Equities

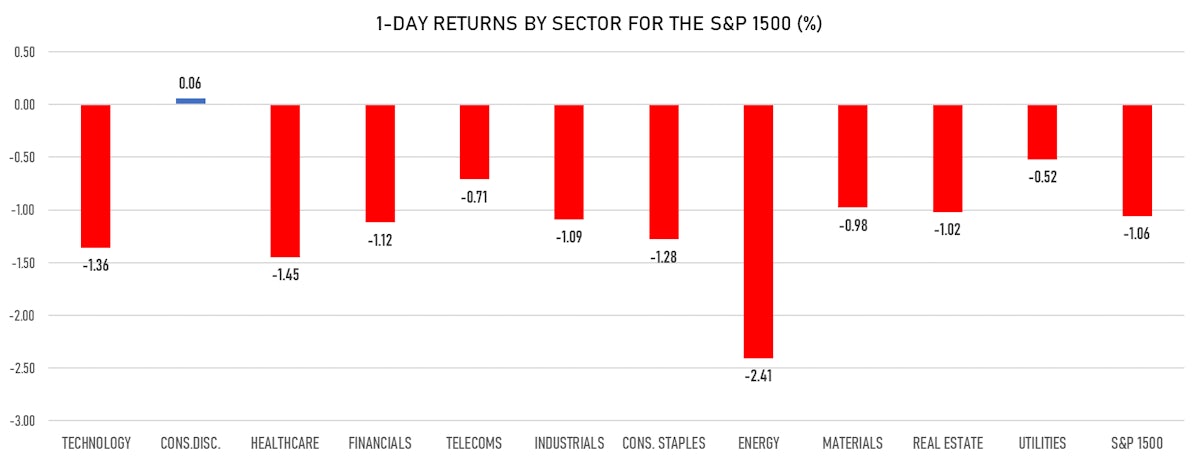

Another Low-Volume Drop In US Stocks, Most Sectors In The Red Today

Broad fall with just 10% of S&P 500 stocks closing up and volatility rising significantly: small caps did slightly better than mid- and large caps

Published ET

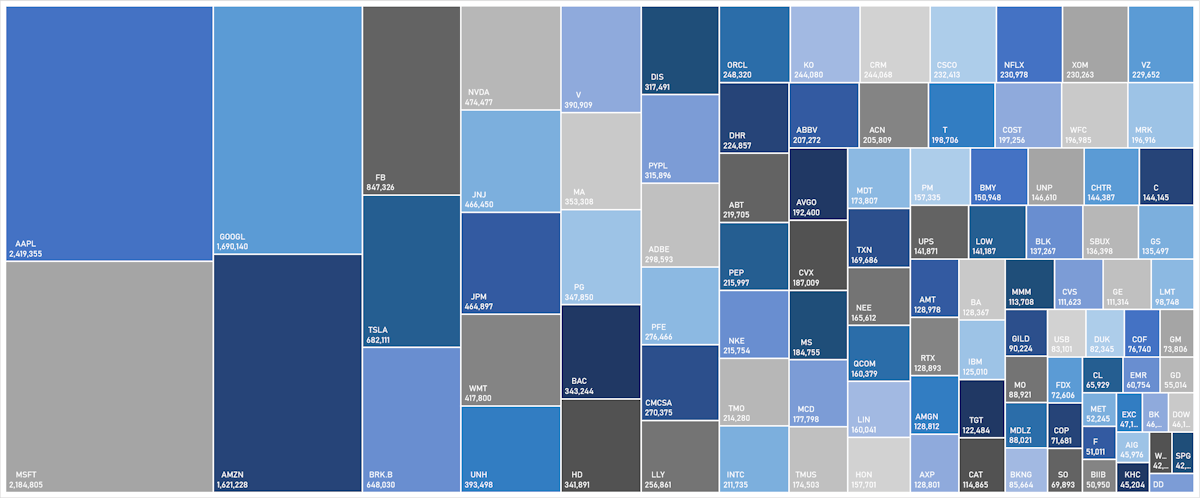

Market Caps Of S&P 100 Constituents | Sources: ϕpost, FactSet data

QUICK SUMMARY

- Daily performance of US indices: S&P 500 down -1.07%; Nasdaq Composite down -0.89%; Wilshire 5000 down -0.96%

- 10.7% of S&P 500 stocks were up today, with 78.2% of stocks above their 200-day moving average (DMA) and 56.0% above their 50-DMA

- Top performing sectors in the S&P 500: consumer discretionary up 0.15% and utilities down -0.47%

- Bottom performing sectors in the S&P 500: energy down -2.40% and healthcare down -1.46%

- The number of shares in the S&P 500 traded today was 483m for a total turnover of US$ 57 bn

- The S&P 500 Value Index was down -1.1%, while the S&P 500 Growth Index was down -1.0%; the S&P small caps index was down -0.8% and mid caps were down -0.9%

- The volume on CME's INX (S&P 500 Index) was 1.9m (3-month z-score: -0.4); the 3-month average volume is 2.0m and the 12-month range is 0.8 - 5.1m

- Daily performance of international indices: Europe Stoxx 600 up 0.14%; UK FTSE 100 down -0.16%; tonight in Asia, China's CSI 300 down -0.86% and Japan's TOPIX 500 down -0.78%

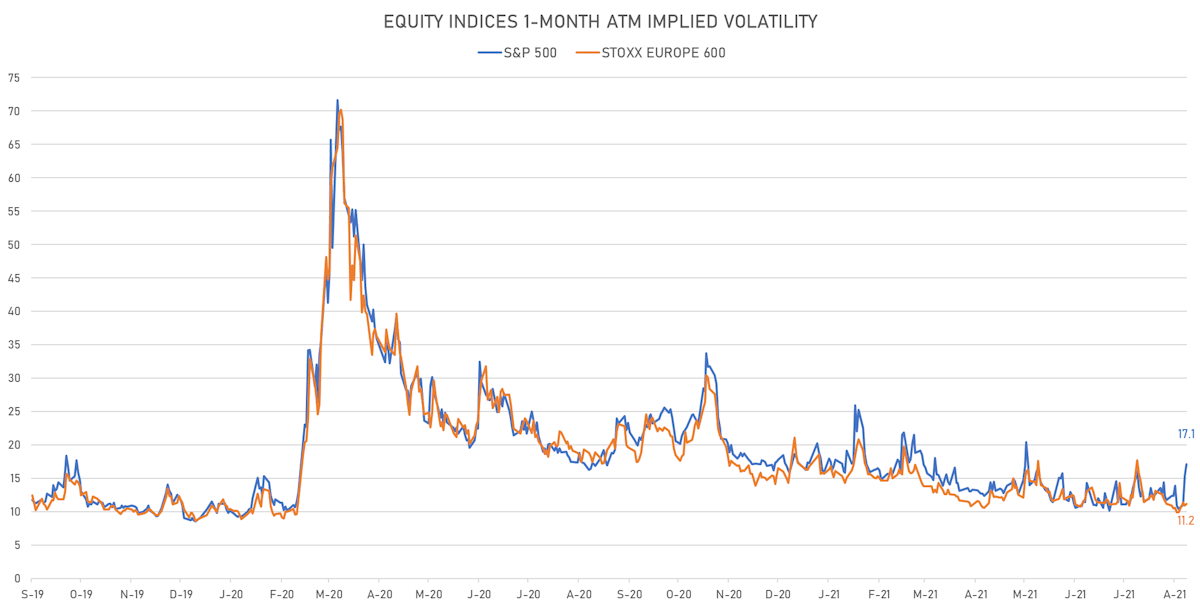

VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 17.1%, up from 15.3%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 11.2%, up from 10.9%

NOTABLE S&P 500 EARNINGS RELEASES

- NVIDIA Corp (Technology): beat on EPS (1.04 act. vs. 0.82 est.) and beat on revenue (6,507m act. vs. 5,410m est.)

- Cisco Systems Inc (Technology): beat on EPS (0.84 act. vs. 0.82 est.) and beat on revenue (13,126m act. vs. 12,563m est.)

- Lowe's Companies Inc (Consumer Cyclicals): missed on EPS (3.75 act. vs. 4.01 est.) and beat on revenue (27,570m act. vs. 26,846m est.)

- Target Corp (Consumer Cyclicals): beat on EPS (3.64 act. vs. 3.49 est.) and beat on revenue (25,160m act. vs. 25,077m est.)

- TJX Companies Inc (Consumer Cyclicals): beat on EPS (0.79 act. vs. 0.31 est.) and beat on revenue (12,077m act. vs. 8,617m est.)

- Analog Devices Inc (Technology): beat on EPS (1.72 act. vs. 1.45 est.) and beat on revenue (1,759m act. vs. 1,606m est.)

- Progressive Corp (Financials): missed on EPS (0.72 act. vs. 1.08 est.) and missed on revenue (11,480m act. vs. 11,522m est.)

- Synopsys Inc (Technology): beat on EPS (1.81 act. vs. 1.52 est.) and beat on revenue (1,057m act. vs. 989m est.)

- Keysight Technologies Inc (Industrials): beat on EPS (1.54 act. vs. 1.34 est.) and beat on revenue (1,222m act. vs. 1,207m est.)

- Bath & Body Works Inc (Consumer Cyclicals): beat on EPS (1.34 act. vs. 1.21 est.) and beat on revenue (3,318m act. vs. 3,007m est.)

TOP WINNERS

- Standard Lithium Ltd (SLI), up 22.6% to $7.16 / YTD price return: +220.4% / 12-Month Price Range: $ .79-9.09 / Short interest (% of float): 0.7%; days to cover: 1.1 (the stock is currently on the short sale restriction list)

- Monday.com Ltd (MNDY), up 16.7% to $355.98 / 12-Month Price Range: $ 155.01-317.69 / Short interest (% of float): 1.0%; days to cover: 2.9

- Alcon AG (ALC), up 12.2% to $80.06 / YTD price return: +21.5% / 12-Month Price Range: $ 54.51-76.53 / Short interest (% of float): 1.4%; days to cover: 10.0

- Caribou Biosciences Inc (CRBU), up 11.3% to $27.04 / 12-Month Price Range: $ 15.00-29.00 / Short interest (% of float): 0.8%; days to cover: 0.2

- Vir Biotechnology Inc (VIR), up 10.5% to $46.25 / YTD price return: +72.7% / 12-Month Price Range: $ 25.31-141.01

- Evolv Technologies Holdings Inc (EVLV), up 10.2% to $9.15 / 12-Month Price Range: $ 7.22-12.90

- ProShares Ultra VIX Short-Term Futures ETF (UVXY), up 10.2% to $26.70 / YTD price return: -74.9% / 12-Month Price Range: $ 22.36-321.80 / Short interest (% of float): 16.0%; days to cover: 0.3

- Bumble Inc (BMBL), up 9.8% to $51.01 / 12-Month Price Range: $ 38.91-84.80

- Weber Inc (WEBR), up 9.7% to $15.86 / 12-Month Price Range: $ 14.13-20.44

- Lowe's Companies Inc (LOW), up 9.6% to $199.73 / YTD price return: +24.4% / 12-Month Price Range: $ 146.72-215.22 / Short interest (% of float): 1.3%; days to cover: 2.9

BIGGEST LOSERS

- Tuya Inc (TUYA), down 19.0% to $12.15 / 12-Month Price Range: $ 14.77-27.65 / Short interest (% of float): 1.4%; days to cover: 5.0 (the stock is currently on the short sale restriction list)

- Vaxcyte Inc (PCVX), down 14.8% to $22.99 / 12-Month Price Range: $ 15.51-58.48 (the stock is currently on the short sale restriction list)

- Cree Inc (CREE), down 9.1% to $78.36 / YTD price return: -26.0% / 12-Month Price Range: $ 56.39-129.90 (the stock is currently on the short sale restriction list)

- IDT Corp (IDT), down 8.8% to $44.01 / YTD price return: +256.1% / 12-Month Price Range: $ 5.95-57.10 / Short interest (% of float): 4.1%; days to cover: 2.5 (the stock is currently on the short sale restriction list)

- Noah Holdings Ltd (NOAH), down 8.7% to $36.65 / YTD price return: -23.3% / 12-Month Price Range: $ 24.77-52.77 / Short interest (% of float): 2.8%; days to cover: 6.4

- CDK Global Inc (CDK), down 8.5% to $41.63 / YTD price return: -19.7% / 12-Month Price Range: $ 41.21-55.51 / Short interest (% of float): 1.7%; days to cover: 3.2 (the stock is currently on the short sale restriction list)

- Rocket Pharmaceuticals Inc (RCKT), down 8.0% to $28.66 / 12-Month Price Range: $ 21.95-67.48

- MacroGenics Inc (MGNX), down 7.7% to $22.02 / YTD price return: -3.7% / 12-Month Price Range: $ 18.16-36.48

- Purecycle Technologies Inc (PCT), down 7.7% to $11.64 / YTD price return: -28.0% / 12-Month Price Range: $ 9.76-35.75

- AiHuiShou International Co Ltd (RERE), down 7.7% to $10.72 / 12-Month Price Range: $ 10.37-18.49 / Short interest (% of float): 0.0%; days to cover: 0.1

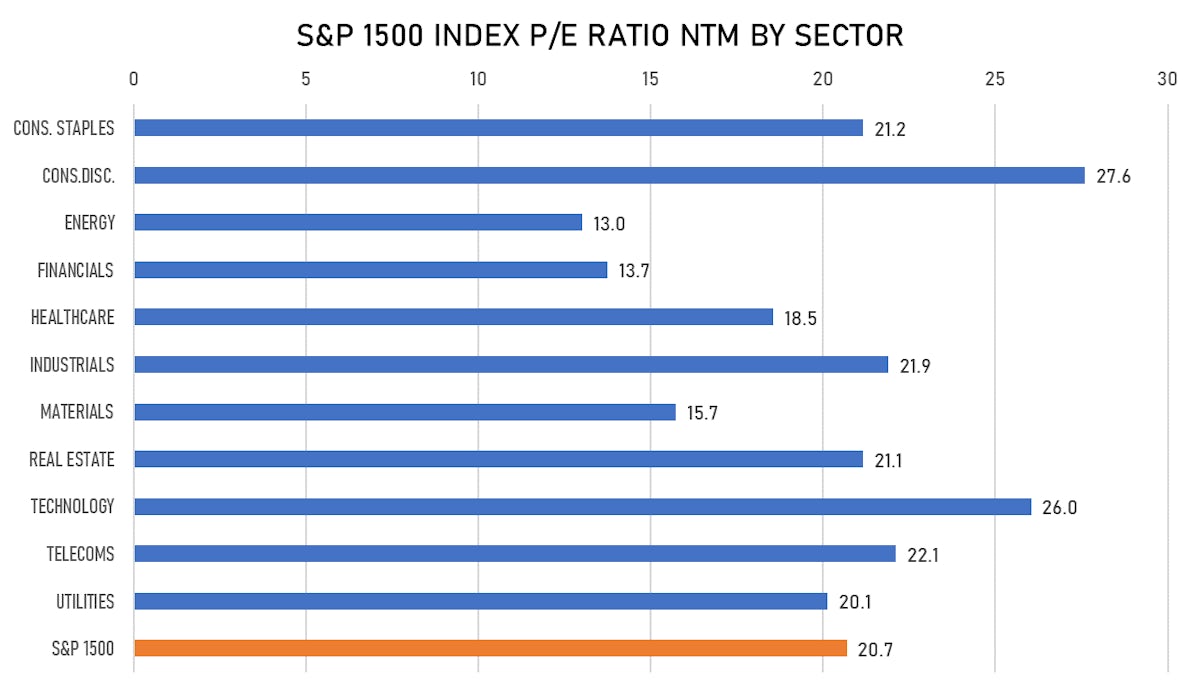

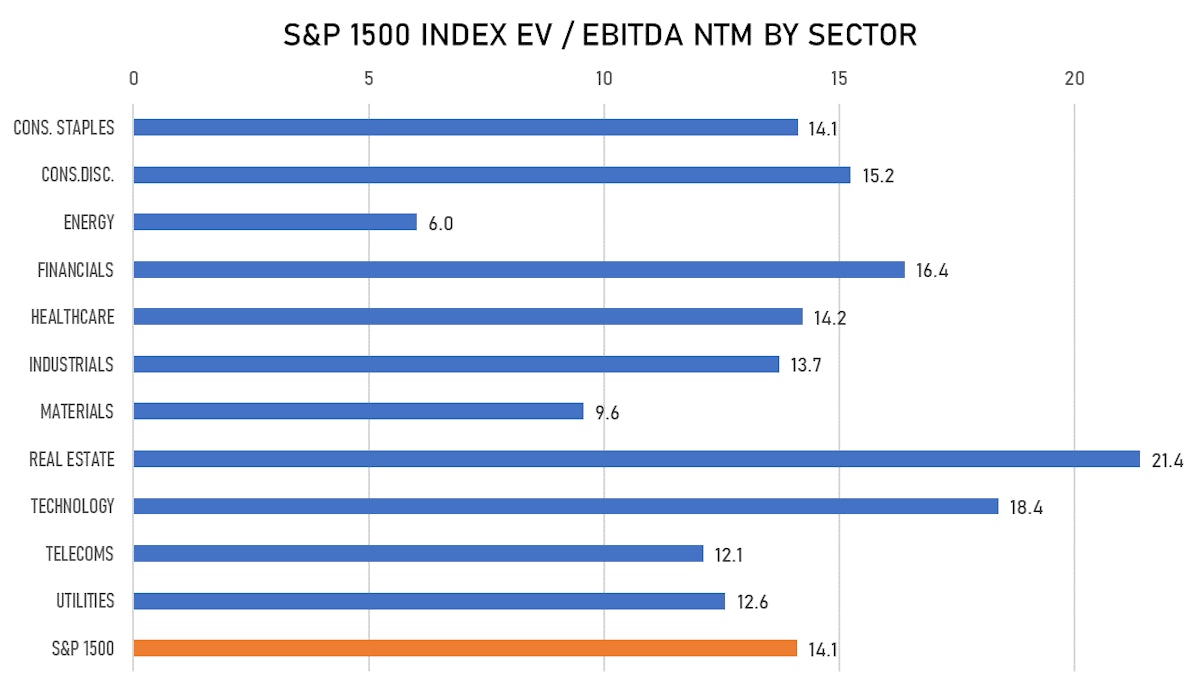

VALUATION MULTIPLES BY SECTORS

NEW IPOs ANNOUNCED OR PRICED

- Chengdu Yiyun Technology Co Ltd / China - High Technology / Listing Exchange: Hong Kong / Ticker: - / Gross proceeds (including overallotment): US$ 300.00m (offering in U.S. Dollar) / Bookrunners: Not Applicable

EQUITY FOLLOW-ONS / SECONDARY OFFERINGS

- Samsung Heavy Industries Co Ltd / South Korea - Industrials / Listing Exchange: Korea / Ticker: 010140 / Gross proceeds (including overallotment): US$ 840.91m (offering in Korean Won) / Bookrunners: Korea Investment & Securities Co Ltd, Shinhan Investment Corp, NH Investment & Securities Co, Mirae Asset Daewoo Co Ltd, KBI Securities Co Ltd

- OBIC Business Consultants Co Ltd / Japan - Consumer Products and Services / Listing Exchange: Tokyo 1 / Ticker: 4733 / Gross proceeds (including overallotment): US$ 227.09m (offering in Japanese Yen) / Bookrunners: Nomura International PLC, Daiwa Securities Capital Markets Co Ltd

- Steadfast Group Ltd / Australia - Financials / Listing Exchange: Australia / Ticker: SDF / Gross proceeds (including overallotment): US$ 144.98m (offering in Australian Dollar) / Bookrunners: JP Morgan Australia Ltd, UBS AG