24.5% to $305.00 / 12-Month Price Range: $ 155.01-269.86 / Short interest (% of float): 1.0%; days to cover: 2.9

- Omega Therapeutics Inc (OMGA), up 17.5% to $22.51 / 12-Month Price Range: $ 15.50-22.98

- Danimer Scientific Inc (DNMR), up 13.2% to $15.02 / YTD price return: -36.1% / 12-Month Price Range: $ 9.75-66.30 / Short interest (% of float): 12.0%; days to cover: 5.3 (the stock is currently on the short sale restriction list)

- Waterdrop Inc (WDH), up 13.0% to $3.90 / 12-Month Price Range: $ 3.30-11.77 / Short interest (% of float): 0.1%; days to cover: 0.5

- Applovin Corp (APP), up 12.0% to $62.57 / 12-Month Price Range: $ 49.41-90.03

- Nuvalent Inc (NUVL), up 12.0% to $27.25 / 12-Month Price Range: $ 17.00-27.49

- Taskus Inc (TASK), up 11.7% to $44.13 / 12-Month Price Range: $ 26.66-41.00

- Douyu International Holdings Ltd (DOYU), up 11.4% to $3.42 / YTD price return: -69.1% / 12-Month Price Range: $ 3.06-20.54 / Short interest (% of float): 2.2%; days to cover: 1.0

- Celularity Inc (CELU), up 11.4% to $6.85 / YTD price return: -37.7% / 12-Month Price Range: $ 6.13-13.40

- Travere Therapeutics Inc (TVTX), up 10.7% to $19.73 / YTD price return: -27.6% / 12-Month Price Range: $ 12.75-33.09 / Short interest (% of float): 11.6%; days to cover: 8.8

BIGGEST LOSERS

- Sema4 Holdings Corp (SMFR), down 17.3% to $9.39 / YTD price return: -14.9% / 12-Month Price Range: $ 9.66-27.18 (the stock is currently on the short sale restriction list)

- Lands End Inc (LE), down 15.6% to $35.58 / YTD price return: +65.0% / 12-Month Price Range: $ 10.48-44.40 (the stock is currently on the short sale restriction list)

- Hippo Holdings Inc (HIPO), down 15.3% to $4.65 / 12-Month Price Range: $ 5.22-15.05 (the stock is currently on the short sale restriction list)

- Microvast Holdings Inc (MVST), down 13.3% to $8.97 / YTD price return: -47.5% / 12-Month Price Range: $ 7.83-25.20 / Short interest (% of float): 2.4%; days to cover: 3.8 (the stock is currently on the short sale restriction list)

- Tencent Music Entertainment Group (TME), down 12.3% to $7.82 / YTD price return: -59.4% / 12-Month Price Range: $ 8.88-32.25 / Short interest (% of float): 2.7%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- Vedanta Ltd (VEDL), down 12.2% to $15.67 / YTD price return: +78.5% / 12-Month Price Range: $ 4.92-18.01 / Short interest (% of float): 1.4%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- F45 Training Holdings Inc (FXLV), down 11.9% to $13.56 / 12-Month Price Range: $ 13.50-17.75 / Short interest (% of float): 5.3%; days to cover: 1.1

- DXC Technology Co (DXC), down 11.8% to $36.81 / YTD price return: +43.0% / 12-Month Price Range: $ 15.64-44.18 / Short interest (% of float): 3.0%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Porch Group Inc (PRCH), down 11.4% to $16.56 / YTD price return: +16.0% / 12-Month Price Range: $ 10.03-24.41 (the stock is currently on the short sale restriction list)

- IDT Corp (IDT), down 11.4% to $48.26 / YTD price return: +290.5% / 12-Month Price Range: $ 5.95-57.10 (the stock is currently on the short sale restriction list)

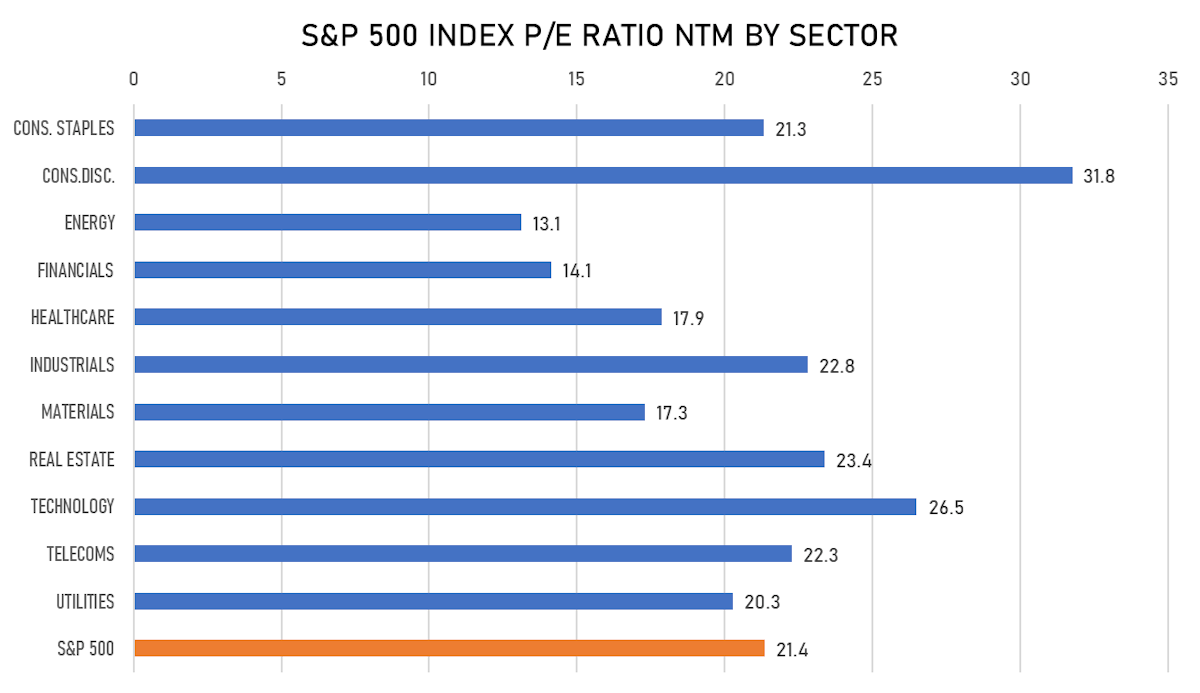

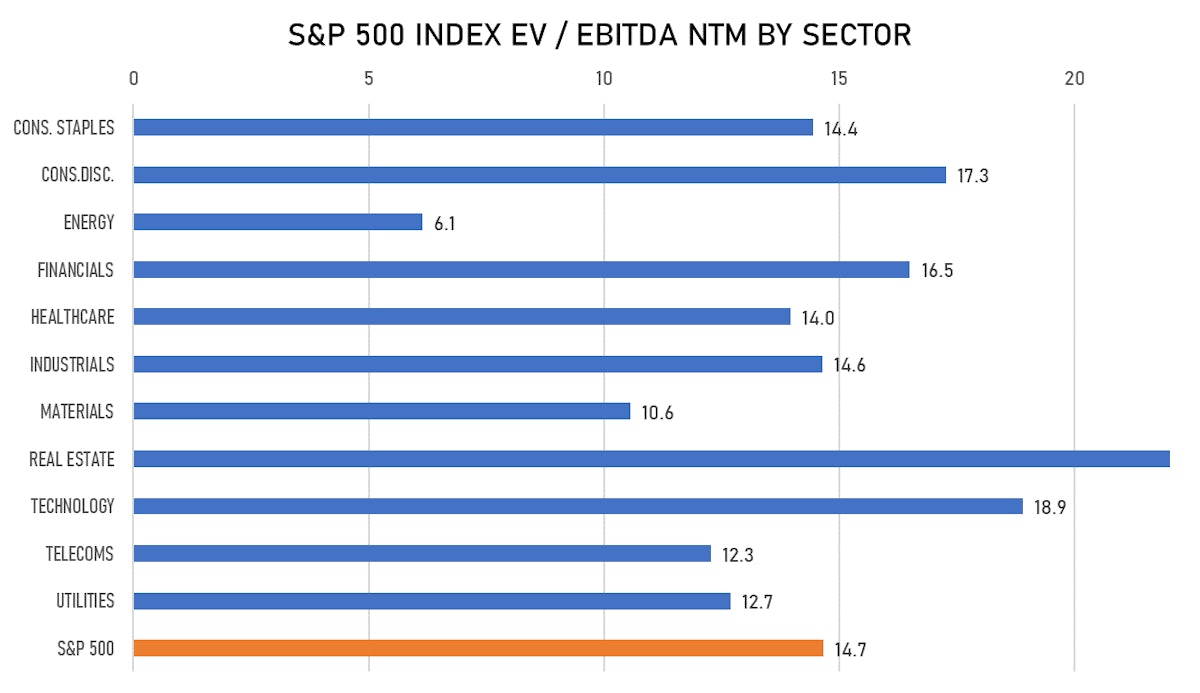

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Sterlite Power Transmission Ltd / India - Energy and Power / Listing Exchange: National / Ticker: N/A / Gross proceeds (including overallotment): US$ 168.55m (offering in Indian Rupee) / Bookrunners: JM Financial Group, ICICI Securities Ltd, Axis Capital Ltd

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Jeld-Wen Holding Inc / United States of America - Consumer Products and Services / Listing Exchange: New York / Ticker: JELD / Gross proceeds (including overallotment): US$ 427.89m (offering in U.S. Dollar) / Bookrunners: JP Morgan Securities LLC

- Ping Identity Holding Corp / United States of America - High Technology / Listing Exchange: New York / Ticker: PING / Gross proceeds (including overallotment): US$ 143.10m (offering in U.S. Dollar) / Bookrunners: Morgan Stanley & Co LLC